Cross-Market ArbitrageConcept and Rationale

In an ideal and perfectly efficient market, the price of an identical asset should be the same everywhere once adjusted for factors such as transaction costs, taxes, and exchange rates. This principle is often referred to as the law of one price. However, in real-world markets, temporary deviations occur due to differences in liquidity, information flow, trading hours, capital controls, regulatory frameworks, and investor behavior. Cross-market arbitrage aims to capitalize on these deviations before prices converge again.

The strategy plays a critical role in maintaining market efficiency. Arbitrageurs, by acting on price discrepancies, help align prices across markets. As more traders exploit an arbitrage opportunity, buying pressure in the cheaper market and selling pressure in the expensive market gradually eliminate the price gap.

Types of Cross-Market Arbitrage

One of the most common forms is geographical arbitrage, where the same asset trades on exchanges in different countries. For example, a stock listed on both the Indian market and a foreign exchange may trade at slightly different prices due to currency movements or local demand-supply dynamics.

Another major form is exchange-based arbitrage, where price differences exist between two domestic exchanges trading the same instrument. In equity markets, this can occur when a stock is listed on multiple exchanges and short-term inefficiencies arise.

Currency-based cross-market arbitrage involves exploiting mispricing between currency pairs across different forex markets or between the spot and offshore markets. This often overlaps with triangular arbitrage, where inconsistencies between three currency exchange rates create profit opportunities.

Derivative-based arbitrage is also significant. Here, traders exploit price differences between a cash market instrument and its derivative, such as an index and its futures contract traded on different exchanges or jurisdictions.

Mechanics of Execution

Successful cross-market arbitrage requires simultaneous execution of buy and sell orders to eliminate directional market risk. Speed and precision are essential, as arbitrage windows are often extremely short-lived. Institutional traders typically rely on algorithmic trading systems and direct market access to identify and execute opportunities in milliseconds.

For example, if a stock is trading lower on one exchange compared to another after accounting for currency conversion and transaction costs, an arbitrageur would buy the stock in the cheaper market and sell it in the higher-priced market at the same time. The profit is realized once the positions are settled, assuming the price gap closes as expected.

Role of Technology

Technology is a decisive factor in cross-market arbitrage. Modern arbitrage strategies heavily depend on real-time data feeds, low-latency infrastructure, co-location services, and automated execution systems. Without these, price discrepancies are likely to disappear before a trade can be completed.

High-frequency trading firms dominate this space because they can react faster than manual traders. However, longer-duration arbitrage opportunities may still exist in less liquid markets or during periods of high volatility, regulatory changes, or market stress.

Risk Factors

Although cross-market arbitrage is often perceived as low risk, it is not risk-free. Execution risk is one of the most significant concerns. If one leg of the trade is executed while the other fails or is delayed, the trader may be exposed to market movements.

Currency risk arises when trades involve assets priced in different currencies. Even small exchange rate fluctuations can impact profitability if not properly hedged.

Liquidity risk is another challenge, especially in emerging markets. A lack of sufficient volume may prevent traders from executing large orders at expected prices.

Regulatory and settlement risk also play a role. Different markets have varying settlement cycles, taxation rules, and capital restrictions, which can complicate arbitrage trades and increase costs.

Costs and Constraints

Transaction costs such as brokerage fees, exchange fees, taxes, and bid-ask spreads significantly influence the viability of cross-market arbitrage. Even a seemingly attractive price difference can become unprofitable once these costs are considered.

Additionally, capital requirements can be high, as traders must maintain positions in multiple markets simultaneously. Margin rules and leverage limits may further constrain strategy implementation.

Market Impact and Importance

Cross-market arbitrage contributes to price discovery and market integration. By narrowing price differences across markets, arbitrageurs enhance transparency and efficiency. This is particularly important in globalized financial systems where capital flows freely across borders.

During periods of market stress, arbitrage opportunities may widen due to panic selling, liquidity shortages, or regulatory disruptions. While this increases potential returns, it also raises risks, making risk management and capital discipline crucial.

Conclusion

Cross-market arbitrage is a sophisticated trading strategy rooted in the fundamental principle of price convergence across markets. While the theoretical concept is straightforward, practical execution requires advanced technology, deep market understanding, and robust risk controls. As global markets continue to integrate and trading becomes increasingly automated, cross-market arbitrage remains a vital mechanism for maintaining efficiency, though opportunities are often fleeting and highly competitive. For skilled traders and institutions, it offers a compelling blend of analytical rigor, speed, and strategic precision.

Trend Lines

Exploring Financial Market Roles in Trading1. Investors

Investors are participants who allocate capital with the primary objective of long-term wealth creation. They include individuals, mutual funds, pension funds, insurance companies, and sovereign wealth funds. Investors typically focus on fundamentals such as earnings growth, economic trends, interest rates, and corporate governance. Their trades provide long-term stability to markets and form the backbone of capital formation. By investing in equities and debt instruments, they help companies raise funds for expansion and governments finance public spending. Although investors trade less frequently than speculators, their large capital base significantly influences market direction and valuation levels.

2. Traders and Speculators

Traders and speculators are more active market participants who seek to profit from short- to medium-term price movements. They include day traders, swing traders, proprietary trading firms, and hedge funds. Unlike investors, traders rely heavily on technical analysis, market sentiment, order flow, and short-term news. Their presence increases market liquidity and narrows bid-ask spreads, making it easier for other participants to enter and exit positions. Speculators also contribute to efficient price discovery by rapidly incorporating new information into market prices, even though they are often perceived as risk-takers.

3. Market Makers

Market makers play a crucial role in ensuring continuous trading in financial markets. They quote both buy (bid) and sell (ask) prices for specific securities and are willing to transact at those prices. By doing so, they provide liquidity and reduce price volatility, especially during periods of low trading activity. Market makers earn profits through the bid-ask spread and, in some cases, incentives provided by exchanges. In modern electronic markets, high-frequency trading firms often act as market makers, using algorithms to manage inventory and risk efficiently.

4. Brokers and Intermediaries

Brokers act as intermediaries between buyers and sellers. They execute trades on behalf of clients and provide access to exchanges and trading platforms. Full-service brokers may also offer research, investment advice, and portfolio management, while discount brokers focus primarily on trade execution at lower costs. Intermediaries reduce information asymmetry, simplify market access for retail participants, and ensure compliance with trading rules. In today’s digital era, online brokerages and trading apps have significantly expanded retail participation in financial markets.

5. Exchanges and Trading Platforms

Exchanges provide the organized infrastructure where trading takes place. They establish rules, ensure transparency, and maintain fair and orderly markets. Examples include stock exchanges, commodity exchanges, and derivative exchanges. Exchanges facilitate price discovery by matching buy and sell orders and disseminating real-time market data. With the rise of electronic trading, alternative trading systems and dark pools have also emerged, offering participants different ways to execute large orders with minimal market impact.

6. Regulators and Policymakers

Regulators and policymakers oversee financial markets to ensure integrity, stability, and investor protection. Their role includes setting trading rules, monitoring market behavior, preventing fraud and manipulation, and managing systemic risk. By enforcing disclosure standards and capital requirements, regulators enhance trust in the trading environment. Stable and transparent regulatory frameworks encourage participation from domestic and international investors, which ultimately supports market growth and efficiency.

7. Clearing Houses and Settlement Institutions

Clearing houses and settlement institutions operate behind the scenes but are vital to the trading process. They act as central counterparties, guaranteeing the completion of trades even if one party defaults. By managing margin requirements and settlement processes, they reduce counterparty risk and enhance market confidence. Efficient clearing and settlement systems are especially important in derivative and high-volume markets, where risk exposure can be significant.

8. Hedgers and Risk Managers

Hedgers participate in financial markets to reduce exposure to adverse price movements. These include corporations, exporters, importers, farmers, and financial institutions. By using derivatives such as futures, options, and swaps, hedgers transfer risk to speculators willing to bear it. This risk-sharing function is fundamental to the smooth functioning of markets, as it allows businesses to focus on core operations while managing financial uncertainty.

9. Information Providers and Analysts

Information providers, research analysts, and rating agencies influence trading decisions by supplying data, analysis, and forecasts. Their insights help market participants assess value, risk, and future prospects. Timely and accurate information enhances market efficiency, while poor or biased information can lead to mispricing and volatility. In the age of digital trading, real-time data feeds and algorithmic analysis play an increasingly important role.

Conclusion

The financial market is a dynamic system driven by the interaction of diverse participants, each performing a specialized role in the trading process. Investors provide long-term capital, traders enhance liquidity, market makers ensure smooth execution, and regulators maintain market integrity. Together with brokers, exchanges, clearing institutions, hedgers, and information providers, these roles create a balanced ecosystem that supports efficient trading and economic growth. For anyone involved in trading, understanding these market roles is not just academic—it is essential for making informed decisions, managing risk, and navigating the ever-evolving financial landscape.

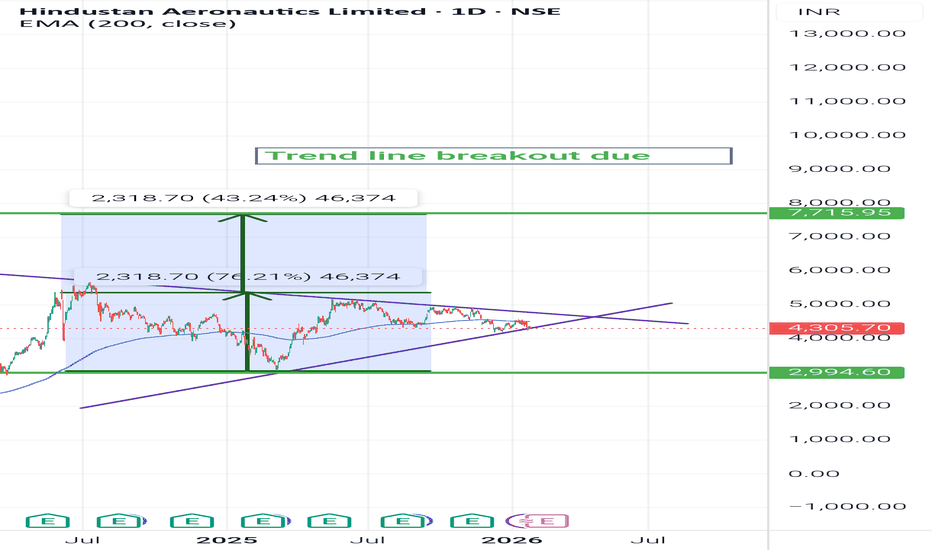

Hal view before budget 2026 24 jan day tf Hal isom sideways move after geo political tension was over with india and neighbourjmh countries.

But hal being a monopoly stock in aviation backed by govt a well known psu.

It's main performance is due because of delivery of tejas mk1 and other next gen planes.

Crash in Dubai was a major setback but having strong order book and work in progress it was somehow accepted.

Also has done deals with isro etc..

Coming to technicals if it crosses 200 dema and a diagonal trendline.

Pattern based target is around 7000.

#HAL

BEL in a Contracting Triangle — Wave 5 Loading?From the ₹240.25 low , Bharat Electronics Limited delivered a powerful upside rally , completing a higher-degree Wave 3 near ₹436 . The advance was strong, extended, and impulsive , clearly establishing the larger bullish trend.

Post the Wave 3 peak, price did not reverse impulsively . Instead, it shifted into sideways consolidation , suggesting a time-wise correction rather than price-wise damage . This behavior fits well with a Wave 4 contracting triangle , a common pause before the final leg of an impulse.

Structurally, the consolidation aligns with an A–B–C–D–E triangle , with price now appearing to be in the final leg — Wave (E) . This leg is expected to unfold as a 3-wave corrective decline (A–B–C) , terminating near the rising A–C–E trendline . A brief throw-under below this trendline remains structurally acceptable and should not be mistaken for a breakdown.

Trade Structure (Execution Focus)

The preferred entry lies near the A–C–E trendline , only if price prints a bullish candlestick pattern , indicating completion of Wave (E).

Invalidation is clearly defined below the low of Wave (C) .

If the triangle resolves as expected, a breakout would signal the start of a higher-degree Wave 5 , with upside potential beyond the Wave 3 high near ₹436 .

Fundamentally, recent order inflows support the broader bullish context , but this remains a structure-led setup , where price confirmation matters more than headlines .

In summary , Wave 3 is complete , Wave 4 is maturing , and Wave (E) completion is the final checkpoint before the next directional move.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) before making any trading decisions.

Nifty Intraday Analysis for 23rd January 2026NSE:NIFTY

Index has resistance near 25475 – 25525 range and if index crosses and sustains above this level then may reach near 25700 – 26750 range.

Nifty has immediate support near 25125 – 25075 range and if this support is broken then index may tank near 24900 – 24850 range.

Market is expected to move upwards due to unwinding of January’26 Month F&O contract expiry as well as India EU trade deal scheduled on 27th January’26. However, downside risk still persists on global geopolitics uncertainty on the long weekend.

Banknifty Intraday Analysis for 23rd January 2026NSE:BANKNIFTY

Index has resistance near 59600 – 59700 range and if index crosses and sustains above this level then may reach near 60100 – 60200 range.

Banknifty has immediate support near 58800 - 58700 range and if this support is broken then index may tank near 58300 - 58200 range.

Market is expected to move upwards due to unwinding of January’26 Month F&O contract expiry as well as India EU trade deal scheduled on 27th January’26. However, downside risk still persists on global geopolitics uncertainty on the long weekend.

Finnifty Intraday Analysis for 23rd January 2026 NSE:CNXFINANCE

Index has resistance near 27375 - 27425 range and if index crosses and sustains above this level then may reach near 27650 - 27700 range.

Finnifty has immediate support near 26925 – 26875 range and if this support is broken then index may tank near 26650 – 26600 range.

Market is expected to move upwards due to unwinding of January’26 Month F&O contract expiry as well as India EU trade deal scheduled on 27th January’26. However, downside risk still persists on global geopolitics uncertainty on the long weekend.

Midnifty Intraday Analysis for 23rd January 2026NSE:NIFTY_MID_SELECT

Index has immediate resistance near 13450 – 13475 range and if index crosses and sustains above this level then may reach 13600 – 13625 range.

Midnifty has immediate support near 13200 – 13175 range and if this support is broken then index may tank near 13050 – 13025 range.

Market is expected to move upwards due to unwinding of January’26 Month F&O contract expiry as well as India EU trade deal scheduled on 27th January’26. However, downside risk still persists on global geopolitics uncertainty on the long weekend.

Part 5 Advance Trading Strategies Option Trading in Different Market Conditions

A. Trending Market

Buyers get benefit

CE/PE give good returns

B. Sideways Market

Sellers benefit

Strangles, straddles perform well

C. High Volatility

Premium expands

Good for selling post-news

D. Low Volatility

Cheap premiums

Good for buying before breakout

PART 2 TECHNNICAL VS. INSTITUTIONALA. Strike Price

The strike price is the predetermined price at which the buyer can buy (CE) or sell (PE) the underlying.

Example:

Nifty Spot = 22,000

You buy Nifty 22,100 CE, meaning you can buy Nifty at 22,100.

B. Premium

Premium is the price you pay (buyer) or receive (seller) to enter the contract. Option prices change based on demand, volatility, time, and underlying movement.

C. Expiry

Options do not last forever. Every option expires:

Weekly (Most popular in Nifty/Bank Nifty)

Monthly

Quarterly (some stocks)

Yearly (LEAPS) in some markets

At expiry, the option will either:

Become In the Money (ITM) → It has intrinsic value.

Become Out of the Money (OTM) → It becomes worthless.

PART 1 TECHNNICAL VS. INSTITUTIONAL What Are Options?

Options are financial derivatives—meaning their value is derived from an underlying asset such as stock, index, commodity, etc. They are contracts between two parties: the option buyer and the option seller (writer).

There are two types of options:

Call Option (CE) – Right to buy the asset at a fixed price.

Put Option (PE) – Right to sell the asset at a fixed price.

The key point:

The buyer has a right but no obligation. The seller has an obligation but no rights.

Renewable Energy Certificates (RECs) and Carbon Credits1. Introduction: Why RECs and Carbon Credits Matter

As countries, corporations, and investors push toward net-zero emissions, two market-based instruments have become central to climate policy and sustainable finance: Renewable Energy Certificates (RECs) and Carbon Credits.

Both aim to reduce greenhouse gas (GHG) emissions, but they operate in different markets, address different problems, and serve different compliance and voluntary needs. Understanding their structure, pricing, and role is critical for policymakers, power producers, corporates, and traders—especially in fast-growing markets like India.

2. Renewable Energy Certificates (RECs): Core Concept

A Renewable Energy Certificate (REC) represents proof that 1 megawatt-hour (MWh) of electricity has been generated from a renewable energy source such as solar, wind, hydro, biomass, or geothermal.

When a renewable power producer generates electricity:

The physical electricity flows into the grid

The environmental attribute is unbundled and issued as a REC

This separation allows electricity consumers to claim renewable usage even if the physical power they consume is from the conventional grid mix.

3. Purpose of RECs

The primary objectives of RECs are:

Regulatory Compliance

In many countries, utilities and large power consumers must meet Renewable Purchase Obligations (RPOs). RECs allow entities that cannot physically procure green power to meet these obligations financially.

Market-Based Incentives

RECs provide additional revenue to renewable generators, improving project viability without direct subsidies.

Corporate Sustainability Claims

Corporates use RECs to meet ESG targets, claim renewable sourcing, and comply with Scope 2 emission accounting under GHG Protocols.

4. REC Markets: Compliance vs Voluntary

Compliance REC Markets

Mandated by government regulation

Prices often volatile and policy-driven

Examples:

India (Solar & Non-Solar RECs)

US state-level Renewable Portfolio Standards (RPS)

Voluntary REC Markets

Purchased by corporates or individuals

Focus on brand value, ESG disclosure, and carbon neutrality

Examples:

International Renewable Energy Certificates (I-RECs)

Guarantees of Origin (EU)

5. India’s REC Framework

India’s REC mechanism is overseen by CERC and operated via power exchanges like IEX and PXIL.

Key features:

Solar RECs and Non-Solar RECs

Issued by the National Load Despatch Centre (NLDC)

Traded through exchange-based auctions

Used for RPO compliance by DISCOMs, open-access consumers, and captive users

India’s REC prices have historically been:

Highly cyclical

Influenced by RPO enforcement

Sensitive to supply-demand mismatches

6. Carbon Credits: Core Concept

A Carbon Credit represents the reduction or removal of 1 metric tonne of CO₂ equivalent (tCO₂e) from the atmosphere.

Unlike RECs (which are linked to energy generation), carbon credits are linked directly to emission reductions, regardless of the sector.

Carbon credits are generated through projects such as:

Renewable energy installations

Afforestation and reforestation

Methane capture

Energy efficiency upgrades

Industrial process improvements

7. Carbon Markets: Compliance vs Voluntary

Compliance Carbon Markets

Created under international or national regulation.

Examples:

EU Emissions Trading System (EU ETS)

China National ETS

California Cap-and-Trade

Key traits:

Mandatory caps on emissions

Allowances traded among regulated entities

Prices often reflect marginal abatement cost

Voluntary Carbon Markets (VCM)

Used by corporates to offset emissions beyond regulatory requirements.

Standards include:

Verra (VCS)

Gold Standard

American Carbon Registry (ACR)

VCM prices vary widely depending on:

Project type

Vintage year

Verification quality

Co-benefits (biodiversity, social impact)

8. Key Differences: RECs vs Carbon Credits

Aspect RECs Carbon Credits

Unit 1 MWh renewable power 1 tonne CO₂e

Purpose Renewable sourcing Emission offset

Scope Electricity only Multi-sector

Accounting Scope 2 Scope 1, 2, or 3

Market Power & ESG Climate finance

Permanence Linked to generation Linked to reduction/removal

9. Corporate Use Cases

Corporates often use both instruments together:

RECs → Claim renewable electricity usage

Carbon credits → Offset residual emissions

For example:

A data center uses RECs to claim 100% renewable power

It then purchases carbon credits to offset diesel backup, logistics, and Scope 3 emissions

10. Price Dynamics and Risks

REC Price Drivers

RPO targets and enforcement

Renewable capacity additions

Regulatory changes

DISCOM financial health

Carbon Credit Price Drivers

Climate policy ambition

Corporate net-zero commitments

Quality and credibility of credits

Supply constraints for nature-based projects

Key Risks

Double counting

Greenwashing

Policy reversals

Low-quality offsets undermining credibility

11. Emerging Trends

Article 6 of Paris Agreement

Enables cross-border carbon trading and international credit transfers.

High-Integrity Carbon Credits

Shift toward removal-based credits (DAC, biochar).

India’s Carbon Market (ICM)

India is transitioning from PAT & REC mechanisms toward a unified Indian Carbon Credit Trading Scheme (CCTS).

Tokenization & Digital MRV

Blockchain-based tracking for transparency and trust.

12. Investment and Trading Perspective

For investors and traders:

RECs offer policy-driven cyclical trades

Carbon credits represent a long-term structural decarbonization play

Quality differentiation will drive price dispersion

Carbon markets may become a new asset class, similar to power and gas

13. Conclusion

Renewable Energy Certificates and Carbon Credits are cornerstones of market-based climate action. RECs accelerate renewable adoption by monetizing clean energy attributes, while carbon credits provide flexibility in achieving emission reduction targets across the economy.

As climate regulation tightens and ESG scrutiny deepens, these instruments will evolve from niche compliance tools into strategic financial assets, shaping energy markets, corporate strategy, and global capital flows.

EURUSD – Breakout From Falling Resistance, Retest Holding WellEUR/USD was trading under a falling resistance trendline for a long time, with sellers consistently stepping in at higher levels. Recently, price managed to break above this trendline, which was the first sign that bearish pressure was easing.

After the breakout, price came back for a retest of the broken structure and previous resistance area. This retest is holding well so far, showing that buyers are defending the level and not allowing price to slip back below the structure.

What stands out here is how price respected the retest and then pushed higher, leaving behind a small imbalance. This often indicates acceptance above the breakout level rather than a false move.

As long as price holds above the retest zone and structure support, the path of least resistance remains to the upside, with higher resistance levels marked on the chart. A clean breakdown below this area would invalidate the bullish view.

This is a structure-based idea, not a prediction. Let price continue to confirm.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading involves risk. Please manage risk responsibly.

GBPUSD – Breakout Retest Looks Healthy, Bulls in ControlGBP/USD has been trading below a falling resistance trendline for quite some time. Recently, price managed to break above this trendline, which is the first sign that selling pressure is weakening.

After the breakout, price did not continue straight up. Instead, it came back for a retest, and that retest is holding well so far. This is usually a healthy sign, showing that buyers are willing to step in at higher levels instead of letting price fall back below structure.

What Price Is Telling Us:

Price is respecting the previous resistance as support and forming higher lows. Sellers are trying, but they are unable to push price back below the trendline. This behavior often appears when the market is preparing for continuation rather than reversal.

As long as price holds above this zone, the bullish bias remains intact, with upside levels marked on the chart. A clean breakdown below the structure would invalidate this view.

This is a structure-based idea, not a prediction. Let price do the work.

If this analysis helped you, like, follow, and comment for more clean Forex breakdowns.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading involves risk, and past performance does not guarantee future results. Please manage risk responsibly.

Nifty Intraday Analysis for 22nd January 2026NSE:NIFTY

Index has resistance near 25325 – 25375 range and if index crosses and sustains above this level then may reach near 25550 – 26600 range.

Nifty has immediate support near 24975 – 24925 range and if this support is broken then index may tank near 24750 – 24700 range.

The market is expected to react to the US President Trump’s speech tonight on conflict with European countries over Greenland and other related issues at WEF, Davos. Short term uptrend will be confirmed only if the index sustains and closes above 25500 level.

Banknifty Intraday Analysis for 22nd January 2026NSE:BANKNIFTY

Index has resistance near 59200 – 59300 range and if index crosses and sustains above this level then may reach near 59800 – 59900 range.

Banknifty has immediate support near 57800 - 57700 range and if this support is broken then index may tank near 57300 - 57200 range.

The market is expected to react to the US President Trump’s speech tonight on conflict with European countries over Greenland and other related issues at WEF, Davos. Short term uptrend will be confirmed only if the index sustains and closes above 59800 level.

Finnifty Intraday Analysis for 22nd January 2026 NSE:CNXFINANCE

Index has resistance near 27175 - 27225 range and if index crosses and sustains above this level then may reach near 27450 - 27500 range.

Finnifty has immediate support near 26725 – 26675 range and if this support is broken then index may tank near 26550 – 26500 range.

The market is expected to react to the US President Trump’s speech tonight on conflict with European countries over Greenland and other related issues at WEF, Davos. Short term uptrend will be confirmed only if the index sustains and closes above 27600 level.