Consumption Trends: Shaping Modern Economies and MarketsThe Central Role of Consumption in the Economy

Consumption is a key driver of economic growth. In many economies, private consumption contributes more than half of Gross Domestic Product (GDP). When consumers are confident and spending rises, businesses expand production, hire more workers, and invest in capacity. Conversely, when consumption slows due to inflation, unemployment, or uncertainty, economic growth weakens. This makes consumption trends a vital indicator of economic health and future growth potential.

Over time, consumption patterns have shifted from basic necessities toward discretionary and experience-based spending as incomes rise. This transition highlights how economic development changes not just how much people consume, but what they consume.

Income Growth and Changing Spending Patterns

Income levels play a decisive role in shaping consumption trends. As disposable incomes increase, households allocate a smaller proportion of spending to essentials such as food and clothing, and a larger share to services like education, healthcare, travel, and entertainment. This phenomenon, often explained by Engel’s Law, is visible across emerging and advanced economies.

In developing economies, rising middle-class populations are driving demand for consumer durables, branded goods, better housing, and personal mobility. In contrast, developed economies show mature consumption patterns, with growth concentrated in premium products, personalized services, and lifestyle-enhancing experiences rather than volume-driven consumption.

Shift from Goods to Services

One of the most significant global consumption trends is the shift from goods-based consumption to services-based consumption. Spending on healthcare, education, financial services, digital subscriptions, tourism, and wellness has grown faster than spending on physical goods. This shift reflects urbanization, longer life expectancy, and changing lifestyle priorities.

The digital economy has accelerated this trend. Streaming platforms, online education, cloud services, and digital entertainment have transformed how consumers allocate their budgets. Ownership is increasingly being replaced by access, seen in subscription-based models for music, video, software, and even transportation.

Impact of Technology on Consumption Behavior

Technology has fundamentally reshaped consumption patterns. E-commerce platforms have changed how consumers shop, offering convenience, wider choice, and price transparency. Mobile payments and digital wallets have reduced friction in spending, encouraging higher transaction frequency and impulse purchases.

Data-driven personalization has also altered consumer expectations. Consumers now expect tailored recommendations, customized products, and seamless omnichannel experiences. Social media and digital marketing play a powerful role in shaping preferences, influencing purchasing decisions through influencers, reviews, and targeted advertising.

At the same time, technology has shortened product life cycles. Consumers replace smartphones, electronics, and fashion items more frequently, contributing to faster consumption cycles and increased demand for innovation.

Demographic and Generational Influences

Demographics strongly influence consumption trends. Younger consumers tend to prioritize experiences, technology, and sustainability, while older populations spend more on healthcare, financial security, and home-related services. Urbanization also shapes consumption, with urban households spending more on convenience services, transportation, and leisure compared to rural households.

Generational shifts are particularly important. Younger generations are more value-conscious, digitally native, and socially aware. They often favor brands that align with their values, such as ethical sourcing, inclusivity, and environmental responsibility. This has forced companies to adapt their offerings and branding strategies to remain relevant.

Sustainability and Conscious Consumption

A major emerging trend is the rise of conscious and sustainable consumption. Environmental concerns, climate change awareness, and social responsibility are influencing buying behavior. Consumers increasingly prefer products that are eco-friendly, ethically produced, and recyclable.

This trend has led to growth in organic food, electric vehicles, renewable energy solutions, and circular economy models such as reuse, repair, and resale. While price sensitivity remains important, especially in developing economies, awareness of sustainability is steadily increasing across income groups.

Businesses are responding by redesigning supply chains, reducing waste, and adopting transparent practices. Sustainable consumption is no longer a niche trend but a growing mainstream consideration.

Inflation, Uncertainty, and Adaptive Consumption

Macroeconomic conditions significantly affect consumption trends. Periods of high inflation reduce purchasing power, forcing consumers to prioritize essentials and cut discretionary spending. In such environments, demand shifts toward value-for-money products, private labels, and discount retailers.

Economic uncertainty also encourages precautionary savings. Consumers delay big-ticket purchases such as homes, cars, and luxury goods. However, certain categories like healthcare, basic food, and affordable entertainment remain relatively resilient.

Interestingly, even during downturns, consumers often seek small indulgences, a behavior sometimes described as “affordable luxuries,” reflecting the emotional dimension of consumption.

Globalization and Cultural Convergence

Globalization has led to partial convergence of consumption patterns across regions. International brands, global cuisines, and shared digital platforms have created common consumer experiences worldwide. At the same time, local preferences and cultural identity continue to shape demand, leading to a blend of global and local consumption.

Companies increasingly adapt products to local tastes while maintaining global brand identity. This balance between standardization and customization is a defining feature of modern consumption trends.

Future Outlook of Consumption Trends

Looking ahead, consumption trends are likely to be shaped by technology, demographics, sustainability, and economic stability. Digital-first consumption, service orientation, and conscious spending will continue to grow. Artificial intelligence and automation may further personalize consumption, while demographic aging in many countries will shift spending toward healthcare and financial services.

At the same time, inequality and income distribution will influence consumption growth. Expanding middle classes in emerging markets will remain a major source of demand, while developed economies may experience slower but more sophisticated consumption growth.

Conclusion

Consumption trends are a dynamic reflection of economic conditions, social values, and technological progress. From the shift toward services and digital platforms to the rise of sustainable and value-conscious consumption, modern spending patterns are evolving rapidly. Understanding these trends is essential for navigating economic cycles, designing effective business strategies, and shaping policies that support inclusive and sustainable growth. As consumer preferences continue to change, adaptability and innovation will remain at the heart of successful participation in the global economy.

Tradingsetup

Quarterly Results: High-Impact Trading Strategies1. Why Quarterly Results Matter So Much

Quarterly earnings influence markets because they:

Update real financial reality versus expectations

Reset valuation assumptions

Alter future growth outlooks

Trigger institutional rebalancing

Create liquidity surges and volatility expansion

Markets do not react to numbers alone. They react to the difference between expectations and reality, known as earnings surprise.

Key drivers of price reaction:

Revenue vs estimates

EPS vs estimates

Guidance upgrades/downgrades

Management commentary tone

Margin expansion or contraction

2. Pre-Earnings Trading Strategies

Pre-earnings trades aim to capture anticipation, positioning, and volatility buildup.

A. Earnings Run-Up Strategy

Many stocks trend upward before results due to:

Analyst upgrades

Institutional accumulation

Positive sector sentiment

Strategy logic

Buy strong stocks 2–4 weeks before earnings

Ride the momentum until just before results

Exit partially or fully before announcement

Best conditions

Strong relative strength vs index

Consistent higher highs and higher lows

Positive earnings history

Risk

Sudden negative leaks or macro shocks

B. Volatility Expansion Play

Implied volatility typically rises before earnings.

Approach

Trade breakout setups near key levels

Use tight stop losses

Target fast momentum moves

Technical focus

Compression patterns (triangle, flag, box range)

Rising volumes into earnings

Narrow daily ranges before expansion

C. Avoid Directional Bets Without Edge

Blindly buying or shorting before results is gambling. Pre-earnings trades should be momentum-based, not prediction-based.

3. Result-Day Trading Strategies (High Risk, High Reward)

Earnings day offers explosive opportunities—but also extreme risk.

A. Gap-Up Continuation Trade

When a stock gaps up strongly and holds above key levels:

Entry

After first 15–30 minutes

Above VWAP or opening range high

Confirmation

Strong volumes

Minimal selling pressure

Price acceptance above gap zone

Target

Measured move or intraday resistance

B. Gap-Up Failure (Fade Trade)

Not all positive results sustain.

Signs of failure

Price rejects opening highs

Heavy selling volume

Break below VWAP

Strategy

Short below VWAP with tight stop

Target gap fill or previous close

This works well when:

Valuations are stretched

Market sentiment is weak

Guidance disappoints despite good numbers

C. Gap-Down Reversal (Dead Cat Bounce or True Reversal)

Large gap-downs can lead to:

Panic selling

Forced institutional exits

Reversal signs

Long lower wicks

Volume climax

Stabilization near support

Only aggressive traders should attempt this strategy.

4. Post-Earnings Trading Strategies (Most Consistent)

Post-earnings trades are statistically safer because uncertainty is removed.

A. Earnings Momentum Continuation

Strong results often lead to multi-week trends.

Ideal setup

Breakout above long-term resistance

Rising volumes post earnings

Analyst upgrades after results

Holding period

Days to weeks

Tools

Moving averages

Trend channels

Trailing stop losses

B. Post-Earnings Drift Strategy

Markets underreact initially and adjust over time.

Characteristics

Gradual trend continuation

Pullbacks bought aggressively

Strong relative strength

This is one of the most reliable earnings-based strategies.

C. Earnings Breakdown Short Trade

Negative earnings surprises can cause:

Structural trend breakdowns

Long-term distribution

Entry

Breakdown below support after results

Failed pullback retests

Target

Next major support zones

Best for:

High-debt companies

Weak cash flows

Deteriorating guidance

5. Sector and Index Influence

Earnings reactions depend heavily on:

Sector sentiment

Index trend (NIFTY, SENSEX, NASDAQ, S&P 500)

Example

Strong results in a weak market may still fail

Moderate results in a bullish sector may outperform

Always align earnings trades with:

Sector momentum

Broader market structure

6. Position Sizing and Risk Management

Quarterly results can move stocks 5–25% overnight.

Key risk rules:

Never risk more than 1–2% of capital per earnings trade

Reduce position size compared to normal trades

Avoid overexposure to multiple earnings trades at once

Respect gap risk—stop losses don’t work overnight

7. Common Mistakes Traders Make

Trading earnings without a plan

Ignoring guidance and commentary

Overtrading on result day

Holding losing trades hoping for reversal

Confusing good numbers with good price action

Remember: Price reaction > numbers

8. Professional Trader’s Earnings Checklist

Before every earnings trade:

Is the stock in a trend?

What is the market expecting?

How has the stock reacted to past earnings?

Where are key support/resistance levels?

What is my predefined risk?

If these answers aren’t clear, skip the trade.

9. Long-Term Perspective

Earnings trading is not about predicting results—it’s about reacting faster and smarter than the crowd. Professionals wait for confirmation, manage risk ruthlessly, and trade only high-quality setups.

The best traders treat earnings as:

Volatility opportunities

Trend accelerators

Risk events to be respected

Conclusion

Quarterly results are among the highest-impact events in financial markets, capable of reshaping trends in minutes and defining direction for months. High-impact earnings trading requires discipline, preparation, technical awareness, and emotional control.

Traders who focus on price behavior, volume confirmation, and post-earnings trends—rather than predictions—consistently outperform those who gamble on numbers alone.

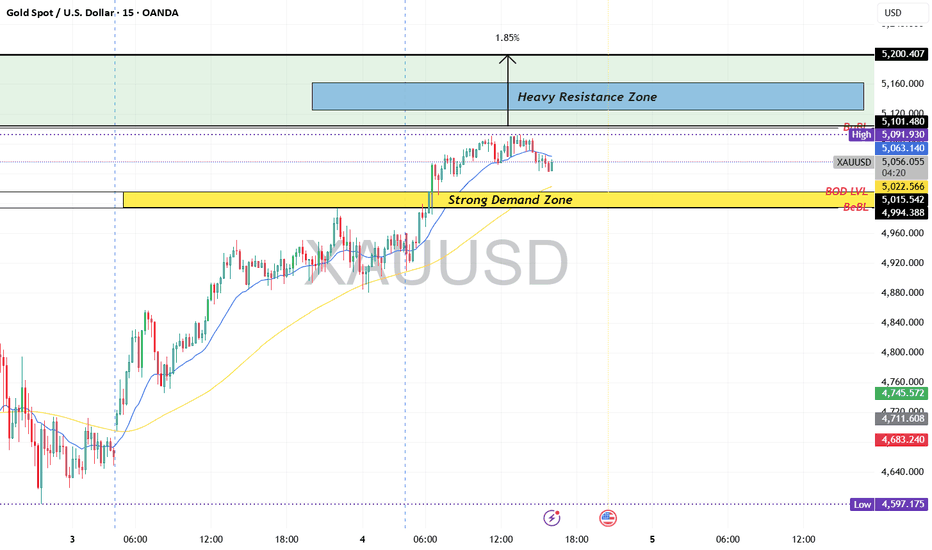

XAUUSD (Gold) | BULLISH VS BEARISH LEVEL | 4th Feb'2026Gold remains bullish above 5,015–4,995, which is the major demand zone and key trend support. Intraday pullbacks toward 5,030–5,050 can offer buy-on-dips opportunities as long as price holds above this base.

On the upside, 5,090–5,100 is the immediate supply zone. A sustained breakout above 5,100 can accelerate momentum toward 5,125–5,160 and further to 5,200. Only a decisive hourly close below 4,995 would weaken the bullish structure and open downside toward 4,960–4,920.

Market Bias: Bullish above 5,015 | Neutral 5,015–5,050 | Bearish below 4,995

XAUUSD (Gold) | TECAHNICAL LEVEL | 3rd FEB'2026Gold trades near 4,930, up +5.8%, with higher timeframes maintaining a bullish structure. Price is holding above the 100 & 200 EMA, while elevated volatility keeps intraday moves sharp. The 4,940–5,000 zone remains a key decision area.

Key Levels

Resistance: 4,990 | 5,080

Support: 4,840 | 4,700

Volatility Zones: Above 4,990 (expansion) | Below 4,840 (pressure)

USD data, Fed commentary, and bond yields remain the primary drivers today.

⚠️ Disclaimer: Educational content only. Markets are risky—manage risk wisely.

Part 3 Institutional Option Trading Vs. Techncal AnalysisOption Buyer vs Option Seller

Buyer pays premium, limited risk, unlimited profit.

Seller collects premium, limited profit, unlimited risk.

In real market volume, 80–90% of time sellers (institutions) dominate.

Expiry

Every option has a deadline (weekly, monthly).

On expiry day, option either:

ITM: Has value.

OTM: Becomes zero.

Algorithmic & Quantitative Trading – Basics Explained1. What is Algorithmic Trading?

Algorithmic Trading (Algo Trading) refers to using computer algorithms to automatically place trades based on predefined rules. These rules can be based on:

Price

Time

Volume

Technical indicators

Mathematical models

Once the algorithm is deployed, it can monitor markets, generate signals, and execute trades without human intervention.

Simple Example

An algorithm may be programmed as:

“Buy 100 shares of a stock when its 20-day moving average crosses above the 50-day moving average, and sell when the reverse happens.”

The computer continuously checks this condition and executes trades instantly when criteria are met.

2. What is Quantitative Trading?

Quantitative Trading (Quant Trading) is a broader concept that focuses on using statistical, mathematical, and probabilistic models to identify patterns in market data.

While algorithmic trading focuses on execution automation, quantitative trading focuses on:

Strategy design

Data analysis

Model building

Risk optimization

Most quantitative strategies are eventually implemented through algorithms, but not all algorithms are deeply quantitative.

3. Key Differences: Algo vs Quant Trading

Aspect Algorithmic Trading Quantitative Trading

Focus Automated execution Strategy development using math

Complexity Can be simple Often highly complex

Tools Rule-based logic Statistics, probability, ML

Human role Minimal after deployment High during research phase

Objective Speed & discipline Edge discovery & optimization

In practice, modern trading combines both.

4. Core Components of Algo & Quant Trading

1. Data

Data is the foundation. Common types include:

Price data (OHLC)

Volume data

Order book data

Corporate actions

Macroeconomic indicators

Data quality directly impacts strategy performance.

2. Strategy Logic

This defines when to buy, sell, or hold. Strategies can be:

Trend-following

Mean-reversion

Momentum-based

Arbitrage-based

Statistical models

Clear logic ensures consistency and removes emotional bias.

3. Backtesting

Backtesting evaluates how a strategy would have performed using historical data.

Key metrics include:

Net profit

Drawdown

Win rate

Sharpe ratio

Risk-reward ratio

Backtesting helps identify flaws before risking real capital.

4. Risk Management

Risk control is crucial. Common rules:

Fixed percentage risk per trade

Stop-loss and take-profit

Maximum drawdown limits

Position sizing models

A profitable strategy without risk control will eventually fail.

5. Execution System

Execution algorithms ensure:

Minimal slippage

Optimal order placement

Reduced market impact

Examples:

VWAP (Volume Weighted Average Price)

TWAP (Time Weighted Average Price)

5. Common Algorithmic Trading Strategies

1. Trend-Following Strategies

These aim to capture sustained price movement using:

Moving averages

Breakouts

Channel systems

Popular among beginners due to simplicity.

2. Mean Reversion Strategies

Based on the idea that prices revert to an average over time.

Examples:

RSI oversold/overbought systems

Bollinger Band reversals

Works well in range-bound markets.

3. Arbitrage Strategies

Exploits price differences between:

Cash and futures

Two exchanges

Related instruments

Requires high speed and low transaction costs.

4. Statistical Arbitrage

Uses correlations and probabilities between assets.

Example:

Pair trading (e.g., Reliance vs ONGC)

Relies heavily on quantitative analysis.

5. Market Making

Continuously places buy and sell orders to profit from bid-ask spread.

Mostly used by institutions due to infrastructure requirements.

6. Quantitative Models Used in Trading

1. Statistical Models

Regression analysis

Correlation & covariance

Z-score models

Used for identifying relationships between assets.

2. Probability & Risk Models

Normal distribution

Value at Risk (VaR)

Monte Carlo simulations

Used for risk estimation and stress testing.

3. Machine Learning Models

Advanced quants use:

Linear regression

Decision trees

Random forests

Neural networks

These models detect hidden patterns but require careful validation.

7. Benefits of Algorithmic & Quant Trading

Eliminates emotional decision-making

Faster execution than manual trading

Consistent application of rules

Ability to test strategies objectively

Scalability across multiple instruments

8. Risks and Challenges

Despite advantages, there are risks:

Overfitting historical data

Strategy failure in changing markets

Technology glitches

Data errors

Regulatory constraints

Successful traders focus on robustness, not perfection.

9. Algo & Quant Trading in Indian Markets

In India, algo trading is widely used in:

Index futures & options

Liquid stocks

Arbitrage strategies

SEBI regulations require:

Broker-approved algorithms

Risk checks

Order limits

Audit trails

Retail traders usually access algo trading through:

Broker APIs

Semi-automated platforms

Strategy builders

10. Skills Required to Learn Algo & Quant Trading

Basic statistics & probability

Market microstructure knowledge

Programming (Python preferred)

Understanding of trading psychology

Risk management principles

You don’t need to be a mathematician initially, but logic and discipline are essential.

11. Conclusion

Algorithmic and Quantitative Trading represent the evolution of trading from intuition-based decisions to systematic, data-driven processes. While institutions dominate advanced quantitative strategies, retail traders can still benefit from simpler rule-based algorithms.

Success in this field comes not from complexity, but from:

Well-tested logic

Strong risk management

Continuous learning

Adaptability to market conditions

When used correctly, algorithmic and quantitative trading can transform trading from speculation into a structured business.

Derivatives Trading Strategies – A Complete GuideDerivatives are financial instruments whose value is derived from an underlying asset such as stocks, indices, commodities, currencies, or interest rates. The most common derivatives used by traders are Futures and Options. Derivatives trading allows participants to hedge risk, speculate on price movements, and generate income with relatively lower capital compared to the cash market. However, derivatives are complex and require disciplined strategies and strong risk management.

Derivatives trading strategies can broadly be classified into futures-based strategies, options buying strategies, options selling strategies, hedging strategies, and advanced multi-leg strategies.

1. Futures Trading Strategies

Futures contracts are agreements to buy or sell an asset at a predetermined price on a future date. They are linear instruments, meaning profit or loss moves directly with price.

a) Trend Following Strategy

This is one of the most popular futures strategies. Traders identify strong trends using indicators like Moving Averages, ADX, or trendlines.

Buy futures in an uptrend

Sell futures in a downtrend

This strategy works best in trending markets and requires strict stop-losses to manage risk.

b) Breakout Strategy

Traders enter trades when price breaks above resistance or below support with strong volume.

Buy on resistance breakout

Sell on support breakdown

This strategy captures sharp moves but may suffer from false breakouts in sideways markets.

c) Pullback Strategy

Instead of chasing price, traders enter during minor retracements within a trend.

Buy near support in an uptrend

Sell near resistance in a downtrend

This provides better risk-reward compared to chasing breakouts.

d) Calendar Spread (Futures)

This involves buying one expiry and selling another expiry of the same contract.

Profits from changes in spread rather than price direction

Lower risk compared to naked futures positions

2. Option Buying Strategies

Option buying involves purchasing Call or Put options with limited risk but high reward potential. Timing is crucial.

a) Long Call Strategy

Used when the trader is bullish.

Buy Call option

Limited risk (premium paid)

Unlimited profit potential

Works best when price moves fast and volatility increases.

b) Long Put Strategy

Used in bearish conditions.

Buy Put option

Limited risk

Profits from falling prices

Effective during strong downtrends or market crashes.

c) Directional Option Buying with Indicators

Traders combine options with indicators like RSI, MACD, or VWAP to time entries. This helps reduce time decay losses.

d) Event-Based Option Buying

Traders buy options before events such as results, budgets, or global news expecting big moves. High risk due to volatility crush after the event.

3. Option Selling Strategies (Income Strategies)

Option selling focuses on earning premium and benefits from time decay (Theta). These strategies require margin and strong risk control.

a) Covered Call

Hold stock + sell Call option

Generates regular income

Limited upside but safer than naked selling

b) Cash Secured Put

Sell Put option with sufficient cash

Suitable for acquiring stocks at lower prices

Generates income in sideways markets

c) Short Straddle

Sell Call and Put at same strike

Profits when market remains range-bound

High risk if market moves sharply

d) Short Strangle

Sell out-of-the-money Call and Put

Lower risk than straddle

Suitable for low-volatility markets

4. Non-Directional Option Strategies

These strategies do not require predicting market direction but depend on volatility.

a) Iron Condor

Combination of Call and Put spreads

Profits in sideways markets

Limited risk and limited reward

Very popular among professional traders.

b) Butterfly Spread

Buy one ITM option, sell two ATM options, buy one OTM option

Low cost strategy

Profits when price stays near middle strike

c) Calendar Spread (Options)

Sell near-term option, buy far-term option

Profits from time decay difference

Lower risk compared to naked selling

5. Volatility-Based Strategies

Volatility plays a major role in options pricing.

a) Long Straddle

Buy Call + Put at same strike

Profits from big moves in either direction

Requires strong volatility expansion

b) Long Strangle

Buy OTM Call and Put

Cheaper than straddle

Needs large price movement

c) Vega Trading

Professional traders buy options when volatility is low and sell when volatility is high.

6. Hedging Strategies Using Derivatives

Derivatives are widely used for risk protection.

a) Portfolio Hedging

Buy Index Puts against stock portfolio

Protects against market crashes

b) Futures Hedging

Short index futures to hedge long equity holdings

Effective during uncertain market conditions

c) Protective Put

Buy Put option against stock holding

Acts like insurance

7. Risk Management in Derivatives Trading

Risk management is more important than strategy selection.

Always use stop-loss

Avoid over-leveraging

Risk only 1–2% of capital per trade

Understand Greeks (Delta, Theta, Vega, Gamma)

Avoid emotional trading

Conclusion

Derivatives trading strategies offer immense opportunities for profit, flexibility, and risk management. Futures strategies suit traders who prefer direct price movement, while options strategies provide multiple ways to trade direction, volatility, and time decay. However, derivatives amplify both profits and losses. Success in derivatives trading depends on discipline, risk control, strategy selection, and continuous learning.

For beginners, it is advisable to start with simple strategies like covered calls, cash-secured puts, or directional option buying before moving to advanced multi-leg strategies. With the right approach, derivatives can become a powerful tool in a trader’s arsenal.

XAUUSD (Gold) | Bull vs Bear Scenerio | 28th Jan'2026XAUUSD (Gold) | Technical Outlook | 28 Jan 2026

Gold (XAU/USD) is trading near 5,291, maintaining a strong bullish trend across intraday, daily, and higher timeframes. Price is holding firmly above all major moving averages (MA5–MA200), confirming trend strength. Momentum indicators (MACD, ADX, ROC, Bull/Bear Power) support further upside, while oscillators (RSI, Stoch RSI, CCI, Williams %R) remain overbought, indicating strong momentum with chances of short-term pullbacks. Volatility remains high (ATR ~59), so key levels are crucial.

Key Levels

Support: 5,232 | 5,198 | 5,135 | 5,101

Resistance: 5,295 | 5,330 | 5,392

Intraday Pivot: 5,232

Breakout & Breakdown

Bullish (Breakout):

Buy Above: 5,295

Targets: 5,330 → 5,392 → 5,400

Trend continuation above resistance

Bearish (Breakdown):

Sell Below: 5,232

Targets: 5,198 → 5,135

Below 5,100 → 5,000–4,950 (correction zone)

Conclusion

Overall trend remains bullish. Buy-on-dips above support is preferred, but avoid chasing near highs due to overbought conditions. Trade strictly on breakout or breakdown confirmation with proper risk management.

Disclaimer :For educational purposes only. Gold trading involves high risk. Always use stop-loss and trade as per your risk appetite.

Part 4 Institutional vs. TechnicalWhy Trade Options?

Retail traders, institutions, and hedgers use options for different reasons:

1. Hedging

Institutions hedge large positions using options to protect risk.

Example:

A mutual fund buys NIFTY PEs to protect its long equity portfolio.

2. Speculation

Small traders use options to generate returns with limited capital.

3. Income Generation

Option sellers earn premium by selling options that they believe will expire worthless.

4. Risk Management

Options allow you to define risk precisely.

Nifty 50 1 Week Time Frame 📊 Current Level (approx)

Nifty 50 ~ 25,200–25,350 area as of the last trading sessions (January 27–28, 2026).

📈 Key Weekly Levels to Watch

🔹 Immediate Resistance

1. ~25,300–25,350 — short‑term upside barrier (recent highs around these levels).

2. ~25,500–25,700+ — next major resistance zone (from prior weekly technical analysis, a breakout above ~26,100 historically signalled stronger bullish control).

🔻 Support Zones

1. ~24,900–25,000 — key short‑term support defended in recent sessions and noted by traders as a pivot area.

2. ~24,500–24,700 — broader weekly support zone (buffer from intermediate trend lines / moving averages).

3. ~24,200–24,300 — deeper weekly support; breach here could imply stronger correction risk.

📌 Weekly Trading Range (Probable)

Based on recent technical ranges and previous weekly outlooks:

➡️ Bullish bias above ~25,000 with resistance towards 25,500–25,700+.

➡️ Bearish/mixed bias if breaks below ~24,900, with support down to 24,500 and 24,200 zones.

⚠️ Important Notes

These levels are technical references used by traders — not investment advice.

Weekly support/resistance can shift quickly with strong market moves or macro events (especially around global policy news or earnings).

Always use stop losses and proper risk management if trading off these levels.

TATAELXSI 1 Week View 📊 Current context

The stock price is in the range of around ₹5,350–₹5,450 (as of last close).

📈 1‑Week Technical Levels

These are typical support/resistance values used by short‑term traders (daily/weekly pivots & swing levels):

🧭 Weekly Support

1. ~₹5,270–₹5,280 — first major weekly support zone.

2. ~₹5,106–₹5,110 — secondary support before lower breakdown risk.

3. ~₹4,700 area — strong downside zone (52‑week low area).

🚧 Weekly Resistance

1. ~₹5,618–₹5,620 — initial weekly resistance level.

2. ~₹5,950–₹6,000 — higher breakout zone for bullish momentum.

3. Above ₹6,300 — strong breakout continuation level.

These weekly levels are useful for planning trades across the next 5–7 sessions — gains above initial resistance suggest near‑term strength, while breaks below support indicate further weakness.

🔁 Daily Pivot Levels (for intraday / short swing)

Pivot Point: ~₹5,400–₹5,407

Support†: ~₹5,355 → ₹5,295 → ₹5,250

Resistance†: ~₹5,460 → ₹5,505 → ₹5,565 (higher targets)

These pivot levels help define day‑to‑day trading range within the week.

LUPIN 1 Day View 📊 Current Market Snapshot (Latest Available Close)

Price: ~₹2,137.20 (NSE) — price range on the most recent session was ₹2,130.30–₹2,178.00.

Previous Close: ₹2,163.20.

52‑week range: ₹1,795.20 low ~ ₹2,226.30 high.

📈 Daily Pivot & Key Levels (Short‑Term Technical)

🔁 Pivot (Reference Level)

Pivot point: ~₹2,166–₹2,160 zone — this is the central level that often defines bull/bear bias intraday.

🔼 Resistance (Upside Levels)

R1: ~₹2,185–₹2,189 — immediate upside barrier.

R2: ~₹2,206–₹2,208 — next medium resistance.

R3: ~₹2,227–₹2,238 — stronger resistance zone (intraday to short‑term).

🔽 Support (Downside Levels)

S1: ~₹2,143–₹2,119 — initial support from recent pivot structures.

S2: ~₹2,124–₹2,100 — mid downside support.

S3: ~₹2,102–₹2,071 — deeper support if bearish momentum accelerates.

🧠 How to Use These Levels Today

Bullish view: Stay above pivot (~₹2,160–₹2,166) for upside bias toward R1→R2.

Neutral/Range: Between S1 and R1 suggests consolidation — trade bounces within this zone.

Bearish breakdown: A close below S2/S3 can indicate deeper correction — watch S2 as key risk cutoff.

(These are not buy/sell recommendations, just short‑term technical reference points.)

HINDALCO 1 Month View 📌 Current Price Snapshot

Approximate recent price: ₹961–₹975 on NSE.

52-week range: ₹546.45 (low) to ~₹985 (high).

📊 1-Month Technical Levels (Support & Resistance)

🔁 Pivot & Balanced Level

Pivot Level: ~₹954 – ₹963 (central zone where trend bias often flips)

📈 Resistance Levels (Upside Barriers)

1. R1: ~₹959 – ₹960 — first key resistance above current pivot.

2. R2: ~₹969 – ₹970 — near recent short-term highs.

3. R3: ~₹975 – ₹980+ — upper resistance and psychological round number area.

💡 Above ~₹980: breakout build-up zone toward recent swing highs (~₹985).

📉 Support Levels (Downside Floors)

1. S1: ~₹944 – ₹945 — first major support zone.

2. S2: ~₹938 – ₹940 — next lower support within recent range.

3. S3: ~₹929 – ₹932 — deeper support if price slides further.

4. Lower structural zone: ~₹907 – ₹921 — broader support band from longer-term pivots.

📅 Trend & Market Context (1-Month)

Momentum: RSI around mid-60s suggesting moderately bullish momentum without being overbought.

Moving averages: Price trading above major short & mid-term averages (20/50 DMA), indicating bullish bias on the monthly view.

Volatility: ATR indicates normal volatility — not extreme swings.

Interpretation:

✔ Stays bullish above ~₹944–₹945 support.

✔ Upside can extend to ~₹969–₹980 if momentum persists.

⚠ A break below ~₹932 could signal deeper pullbacks toward ~₹907 area.

ASIANPAINT 1 Month View 📊 Recent Price Context

Asian Paints trading around ₹2,700–₹2,730 zone as of late Jan 2026 (approximate price) according to live quotes.

🔁 Key Pivot / Support & Resistance (Daily)

(Based on classic pivot calculations — often used by traders for 1-month/short-term analysis)

Resistance Levels:

R1: ~₹2,760–₹2,761 📈

R2: ~₹2,817–₹2,818 📈

R3: ~₹2,852–₹2,853 📈

Pivot (Central Reference):

Pivot: ~₹2,725–₹2,727 🔄

Support Levels:

S1: ~₹2,668–₹2,669 📉

S2: ~₹2,633–₹2,634 📉

S3: ~₹2,576–₹2,577 📉

These levels give a short-term structure of zones where price often reacts (bounces or stalls) on daily charts.

📌 Short Interpretation

Bullish break above ₹2,760–₹2,800 could open the path toward higher resistances near ₹2,820–₹2,850+ in the current move.

Support cluster around ₹2,630–₹2,670 is the key downside band — if this fails, wider losses toward the ₹2,576+ region are possible.

Part 2 Candle Stick PatternOption Buyer vs Option Seller

Option Buyer

Pays premium upfront

Has limited loss (premium)

Unlimited or large profit potential

Suffers from time decay

Option Seller (Writer)

Receives premium upfront

Limited profit (premium received)

Potentially unlimited loss (especially naked calls)

Benefits from time decay

Cross-Market ArbitrageConcept and Rationale

In an ideal and perfectly efficient market, the price of an identical asset should be the same everywhere once adjusted for factors such as transaction costs, taxes, and exchange rates. This principle is often referred to as the law of one price. However, in real-world markets, temporary deviations occur due to differences in liquidity, information flow, trading hours, capital controls, regulatory frameworks, and investor behavior. Cross-market arbitrage aims to capitalize on these deviations before prices converge again.

The strategy plays a critical role in maintaining market efficiency. Arbitrageurs, by acting on price discrepancies, help align prices across markets. As more traders exploit an arbitrage opportunity, buying pressure in the cheaper market and selling pressure in the expensive market gradually eliminate the price gap.

Types of Cross-Market Arbitrage

One of the most common forms is geographical arbitrage, where the same asset trades on exchanges in different countries. For example, a stock listed on both the Indian market and a foreign exchange may trade at slightly different prices due to currency movements or local demand-supply dynamics.

Another major form is exchange-based arbitrage, where price differences exist between two domestic exchanges trading the same instrument. In equity markets, this can occur when a stock is listed on multiple exchanges and short-term inefficiencies arise.

Currency-based cross-market arbitrage involves exploiting mispricing between currency pairs across different forex markets or between the spot and offshore markets. This often overlaps with triangular arbitrage, where inconsistencies between three currency exchange rates create profit opportunities.

Derivative-based arbitrage is also significant. Here, traders exploit price differences between a cash market instrument and its derivative, such as an index and its futures contract traded on different exchanges or jurisdictions.

Mechanics of Execution

Successful cross-market arbitrage requires simultaneous execution of buy and sell orders to eliminate directional market risk. Speed and precision are essential, as arbitrage windows are often extremely short-lived. Institutional traders typically rely on algorithmic trading systems and direct market access to identify and execute opportunities in milliseconds.

For example, if a stock is trading lower on one exchange compared to another after accounting for currency conversion and transaction costs, an arbitrageur would buy the stock in the cheaper market and sell it in the higher-priced market at the same time. The profit is realized once the positions are settled, assuming the price gap closes as expected.

Role of Technology

Technology is a decisive factor in cross-market arbitrage. Modern arbitrage strategies heavily depend on real-time data feeds, low-latency infrastructure, co-location services, and automated execution systems. Without these, price discrepancies are likely to disappear before a trade can be completed.

High-frequency trading firms dominate this space because they can react faster than manual traders. However, longer-duration arbitrage opportunities may still exist in less liquid markets or during periods of high volatility, regulatory changes, or market stress.

Risk Factors

Although cross-market arbitrage is often perceived as low risk, it is not risk-free. Execution risk is one of the most significant concerns. If one leg of the trade is executed while the other fails or is delayed, the trader may be exposed to market movements.

Currency risk arises when trades involve assets priced in different currencies. Even small exchange rate fluctuations can impact profitability if not properly hedged.

Liquidity risk is another challenge, especially in emerging markets. A lack of sufficient volume may prevent traders from executing large orders at expected prices.

Regulatory and settlement risk also play a role. Different markets have varying settlement cycles, taxation rules, and capital restrictions, which can complicate arbitrage trades and increase costs.

Costs and Constraints

Transaction costs such as brokerage fees, exchange fees, taxes, and bid-ask spreads significantly influence the viability of cross-market arbitrage. Even a seemingly attractive price difference can become unprofitable once these costs are considered.

Additionally, capital requirements can be high, as traders must maintain positions in multiple markets simultaneously. Margin rules and leverage limits may further constrain strategy implementation.

Market Impact and Importance

Cross-market arbitrage contributes to price discovery and market integration. By narrowing price differences across markets, arbitrageurs enhance transparency and efficiency. This is particularly important in globalized financial systems where capital flows freely across borders.

During periods of market stress, arbitrage opportunities may widen due to panic selling, liquidity shortages, or regulatory disruptions. While this increases potential returns, it also raises risks, making risk management and capital discipline crucial.

Conclusion

Cross-market arbitrage is a sophisticated trading strategy rooted in the fundamental principle of price convergence across markets. While the theoretical concept is straightforward, practical execution requires advanced technology, deep market understanding, and robust risk controls. As global markets continue to integrate and trading becomes increasingly automated, cross-market arbitrage remains a vital mechanism for maintaining efficiency, though opportunities are often fleeting and highly competitive. For skilled traders and institutions, it offers a compelling blend of analytical rigor, speed, and strategic precision.

Option Chain Terms – A Comprehensive Explanation1. Underlying Asset

The underlying asset is the security on which the option contract is based. This could be an equity stock (like Reliance or TCS), an index (such as NIFTY or BANKNIFTY), a commodity, or a currency. All option prices in the option chain are derived from the movement of this underlying asset.

2. Expiry Date

The expiry date is the last date on which an option contract remains valid. After this date, the option either expires worthless or is settled (cash or physical settlement, depending on the contract). Option chains usually show multiple expiries—weekly, monthly, and sometimes quarterly—allowing traders to choose contracts based on their time horizon.

3. Strike Price

The strike price is the predetermined price at which the underlying asset can be bought (in the case of a Call option) or sold (in the case of a Put option). Strike prices are arranged vertically in the option chain, with Calls on one side and Puts on the other. The choice of strike price reflects the trader’s market view and risk appetite.

4. Call Option (CE)

A Call option gives the buyer the right, but not the obligation, to buy the underlying asset at the strike price before or on the expiry date. In the option chain, Call options are typically displayed on the left side. Rising Call premiums often indicate bullish sentiment, while heavy Call writing may signal resistance levels.

5. Put Option (PE)

A Put option gives the buyer the right, but not the obligation, to sell the underlying asset at the strike price before or on expiry. Put options are shown on the right side of the option chain. Increasing Put premiums usually reflect bearish sentiment or demand for downside protection.

6. Option Premium (Last Traded Price – LTP)

The option premium is the price paid by the option buyer to the seller (writer). In the option chain, this is shown as the Last Traded Price (LTP). The premium consists of intrinsic value and time value and fluctuates based on factors like underlying price, volatility, time to expiry, and interest rates.

7. Intrinsic Value

Intrinsic value is the real, in-the-money value of an option.

For a Call option: Intrinsic Value = Underlying Price − Strike Price

For a Put option: Intrinsic Value = Strike Price − Underlying Price

If this value is negative, intrinsic value is considered zero.

8. Time Value

Time value is the portion of the option premium beyond intrinsic value. It represents the possibility that the option may gain value before expiry. Time value decreases as expiry approaches, a phenomenon known as time decay or theta decay.

9. Open Interest (OI)

Open Interest refers to the total number of outstanding option contracts that have not been settled or closed. High OI indicates strong participation and liquidity at that strike price. Traders analyze changes in OI to understand whether new positions are being created or old ones are being unwound.

10. Change in Open Interest (ΔOI)

Change in Open Interest shows the increase or decrease in OI compared to the previous trading session.

Rising OI with rising price suggests strong trend continuation.

Rising OI with falling price indicates bearish buildup.

Falling OI suggests position unwinding.

11. Volume

Volume represents the number of option contracts traded during a particular trading session. High volume signals active trading interest and often precedes strong price movements.

12. Implied Volatility (IV)

Implied Volatility reflects the market’s expectation of future price fluctuations in the underlying asset. Higher IV means higher option premiums, while lower IV results in cheaper options. Traders closely track IV to decide whether options are expensive or cheap.

13. Bid Price and Ask Price

Bid Price: The highest price a buyer is willing to pay for an option.

Ask Price: The lowest price a seller is willing to accept.

The difference between them is called the bid-ask spread, which indicates liquidity.

14. At-the-Money (ATM), In-the-Money (ITM), Out-of-the-Money (OTM)

ATM: Strike price closest to the current underlying price.

ITM: Options with intrinsic value.

OTM: Options with no intrinsic value.

These classifications help traders select appropriate strikes.

15. Greeks in Option Chain

Some option chains also display Option Greeks, which measure sensitivity:

Delta: Sensitivity to underlying price changes

Gamma: Rate of change of Delta

Theta: Time decay

Vega: Sensitivity to volatility

Rho: Sensitivity to interest rates

Conclusion

An option chain is far more than a list of prices—it is a powerful analytical tool that reveals market psychology, support and resistance levels, volatility expectations, and trading opportunities. By understanding option chain terms such as strike price, open interest, implied volatility, and option Greeks, traders can make informed decisions, manage risk effectively, and build well-structured option strategies. Mastery of option chain terminology is a foundational step toward successful options trading.

PART 2 TECHNNICAL VS. INSTITUTIONALA. Strike Price

The strike price is the predetermined price at which the buyer can buy (CE) or sell (PE) the underlying.

Example:

Nifty Spot = 22,000

You buy Nifty 22,100 CE, meaning you can buy Nifty at 22,100.

B. Premium

Premium is the price you pay (buyer) or receive (seller) to enter the contract. Option prices change based on demand, volatility, time, and underlying movement.

C. Expiry

Options do not last forever. Every option expires:

Weekly (Most popular in Nifty/Bank Nifty)

Monthly

Quarterly (some stocks)

Yearly (LEAPS) in some markets

At expiry, the option will either:

Become In the Money (ITM) → It has intrinsic value.

Become Out of the Money (OTM) → It becomes worthless.

XAUUSD (Gold) | Bullish vs Bearish SetupS | 23rd Jan'2026XAU/USD – Key Levels (23 Jan 2026)

Resistance:

* R1: 4975–4985 → Near-term supply

* R2: 5000–5015 → Psychological breakout zone

Support:

* Pivot / Demand Zone: 4940–4955 → Intraday balance

* Primary Support: 4920–4940 → Trend bullish above

* Secondary Support: 4880–4900 → Strong swing support

* Trend Invalidation: 4850 → Break weakens bullish trend

Bullish Swing Setup

* Buy on Dip: 4920–4940 | SL: 4900 | Targets: 4975 → 5000 → 5015

* Breakout Buy: Above 4985 | SL: 4955 | Targets: 5000 → 5030 → 5050

Bearish Swing Setup (Corrective)

* Pullback Sell: Below 4920 | SL: 4940 | Targets: 4880 → 4850 → 4820

* Trend Shift Sell: Break below 4850 | SL: 4880 | Targets: 4800 → 4760

PART 1 TECHNNICAL VS. INSTITUTIONAL What Are Options?

Options are financial derivatives—meaning their value is derived from an underlying asset such as stock, index, commodity, etc. They are contracts between two parties: the option buyer and the option seller (writer).

There are two types of options:

Call Option (CE) – Right to buy the asset at a fixed price.

Put Option (PE) – Right to sell the asset at a fixed price.

The key point:

The buyer has a right but no obligation. The seller has an obligation but no rights.

Data Centre & Semiconductor Theme Trading A Deep-Dive for Market Participants

The data centre and semiconductor theme has emerged as one of the most powerful structural trades of the decade. It sits at the intersection of AI, cloud computing, digitalization, electrification, and geopolitics, making it a multi-year secular opportunity rather than a short-term cyclical play. For traders and investors, this theme offers momentum bursts, relative-value trades, and long-term compounding stories—if approached with the right framework.

1. Why This Theme Matters

At its core, every digital action—AI inference, cloud storage, video streaming, fintech transactions, autonomous driving—ultimately ends up in data centres powered by semiconductors.

Think of the chain as:

AI / Cloud Demand → Data Centres → Chips → Equipment → Power & Cooling

This creates a stacked value chain where multiple listed companies benefit simultaneously, but at different points in the cycle. Theme trading is about identifying which layer is leading and which is lagging.

2. Structural Demand Drivers

a) Artificial Intelligence Explosion

Generative AI, LLMs, and enterprise AI workloads are orders of magnitude more compute-intensive than traditional applications.

Training AI models requires high-end GPUs / accelerators

Inference workloads demand low latency, high bandwidth memory

AI data centres consume 2–4× more power than traditional centres

This directly fuels demand for:

Advanced semiconductors

Memory (HBM, DRAM)

Networking chips

Power management ICs

b) Cloud & Hyperscale Capex Cycles

Hyperscalers (AWS, Azure, Google, Meta) invest in multi-year capex waves. When capex accelerates:

Semiconductor orders surge first

Data centre construction follows

Cooling, power, and networking companies benefit later

Traders track capex guidance as a leading indicator.

c) Digital Sovereignty & Geopolitics

Governments want domestic chip manufacturing for security reasons:

US CHIPS Act

EU Chips Act

India Semiconductor Mission

This adds a policy-driven floor to semiconductor demand, even during economic slowdowns.

3. Key Segments Within the Theme

a) Semiconductor Designers (High Beta Leaders)

These companies design chips but outsource manufacturing.

Traits

Highest operating leverage

Strong momentum during AI upcycles

Sharp drawdowns during corrections

Trading View

Best for momentum and breakout strategies

Sensitive to earnings surprises and guidance

b) Foundries & Manufacturers

Companies that actually fabricate chips.

Traits

Capital intensive

Long-term contracts

Less volatile than designers

Trading View

Suitable for swing trades around utilization rates

React strongly to capex and yield improvement news

c) Semiconductor Equipment & Materials

They supply lithography, etching, deposition, chemicals, and wafers.

Traits

Benefit before chips are sold

Orders lead end-market demand by 2–4 quarters

Trading View

Ideal for early-cycle positioning

Strong relative performance when capex cycles turn up

d) Data Centre Infrastructure & REITs

Includes:

Data centre builders

Power distribution

Cooling systems

Data centre REITs

Traits

More stable cash flows

Yield + growth combination

Trading View

Better for positional and defensive thematic trades

Outperform during rate cuts or stable macro environments

4. How Theme Trading Actually Works

a) Momentum Phase Trading

When AI or cloud narratives dominate headlines:

Leaders break out of long consolidations

Volume expansion confirms institutional participation

Indicators used

Relative strength vs index

20/50-DMA trend alignment

Sectoral ETF flows

b) Rotation Trades Inside the Theme

Not all sub-segments lead together.

Typical rotation:

Chip designers lead

Equipment stocks catch up

Data centre infra plays follow

Power & cooling benefit last

Advanced traders rotate capital within the theme, not out of it.

c) Mean Reversion & Pullback Buying

Even strong secular themes correct 20–30%.

High-probability setups:

Pullbacks to rising 50-DMA

RSI reset without trend break

Volume contraction during corrections

5. Valuation vs Growth: The Constant Debate

Semiconductor and data centre stocks often look expensive on traditional metrics.

Key point:

In secular tech cycles, earnings catch up to price, not the other way around.

Smart traders:

Focus on forward earnings revisions

Track order backlog growth

Watch capex-to-revenue ratios

Overvaluation becomes a risk only when growth decelerates.

6. Macro Risks to Watch

a) Interest Rates

Data centres are capital-intensive

Higher rates compress valuations, especially REITs

b) Cyclical Slowdowns

Consumer electronics downturns affect legacy chip demand

AI demand may offset but not fully eliminate cyclicality

c) Supply Chain Bottlenecks

Advanced nodes depend on few suppliers

Delays can cause earnings volatility

7. India Angle in This Theme

India is becoming relevant in:

Data centre construction (cloud, fintech, OTT demand)

Semiconductor assembly, testing, and packaging (ATMP)

Power infrastructure and cooling solutions

Indian traders often use:

Global semiconductor indices as trend indicators

Domestic infra & power plays as satellite trades

This creates cross-market correlation opportunities.

8. Portfolio Construction for Theme Traders

A balanced approach:

40% Momentum Leaders – High beta semiconductor names

30% Enablers – Equipment, power, cooling

20% Stability – Data centre REITs / infra

10% Tactical Cash – For sharp corrections

Risk management is critical because these stocks move together during risk-off phases.

9. Why This Is a Multi-Year Trade

Unlike past tech cycles, this theme is supported by:

AI workload explosion

Government policy support

Long-duration capex visibility

Structural digital dependency

This makes the data centre & semiconductor trade closer to an “infrastructure cycle” than a traditional tech boom.

10. Final Takeaway

Data centre and semiconductor theme trading is not about picking one stock—it’s about understanding the ecosystem and riding capital flows. The biggest edge comes from:

Identifying which layer is leading

Entering during healthy pullbacks

Rotating within the theme rather than abandoning it

For traders who respect trend structure and manage risk, this theme remains one of the cleanest, most powerful opportunities of the current decade.

NIFTY : Intraday Trading levels and Plan for 23-Jan-2026📘 NIFTY Trading Plan – 23 Jan 2026

Timeframe: 15-Minute

Gap Considered: 100+ Points

Market Context: After a sharp intraday recovery from lower levels, NIFTY is now approaching a key decision-making zone. Trend is still corrective, with range expansion possible on either side.

🔼 SCENARIO 1: GAP UP OPENING (100+ points) 🚀

If NIFTY opens above 25,498, it indicates follow-through buying and short-covering.

The zone 25,498 – 25,537 will act as the first opening resistance.

Sustained 15-min close above 25,537 can trigger momentum toward:

• 25,666 – 25,718 (Last Resistance Zone)

Above 25,718, trend strength improves and fresh longs may emerge.

Failure to sustain above 25,498 = high probability of rejection and pullback.

📌 Educational Insight:

Gap-up openings near resistance often trap late buyers. Confirmation is mandatory before aggressive longs.

📌 Options View:

• Bull Call Spread preferred over naked CE

• Partial profit booking near resistance

• Avoid chasing premiums 🚀

➡️ SCENARIO 2: FLAT / RANGE OPENING ⚖️

If NIFTY opens between 25,301 – 25,378, expect range-bound and whipsaw price action.

This zone acts as a No-Trade Zone / Balance Area.

Multiple fake breakouts are likely.

Upside confirmation only above 25,498.

Downside weakness below 25,301.

Wait for a 15-min close outside the range before taking trades.

📌 Educational Insight:

Flat opens after volatile sessions usually lead to time correction, not directional moves.

📌 Options View:

• Iron Fly / Short Strangle with strict SL

• Low quantity & fast exits

• Protect capital over profits ⏳

🔽 SCENARIO 3: GAP DOWN OPENING (100+ points) 📉

If NIFTY opens below 25,301, sellers regain short-term control.

Immediate support lies near 25,177.

Break below 25,177 opens downside toward:

• 25,031 – 25,077 (Last Intraday Support)

Below 25,030, bearish momentum can accelerate.

Any pullback toward 25,301 – 25,378 should be treated as sell-on-rise.

📌 Educational Insight:

Gap-down opens demand patience — let volatility settle before initiating trades.

📌 Options View:

• Bear Put Spread preferred

• Avoid PE selling in falling markets

• Trail stop-loss aggressively 📉

🧠 Risk Management Tips for Options Traders 🛡️

Risk only 1–2% of capital per trade.

Expiry proximity = faster theta decay.

Prefer spreads over naked options.

No candle confirmation = no trade.

Avoid overtrading inside no-trade zones.

📌 Summary & Conclusion ✨

NIFTY is trading near a critical equilibrium zone.

📍 25,301 – 25,378 = decision area

📍 Strength only above 25,498 → 25,718

📍 Weakness below 25,301 → 25,177 → 25,030

Patience, discipline, and level-based execution will be key for 23 Jan.

⚠️ Disclaimer

This analysis is strictly for educational purposes only.

I am not a SEBI registered analyst.

Markets are uncertain and I may be wrong.

Please consult your financial advisor before trading.

AXISBANK 1 Week Time Frame 📈 Current Price Context

Axis Bank is trading around ₹1,300–₹1,305 range recently.

🔑 1‑Week Pivot & Key Levels

These levels are commonly used by traders to identify likely reversal zones or breakouts for the week ahead:

🔥 Weekly Resistance (Upside Targets)

1. R1: ~₹1,317–₹1,320 – First resistance zone this week.

2. R2: ~₹1,341–₹1,342 – Next resistance zone if bullish momentum continues.

3. R3: ~₹1,370+ (approx) – Major higher resistance for breakout scenario.

👉 Bullish condition: Week closes above ₹1,317–₹1,320 with volume → look for extended upside moves toward ₹1,340+.

🛡️ Weekly Support (Downside Floors)

1. S1: ~₹1,262–₹1,265 – Near‑term support for the week.

2. S2: ~₹1,230 – Mid‑range support if breakdown below first support happens.

3. S3: ~₹1,206 – Broader downside support level.

👉 Bearish condition: Cleared break below ₹1,262–₹1,265 may accelerate downside toward ₹1,230 → ₹1,206.

📊 Support/Resistance (Pivot‑Based Technical)

From short‑term pivot derivations (daily/weekly calculations):

Resistance

R1: ~₹1,306–₹1,307

R2: ~₹1,319–₹1,320

R3: ~₹1,329–₹1,330

Support

S1: ~₹1,284–₹1,285

S2: ~₹1,274–₹1,275

S3: ~₹1,261–₹1,262

These extra pivot levels (especially R1/R2/S1/S2) help fine‑tune next day or mid‑week entries.

📌 How to Use This Weekly Level View

📈 Bullish Scenario

Hold above ₹1,317–₹1,320 zone

Short‑term resistance becomes support on breakout

Targets → ₹1,340 → ₹1,373+

📉 Bearish Scenario

Close below ₹1,262–₹1,265

Potential decline toward ₹1,230 → ₹1,206 zones

📊 Consolidation Range

If price stays between ₹1,262–₹1,320 → expect range‑bound trading for the week.