Market Structure & Types of MarketsWhat Is Market Structure?

Market structure refers to the overall organization and behavior of a market. It explains how prices are formed, how trades occur, who participates, and how efficiently information is reflected in prices. Market structure influences liquidity, volatility, transaction costs, and transparency.

In financial markets, market structure is shaped by:

Number of buyers and sellers

Degree of competition

Availability of information

Entry and exit barriers

Trading mechanisms and regulations

Understanding market structure is especially important for traders because price movements, trends, and reversals are directly influenced by it.

Key Elements of Market Structure

1. Price Discovery

Price discovery is the process by which market prices are determined based on supply and demand. Efficient markets quickly reflect new information such as earnings, economic data, or geopolitical events.

2. Liquidity

Liquidity refers to how easily an asset can be bought or sold without significantly affecting its price. High liquidity means tighter bid-ask spreads and smoother price movements.

3. Volatility

Volatility measures the degree of price fluctuations. Certain market structures encourage stability, while others allow sharp price swings.

4. Transparency

Transparency indicates how easily participants can access information related to prices, volumes, and orders.

Types of Market Structure (Based on Competition)

1. Perfect Competition

In a perfectly competitive market:

There are many buyers and sellers

No single participant can influence prices

Products are homogeneous

Information is freely available

Although perfect competition is rare in financial markets, highly liquid markets like major forex pairs (EUR/USD) come close to this structure.

2. Monopoly

A monopoly exists when:

There is only one seller

High entry barriers exist

The seller controls pricing

In financial markets, pure monopolies are uncommon, but some exchanges or clearing corporations may show monopolistic characteristics due to regulatory control.

3. Oligopoly

An oligopoly involves:

A few dominant participants

High entry barriers

Interdependence among players

Investment banking, credit rating agencies, and large institutional trading often reflect oligopolistic structures.

4. Monopolistic Competition

This structure has:

Many sellers

Differentiated products

Moderate competition

Mutual funds, portfolio management services, and financial advisory firms operate under monopolistic competition.

Types of Markets (Based on Function)

1. Capital Market

The capital market deals with long-term funds and securities. It is divided into:

a) Primary Market

New securities are issued

Companies raise capital through IPOs, FPOs

Investors buy directly from issuers

b) Secondary Market

Existing securities are traded

Includes stock exchanges like NSE and BSE

Provides liquidity and price discovery

2. Money Market

The money market deals with short-term funds (up to one year).

Instruments include:

Treasury bills

Commercial papers

Certificates of deposit

Call money

Money markets are used by banks, financial institutions, and governments to manage short-term liquidity.

3. Derivatives Market

The derivatives market trades instruments whose value is derived from an underlying asset such as stocks, indices, commodities, or currencies.

Common derivatives include:

Futures

Options

Swaps

This market is widely used for hedging, speculation, and arbitrage.

4. Commodity Market

Commodity markets facilitate trading in physical goods like:

Gold, silver

Crude oil, natural gas

Agricultural products

They help producers and consumers manage price risk and ensure efficient allocation of resources.

5. Forex (Currency) Market

The forex market enables trading of currencies.

Key features:

Largest financial market in the world

Operates 24 hours

Highly liquid and decentralized

It plays a vital role in international trade and capital flows.

Types of Markets (Based on Market Conditions)

1. Bull Market

A bull market is characterized by:

Rising prices

Strong investor confidence

Economic growth

Investors focus on buying opportunities, trend-following strategies, and long-term investments.

2. Bear Market

A bear market shows:

Falling prices

Pessimism and fear

Weak economic indicators

Traders prefer short selling, defensive stocks, and capital preservation strategies.

3. Sideways or Range-Bound Market

In this market:

Prices move within a fixed range

No clear trend

Low volatility

Range trading, options strategies, and mean-reversion approaches work best here.

4. Volatile Market

A volatile market experiences:

Sharp price swings

High uncertainty

News-driven movements

Risk management becomes crucial, and position sizing plays a major role.

Types of Markets (Based on Trading Mechanism)

1. Exchange-Traded Market

Trades occur on regulated exchanges

Transparent pricing

Standardized contracts

Examples: NSE, BSE, CME

2. Over-the-Counter (OTC) Market

Trades occur directly between parties

Customized contracts

Less transparency

Forex forwards and interest rate swaps are common OTC instruments.

Importance of Understanding Market Structure

Understanding market structure helps:

Traders choose appropriate strategies

Investors manage risk effectively

Policymakers regulate markets efficiently

Institutions ensure fair and orderly trading

Market structure also determines how quickly information is reflected in prices, which directly affects profitability.

Conclusion

Market structure and types of markets form the foundation of financial systems. From capital markets and money markets to derivatives and forex, each market serves a unique purpose. Market structure defines how participants interact, how prices are discovered, and how efficiently markets function.

For traders and investors, understanding market structure is not optional—it is essential. It helps in selecting the right instruments, timing entries and exits, managing risk, and adapting strategies to different market conditions. A strong grasp of these concepts leads to better decision-making and long-term success in financial markets.

Trendindicator

Part 1 Technical Vs. Institutional Why Trade Options?

Option trading is preferred because it offers:

Leverage – Control large positions with small capital

Hedging – Protect portfolios against losses

Income Generation – Through option selling

Flexibility – Profit in bullish, bearish, and sideways markets

Defined Risk Strategies – With spreads and hedges

Part 2 Intraday Mater ClassUnderstanding the Basics of Options

1. Underlying Asset

The underlying asset can be:

Stocks (Reliance, TCS, HDFC Bank)

Indices (NIFTY 50, BANK NIFTY)

Commodities, currencies (in broader markets)

The option’s value depends entirely on the price movement of this underlying asset.

2. Types of Options

There are two primary types of options:

Call Option (CE)

A Call Option gives the buyer the right to buy the underlying asset at a fixed price (strike price).

Bought when you expect the market to rise

Profit potential is unlimited

Loss is limited to the premium paid

Put Option (PE)

A Put Option gives the buyer the right to sell the underlying asset at a fixed price.

Bought when you expect the market to fall

Profit potential increases as price falls

Loss is limited to the premium paid

STARHEALTH 1 Week View📌 Current Reference Price: ~₹469 (last session high ~₹478, low ~₹446) (not real‑time).

📊 Weekly Time Frame Levels (Support & Resistance)

🔺 Weekly Resistance Levels

These are areas where price may face selling pressure or pause on upward moves:

R1: ~₹478–₹480 zone — recent short‑term rejection area near high of week.

R2: ~₹492–₹495 — next weekly resistance from pivot projections.

R3: ~₹514–₹516 — extended weekly resistance from standard pivot/levels.

Key Breakout Level:

➡️ Weekly close above ~₹480–₹485 would signal stronger upside continuation on the weekly chart.

🔻 Weekly Support Levels

Important zones where buyers may step in on pullbacks:

S1: ~₹450–₹455 area — near pivot support & intermediate support.

S2: ~₹430–₹435 — broader weekly support cluster.

S3: ~₹408–₹420 — structural support from longer pivot zones.

Key Breakdown Level:

➡️ Weekly close below ~₹430–₹435 could open deeper correction toward the ₹408–₹420 area.

📈 Weekly Pivot Context (Classic/Fibonacci)

From wider pivot calculations for weekly timeframe:

Weekly Pivot (Center): ~₹454–₹460

Weekly Fibonacci Resistances: ~₹478 (R1), ~₹492 (R2)

Weekly Fibonacci Supports: ~₹431 (S2), ~₹393–₹408 range lower support.

This means the current weekly range is roughly ₹430–₹480, with the pivot/cycle zone around ₹454–₹460 providing a reference for bias (bullish above, bearish below).

📌 Weekly Technical Bias

Weekly momentum on some platforms shows mixed/neutral signals (RSI near neutral, price around pivot).

Shorter price action suggests recent rejection near higher levels (~₹478–₹480).

Interpretation:

📌 Bullish weekly view as long as price holds above ~₹450–₹455.

📌 Bearish weekly view if price closes below ~₹430 weekly, which could risk deeper support tests.

Part 2 Intraday Institutional TradingBest Practices for Retail Traders

1. Start with Buying Options

Risk is limited.

2. Prefer ATM or Slight ITM

Better stability, realistic probability.

3. Avoid Holding Overnight

Unless you understand IV, theta, and event risk.

4. Track Implied Volatility

Buy when IV is low, sell when IV is high.

5. Use a Trading Plan

Entry levels

Stop loss

Target

Position size

6. Don’t Chase Cheap OTM Options

They expire worthless most of the time.

Part 4 Institutional VS. Technical1. Delta

Measures how much the premium changes with a ₹1 move in the underlying.

Call delta: +0.0 to +1.0

Put delta: –0.0 to –1.0

High delta = faster premium movement.

2. Gamma

Measures how fast delta changes. Used to evaluate momentum and risk.

3. Theta

Measures time decay—how much premium decreases as expiration approaches.

Sellers benefit from theta.

Buyers lose value daily.

4. Vega

Measures sensitivity to implied volatility (IV).

Higher IV → higher premium.

5. Rho

Impact of interest rates (less important for short-term traders).

PFC 1 Day Time Frame 📌 Current Live Context (Daily)

📊 Approx Live Price: ~₹377‑₹379 (today’s trading range: ₹376 – ₹384) on NSE intraday quotes.

📈 Daily Pivot / Support & Resistance (Reliable Levels)

🔹 Pivot / Reference Zone

Central Pivot (CPR) ~ ₹386.8 area — key reference point for bias (above = bullish bias; below = bearish).

🚀 Resistance Levels (Upside)

R1 ~ ₹390–₹392 — initial resistance near current zone.

R2 ~ ₹394–₹398 — next supply zone.

R3 ~ ₹402–₹406 — stronger resistance on daily view.

Above ₹400 reinforces bullish structure and opens potential next targets up if breakout sustains.

🛑 Support Levels (Downside)

S1 ~ ₹382–₹386 — near‑term support zone (first buyer interest).

S2 ~ ₹378–₹381 — lower support region on daily pivots.

S3 ~ ₹370–₹376 — deeper support zone if price weakens.

Daily bias turns bearish if price closes clearly below the S2/S3 range (~₹378–₹376).

🔎 Quick Technical Bias Notes

Since current price (~₹377‑₹379) is below the pivot/CPR (~₹387), short‑term bias leans slightly bearish to neutral unless bulls reclaim pivot with volume.

A daily close above ~₹398‑₹400 could shift view bullish toward ~₹402+ and beyond.

Part 2 Institutional VS. TechnicalWhat Are Options?

Options are derivative contracts whose value is derived from an underlying asset—such as stocks, indices, commodities, currencies, or ETFs. There are two basic types of options:

1. Call Option

A call option gives you the right to buy the underlying asset at a fixed price (called the strike price) within a specified period.

Traders buy calls when they expect price to rise.

Profit increases as the underlying price moves above the strike price.

2. Put Option

A put option gives you the right to sell the underlying asset at the strike price within a specified period.

Traders buy puts when they expect price to fall.

Profit increases as the underlying price moves below the strike price.

Every option has two key components:

Strike Price: The price at which the asset can be bought/sold.

Expiration Date: When the option becomes invalid.

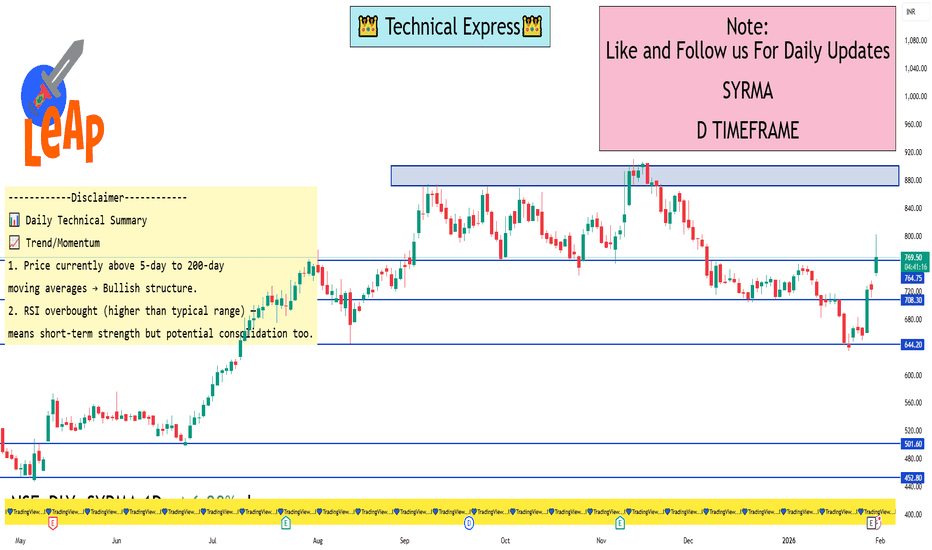

SYRMA 1 Day View 📍 Current Price (approx): ~₹760–₹770 (up strongly with gap‑up & volatility today) — trading above most MA’s signalling strong bullish bias.

🔁 Pivot & Key Levels (Daily Time‑Frame)

📌 Standard Daily Pivot Levels

🟡 Pivot Point: ~₹736–₹737 — central level for trend bias

🟢 Resistance 1 (R1): ~₹748–₹749

🟢 Resistance 2 (R2): ~₹761–₹762

🟢 Resistance 3 (R3): ~₹773–₹774

🔴 Support 1 (S1): ~₹698–₹700

🔴 Support 2 (S2): ~₹689–₹690

🔴 Support 3 (S3): ~₹685–₹686

👉 Interpretation: Trading above pivot & R1 suggests buyers are in control today. R2/R3 are key upside obstacles. S1/S2/S3 are important support zones in case of pullbacks.

🔑 Key Levels to Watch (for Today / Daily)

✅ Bullish breakout continuation levels:

Short‑term upside: ~₹748 → ₹762 → ₹774 (R1/ R2/ R3)

⚠️ Pullback / support levels:

Initial support: ~₹700–₹698 (S1)

Next support: ~₹690–₹686 (S2 / S3)

📊 Bias reference: Price above pivot → bullish bias today. A break below pivot could soften momentum.

🧠 How to Use These Levels

Bullish scenario:

Hold above ₹748 → higher targets: ₹761 / ₹773+.

Conservative traders:

Watch support at ₹700 / ₹690 for dips as potential trend continuation entry/stop‑loss areas.

Risk control:

If price drops below pivot (~₹737) decisively, momentum may weaken intraday.

Part 5 Best Trading Strategies Simple Example to Understand

Scenario

Nifty at 21500

You expect it to go to 21650.

Call Option Buy

Buy 21500 CE

If Nifty moves up → premium increases → profit

If Nifty falls → premium collapses → loss

Put Option Buy

Not useful in this scenario

Option Seller’s View

If seller expects market to remain sideways:

Seller sells 21600 CE

Seller sells 21400 PE

Both sides decay → seller profits

IOC 1 Day time Frame 📊 Current Daily Price (Live / Latest)

Current price: ~₹162.8 – ₹163.8 (NSE) on 29 Jan 2026 during the session.

Today’s range so far: Low ~₹161.7, High ~₹164.6.

📈 Key Daily Levels (Support & Resistance)

📌 Immediate Support

S1: ~₹161.0 – ₹161.8 — today’s low region.

S2: ~₹158.6 – ₹159.0 — short‑term near support zone.

S3: ~₹156 – ₹157 — broader support if prices weaken further.

📌 Pivot / Neutral Zon

Pivot level: around ₹161.8 – ₹162.5 — inside today’s trading range.

📌 Immediate Resistance

R1: ~₹164 – ₹165 — today’s high zone.

R2: ~₹167 – ₹168 — next upside resistance cluster.

R3: ~₹170 – ₹170+] — stronger breakout region above recent swings.

📌 How to Use These Levels Today

Bullish scenario:

A clean break above ₹164–₹165 on strong volume could open the way toward ₹167–₹168+.

Bearish scenario:

A drop below ₹161 and especially below ₹158–₹159 could lead to deeper testing of ₹156–₹155 support.

ULTRACEMCO 1 Day View 📊 Current Price (approx)

• ULTRACEMCO is trading around ₹12,620–₹12,770 on NSE in today’s session based on multiple live price feeds.

📈 Daily Support & Resistance Levels – NSE (Pivot-based)

📌 Daily Pivot & Range (classic pivot levels):

Resistance 3 (R3): ~ ₹13,101

Resistance 2 (R2): ~ ₹12,963

Resistance 1 (R1): ~ ₹12,776

Pivot Point (PP): ~ ₹12,638

Support 1 (S1): ~ ₹12,451

Support 2 (S2): ~ ₹12,313

Support 3 (S3): ~ ₹12,126

👉 Key intraday reference:

• If price holds above Pivot ~₹12,638, bulls may target the R1–R3 zone.

• A break below S1/S2 could open downside to ₹12,313–₹12,126 S3.

🔁 Alternate Daily Support / Resistance (Pivot Speed)

• R1: ~ ₹12,521

• R2: ~ ₹12,673

• R3: ~ ₹12,792

• Support 1: ~ ₹12,250

(Different pivot provider with slightly variation — good as corroborative levels)

📊 Short-Term Support & Resistance (Alternative)

• Daily Support (Munafasutra): ~ ₹12,264–₹12,265

• Daily Resistance: ~ ₹12,499–₹12,500

(These can be useful for tighter intraday stops)

📌 What This Means for 1D Trading

Bullish above:

• ₹12,638 Pivot — key to stay above for bullish bias today.

• Above ₹12,776–₹12,963 — adds confidence for breakout toward ₹13,101 R3.

Bearish below:

• Below ₹12,451 S1 — risk to ₹12,313–₹12,126 S3.

• Sustained close below Pivot may signal short-term pressure.

CANDLE PATTERNS Candlestick patterns are one of the most important tools in technical analysis because they visually represent market psychology: who is in control—the buyers (bulls) or the sellers (bears). Each candlestick captures the battle between demand and supply within a specific timeframe, such as 1 minute, 5 minutes, 30 minutes, daily, or weekly. By studying the shape, size, and position of candles, traders can understand momentum, reversals, trend continuation, and market indecision.

Candlestick charts were first developed by Japanese rice merchants over 300 years ago. Today, they are used by traders across stock markets, index futures, options trading, forex, and crypto. A single candle contains four key pieces of information:

Open

High

Low

Close

A candle is generally green (bullish) if the close is above the open, and red (bearish) if the close is below the open. The body shows the range between open and close, while the wicks (shadows) show the highest and lowest price levels touched.

Patterns form when two or more candles appear together in a particular sequence indicating reversal, continuation, or indecision.

Part 5 Advance Option Trading Option Buyers vs. Sellers

Option Buyer

Limited risk (premium paid)

Unlimited profit potential

Theta works against them

Need strong directional move

Option Seller

Unlimited risk but high probability

Earn from premium decay

High margin requirement

Best when market stays in range

Institutions prefer selling due to deep pockets, while retail often leans towards buying due to lower capital requirements.

BANDHANBNK 1 Month View 📊 Current Context (Latest Market Data)

Recent price range: ~₹145–₹152 intraday.

52-week range: ~₹128–₹192.

📈 1-Month Key Resistance Levels

These are levels where price may face selling pressure on upward moves:

Primary Resistances

1. ~₹152–₹153 — near recent highs and short-term swing resistance.

2. ~₹155–₹156 — higher pivot resistance zone seen in short-term technical data.

3. ~₹159–₹160 — aligned with 100/200-day moving averages acting as dynamic resistance.

👉 A break above ₹155–₹156 with volume could open way to ₹160+ short-term.

📉 1-Month Key Support Levels

These are levels where price may find buys/defense if it corrects:

Primary Supports

1. ~₹145–₹146 — recent short-term support and pivot zone.

2. ~₹142–₹143 — recent reaction lows intraday.

3. ~₹138–₹140 — deeper support and previous swing area.

👉 A decisive break below ₹142 may signal further weakness toward ₹138–₹136 on extended weakness.

🧠 Technical Indicators (Short-Term Bias)

RSI around mid-range (~57) — slightly bullish/neutral momentum.

Short-term moving averages mixed but range bound (20D near current price) — suggests range trading in the month.

So short-term technically, price is not in a strong trending breakout but more in a range with potentials to oscillate between support & resistance.

Part 4 Institutional Trading Vs. Technical AnalysisOption Buyer (Long Option)

Advantages:

Limited risk

Unlimited profit potential (for calls)

High leverage

Clear risk-reward structure

Disadvantages:

Time decay works against buyer

Requires strong directional or volatility move

High probability of small losses

Part 2 Techical Analysis Vs. Institutional Option Trading Key Terminologies in Option Trading

Strike Price – The pre-decided price at which you get the right to buy or sell.

Premium – Amount you pay to buy an option.

Spot Price – Current market price of the underlying.

Intrinsic Value – Actual value of an option if exercised now.

Time Value – Extra premium due to time left until expiry.

OTM (Out of The Money) – No intrinsic value; cheaper premiums.

ATM (At The Money) – Strike closest to current market price.

ITM (In The Money) – Has intrinsic value; expensive premiums.

Expiry – Last date on which the option is valid.

Lot Size – Minimum number of units per option contract.

MCX Crude Oil Futures 1 Month time frame level📊 Current Price Snapshot (Indicative)

MCX Crude Oil futures (Feb/near‑month) recently around ₹5,600–₹5,620 range.

📈 Key Technical Levels — 1‑Month Time Frame

(Levels are approximate and from aggregated chart analyses; actual quotes can vary minute‑by‑minute)

🎯 Resistance Levels

1. ₹5,780–₹5,800 – Upper resistance zone from short‑term breakout projections.

2. ₹5,700–₹5,750 – Near‑term Resistance (sell/stop zone).

3. ₹5,730–₹5,842 – Broader resistance cluster seen in chart studies.

🛑 Support Levels

1. ₹5,430–₹5,450 – Key near‑term demand zone (retracement support).

2. ₹5,300 – Major short‑term structural support. Break below suggests bearish risk.

3. ₹5,245–₹5,350 – Additional support band seen on chart levels.

📅 What to Watch

✔ Breakout above 5,780‑5,800 – Signals strong continuation.

✔ Close below 5,300 – Increases bearish risk.

✔ Option Chain PCR & OI changes – Can help gauge near‑term sentiment (MCX data).

Trading Breakouts and Fakeouts: Capturing Momentum Understanding Breakouts in Trading

A breakout occurs when price moves decisively beyond a well-defined support or resistance level with the potential to start a new trend or accelerate an existing one. These levels usually represent areas where price has previously struggled to move beyond due to a balance between buyers and sellers. When that balance shifts, price breaks out.

Breakouts are powerful because they often reflect a change in market sentiment. For example, when resistance is broken, sellers who were defending that level are overwhelmed, and new buyers enter the market expecting higher prices. At the same time, traders who were short may be forced to cover their positions, adding fuel to the move.

Breakouts commonly occur from chart structures such as consolidation ranges, triangles, flags, head-and-shoulders patterns, and channels. The longer the price consolidates and the more times a level is tested, the more significant the breakout tends to be. Volume often plays a critical role here; a true breakout is usually accompanied by an expansion in volume, signaling strong participation.

Types of Breakouts

Breakouts can be classified in several ways. Range breakouts happen when price moves above resistance or below support after trading sideways for a period. Trendline breakouts occur when price breaks a downward or upward sloping trendline, often indicating a trend reversal or acceleration. Volatility breakouts happen when price exits a low-volatility environment, often after a squeeze, leading to sharp directional moves.

Another important distinction is time-frame based breakouts. Intraday traders focus on breakouts of previous day highs/lows or key intraday levels, while swing and positional traders look for breakouts on daily, weekly, or even monthly charts. Higher time-frame breakouts generally carry more reliability, but they also require wider stop losses and patience.

What Are Fakeouts and Why They Happen

A fakeout, also known as a false breakout, occurs when price briefly moves beyond a key level but fails to sustain the move and quickly reverses back into the prior range. Fakeouts are common because markets are driven by liquidity. Large participants often push price beyond obvious levels to trigger stop losses and breakout orders, then reverse price once sufficient liquidity is collected.

Fakeouts happen for several reasons. One major reason is lack of follow-through buying or selling. Price may break a level, but if volume is weak and broader market sentiment does not support the move, the breakout fails. News-driven volatility can also cause fakeouts, where price reacts sharply to an announcement but then retraces once emotions cool down.

Retail trader behavior plays a role as well. Many traders place stops just beyond obvious support or resistance. When price reaches these areas, stop orders get triggered, causing a brief surge that looks like a breakout. Once those stops are absorbed, price reverses, trapping late breakout traders.

Identifying High-Probability Breakouts

Not all breakouts are equal. High-probability breakouts usually have a few common characteristics. First, the level being broken should be clearly visible and respected in the past. Second, price action before the breakout often shows contraction, such as lower volatility or tighter ranges, indicating pressure buildup. Third, confirmation through volume expansion, strong candle closes, or alignment with the higher-time-frame trend increases reliability.

Context is critical. A breakout in the direction of the broader trend has a much higher success rate than a counter-trend breakout. For example, an upside breakout in a strong bullish market is more likely to succeed than the same breakout during a choppy or bearish environment.

Recognizing and Trading Fakeouts

Fakeouts are frustrating, but experienced traders learn to identify and even trade them. Common signs of a fakeout include weak candle closes beyond the level, long wicks showing rejection, low volume on the breakout attempt, and immediate failure to hold above or below the key level.

One effective approach is the “break and retest” method. Instead of entering immediately on the breakout, traders wait for price to break the level and then retest it from the other side. If the level holds during the retest, the breakout is more likely to be genuine. If price fails quickly and moves back into the range, it signals a potential fakeout.

Some advanced traders deliberately trade fakeouts by entering in the opposite direction once price reclaims the broken level. These trades can be powerful because trapped breakout traders are forced to exit, accelerating the reversal move.

Risk Management in Breakout and Fakeout Trading

Risk management is the backbone of trading breakouts and fakeouts. Breakout trades should have clearly defined stop losses, usually just inside the broken level or below the breakout candle’s low in bullish setups. Because fakeouts are common, position sizing should be conservative, especially in volatile markets.

For fakeout trades, stops are typically placed beyond the extreme of the false breakout. Since reversals can be sharp, reward-to-risk ratios are often favorable, but discipline is essential. Overtrading every breakout or fakeout leads to emotional decisions and inconsistent results.

Psychology and Discipline

The psychology of breakout trading is intense. Fear of missing out (FOMO) often pushes traders to chase breakouts late, increasing the chance of getting trapped in a fakeout. Successful traders stay patient, wait for confirmation, and accept that missing a trade is better than taking a low-quality setup.

Equally important is accepting losses. Even the best breakout traders experience fakeouts regularly. The key is to keep losses small and let successful breakouts run. Over time, consistency and discipline matter more than predicting every move correctly.

Conclusion

Trading breakouts and fakeouts is about understanding market structure, liquidity, and trader behavior. Breakouts offer opportunities to ride strong momentum, while fakeouts remind traders of the market’s deceptive nature. By combining technical analysis with volume, context, and disciplined risk management, traders can improve their ability to capture genuine breakouts and avoid or even profit from fakeouts. Mastery of this approach does not come from avoiding losses entirely, but from managing them wisely while staying aligned with high-probability market conditions.