Assuming the mindset of Warren Buffett, let us evaluate BSE Ltd.📊 1. Understand the Business (Circle of Competence)

BSE Ltd. is one of India’s two major stock exchanges (along with NSE). It earns revenue from:

Listing fees

Transaction/clearing charges

Data dissemination

Subsidiary businesses (e.g., mutual funds, SME platform)

🔍 Buffett View:

The stock exchange business is a monopoly-like, high-moat business with few players.

It benefits from network effects – more listings attract more investors and vice versa.

It has low capital requirements to grow and high operating leverage – very Buffett-friendly traits.

📈 2. Financial Health (Conservative Analysis)

Let’s assume a financial breakdown based on known fundamentals (recent as of 2024-25):

| Metric | Value | Buffett Interpretation |

| ---------------------- | ---------------------- | ----------------------------------------------- |

| ROE (Return on Equity) | >20% | Excellent – Indicates efficient use of capital |

| Debt-to-Equity Ratio | Close to 0 | Strong – Buffett avoids debt-heavy firms |

| Free Cash Flow | Positive, consistent | Good – Buffett loves cash-generating businesses |

| Dividend Yield | 1.5%–2.5% | Moderate, not key, but shows surplus cash |

| Earnings Growth | CAGR \~20–25% (recent) | Promising – but must sustain organically |

🔍 Buffett prefers stable and predictable earnings, and BSE shows that in its core exchange business, though it remains sensitive to market cycles.

🏰 3. Economic Moat

BSE's Competitive Advantages:

Brand heritage (Asia’s oldest exchange)

Government regulations ensure limited competitors

High switching costs for existing listed companies

High margin data services, SME listings, and mutual fund platforms

🛡 Buffett’s View:

> “I want a business with a durable competitive advantage.”

> BSE fits this well.

👨💼 4. Management Quality

Buffett places immense importance on management honesty and competence.

BSE’s leadership has been conservative, focused on transparency and innovation (e.g., India INX, BSE StAR MF).

Consistent improvement in digital platforms and growing relevance in mutual fund distribution indicates forward-thinking leadership.

✅ Buffett’s View: Passes the integrity and competency test.

🌏 5. Industry Outlook

Indian capital markets are expanding.

Retail participation, SIP inflows, and startups going public will grow exchange volume.

Fintech and tech listings offer upside.

Regulatory tailwinds from SEBI are improving transparency and scale.

📘 Buffett likes industries with tailwinds, and Indian capital markets are structurally growing.

📉 6. Technical Entry (Buffett seldom uses technicals but we’ll blend it)

> "Price is what you pay. Value is what you get."

Looking at the Fibonacci retracement levels from the chart:

CMP: ₹2,456.70

38.2% Level: ₹2,337.15 →Potential entry zone

50% Level: ₹2,123.35 → Strong support / high conviction entry

61.8% Level: ₹1,909.50 → Ideal deep value buy (high margin of safety)

🟩 Accumulation Zone: ₹2,100 – ₹2,337

🛑 Stop-loss (Fundamental): ₹1,850 (below 61.8% retracement and key support)

🎯 Target (Intrinsic Value): ₹3,000–₹3,200 over 2–3 years (based on earnings growth)

📌 7. Intrinsic Value Estimation (Buffett’s Method)

DCF-style rough estimate:

EPS: ₹75 (assumed)

Growth: 15% CAGR (conservative)

Terminal PE: 25 (market average for strong moats)

Holding period: 5 years

Future EPS = 75 × (1.15)^5 ≈ ₹150

Target Price = 150 × 25 = ₹3,750

Present Value (with 12% discount) ≈ ₹2,120 – ₹2,350

🔎 Fair Value Range: ₹2,100–₹2,350

💵 Buy Below: ₹2,350 (for margin of safety)

✅ Final Verdict (Buffett Style Summary)

| Criteria | Verdict |

| ----------------------- | ---------------------------- |

| Understandable Business | ✅ Yes |

| Economic Moat | ✅ Strong |

| Management Quality | ✅ Trusted & Competent |

| Financial Strength | ✅ Excellent |

| Industry Tailwind | ✅ Positive |

| Intrinsic Value Range | ₹2,100–₹2,350 |

| Current Price | ₹2,456 – Slightly overvalued |

| Buy Recommendation | Wait for dip below ₹2,350 |

| Stop Loss (Soft) | ₹1,850 |

| Target (Long-Term) | ₹3,500+ |

Warrenbuffet

Magic of Coffee Can Investing : Brewing Wealth☕Ever heard the legendary tale of Robert Kirby and the magical coffee can? ☕

📜 Let's embark on a financial journey, merging history, numbers, and wisdom to unlock the secrets of Coffee Can Investing for the Indian stock market!

📜 Historical Tale:

In the 1980s, financial wizard Robert Kirby shared a captivating story. He spoke of a wealthy widow who stashed her stock picks in a literal coffee can, leaving them untouched for years. When the can was opened, it revealed a fortune! This timeless tale laid the foundation for Coffee Can Investing.

📊 Screener - Criteria to Filter Stocks:

1. Earnings Growth Rate: Aim for companies with consistent earnings growth. A 10% or higher annual growth rate could be a strong indicator.

2. Return on Equity (ROE): Seek companies with a solid ROE, indicating efficient use of shareholder equity. A minimum of 15% is often a good benchmark.

3. Debt-to-Equity Ratio: Low debt is a sign of financial health. Companies with a debt-to-equity ratio below 0.5 are generally considered safe.

🌐 Context for the Indian Stock Market:

In the vibrant world of Indian stocks, Coffee Can Investing aligns perfectly. Blue-chip stocks like Reliance Industries and stalwarts like TCS exemplify the strategy, consistently thriving and showcasing the enduring power of quality investments.

📈 Benefits of Coffee Can Investing:

1. Compound Wealth: Historical data shows that patient investors who embrace the Coffee Can approach benefit from the power of compounding. If you invested ₹1,00,000 in Infosys in 2004, it would have grown to ₹23,00,000 by 2021.

2. Reduced Emotional Stress: Fewer trades mean less emotional decision-making. A calmer mind often leads to better long-term choices.

3. Long-Term Vision: Companies like HDFC Bank, Wipro, and HUL have demonstrated sustained growth over decades, aligning perfectly with the Coffee Can philosophy.

🔍 Warren Buffett's Influence:

Warren Buffett, the Oracle of Omaha, is a living example of the Coffee Can approach. His investment in Coca-Cola in the 1980s is legendary. Buffett held onto his Coca-Cola shares, letting them compound over the years, turning a modest investment into a multibillion-dollar holding.

☕ How to Invest Systematically:

1. Start with Research: Identify quality stocks, check financial health, and select companies with proven stability.

2. Set a Regular Investment Schedule: Contribute consistently, aligning with your financial goals.

3. Diversify Thoughtfully: Spread investments across sectors to reduce risk.

4. Reinvest Dividends: Accelerate compounding by reinvesting dividends.

5. Periodic Review (Not Overreaction): Strategically review and adjust if necessary.

6. Learn and Stay Informed: Stay updated on market trends and financial news.

7. Patience is Key: Embrace market fluctuations with a calm mindset.

🚀 In Conclusion:

The Coffee Can Investing strategy isn't just a theory; it's a time-tested approach backed by historical successes. So, next time you enjoy your cup of coffee, remember - your portfolio might just be brewing its own success story! ☕💰

📌 Disclaimer:

The information provided is for educational purposes only and should not be considered as financial advice. Investing involves risks, and individuals should conduct thorough research or consult with a financial advisor before making investment decisions.

My crazy partner is Mr. Market!We are used to the fact that the world's most prominent investors are known for their outstanding deals, returns and stability of results over a long time horizon. Yes, all this is certainly a sign of excellence, but no investor has gained his popularity through books. The books he wrote.

This man created his writings back in the 1930s and 1940s, but they still inspire anyone who has taken the path of smart stock investing. You've probably guessed by now who we're talking about. It's the humble author of The Intelligent Investor and Warren Buffett's teacher, Benjamin Graham.

It's amazing that after many years, this book is still considered the bible of investing on the basis of fundamental analysis - Graham wrote such a thorough description of how a person investing in stocks should think. His insight into the market can be useful to anyone who is exposed to this chaotic environment.

To understand Graham's philosophy, imagine that the market is your business partner "Mr. Market." Every day he stops by your office to visit and offer you a deal on your mutual company stock. Sometimes he wants to buy your stock, sometimes he wants to sell his own. And each time he offers a price at random, relying only on his gut. When he panics and is afraid of everything, he wants to get rid of his shares. When he feels euphoric and blind faith in the future, he wants to buy your share. That's the kind of crazy partner you have. Why is he acting this way? According to Graham, this is the behavior of all investors who don't understand the real value of what they own. They jump from side to side and do it with the regularity of a "maniac" every day.

The task of the prudent investor is to understand the fundamental value of your business and just wait for another visit from the crazy Mr. Market. If he panics and offers to buy his stock at an extremely low price - take it and wish him luck. If he begs to sell him the stock and calls an unusually generous price - sell it and wish him luck.

Of course, after a while, it may turn out that Mr. Market was not bad at all and made a very profitable deal with you. But the fact is that on the long horizon of time his luck will be washed away by a series of stupid things he will inevitably do. As for you, rest assured that tomorrow you will meet another Mister. So, as Graham has taught us, is teaching us, and will continue to teach us - you just have to be ready for it. Understanding the fundamental value of the company, this meeting will bring you nothing but pleasure!

The golden Years of wealth Creation💰💰all stocks flying 😉

don't know how many of you

enjoying the benefit💰💰💰

➣"I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful." — Warren Buffett

Be prepared to invest in a down market and to "get out" in a soaring market, as per the philosophy of Warren Buffett.

➣"An investment in knowledge pays the best interest." — Benjamin Franklin

When it comes to investing, nothing will pay off more than educating yourself. Do the necessary research and analysis before making any investment decisions

➣"It's not whether you're right or wrong that's important, but how much money you make when you're right and how much you lose when you're wrong." — George Soros

Too many investors become obsessed with being right, even when the gains are small. Winning big and cutting your losses when you're wrong are more important than being right.

➣“If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”— Warren Buffett

➣“Risk comes from not knowing what you are doing.”— Warren Buffett

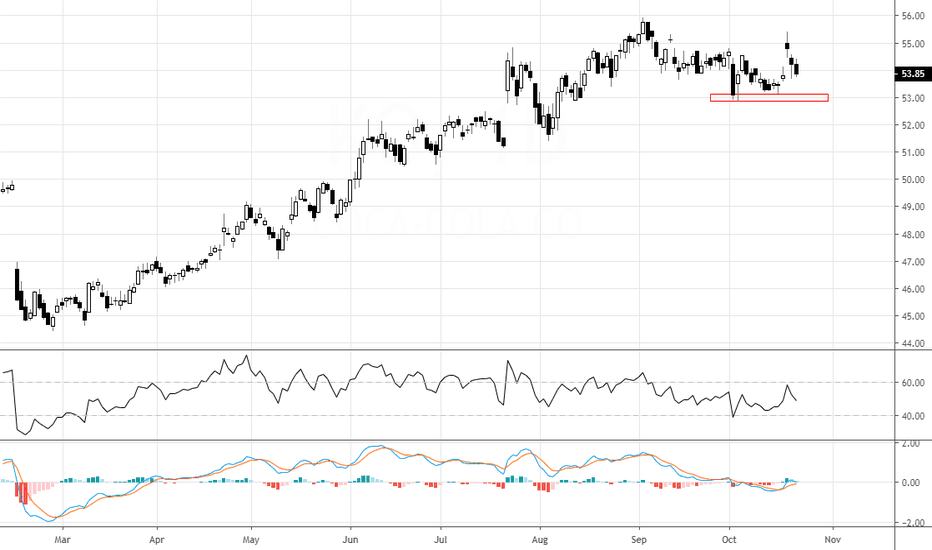

Coca Cola may get bitter here!The stock is in a dominant trend up. Recently a lower high and lower low price pattern has been noticed on the daily charts. The RSI also seems to have shifted the range from bullish 80-40 zones to neutral 60-40 zones in the past few weeks. Important support levels are marked on the charts. Breaking them may result into corrections. The degree of the corrections are still not predictable, but the RSI forewarns. To get more insights into RSI visit www.prorsi.com

ILong