MTARTECH 1 Week Time Frame 📊 Current Price Snapshot

MTAR Technologies closed around ₹2,931–₹2,932 recently.

📈 Weekly Pivot & Support/Resistance Levels

(Important zones likely to act as reference over ~1 week)

🔹 Pivot Levels

These are calculated based on recent price activity and help gauge short-term bias:

Central Pivot ≈ ₹2,909–₹2,954 (key balance level)

🔹 Resistance Levels

Potential upside barriers where price may slow/reverse:

₹2,995–₹3,031 near short-term upper range

₹3,100–₹3,178 next resistance cluster

Above ₹3,200 breakout target (longer weekly/extension)

🔻 Support Levels

Important zones to watch if price pulls back:

₹2,741–₹2,762 area (S1) — near immediate short-term support

₹2,562–₹2,600 range (S2) — strong secondary support

₹2,461–₹2,500 (S3/S4) — deeper pullback zone

These resistances/supports are based on pivot point calculations & Fibonacci extensions covering multiple pivot methods.

📊 Technical Indicators (Short-Term Context)

Moving averages (20, 50, 100, 200 DMA) are largely bullish in daily/weekly analysis, supporting upward momentum.

RSI is near bullish territory but approaching overbought on shorter frames — indicating possible consolidation ahead.

Some technical tools show short-term buy signals; others show neutral — indicating range movement with upside bias.

📌 How to Use These Levels

Bullish Scenario:

➡ Price sustaining above the pivot (~₹2,890-₹2,950) suggests continuation toward ₹3,000 → ₹3,100+ resistance levels.

Bearish/Retracement Scenario:

➡ Failure below pivot or key support near ₹2,740 could trigger pullbacks toward ₹2,600 → ₹2,500 support zones.

This setup works well for 3–7 day trading or planning entry/exit zones.

W-patterns

TEJASNET 1 Month Time Frame 📊 Current Price Snapshot (Approx)

Last traded price ~ ₹330-₹345 on NSE/BSE during late Jan 2026, after recent volatility and sell-offs.

📉 1-Month Timeframe — Key Levels

🔻 Support Levels (Downside)

These are levels where the stock could find buyers or pause losses on a 1-month chart:

Support Zone Significance

₹320 – ₹325 Immediate support; recent intraday floor (current price region)

₹301 – ₹315 Secondary support zone from pivot breakdowns

₹285 – ₹300 Deeper support if broader bearish momentum continues

📈 Resistance Levels (Upside)

Resistance Zone Importance

₹355 – ₹360 1st resistance from short-term moving average relevance

₹370 – ₹375 Next resistance cluster near recent intraday reactions

₹390 – ₹395 Higher resistance if bounce gains strength

🧠 Technical Indicator Context (1-Month)

📉 Trend Bias: Bearish overall, price trading significantly below major moving averages (20-day, 50-day, etc.).

📊 RSI: Near oversold but not confirmed bottom — suggests bearish momentum but potential for short-term rebounds.

📉 MACD & STOCH: Bearish signals persist, indicating weak price action on the 1-month chart.

🗂 Summary — 1-Month View

⚠️ Bearish Bias: The stock is in a short-term downtrend, trading below key moving averages and suffering weak momentum.

🛑 Support in Focus: ₹320-₹315 first; further deeper zone near ₹285-₹300 if bears intensify.

📈 Resistance Roadblock: ₹355-₹360 key for initial bounce; stronger rally needs break above ₹370+.

📉 Bearish Technicals: RSI not strongly indicating reversal yet; MACD remains bearish.

HINDZINC 1 Month Time Frame 📍 Current Price Snapshot (latest close / recent trade)

HINDZINC is trading around ~₹628–₹630 on NSE/BSE — after some volatility in recent sessions. Its 52‑week high is ~₹733 and 52‑week low ~₹378.15, showing wide longer‑term movement.

🛠 1‑Month Technical Levels (Support & Resistance)

These are the key zones traders watch for a 1‑month period based on pivot analysis and recent price action:

🔼 Resistance Levels (Upside Targets)

1. ₹705 – ₹715: Immediate resistance zone around recent highs and pivot R1/R2 cluster.

2. ₹735 – ₹750: Next major supply/resistance area — crossing this would signal stronger upside continuation.

3. ₹760 – ₹780+: Extended breakout zone if sentiment turns sharply bullish (higher targets from pivot extensions).

📌 Overall, ₹705–₹715 is the near‑term hurdle the stock needs to clear for a bullish run.

🔽 Support Levels (Downside Price Floors)

1. ₹690 – ₹700: First strong support near recent consolidation lows/pivot S1.

2. ₹670 – ₹680: Secondary support — a deeper pullback zone.

3. ₹650 – ₹660: Key base area — breakdown below this can signal more downside pressure.

4. ₹620 – ₹630: Major structural support if broad market or metals weakness intensifies.

📌 The ₹670–₹700 band acts as the core support area this month.

⚠️ Quick Summary

✔ Above ₹705–₹715 = bullish continuation likely.

✔ Between ₹670–₹700 = consolidation zone.

✔ Below ₹650 = risk of deeper retracement.

STARHEALTH 1 Week Time Frame 📊 Weekly Price Range (1‑Week History)

High (last week): ~₹469.8

Low (last week): ~₹442.45

(Source: Marketscreener weekly price extremes)

📌 Key Weekly Support Levels

Support zones you may watch on the weekly timeframe:

1. Support 1: ~₹440–₹442 (recent weekly low)

2. Support 2: ~₹430 area (round‑number psychological / pivot cluster)

3. Support 3: ~₹408–₹415 range (broader structural support from pivot supports seen on shorter pivots)

Weakness below ₹430 could open the lower band towards ₹405–₹410.

📌 Key Weekly Resistance Levels

Potential weekly resistance zones to monitor:

1. Resistance 1: ~₹470–₹472 (recent weekly highs & EMA cluster)

2. Resistance 2: ~₹480–₹485 (psychological and medium MA area)

3. Resistance 3: ~₹495+ (upper pivot / longer‑term range top)

A weekly close above ₹480–₹485 would indicate stronger upside pressure.

📈 Technical Indicator Context (Weekly)

RSI and weekly momentum indicators on some platforms suggest neutral‑to‑slightly bullish conditions rather than extreme overbought levels.

Weekly pivot and moving average positions (when available) confirm ₹462–₹470 as an important zone for bullish continuation.

JLHL 1 Day Time Frame 📌 Current Live Price (1‑Day)

Last traded price: ~₹1,305–₹1,322 range today on NSE/BSE.

Day’s range: ~₹1,301–₹1,359.

📊 Intraday Technical Levels (1‑Day Time Frame)

🔹 Pivot & Reference

No concrete official pivot published for today across many free data sites, but general intraday pivot technique (based on brokers’ short‑term screens) focuses around mid‑range prices near ₹1,310–₹1,320 as neutral area.

🔼 Resistance Levels (Upside)

These are zones where the price may face selling pressure on the same trading day:

1️. ₹1,350–₹1,360 — initial resistance zone (recent intraday high area).

2️. ₹1,375–₹1,390 — secondary resistance if price clears the initial zone.

🔽 Support Levels (Downside)

These are zones where buyers may step in intraday:

1️. ₹1,290–₹1,300 — nearest support band (recent intraday low).

2️. ₹1,270–₹1,280 — next lower support cluster (near the 52‑week low region).

🧠 Intraday Trading Interpretation

Bullish bias intraday if:

Price breaks above ₹1,350–₹1,360 with volume → could test higher around ₹1,375–₹1,390.

Bearish bias intraday if:

Price loses ₹1,290 support → risk of slide toward ₹1,270+ zone.

Range‑bound scenario:

Price oscillates between ₹1,290–₹1,350 if participation stays muted.

CONCOR 1 Day Time Frame 📊 CONCOR — 1‑Day Time Frame Key Levels (Indicative)

Current Price (recent session)

• ~₹478–₹480 (down intraday) — trading near session lows.

🔁 Pivot & Classic Levels (from standard technical calculation)

These are typical pivot/SR levels used by traders for one‑day setups:

Pivot Point: ~₹520

➡️ The central reference level where bias may shift.

If price trades above this level intraday → bullish bias; below → bearish bias.

Resistance Levels:

• R1: ~₹524

• R2: ~₹527

• R3: ~₹531

➡️ Levels where selling pressure may emerge if price rallies.

Support Levels:

• S1: ~₹516

• S2: ~₹513

• S3: ~₹509

➡️ Key intraday levels where buyers may step in on pullbacks.

📉 Today’s Range & Observations

Day’s High: ~₹497–₹498

Day’s Low: ~₹477–₹478

➡️ CONCOR is trading nearer its session low, showing short‑term selling pressure.

52‑Week Context:

• 52‑week low ~₹472–₹478

• 52‑week high ~₹652 (prior broader trend)

📌 How Traders Use These Levels (1 Day Time Frame)

Bullish Scenarios (intraday):

✔ If price breaks above Pivot (~₹520) with volume → potential move toward R1 ~₹524 and beyond.

✔ Strength above R1/R2 indicates buyers stepping in.

Bearish Scenarios (intraday):

✔ Price staying below pivot and failing at R1/R2 → continuation lower.

✔ Breakdown below S1 (~₹516) and S2/S3 amplifies downside pressure.

HINDZINC 1 Day Time Frame 📌 Current Price (intraday basis):

• ~ ₹667–₹670.8 (range seen today) with highs near ~₹694 and lows near ~₹652.65 earlier in the session.

📈 Intraday Pivot Levels (Daily)

These are calculated from recent price action and are widely used by traders to gauge intraday support and resistance:

📊 Pivot & Levels (Standard Daily)

• Pivot Point (PP): ~₹705.45

• Resistance

• R1: ~₹713.35

• R2: ~₹725.70

• Support

• S1: ~₹685.20

• S2: ~₹672.85

• S3: ~₹664.95

📍 Central Pivot Range (CPR)

• Top CPR: ~₹695.32

• Middle CPR: ~₹693.10

• Bottom CPR: ~₹690.88**

(Note: Pivot and CPR may shift slightly as market updates.)

📍 Summary – 1D Intraday Levels

Level Price (₹) Role

R2 ~725.70 Major upside resistance

R1 ~713.35 Near‑term resistance

Pivot ~705.45 Key directional trigger

CPR Top/Mid/Bottom ~695–690.9 Important intraday range

S1 ~685.20 Near‑term support

S2 ~672.85 Secondary support

S3 ~664.95 Lower support zone

DIXON 1 Day Time Frame 📉 Intraday Price Action (Today’s Range)

Day’s Range: ~₹10,274 – ₹10,790

This indicates where the stock has been trading so far today.

📊 Key Intraday Levels for 1‑Day Time Frame

🟢 Support Levels

S1: ~₹10,545 – ₹10,550

S2: ~₹10,359 – ₹10,360

S3: ~₹10,016 – ₹10,020

🔴 Resistance Levels

R1: ~₹11,070 – ₹11,075

R2: ~₹11,410 – ₹11,420

R3: ~₹11,600 – ₹11,605

These pivot‑derived support/resistance levels are typical for intraday reference (classic pivot methodology).

🧠 How to Use These Levels (Intraday)

Bullish bias: A sustained break above R1 ~₹11,070 with volume can open moves toward R2 ~₹11,410.

Bearish bias: If price loses S1 ~₹10,545, next support guards are S2 ~₹10,360 and S3 ~₹10,016.

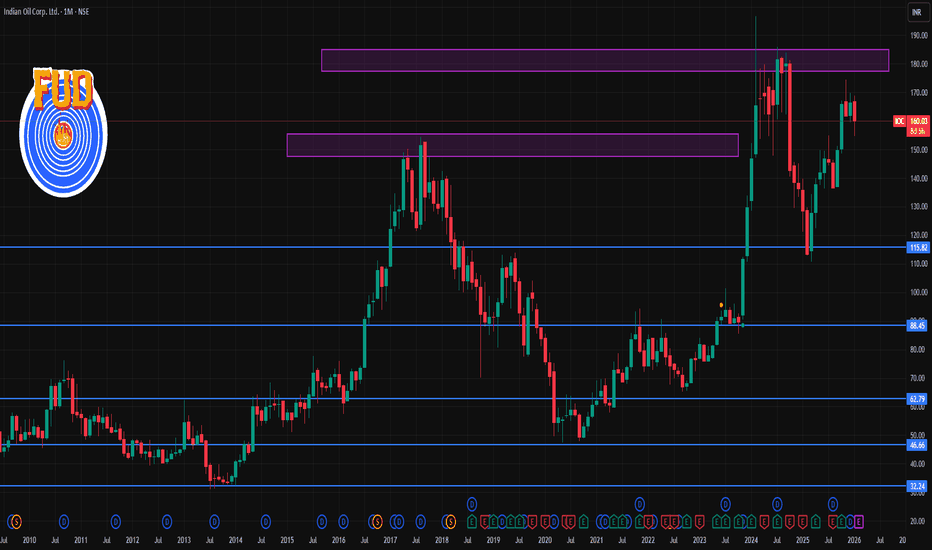

IOC 1 Month Time Frame 📌 CURRENT PRICE (as of 22 Jan 2026)

IOC share price: ~₹159.9 per share (NSE/BSE).

📊 1‑Month Technical Levels (Current & Accurate)

Resistance (Upside Levels)

These are levels where price may find selling pressure in the near term:

R1 – Immediate Resistance: ~₹160.6–₹162.5

R2 – Mid Resistance: ~₹162.5–₹163.9

R3 – Higher Resistance: ~₹164–₹165.2

A broader longer‑range resistance zone near ₹170–₹171+ remains significant if the market strengthens.

Why these matter:

Resistance levels show where the stock has historically paused or reversed on recent charts — useful for targets or exits.

Support (Downside Levels)

These are key near‑term supporting price zones:

S1 – Immediate Support: ~₹156.8–₹159.4

S2 – Secondary Support: ~₹154.7–₹157.9

S3 – Deeper Support: ~₹152.9–₹155.0

Note: If price breaks below ~₹155, it could signal further weakness in the short term.

🧠 How to Use These Levels

Swing traders: Use support zones for entry zones and resistance levels as targets.

Breakouts: A clear close above ₹164–₹165 could open room toward the ₹170+ zone.

Breakdown: A close below ₹155 could escalate selling into deeper support.

HINDCOPPER 1 Month Time Frame 📊 Current Reference Price

The stock is trading around ₹540 – ₹560 on the NSE today.

🧠 1‑Month Timeframe Key Levels

📈 Resistance (Upside Barriers)

These are levels where the stock might face selling pressure or pauses if it continues higher:

1. ₹570 – ₹575 — Immediate near‑term resistance zone (recent highs).

2. ₹580 – ₹585 — Next resistance cluster above current price — psychological plus pivot area.

3. ₹595 – ₹600+ — Extended upside target if price breaks above the near zone.

Interpretation: A daily/weekly close above ~₹575–₹580 can confirm strength on the 1‑month chart and open the move toward ~₹600+.

📉 Support (Downside Floors)

These are levels where buyers may step in if price corrects:

1. ₹522 – ₹525 — Near pivot support on medium timeframe.

2. ₹500 – ₹510 — Secondary support zone that has seen demand historically on pullbacks.

3. ₹480 – ₹490 — Deeper short‑term support — a key level if price weakens further.

Interpretation: Holds above ~₹520–₹525 are bullish for the 1‑month swing; breaks below that raise risk of deeper pullback toward ₹500 or lower.

✍️ 1‑Month Trading Perspective (Short Summary)

📌 Bullish Scenario

Sustained daily closes above ~₹575–₹580 → watch ₹590–₹600+ as next short‑term targets.

📌 Neutral / Range Scenario

Price consolidates between ₹525 and ₹575 — likely choppy movement before next directional breakout.

📌 Bearish / Correction Scenario

Close below ~₹522–₹525 → deeper support zones around ₹500–₹490 may get tested.

⚠️ Important Notes

✅ These are technical reference levels, not buy/sell recommendations.

✅ Price action can change quickly with market news, global copper trends, or broader index moves (e.g., Nifty/commodity dynamics).

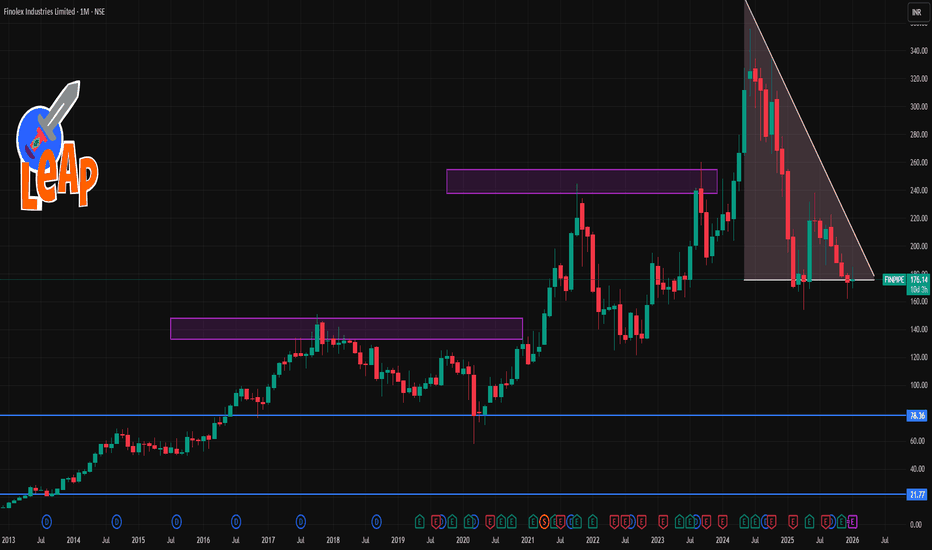

FINPIPE 1 Month Time Frame📊 Current Context

The share has been moderately positive over the past month (~+5–8% gains) in recent price data.

Recent share price (late Jan 2026) is near ₹175–177 levels.

📈 Key Levels (1‑Month Timeframe)

🔹 Resistance Levels

These are levels where the price may face selling pressure:

1. ~₹177–179 — Immediate resistance seen on short‑term pivot structure.

2. ~₹185–189 — Next meaningful resistance zone based on recent moving average clusters (20–50 day EMAs/SMAs).

3. ~₹194–198 — Higher resistance around 50–100 day average / upper consolidation of the last month/quarter.

Break above ₹185–189 with volume could signal a stronger short‑term uptrend continuation.

🔻 Support Levels

Important price floors where the price may find buyers:

1. ~₹173–175 — Near short‑term support and recent intraday pivot levels.

2. ~₹169–170 — Lower support seen from short swing lows over the past month.

3. ~₹164–165 — Deeper support from prior month low levels before recent recovery. (Estimated from recent historical lows.)

A close below ~₹169 on daily charts could indicate weakening short‑term structure.

🗺️ Trading Mindset (not financial advice)

Bullish view: A sustained move above ₹185–189 with increased volumes may target higher resistance near ₹195+.

Bearish view: A close under ₹170–169 could restart short‑term weakness toward lower support levels.

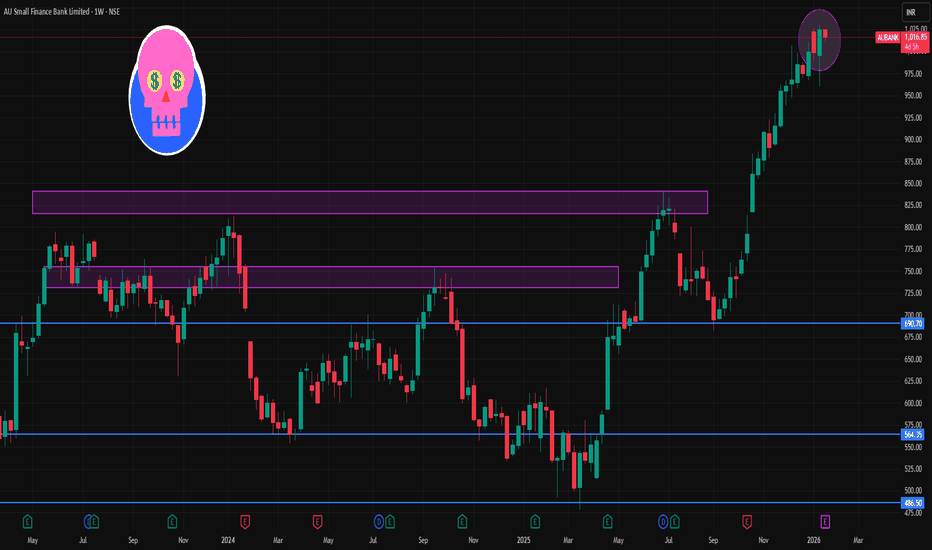

AUBANK 1 Week Time Frame 📌 1‑Week (Current) Key Levels

📍 Current Price Context

The stock has been trading around ₹1,020–₹1,030 area recently on NSE technical feeds.

🧱 Resistance Levels (Upside Targets)

1. Immediate Resistance (R1): ~₹1,050.35 – first barrier on the upside.

2. Major Resistance (R2): ~₹1,075.30 – next meaningful supply zone.

3. Higher Resistance (R3): ~₹1,120.65 – extended bullish breakout territory.

🛡️ Support Levels (Downside Defenses)

1. Immediate Support (S1): ~₹980.05 – crucial for weekly structure.

2. Major Support (S2): ~₹934.70 – deeper correction zone if S1 breaks.

3. Lower Support (S3): ~₹909.75 – extended bearish support for the week.

📊 Weekly Trading Range Projection

Bearish range: ~₹909–₹980

Bullish range: ~₹1,050–₹1,120 +

Price needs to hold above ₹980 weekly close to maintain bullish bias for the week.

📈 Trend & Indicators (Weekly)

Moving averages and oscillators on short‑term charts show neutral to mildly bullish momentum around ₹1,020–₹1,030.

EMA & SMA structures on daily charts support trend continuation if above key moving averages.

🔎 How to Use These Levels This Week

📌 Bullish setup:

Break and sustain above ~₹1,050 → potential run to ~₹1,075 → ₹1,120.

📌 Bearish setup:

Close below ~₹980 support → target ~₹935 → ₹910 on a deeper correction.

📌 Neutral / Swing range:

Between ₹980 and ₹1,050 → sideways action and range trades.

JSWSTEEL 1 Day Time Frame 📌 Daily Pivot Reference

Pivot (Daily): ~ ₹1,184 – ₹1,185 (central reference point)

📈 Resistance Levels (Upside)

1. R1: ~₹1,199 – ₹1,200 (first resistance)

2. R2: ~₹1,216 – ₹1,217 (second resistance)

3. R3: ~₹1,230 – ₹1,231 (third resistance / extended resistance)

📉 Support Levels (Downside)

1. S1: ~₹1,167 – ₹1,168 (first support)

2. S2: ~₹1,153 – ₹1,155 (second support)

3. S3: ~₹1,135 – ₹1,136 (third support)

📊 How to interpret on a 1D chart

A break above ₹1,200–₹1,216 with strong volume may open room for testing ₹1,230+ short-term.

On the downside, a slip below ₹1,167 could accelerate to ₹1,153 and then ₹1,135.

The pivot around ₹1,184–₹1,185 acts as a baseline: closes above suggest bullish bias intraday; closes below suggest bearish bias.

TATACAP 1 Hour Time Frame 📊 Current Price (approx, delayed)

₹355 – ₹358 range today (intraday high ~361.65 & low ~354.00).

📈 Intraday / 1‑Hour Key Levels (Indicative)

🧠 Pivot & Resistance Levels

These are useful for short term/1‑hour chart bias:

Level Price (₹ approx) Role

R3 368.4 Extended upside resistance

R2 363.2 Secondary resistance

R1 359.0 – 359.1 First resistance zone — breakout confirmation above boosts

bullish bias

Pivot (PP) 353.8 – 354.0 Central pivot — above = bullish, below = bearish

Source: ICICI Direct / Kotak Securities pivot data

📉 Support Levels

Level Price (₹ approx) Role

S1 349.7 Immediate support

S2 344.5 Next downside support

S3 340.3 – 340.4 Deeper support zone

Source: ICICI Direct / Kotak pivot data

📌 How To Use These Levels (1‑Hour Context)

Bullish Scenario

Above Pivot (~354) → bulls in control.

Break above R1 (~359) → stronger upside probability toward R2 (363) and R3 (368).

Bearish Scenario

Below Pivot (~354) → bias turns neutral → bearish if it closes below S1 (~349.7).

A close below S2 (~344) opens swing toward S3 (~340).

Intraday Strategy Tips

In fast moves, use R1/S1 on the 1‑hour chart as your initial entry/exit reference.

Confirm move with volume + RSI/MACD (positive signals add confidence).

SOLARINDS 1 Day Time Frame 📊 Live Price Snapshot (approx)

Current NSE price: ~₹13,190 – ₹12,875 range (end of last session)

📈 Daily Pivot & Key Levels (1-Day Timeframe)

These come from recent pivot point calculations and live technical feeds:

Resistance Levels (Upside)

R1: ~₹13,577

R2: ~₹13,963

R3: ~₹14,214

(Potential upside barriers / targets)

Pivot Point

Pivot (Daily Reference): ~₹13,300 zone (approx midpoint)

Support Levels (Downside)

S1: ~₹12,940

S2: ~₹12,689

S3: ~₹12,303

(Zones where buying interest often emerges intraday)

🔍 Short-Term Bias & Indicators

Technical indicator signals today (1D):

RSI: Neutral/around mid-range → neither overbought nor oversold.

MACD: Bullish crossover on short timeframe.

Moving Averages (short & mid DMA/EMA): Mixed (some short EMAs bullish, some bearish), signaling consolidation bias around current price.

🕒 Summary for Today (1D)

Neutral to slightly bullish near current levels with balanced indicator setup

Key levels to watch:

Upside: 13,577 → 13,963 → 14,214

Downside: 12,940 → 12,689 → 12,303

Immediate pivot bias around ₹13,300 will determine intraday direction.

VEDL 1 Moth Time Frame 📌 Latest Market Context

• The stock is trading near multi‑month and all‑time highs (around ₹670+ on NSE) on strong momentum and positive sentiment after broker upgrades and structural catalysts.

• RSI readings suggest strong upside momentum but near overbought in some sources.

📈 1‑Month Timeframe Key Levels

(These combine pivot, swing support/resistance & recent price action ranges)

Resistance (Upside Targets)

₹656–₹660 — Upper daily pivot resistance zone.

₹650–₹656 — R2–R3 levels from technical pivot indicators.

Above ₹670–₹680 — Near current multi‑week highs / psychological zone (strong breakout if sustained).

Support (Downside Floors)

₹630–₹635 — Immediate pivot support (~S1) & short‑term cushion.

₹622–₹625 — Secondary demand zone near moving average clusters.

₹616–₹620 — Deeper swing support if short correction unfolds.

📊 What These Levels Mean

✅ Holding Above ₹630–₹635

Maintains bullish momentum in the 1‑month view.

Prospects for retesting ₹650+ and potentially ₹670–₹680 if buying continues.

⚠️ Break Below ₹620

Could open a pullback toward ₹616 and lower pivot zones before buyers re‑emerge.

A close below ~₹616 on monthly/daily charts may signal short‑term loss of structure.

📍 How to Use These Levels

Bullish Trade Setup (1M swing)

Buy or add near support ₹630–₹620 with stops slightly below ₹616

Targets: ₹650 → ₹670+

Neutral/Profit‑Taking Zone

₹650–₹670+ is the next potential resistance breakeven/exit zone

Bearish/Defensive

If price decisively closes below ₹620–₹616, reduce risk exposure and watch for support at lower levels.

CHART PATTERNS Chart patterns are visual shapes formed by price movements on a chart. These patterns occur repeatedly across markets and timeframes because human psychology doesn’t change. Fear, greed, panic, and hope create predictable structures.

Chart patterns fall into three categories:

1. Reversal Patterns

2. Continuation Patterns

3. Bilateral Patterns

Understanding Chart Patterns with Market Psychology

Every chart pattern reflects the psychological war between buyers and sellers.

Higher highs & higher lows: Buyers strong

Lower highs & lower lows: Sellers strong

Flat areas: Indecision

Breakouts: One side finally wins

MPHASIS 1 Week Time Frame 📊 Weekly Support & Resistance Levels

(From recent weekly technical outlook)

Resistance

R1: ₹2,863 – ₹2,865 region

R2: ~₹2,920 – ₹2,919

R3 (Bullish breakout): ~₹2,965

Support

S1 (Immediate): ~₹2,762

S2: ~₹2,717

S3 (Strong support): ~₹2,660

This gives a probable weekly trading range of ~₹2,660 to ₹2,965.

📉 Pivot Point Reference (Short-Term)

From a recent pivot calculation — can help identify intra-week turning points:

Classic pivot point around ~₹2,817 with:

S1: ~₹2,796

S2: ~₹2,776

S3: ~₹2,755

R1: ~₹2,817

R2: ~₹2,837

R3: ~₹2,858**

📈 Current Technical Signals Context

EMA/SMA and oscillators on daily/weekly are mixed to neutral-bullish — some sources show buy bias while others show weak trend — indicating no strong breakout trend yet and trending within range unless a clear break happens.

✅ Summary for 1-Week Level Strategy

Bullish break above: ~₹2,920–₹2,965

Key support zone to watch: ~₹2,660–₹2,762

Neutral pivot: ~₹2,800–₹2,830

BTC/USD 1 Month Time Frame 📊 Current Price Snapshot (Latest Available)

$90,478.00

📊 1‑Month Key Levels — BTC / USD

🛑 Resistance Levels (Upside)

These are areas where price has struggled to break above recently:

1. Major Resistance: ~$108,000–$112,000

• Multiple tests and sellers here — strong supply zone.

2. Intermediate Resistance: ~$100,000

• Psychological barrier and past pivot point.

💡 A successful break above these could signal bullish continuation and a shift in momentum.

🟩 Support Levels (Downside)

These are floors where price tends to stabilize or bounce:

1. Immediate Support: ~$84,000–$87,000

• Critical support zone on monthly chart — losing this could strengthen bearish momentum.

2. Secondary Support Zone: ~$80,000

• Structural support from past price action.

3. Lower Support: ~$75,000

• Major defense area if broader sell‑offs continue.

📉 If these support levels break decisively with volume, risk increases for deeper pullbacks.

📌 How to Use These Levels

🕐 1‑Month Time Frame Interpretation

Bullish bias if BTC holds above ~$90k–$100k, especially with higher highs.

Neutral / Range‑bound if price oscillates between ~$84k–$108k.

Bearish bias if BTC breaks below ~$84k with conviction (higher volume and clear close below).

These levels reflect recent technical structure and psychological zones, commonly used by traders to set entries, exits, and risk management.

STEELCAS 1 Day Time Frame 📊 Current Price Snapshot (Latest Available)

Approx Live Price: ~₹210–₹213 per share (recent session)

Today’s Day Range (recent close): ~₹208–₹214

📈 Accurate Daily Support & Resistance Levels

🔹 Pivot Point (Day Reference)

Pivot: ~₹206.55–₹213.62 (central reference)

📉 Support Levels

S1: ~₹203.7–₹205.8 – first key support

S2: ~₹197.1–₹201.1 – stronger secondary support

S3: ~₹188.8–₹193.3 – deep support zone

📈 Resistance Levels

R1: ~₹218.5–₹218.3 – first resistance

R2: ~₹226.8–₹226.1 – next upside target

R3: ~₹233.4–₹230.7 – higher resistance

🧠 How to Use These Levels (Daily Time Frame)

Bullish scenario

Break and hold above R1 (~₹218–219) could signal continuation toward R2 (~₹226+).

Sustained break above R2 strengthens trend.

Bearish scenario

Failure under Pivot (~₹206–213) with close below S1 (~₹204–206) may open S2 (~₹197) and S3 (~₹188).

Look for volume confirmation on breakdowns.

📍 Quick Reference Summary (Daily Levels)

Level Price Approx

R3 ~₹230–₹233+

R2 ~₹226–₹227

R1 ~₹218–₹219

Pivot ~₹206–₹213

S1 ~₹203–₹206

S2 ~₹197–₹201

S3 ~₹188–₹193

HCLTECH 1 Month Time Frame 📌 Current Price Snapshot

Approx. live share price: ₹1,640–₹1,650 range on NSE today.

📅 1‑Month Price Context

Over the past month, HCLTECH has generally traded between roughly ₹1,590 – ₹1,680 before recent moves.

📊 Key 1‑Month Technical Levels

🔹 Immediate Support Levels

These are short‑term levels where price may find buying interest:

S1: ~₹1,620

S2: ~₹1,605

S3: ~₹1,592

(support levels from pivot analysis)

Additional support areas if price falls further:

~₹1,580–₹1,570 (psychological region and recent consolidation area)

🔺 Immediate Resistance Levels

These are short‑term levels where price may face selling pressure:

R1: ~₹1,647–₹1,650

R2: ~₹1,660

R3: ~₹1,670–₹1,675

(pivot‑based resistance zones)

If bulls push higher:

~₹1,690–₹1,700 is a possible zone of next resistance before bigger range tests.

📈 Trend & Moving Averages (1‑Month)

20 DMA: ~₹1,659

50 DMA: ~₹1,610

100 DMA: ~₹1,536

200 DMA: ~₹1,564

(latest moving averages reflect neutral‑to‑bullish alignment with price above most SMAs)

📌 How to Use These Levels

Bullish scenario:

If HCLTECH sustains above ₹1,650–₹1,660, the next resistance to watch is ₹1,675–₹1,700, and potential testing of recent broader highs.

Bearish scenario:

If it breaks below ₹1,592–₹1,580, short‑term support weakens and price could drift toward ₹1,550–₹1,570.

RELIANCE 1 Week Time Frame 📌 Current Price Snapshot

RELIANCE.NS is trading around ~₹1,507 – ₹1,510 per share on NSE.

📉 Key Weekly Support Levels

These are levels where price may find buying support on pullbacks:

🟩 Support 1: ~₹1,518 – ₹1,520 — near short‑term pivot support zone for the week.

🟩 Support 2: ~₹1,498 – ₹1,500 — next floor if sellers dominate early week.

🟩 Lower Support: ~₹1,479 – ₹1,480 — broader weekly downside reference.

👉 A weekly close above ₹1,518 would suggest short‑term stabilization before potential bounce.

📈 Key Weekly Resistance Levels

Levels where upside may face selling pressure:

🔴 Resistance 1: ~₹1,555 – ₹1,560 — nearest upside hurdle.

🔴 Resistance 2: ~₹1,600 – ₹1,612 — mid‑week challenge zone (~52‑week area).

🔴 Higher Resistance: ~₹1,630 – ₹1,668 — stretch target if bullish momentum picks up.

👉 A weekly close above ~₹1,612–₹1,620 would signal stronger bullish bias and possible follow‑through to higher levels.

📊 Weekly Price Range Estimate

Expected trading corridor for this week:

📉 Downside: ~₹1,498 – ₹1,500

📈 Upside: ~₹1,630 – ₹1,668

This range represents the key support and resistance boundaries traders may watch for breakouts or breakdowns during the week’s sessions.

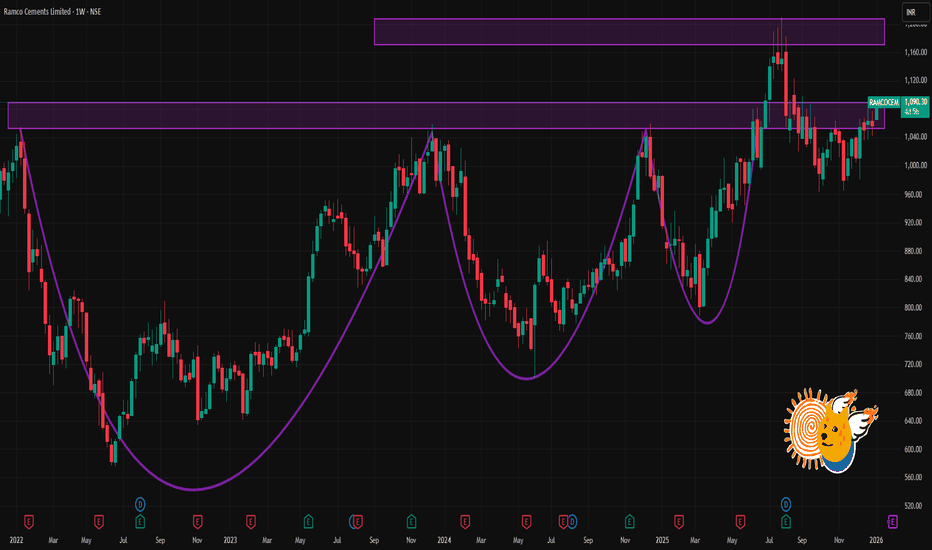

RAMCOCEM 1 Week Time Frame📌 Current Price (Approx)

~₹1,060 per share (latest trading range) — stock has been trading around this level recently.

📉 1-Week Key Levels (Support & Resistance)

🔹 Support Levels

Support 1: ~₹1,050 — short-term support zone.

Support 2: ~₹1,040–₹1,042 — secondary support.

Support 3: ~₹1,032–₹1,035 — deeper weekly support.

👉 If price closes below ₹1,040 on weekly basis, it may signal short-term weakness.

🔺 Resistance Levels

Resistance 1: ~₹1,068–₹1,070 — first near-term hurdle.

Resistance 2: ~₹1,077–₹1,078 — higher weekly resistance.

Resistance 3: ~₹1,087–₹1,093 — extended resistance zone.

👉 Break above ₹1,070–₹1,078 could open room toward ~₹1,087–₹1,093+ levels this week.

📊 Weekly Price Action Summary

Price has been trading near ~₹1,060 range, making this region a pivotal short-term level.

Short-term oscillators and technical ratings are mixed/neutral to mild buy.

Bullish bias this week if price stays above ₹1,050–₹1,055 and takes out ₹1,070+.

Bearish tilt if price closes below ₹1,040–₹1,050 on a weekly chart.

📍 Summary: 1-Week Levels

Level Type Price Zone

Major Support ₹1,050

Next Support ₹1,040–₹1,042

Lower Support ₹1,032–₹1,035

First Resistance ₹1,068–₹1,070

Higher Resistance ₹1,077–₹1,078

Extended Resistance ₹1,087–₹1,093+