SAMMAAN Capital: Trendline Breakout, Chart of the weekFrom Housing Finance Giant to NBFC Phoenix: Why NSE:SAMMAANCAP Breakout Could Signal a Multi-Bagger Opportunity. Let's Analyse in the Chart of the Week.

As per the Latest SEBI Mandate, this isn't a Trading/Investment RECOMMENDATION nor for Educational Purposes; it is just for Informational purposes only. The chart data used is 3 Months old, as Showing Live Chart Data is not allowed according to the New SEBI Mandate.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Price Action Analysis:

Overall Trend Structure:

- The stock has been in a prolonged downtrend from its recent high of ₹260 in early 2022

- A major capitulation event occurred in July 2024, creating a panic low at ₹79.38

- Since the July 2024 low, the stock has formed a clear accumulation phase with higher lows

- Recent price action shows a strong breakout from a descending trendline that acted as resistance since early 2024

- Current price at ₹165.03 represents a 107% rally from the lows, indicating strong momentum recovery

Candlestick Patterns & Momentum:

- The most recent weekly candle shows a massive bullish engulfing pattern with a substantial body, suggesting strong buying conviction

- Price has cleared multiple resistance zones with authority, indicating institutional accumulation

- The breakout candle shows no upper wick, demonstrating aggressive buying and a lack of selling pressure at higher levels

- Consecutive green candles in recent weeks suggest sustained buying interest

- The price action exhibits characteristics of a potential trend reversal from bear to bull phase

Moving Averages & Dynamic Support:

- Price has reclaimed all major short-term moving averages

- The stock is now trading above its 50-week moving average

- A golden cross formation appears imminent as shorter-term MAs cross above longer-term MAs

- Previous resistance zones are now expected to act as support on pullbacks

Volume Spread Analysis:

Volume Profile:

- Massive volume spike on the latest breakout candle (462.74M vs average 86.92M) - approximately 5.3x the average volume

- This represents the highest volume since early 2022, indicating significant institutional participation

- Volume during the accumulation phase (July 2024 - September 2025) was relatively subdued, typical of smart money accumulation

- Previous high-volume events coincided with panic selling in 2022 and mid-2024

- Current volume expansion during upward movement is a classic sign of breakout validity

Volume-Price Correlation:

- The price-to-volume ratio shows a healthy correlation during the recent rally

- Higher volume on up days compared to down days indicates bullish sentiment

- The massive volume breakout suggests this move has strong institutional backing

- No signs of distribution (high volume on down days) at current levels

Volume Analysis Inference:

- The 5x volume expansion confirms a genuine breakout rather than a false move

- Smart money appears to be entering positions aggressively

- Retail participation is likely to increase given the media coverage and the F&O ban lifting

- Volume profile supports continuation of the uptrend in the near-term

Key Support & Resistance Levels:

Major Resistance Zones:

- R1 (Immediate): ₹175-180 - Minor psychological resistance

- R2 (Near-term): ₹200-220 - Previous consolidation zone and descending trendline confluence

- R3 (Major): ₹240-260 - Recent high zone with significant supply potential

- R4 (Psychological): ₹300 - Round number psychological barrier

Major Support Zones:

- S1 (Immediate): ₹150-155 - Recent breakout level, now acting as support

- S2 (Strong): ₹135-140 - Multiple touch points and previous resistance turned support

- S3 (Critical): ₹113-120 - Horizontal support zone with high volume node

- S4 (Ultimate): ₹100-105 - Major accumulation zone and swing low area

Key Price Levels to Watch:

- Breakdown level to watch: ₹145 (invalidation of bullish setup)

- Pivotal zone: ₹135-140 (must hold for bullish continuation)

- Stop-loss zone for longs: Below ₹130

Base Formation & Pattern Recognition:

Primary Base Structure:

- The base shows characteristics of a "Stage 1" accumulation base as per the Weinstein methodology

Secondary Patterns Identified:

- Descending Channel: From January 2024 to September 2025, the stock traded within a falling channel

- Breakout Pattern: Recent weekly candle broke above the descending trendline resistance with authority

- Double Bottom: A smaller double bottom formation exists at the ₹100-105 level (June-July 2025)

- Higher Low Sequence: Since the July 2024 bottom, the stock has made consistent higher lows - ₹79, ₹100, ₹130, ₹135

Pattern Implications:

- The quality of base formation (15 months) indicates strong institutional accumulation

Technical Indicators Assessment:

Trend Indicators:

- Price trading above descending trendline for the first time in 18 months

- Structure shifted from lower highs/lower lows to higher highs/higher lows

- Breakout above multi-month resistance confirms trend reversal

- Weekly timeframe showing a clear momentum shift

Volatility Indicators:

- Recent expansion in price range indicates increasing volatility

- Volatility expansion during upward movement is a bullish characteristic

- ATR (Average True Range) is likely expanding, providing better trading opportunities

Diversification Rules:

- Maximum NBFC/Financial sector exposure: 15-20% of portfolio

- Since Sammaan Capital is an NBFC, ensure other NBFC holdings don't exceed the sector limit

- Correlation check: Avoid overweight in stocks moving in tandem

- Rebalance if a single position grows beyond 10% due to appreciation

Risk Management Framework:

Technical Risk Factors:

- Breakout failure risk: 30% probability of pullback to ₹140-150

- False breakout risk: Volume sustenance needed for confirmation

- Resistance rejection risk: ₹220 zone has strong supply potential

- Trend reversal risk: Any weekly close below ₹130 invalidates the bullish thesis

- Volatility risk: NBFC stocks prone to sudden regulatory/news-driven moves

Risk Mitigation Strategies:

- Never invest more than planned position size, even if the setup looks perfect

- Use limit orders instead of market orders to avoid slippage

- Don't average down if SL is hit - accept loss and re-evaluate

- Keep a 30% cash reserve for better entry opportunities

- Use trailing stops religiously once in profit

- Maintain a trading journal to track decisions and learn from mistakes

Portfolio Risk Constraints:

- Maximum drawdown tolerance: 20% on this position

- Overall portfolio heat: Not more than 4-5% at risk across all open positions

- Correlation check: If market corrects 5%, financial stocks may correct 7-8%

- Sector concentration: Limit NBFC exposure even if multiple opportunities arise

- Black swan provision: Always keep an emergency exit plan

Risk Monitoring Checklist:

- Daily: Check if price respects support zones

- Weekly: Review volume patterns and trend integrity

- Monthly: Reassess fundamental drivers and news flow

- Quarterly: Deep-dive into earnings, asset quality, regulatory changes

- Event-driven: Monitor RBI policies, interest rate decisions, sector news

Exit Risk Management:

- Never hold through a major support breakdown, hoping for recovery

- If SL hit, stay away for 2-3 weeks before re-entry consideration

- Avoid revenge trading after the stop-loss trigger

- Book partial profits at predetermined levels - don't get greedy

- If the target is achieved faster than expected, evaluate for signs of exhaustion

Sectoral Analysis - NBFC & Housing Finance:

NBFC Sector Overview:

- NSE:SAMMAANCAP is a mortgage-focused non-banking financial company (NBFC) regulated by the Reserve Bank of India (RBI) and rated 'AA' by CRISIL and ICRA

- The NBFC sector has witnessed consolidation over the past 3 years post-COVID disruptions

- The regulatory framework has tightened with the RBI implementing scale-based regulations

- A favourable policy environment exists with a stable macroeconomic backdrop

- Housing finance remains a priority sector with government's push for affordable housing

Current Sector Dynamics:

- Interest rate cycle appears to be stabilising after aggressive hikes in 2022-2023

- Credit growth in retail segments (housing, LAP) remains robust at 15-18% YoY

- Asset quality concerns have moderated across the NBFC sector

- Competition is intensifying with banks offering competitive home loan rates

- Digital transformation and fintech partnerships reshaping distribution

Sector Growth Drivers:

- India's housing demand remains strong, driven by urbanization and nuclear families

- Under-penetrated mortgage market compared to developed economies (10% vs 50-70% mortgage-to-GDP)

- Government schemes like PMAY (Pradhan Mantri Awas Yojana) support affordable housing

- The Loan Against Property (LAP) segment is growing as businesses seek growth capital

- Co-lending arrangements between NBFCs and banks gaining traction

Sector Headwinds:

- Asset-liability management challenges for smaller NBFCs

- Rising cost of funds impacting margins

- Regulatory compliance costs are increasing

- Competition from banks with lower cost of funds

- Economic slowdown risks impacting borrower repayment capacity

Regulatory Environment:

- RBI's scale-based regulation framework implemented in October 2022

- Enhanced monitoring of large NBFCs (asset size >₹10,000 crore)

- Stricter provisioning and capital adequacy norms

- Focus on corporate governance and risk management frameworks

- Recent F&O ban lifting indicates regulatory confidence restoration

Fundamental Analysis:

Business Model & Operations:

- Incorporated in 2005, registered and regulated by the National Housing Bank (NHB), engaged in providing home loans, loans against property, corporate mortgage loans, lease rental discounting, and residential construction finance

- The company has adopted an asset-light business model with a differentiated origination strategy and proven co-lending execution across affordable housing and MSME segments

- Operates with co-lending partnerships - had 10 bank partnerships as of September 2024, with plans to increase to 12 by March 2025

- Product portfolio: Home Loans, Loan Against Property (LAP), Construction Finance, Lease Rental Discounting

Financial Performance Analysis

- Market capitalization: ₹13,670 crore; Revenue: ₹8,947 crore; Current year profit: -₹1,800 crore

- The company has delivered poor sales growth of -8% over the past five years

- Q1 FY26: Reported profit of ₹334 crore on total income of ₹2,400 crore; For FY25, posted loss of -₹1,807 crore on total income of ₹8,676 crore

- Recent profitability turnaround visible in quarterly results suggests business stabilization

- The company has a low interest coverage ratio, indicating higher financial leverage

Recent Corporate Developments:

- Abu Dhabi's IHC (International Holding Company) approved preferential allotment to buy 43.5% stake for ₹8,850 crore through Avenir Investment RSC Ltd, paving the way for IHC to assume promoter status

- This massive foreign investment indicates strong confidence in turnaround story

- Company rebranded from Indiabulls Housing Finance to Sammaan Capital to shed legacy issues

- Credit ratings upgraded by S&P and Moody's changed outlook to 'positive' from 'stable'; retained AA/Stable rating from CRISIL and ICRA

- F&O ban recently lifted, signalling renewed market confidence

Asset Quality & Risk Metrics:

- Assets Under Management of ₹12,777 crore as of September 2024

- Shift towards an asset-light model, reducing balance sheet risk

- Co-lending partnerships diversify risk and improve capital efficiency

- Need to monitor gross NPA and net NPA trends in upcoming quarters

- Provisioning coverage ratio and capital adequacy ratio are key metrics to watch

Valuation Metrics:

- PE ratio currently at 0, indicating the company was loss-making in the recent period

- Market cap growth of 3.48% the last 1 year - recent rally not fully reflected in this data

- Price-to-Book ratio likely attractive given low valuation during the distress period

- Current valuation at ₹165 offers asymmetric risk-reward if turnaround sustains

- Comparable NBFCs trading at 1.5-3x book value; Sammaan could rerate as profitability improves

Management & Corporate Governance:

- Company underwent significant management changes post-rebranding

- Abu Dhabi's IHC taking promoter status brings international credibility

- Focus on transparent reporting and governance improvements post legacy issues

- Strategic shift to asset-light model shows adaptive management

Competitive Position & Market Share:

- Competes with players like HDFC Ltd, LIC Housing Finance, PNB Housing, and Bajaj Housing Finance

- Differentiated strategy focusing on emerging geographies and affordable housing segment

- Co-lending model provides a competitive advantage in a capital-constrained environment

- Brand recall is still building after rebranding from Indiabulls

Key Strengths:

- Strong rating from CRISIL and ICRA (AA/Stable) indicates a robust credit profile

- ₹8,850 crore investment by Abu Dhabi's IHC validates business potential

- Asset-light model reduces capital requirements and improves ROE potential

- Regulatory compliance and risk management frameworks strengthened

- Experienced in affordable housing and MSME lending segments

Key Concerns & Risks:

- Historical loss of ₹1,800 crore in FY25 raises sustainability questions

- Poor revenue growth of -8.08% over 5 years indicates business challenges

- A low interest coverage ratio suggests vulnerability to interest rate volatility

- Ongoing investigations related to past operations remain overhang

- Execution risk in scaling up co-lending partnerships

- Asset quality deterioration risk if economic conditions weaken

Integrated Technical-Fundamental Outlook:

Confluence Factors Supporting Bullish Thesis:

- Technical breakout coinciding with fundamental catalysts (IHC investment, F&O ban lifting)

- Volume expansion confirming institutional interest aligning with ₹8,850 crore IHC investment

- 15-month base formation suggesting strong accumulation by informed investors

- Credit rating upgrades provide fundamental validation to the technical setup

- Quarterly profitability turnaround supporting higher valuation rerating

Scenario Analysis:

Bull Case Scenario

- IHC investment successfully closes and brings operational improvements

- Asset quality remains stable, and profitability is sustained in the upcoming quarters

- Co-lending partnerships expand as planned, driving AUM growth

Base Case Scenario

- Business stabilises with moderate growth in AUM and profitability

- Volatility remains elevated due to sector and stock-specific news

Bear Case Scenario

- Asset quality deterioration or operational challenges emerge

- IHC deal gets delayed or faces regulatory hurdles

- Technical breakdown below ₹145 leads to retest of ₹120-130 zone

- Macro headwinds (RBI policy tightening, economic slowdown) impact the sector

- Exit recommended if the weekly close is below ₹130

Critical Events to Monitor:

Next 3 Months:

- Completion of IHC preferential allotment and fund infusion

- Q2 FY26 earnings (October/November 2025) - profitability sustainability check

- Any regulatory updates or clarifications on past investigations

- Technical retest of ₹150-155 support zone and price reaction

Next 6 Months:

- Q3 FY26 earnings showing consistent profitability

- Expansion of co-lending partnerships (target 12 banks)

- AUM growth trajectory and disbursement trends

- NPA trends and provisioning coverage

- Technical breakout above ₹220 resistance

Next 12 Months:

- Full-year FY26 results demonstrating turnaround completion

- Market share gains in affordable housing and LAP segments

- ROE and ROA improvement trends

- PE multiple rerating towards industry average

Recommended Action Plan:

- Allocate 4-6% of portfolio with strict stop-loss discipline

- Book partial profits

- Trail remaining position

- Monitor quarterly results and credit metrics religiously

- Re-evaluate thesis if any fundamental red flag emerges

My 2 Cents:

The chart presents a textbook example of a turnaround setup with a well-defined 15-month base formation, decisive breakout on exceptional volume (5.3x average), and a clear risk-reward structure. The combination of descending channel breakout and momentum shift from lower lows to higher highs creates a compelling technical narrative.

NSE:SAMMAANCAP represents a high-risk, high-reward turnaround play backed by credible fundamental catalysts. The ₹8,850 crore investment by Abu Dhabi's IHC provides a strong validation of intrinsic value. The transition to an asset-light model, credit rating upgrades, and return to quarterly profitability suggest the worst may be behind. However, the legacy of past losses, low interest coverage, and ongoing investigations warrants cautious optimism and strict risk management.

Full Coverage on my Newsletter this Week

Keep in the Watchlist and DOYR.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

As per the Latest SEBI Mandate, this isn't a Trading/Investment RECOMMENDATION nor for Educational Purposes; it is just for Informational purposes only. The chart data used is 3 Months old, as Showing Live Chart Data is not allowed according to the New SEBI Mandate.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Volumespreadanalysis

NETWEB: AI Infrastructure Goldmine ? Chart of the MonthNSE:NETWEB MarchingTowards 4,000: Is This the AI Infrastructure Goldmine You've Been Waiting For? Let's analyze in the "Chart of the Month".

As per the Latest SEBI Mandate, this isn't a Trading/Investment RECOMMENDATION nor for Educational Purposes; it is just for Informational purposes only. The chart data used is 3 Months old, as Showing Live Chart Data is not allowed according to the New SEBI Mandate.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Price Action Analysis:

- Current Price: ₹3,695.40

- 52-Week Range: ₹738.60 - ₹3,745.00

- Recent Performance: +64% gain in a Month with strong momentum

- Price structure shows consistently higher highs and higher lows pattern

- Stock has demonstrated remarkable resilience with a 380% rally from its 52-week low

Volume Spread Analysis:

- Volume surge visible during recent breakout phases

- High volume of 24.25M shares traded, indicating institutional participation

- Volume expansion coinciding with price breakouts confirms genuine buying interest

- Strong volume accumulation during consolidation phases suggests smart money positioning

Chart Patterns Identified:

- Symmetrical Triangle Breakout: Successfully broken above the triangle pattern

- Ascending Triangle: Multiple resistance tests followed by decisive breakout

- Flag and Pennant Patterns: Short-term consolidation after sharp moves

Key Technical Levels:

Support Levels:

- Immediate Support: ₹3,200 (recent consolidation zone)

- Strong Support: ₹2,800 (previous resistance turned support)

- Major Support: ₹2,400 (trendline support and psychological level)

- Critical Support: ₹2,000 (long-term ascending trendline)

Resistance Levels:

- Immediate Resistance: ₹3,745 (52-week high)

- Next Resistance: ₹4,000 (psychological round number)

- Extended Resistance: ₹4,400 (measured move projection)

- Long-term Resistance: ₹5,000

Base Formation:

- Primary Base: ₹1,200-₹1,600 range (established during deep consolidation)

- Secondary Base: ₹2,400-₹2,800 range (recent re-accumulation zone)

- The stock has clearly established a strong foundation above the ₹2,400 levels

Technical Indicators Assessment:

Momentum Indicators:

- RSI is in overbought territory but showing positive divergence

- MACD showing bullish crossover with expanding histogram

- Stochastic indicates strong upward momentum

- ADX suggesting strong trending behaviour

Moving Averages:

- Price trading well above all major moving averages

- 20 EMA, 50 EMA, and 200 EMA in perfect bullish alignment

- Strong uptrend confirmed by ascending moving averages

- No signs of trend reversal in the near term

Sectoral and Fundamental Backdrop:

AI Infrastructure Sector Outlook:

- India's IndiaAI Mission with ₹10,372 crore budget creating massive opportunities

- Government's push for sovereign AI infrastructure benefiting domestic players

- Global demand for AI computing infrastructure is experiencing exponential growth

- Limited domestic competition in the high-end computing solutions space

Company-Specific Fundamentals:

- Netweb's supercomputers have appeared 15 times across three entries in the global Top 500 supercomputers ranking

- The company is almost debt-free with a market cap of ₹20,936 crore

- Recent order wins worth ₹1,734 crore for IndiaAI Mission and ₹450 crore additional order

- Order pipeline of ₹4,142.1 crore as of June 2025, excluding new mandates

Key Growth Catalysts:

- Delivery of servers built on NVIDIA's Blackwell Architecture for India's Sovereign AI System

- Expanding presence in high-performance computing and AI systems

- Strong relationships with global technology partners

- Beneficiary of the government's Digital India and AI initiatives

Financial Performance Metrics:

- Strong revenue visibility from a large order book

- Improving profit margins due to premium product offerings

- Healthy cash flows supporting future expansion

- Zero debt structure providing financial flexibility

Strategic Outlook:

- Expect continued momentum driven by the AI infrastructure theme

- News-driven volatility possible around order execution updates

- Sector rotation into a technology infrastructure play is expected

- Quarterly results will be the key catalyst for sustained momentum

- India's AI infrastructure buildout is a multi-year opportunity

- The company is well-positioned to capture significant market share

Risk Factors to Monitor:

Technical Risks:

- Overbought conditions may lead to profit-taking

- High volatility expected given the stock's momentum

- Any break below ₹3,000 would signal trend weakness

Fundamental Risks:

- Execution risk on large government orders

- Competition from global players in AI infrastructure

- Technology disruption risks in a rapidly evolving sector

- Dependence on government spending cycles

Market Risks:

- Overall market correction could impact high-beta stocks

- Sector rotation away from technology themes

- Global supply chain disruptions affecting component availability

My 2 Cents:

NSE:NETWEB presents a compelling technical setup with strong fundamental support from India's push for AI infrastructure. The stock's breakout from multiple chart patterns, combined with substantial order wins and sector tailwinds, creates an attractive risk-reward proposition. However, position sizing and disciplined risk management remain crucial given the stock's high volatility and premium valuation.

Full Coverage on my Newsletter this Week

Keep in the Watchlist and DOYR.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

As per the Latest SEBI Mandate, this isn't a Trading/Investment RECOMMENDATION nor for Educational Purposes; it is just for Informational purposes only. The chart data used is 3 Months old, as Showing Live Chart Data is not allowed according to the New SEBI Mandate.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

BANCOINDIA: BO after Consolidation, Chart of the WeekBanco Products Broke Out From a Consolidation, Continuing Its Massive Bull Run. Let's analyse in "Chart of the Week"

As per the Latest SEBI Mandate, this isn't a Trading/Investment RECOMMENDATION nor for Educational Purposes; it is just for Informational purposes only. The chart data used is 3 Months old, as Showing Live Chart Data is not allowed according to the New SEBI Mandate.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Price Action Analysis:

- Banco Products has completed a consolidation phase

- The stock has demonstrated exceptional momentum with a breakout above the ₹400 levels in April 2024

- Current trading price of ₹835.60 represents a gain of over 100% from the breakout point

- Price action shows strong institutional accumulation with increasing volumes during upward moves

Volume Spread Analysis

- Volume spikes are clearly visible during key breakout moments, particularly in Q2 2024

- The highest volume bars (green) coincide with price advances, indicating genuine buying interest

- Recent volume of 36.75M shares traded shows sustained institutional participation

- Volume patterns suggest smart money accumulation rather than retail speculation

Key Technical Levels:

Base Formation:

- Multi-year base formed between ₹100-400 levels from 2022 to early 2024

- This represents a classic cup and handle pattern on the weekly timeframe

- The base provided strong support and allowed for institutional accumulation

- Depth of base (approximately 18 months) suggests a strong foundation for future moves

Support Levels:

- Primary Support: ₹650-680 (previous resistance turned support)

- Secondary Support: ₹550-580 (50% retracement of recent rally)

- Major Support: ₹400-420 (breakout zone)

- Ultimate Support: ₹300 (top of multi-year base)

Resistance Levels:

- Immediate Resistance: ₹850-870 (current highs)

- Next Resistance: ₹950-1000 (psychological round number)

- Extended Resistance: ₹1200-1250 (measured move from base)

Position Sizing:

- Allocate a maximum of 3-5% of the portfolio to a single stock

- Use the pyramiding approach: 50% on initial entry, 25% on confirmation, 25% on extension

- Risk per trade should not exceed 2% of total capital

Risk Management Rules:

- Honour stop-losses strictly without emotional interference

- Book partial profits at predetermined levels

- Reduce position size if the stock shows signs of distribution

- Monitor sector rotation and overall market conditions

Sectoral and Fundamental Backdrop:

Auto Components Sector Overview:

- India's auto component industry is driving macroeconomic growth, with the market estimated to grow by USD 259.03 billion from 2025 to 2029 at a CAGR of 37%

- The auto components sector achieved 32.8% growth in FY24, with optimism for continued strong performance

- Export revenues could soar to $100 billion by 2030 from $21 billion in 2024, at a 30% CAGR

Fundamental Strengths of Banco Products:

- Market Cap of ₹11,952 crores with revenue of ₹3,379 crores and profit of ₹433 crores

- Leading manufacturer and exporter of automotive and industrial gaskets, heat shields, and sealing solutions since 1961

- Promoter holding at 67.88% shows strong management confidence

Growth Catalysts:

- Expanding electric vehicle segment creating new opportunities

- Sector attracted ₹2,45,771 crore FDI between April 2000 and December 2024

- Export potential with global OEM partnerships

- Various Indian auto component manufacturers are entering joint ventures with foreign companies for domestic production

Risks and Challenges:

- Commodity price fluctuations affecting margins

- Global economic slowdown impacting export demand

- Competition from Chinese manufacturers

- Trading at 9.17 times book value indicates a premium valuation

Market Outlook:

Short-term Outlook (1-3 months):

- Expect consolidation in the ₹750-870 range

- Watch any dip below ₹700

- Watch for a breakout above ₹870 for the next leg up

Medium-term Outlook (3-12 months):

- Sustained institutional interest expected

- Earnings growth should support price appreciation

Long-term Outlook (1-3 years):

- Export opportunities provide additional upside

- EV transition could create new revenue streams

- Sector leadership position makes it a preferred play in the auto components space

Full Coverage on my Newsletter this Week

Keep in the Watchlist and DOYR.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

As per the Latest SEBI Mandate, this isn't a Trading/Investment RECOMMENDATION nor for Educational Purposes; it is just for Informational purposes only. The chart data used is 3 Months old, as Showing Live Chart Data is not allowed according to the New SEBI Mandate.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

E2E: Base Formation and Trend Change Chart of the WeekNSE:E2E : Cloud Computing Giant Shows Strong Breakout After Trendline Breakout. Let's analyse in "Chart of the Week"

As per the Latest SEBI Mandate, this isn't a Trading/Investment RECOMMENDATION nor for Educational Purposes; it is just for Informational purposes only. The chart data used is 3 Months old, as Showing Live Chart Data is not allowed according to the New SEBI Mandate.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Price Action Analysis:

• Stock has formed a massive symmetrical triangle/wedge pattern

• Recent breakout above the upper trendline resistance around 2,900-3,000 levels

• Currently trading at 3,084.10 with strong momentum and above-average volume

• Price action shows a clear shift from consolidation to the trending phase

• Multiple higher lows formation during the consolidation phase indicates underlying strength

Volume Spread Analysis:

• Volume spike visible during the recent breakout, confirming genuine buying interest

• Volume at 813.46K vs average volume of 422.91K, indicating a 92% increase

• Consistent volume support during the base formation phase

• Volume-price confirmation suggests institutional participation

Key Technical Levels:

Support Levels:

• Primary Support: 2,700-2,800 (previous resistance turned support)

• Secondary Support: 2,400-2,500 (triangle breakout level)

• Major Support: 2,000-2,100 (psychological level and previous consolidation zone)

Resistance Levels:

• Immediate Resistance: 3,200-3,300 (next psychological level)

• Major Resistance: 3,500-3,600 (measured move target from triangle)

• All-time High: 5,487.65 (long-term target)

Technical Patterns:

• Symmetrical Triangle: 15-month consolidation pattern completed with upside breakout

• Base Formation: Strong base around 1,600 levels as mentioned in the chart annotation

• Ascending Triangle: Multiple retests of resistance with higher lows

• Volume Breakout Pattern: Confirmed with increased participation

Technical Assessment:

• Trendline Breakout: Clean break above descending trendline resistance

• Price Structure: Shift from consolidation to trending phase

• Momentum: Strong upward momentum post-breakout

• Support-Resistance Flip: Previous resistance becomes new support

Risk Management:

• Maximum Risk: 10% of position size

• Volatility Risk: High (small-cap IT stock)

• Sector Risk: Technology sector concentration

Risk Mitigation:

• Diversification across the IT portfolio

• Position sizing discipline

• Regular monitoring of technical levels

• Sector rotation consideration

Sectoral Analysis:

Industry Overview:

• India's data center industry is undergoing a major transformation, driven by the rapid rise in digital adoption, AI-driven workloads, and cloud computing adoption

• In 2025, E2E Cloud, a leading AI-centric cloud service provider, announced the launch of India's largest NVIDIA H200 GPU infrastructure

• Strong government support for Digital India initiatives

• Growing demand for cloud computing and AI/ML services

Sector Positioning:

• E2E network provides a full-stack AI/ML and GenAI cloud ecosystem designed for scalable, accessible, and cost-efficient deployment of large-scale compute clusters

• E2E Networks provides enterprise-grade GPU computing at a much lower cost by removing the complexity and extra expenses linked to global hyperscale providers

• Strategic focus on AI and machine learning infrastructure

• Competitive advantage in cost-effective cloud solutions

Growth Drivers:

• Increasing AI adoption across industries

• Digital transformation acceleration post-COVID

• Government push for data localization

• Growing startup ecosystem requiring cloud infrastructure

Fundamental Backdrop:

Financial Performance:

• Revenue: 159 Cr with Profit: 34.5 Cr (TTM)

• Revenue from operations slumped -12.63% YoY to Rs 36.11 crore in Q1 FY26

• Profit before tax (PBT) stood at Rs -2.84 crore in Q1 FY26, steeply lower than Rs 10.14 crore in Q1 FY25

• Strong profitability growth trajectory

Market Capitalization & Valuation:

• Mkt Cap: 6,166 Crore (up 10.8% in 1 year)

• Small Cap company classification

Shareholding Pattern:

• Promoter Holding: 40.6%

• Promoter holding has decreased over the last quarter: -3.00%

• Mutual Fund Shareholding in E2E Networks was 1.86%

• Strong promoter holding with some recent reduction

Business Model Strength:

• E2E CDN is a global content delivery network that distributes your content & web pages to end-users with minimal latency

• Asset-light scalable business model

• Recurring revenue from cloud services

• Growing customer base in the AI/ML segment

Key Concerns:

• Though the company is reporting repeated profits, it is not paying out a dividend

• High valuation multiples indicate growth expectations

• Small-cap volatility and liquidity concerns

• Intense competition from global cloud providers

Bull Case:

• Strong technical breakout

• Leadership position in Indian AI/ML cloud infrastructure

• Beneficiary of India's digital transformation

• Scalable business model with high growth potential

Bear Case:

• Expensive valuation with high growth expectations

• Competition from global hyperscalers

• Small-cap inherent volatility

• Dependency on the technology sector performance

Overall Assessment:

• Technically strong setup with favourable risk-reward

• Fundamentally positioned in a high-growth sector

• Regular monitoring required due to small-cap nature

Full Coverage on my Newsletter this Week

Keep in the Watchlist and DOYR.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

As per the Latest SEBI Mandate, this isn't a Trading/Investment RECOMMENDATION nor for Educational Purposes, it is just for Informational purposes only. The chart data used is 3 Months old, as Showing Live Chart Data is not allowed according to the New SEBI Mandate.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

VIMTALABS: Parallel Channel & Flag BO, Chart of the WeekNSE:VIMTALABS Explodes 50%: From Parallel Channel Prison to Trendline Freedom Post Q1 FY26 Flag Breakout. Let's analyse it in the "Chart of the Week"

As per the Latest SEBI Mandate, this isn't a Trading/Investment RECOMMENDATION nor for Educational Purposes; it is just for Informational purposes only. The chart data used is 3 Months old, as Showing Live Chart Data is not allowed according to the New SEBI Mandate.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Price Action Analysis:

- Current Price: ₹887.20 (as per chart)

- 52-Week Range: ₹252 to ₹903

- Market Cap: ₹3,901 Crores

- Recent Performance: Stock has shown exceptional momentum with 171% returns in the past year

Volume Spread Analysis:

- Breakout Volume: Exceptional volume spike during the August 2025 breakout

- Volume Confirmation: Higher volumes on up-moves, lower on corrections

- Accumulation Phase: Steady volume during the consolidation phase indicates smart money accumulation

Chart Patterns:

- Long-term Ascending Trendline: Yellow trendline acting as dynamic support since May 2024

- Parallel Channel Breakout: Stock consolidated in a 6-month parallel channel (₹400-550) from December 2024 to July 2025

- Flag and Pennant Formation: Classic continuation pattern post Q1 FY26 results

- Volume Breakout: Massive volume surge accompanying the breakout, confirming genuine momentum

Key Technical Levels:

- Base Formation: ₹400-450 level established during Dec 2024 - Jul 2025 consolidation

- Primary Support: ₹550-600 (previous resistance turned support)

- Secondary Support: ₹500 (parallel channel upper boundary)

- Immediate Resistance: ₹700-750 (psychological levels)

- Final Resistance: ₹900-1000

Fundamental and Sectoral Backdrop:

Company Overview:

- Contract Research and Testing Organization serving biopharmaceutical, food, consumer goods, electronic, electrical, agrochemical, healthcare, and medical device sectors

Financial Performance:

- Q1 FY26 Results: Net profit rose 53.83% to ₹19 Crore, sales increased 30.29% to ₹98 crore

- Recent Quarter: EBITDA margins at 35.7%

- Debt Position: The Company is almost debt-free

Sector Dynamics:

- CRO/CRAMS Sector: Strong tailwinds from global pharmaceutical outsourcing

- Biologics Focus: Company expanding in high-growth biologics testing segment

- Regulatory Compliance: Successfully completed US FDA GCP certification

Other Highlights:

- Consistent revenue growth across quarters

- Strong margin expansion and operational efficiency

- Debt-free balance sheet providing financial flexibility

- Expanding service offerings in high-margin biologics

- Beneficiary of the global pharma outsourcing trend

Key Risk Factors:

- High valuation metrics post recent rally

- Dependence on the pharmaceutical sector cycles

- Regulatory compliance requirements

- Competition from larger CRO players

Market Sentiment:

- Recent 31% surge to hit a new 52-week high of ₹902, reflecting strong investor interest

- Strong institutional interest evidenced by consistent buying

- Positive analyst coverage post strong quarterly results

Full Coverage on my Newsletter this Week

Keep in the Watchlist and DOYR.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

As per the Latest SEBI Mandate, this isn't a Trading/Investment RECOMMENDATION nor for Educational Purposes, it is just for Informational purposes only. The chart data used is 3 Months old, as Showing Live Chart Data is not allowed according to the New SEBI Mandate.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

APOLLO: C&H and Rounding Bottom BO: Chart of the Week NSE:APOLLO : The Cup and Handle Breakout That Finally Delivered After Multiple False Starts with Rounding Bottom Breakout on Daily TF Let's Analyze it in the Chart of the Week.

As per the Latest SEBI Mandate, this isn't a Trading/Investment RECOMMENDATION nor for Educational Purposes; it is just for Informational purposes only. The chart data used is 3 Months old, as Showing Live Chart Data is not allowed according to the New SEBI Mandate.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Price Action:

• The chart reveals a sophisticated Cup and Handle pattern formation spanning from Late-2023 to August 2025, with the "cup" forming between 205-160 levels and the "handle" consolidating around the 180-200 zone

• Multiple breakout attempts were witnessed - first in December 2024 with a King Candle formation, followed by another sharp rally in May 2025, both failing to sustain above the descending trendline

• The current August 2025 breakout represents the third and most convincing attempt, breaking through both the descending resistance trendline and the horizontal resistance at 205-220 levels

• Volume surge during the current breakout (119.95M vs average 54.33M) confirms institutional participation and validates the breakout authenticity

• The curved line clearly marks the rounding bottom formation, indicating a gradual shift from bearish to bullish sentiment

Volume Spread Analysis:

Volume Pattern Insights:

• Exceptional volume breakout with nearly 2.2x average daily volume during the recent surge

• Volume accumulation visible during the cup formation, indicating smart money participation

• Low volume during handle formation, suggesting healthy consolidation

• Volume expansion coinciding with price breakout confirms institutional buying

Key Support and Resistance:

• Immediate Support Zones:

- Primary: 220-225 (previous resistance turned support)

- Secondary: 200-205 (handle formation base)

- Major: 180-185 (cup formation low)

• Critical Resistance Levels:

- Near-term: 250-260 (measured move target from cup depth)

- Intermediate: 280-290 (Fibonacci extension 1.618 level)

- Long-term: 320-340 (cup and handle pattern target)

• Base Formation: Strong accumulation base established between 160-220 over 18+ months

Multi-Pattern Technical Setup:

• Cup and Handle Pattern: Classic bullish continuation pattern with 18-month formation period

• Descending Triangle Breakout: Successfully breached the falling trendline resistance

• Rounding Bottom: Long-term reversal pattern indicating strong institutional accumulation

• Volume Breakout Pattern: Exceptional volume expansion confirming price breakout validity

Fundamental and Sectoral Backdrop:

Latest Financial Performance:

• Net profit surged 126% to Rs 19 crore in Q1 FY2026 compared to Rs 8 crore in Q1 FY2025

• Revenue growth of 46.5% to Rs 134 crore versus Rs 91 crore in the previous year, same quarter

• Quarterly growth basis shows a 32.21% jump in net profits since last quarter

• Market capitalization stands at approximately Rs 7,854 crores, reflecting strong market confidence

Strategic Business Positioning:

• Company is involved in more than 150 indigenous defence programs and 60 DcPP (Defence Capital Procurement Policy) programs as a sub-system partner

• Specializes in ruggedized electronic hardware and software solutions for critical sectors

• Strong focus on import substitution and Atmanirbhar Bharat initiatives

• Diversified client base including DRDO, HAL, BEL, and other major defence contractors

Sector Momentum Analysis:

• Apollo Micro Systems gained 14.6% on August 22, 2025, demonstrating resilience amid market fluctuations

• Stock has significantly outperformed the broader market year-to-date, reflecting strong performance in the Aerospace & Defence sector

• Defence budget allocation increases continue to provide sectoral tailwinds

• Growing focus on indigenous defence manufacturing creates long-term opportunities

Market Participation Analysis:

• High institutional interest is evident from volume patterns

• Retail participation is likely to increase given the breakout visibility

• Options activity expected to increase as the stock approaches higher price levels

• Potential inclusion in small-cap/midcap indices could trigger passive fund buying

Risk Assessment and Scenario Analysis:

Technical Risk Factors:

• Failed breakout history (December 2024 and May 2025) suggests caution is required

• High beta nature means increased volatility during market corrections

• Potential for profit booking at psychologically important 250 levels

• Need for sustained volume to validate the breakout authenticity

Fundamental Risk Considerations:

• Defence sector dependency on government policy changes and budget allocations

• Long procurement cycles are typical in defence contracts, affecting quarterly results

• Competition from established defence majors and emerging players

• Currency fluctuation impact on imported components and raw materials

Full Coverage on my Newsletter this Week

Keep in the Watchlist and DOYR.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

As per the Latest SEBI Mandate, this isn't a Trading/Investment RECOMMENDATION nor for Educational Purposes, it is just for Informational purposes only. The chart data used is 3 Months old, as Showing Live Chart Data is not allowed according to the New SEBI Mandate.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

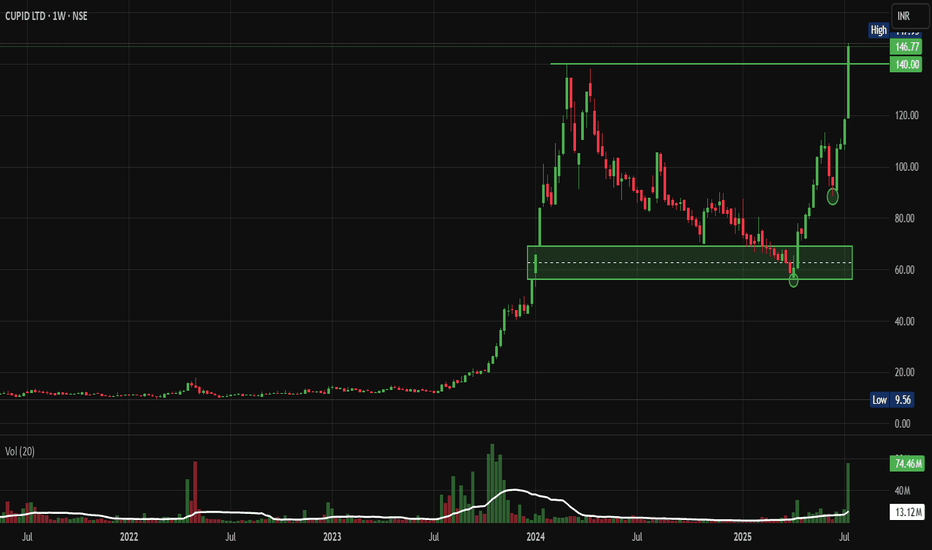

Cupid: Past Multibagger Forming Rounding Bottom BreakoutFrom ₹10 to ₹150: How CUPID Stock Became a Multibagger Dream and What's Next. Let's analyse and Deep Dive into my Chart of the Week Idea.

Price Action Analysis:

Long-term Trend Analysis:

- Primary Trend: Strongly bullish multi-year uptrend since 2023

- Trend Structure: Classic accumulation-markup-distribution pattern visible

- Price Progression: Massive rally from ₹10 levels in 2023 to ₹145+ levels

- Current Phase: Potential early stage of renewed markup phase after consolidation

Volume Spread Analysis:

Volume Profile Assessment:

- Accumulation Phases: High volume during the 2023-2024 markup phase

- Distribution Evidence: Volume spike during 2024 highs suggesting profit-taking

- Current Volume: Recent volume expansion (74.46M) confirming breakout momentum

- Volume Trend: Healthy volume participation during the current breakout phase

Volume-Price Relationship:

- Positive Correlation: Rising prices accompanied by expanding volume

- Breakout Validation: Current breakout supported by above-average volume

- Distribution Concerns: Previous high volume at peaks indicated selling pressure

Key Price Levels:

Support Levels:

- Immediate Support: ₹95-100 (recent consolidation base)

- Critical Support: ₹80-85 (previous resistance turned support)

- Major Support: ₹65-70 (rectangle pattern lower boundary)

- Ultimate Support: ₹50-55 (long-term trend line support)

Resistance Levels:

- Key Resistance: ₹145-150 (previous highs)

- Major Resistance: ₹150-155

- Target Extension: ₹170-180 (measured move projection)

Technical Indicators Assessment:

Trend Indicators:

- Moving Averages: Price clearly above major moving averages, indicatinga bullish bias

- Trend Strength: Strong upward trajectory since the consolidation base

- Momentum: Building positive momentum after prolonged consolidation

Trade Setup & Strategy:

Primary Long Setup:

- Entry Strategy: Buy on dips to ₹115-120 support zone

- Confirmation: Entry above ₹145 for momentum traders

Alternative Strategies:

Conservative Approach:

- Entry: Wait for pullback to ₹100-105 levels

- Timeframe: Medium to long-term holding period (Weekly Charts)

- Risk Profile: Lower risk, moderate reward

Aggressive Approach:

- Entry: Immediate entry at current levels (₹145)

- Timeframe: Short to medium-term momentum play (Daily Charts)

- Risk Profile: Higher risk, higher reward potential

Entry and Exit Levels:

Entry Zones:

- Zone 1: ₹115-120 (Primary entry for dip buyers)

- Zone 2: ₹145-150 (Momentum breakout entry)

- Zone 3: ₹100-105 (Deep pullback opportunity)

Target Levels:

- Target 1: ₹150-155 (Short-term objective)

- Target 2: ₹160-165 (Medium-term target based on pattern)

- Target 3: ₹180-190 (Long-term extension target)

- Ultimate Target: ₹200+ (Bull market extension)

Exit Strategy:

- Profit Booking: Book 30% at Target 1, 40% at Target 2, and the remaining at Target 3

- Trailing Stop: Implement trailing stop-loss above ₹140

- Time Stop: Review position if targets are not achieved in 8-12 months

Stop-Loss Strategy:

Stop-Loss Levels:

- Aggressive Stop: ₹110 (for entries around ₹120)

- Moderate Stop: ₹100 (for swing traders)

- Conservative Stop: ₹85 (for long-term investors)

Stop-Loss Management:

- Initial Risk: Limit to 8-10% of the entry price

- Trailing Mechanism: Move stop-loss to breakeven after 15% gains

- Pattern Stop: Below ₹95 invalidates the breakout setup

- Time-based Stop: Exit if below ₹110 for more than 2 weeks

Position Sizing & Risk Management:

Position Sizing Guidelines:

- Conservative Investors: 2-3% of portfolio

- Moderate Risk Takers: 4-5% of portfolio

- Aggressive Traders: 6-8% of portfolio (maximum)

- Sectoral Exposure: Limit total pharma/healthcare exposure to 15-20%

Risk Management Framework:

- Maximum Loss: Limit loss to 2% of total portfolio per trade

- Diversification: Don't concentrate more than 10% in a single stock

- Sector Allocation: Balance with other defensive sectors

- Time Diversification: Stagger entries over 2-3 weeks

Portfolio Integration:

- Correlation Check: Monitor correlation with other pharma stocks

- Sector Rotation: Consider the pharma sector cycle and rotation

- Market Cap Allocation: Balance small-cap exposure with large-caps

- Liquidity Consideration: Account for small-cap liquidity constraints

Risk Assessment:

Technical Risks:

- Failed Breakout: Risk of false breakout below ₹115

- Distribution Pattern: High volume at peaks may indicate selling

- Overbought Conditions: Rapid rise may lead to consolidation

- Support Breakdown: Break below ₹95 would be technically negative

Fundamental Risks:

- Valuation Concerns: High PE ratio of 96+ indicates premium valuation

- Sales Decline: The Recent 7% sales decline raises growth concerns

- Sector Competition: Increasing competition in the contraceptive market

- Regulatory Changes: Healthcare sector regulatory modifications

Market Risks:

- Small-Cap Volatility: Higher volatility compared to large-caps

- Liquidity Risk: Potential liquidity issues during market stress

- Sentiment Risk: Healthcare sector sentiment shifts

- Global Economic: Impact of global economic conditions on exports

Company Overview & Fundamental Backdrop:

Business Profile:

- NSE:CUPID is India's premier manufacturer of male and female condoms, personal lubricant, and IVD kits, established in 1993

- The company manufactures and exports contraceptives, including male and female condoms, and medical devices, with a focus on sexual health and reproductive safety, serving both domestic and international markets, supplying high-quality products to governments and NGOs

- Market capitalization: ₹3,940 crores as of July 2025, classified as a Small Cap company

Financial Performance:

- Current valuation metrics: PE ratio of 96.3 and PB ratio of 11.5

- Recent performance: Sales declined by 7.24% to Rs 61 crore in Q4 FY25 versus Rs 66 crore in Q4 FY24; however, net profit rose 2.71% to Rs 41 crore for FY25

- Long-term returns: The stock has delivered 133% returns in the last 3 years

Sectoral Growth Outlook:

- The Indian contraceptive devices market is expected to grow at a CAGR of 6.2-6.3% from 2025 to 2030

- Market size estimated at USD 264.01 million in 2025, expected to reach USD 377.61 million by 2030, at a CAGR of 7.42%

- India's pharmaceutical sector aims to grow from the current US$50 billion to US$450 billion by 2047, with India being the 3rd largest producer of drugs globally

Monitoring Parameters:

What to Look Closely at Technically?

- Weekly Close: Monitor weekly closes above ₹115 for trend continuation

- Volume Trends: Watch for volume expansion on up-moves

- Relative Strength: Compare performance with the Nifty Healthcare Index

What to Look Closely at Fundamentally?

- Quarterly Results: Track revenue growth and margin expansion

- Order Book: Monitor new contract wins and export orders

- Sector Trends: Keep track of contraceptive market growth

- Management Commentary: Follow management guidance and outlook

Now, when to exit?

- Technical Breakdown: Close below ₹95 for two consecutive days

- Volume Reversal: High volume selling at resistance levels

- Fundamental Deterioration: Significant decline in business metrics

- Sector Weakness: Broad-based healthcare sector underperformance

So, My Take:

NSE:CUPID presents a compelling technical setup with a confirmed breakout from a year-long consolidation pattern. The stock has transformed from a ₹10 stock to a multibagger, and current technical indicators suggest potential for further upside. However, premium valuation and recent sales decline warrant careful risk management. The trade offers an attractive risk-reward profile for investors willing to accept small-cap volatility in exchange for participation in a growing healthcare subsector.

Keep in the Watchlist and DOYR.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

SMLISUZU: Explosive Cup and Handle Breakout, Chart of the Month From Years of Consolidation to Explosive Breakout: Why NSE:SMLISUZU Cup & Handle Pattern Could Deliver Multi-Bagger Returns. Let's Deep Dive into "Chart of the Month"

Price Action Analysis:

- Current trading price is approximately ₹3,799.40

- The stock has demonstrated a textbook Cup & Handle formation spanning over a decade (2015-2025)

- Post-breakout momentum shows strong bullish continuation with healthy volume expansion

- Recent breakout above the ₹2,400 breakout level indicates institutional accumulation

Volume Spread Analysis:

- Volume spike during the 2024-2025 breakout phase confirms genuine institutional interest

- Average daily volume has increased significantly from historical levels

- Volume pattern shows healthy distribution during consolidation phases and accumulation during breakouts

- Recent volume bars indicate sustained buying interest at higher levels

Key Technical Levels:

Base Formation:

- Primary base formed between 2020-2023 at ₹400-800 levels

- Secondary base consolidation occurred in 2023-2024 around ₹1,200-1,600 range

- The decade-long cup formation created a strong foundation for the current uptrend

Support Levels:

- Immediate support: ₹3,200-3,400 (recent consolidation zone)

- Strong support: ₹2,400-2,600 (cup breakout level)

- Critical support: ₹1,800-2,000 (previous resistance turned support)

- Long-term support: ₹1,200-1,400 (base formation)

Resistance Levels:

- Immediate resistance: ₹4,200-4,400 (psychological round number)

- Next resistance: ₹4,800-5,000 (projected target based on cup depth)

- Long-term target: ₹6,000+ (measured move from cup formation)

Technical Pattern:

Cup & Handle Pattern

- Formation period: 2015-2025 (10-year formation)

- Cup depth: Approximately ₹1,800 (from ₹2,400 high to ₹600 low)

- Handle formation: 2024-2025 consolidation

- Breakout confirmation: Volume expansion above ₹2,400

Moving Average Alignment:

- Price trading above all major moving averages

- Strong uptrend with moving averages in bullish sequence

- No signs of trend reversal in the immediate term

Trade Setup:

Entry Levels:

- Aggressive entry: ₹3,600-3,700 (current market price on minor dips)

- Conservative entry: ₹3,200-3,400 (on pullback to support)

- Accumulation zone: ₹2,800-3,200 (for long-term positions)

Exit Levels:

- Target 1: ₹4,500-4,700 (25-30% upside)

- Target 2: ₹5,500-5,800 (50-60% upside)

- Target 3: ₹6,500+ (multi-bagger potential)

Stop-Loss Strategy:

- For aggressive entries: ₹3,100 (8-10% risk)

- For conservative entries: ₹2,800 (12-15% risk)

- Trailing stop: Use a 20% trailing stop once the position moves 30% in favour

Position Sizing & Risk Management:

Position Sizing Guidelines

- Conservative investors: 2-3% of portfolio

- Moderate risk investors: 3-5% of portfolio

- Aggressive investors: 5-8% of portfolio (maximum recommended)

Risk Management Framework

- Never risk more than 2% of the total portfolio on a single trade

- Use position sizing formula: (Portfolio Risk ÷ Trade Risk) × 100

- Implement pyramid buying on pullbacks to support levels

- Book partial profits at each target level (33% at each target)

Portfolio Allocation Strategy:

- Core holding: 60% of position for long-term (2-3 years)

- Trading position: 40% for swing trades and profit booking

- Rebalance quarterly based on technical developments

Sectoral & Fundamental Backdrop:

Commercial Vehicle Sector Overview:

- The Commercial Vehicles market in India is projected to grow by 2.13% (2025-2030), resulting in a market volume of 1,165.00k vehicles in 2030

- India's commercial vehicle industry is gearing up for a modest recovery, with ICRA forecasting a 3-5 per cent year-on-year growth in wholesale volumes for FY26

- The India Commercial Vehicles Market size is estimated at 51.09 billion USD in 2025, and is expected to reach 62.95 billion USD by 2029, growing at a CAGR of 5.36%

Industry Dynamics:

- Infrastructure development is driving demand for commercial vehicles

- The government's focus on road construction and the logistics sector

- The e-commerce boom is increasing last-mile delivery vehicle demand

- Replacement demand cycle supporting steady growth

Company Fundamentals:

- Net profit of SML ISUZU rose 44.34% to Rs 67 crore in the quarter ended June 2025 as against Rs 46 crore during the previous quarter ended June 2024. Sales rose 13.39% to Rs 846 crore in the quarter ended June 2025

- Market Cap: 5,498 Crore (up 84.8% in 1 year), Revenue: 2,498 Cr, Profit: 142 Cr, Promoter Holding: 43.96%

Business Model Strengths:

- NSE:SMLISUZU Limited manufactures and sells commercial vehicles and related parts in India and internationally. Its products include trucks and buses

- Strong partnership with Isuzu Motors for technology and product development

- Focus on fuel-efficient and reliable commercial vehicles

- Growing aftermarket services contributing to recurring revenue

Financial Health Indicators:

- Consistent revenue growth over recent quarters

- Improving profit margins, indicating operational efficiency

- Stable promoter holding, suggesting management confidence

- Strong balance sheet supporting growth investments

Risk Assessment:

Technical Risks:

- Failure to hold ₹3,200 support could trigger correction to ₹2,800

- High volatility expected due to recent sharp price appreciation

- Potential profit booking pressure at psychological levels

Fundamental Risks:

- Cyclical nature of the commercial vehicle industry

- Dependency on economic growth and infrastructure spending

- Competition from established players like Tata Motors

- Raw material cost fluctuations impacting margins

Market Risks:

- Overall market correction could impact individual stock performance

- Interest rate changes affecting vehicle financing demand

- Regulatory changes in emission norms requiring investment

My Take:

NSE:SMLISUZU presents a compelling technical setup with the successful breakout from a decade-long Cup & Handle pattern. The combination of strong fundamentals, improving sector dynamics, and bullish technical indicators suggests potential for significant upside. However, investors should implement proper risk management given the stock's recent appreciation and inherent sector volatility.

The stock appears well-positioned to benefit from India's infrastructure growth story and the recovery of the commercial vehicle sector. Technical indicators support a bullish outlook with multiple price targets achievable over the next 12-18 months.

Keep in the Watchlist and DOYR.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

ABCAPITAL(cup& handle)My analysis is large capital company with good returns.

Key piont is Make cup and handle pattern look into chart how was possible to Target reach . Road map create for our target is 230, 300 but .. respect to SL .. LIKE ME .

Company has delivered good profit growth of 47.2% CAGR over last 5 years

Shareholding pattern (%)

As On Dec-23

Promoter 69.0 %

DII 8.4%

FII 10.6 %

Others 12.0 %

for MORE check in my TradingView ID

If You LIKE👌👌 MY Idea ......Boost.🔥🔥🔥.. its.

"Disclosure : I am not Sebi-registered." This channel is for only educational purpose. Any profit/loss, I am not responsible.

Before taking any trade on our charts / calls, please consult your financial advisors. Thanks🙏

CARTRADE: Breaks Free with Rising Wedge Breakout Post Q1 FY 26NSE:CARTRADE Breaks Free: The Rising Wedge Breakout That's Driving This Auto-Tech Giant to New All-Time Heights with Strong Q1 FY 26

Price Action:

Price Movement and Trend Structure:

• Current Price: ₹2,066.90 (as of July 28, 2025)

• Daily Change: +₹172.20 (+9.09%) - Strong bullish momentum

• Price Range: High ₹2,140.90 | Low ₹2,100.90 | Volume 5.36M shares

• Price Trajectory: Consistent higher highs and higher lows pattern from October 2024

• Recent Action: Sharp acceleration in price movement post-July breakout

• Momentum Character: Strong bullish momentum with gap-up openings and sustained buying

Volume Spread Analysis:

Volume Characteristics:

• Breakout Volume: Exceptional volume spike during the breakout phase (5.36M shares)

• Volume Pattern: Generally increasing volume during upward moves, declining during consolidations

• Average Volume: Approximately 1-2M shares on regular trading days

• Volume Confirmation: The breakout is well-supported by above-average volume, validating the move

Volume Indicators:

• Volume Expansion: 3-4x normal volume during breakout sessions

• Distribution vs Accumulation: Clear accumulation pattern throughout the wedge formation

• Volume-Price Relationship: Positive correlation between volume and price advancement

Chart Patterns:

• Rising Wedge Breakout: The stock has successfully broken out of a long-term rising wedge pattern that was forming since October 2024

• Timeframe: Daily chart showing progression from October 2024 to July 2025

• Breakout Confirmation: Strong breakout above the upper trendline of the wedge with significant volume expansion

• Breakout Level: Approximately ₹1,850-1,900 range

• Pattern Completion: Clean breakout with follow-through buying confirming pattern validity

Key Price Levels:

• All-Time High: ₹2,140.90 (recent high)

• Previous Resistance Zones: ₹1,800, ₹1,900, ₹2,000

• Immediate Support: ₹1,850-1,900 (previous breakout zone)

• Major Support: ₹1,650-1,700 (middle of previous consolidation)

• Long-term Support: ₹1,400-1,450 (bottom of the rising wedge)

Trend Analysis:

• Primary Trend: Strong bullish momentum with consistent higher highs and higher lows

• Secondary Trend: Recently accelerated upward movement post-breakout

• Trend Strength: Multiple touchpoints on both trendlines confirm the validity of the wedge pattern validity

• Momentum: Increasing momentum as evidenced by the steepening price action

Key Support and Resistance Levels:

Key Resistance Levels:

• Immediate Resistance: ₹2,150-2,200 (psychological and technical resistance)

• Next Target: ₹2,300-2,350 (measured move from wedge breakout)

• Long-term Target: ₹2,500+ (extension based on wedge height projection)

Critical Support Levels:

• First Support: ₹1,950-2,000 (recent consolidation zone)

• Strong Support: ₹1,850-1,900 (breakout confirmation level)

• Major Support: ₹1,650-1,700 (50% retracement of recent move)

• Ultimate Support: ₹1,400-1,450 (wedge bottom - unlikely to be tested)

Base Formation:

• Base Pattern: Rising wedge base formed over 9 months (October 2024 to July 2025)

• Base Depth: Approximately ₹1,000 to ₹1,900 range

• Base Quality: High-quality base with multiple retests of support and resistance

• Breakout Strength: Clean breakout with gap-up opening confirming institutional interest

Technical Patterns and Indicators:

Chart Patterns:

• Completed Pattern: Rising Wedge Breakout (Bullish continuation pattern)

• Pattern Reliability: High - well-defined trendlines with multiple touchpoints

• Measured Move Target: ₹2,300-2,400 (based on wedge height projection)

• Time Frame: 9-month pattern completion

Technical Formations:

• Flag and Pennant Potential: Post-breakout consolidation may form continuation patterns

• Gap Analysis: Potential gap fills not immediately concerning given strong fundamentals

• Trend Channel: Stock is establishing a new, steeper upward channel post-breakout

Trade Setup and Strategy:

Entry Levels:

• Aggressive Entry: ₹2,050-2,070 (current market price on dips)

• Conservative Entry: ₹1,950-1,980 (on pullback to breakout zone)

• Momentum Entry: ₹2,100-2,120 (on continuation above resistance)

• Scale-in Strategy: 40% at ₹2,000, 35% at ₹1,950, 25% at ₹1,900

Exit Levels and Targets:

• Target 1: ₹2,200-2,250 (immediate resistance zone) - Book 30% profits

• Target 2: ₹2,350-2,400 (measured move target) - Book 40% profits

• Target 3: ₹2,500-2,600 (extension target) - Book remaining 30%

• Trail Strategy: Trail stop-loss 8-10% below recent swing lows after Target 1

Stop-Loss Strategy:

• Aggressive Stop: ₹1,900-1,920 (below recent support)

• Conservative Stop: ₹1,850-1,870 (below breakout zone)

• Disaster Stop: ₹1,750-1,780 (below major support)

• Risk-Reward Ratio: Minimum 1:2, targeting 1:3 for optimal entries

Position Sizing and Risk Management:

Position Sizing Guidelines:

• Conservative Allocation: 2-3% of portfolio (suitable for risk-averse investors)

• Moderate Allocation: 4-5% of portfolio (balanced approach)

• Aggressive Allocation: 6-8% of portfolio (for high-conviction trades)

• Maximum Position: Not exceeding 10% of the total portfolio, regardless of conviction

Risk Management Rules:

• Single Trade Risk: Maximum 1-2% of portfolio value per trade

• Stop-Loss Discipline: Strict adherence to predetermined stop-loss levels

• Profit Booking Strategy: Systematic profit booking at predetermined targets

• Position Monitoring: Daily review of technical levels and volume patterns

Risk Mitigation Techniques

• Diversification: Avoid overconcentration in a single stock or sector

• Hedging Options: Consider protective puts for large positions

• Correlation Analysis: Monitor correlation with broader auto and tech indices

• News Sensitivity: Be prepared for volatility around earnings and sector news

Sectoral and Fundamental Backdrop:

Industry Landscape:

• Auto Marketplace Growth: India's online auto marketplace is growing at a 27.5% CAGR (2025-2030)

• Digital Transformation: Increasing shift from offline to online vehicle transactions

• Market Leadership: CarTrade Tech is India's leading and only profitable auto marketplace

• Competitive Advantage: Multi-platform presence with CarWale, BikeWale, CarTrade, and OLX India

Business Model Strength:

• Asset-Light Model: Operates 114 auto malls, mostly leased, ensuring capital efficiency

• Revenue Diversification: Multiple revenue streams including listing fees, transaction commissions, and financial services

• Platform Integration: Comprehensive ecosystem covering new cars, used cars, commercial vehicles, and two-wheelers

• Strategic Acquisitions: OLX India acquisition for ₹535.54 crore, strengthening market position

Recent Fundamental Performance:

• Q1 FY26 Results: Revenue of ₹173 crore (22% YoY growth)

• Profit Growth: Net profit doubled year-on-year in Q1 FY26

• Market Capitalization: ₹9,801 crore (up 139% in past year)

• Valuation Metrics: Trading at 4.42 times book value

• EBITDA Performance: EBITDA almost doubled in Q1 FY26

Growth Catalysts:

• Market Expansion: Penetration into tier-2 and tier-3 cities

• Technology Enhancement: AI and ML integration for better user experience

• Financial Services: Growing fintech vertical with loan facilitation

• Electric Vehicle Segment: Positioning for EV marketplace opportunities

• B2B Growth: Expanding dealer and OEM partnerships

Sector Tailwinds:

• Digital Adoption: Accelerated post-pandemic shift to online platforms

• Used Car Market: Growing preference for certified pre-owned vehicles

• Credit Penetration: Increasing vehicle financing accessibility

• Regulatory Support: Government push for digitization and transparency

• Consumer Behaviour: Millennial and Gen-Z preference for online research and transactions

Risk Factors and Considerations:

Technical Risks:

• Overbought Conditions: Stock may be due for consolidation after a sharp run-up

• Gap Risk: Potential for gap-down on negative news or market corrections

• Volume Sustainability: Need for continued high volume to sustain momentum

• Market Correlation: High beta stock susceptible to broader market volatility

Fundamental Risks:

• Economic Slowdown: Auto sales sensitivity to economic cycles

• Competition Intensification: New entrants and existing players' aggressive strategies

• Regulatory Changes: Potential policy changes affecting online marketplaces

• Technology Disruption: Emergence of new technologies or business models

Market Risks:

• Sector Rotation: Shift in investor preference away from auto-tech stocks

• Liquidity Concerns: Mid-cap stock with potential liquidity constraints during market stress

• Earnings Expectations: High growth expectations leading to volatility on any disappointment

• Valuation Concerns: Premium valuations make stock sensitive to market sentiment changes

My Take and Investment Thesis:

NSE:CARTRADE presents a compelling technical setup with a successful rising wedge breakout supported by strong volume and robust fundamental performance. The stock has established itself as a leader in India's growing auto marketplace sector with a diversified business model and strong growth trajectory.

The technical breakout, combined with excellent Q1 FY26 results showing doubled profits and 22% revenue growth, creates a favourable risk-reward scenario for investors. However, given the stock's significant run-up (146% in 11 months), careful position sizing and strict risk management are essential.

The investment thesis is supported by both technical momentum and fundamental strength, making it suitable for investors seeking exposure to India's digital transformation in the automotive sector. The key to success will be disciplined execution of the outlined entry, exit, and risk management strategies while monitoring both technical levels and fundamental developments closely.

Keep in the Watchlist and DOYR.

NO RECO. For Buy/Sell.