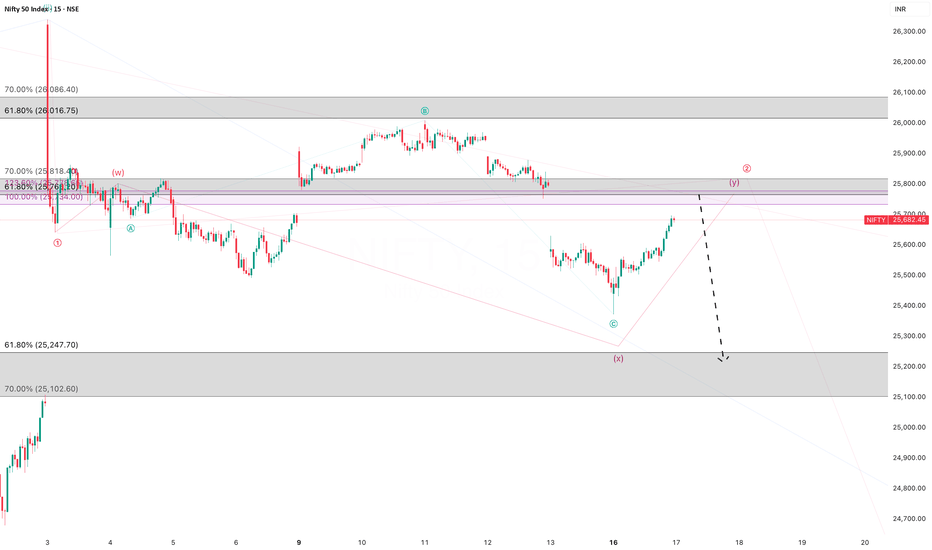

Nifty Analysis for Feb 16-18, 2026Wrap up:-

Nifty is now in wave 3 of major wave c, in which wave 1 is completed at 25641 and wave 2 is in progress which is making a abc/wxy corrected pattern of which wave a or w is completed at 25685 and currently, wave x or b is expected to be completed at 25444 once nifty breaks and sustains above 25660. Thereafter, wave c or y will head towards for a Probable target i.e. 25932.

What I’m Watching for Feb 16-18, 2026 🔍

Once nifty breaks and sustains above 25660, low risk entry range is 25523-25577 for a Probable target i.e. 25932 with a stoploss of 25444.

Disclaimer: Sharing my personal market view — only for educational purpose not financial advice.

"Don't predict the market. Decode them."

Wave Analysis

NIFTY : Trading levels and Plan for 16-Feb-2026📘 NIFTY Trading Plan – 16 Feb 2026

(Timeframe: 15-Min | Instrument: NIFTY | Educational Purpose Only)

🔑 Key Intraday Levels (From Chart)

🟢 25,727 – Last Intraday Resistance

🟢 25,622 – Opening Resistance

🟠 25,350 – 25,427 – Opening Support Zone (Consolidation)

🟢 25,120 – 25,207 – Buyer’s Demand Zone

🟢 25,460 – Current Reference Price

🧠 Market Structure & Price Psychology

NIFTY has completed a short-term ABC corrective decline and is now reacting from a demand accumulation zone.

👉 This suggests dip buying interest emerging

👉 However, confirmation requires acceptance above resistance

Market is currently in a reversal attempt phase, not a confirmed uptrend yet.

🚀 Scenario 1: GAP UP Opening (100+ Points)

(Opening near / above 25,600)

🧠 Psychology

Gap up indicates short covering + demand follow-through, but supply overhead may trigger profit booking.

🟢 Bullish Plan

🔵 Sustaining above 25,622 (15-min close)

🔵 Upside opens towards 25,727

🔵 Break & hold above → Trend reversal confirmation

🔴 Rejection Plan

🔴 Failure near 25,727

🔴 Pullback towards 25,622 → 25,427

📌 Why this works

Reversal rallies need acceptance above supply, not just gap spikes.

➖ Scenario 2: FLAT Opening

(Opening between 25,420 – 25,550)

🧠 Psychology

Flat opening inside consolidation reflects base formation & liquidity absorption.

🟠 Consolidation Zone

🔸 25,350 – 25,427

🔸 Expect sideways chop until breakout

🟢 Upside Plan

🔵 Break & hold above 25,622

🔵 Targets: 25,727

🔴 Downside Plan

🔴 Breakdown below 25,350

🔴 Drift towards 25,207 → 25,120

📌 Why this works

Bases resolve with expansion — patience improves entries.

🔻 Scenario 3: GAP DOWN Opening (100+ Points)

(Opening near / below 25,350)

🧠 Psychology

Gap down signals fear sentiment continuation, but strong demand zones attract institutional buying.

🟢 Bounce Setup

🔵 If 25,120 – 25,207 holds

🔵 Expect sharp short-covering bounce towards 25,350 → 25,622

🔴 Breakdown Setup

🔴 Clean break below 25,120

🔴 Downside momentum may accelerate

📌 Why this works

Demand zones create either V-shaped reversals or panic breakdowns.

🛡️ Risk Management Tips (Options Traders)

🟢 Wait for first 15-min candle confirmation

🟢 Prefer defined-risk spreads in volatile openings

🟢 Avoid trading inside consolidation zones ❌

🟢 Risk only 1–2% capital per trade

🟢 Book partial profits at next levels

🟢 Discipline > Prediction 📌

🧾 Summary & Conclusion

📌 NIFTY reacting from ABC corrective demand zone

📌 25,622 & 25,350 are key intraday triggers

📌 Break above 25,727 confirms reversal continuation

📌 Trade reaction, not bias 📈

⚠️ Disclaimer

This analysis is strictly for educational purposes only.

I am not a SEBI registered analyst.

Please consult your financial advisor before taking any trades.

Market investments are subject to risk.

What Are Leveraged Hedge Funds?Understanding Leverage in Simple Terms

Leverage means using borrowed capital to increase investment exposure.

For example:

A fund has $100 million in investor capital.

It borrows $200 million from a prime broker.

It now controls $300 million in investments.

Its leverage ratio is 3:1.

If the portfolio rises 10%, the gain is $30 million. On $100 million of original capital, that is a 30% return (before interest and fees).

But if the portfolio falls 10%, the fund loses $30 million—meaning a 30% loss on its capital.

Leverage multiplies outcomes in both directions.

How Hedge Funds Use Leverage

Leveraged hedge funds employ several mechanisms to increase exposure:

1. Margin Borrowing

Funds borrow directly from banks or prime brokers using securities as collateral. This is common in equity long/short strategies.

2. Derivatives

Derivatives provide synthetic leverage.

Futures contracts require only margin, not full capital.

Options allow large exposure with limited upfront cost.

Swaps (especially total return swaps) allow exposure without owning the underlying asset.

For example, during the collapse of Archegos Capital Management in 2021, the firm used total return swaps to build massive leveraged equity positions without directly owning the stocks, hiding the true scale of exposure from markets.

3. Repo Financing

In fixed-income strategies, hedge funds use repurchase agreements (repos) to borrow funds short-term and amplify bond holdings.

4. Structured Products

Some hedge funds invest in structured credit instruments that embed leverage within the product itself.

Types of Hedge Fund Strategies That Use Leverage

Not all hedge funds use leverage equally. Some rely heavily on it.

Long/Short Equity

Managers go long undervalued stocks and short overvalued ones. Leverage increases both sides of the book to amplify spread returns.

Global Macro

Funds take leveraged positions in currencies, bonds, commodities, and interest rate markets. Because these markets often have small price movements, leverage is essential for meaningful returns.

Fixed Income Arbitrage

This strategy depends heavily on leverage because spreads between bonds are typically very small. To generate attractive returns, funds must scale up exposure dramatically.

A classic example is Long-Term Capital Management (LTCM), which used extreme leverage—reportedly over 25:1—and collapsed in 1998 after market volatility spiked. The crisis required coordinated intervention led by the Federal Reserve to prevent systemic fallout.

Quantitative Funds

Quant funds often use leverage to exploit small statistical inefficiencies across thousands of trades.

Why Hedge Funds Use Leverage

1. Enhance Returns

Many hedge fund strategies target small price inefficiencies. Without leverage, returns would be too modest to justify fees.

2. Capital Efficiency

Leverage allows funds to diversify across more positions without tying up all capital.

3. Risk-Adjusted Strategies

Some funds claim that leverage allows them to apply modest risk across many uncorrelated trades, potentially smoothing volatility.

Risks of Leveraged Hedge Funds

Leverage increases complexity and risk significantly.

1. Magnified Losses

Small adverse moves can wipe out large portions of capital.

2. Margin Calls

If asset values fall, lenders demand additional collateral. If the fund cannot provide it, forced liquidation occurs—often at the worst time.

3. Liquidity Risk

In stressed markets, funding sources can disappear. Even strong funds may collapse if liquidity dries up.

4. Counterparty Risk

Funds depend on banks for leverage. If counterparties reduce exposure suddenly, positions must unwind quickly.

The collapse of LTCM demonstrated how leverage can turn minor market dislocations into near-systemic events.

Regulatory and Systemic Implications

Leveraged hedge funds operate with less regulation than banks. However, after the 2008 financial crisis, oversight increased.

In the United States, the Securities and Exchange Commission requires many hedge funds to register and disclose certain information, though leverage levels are not always transparent to the public.

Regulators monitor hedge fund leverage because:

Highly leveraged funds can trigger fire sales.

Interconnected exposures can amplify systemic risk.

Sudden deleveraging can destabilize markets.

Events like the 2008 crisis and the Archegos collapse reinforced concerns about hidden leverage.

Benefits of Leveraged Hedge Funds

Despite risks, leveraged hedge funds serve several functions:

1. Market Liquidity

They provide liquidity in complex markets, including bonds and derivatives.

2. Price Efficiency

Arbitrage strategies help align prices across markets.

3. Risk Transfer

They assume risks other investors may not want.

4. Portfolio Diversification

Institutional investors use hedge funds to diversify portfolios beyond traditional stocks and bonds.

Comparing Leveraged Hedge Funds to Other Financial Institutions

Feature Hedge Funds Banks Mutual Funds

Leverage Limits Flexible Regulated capital ratios Limited

Investor Base Accredited investors Depositors Retail investors

Strategy Flexibility Very high Moderate Limited

Transparency Lower Higher High

Banks operate under strict capital requirements, while hedge funds can structure leverage creatively through derivatives and off-balance-sheet exposures.

Leverage Ratios: How Much Is Too Much?

There is no universal safe leverage ratio. It depends on:

Asset liquidity

Volatility

Correlation assumptions

Funding stability

Fixed income arbitrage funds historically used leverage above 20:1, while equity long/short funds often operate between 2:1 and 5:1.

Extreme leverage combined with low liquidity is particularly dangerous.

The Future of Leveraged Hedge Funds

Leverage will remain central to hedge fund operations because:

Competition for alpha is intense.

Markets are increasingly efficient.

Institutional investors demand higher returns.

However, trends shaping the future include:

Greater transparency demands from investors.

Improved stress testing and risk modeling.

Regulatory scrutiny of systemic exposures.

Use of technology to monitor real-time leverage risk.

The industry continues to balance return enhancement with risk control.

Conclusion

Leveraged hedge funds are powerful financial vehicles that use borrowed money and derivatives to magnify investment exposure. When used prudently, leverage can enhance returns, improve capital efficiency, and support market liquidity. When mismanaged, it can lead to dramatic collapses and systemic instability.

The history of firms like Long-Term Capital Management and Archegos Capital Management illustrates both the potential and peril of leverage. At its core, leverage is neither inherently good nor bad—it is a tool. Its effectiveness depends entirely on risk management, liquidity conditions, and market discipline.

In modern financial markets, leveraged hedge funds remain influential players. Their ability to amplify returns ensures they will continue to attract capital—but their capacity to amplify risk ensures they will always require careful oversight and sophisticated management.

Nifty Analysis for Feb 17-19, 2026Wrap up:-

Nifty is now in wave 3 of major wave c, in which wave 1 is completed at 25641 and wave 2 is in progress which is making a wxy corrected pattern of which wave w is completed at 25685.

Earlier, we have taken breakout above 25660 will complete wave x of inner wave 2 but now, after today low counts have been changed.

Now, wave x is completed at 25372, as nifty breaks and sustains above 25615 and therefore, wave y will head towards for a Probable target i.e. 25932.

What I’m Watching for Feb 17-19, 2026 🔍

As nifty breaks and sustains above 25615, low risk entry range is 25522-25470 for a Probable target i.e. 25932 with a stoploss of 25372.

Disclaimer: Sharing my personal market view — only for educational purpose not financial advice.

"Don't predict the market. Decode them."

RECLTD : Entry at the Deep Retracement Zone — Bulls Loading?📝 The Technical Breakdown (Educational Guide)

This chart is a textbook example of how to identify a trend reversal by combining Price Action structures with Volume analysis. Here are 4 key educational points:

1. Demand Zone at Deep Retracement 🛡️

The price has returned to the Demand zone at deep retracement of Last swing low (blue box).

Educational Logic: This is where big institutions typically place buy orders. It is a "value" zone where the price is considered "cheap" relative to its recent history.

2. The ABC Correction & Failed ChocH 📉

Notice the labeled a-b-c corrective wave.

The chart shows a "Failed CHoCH" (Change of Character). This indicates that while the first attempt to break the bearish trend failed, it successfully "trapped" early sellers, creating a liquidity pocket for a real reversal.

3. Volume Buildup Zone 📊

At the very bottom of the current curve, we see a "Volume buildup zone".

When price remains sideways or dips slightly while volume starts increasing, it indicates Accumulation. Smart money is absorbing the selling pressure before the next leg up.

4. Risk-to-Reward Ratio (The Professional Edge) 🎯

The setup is labeled as "Lowest Risk, High Reward level" because the current price (346.90) is very close to the STOP LOSS (339.85).

You are risking ~2% to potentially gain over 25% if it hits the Swing Target (438 - 450). This is the hallmark of a professional trade.

📊 Strategic Trade Setup

⏺ Current Price: 346.90

⏺ Entry Range: 340 — 348 (Accumulation Zone)

⏺ Stop Loss: 339.85 (On a Daily Candle Close basis)

⏺ Swing Target: 438 — 450 🚀

⏺ Bearish Invalidation: If the 339.85 level fails, the next major support sits way down at 297.60.

⚠️ Disclaimer: I am not a SEBI registered analyst. This post is for educational purposes only.

NIFTY : Expiry Day Trading levels and Plan for 17-Feb-2026

Current Context: Nifty closed at 25,682.75 on Feb 16, rebounding strongly by ~0.83%. The index is currently sitting right at the "Flat Opening Case" level shown on your chart, sandwiching itself between the 25,554 - 25,691 decision zone.

🟢 Scenario 1: Gap Up Opening (Above 25,780)

A Gap Up of 100+ points would open the index near 25,780 - 25,800, approaching the 25,873 resistance level shown on your chart.

🔸 Plan Action:

Wait for Resistance Test: Do not chase the gap immediately. Watch for price action at 25,873.

Bullish Breakout: If the first 15-minute candle closes above 25,873, initiate long positions targeting the upper red line at 26,089.

Rejection Play: If price faces rejection at 25,873 (forming a shooting star or bearish engulfing), look for a short trade back towards the gap fill at 25,691.

Educational Logic: A gap up into a resistance zone often invites profit booking from overnight bulls. A "sustained" breakout above 25,873 confirms that buyers are ready to attack the 26,000 psychological barrier (Call Writer's Zone).

🟡 Scenario 2: Flat Opening (Range 25,650 - 25,720)

A flat opening keeps the price inside the Opening Support/Resistance Zone (25,554 - 25,691) marked in beige on your chart.

🔸 Plan Action:

No Trading Zone: The area between 25,554 and 25,691 is a volatility trap. Avoid aggressive trades here.

Buy the Dip: If price dips to the lower boundary of 25,554 and forms a bullish hammer, take a low-risk CALL trade.

Sell the Rip: If price struggles at 25,691, look for a PUT trade targeting the lower end of the box.

Educational Logic: In a flat opening, the market often oscillates within the previous day's value area. The 25,554 level is crucial because it aligns with the recent breakout zone; holding this level keeps the "Buy on Dips" structure intact.

🔴 Scenario 3: Gap Down Opening (Below 25,580)

A Gap Down of 100+ points would threaten the 25,554 support level marked as "Opening Support (Negative Opening Case)."

🔸 Plan Action:

Crucial Support Test: Watch the 25,554 level closely. If the opening candle closes below this level, the bullish structure is damaged.

Bearish Momentum: A sustained break below 25,554 opens the door for a slide to 25,442 (Last Intraday Support). Aggressive shorts can trigger here.

Panic Level: If 25,442 is broken, the next major support is substantially lower at 25,205.

Educational Logic: A large gap down that breaks the 25,554 support traps the late bulls who bought the Feb 16 recovery. Their stop-loss triggers will fuel a sharper decline towards the 20-day Moving Average or lower support zones.

🛡️ Risk Management for Options Trading

🔹 Position Sizing: Volatility (VIX) is around 13.3, meaning premiums are not very expensive but spikes can be sudden. Use only 30-40% of your capital for overnight positions.

🔹 The "Zone" Rule: strictly avoid trading inside the 25,554 - 25,691 box if you are an option buyer. Theta decay will eat your premium. Wait for the breakout/breakdown.

🔹 Stop Loss Trail: If you are long above 25,691, trail your SL to cost once the index moves 40 points in your favor.

🔹 Hedge for Gap Downs: Since global cues can be mixed, always carry a hedge (like a far OTM Bear Put Spread) if holding heavy long positions overnight.

📝 Summary & Conclusion

The Nifty 50 has shown resilience by reclaiming 25,680, but the battle is not won. The key for Feb 17 is the 25,554 support. As long as price stays above this, the bulls have a chance to test 25,873 and 26,089. A breach of 25,554 invalidates the recovery and puts the bears back in control targeting 25,442.

⚠️ Disclaimer: I am not a SEBI registered analyst. This post is for educational purposes only. Trading involves financial risk; please consult a financial advisor before taking any trades.

NIFTY LOOKS UPToday was quite a turnaround session for the Indian markets. After a weak opening that saw the Nifty slip below 25,400, a strong late-day rally led by the banking and energy sectors helped indices snap a losing streak.

## Market Performance (Feb 16, 2026)

Nifty 50: Ended at 25,682.75, up 211.65 points (+0.83%).

Sensex: Closed at 83,277.15, surging 650.39 points (+0.79%).

Bank Nifty: Recovered sharply to close at 60,949.10, nearly hitting the 61,000 mark.

Top Gainers: Power Grid (+4.5%), Coal India, HDFC Bank, and Axis Bank.

Top Losers: Tech Mahindra, Infosys, and Wipro (the IT sector continued to struggle due to AI disruption fears).

## Why is Put Option Volume High?

While specific exchange "Put-Call Ratio" (PCR) numbers fluctuate throughout the day, the high Put volume today likely stems from a few key technical and psychological factors:

Hedging Against IT Weakness: Even though the main indices rallied, the Nifty IT index fell nearly 1%. Traders often buy Puts on the Nifty or specific IT stocks to hedge their portfolios against the continued sell-off in technology majors like Infosys and TCS.

Support Defense at 25,400/25,500: Early in the session, Nifty was testing the 25,400 support level. High Put volume (specifically Put writing/selling) often occurs at these psychological "floors" as big players (DIIs/HNIs) bet that the market won't fall further.

Bullish Engulfing Pattern: Technically, today’s price action formed a Bullish Engulfing candle on the daily chart. This often triggers high volume as traders position themselves for a reversal, using Puts either to protect gains or as part of complex spread strategies.

RBI Policy & Capital Norms: The RBI recently tightened lending norms for capital market intermediaries, which caused some stocks (like BSE and Angel One) to plunge up to 10%. This volatility naturally increases the demand for Puts as a protective measure.(Kuch Bhi)

Trading Note: With the "India AI Impact Summit 2026" starting today, the IT sector remains a "wildcard." High put volume suggests that while the broader market is recovering, traders are still cautious about a potential extended correction in tech stocks.

RCF: The Golden Retracement Reversal📝 The Technical Breakdown (Educational Guide)

This chart provides a textbook example of identifying a bottom using harmonic waves and retracement levels. Here are 4 critical educational points:

1. The Falling Wedge & Elliot Wave Structure 📉

The price has been oscillating within a large descending channel, recently completing a 5-wave internal structure (labeled 1-5).

Educational Logic: The 5th wave often represents the final "capitulation" or exhaustion of sellers. When it ends at a major support zone, the probability of a sharp reversal increases significantly.

2. Golden Retracement Zone (50% - 78%) 🎯

The green box highlights the Golden retracement zone, calculated from the last major swing low and high.

Price is currently finding strong buyers between the 50% and 78.6% levels.

Tip: In technical analysis, the 61.8% to 78.6% zone is often called the "Deep Discount" zone where institutions look to re-accumulate.

3. Trendline Breakout Anticipation ⚡

RCF is currently challenging the upper boundary of the multi-month descending trendline.

A sustained close above this line confirms a Trend Reversal from "Lower Highs" to "Higher Highs."

4. Risk-Defined Setup 🛡️

A professional trade is defined by its exit plan. The STOP LOSS is clearly marked at 120.14 (Daily close basis).

This level is chosen because it sits just below the 78.6% retracement. If this fails, the bullish thesis is invalidated.

📊 Strategic Trade Setup

⏺ Current Price: 130.65

⏺ Entry Zone: 125 — 132 (Accumulation in the Green Box)

⏺ Stop Loss: 120.14 (Daily Close)

⏺ Target Zone: 176 — 182 🚀

⚠️ Disclaimer: I am not a SEBI registered analyst. This post is for educational purposes only.

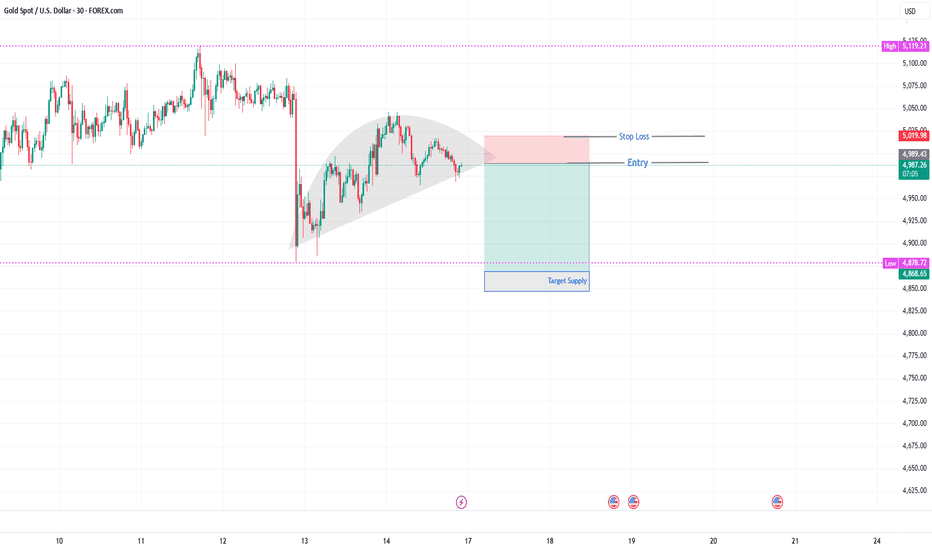

XAUUSD – Weekly Outlook: ConsolidationXAUUSD – Weekly Outlook: Consolidation Before Expansion? | Lana ✨

Gold is entering the new week in a clear consolidation phase around the 4,960–5,000 region after defending the mid-range support and completing a corrective pullback from previous highs. On the 3H structure, price continues to respect the broader recovery framework formed since early February, with higher lows gradually building beneath the 5,030–5,050 liquidity band.

🔎 Technical Structure

4,950–4,970: Immediate support and short-term balance zone. Price is compressing here, suggesting energy build-up.

5,030–5,060: Near-term resistance and liquidity cluster. A sustained break above this area opens room for expansion.

5,350–5,450: Medium-term upside liquidity target if bullish continuation confirms.

4,220–4,300: Higher-timeframe liquidity base. Remains protected unless structure decisively shifts bearish.

Current price behaviour reflects accumulation rather than distribution. The compression under resistance often precedes expansion — direction will depend on which side liquidity is taken first.

🌍 Fundamental Context

Political uncertainty in the U.S., including budget tensions surrounding Homeland Security and enforcement policy debates, continues to add background instability. At the same time:

The USD remains sensitive to rate-cut expectations.

Treasury yields have softened compared to prior peaks.

Broader geopolitical uncertainty still underpins safe-haven demand.

These elements provide medium-term structural support for gold, even as short-term volatility persists.

📈 Weekly Projection

If 4,950 holds as support, gold may attempt another breakout toward 5,080 and potentially extend toward 5,350+ in the coming sessions.

However, a decisive breakdown below 4,950 would shift focus toward deeper liquidity at 4,880–4,900 before any renewed bullish attempt.

🧠 Lana’s Perspective

The broader structure remains constructive. Current movement appears to be a pause within a recovery trend rather than a confirmed reversal. Patience is key — allow price to confirm direction through liquidity sweep and structural break.

✨ Trade the structure. Respect liquidity. Let the market reveal the next expansion phase.

OBEROIRLTY 1 Week Time Frame 📍 Current Price (approx): ~₹1,560 – ₹1,565 on Feb 16 (based on latest exchange data)

📈 Weekly Support & Resistance Levels

1-Week (16 – 20 Feb 2026)

🔹 Immediate Resistance Levels

R1: ₹1,581.83 — near-term upside barrier

R2: ₹1,616.07 — next bullish test

R3: ₹1,649.33 — extended resistance if breakout sustains

🔸 Immediate Support Levels

S1: ₹1,514.33 — key near-term support

S2: ₹1,481.07 — secondary downside level

S3: ₹1,446.83 — deeper support range for weak price action

📊 Weekly Expected Trading Range:

₹1,447 – ₹1,649 (typical range without strong news impact).

📌 How to Use These Levels (Weekly Context)

Bullish Scenario

If Oberoi Realty closes above ₹1,581.83 on weekly basis → bullish continuation likely

Break above ₹1,616–₹1,649 increases probability of further upside momentum.

Bearish Scenario

If price breaks below ₹1,514.33 → downside might accelerate

Sustained weakness could target ₹1,481 then ₹1,447.

🧠 Intermediate Technical Context

Daily support/resistance (classic pivot method) also suggests shorter intraday levels (good for trade timing):

S1: ~₹1,545–₹1,550

S2: ~₹1,526–₹1,514

Pivot: ~₹1,558–₹1,560

R1: ~₹1,577–₹1,589

R2: ~₹1,589–₹1,608

This daily pivot cluster feeds into broader weekly zones.

📊 Technical Indicator Snapshot (Recent)

Moving averages (20/50/100/200) around current price — trading mostly neutral with slight resistance overhead.

Oscillators like RSI near neutral (~50), suggesting neither strongly overbought nor oversold conditions.

Analysis – Demand Zone Bounce Toward Key Resistance🔎 Market Overview

On the 1-hour timeframe, BTCUSDT (Bybit) shows a strong bullish reaction after forming a short-term bottom near the 65,000 area. Price has broken structure to the upside and is now consolidating above a marked demand zone, suggesting buyers are in control for the short term.

🟢 Key Technical Observations

1️⃣ Demand Zone Holding (≈ 68,700 – 69,000)

Price impulsively moved up from this area.

Current consolidation above it confirms it as short-term support.

This zone aligns with the proposed entry region.

2️⃣ Stop Loss Placement (≈ 68,374)

Positioned below the demand zone.

Logical invalidation level — if price breaks below, bullish structure weakens.

3️⃣ Resistance Level (≈ 71,200)

Previous rejection zone.

Likely liquidity area where sellers may step in.

4️⃣ Upside Target (≈ 71,200+)

First major take-profit aligns with resistance.

Break above could open continuation toward 72,000+.

📊 Trade Idea Summary (Bullish Setup)

Bias: Short-term bullish

Entry: Retest/hold above 68,800–69,000

Stop Loss: Below 68,374

Target: 71,200 resistance

Risk-to-Reward: Favorable if targeting full resistance move

⚠️ What Would Invalidate This Setup?

A strong 1H close below the demand zone.

Failure to hold 68,700 with increasing selling volume.

📌 Conclusion

BTC is showing bullish momentum after reclaiming structure and holding a demand zone. As long as price remains above 68.7K, probability favors a push toward the 71.2K resistance area. A clean breakout above resistance could accelerate upside momentum.

If you'd like, I can also provide:

A bearish alternative scenario

Lower timeframe confirmation plan

Risk management sizing example

Volume/liquidity breakdown analysis

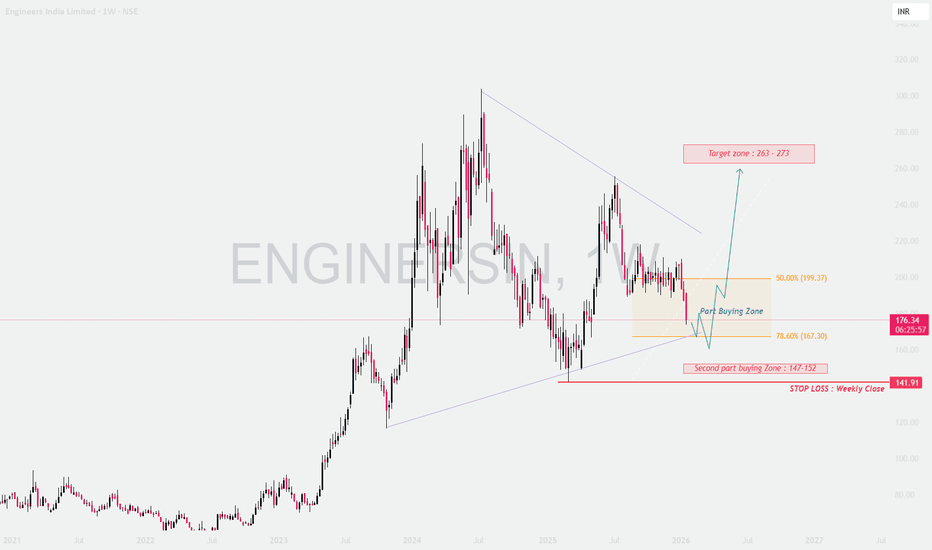

ENGINERSIN : at a Make-or-Break Weekly Zone📊 Engineers India Limited – Weekly Technical View

CMP: ~₹176 | Timeframe: Weekly

Trend: Higher-timeframe uptrend, currently correcting

🔍 Structure

After a strong rally in 2023–24, the stock is in a healthy corrective phase inside a broad rising structure. This is consolidation, not breakdown.

📌 Key Levels & Psychology

🟦 Buy Zone: ₹167–199 (50%–78.6%)

• Value area after rally

• Dip buyers & short covering active

🟨 Deeper Buy Zone: ₹147–152

• Panic selling exhaustion zone

🔴 Invalidation: Weekly close below ₹141

• Structure weakens below this

🎯 Upside Levels

• ₹199: First resistance

• ₹263–273: Major target zone (prior supply)

🔮 Outlook

Above ₹167 → base building likely

Above ₹199 → momentum revival

Below ₹147 → caution

Below ₹141 → trend damage

📌 Corrections test patience before trends resume.

⚠️ Educational only | Not a SEBI registered analyst

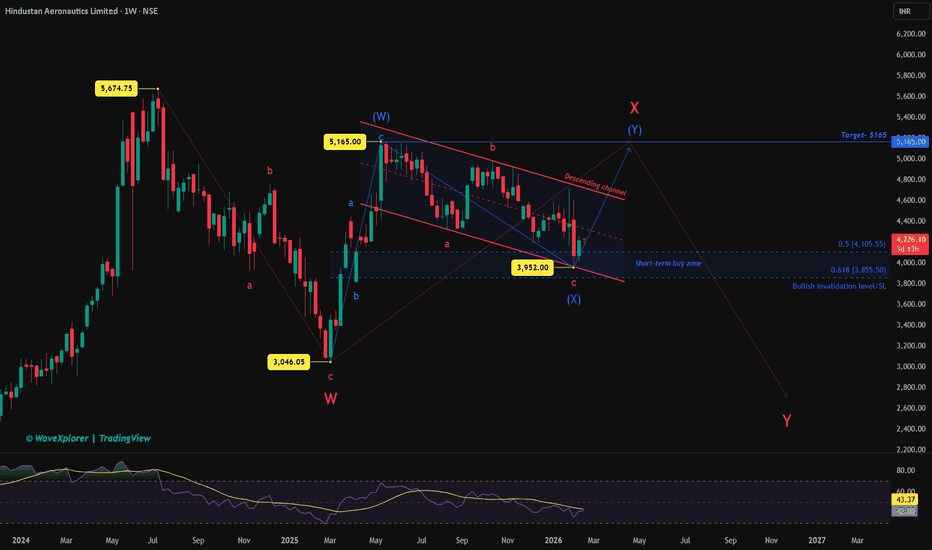

HAL Compressing in Channel – Bounce Setup Taking ShapeHAL has corrected from 5674.75 to 3046.05 forming Wave W.

The rally to 5165 unfolded in three waves, and price has now declined in an abc structure to 3952 inside a descending channel.

This zone aligns with the 0.5–0.618 Fibonacci retracement of the 3046 to 5165 move.

Structure suggests a possible short-term bounce toward prior high near 5165.

Trade Plan

Buy Area: 3855 – 4100

Target: 5165

Invalidation / SL: Weekly close below 3855

If price sustains above 5165, structure turns stronger.

If 3855 breaks, probability shifts toward deeper downside.

Defined risk. Defined target. Let see how the strcuture plays out.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) before making any trading decisions.

Hindustan Zinc (1H): Clean Zigzag – Bounce Incoming?From 732.70 to 543.55 as blue (A):

Clear sharp fall. Strong selling. RSI went deep into oversold zone. Looks like a completed higher-degree wave (A).

From 543.55 to 643.20 as black (a):

The bounce from the lows moved in a proper five-wave structure. It did not look random. Structure supports it being wave (a).

From 643.20 to 582.60 as black (b):

This correction unfolded as a clean zigzag. Inside this, red wave c matched almost 100% of red wave a measured from red wave b. That kind of symmetry is typical in zigzags and strengthens the count.

As long as 583.30 holds, black wave (c) can move higher, possibly towards the 660–665 zone. That area is the 0.618 retracement of the entire blue (A) fall.

But this upside, if it comes, may still be corrective before a larger blue (C) move down.

583.30 is important support.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) before making any trading decisions.

Updated Nifty Analysis for Feb 17-19, 2026Wrap up:-

Nifty is now in wave 3 of major wave c, in which wave 1 is completed at 25641 and wave 2 is in progress which is making a wxy corrected pattern of which wave w is completed at 25685.

Earlier, we have taken breakout above 25660 will complete wave x of inner wave 2 but now, after today low counts have been changed.

Now, wave x is completed at 25372, as nifty breaks and sustains above 25615 and therefore, wave y is heading towards for a Probable target i.e. 25734-25778.

What I’m Watching for Feb 17-19, 2026 🔍

As nifty is near to resistance, low risk entry range is 25734-25778 for a Probable target i.e. 25247-25102 with a stoploss of 25971.

Disclaimer: Sharing my personal market view — only for educational purpose not financial advice.

"Don't predict the market. Decode them."

The German Index at resistanceDAX CMP - 24914

Elliott- The current rally to the highs is part of correction. To me wave B is over and now the C wave has started. C waves are fast and furious. As of now the minimum correction is 22500 which the 61.8% of the swing.

RSI - The Index made new highs while the oscillator could not go past the bear zone is very very negative. It is also just under the MA cross which is again negative.

Composite- on the monthly chart on the right we have -ve divergence.

Conclusion - Since this Index is ahead of us these negative signs are a precursor to what will follow in our mkt. Caution is the call now.

NATCOPHARM 1 Month Time Frame 📊 Current & 1-Month Price Context

Over the past month the stock has traded roughly between ₹806 – ₹894 on the NSE, with observed closes in that range.

Recent prices have been volatile but staying within this ~₹800–₹900 band.

🔹 Near-Term Support Levels (1-Month Focus)

Key support zones you might watch:

₹806 – ₹810 — recent 1-month low area / first major floor.

₹817 – ₹821 — short-term pivot support and lower boundary of consolidation.

₹840 – ₹850 — mid-range support that has acted as a buffer on pullbacks recently.

These levels are typical areas where buyers have previously stepped in or price has bounced within the month.

🔺 Near-Term Resistance Levels (1-Month Focus)

Potential upside resistance levels:

₹868 – ₹875 — initial resistance from recent consolidation highs.

₹880 – ₹894 — higher resistance zone aligned with recent swings and weekly highs.

₹900+ — psychological/round number resistance (also coincides with some moving averages).

These levels often act as supply zones where price has slowed or reversed in recent weeks.

📌 Summary — 1-Month Price Band

Typical recent trading zone: ~₹806–₹894 per share on NSE.

Support cluster: ~₹806–₹840

Resistance cluster: ~₹868–₹900+

Part 1 Institutional Option Trading VS. Technical Analysis Core Philosophy

Institutional Option Trading (IOT)

Institutions like hedge funds, quant desks, proprietary trading desks, banks, and market makers trade options based on:

Order-flow dominance

Risk-neutral hedging

Volatility arbitrage

Liquidity extraction

Portfolio hedging strategies

Macro + quantitative modeling

They don’t focus on chart patterns.

They focus on controlling volatility, absorbing liquidity, and managing large risk exposure.

Technical Analysis (TA)

Retail and discretionary traders use price charts to:

Find patterns

Identify support & resistance

Predict breakouts

Understand market psychology

Time entries and exits

Trendlines, indicators, candlestick patterns = core decision drivers.

👉 TA looks at price.

IOT looks at order flow + volatility.

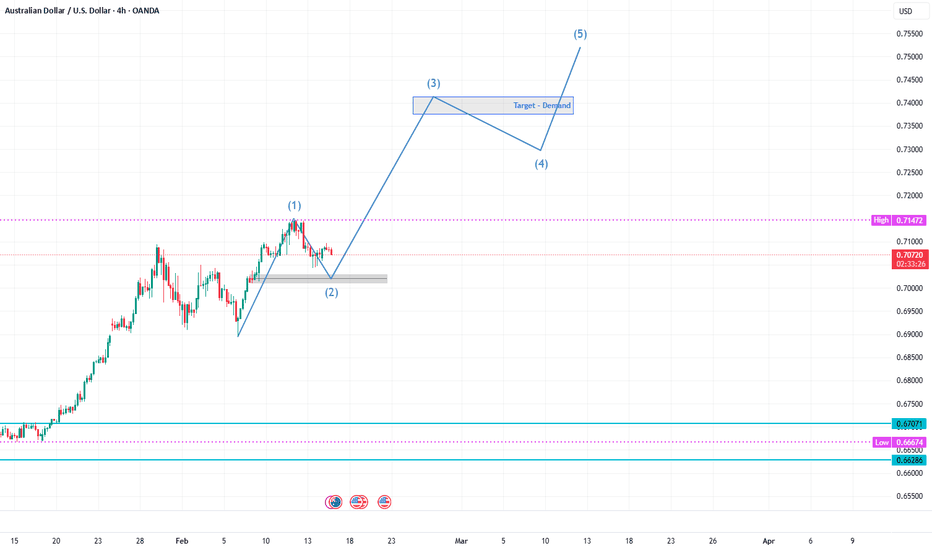

#NASDAQ FINAL DOWNWARD MOVE📊 Nasdaq Elliott Wave Update

The Nasdaq began its daily correction on 29 Oct 2025 📉, forming its A wave on 21 Nov 2025 with a low at 23,854.

- 🔎 The A wave unfolded in 3 subwaves, signaling a flat correction.

- 📈 As expected, the B wave retraced >61.8%, rising to 26,165.

Now, the index is progressing through its C wave:

- 🌀 C waves typically fall in a 5-wave structure.

- ✅ 4 waves are complete, and the 5th wave is unfolding.

- 🎯 This final leg could potentially drive the Nasdaq down toward 24,000.