USDT Dominance Forming Triple Bottom – Bearish SignalUSDT Dominance is showing a triple bottom formation on the daily timeframe – a pattern that historically signals a potential reversal or bounce. Each time USDT.D has tested this region in the past, we've seen a strong bounce in dominance, often followed by pullbacks in BTC and altcoins due to their inverse relationship.

Key indicators aligning:

RSI is rebounding from oversold levels

Stochastic RSI showing upward momentum

MACD also signaling a possible bullish crossover

With August traditionally being a bearish month, we may be heading into a corrective phase or even a sharp dump across the crypto market.

📉 Take profits where needed and prepare for the next opportunity. Stay cautious and trade with discipline.

Usdtdominance

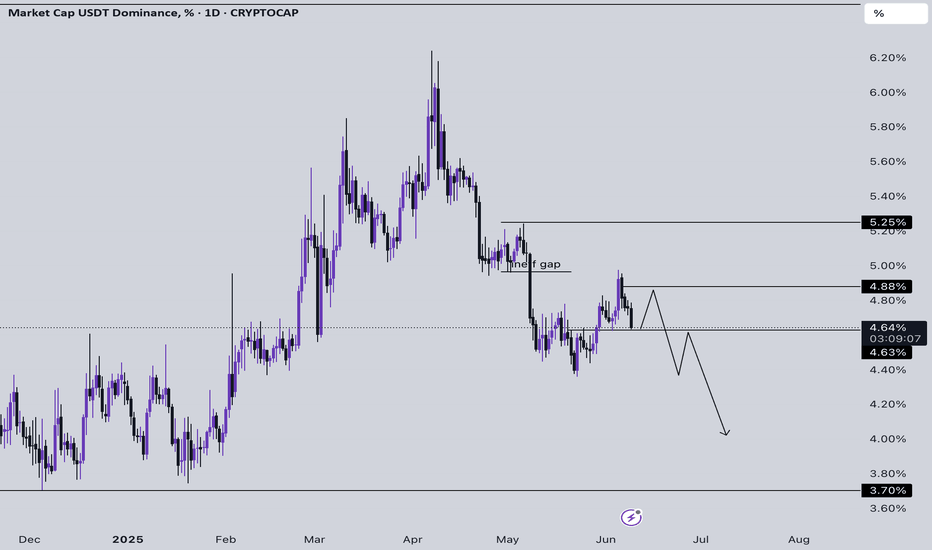

USDT Dominance Crypto Path & Commentary for Bull Run- USDT D is currently trading at 4.64% and looks bearish from a Market Structure Shift

- USDT D can now soon move towards 4.88% and purge that to trap late longs and that should be the last bounce before we drop to 3.7%

- Another case is if we don't see USDT getting rejected badly from 4.88% then we might see another structure shift which will be Bullish and then we might soon see USDT heading towards 5.25%

- From a structure perspective I like how the setup is building in USDT D from a Bullish Perspective for the overall market

- USDT D dropping to 3.7 will help in a good recovery when it comes to Alts

- From an entry perspective watch out for 4.79-4.88% 5.15-.5.25% in Spot

USDT.D BULLISH DIVERGENCE SET TO BLEED BTCCRYPTOCAP:USDT.D has formed a bullish divergence and a clear double bottom with proper higher lows, signaling a potential surge toward the 4% to 4.10% resistance area. This movement could lead to a significant drop in BTC and altcoins, as USDT.D and the crypto market are inversely correlated.

USDT.D DOUBLE BOTTOM & BULLISH DIVERGENCE , POSSIBLE RETEST 4.7%#USDT dominance ( CRYPTOCAP:USDT.D ) has formed a double bottom on the higher timeframe, aligning with another double bottom visible on the daily timeframe. The RSI is showing a clear bullish divergence, further strengthening the probability of a retest toward the 4.7% resistance area from the current 4% level. Looks bear in BTC & altcoins go short correction.

Crypto USDT Dominance Update & Commentary- USDT Dominance is currently trading at 4.61%

- USDT Dominance works inversely with the Crypto Market

- If you see USDT Dominance falling and being bearish then are high chances of crypto moving up impulsively

- Current Market Structure of USDT Dominance looks highly bearish

- We can expect USDT Dom to easily fall down to 4.29% and 3.81%

- These 2 zones are highly going to be important because in between that we will also see some sort of upside retracement followed by more downside moves

- I have drawn more downside zones like 2.45% and 1.90% as well where you can expect USDT Dominance to absolutely get slaughtered and this should mark the local end of bull run.

A comparison of US Economy under Trump Vs Joe Biden PresidencyIt is debatable whether any sitting US President can exert much control over an economy that is as large and as complex as that of the U.S. But Stock Markets are a fair indicator of the overall state of the US economy based on investor sentiment in the markets.

So let's have a look at the various factors that affected how the Dow Jones (as an illustrative example) and the US economy in general fared under Trump Vs Biden-Harris.

1. The DJI gained an impressive approx +12337 points (+67.22%) during the Presidency of Donald Trump, whereas it gained an equally impressive +11,868 points (+38.70%) under Biden-Harris.

2. Yet, the markets stumbled in the Second year of each Presidency - due to COVID lock downs, rising interest rates, Government shutdowns, Trade friction with China (under Trump), and rise in Inflation and interest rates (under Biden).

3. Year-3 was best under each Presidency, with impressive returns and dividends partly driven by reduction in interest rates (under Trump), Billions of Dollars in Stimulus packages, and reopening of economy post COVID and burgeoning AI driven boom (under Biden) and also lowering of interest rates (late into Biden Presidency).

4. Americans enjoyed relatively low Inflation under Trump, whereas resurgence of Inflation has been the biggest problem of Biden-Harris administration. The COVID induced supply chain snarls, geopolitical pressures, unleashing of pent-up demand, all pushed prices sharply higher under Biden-Harris.

5. Inflation has since cooled, most supply chains have normalised, Aggressive Fed rates have helped bring down price growth, still Inflation has increased by +20% during Biden-Harris Presidency and Americans are grappling under it's debilitating effects.

6. The US economy added 6.8 million jobs in the first three years under Trump, it then lost 9.8 million jobs in 2020 producing a Net Loss in employment under Trump. The US added 16.4 million jobs under Biden-Harris.

7. Americans ability to spend is usually their view of the economy. It is no surprise that most Americans feel they did better under Trump, when although wages were lower, but so was Inflation, with average hourly earnings rising +6.4% under Trump. While a tight labour market brought significant wage growth for most Americans under Biden-Harris, high Inflation has restricted purchasing power. The REAL Inflation adjusted wage growth under Biden-Harris is only +1.4%.

8. Notwithstanding a strong job market and economy under Biden-Harris, consumers aren't pleased with economic the conditions. But the Biden-Harris administration inherited a country suffering from the COVID pandemic fallout and soon Inflation added to the woes. Considering these factors Biden-Harris has done a fair job of keeping it together despite the added presuure of global geopolitical challenges.

Even as the US markets are at All Time High levels, confidence in the trajectory of the economy is very low. The Gallup's Global Life Evaluation Index for US is registering low levels of confidence typically seen during recession.

So, which Presidential candidate Trump or Harris, do you think will be better for the US economy in General and US and global markets in particular?

Please let us know in the comments below.

And we will have to wait and see who wins the elections this time and how the markets react.

USDT Dominance Crypto Update - The USDT Dominance is currently trading at 5.58%

- USDT Dominance is something that follows market structure a lot and you will see this delivering easy price actions

- USDT Dominance is expected to drop to 5.2%, and if that doesn't hold, then to 4.6%.

- USDT Dominance in crypto works inversely with the overall market if you see this dipping that triggers an impulsive leg in cryptos

- The last time when we saw USDT Dominance dropping from 6.5% to 3.81% it triggered a huge Altcoins season which led to many altcoins moving 300-500%

- As an Investor and Trader your job is to closely monitor USDT Dominance

USDT Dominance Update - USDT Dominance is currently trading at 5.31%

- USDT is at its crucial support or demand zone

- This signifies we can soon expect a drop in the prices of cryptos

- Watch out for your Spot Longs and try locking in gains before market goes back to your cost

- I have locked in 50% gains in many positions and I will plan to add fresh positions once I see a dip again

Crypto USDT Dominance Update- USDT Dominance is currently trading at 6.28%

- USDT dominance got rejected exactly from 6.51% where I was expecting it to get rejected from

- Now the whole interest lies in whether it will again flip 6.51% or reject from here and flip its structure to bearish

- But if it makes a weekly close above 7% you can easily expect the Crypto Market to show a Major bloodbath

- Stay Cautious and keep tracking this

USDT.D Retesting Previous Support as New ResistanceUSDT.D Bullish Divergence and Double Bottom Signal a Trendline Retest

USDT dominance ( CRYPTOCAP:USDT.D ) has formed a bullish divergence on the 4-hour chart, along with a double bottom pattern.

These signals suggest that USDT.D is gearing up to retest the trendline. Meanwhile, Bitcoin and altcoins are likely to undergo a retracement, offering another healthy opportunity to enter long positions.

This setup indicates potential strength in USDT.D, which may lead to a temporary pullback in the broader crypto market before resuming the uptrend.

USDT.D formed bearish shark pattern USDT.D formed bearish shark patten and also formed clear bearish divergence .

which clearly shows it will retest 5.19% area if that also breaks bullish for crypto market

usdt.d and btc & altcoins are inversely related so we can expect pull back .

btc targets around 65k & 69k.

USDT Dominance Trade Setup - USDT Dominance is trading at no trade zone

- To determine a one-sided bias its going to be tough

- IMO I believe we can see more retracement worth 0.5% and then pull back so watch out for that pullback if you are holding altcoins because they will start bleeding again unless the structure gets broken badly with mass volume

- Manage risk and position accordingly

USDT.D Bearish Shark Pattern Signals Move to Key Support LevelsUSDT.D has formed a bearish shark pattern and has broken the support trendline, indicating a likely move towards the 4.6% and 4.10% support areas. The bearish confirmation is further supported by the RSI falling from the overbought zone and a clear bearish cross on the MACD.

#USDTDominance #BearishSharkPattern #TechnicalAnalysis #Crypto #RSI #MACD #SupportLevels #CryptoTrading

USDT.D FORMED BEARISH PENNET HUGE CRYPTO BULLUSDT.D has formed a bullish pennant pattern, and the daily RSI is in the overbought area. At the same time, the weekly RSI trendline has been rejected. This indicates a likely decline for USDT.D, giving the crypto market a chance to move upwards—a bullish sign for BTC and crypto. 🚀📈

#USDT.D #Crypto #CryptoMarket #BullishPennant #RSI #Overbought #MarketAnalysis #CryptoTrading #Bitcoin #BTC #Altcoins #Bullish #CryptoInvesting #TechnicalAnalysis #CryptoSignals

Impending Drop: USDT.D Faces Significant DeclineHi friends,

If you observe the recent behavior of USDT dominance (USDT.D), it bounced back and touched 5%, but now it has clearly formed a double top pattern, which is a bearish sign. Additionally, the RSI is declining, supporting our bearish scenario. Whenever USDT.D falls, the crypto market tends to rise, and BTC often rallies. These two are inversely related.

#USDT #CryptoMarket #Bitcoin #BTC #CryptoTrading #TechnicalAnalysis #DoubleTop #BearishPattern #RSI #CryptoNews #Cryptocurrency #TradingAnalysis #MarketTrends #InverseRelationship #CryptoInvesting

#USDT Dominance (USDT.D) Loses Support, Plunges to 4%#USDT Dominance (USDT.D) Breaks Support, Now Acting as Resistance with Potential Drop to 4% Key Support Area**

1. **Support Break and Role Reversal**: #USDT.D recently broke through its significant support level, which has now flipped to act as resistance. This shift indicates a potential for continued downward movement.

2. **Technical Patterns**: The previous support level is now exerting downward pressure as resistance, aligning with bearish technical patterns observed in the market.

3. **Target Levels**: With resistance firmly established, #USDT.D is poised to decline further, potentially reaching the critical support area around 4%. This zone is essential for traders to monitor as it could provide a temporary halt or reversal point.

4. **Market Implications**: The weakening of #USDT.D suggests a possible increased confidence in alternative cryptocurrencies, as funds might be flowing from stablecoins to other digital assets. This shift could indicate a broader bullish sentiment in the cryptocurrency market.

USDT.D: Identifying a Falling Wedge#USDT Dominance (USDT.D) Analysis

#Current Technical Setup

**Timeframe**: 4-hour chart

**Patterns Observed**:

1. **Bullish Divergence**: USDT.D has formed a bullish divergence, indicating potential upward momentum. Bullish divergence occurs when the price makes lower lows, but the oscillator (such as RSI or MACD) makes higher lows, suggesting weakening downward momentum and a possible reversal to the upside.

2. **Falling Wedge**: The chart is currently forming a falling wedge pattern, a bullish reversal pattern. This pattern is characterized by converging trend lines sloping downward, indicating a potential break to the upside if the price manages to break out above the upper trend line.

#### Key Resistance Levels

1. **5.18%**: This is the initial resistance level that USDT.D might encounter after a breakout from the falling wedge. It marks a significant level where the price has previously faced selling pressure.

2. **6.2%**: If USDT.D successfully breaks above the 5.18% resistance, the next major resistance level is at 6.2%. This level represents a more substantial barrier and could be a pivotal point in determining the continuation of the upward trend.

#### Support Levels and Bearish Scenario

1. **4.5%**: If USDT.D fails to sustain above the current support level within the falling wedge, it could experience a significant decline, with the next support level at 4.5%. This would represent a bearish scenario, suggesting a potential plunge in USDT dominance and possible increased risk appetite in the broader cryptocurrency market.

### Detailed Description

**Bullish Divergence**: The presence of a bullish divergence on the 4-hour chart is a positive sign for USDT.D. Divergences are powerful indicators that often precede significant price movements. In this case, the divergence suggests that despite the recent downward price action, the selling pressure is diminishing, and buyers may soon gain control.

**Falling Wedge Pattern**: The falling wedge is a well-known bullish reversal pattern. It indicates that while the price is falling, the downward momentum is slowing down, and a breakout to the upside is likely. Traders often look for confirmation of this pattern by waiting for the price to close above the upper trend line with increased volume.

**Resistance Levels**:

- **5.18%**: This level is crucial as it has acted as resistance in the past. A break above this level would likely attract more buyers, pushing the price higher.

- **6.2%**: A further move to this level would confirm the strength of the breakout. It is a more significant resistance level and could determine whether the bullish trend continues.

**Support Level at 4.5%**: If USDT.D fails to hold its current support level and breaks downwards, a decline to 4.5% is possible. This would indicate a bearish turn and suggest that traders are moving away from USDT into other assets, reflecting a more risk-on sentiment in the market.

#Conclusion

USDT.D is at a critical juncture with a bullish divergence and a potential falling wedge pattern. The key resistance levels to watch are 5.18% and 6.2%. A break above these levels would confirm the bullish outlook. Conversely, failure to hold support could lead to a decline to 4.5%, indicating a shift in market sentiment. Traders should closely monitor these levels and patterns to make informed decisions.

Bullish Flag Pattern Emerging on #USDT.D The formation of a bullish flag pattern on #USDT.D (Tether dominance index) could have significant implications for the broader cryptocurrency market, particularly Bitcoin (BTC) and altcoins.

A bullish flag pattern typically occurs after a strong upward price movement (flagpole), followed by a period of consolidation (flag). This consolidation phase is characterized by lower trading volumes and a narrowing price range, forming a flag-like shape on the chart.

If USDT.D breaks out of this bullish flag pattern to the upside, it could indicate a continuation of the previous uptrend in Tether dominance. In the context of the broader market, this could mean a preference for stablecoins like USDT over other cryptocurrencies, suggesting a potential shift towards risk aversion or uncertainty among investors.

Given the inverse relationship between USDT.D and the rest of the crypto market, a breakout to the upside in USDT.D could indeed lead to a significant correction in both Bitcoin and altcoins. This is because investors may perceive stablecoins as safer assets during periods of market turbulence, leading to selling pressure on riskier assets like BTC and altcoins.

In summary, a bullish flag pattern formation on USDT.D carries implications of potential risk aversion in the cryptocurrency market, with the possibility of Bitcoin and altcoins experiencing a notable correction if the pattern breaks to the upside. Traders and investors should closely monitor USDT.D for confirmation of this pattern and adjust their strategies accordingly to manage risk effectively.

#USDT.D (Tether Dominance) Bullish: Signs of Strength#USDT.D (Tether Dominance) has formed a bullish divergence pattern, indicating a potential uptrend reversal. The price is currently surging towards the 5.04% resistance level, which, if retested or broken, could lead to a further upward movement.

It's important to note the inverse relationship between USDT.D and the overall cryptocurrency market. When USDT.D rises, it suggests a flight to safety into stablecoins like Tether, often leading to a decline in the prices of cryptocurrencies such as Bitcoin and altcoins.

The next key resistance level to watch is around 5.63%. If USDT.D breaks above this level, it could signal a significant move towards higher levels, potentially causing a plunge in the crypto market.

Traders should closely monitor the price action of USDT.D and consider its implications for the broader cryptocurrency market. Factors such as market sentiment and external events can also impact the relationship between USDT.D and other cryptocurrencies. market sentiment and overall market conditions when making trading decisions based on technical analysis.