Part 5 Advance Option Trading Strategies Risks in Option Trading

Options offer high rewards, but also involve risks if not used carefully.

1. For Option Buyers

High time decay (theta loss daily)

Need strong, fast movement

2. For Option Sellers

Unlimited risk (if naked selling)

High margin requirement

Volatility spikes kill profits

3. Liquidity Risk

Wide bid-ask spreads reduce profit potential.

4. Event Risk

News announcements can cause unpredictable moves.

Trend Analysis

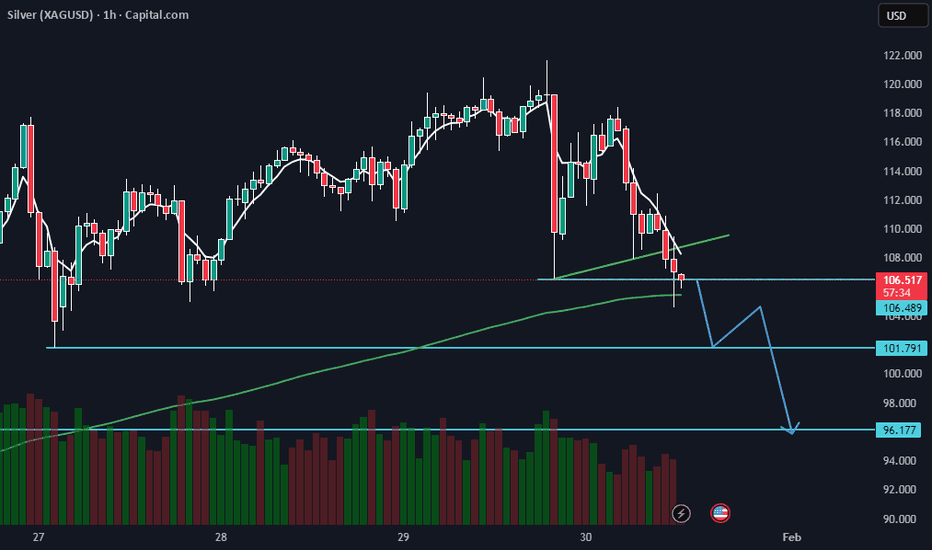

SILVER (XAGUSD) 1HRSWING TRADE

- EARN WITH ME DAILY 10K-20K –

SILVER (XAGUSD) Looking good for Downside..

When it break level 106.86 and sustain.. it will go Downside...

SELL @ 106.86

Target

1st 101.79

2nd 96.177

Enjoy trading traders.. Keep add this STOCK in your watch list..

Big Investor are welcome..

Like this Post??? Hit like button..!!!

Follow me for FREE Educational Post and Alert..

Advance Trade Setup - KSCLKaveri Seed Company Ltd

BSE : 532899

NSE : KSCL

💡 Liked the idea?

Then don’t forget to Boost 🚀 it!

Comments are Most Welcome

Techincal Setup Details

LTP 818.00

VRVP

RSI

LinReg

VRVP :

The Visible Range Volume Profile (VRVP) indicator, often referred to as VPVR, displays trading volume by price rather than time, specifically for the visible chart area. The Value Area High (VAH) is the upper boundary of the price range where a significant percentage (default 70%) of volume occurs, acting as a crucial resistance or support level.

Significance of VAH:

Resistance : When prices are below or approaching the VAH, it often acts as resistance, signaling a potential pullback.

Support : In an upward trend, a breakthrough above the VAH can signal a continuation, turning the former VAH into support.

Trading VAH with VRVP:

Range Trading : If the price is within the VAH (Value area High) & VAL (Value area Low), it suggests a range-bound market. Sellers often enter near the VAH.

Trend Identification : A price moving well above the VAH indicates strong bullish sentiment, while price staying below the VAH suggests bearish sentiment.

RSI :

The Relative Strength Index (RSI) is a momentum oscillator ranging from 0 to 100 that measures the speed and change of price movements to identify overbought (>70) or oversold (<30) conditions. It helps traders detect potential trend reversals or corrections.

Linear Regression Channel :

The Linear Regression Indicator (LRI) is a technical analysis tool that fits a straight line, known as the "least squares regression," to a specific number of price bars (e.g., closing prices) to identify the current trend. It plots the final, predicted value of this regression line, acting as a responsive, noise-filtering alternative to moving averages that indicates where price "should" be

Purpose: Identifies trend direction, potential reversals, and acts as dynamic support/resistance

I've extended the Indicator/Lines on the Right so that when the actual reversal happens, it easy to go with the flow, will be a Helping hand.

In the Current Scenario # KSCL

VAH is @ 740

Price has Broken LinReg Lower Deviation # Channel Broken, which means we can expect further weakness

RSI is @ 30 odd with Bearish signal still ON

Why this idea is Titled as ADVANCE TRADE SETUP, because we must understand that further weakness is expected & we also need to know well in advance whats the BEST possible price to enter for a Decent RR Ratio

LTP stands @ 818

once its below 760 mark, start adding in tranches till 690 Levels

There is one important point that needs to be highlighted.

KSCL operates in the seed business, which is largely driven by the monsoon cycle.

If you look at its balance sheet, you’ll notice a clear revenue swing around June, and historically, the stock price also reacts during the March–June quarter.

As of now, we are nearing the end of January.

Till mid-March, we may get opportunities to accumulate the stock near the above-mentioned best buy zone.

Once the position is in place, the idea is to hold for an upswing, which could range between 40% to 80%, and possibly more.

Stop-loss (closing basis):

• ₹620 / ₹590

Important Note:

This idea is being shared well in advance.

All price levels mentioned are assumptions and expectations, meant only for guidance.

Actual prices may vary by ±10% to 15%.

Members are advised to act based on real-time market behavior and their own judgment.

Plan patiently. Execute with discipline.

For more insights & trade ideas,

📲 Visit my profile and hit Follow

Warm regards,

Naresh G

SEBI Registered Research Analyst

💬 Comment below if you want me to analyse any stock for you 🔍

If You Want to Catch the Bottom, First Wait for RSI.To Do Nothing.

Right now, staying out is already a win.

The market is moving fast, noisy, and uncomfortable. Both buyers and sellers are getting trapped — not because direction is unclear, but because the market has not finished its process yet.

This is a moment to stay calm and observe, not to force a trade.

Observe how price begins to slow down.

Observe how selling pressure fades.

Note:

Stay focused on RSI behavior. When price decelerates and RSI shows clear convergence / stabilization, that’s when it makes sense to start thinking about potential long ideas — not before.

Until then, observation comes first.

Sometimes, doing nothing is the most disciplined decision you can make.

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Resistance Breakout in MTARTECH

BUY TODAY SELL TOMORROW for 5%

XAUUSD – H2 Technical AnalysisXAUUSD – H2 Technical Outlook: Short-Term Sell Pressure as Liquidity Gets Cleared | Lana ✨

Gold is showing signs of short-term weakness after an aggressive upside expansion. Price action suggests the market may continue to move lower in the near term, not as a trend reversal, but as a liquidity-driven correction within a broader bullish structure.

At this stage, the focus shifts from continuation to how price behaves while liquidity is being taken below structure.

📈 Market Structure & Price Behavior

The recent vertical rally has left the market overextended, making a corrective phase technically healthy.

Price has broken below short-term support and is now trading under a descending corrective trendline, signaling short-term bearish pressure.

This type of structure often develops when the market needs to clean buy-side positions before rebuilding for the next leg.

While the higher-timeframe trend remains bullish, the intraday bias has shifted to corrective / bearish until liquidity objectives are met.

🔍 Key Liquidity Zones on the Chart

Short-term sell zone: the descending trendline near current price As long as price reacts below this trendline, rallies are more likely to be sold.

Scalping buy liquidity: around 5050–5070 This area may generate temporary bounces, but reactions here should be treated as short-term only.

Key bullish order block: 4825 – 4830 A critical zone where stronger buyer participation may appear if the sell-off extends.

Major swing liquidity zone: 4613 – 4625 This is a high-confidence liquidity pocket where the market could complete a deeper correction and reset the broader bullish structure.

🎯 Trading Scenarios

Primary scenario – Continuation of the pullback: As long as price remains below the descending trendline, gold may continue to move lower to sweep liquidity below recent lows. This favors sell-on-rallies rather than buying strength.

Secondary scenario – Temporary reaction: Short-term bounces may occur around the 5050–5070 area, but without structural reclaim, these moves are more likely corrective than trend-changing.

Structural defense scenario: If price reaches the 4825–4830 or 4613–4625 zones, watch closely for signs of stabilization and absorption, which would signal that the liquidity objective has been completed.

🧠 Lana’s View

This move lower is best seen as liquidity cleanup, not panic selling. Lana stays patient during corrective phases, avoiding early longs and waiting for price to reach clear liquidity zones before reassessing bullish continuation.

✨ Let the market take what it needs, then look for structure to rebuild.

XAUUSD 30 MIN T/F ANALYSIS---

📊 Market Structure Explanation (Gold – 30 Min)

The price show heavy selling so we can measure recent top supply and copy it

after retesting we can measure from retesting top and past previous supply and match current supply so supply will be completed --

🔍 What the market can do next:

Scenario 1 – Pullback / Reversal (Needs Confirmation):

For any meaningful reversal to occur, the market must first show clear bullish candlestick confirmation.

This includes patterns such as:

bullish engulfing candles

Strong rejection wicks (lower shadows)

morning star formations

Consecutive bullish closes

Short lower-wick rejection candles showing bullish pressure

Without these bullish structures, any upside move should be treated as a temporary pullback, not a reversal.

Scenario 2 – Continuation:

If sellers stay strong and bullish confirmation does not appear, price can break down this zone and continue lower with another impulsive bearish move.

Scenario 3 – Range formation:

Market may form a small sideways structure near this level before choosing a clear direction.

🧭 Summary:

The trend is bullish, but price is at a sensitive support zone.

Reversal is only valid if bullish candlestick patterns and bullish pressure appear.

Otherwise, the structure favors continuation or short-term consolidation before the next move.

Gold 4900/4hJust like silver, i see gold coming down to check 5000 levels or maybe 4900. Logic is simple too bullish too soon, without forming base. 8 continuous green candles on 1D, now finally a red doji and today broke that doji. So there might be some fake bullishness.

Be vigilant but remember everything is possible.

#All this is my view not a financial advise.

Silver Down to 90/4hAlthough we saw a good correction here, around -10% today. Somewhat somewhere i see silver moving further down to 90 levels (might come to check the old channel).

Well we could also see some buying here as it is bottom of its yellow channel(current), just to trap people in fomo bullishness.

My long term view is, I am still bullish, year end 200$+. But right now dont go all in, keep risk management and money management tight. Remember, Anything can happen.

#My views not a financial advice.

INDIANB 1 Month Time Frame 📌 Current Price Context (as of latest trading)

Indian Bank is trading near ₹910–₹920 levels on NSE.

📈 1‑Month Key Resistance Levels (Upside)

These are the levels where price may face selling pressure or reversal if bulls weaken:

R1 — ₹918–₹920 — immediate resistance area just above current trade.

R2 — ₹927–₹930 — secondary resistance zone.

R3 — ₹935–₹940 — further upside resistance zone for continuation moves.

Summary: Immediate upside capped around ~₹918–₹930. Break and close above this band can signal stronger bullish continuation.

📉 1‑Month Key Support Levels (Downside)

Important levels that can act as rebound zones on pullbacks:

S1 — ~₹880–₹885 — first meaningful support near recent swing lows.

S2 — ~₹860–₹865 — secondary support from broader short‑term structure.

S3 — ~₹830–₹835 — major zone where bigger trend buyers may step in.

Summary: Minor supports start ~₹880, stronger support cluster around ~₹860‑₹835.

📊 Pivot / Neutral Reference

Pivot around ~₹907–₹910 — current central reference area.

Price above pivot suggests bullish bias, below could tilt neutral to bearish within the month.

📌 Interpretation For 1‑Month View

Bullish scenario:

Holds above ₹900–₹910 pivot → targeting ₹927–₹940 zone.

Neutral / consolidation:

Trading between ₹880–₹910.

Bearish risk:

Break below ₹860–₹845 could open deeper correction toward ₹830.

Trump speaks tonight — Gold at decision point.Market Context (H1–H4)

Gold remains in a broader bullish structure, but short-term price action has shifted into a decision phase after rejecting ATH. The sharp drop created a displacement leg, followed by a corrective bounce — typical post-event behavior.

Structurally:

HTF trend is still upward (ascending channel intact)

No confirmed HTF bearish reversal yet

Current move looks like rebalancing, not trend failure

Fundamental Context

Trump’s speech tonight is the key volatility trigger

Any geopolitical / USD-impacting rhetoric can cause:

A liquidity sweep before direction

Or a direct continuation if risk-off sentiment returns

Market is likely positioning → expect fake moves before clarity

Technical Breakdown

ATH: recent distribution, not yet reclaimed

FVG (upper): potential reaction zone for sellers if price rallies

Mid Zone (~5090–5120): short-term decision / balance area

Strong Demand (~4980–5000): HTF buy zone, aligns with trendline & prior BOS base

Trading Scenarios (If–Then)

If price holds above 5090–5120 → look for continuation into FVG, then ATH test

If price sweeps below 5090 but reclaims → classic liquidity grab → BUY continuation

If price breaks and holds below 5000 (H1 close) → deeper pullback, bullish bias pauses (not flips yet)

Key Takeaway

This is not the place to chase.

Trade reactions, not headlines.

Let Trump speak → let liquidity show → then follow structure.

Bias: Bullish continuation unless strong demand fails.

Gold Rejected at High – Sellers Take Control🔴 What the chart is saying NOW

Big rejection from 5600

Sharp breakdown below 5500

Structure shifted from bullish flag → bearish continuation

Current price ~5196

Lower high + lower low = trend flip intraday

This is distribution → breakdown, not a dip-buy anymore.

🧠 Market Bias (important)

Below 5250 = Sell on rise

Bulls invalidated for intraday

Only bounce trades, no blind buys

✅ If you want a FRESH TRADE idea (optional)

Sell below 5230

Targets: 5150 → 5080

SL: 5285

Entry setup11Before Trade Entry Follow the Step:-(check list)

Step 1:- Identify the Trend

Step 2:- Bullish Trend Wait for Support Price & Reversal Candlestick(Take Buy)

Step 3:- Bearish Trend Wait for Resistance & Reversal Candlestick(Take Sell)

Step 4:- Fibonacci retracement confirm

Step 5:- Wait for Reversal candlestick

My Trading Role:-

1. Don't Lose capital

2. Trade less Earn More

Focus On:-

1. Quality Trades

2. Risk Management

3. Self - Discipline

RISK WARNING:- All trading involves risk. Only risk capital you're prepared to lose. This chart has not given any investment advice, only for educational purposes

Part 1 Institutional VS. Technical

Key Components of Options- Underlying Asset: The security (stock, index, etc.) the option is based on.

- Strike Price: The price at which the underlying asset can be bought or sold.

- Expiry Date: The last day the option can be exercised.

- Premium: The price of the option contract.

VEDL 1 Day Time Frame 📊 Key Daily Price Levels (NSE)

(Current price context — road-tested from multiple live feeds)

⛳ Pivot & Intraday Reference (Daily pivot is the key bias level)

• Daily Pivot: ~₹685 – ₹719 region (major pivot range varies by source)

📈 Resistances (Upside Levels)

• R1: ~₹725 – ₹730 zone — initial resistance for bulls today

• R2: ~₹738 – ₹751 — stronger barrier area where sellers may step in

• R3: ~₹760 – ₹803 (higher overhead zone) — breakout target if momentum is strong

📉 Supports (Downside / Bounce Zones)

• Immediate Support: ~₹700 – ₹710 (near today’s intraday low mid-range)

• Next Support: ~₹689 – ₹690 (lower circuit boundary / near recent low)

• Deeper Support Zones: ₹665-₹660 cluster — a demand zone if price slips further

📌 What Today’s Price Action Looks Like

• Currently trading in a wide intraday range ~₹695–₹755 today on NSE — volatile with a broadened circuit range of ₹689.75 (LC) to ₹842.95 (UC).

• The stock has been in strong short-term uptrend, but faces selling pressure near upper resistances — this suggests cautious profit-booking near R1-R2 unless breakout with volume confirms strength.

📊 Technical Indicator Context (Daily)

⚡ RSI/oscillators on some providers show overbought conditions on short timeframe, indicating possible pullbacks if resistance holds.

Key Levels to Use for Stops/Entries:

Stop-loss (for long trades): below ₹689 (intraday structural support).

Aggressive breakout entry: above ₹738-₹750 (for momentum play).

Support test entry: near ₹700-₹690 (with tight stop).

GOLD FUTURERS :Shooting star Candle shows exhaustion Buy on DipsGOLD Futurers : It has formed a Shooting Star at resistance shows exhaustion at higher levels. Expect a pullback towards 158000-151000.

Trend for Gold MCX remains bullish, but a Shooting Star at resistance signals a short-term pullback

As per Fib retracement and EMA Levels i will be a buyer at the following levels 1. At Between 10 EMA: 157,735-20 EMA: 150,960 zone -part

2.At 50% Fib retracement levels of around 1,39,000-Aggressive buy

For educational purpose only)

Two Very Different Futures for Bitcoin Two Very Different Futures for Bitcoin 🔥

Don’t skip this one - the monthly chart decides

Bitcoin is approaching a critical decision zone on the monthly timeframe — one that could shape market behaviour well beyond short-term volatility.

From a structural and macro lens, a few developments stand out clearly:

1. Major supply has been swept, suggesting late-stage participation at higher levels

2. The long-term monthly trendline has been decisively broken

3. Price retested the broken trendline and has since started to roll over — a classic structural shift

4. A clearly defined demand zone between 48K–64K now sits below current price

5. This zone aligns with the 50-period EMA, strengthening it as a potential reaction area

Two macro-consistent paths emerge from here:

Scenario 1 (Higher probability):

Bitcoin retraces into the 48K–64K demand zone, finds support near the 50 EMA, and then resumes its broader bullish trajectory — eventually targeting liquidity above prior all-time highs (~125K).

This would represent a structural reset within a larger bullish cycle, consistent with historical behaviour during expansionary phases.

Scenario 2 (Lower probability, higher impact):

Bitcoin tests the same demand zone but fails to hold, leading to continued downside and a deeper move toward the long-term trendline low near ~18K.

This outcome would likely require a material macro trigger — tighter global liquidity, regulatory shocks, or a broader risk-off event. Less probable, but not dismissible.

Sharing this as a macro-structural study, not a directional call.

Analysis only. Not investment advice.

XAUUSD (H1) – Liam PlanUptrend intact, but signs of short-term exhaustion | Trade reactions, not impulse

Quick summary

Gold remains in a strong H1 uptrend, continuing to print higher highs and higher lows within a well-defined bullish structure. However, after the recent sharp advance, price is starting to slow near the highs, increasing the likelihood of short-term pullbacks and two-sided price action.

➡️ The broader trend stays bullish, but execution should now be level-driven and reaction-based, not momentum chasing.

Technical view

Price is currently trading at elevated levels relative to recent structure, where prior buying activity has already been absorbed.

Key price areas to watch:

Short-term sell area: 5520 – 5530

Upper resistance area: around 5600

Pullback buy area: 5405 – 5420

Primary buy zone: 5150 – 5155

The current structure favors a pullback and rebalancing phase before any sustained continuation higher.

Trading scenarios

SELL – short-term reaction trades

Look for sell reactions around 5520 – 5530 if price shows weakness.

Downside targets sit near 5420, with further extension possible if the pullback develops.

These sells are tactical and short-term, not calls for a trend reversal.

BUY – aligned with the main trend

Primary scenario

Buy pullbacks into 5405 – 5420 if the area holds.

Targets back toward 5520 and higher.

Deeper scenario

If volatility increases, wait for price to retrace toward 5150 – 5155.

This area offers the best risk-to-reward for trend continuation.

Key notes

Strong trends still correct; patience matters.

Avoid entries in the middle of the range where risk outweighs reward.

Short positions are tactical only while the broader structure remains bullish.

What’s your plan:

selling reactions near 5520 – 5530, or patiently waiting for a pullback into 5405 – 5420 to rejoin the uptrend?

— Liam