Big Mistakes Traders Must Avoid1. Trading Without a Strategy

One of the biggest mistakes beginners make is trading without a clearly defined plan. They enter trades based on gut feelings, social media tips, or random chart patterns. Without a structured system, the trader relies on luck — and luck is not a strategy.

A proper trading strategy should define:

Entry rules

Exit rules

Stop-loss placement

Profit targets

Risk per trade

Market conditions (trend, range, volatility)

Beginners often jump between strategies, copying YouTubers or Telegram channels, killing their consistency. A good trader tests one system, refines it, and masters it over time.

2. No Risk Management

Many beginners believe making money is all about finding perfect entries. In reality, risk management is 70% of trading success.

Common risk mistakes:

Trading without stop-loss

Risking too much capital on a single trade

Averaging losers

Over-leveraging

A general rule is to risk only 1–2% of capital per trade. But new traders often risk 10–50% hoping for fast profits, and the market punishes this instantly.

Professional traders survive because they preserve capital first and grow second. Beginners try to grow fast and lose everything quickly.

3. Overtrading

Overtrading happens when traders take too many trades, either out of excitement or boredom. Many beginners think more trades equal more profit — but in trading, quality matters more than quantity.

Reasons beginners overtrade:

Wanting to recover losses

Emotional rush of the market

Fear of missing out (FOMO)

Misunderstanding setups

Overtrading leads to mistakes, emotional decision-making, and burnout. Elite traders might take only 1–5 high-quality trades a week, while beginners take 30–50 impulsive ones.

4. Emotional Trading

The market is a mirror that reflects a trader’s emotions: fear, greed, impatience, and ego. Beginners often have emotional reactions such as:

Fear of missing a move

Greed for a larger profit

Fear of losing

Revenge trading after losses

Impulsive decisions when stressed

Trading emotionally leads to:

Early exits

Late entries

Ignoring stop-losses

Forced trades

Losses due to panic

Successful trading requires a calm, disciplined mind that follows predefined rules. Consistency comes from emotional stability, not excitement.

5. Lack of Patience

Beginners often want profits now. They enter trades prematurely or exit too soon. But the market rewards patience — waiting for the right setup, the right confirmation, and the right time.

Patience is needed in:

Waiting for the chart to reach key levels

Allowing trade to hit targets

Avoiding unnecessary trades

Backtesting and learning

Most losses come from impatience, not lack of knowledge.

6. Not Accepting Losses

A major psychological trap is refusing to accept small losses. Beginners often say:

“It will come back.”

“I’ll wait a little more.”

“I can’t close in loss.”

This leads to:

Blown accounts

Huge drawdowns

Emotional distress

Professional traders accept losses as a cost of doing business. They keep losses small and controlled. Beginners avoid losses emotionally and end up taking catastrophic ones.

7. Following Tips, News, and Others’ Opinions

Many beginners follow:

Telegram tips

YouTube signals

WhatsApp groups

Friends’ opinions

Influencer recommendations

This creates dependency and confusion because:

The tip provider may not share risk levels

Market conditions differ

Signals can be manipulated

No one understands your trading style better than you

The best traders rely only on their own analysis, not random noise from outside.

8. Unrealistic Expectations

New traders enter the market thinking:

They’ll double their capital in a month

They can turn ₹10,000 into ₹10 lakh quickly

Trading is easy money

They will never lose

This mindset leads to frustration, losses, and quitting. Trading is a marathon, not a sprint. Realistic expectations:

Consistent returns are usually 2–8% per month for skilled traders

Losses are part of the process

Skill takes months or years to build

The market rewards discipline, not fantasy

9. Ignoring Market Structure

Beginners focus too much on indicators and too little on price action and market structure. Indicators lag; the structure leads.

Ignoring structure means beginners miss:

Trends

Support and resistance

Breakouts and reversals

Liquidity zones

Demand and supply

Trading blindly based on indicators creates confusion. Smart traders combine structure + indicators + risk rules.

10. Not Keeping a Trading Journal

A huge mistake beginners make is not recording their trades. Without a journal, traders cannot track mistakes, improve patterns, or refine discipline.

A journal should include:

Entry/exit

Timeframe

Emotions felt

Mistakes

Screenshots

Lessons

Every professional trader documents their trades. Beginners often don’t — and remain stuck.

11. Using High Leverage

Leverage is a double-edged sword. Beginners see it as a shortcut to big profits. In reality, it multiplies losses faster than profits.

High leverage causes:

Sudden liquidation

Panic during volatility

Overconfidence

Overtrading

Using low, controlled leverage is safer and keeps the account alive.

12. Not Learning Continuously

Markets evolve. Strategies stop working. Volatility changes. Without ongoing learning, traders become outdated. Beginners often stop learning once they know basics — but basics don’t create long-term success.

Continuous learning includes:

Studying charts daily

Backtesting setups

Understanding macro concepts

Improving psychology

Reviewing mistakes

The best traders treat trading like a profession that requires constant improvement.

Conclusion

Beginners make these mistakes not because they are incapable, but because trading feels deceptively simple. The biggest errors come from emotions, lack of discipline, and unrealistic expectations. To succeed, a trader must:

Focus on strategy

Manage risk strictly

Control emotions

Trade fewer but high-quality setups

Accept losses

Learn continuously

Trading is not about being right — it’s about managing risk, controlling emotions, and building discipline over time. Those who avoid the above mistakes build long-term, consistent profitability and survive the challenges that wipe out others.

Traderchamp

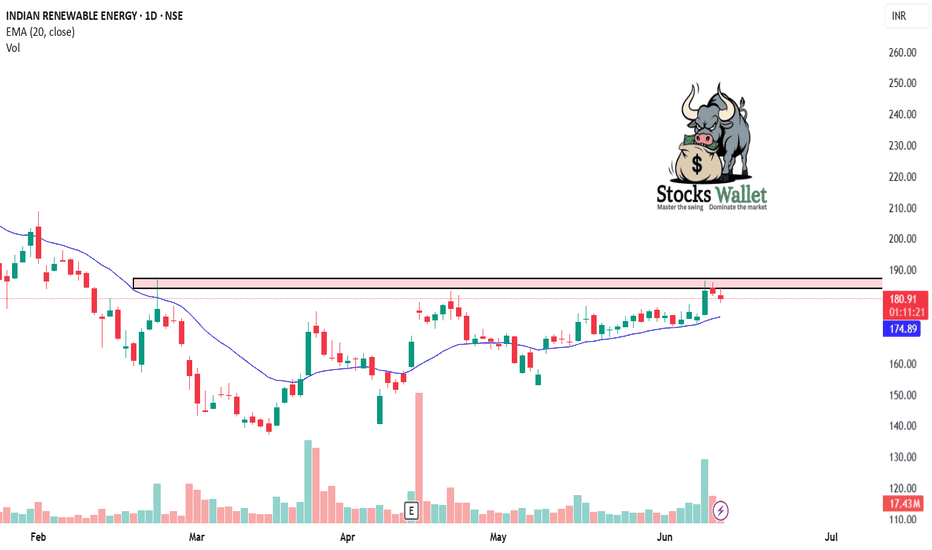

IREDA – Strong Bullish Continuation Setup After Healthy Consolid⚡ IREDA – Strong Bullish Continuation Setup After Healthy Consolidation

Chart: IREDA – Daily Timeframe

IREDA is showing a bullish continuation pattern after consolidating in a tight range near ₹140. The stock has formed a higher low structure, and recent breakout candles with rising volume suggest a renewed upside momentum.

🔹 Technical Highlights:

Ascending triangle breakout around ₹190

Strong support near ₹130–135 range

RSI rising above 60 – bullish strength confirmation

Price holding above 20 EMA and 50 EMA, signaling trend support

Volume breakout confirms buying interest from lower levels

📌 Trade Setup:

Entry Zone: ₹189–190

Target 1: ₹220

Target 2: ₹256

Stop Loss: ₹150 (closing basis)

The stock is part of the renewable energy theme and could see strong interest from positional traders and investors if broader market sentiment supports.

⚠️ This analysis is for educational purposes only. Always manage your risk and do your own research before taking any position.

TANLA: Bullish Momentum Resumes After ConsolidationTANLA has exhibited a robust upward movement, marked by a significant upside followed by a consolidation phase lasting a few days. The current price action suggests a renewed bullish momentum as the stock emerges from the consolidation zone.

Key Points:

1.Strong Historical Performance: TANLA has a history of delivering strong upside moves,

indicating its potential for substantial price appreciation.

2.Consolidation Breakout: After a brief consolidation period, TANLA is now breaking out of the

consolidation zone. This breakout often signifies the resumption of an upward trend.

3.Volume Confirmation: The positive price movement is supported by a notable increase in

trading volume on positive candlesticks. This volume confirmation enhances the reliability

of the bullish signal.

4.Swing Trade Opportunity: Given the recent price action and volume trends, TANLA appears

well-suited for a swing trade. Swing traders can capitalize on short to medium-term price

fluctuations, aiming to profit from the anticipated upward movement.

It's important for traders to conduct their own technical analysis, set appropriate stop-loss levels, and consider other relevant factors before entering any trade.

This content should not be considered as investment advice. Trading involves risks, and past performance is not indicative of future results.

Dalmia bharat a Very High Probability Trade ideaA Very High probability trade of Dalmia Bharat. Long between 1945-1955 for the first target of 2110 & 2250 with SL of 1900. As per the price action pattern we have seen, Whenever stock has touched the 200 EMA the same will bounce back from the level with increased volumes. Watch the levels of the stock in the coming days. This is for your educational purpose only.

19 July Nifty Prediction based on Multiple AnylysisNSE:NIFTY

As we can see in the chart at 45 minutes time frame, Market took support at 15864 and gone up by almost 100 points and in the process forming a W pattern.

If the market Opens flat and starts going up based on the candlestick pattern and breaches 16070 we can take at the money CE for a target of 16,150.

If because of any news the market starts going down we can take a PE only if the market breaks 15864.