Usmarkets

Bullish Divergence in Dow Jones Industrial AverageRSI Bullish Convergence was there on weekly charts of Dow Jones only 5 times in last 20 years, which was always followed by average 15-18% market rally

similar RSI convergence is visible on weekly Dow Jones chart Right now, pre-covid highs are acting as a support

Disclaimer: Chart, data and levels for study purpose only. I am not a financial advisor. Use your intelligence before investing.

US VIX Alarming Further Sharp CorrectionThe US VIX (volatility index) is over heated at +32 which is unusual. As the US indices have been corrected up to 20-32% from the swing high, technically it is already a crash and enter of bear market especially the technology sector, the most hit one. Next level is recession. My observation is, the increasing VIX is alarming further potential sharp correction in the US market. So brace for the worst and plan your investment programs accordingly even though if it is mutual funds or SIPs. Personal views only. Please consult your financial advisors before investing or divesting in the market.

DOW JONES: A leading diagonalIndex is unfolding as a leading diagonal of which 4th wave is already concluded and right now we are into the last stages to complete the 5th wave of this leading diagonal which will bring the index below the level of 30635 in the near term. Traders should remain short for the minimum target region of 30600-30000 in the coming weeks with stop loss of 32600.

Russell 2000 | At 0.5 Fibonacci RetracementRussell 2000 We can see this has already corrected to 0.5 Fibonacci Levels, and also we can see 2 previous Highs made in 2018 and 2020, As shared in the analysis of S&P 500 previously that we could notice further breakdown but after some pullback makes more sense looking at Russell 2000's chart.

S&P 500 | Bearish Head & Shoulder PatternOn the Weekly chart in S&P 500 , I can notice Bearish Head and Shoulder Pattern , but coming week after this drastic fall maybe we can see some pullback to the neckline and then further collapse on the downside at least till the level I have marked that is 3491.25 SP:SPX

MSFT in correction mode after extended wave 3?Microsoft corporation is undergoing wave 4 correction in long term, wherein wave A is unfolding in 5 waves.

Currently wave (5) is extending and expected to tag 242 range. After this there would be a pull back and this would then named as Wave B in long term (This wave may 3 or 5 wave structure)

Lets wait and watch

Dow Jones AnalysisOn a verge of breakout from falling wedge pattern. If happens it bullish sign and for more confirmation need to cross swing high of 35700.

All Important Supports and Resistances are drawn in chart. All levels are on closing basis.

Please have a look and revert back if you need some more study on it.

Disclaimer : Consult Your Financial Advisor Before Taking Any Decision On This Analysis.

Four benefits of investing in US markets; check how Indian invesIndian economy is expected to record a sharp V-shaped recovery as the business environment normalizes. Despite this, Indians should overcome the home country bias and ideally consider diversification of portfolio through investment opportunities in international markets. This will diversify the extant geopolitical risk associated with emerging economies, especially during periods of global/ regional financial crisis (i.e., East Asian crisis (96-97), 9/11 terror attacks and global financial crisis of 2008-09). So should form part of investor’s portfolio as part of as a prudent asset allocation and risk mitigation strategy

Indian economy has witnessed above average growth rate amongst the G-20 large economies, next only to China, over the last 20 years. This trend is expected to continue for the foreseeable future. According to the IMF, Indian economy contributes about 3.3% to the global Gross Domestic Product (GDP). Countries such as the USA and China contribute 23.6% and 15.5% to the global GDP, respectively.

It brings to fore a pertinent question in the minds of most investors, “Should we really be considering investments in overseas markets?” Clearly, India presents decent broad-based opportunities for growth, as corporate profitability generally tracks the GDP growth and the stock prices follow suit.

While the question remains a pertinent one, Indian investors still have a lot to benefit by investing in overseas markets. Here is my take on a few important points which corroborate the need for investing in overseas markets.

An extensive array of investment opportunities

Whenever you think about the top brands in the world or brands of products and services you use on a daily basis, more often than not, you will think about Apple, Google, Facebook, Microsoft, Samsung, Amazon, Netflix and the likes of these. And you will notice that brands that feature mostly prominently in your list, are not listed on the Indian Stock Exchanges.

So, despite India being amongst the fastest growing economies, it does not house some of the best brands a.k.a. companies in the world. Thus most of the opportunities for wealth creation arising out of the growth of such companies isn’t available for domestic investors. The leading companies of truly global nature, especially cutting edge technology and consumer internet/electronics space, which enjoy a deep moat are listed predominantly on the US stock exchanges. Also, exposure to next-gen innovation-led sectors like electric/autonomous vehicles (EV/AV), AI & ML (Artificial Intelligence & Machine Learning), robotics and bio-medical/ pharma can be taken through these markets. Also the United States, for instance, houses many of the largest consumer, banking and services companies, which are world leaders in their sectors.

So as an investor, allocating a part of the overall equity allocation to international equities can prove to be advantageous for boosting the overall returns of the portfolio.

Benefits of Geographical Diversification

Most investors are aware of the power of diversification and prudently manage diversification across asset classes, like equity, debt, gold, etc. Within equities too, investors with guidance from their advisors or wealth managers manage efficiently allocation between large cap or mid & small cap.

Similarly, investing a portion of your asset in overseas markets will add the benefit of diversification in your portfolio by not completely depending on the Indian stock markets or Indian economy, but by placing bets on the global GDP growth and consumer/technology spend and the companies/sectors which will ride on the wave for business and profitability.

This will help an investor mitigate the factors which impact the domestic stock markets and the overall economy in general. These factors could be both local or global, e.g. foreign investors pull money out from the emerging economies due to some global exigency and shifting assets to a safer haven investments like US treasuries or Gold, or changes in domestic regulations or policies which could have a knee jerk reaction in the stock market.

Thus adding an overseas flavor to an investors’ portfolio would give a geographical diversification based cushion to the investors overall portfolio.

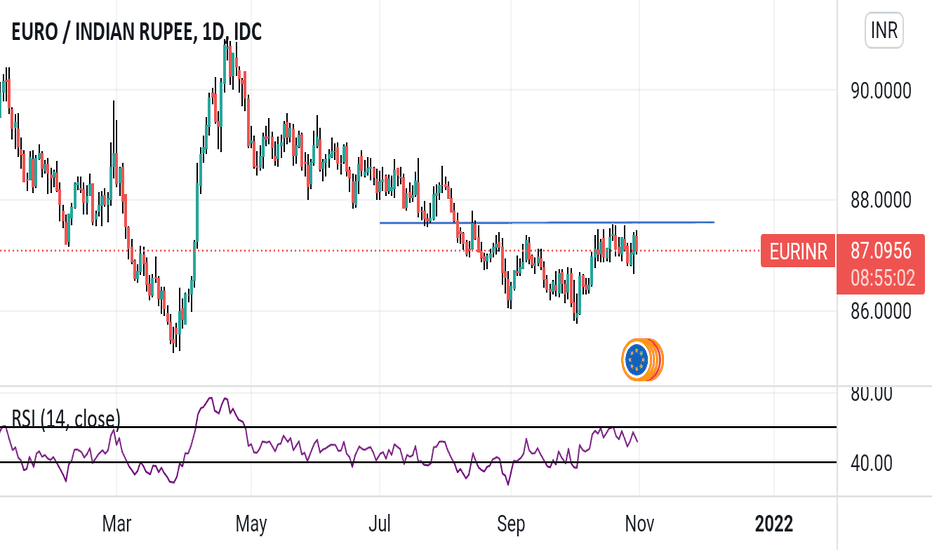

Profit Rupee depreciation

There is a proven long term trend of depreciation of rupee versus currencies of developed economies which adds to investors’ returns year on year. It is well known that US dollar is the safe haven currency for global investors especially in times of a global crisis. This was evident as when the recent Covid-19 pandemic hit the world with a shock, Indian rupee depreciated almost 8.5% from the high on January 13, 2020 to the low on April 22, 2020.

Indian economy, historically has always been in a state of current account deficit and coupled with high structural inflation rate thereby leading to a higher interest rate regime compared to the developed economies, the Rupee always remains under depreciating pressure.

The long term rupee depreciation is in the range of 3-4% p.a. and this straight away bumps up the returns an investor makes on global/dollar investments.

Building a global currency pool

There has been a steady change in social and demographic profile of Indian investors. Now most of us are aligned to the global economy in terms of our consumption, thus making large substantial direct or indirect expenses in foreign currency. These include either kids’ education or medical expenses or business / travel requirements. So one could protect themselves from currency risk while planning for such future expenses by investing in foreign currency assets.

What are the various ways for Indian investors to invest globally?

There is free app indmoney

Invest in US Stocks from India

Zero fee to remit money. There are no setup fees to get started or monthly fees.

Best exchange rate. Get more dollars for your rupees.

No paper work. Instant processing within a few minutes.

I am gifting you ₹150 Amazon Stock free . Join me on the INDmoney app using my link to claim today you

won't charge commissions for any buy/sell orders.

There is one more advantage you can buy shares in firctions.

Use My Referral code:SOM18597AMZ

HOW TO INVEST IN US MARKETS | STEP BY STEP GUIDENYSE:V

Trade Logic | UPTREND STOCK BUY ON BREAKOUT . INVEST LONG TERM . US STOCK #1.

Entry 235

Stop 225 -4%

Target 250 +6%

RR 2.2+ 2nd Target Open

Details on chart as always

1 free US Stock Trade Idea Every Weekend.

TOPIC THIS WEEK | HOW TO INVEST IN US MARKET FROM INDIA

STEP 1. You can do it in many ways. Some Brokers provide you this facilities. Upstox used to do it earlier. Maybe some other brokers also. If you know any comment Below. Share with other trades too.

But 1 Simple way is start with INDMONEY app. You can search on Internet for more info. Its registered with SEBI too so hopefully safe.

STEP 2. Do all the Registration formalities. You can tranfer funds online and offline too. Best way is to Start with ICICIBANK account. It is only Bank for online Quick Transfer of funds currently . More details ON TWITTER.

STEP 3. Stay connected with us here on TRADINGVIEW. Every weekend we will share 1 good Trade and investment idea on US stocks. You can study and invest after your own analysis.

Thanks for Reading. Share with your friends. If you have any Doubts comment below. Happy Investing.

TEST FIRST / THEN INVEST