SML Mahindra cmp 4330.70 by Daily Chart viewSML Mahindra cmp 4330.70 by Daily Chart view

- Support Zone 3610 to 3910 Price Band

- Resistance Zone 4380 to ATH 4743 Price Band

- Volumes are spiking above avg traded qty over past few days

- Bullish Cup & Handle with in completion stage Rounding Bottom

- Support Zone is standing ground for up trending price momentum

Trendlineanalysis

Part 1 Institutional Trading VS. Technical Analysis What Is Premium?

The premium is the price of the option contract. It is influenced by several factors:

Current price of the underlying

Strike price

Time remaining till expiry

Volatility

Interest rates

Dividends

Premiums are higher when:

Market is volatile

Expiry is far away

Stock price is near the strike price

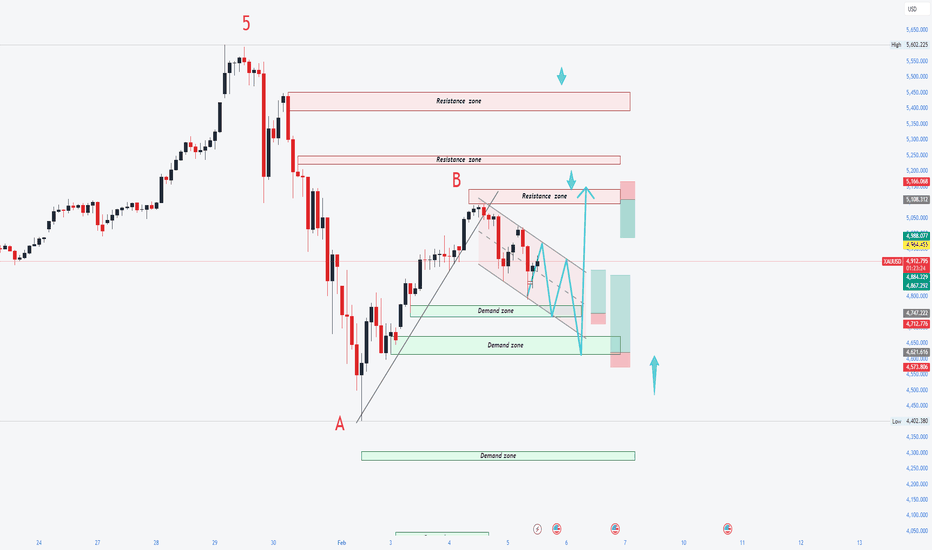

Breakdown or Breakout – Gold Compression Phase🔎 Market Context

• Gold is compressing within the 5000 – 5080 range

• Accumulation phase after the previous sharp sell-off

• Volatility is contracting → expansion is likely soon

• CPI & Non-Farm Payrolls are key catalysts

➡ Do not predict direction. Wait for a confirmed breakout.

📌 Strategic Zones

Resistance: 5078–5080 | 5100 | 5148 | 5200 | 5300 | 5345

Support: 5000 | 4980 | 4850 | 4830 | 4600 | 4400

• 5078–5080: Upper boundary of the range

• 5000: Lower boundary of the range

• 4980: Market structure decision level

⚖ Trading Bias

• Above 5080 → Favor upside continuation (Wave C extension)

• Below 4980 → Bullish structure breaks → favor downside

• Inside 5000–5080 → Compression phase, avoid FOMO

⚠ Key Notes

• Major data releases may cause false breakouts

• Wait for candle close confirmation

• Volatility likely to increase → manage risk carefully

• Avoid trading mid-range without clear edge

Part 3 Institutional Option Trading VS. Technical Analysis⭐Why Trade Options? Benefits

Lower capital requirement than futures or stocks.

Unlimited profit potential for buyers (CE/PE).

Limited risk — premium paid is the maximum loss.

Multiply returns because of leverage.

Profit in any market direction — up, down, or sideways.

Hedge portfolio risk (insurance for your positions).

Create income strategies, like selling options.

Combine multiple options for advanced setups.

Manage risk precisely using Greeks.

Control emotions better with predefined risk.

Part 2 Institutional Option Trading VS. Technical Analysis⭐ Types of Options

Two main types:

Call Options (CE)

A call gives you the right to buy.

You buy a call when you expect the market to go up.

If the price rises, your call premium increases.

You can sell the call later and book profit.

You are not required to buy the stock — you only trade the premium.

Put Options (PE)

A put gives you the right to sell.

You buy a put when you expect the market to fall.

If the price falls, your put premium increases.

You sell the put later to book profit.

No obligation to actually sell the stock.

Part 2 Intraday Institutional Trading Option Buyers vs Option Sellers

There are two sides to every option contract:

1. Option Buyer (Holder)

Pays a premium

Has limited risk (only premium paid)

Has unlimited profit potential (for calls)

Benefits from volatility

2. Option Seller (Writer)

Receives a premium upfront

Has limited profit (only premium earned)

Has potentially unlimited risk

Benefits when the market remains stable

Buyers look for big moves; sellers look for stability.

Oil India Ltd cmp 488 by Daily Chart viewOil India Ltd cmp 488 by Daily Chart view

- Support Zone 465 to 487 Price Band

- Resistance Zone 52 to 545 Price Band

- Support Zone tested retested for probable reversal

- Volumes spiking intermittently above average traded quantity

- Breakout from 1st Falling Resistance Trendline, 2nd Breakout anticipated

- Bullish Rounding Bottoms around Support Zone and by Resistance Zone neckline

Best Sectors For DIP Buying: Long-Term Investor + Smart TraderUnderstanding DIP Buying at a Sector Level

Sector-based DIP buying works better than stock-only dip buying because:

Sector corrections are often cyclical, not permanent

Money rotates between sectors, not out of markets forever

Institutions buy sectors in phases, not randomly

The goal is to buy quality sectors during pessimism, not hype.

1. Banking & Financial Services

Why banks are prime DIP-buying candidates

Banking is one of the most cyclical sectors in any economy. Corrections often occur due to:

Interest rate uncertainty

Rising NPAs fears

Credit cycle slowdowns

Regulatory tightening

Yet banks are the backbone of economic growth.

Why dips happen

Rate hikes compress short-term margins

Liquidity fears create panic

Temporary credit slowdown

Why dips are opportunities

Strong banks adapt faster to rate cycles

Loan growth rebounds with GDP recovery

Financialization keeps expanding

Best for DIP buying

Large private banks

Strong PSU banks post-cleanup

NBFCs with diversified loan books

📌 DIP logic: When fear peaks, banks trade below historical valuations—this is where institutions quietly accumulate.

2. Information Technology (IT & Tech Services)

Why IT corrects sharply

IT is highly sensitive to:

US recession fears

Dollar volatility

Global tech spending cuts

This makes IT stocks fall fast and deep.

Why it’s a classic DIP sector

Global outsourcing demand never disappears

Cost-cutting cycles actually increase outsourcing

Digital transformation is structural, not optional

Common dip triggers

Weak quarterly guidance

Margin compression

Hiring slowdown

Why recovery is powerful

Currency tailwinds kick in

Deal pipelines revive suddenly

Valuations re-rate quickly

📌 DIP logic: IT rarely dies—it pauses. Dips usually reflect timing issues, not broken business models.

3. Pharmaceuticals & Healthcare

Why pharma is defensive but volatile

Pharma behaves oddly:

Defensive during crises

Volatile due to regulations and approvals

Why dips occur

USFDA warnings

Price erosion in generics

R&D failures

Why it’s great for DIP buying

Healthcare demand is non-cyclical

Aging population supports long-term growth

Innovation cycles create rebounds

Ideal DIP scenarios

Regulatory scare without long-term damage

Temporary margin pressure

Currency-driven corrections

📌 DIP logic: Fear-driven pharma sell-offs often overshoot reality, creating value zones.

4. Capital Goods & Infrastructure

Why this sector crashes hard

Capital goods depend on:

Government spending

Private capex cycles

Interest rate environment

When capex slows, this sector gets punished brutally.

Why dips are golden

Infrastructure cycles last many years

Order books provide long visibility

Government-led spending revives demand

Dip triggers

Election uncertainty

Fiscal deficit concerns

Rate hike cycles

Why rebound is explosive

Operating leverage kicks in

Margins expand rapidly

Earnings surprise on the upside

📌 DIP logic: Buy when nobody believes capex will return—that’s usually the bottom.

5. FMCG & Consumer Staples

Why even defensive sectors dip

FMCG falls during:

Inflation spikes

Rural demand slowdown

Input cost pressure

Why it’s safe for DIP buying

Strong brands have pricing power

Demand never vanishes, only delays

Cash flows remain steady

Ideal DIP conditions

Margin compression due to raw material costs

Temporary volume slowdown

Sentiment-driven derating

📌 DIP logic: FMCG dips don’t last long. Institutions love buying these quietly during pessimism.

6. Energy, Oil & Gas

Why energy is deeply cyclical

Energy stocks swing due to:

Crude oil volatility

Government policy changes

Global demand fears

Why dips matter

Energy demand grows with GDP

Refining margins normalize over time

Transition to renewables creates optionality

Best DIP moments

Crude price crashes

Windfall tax fears

ESG-driven selling

📌 DIP logic: Energy is hated at bottoms and loved at peaks—DIP buying flips that psychology.

7. Metals & Mining

Why metals crash the hardest

Metal stocks are hit by:

China slowdown fears

Dollar strength

Global recession narratives

Why they rebound violently

Supply constraints kick in suddenly

Infrastructure demand revives

Commodity cycles turn faster than expected

DIP buying sweet spots

Panic around global growth

Inventory overhang fears

Peak pessimism headlines

📌 DIP logic: Metals are pure sentiment trades—best bought when macro fear dominates news flow.

8. Automobiles & Auto Ancillaries

Why autos dip frequently

Interest rate hikes

Fuel price volatility

Demand slowdown fears

Why they recover

Replacement demand never stops

EV transition creates new growth layers

Rural + urban demand cycles rotate

Best DIP phases

Sales slowdown narratives

Input cost pressure phases

Policy uncertainty

📌 DIP logic: Auto dips reward patience—cycles turn faster than expectations.

Key Rules for Sector DIP Buying

1. Buy fear, not hope

If headlines sound scary but balance sheets are intact—you’re close.

2. Time > Timing

Accumulate in tranches, not all at once.

3. Follow institutional footprints

Volume spikes at lows often signal smart money entry.

4. Avoid structurally broken sectors

DIP buying works for cyclical pain, not dying industries.

5. Align with macro cycles

Rate cuts, fiscal spending, and liquidity shifts fuel sector recoveries.

Final Takeaway

The best sectors for DIP buying are those that:

Are economically essential

Go through repeated cycles

Attract institutional capital

Have long-term relevance

Banking, IT, Pharma, Infrastructure, FMCG, Energy, Metals, and Autos consistently reward disciplined DIP buyers—not impulsive ones.

DIP buying isn’t about bravery.

It’s about preparation, patience, and psychology.

Mastering Technical Analysis: From Charts to Consistent Decision1. The Core Philosophy of Technical Analysis

Technical analysis is built on three foundational principles:

Price discounts everything

News, fundamentals, expectations, fear, and greed are all embedded in price. A chart is a real-time emotional record of market participants.

Prices move in trends

Markets rarely move randomly. Once a trend starts, it tends to persist until a clear reversal occurs.

History repeats itself

Human behavior does not change. Fear and greed create recurring patterns that appear again and again on charts.

Mastering technical analysis begins with accepting that certainty does not exist—only probability.

2. Understanding Market Structure

Before indicators, mastery begins with price structure.

a. Trends

Uptrend: Higher highs and higher lows

Downtrend: Lower highs and lower lows

Range: Sideways movement between support and resistance

Trading with the trend dramatically increases odds. Many traders fail not due to bad indicators, but because they fight the dominant trend.

b. Support and Resistance

Support is where demand overcomes supply. Resistance is where supply overwhelms demand. These levels form due to:

Institutional order placement

Psychological round numbers

Previous highs and lows

Advanced traders understand that support and resistance are zones, not exact lines.

3. Candlestick Psychology

Candlesticks are the language of price.

Each candle tells a story:

Long bodies: Strong conviction

Long wicks: Rejection of price

Small bodies: Indecision

Key candlestick formations include:

Pin bars

Engulfing patterns

Inside bars

Doji structures

However, candlesticks must be read in context—at key levels, in trends, or during breakouts. Patterns alone are meaningless without location.

4. Indicators: Tools, Not Crutches

Indicators are derivatives of price. They confirm, not predict.

a. Trend Indicators

Moving Averages (EMA, SMA)

VWAP

Used to identify direction and dynamic support/resistance.

b. Momentum Indicators

RSI

MACD

Stochastic

Momentum reveals strength or weakness, divergence, and exhaustion points.

c. Volatility Indicators

Bollinger Bands

ATR

Volatility expands before big moves and contracts before breakouts.

A master trader uses 2–3 complementary indicators, not 10 conflicting ones.

5. Volume: The Institutional Footprint

Price moves, but volume explains why.

Rising price + rising volume = healthy trend

Rising price + falling volume = weak move

Volume spikes at support/resistance = institutional activity

Volume confirms breakouts, validates reversals, and exposes false moves. Without volume, price action is incomplete.

6. Chart Patterns and Market Behavior

Chart patterns represent crowd psychology unfolding over time.

Common patterns:

Head and shoulders

Double top/bottom

Flags and pennants

Triangles

Cup and handle

Patterns work not because of shape—but because they show accumulation, distribution, or continuation by large players.

7. Multi-Timeframe Analysis

Professionals analyze markets top-down:

Higher timeframe → trend and key levels

Lower timeframe → entries and exits

For example:

Weekly defines direction

Daily defines structure

Intraday defines execution

This alignment prevents trading against higher-timeframe forces.

8. Risk Management: The Real Edge

Technical analysis without risk control is gambling.

Key principles:

Risk only 1–2% per trade

Predefine stop-loss before entry

Maintain favorable risk-reward (minimum 1:2)

Accept losses as business expenses

Mastery is not about winning every trade—it’s about surviving long enough for probabilities to play out.

9. Trading Psychology and Discipline

Charts test emotions more than intelligence.

Common psychological traps:

Overtrading

Revenge trading

Fear of missing out (FOMO)

Moving stop-losses

Ignoring plans

Elite technical traders follow rules even when emotions disagree. Discipline turns strategy into consistency.

10. Developing a Personal Trading System

True mastery comes when you:

Trade specific setups only

Use clear entry, stop, and target rules

Journal every trade

Review mistakes objectively

A simple system executed perfectly will always outperform a complex system executed emotionally.

Conclusion: The Path to Mastery

Mastering technical analysis is not about finding a “holy grail” indicator. It is about:

Understanding price behavior

Aligning with trends

Managing risk

Controlling emotions

Repeating a proven process

Charts do not predict the future—they prepare you for it.

In the end, the best technical analysts are not those who forecast perfectly, but those who respond correctly when the market reveals its hand.

Part 5 Advance Trading Strategies Why Do Options Have Time Decay? (Theta)

Options lose value as expiry approaches.

This is called Theta Decay.

Example:

Monday premium: ₹100

Thursday premium: ₹20

Expiry day: ₹0

This happens because time is part of the option’s value. If market doesn’t move, buyer loses money; seller gains.

Part 4 Technical Analysis Vs. Institutional Option TradingPut Options (PE) Explained

Put = Right to sell

You buy a put when you expect the price to go down.

Loss is limited to premium paid.

Profit can rise significantly in sharp downtrends.

Example:

If Nifty is at 22,000 and you buy 21,900 PE, you are expecting Nifty to fall below 21,900.

Private vs. Public Banks: Who Will Win in a Trade War?Trade wars are no longer just geopolitical events—they are financial stress tests for entire economies. Tariffs, supply-chain disruptions, currency volatility, and slowing global growth directly affect capital flows, corporate profitability, and credit demand. In this environment, the banking sector becomes both a shock absorber and a transmission channel of economic stress.

The big question investors and traders ask is simple but powerful:

In a trade war scenario, will private sector banks outperform public sector banks—or vice versa?

The answer isn’t one-dimensional. It depends on balance sheet strength, risk appetite, government backing, operational efficiency, and adaptability. Let’s break it down clearly.

Understanding the Trade War Impact on Banks

A trade war typically leads to:

Slower GDP growth

Pressure on exports and manufacturing

Currency depreciation or volatility

Rising input costs

Corporate margin compression

Higher credit risk and potential NPAs

Banks feel the impact through:

Lower credit growth

Stress in MSME and export-oriented sectors

Volatile treasury income

Higher provisioning requirements

This is where the difference between private and public banks becomes critical.

Public Sector Banks: Strength Through Sovereign Support

Public sector banks (PSBs) operate with the implicit and explicit backing of the government. In a trade war, this backing becomes a major advantage.

Key Strengths

1. Government Capital Support

During economic stress, governments often inject capital into public banks to ensure stability. This reduces solvency risk and keeps lending channels open.

2. Counter-Cyclical Lending Role

Public banks are often directed to continue lending even when private banks pull back. In a trade war, this helps:

Support infrastructure projects

Maintain credit flow to MSMEs

Stabilize employment

3. Lower Risk of Bank Failure

Markets generally assume PSBs are “too important to fail.” This improves depositor confidence during volatile periods.

4. Strong Rural and PSU Exposure

Public banks are deeply connected to agriculture, public sector units, and government-linked projects, which are relatively insulated from global trade shocks.

Weaknesses of Public Sector Banks

However, trade wars also expose PSB vulnerabilities:

Higher exposure to stressed sectors like steel, power, and exports

Slower decision-making due to bureaucracy

Lower profitability and ROE

Historically higher NPAs during downturns

In a prolonged trade war, asset quality deterioration can resurface, forcing higher provisioning and pressuring stock performance.

Private Sector Banks: Agility and Precision

Private banks thrive on efficiency, technology, and risk management. In a trade war, these qualities matter more than ever.

Key Strengths

1. Superior Risk Management

Private banks use advanced credit models, early warning systems, and tighter underwriting standards. This helps them:

Exit risky sectors early

Reduce NPA formation

Maintain healthier balance sheets

2. Faster Strategic Shifts

Private banks can quickly:

Reprice loans

Adjust sector exposure

Shift focus from corporate to retail lending

This agility is critical during trade-driven uncertainty.

3. Strong Retail and Fee Income

Retail loans (home, auto, personal) and fee-based income (cards, wealth, payments) are less directly impacted by global trade disruptions.

4. Higher Profitability Metrics

Even during economic slowdowns, private banks usually maintain:

Better Net Interest Margins (NIMs)

Higher ROA and ROE

Lower cost-to-income ratios

Weaknesses of Private Banks

Despite their strengths, private banks face unique challenges in a trade war:

No guaranteed government capital support

Higher sensitivity to market sentiment

More exposed to capital market volatility

Tendency to sharply reduce lending during stress

In severe trade wars, this risk aversion can slow growth and limit upside.

Lending Behavior During Trade Wars: The Key Difference

One of the most important distinctions is how each bank type behaves under stress.

Public Banks:

Continue lending → Support the economy → Absorb stress

Private Banks:

Protect balance sheets → Reduce risk → Preserve profitability

This difference means:

Public banks help stabilize the economy

Private banks protect shareholder value

Stock Market Perspective: Who Performs Better?

From an equity market standpoint, history shows a clear pattern:

Short to Medium Term:

👉 Private banks outperform due to better earnings visibility, lower NPAs, and investor confidence.

Crisis or Extreme Stress Phase:

👉 Public banks stabilize faster because of government intervention and recapitalization.

However, stability does not always mean stock returns. Recapitalization often comes with dilution, which limits upside for PSB stocks.

Currency Volatility and Treasury Income

Trade wars often lead to:

Bond yield fluctuations

Forex volatility

Private banks generally manage treasury risks more actively, while public banks may benefit when bond yields fall due to policy easing.

This creates mixed outcomes, but private banks usually adjust faster.

The Long-Term Winner: A Balanced Verdict

If the trade war is:

Short-lived or moderate → Private banks win

Better asset quality

Faster recovery

Superior shareholder returns

If the trade war is:

Severe and prolonged → Public banks survive better, but private banks still outperform in profitability

In other words:

Public banks win on survival and systemic importance

Private banks win on efficiency, returns, and market confidence

Final Conclusion

In a trade war, no bank is immune, but the nature of victory differs.

Public sector banks act as economic shock absorbers, backed by the state and focused on stability.

Private sector banks act as capital protectors, prioritizing asset quality, margins, and shareholder value.

From a trader or investor perspective, private banks are more likely to “win” in terms of stock performance, while public banks play a critical defensive role in keeping the financial system stable.

The smartest strategy in a trade-war environment isn’t choosing one side blindly—but understanding when stability matters and when efficiency dominates.

PSU Banks Rising: Understanding the Structural Turnaround1. Resolution of the NPA Crisis

The most important reason behind the rise of PSU banks is the significant improvement in asset quality. Between 2015 and 2019, PSU banks were hit hard by a surge in Non-Performing Assets (NPAs), mainly from stressed corporate loans in sectors such as infrastructure, power, steel, and telecom. This period forced banks to recognize bad loans transparently under stricter RBI norms.

With the introduction of the Insolvency and Bankruptcy Code (IBC), banks finally received a structured mechanism to resolve stressed assets. Large recoveries from major defaulters, write-offs of legacy bad loans, and aggressive provisioning cleaned up balance sheets. As a result, Gross NPA and Net NPA ratios of PSU banks have fallen sharply, restoring investor confidence.

2. Strong Credit Growth Cycle

India is currently witnessing a strong credit growth cycle, supported by economic expansion, rising consumption, infrastructure spending, and corporate capex revival. PSU banks, with their extensive branch networks and dominance in corporate and MSME lending, are well-positioned to benefit from this trend.

Loan growth for PSU banks has accelerated across segments such as retail loans, agriculture credit, MSMEs, and large corporates. Unlike earlier cycles, this growth is more diversified and less concentrated in risky sectors, reducing the probability of future asset quality stress.

3. Improved Profitability and ROE Expansion

Another major driver behind the rally in PSU bank stocks is improving profitability. Several factors are contributing to this:

Lower credit costs due to reduced NPAs

Higher Net Interest Margins (NIMs) from better loan pricing

Rising fee income from retail banking and government-linked transactions

Operating leverage as credit growth outpaces cost growth

As a result, PSU banks are now reporting strong quarterly profits and a steady improvement in Return on Equity (ROE) and Return on Assets (ROA). Investors who once dismissed PSU banks as low-return institutions are now re-rating them as sustainable profit generators.

4. Government Reforms and Capital Support

The government has played a crucial role in reviving PSU banks. Large-scale recapitalization over the last decade strengthened balance sheets and ensured regulatory capital adequacy. In addition, the consolidation of PSU banks through mergers has improved scale, efficiency, and competitiveness.

Policy initiatives such as digitalization, governance reforms, and performance-linked incentives have improved operational discipline. The government’s continued focus on banking sector stability reassures investors that systemic risks are well managed.

5. Beneficiaries of Rising Interest Rates

In a rising interest rate environment, banks typically benefit from higher lending yields. PSU banks, with a large proportion of floating-rate loans linked to external benchmarks, have been able to reprice loans faster than deposits. This has supported margins and profitability.

At the same time, PSU banks enjoy a strong base of low-cost CASA (Current Account Savings Account) deposits due to their trust factor and government backing. This allows them to manage funding costs better than many smaller lenders.

6. Valuation Re-rating Opportunity

For years, PSU banks traded at deep discounts to private sector banks due to concerns over governance, asset quality, and efficiency. As these concerns fade, markets are gradually re-rating PSU banks.

Even after the rally, many PSU banks still trade at reasonable price-to-book valuations compared to private peers. This valuation gap attracts long-term investors who see further upside as profitability stabilizes and growth remains strong.

7. Increased Institutional and Retail Participation

Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) have significantly increased their exposure to PSU banks. The sector’s improving fundamentals, combined with attractive valuations, make it a preferred choice during bullish market phases.

Retail investors have also shown renewed interest, driven by strong price momentum, improved quarterly results, and positive news flow. PSU bank stocks have become key components of momentum and value-based portfolios.

8. Digital Transformation and Operational Efficiency

Contrary to the old perception of PSU banks being technologically backward, many have made significant progress in digital banking. Investments in core banking systems, mobile apps, UPI platforms, and fintech partnerships have improved customer experience and reduced operating costs.

Digitization has also enhanced credit underwriting, risk management, and fraud detection, making PSU banks more competitive in the modern banking landscape.

9. Macro-Economic Tailwinds

India’s macroeconomic environment strongly favors banks. Stable inflation, manageable fiscal deficits, rising formalization of the economy, and increasing financial inclusion all support banking sector growth. PSU banks, being closely aligned with government initiatives such as infrastructure development, rural credit expansion, and MSME support, directly benefit from these tailwinds.

10. Shift in Market Narrative

Perhaps the most powerful driver behind PSU banks rising is the change in market narrative. From being considered “value traps,” PSU banks are now seen as “turnaround stories.” Markets reward not perfection, but improvement—and PSU banks have delivered consistent improvement across multiple parameters.

As long as asset quality remains under control and credit growth continues, PSU banks are likely to remain in focus for investors.

Conclusion

The rise of PSU banks is not a speculative bubble but a reflection of a deep structural transformation. Cleaner balance sheets, strong credit growth, improving profitability, supportive government policies, and attractive valuations have collectively reshaped the sector’s outlook. While risks such as economic slowdown or policy changes remain, the overall trend suggests that PSU banks have entered a new growth phase.

For investors and traders alike, PSU banks now represent a blend of value, momentum, and long-term potential—making their rise one of the most significant stories in India’s financial markets today.

RSI Indicator SecretsMastering Momentum Beyond Overbought & Oversold

The Relative Strength Index (RSI) is one of the most popular technical indicators in trading—and also one of the most misunderstood. Created by J. Welles Wilder, RSI is a momentum oscillator that measures the speed and change of price movements, oscillating between 0 and 100. While beginners treat RSI as a simple buy-low, sell-high tool, professionals use it as a market psychology meter, trend validator, and timing weapon.

Understanding RSI deeply can transform it from a basic indicator into a high-probability decision framework.

1. The True Purpose of RSI

Most traders think RSI measures overbought and oversold conditions. In reality, RSI’s primary job is to measure momentum strength.

Strong markets stay strong

Weak markets stay weak

Momentum often shifts before price does

RSI reveals whether buyers or sellers are gaining or losing control, not just whether price has gone “too far.”

That distinction alone separates amateurs from professionals.

2. The Biggest RSI Myth: Overbought ≠ Sell, Oversold ≠ Buy

One of the most dangerous mistakes traders make is:

Selling just because RSI is above 70

Buying just because RSI is below 30

In strong trends, RSI can remain overbought or oversold for extended periods.

The Secret:

Overbought in an uptrend = strength

Oversold in a downtrend = weakness

Professional traders don’t fight RSI extremes—they trade with them.

3. RSI Trend Zones (A Game-Changer)

Instead of fixed 30–70 levels, experienced traders use RSI trend zones.

Bullish Market RSI Behavior

RSI support around 40–45

RSI resistance near 80–85

Pullbacks stop above 40

Bearish Market RSI Behavior

RSI resistance around 55–60

RSI support near 20–25

Rallies fail below 60

The Secret:

If RSI refuses to drop below 40, the trend is bullish—even if price pulls back sharply.

4. RSI Divergence: The Smart Money Signal

RSI divergence occurs when price and momentum disagree.

Types of Divergence

Regular Bullish Divergence

Price makes lower lows

RSI makes higher lows

Signals selling pressure is weakening

Regular Bearish Divergence

Price makes higher highs

RSI makes lower highs

Signals buying pressure is weakening

Hidden Divergence (Trend Continuation)

Bullish hidden divergence appears in uptrends

Bearish hidden divergence appears in downtrends

The Secret:

Divergence works best near support or resistance

Divergence alone is a warning, not a trigger

5. RSI Failure Swings: Pure Momentum Signals

Failure swings are one of RSI’s most powerful—but rarely used—patterns.

Bullish Failure Swing

RSI drops below 30

RSI rises above 30

RSI pulls back but stays above 30

RSI breaks its previous high → BUY signal

Bearish Failure Swing

RSI rises above 70

RSI falls below 70

RSI rallies but stays below 70

RSI breaks its previous low → SELL signal

The Secret:

Failure swings don’t need price confirmation—they reflect internal momentum shifts before price reacts.

6. RSI Support and Resistance (Yes, It Exists)

RSI forms its own support and resistance levels, just like price.

Horizontal RSI levels often repeat

Trendlines can be drawn directly on RSI

Breakouts on RSI often precede price breakouts

The Secret:

When RSI breaks a trendline before price, it’s often an early entry signal.

7. RSI and Market Structure

RSI becomes extremely powerful when combined with higher highs, higher lows, lower highs, and lower lows.

Higher highs in price + RSI holding above 50 = bullish continuation

Lower lows in price + RSI holding below 50 = bearish continuation

The 50-Level Rule

RSI above 50 → buyers dominate

RSI below 50 → sellers dominate

The Secret:

The 50 level is more important than 70 or 30 in trending markets.

8. Timeframe Secrets: RSI Is Not Universal

RSI behaves differently across timeframes.

Higher timeframes (daily, weekly) define trend bias

Lower timeframes (5m, 15m) define entries

Professional Approach:

Identify trend using daily RSI

Enter trades using intraday RSI pullbacks

The Secret:

Never trade RSI on a lower timeframe against higher timeframe RSI direction.

9. RSI Period Adjustment (Advanced Edge)

The default RSI period is 14—but that’s not sacred.

RSI 7 → faster, more signals (scalping)

RSI 14 → balanced (swing trading)

RSI 21 or 28 → smoother (position trading)

The Secret:

Shorter periods increase sensitivity but also noise. Match RSI length to your trading style, not convenience.

10. RSI with Volume & Price Action

RSI is strongest when it confirms price action and volume.

Bullish candle + RSI holding above 50 = high-probability setup

Volume spike + RSI divergence = strong reversal clue

Breakout + RSI expansion = momentum confirmation

The Secret:

RSI should confirm, not replace, price analysis.

11. RSI in Ranges vs Trends

Range-Bound Markets

Buy near RSI 30

Sell near RSI 70

RSI works extremely well

Trending Markets

Ignore extremes

Trade pullbacks to RSI 40–50 in uptrends

Trade rallies to RSI 55–60 in downtrends

The Secret:

Before using RSI, first ask: Is the market trending or ranging?

12. Common RSI Mistakes to Avoid

Using RSI alone without context

Blindly shorting overbought markets

Ignoring higher timeframe RSI

Over-optimizing RSI settings

Treating RSI as a prediction tool instead of a probability tool

Final Thoughts: The Real RSI Edge

RSI is not about predicting tops and bottoms—it’s about reading momentum, strength, and intent. When used correctly, RSI reveals:

Who controls the market

When momentum shifts

Whether trends are healthy or exhausted

The real secret isn’t the indicator—it’s how you think about it.

Chumtrades XAUUSD Has Wave B finished?GOLD – DAILY PLAN

Has Wave B finished?

→ No confirmation yet.

Macro & Market Sentiment

US–Iran negotiations have been cancelled. Geopolitical risks remain, but not strong enough to trigger a new bullish wave.

Gold experienced a relatively calm trading session, failed to break above the key level around 5,100, and saw a moderate pullback during the US session.

The Daily candle formed a Spinning Top, indicating market indecision and consolidation, with a lack of momentum for a breakout.

👉 Macro factors are supporting prices, but not pushing the market into an immediate uptrend.

Technical Structure & Outlook

Price is still moving within a descending price channel.

On the H1 timeframe, price has broken above the 4,888 key level, showing a technical rebound.

However, the higher timeframe structure remains bearish, with no confirmed trend reversal.

→ Therefore, current rebounds are considered pullbacks within a downtrend.

Key Levels

Support: 4,810 | 4,830 | 4,700–4,750 | 4,650–4,624

Resistance: 4,950–5,000 | 5,100

Trading Scenarios

Primary strategy: Sell the rallies within the descending channel.

Look for SELL setups near resistance zones, targeting lower lows.

Momentum SELL may be considered if price clearly breaks below 4,882–4,890, with confirmation on H2 or H4, targeting around 4,810.

No BUY positions while price remains inside the descending channel.

👉 Only if price breaks and holds above 5,100, will we start reassessing a trend-following BUY scenario.

👉 Deeper pullbacks are viewed as potential zones for swing BUY opportunities, not short-term buys at this stage.

Note: The market is in a “confidence-testing” phase. Focus on zone-based trading, trend alignment, reduced position size, and avoid FOMO.

Part 1 Technical Analysis VS. Institutional Option Trading What Are Options?

Options are contracts that give you the right but not the obligation to buy or sell an asset at a fixed price before a certain date.

They are derivative instruments — their value comes from the underlying asset (index, stock, commodity, currency).

Options are mostly used for hedging, speculation, and income generation.

Two Types of Options

Call Option (CE): Right to buy at a chosen price.

Put Option (PE): Right to sell at a chosen price.

Role of FII and DII in the Indian Stock MarketIntroduction

The Indian stock market is one of the fastest-growing capital markets in the world and attracts investments from both domestic and global participants. Among the most influential players in this ecosystem are Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs). Their investment decisions significantly impact market direction, liquidity, volatility, and investor sentiment. Understanding the role of FIIs and DIIs is crucial for traders, long-term investors, policymakers, and anyone seeking to analyze market movements in India.

What are FIIs?

Foreign Institutional Investors (FIIs) are investment entities registered outside India that invest in Indian financial assets. These include:

Mutual funds

Pension funds

Hedge funds

Insurance companies

Sovereign wealth funds

Foreign portfolio investors (FPIs)

FIIs invest in equities, bonds, government securities, derivatives, and ETFs after registering with the Securities and Exchange Board of India (SEBI).

Key Characteristics of FIIs

Operate with large capital

Highly sensitive to global economic conditions

Often short- to medium-term focused

Move funds quickly across countries

Strong influence on benchmark indices like NIFTY 50 and Sensex

What are DIIs?

Domestic Institutional Investors (DIIs) are India-based institutions that invest in Indian financial markets. These include:

Mutual funds

Insurance companies (LIC, GIC)

Banks

Pension funds

Provident funds (EPFO, NPS)

DIIs represent domestic savings channeled into capital markets.

Key Characteristics of DIIs

Long-term investment horizon

More stable and less speculative

Influenced by domestic economic growth

Act as counter-balance to FIIs

Increasingly powerful due to SIP culture

Role of FIIs in the Indian Stock Market

1. Liquidity Provider

FIIs bring massive liquidity into Indian markets. Their large trade volumes:

Increase market depth

Reduce bid-ask spreads

Improve price discovery

High FII participation makes Indian markets more efficient and globally competitive.

2. Market Direction and Trend Formation

FII flows often decide market trends:

Net buying by FIIs → bullish markets

Net selling by FIIs → bearish or corrective markets

Sharp rallies and crashes are frequently linked to sudden FII inflows or outflows.

3. Impact on Blue-Chip Stocks

FIIs prefer:

Large-cap stocks

Index heavyweights

High-liquidity stocks

As a result, stocks like Reliance, HDFC Bank, Infosys, TCS, ICICI Bank are heavily influenced by FII activity.

4. Sensitivity to Global Factors

FIIs react strongly to:

US Federal Reserve interest rate decisions

Dollar strength or weakness

Global inflation data

Geopolitical tensions

Recession fears

This makes Indian markets sensitive to global news even if domestic fundamentals are strong.

5. Currency Impact

When FIIs invest:

They bring foreign currency → Rupee strengthens

When they exit:

Capital outflows → Rupee weakens

Thus, FII behavior directly impacts INR–USD exchange rates.

Role of DIIs in the Indian Stock Market

1. Market Stabilizers

DIIs act as a shock absorber during market downturns. When FIIs sell aggressively, DIIs often step in to buy, preventing deep crashes.

Example:

During global sell-offs, strong DII buying has helped Indian markets outperform peers.

2. Long-Term Wealth Creation

DIIs invest with a long-term vision aligned with:

India’s GDP growth

Corporate earnings

Demographic advantage

Their investments support sustainable wealth creation rather than short-term speculation.

3. Support from Retail Investors

The rise of:

SIPs (Systematic Investment Plans)

Mutual fund awareness

Digital investing platforms

has strengthened DIIs tremendously. Monthly SIP inflows provide consistent buying power even during volatile markets.

4. Reduced Dependence on Foreign Capital

As DII participation grows:

India becomes less vulnerable to sudden FII exits

Market volatility reduces

Financial independence increases

This shift is critical for long-term market stability.

5. Sectoral Impact

DIIs invest heavily in:

Banking and financial services

Infrastructure

FMCG

Manufacturing

PSU stocks

Their investments often align with national development priorities.

FII vs DII: Key Differences

Aspect FII DII

Origin Foreign Indian

Investment Horizon Short to medium Long term

Risk Appetite High Moderate

Sensitivity Global factors Domestic factors

Market Role Trend creator Trend stabilizer

Volatility Impact Increases volatility Reduces volatility

Interaction Between FIIs and DIIs

The Indian stock market often behaves like a tug-of-war between FIIs and DIIs.

When both buy → Strong bull market

When FIIs sell and DIIs buy → Sideways or controlled correction

When both sell → Sharp market crash

Understanding daily FII–DII data helps traders anticipate short-term market moves.

Impact on Retail Investors

Retail investors are indirectly influenced by FII and DII actions:

Rising FII inflows attract retail participation

DII buying builds confidence during corrections

Sharp FII selling can cause panic if not absorbed by DIIs

Smart investors track institutional flow data before making major decisions.

Regulatory Framework

SEBI closely monitors FII and DII activity to:

Prevent market manipulation

Ensure transparency

Maintain financial stability

Limits are placed on foreign ownership in certain sectors to protect national interests.

Importance for Traders and Investors

For Traders:

FII flow data helps in index trading

Short-term momentum often follows FII behavior

For Long-Term Investors:

DII accumulation signals confidence in fundamentals

Corrections caused by FII selling can offer buying opportunities

Conclusion

FIIs and DIIs are the backbone of the Indian stock market. FIIs bring global capital, liquidity, and momentum, while DIIs provide stability, long-term vision, and domestic strength. The growing influence of DIIs has made Indian markets more resilient and less dependent on foreign money.

For anyone serious about the Indian stock market, understanding the roles, behavior, and interaction of FIIs and DIIs is essential. Their combined actions shape market trends, influence valuations, and determine how India positions itself in the global financial landscape.

Part 3 Institutional Vs. Technical AnalysisMax Pain Theory

Price gravitates toward the strike where option writers lose the least.

Works well near expiry.

Building an Option Trading System

Identify trend with market structure.

Use volume profile for levels.

Use OI for confirmation.

Use Greeks for probability.

Execute with discipline.

Axis Bank | Gann Square of 9 Intraday Observation | 15 March 202Disclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered advisor. This is not financial advice.

Symbol: AXISBANK (NSE)

Date Observed: 15 March 2024

Time Frame: 15-Minute Chart

Method: Gann Square of 9 (Price Capacity & Time Study)

This post documents a historical intraday market observation using the Gann Square of 9, focusing on how price capacity, trend context, and time alignment can highlight potential intraday reaction zones.

📉 Market Context & Reference Point Selection

Axis Bank showed downside pressure from the opening 15-minute candle.

In such conditions, the high of the first 15-minute candle (~1050) was treated as the 0-degree reference level, following Gann methodology.

This level acts as the starting point for measuring the intraday downward price cycle.

Correct trend identification and reference selection are essential before applying Square of 9 calculations.

🔢 Square of 9 Price Mapping

Based on the selected reference:

0 Degree: ~1050

45 Degree (Observed Normal Capacity): ~1034

The 45-degree level often represents the normal intraday price expansion range under regular market conditions.

⏱️ Price–Time Interaction (Observed Behavior)

Price interacted with the 45-degree level early in the session (around the third 15-minute candle).

Completion of normal price capacity well before the later part of the trading day has historically shown signs of temporary downside exhaustion.

After reaching this zone, the market displayed short-term stabilization followed by upward expansion.

This aligns with a commonly observed Gann concept:

When expected price capacity is completed early in time, the probability of a directional reaction may increase.

📘 Educational Takeaways

Gann Square of 9 helps define intraday price limits in advance

Trend context determines how reference points are selected

Time alignment adds confirmation to price-degree levels

Normal (45-degree) reactions are more frequent than rare cases

The approach encourages rule-based observation over emotional reaction

📌 Shared strictly for educational and historical chart-study purposes.

#AxisBank #GannSquareOf9 #WDGann #IntradayAnalysis #MarketEducation #PriceTime #TechnicalAnalysis

News-Based Trading (Budget & RBI Policy)News-based trading is a market strategy where traders make decisions based on economic, political, and financial news events that can cause sudden changes in price, volume, and volatility. Unlike pure technical or long-term fundamental trading, news-based trading focuses on short-term price reactions driven by new information entering the market.

In India, two of the most powerful news events for traders are:

Union Budget

RBI Monetary Policy

Both events can move indices like NIFTY, BANK NIFTY, FINNIFTY, and individual stocks sharply within minutes.

1. Why News Moves Markets

Markets move because prices reflect expectations. When actual news differs from expectations, prices adjust rapidly.

Better than expected news → bullish reaction

Worse than expected news → bearish reaction

In-line with expectations → muted or volatile sideways move

News impacts markets through:

Liquidity changes

Interest rate expectations

Corporate earnings outlook

Investor confidence

For traders, news creates opportunity + risk.

2. Budget-Based Trading

What is the Union Budget?

The Union Budget is the annual financial statement of the Indian government, usually presented in February. It outlines:

Government spending

Taxation changes

Fiscal deficit targets

Sector-specific incentives

Why Budget Day is Important for Traders

High volatility across equity, currency, bond, and commodity markets

Sudden directional moves in indices

Sector-specific rallies or sell-offs

Key Budget Elements Traders Track

Fiscal Deficit – Higher deficit can pressure markets

Capital Expenditure (Capex) – Boosts infra, PSU, cement, steel

Tax Changes – Impacts FMCG, auto, real estate

Sector Allocations – Defence, railways, renewable energy, banking

Disinvestment Plans – Affects PSU stocks

Budget Trading Phases

1. Pre-Budget Phase

Markets often move on expectations and rumors

Certain sectors start outperforming early

Volatility gradually increases

Common trader approach:

Light positional trades

Avoid heavy leverage

Focus on sector rotation

2. Budget Day Trading

This is the most volatile phase.

Characteristics:

Sharp spikes in the first 30–60 minutes

Fake breakouts common

Option premiums expand rapidly

Index Behavior:

NIFTY & BANK NIFTY can move 2–4% intraday

Sudden trend reversals possible

Popular Budget Trading Strategies:

Option Straddle / Strangle (for volatility)

Post-speech breakout trading

Wait-and-trade strategy (after first hour)

⚠️ Many professional traders avoid trading during the speech and trade only after clarity emerges.

3. Post-Budget Phase

Real trend often emerges 1–3 days later

Markets digest data and reprice expectations

Best phase for positional trades

3. RBI Monetary Policy-Based Trading

What is RBI Monetary Policy?

RBI announces monetary policy every two months, focusing on:

Repo rate

Reverse repo

Liquidity measures

Inflation outlook

GDP growth projections

Why RBI Policy Impacts Markets

Interest rates influence:

Bank profitability

Loan demand

Corporate earnings

Currency valuation

Bond yields

Even a single word change in RBI commentary can move markets.

Key RBI Policy Components Traders Watch

Interest Rate Decision

Rate hike → bearish for equities, bullish for banks short term

Rate cut → bullish for equities

Policy Stance

Accommodative → growth-friendly

Neutral / Withdrawal → cautious sentiment

Inflation Outlook

Higher inflation → rate hike fears

Lower inflation → easing expectations

Liquidity Measures

Tight liquidity → market pressure

Easy liquidity → risk-on mood

RBI Policy Trading Phases

1. Pre-Policy

Markets move on expectations

Bond yields and banking stocks react early

Option IV rises

2. Policy Announcement (2:00 PM)

Immediate spike in volatility

Algo-driven moves dominate

Sharp whipsaws common

Common mistakes:

Market orders during announcement

Over-leveraged option buying

3. Governor’s Speech

Trend clarity often comes during speech

Commentary matters more than rate decision sometimes

4. Instruments Used in News-Based Trading

Cash Market

Suitable for experienced traders

Slippage risk high

Better post-event

Futures

High risk due to gap moves

Strict stop-loss required

Options (Most Popular)

Limited risk strategies

Best suited for volatility events

Common Option Strategies:

Long Straddle / Strangle (high volatility)

Iron Condor (if volatility expected to drop)

Directional option buying after confirmation

5. Risk Management in News Trading

News-based trading is high-risk, high-reward. Risk control is non-negotiable.

Key Rules:

Reduce position size

Avoid trading without a plan

Do not chase first move

Use defined-risk option strategies

Accept slippage as part of the game

Many traders lose money not because of wrong direction, but because of overconfidence and overtrading.

6. Psychology of News Trading

News trading tests emotional discipline.

Common psychological traps:

FOMO during fast moves

Panic exits

Revenge trading after loss

Successful news traders:

Stay calm during volatility

Trade reactions, not headlines

Accept that missing a trade is better than forcing one

7. Advantages of News-Based Trading

Large moves in short time

High liquidity

Clear catalysts

Opportunity across asset classes

8. Disadvantages

Extreme volatility

Algo dominance

Slippage and spread issues

Emotional pressure

Conclusion

News-based trading around the Union Budget and RBI Monetary Policy is one of the most exciting yet challenging styles of trading in the Indian market. These events can create massive opportunities, but only for traders who understand expectations, volatility, and risk management.

For beginners, it is better to observe first, trade later. For experienced traders, combining news understanding with technical levels and options strategies can be highly rewarding. Ultimately, success in news-based trading comes not from predicting the news, but from managing risk and trading market reactions intelligently.