DMART 1 Week Time Frame 📊 Recent Price Range (Last Week)

Stock was trading around ₹3,780–₹3,900 in the recent trading sessions.

Weekly price change has been relatively modest, showing a small rise over the past week (~+1–2%) in some data and a slight variation in others due to different closing levels.

🛑 Weekly Support Levels

These are key zones where the price may find buying interest / downside support over a short 1‑week horizon:

1. ₹3,665–₹3,705 — Short-term pivot/support cluster (near prior recent lows).

2. ₹3,531–₹3,597 — Lower support range that may act if the stock breaks below near‑term levels.

3. ₹3,340 — Broader 52‑week low area (reference of major historical support).

📈 Weekly Resistance Levels

These are zones where the price may see selling pressure / upside barriers in the near term:

1. ₹3,841–₹3,881 — Near current pivot and first resistance for short‑term trading.

2. ₹3,929–₹3,950+ — Next upside resistance from classic pivot methods.

3 .Above ~₹4,000 — Psychological and technical interest level (also broker target levels in wider timeframe).

📌 Summary — 1‑Week Key Levels to Watch

Level Type Price Zone

Immediate Support ₹3,665 – ₹3,705

Deeper Support ₹3,531 – ₹3,597

Short‑Term Resistance ₹3,841 – ₹3,881

Higher Resistance ~₹3,929 – ₹3,950+

Wave Analysis

GODREJPROP 1 Day Time Frame 📊 Current Price Context

• Trading around ₹1,930 – ₹2,055 region recently on NSE (price may vary slightly with live market conditions).

📌 Daily Pivot & Standard Levels

(Calculated from recent daily price ranges)

• Pivot (P): ~ ₹2,021 – ₹2,030

• Resistance:

• R1: ~ ₹2,060–₹2,080

• R2: ~ ₹2,120–₹2,130

• R3: ~ ₹2,160–₹2,170

• Support:

• S1: ~ ₹1,950–₹1,970

• S2: ~ ₹1,910–₹1,920

• S3: ~ ₹1,845–₹1,860

These are classic pivot derived zones — useful for identifying likely intraday reversal points.

📈 Alternate Pivot Levels (Other Calculations)

Different providers have slightly varied daily pivot estimates:

• Trendlyne style pivots: Pivot ~₹2,093, R1 ~₹2,124, R2 ~₹2,154, R3 ~₹2,180, S1 ~₹2,068, S2 ~₹2,042, S3 ~₹2,012.

📌 How to Use These Levels (1D timeframe)

Bullish scenario:

• A breakout above R1 (~₹2,060) could target R2 (~₹2,120) and R3 (~₹2,160+).

Bearish scenario:

• A break below S1 (~₹1,950) can expose S2 (~₹1,910) and then S3 (~₹1,845).

Pivot behaviour:

• Price holding above pivot (~₹2,021) suggests bulls may have edge intraday; below pivot suggests sellers may dominate.

PNB 1 Day Time Frame 📊 Daily Support & Resistance Levels

These are common pivot-style levels based on recent price action — good for short-term intraday/next-day reference:

Pivot (Daily Reference Zone): ~₹123.5-₹124 range (approximate)

Resistance Levels (Upside Targets)

R1: ~₹124.9–₹125.0 — first resistance zone near recent pivot upside.

R2: ~₹127.1–₹127.2 — higher resistance zone on daily.

R3: ~₹128.4–₹128.5 — extended resistance near recent highs.

Support Levels (Downside Barriers)

S1: ~₹121.5–₹121.8 — immediate support close below pivot.

S2: ~₹120.2–₹120.7 — secondary support zone.

S3: ~₹118.0–₹118.0+ — deeper support if price weakens.

📉 Other Short-Term Levels From Recent Technical Tools

Pivot-based support (Choice India): ~₹101.7, ~₹100.5, ~₹98.4 — longer-range levels (not daily but multi-session reference).

Bollinger bands (approx high/low daily bands): ~₹124.6 upper, ~₹115.0 lower.

🧠 Context from Indicators

RSI around mid-range (~50–65), suggests no extreme in daily momentum right now.

Moving average support around 50/100-day range (₹120–₹117) can act as dynamic support zones.

📌 How to Use These Levels

Bulls watch: Break above R1 (~₹125) for continuation toward R2/R3 (~₹127-128).

Bears watch: If price breaks below S1 (~₹121.5), next support comes around S2/S3 (~₹120 / ~₹118).

Pivot levels near ₹123-124 act as a short-term sentiment line — above is bullish, below is cautious.

Mastering High-Speed Profits in the Stock MarketIntraday Scalping:

Intraday scalping is one of the most fast-paced and skill-intensive trading strategies in financial markets. It focuses on capturing small price movements multiple times within a single trading day, often within minutes or even seconds. Unlike swing trading or positional investing, scalping does not rely on large trends. Instead, it exploits micro-price fluctuations, liquidity, and volatility to generate consistent profits through volume and precision.

Below is a detailed 1000-word explanation of intraday scalping, covering its philosophy, tools, strategies, risks, and mindset.

1. What Is Intraday Scalping?

Intraday scalping is a short-term trading technique where traders:

Enter and exit trades within the same trading session

Hold positions for a few seconds to a few minutes

Target small price movements

Execute multiple trades per day

The core idea is simple: small profits × high frequency = meaningful returns.

Scalpers do not carry positions overnight, avoiding gap risk, global news shocks, and overnight volatility.

2. Why Scalping Works in Intraday Markets

Scalping thrives because markets constantly fluctuate due to:

Order flow imbalance

High liquidity in index stocks and derivatives

Algorithmic trading activity

Institutional participation

News-driven momentum bursts

In highly liquid instruments, prices rarely stay still. Scalpers capitalize on these continuous movements with disciplined execution.

3. Key Characteristics of a Scalping Strategy

Intraday scalping has distinct features:

Very Short Timeframes

Common charts include 1-minute, 2-minute, and 5-minute

High Trade Frequency

10–50 trades per session is common for active scalpers

Small Stop Loss & Target

Typical risk-reward ranges from 1:1 to 1:1.5

High Accuracy Over High Reward

Win rate matters more than big profits per trade

Strict Discipline

No emotional trading, no hope-based holding

4. Instruments Best Suited for Scalping

Not all instruments are suitable for scalping. The best ones offer high liquidity and tight spreads:

Index futures (NIFTY, BANK NIFTY, FINNIFTY)

Large-cap stocks with high volume

Highly liquid options (near-ATM strikes)

Forex major pairs (for global traders)

Index ETFs

Illiquid stocks are avoided due to slippage and erratic price behavior.

5. Technical Tools Used in Intraday Scalping

Scalpers rely heavily on technical analysis and market structure:

A. Moving Averages

9 EMA, 20 EMA, VWAP

Used for trend direction and dynamic support/resistance

B. VWAP (Volume Weighted Average Price)

A critical tool for intraday bias

Above VWAP = bullish sentiment

Below VWAP = bearish sentiment

C. Support & Resistance

Previous day high/low

Opening range

Intraday demand and supply zones

D. Momentum Indicators

RSI (short periods like 7 or 9)

Stochastic Oscillator

MACD histogram for momentum bursts

E. Volume & Price Action

Volume spikes confirm breakout validity

Candlestick patterns like engulfing, pin bars, and inside bars

6. Popular Intraday Scalping Strategies

1. VWAP Rejection Strategy

Trades are taken when price rejects VWAP with strong volume confirmation.

2. Opening Range Breakout (ORB) Scalping

The first 5–15 minutes define a range. Breakout with volume leads to quick scalps.

3. Pullback Scalping

Trade in the direction of the main trend after a shallow retracement to EMA or VWAP.

4. Momentum Burst Scalping

Quick entries during sudden volume and price expansion caused by news or institutional orders.

5. Range Scalping

Buying near support and selling near resistance in sideways markets.

7. Risk Management in Scalping

Risk control is the foundation of successful scalping:

Fixed stop loss for every trade

Risk only 0.25%–0.5% of capital per trade

Daily maximum loss limit

Stop trading after consecutive losses

Never average losing trades

In scalping, capital protection is more important than profit chasing.

8. Psychology of a Successful Scalper

Scalping is mentally demanding. Successful scalpers develop:

Emotional neutrality

Ability to accept small losses quickly

High focus and alertness

Discipline to follow rules strictly

Detachment from individual trade outcomes

Overtrading, revenge trading, and hesitation are the biggest enemies of scalpers.

9. Technology & Execution Speed

Because scalping depends on precision:

Fast internet connection is essential

Reliable trading platform

Low brokerage and transaction costs

Quick order execution

Direct market access where possible

Even a small delay can turn a profitable trade into a loss.

10. Advantages of Intraday Scalping

No overnight risk

Quick feedback and learning curve

Works in both trending and ranging markets

Capital efficiency

Clear entry and exit rules

11. Challenges and Risks

High stress and screen time

Requires constant attention

Transaction costs can eat profits

Emotional fatigue

Not suitable for part-time traders

Scalping is not a shortcut to quick money—it is a professional-level trading approach.

12. Who Should Choose Scalping?

Intraday scalping is ideal for traders who:

Can monitor markets actively

Have strong discipline

Enjoy fast decision-making

Are comfortable with frequent trades

Prefer short exposure durations

It is not suitable for investors or traders who dislike screen-based work.

Conclusion

Intraday scalping is a precision-driven, high-discipline trading methodology designed for traders who thrive in fast environments. Success in scalping does not come from prediction, but from probability, execution, and consistency. When combined with proper risk management, sound psychology, and robust technical frameworks, scalping can become a powerful tool for generating steady intraday income.

Indian IPO and SME Boom Play: The Next Wave of Growth in CapitalThe Rise of the Indian IPO Market

Over the last few years, India has emerged as one of the most active IPO markets globally. Companies across sectors such as technology, manufacturing, renewable energy, healthcare, financial services, and consumer goods are tapping the public markets to fund expansion, reduce debt, and provide exits to early investors.

Several factors are driving this IPO momentum. First, India’s strong macroeconomic fundamentals—robust GDP growth, a large domestic market, and rising consumption—have increased confidence among promoters and investors alike. Second, reforms by market regulators have improved transparency, governance standards, and ease of raising capital. Third, domestic liquidity has surged due to the rapid growth of retail investors, mutual funds, insurance companies, and pension funds.

Unlike earlier cycles dominated by a few large conglomerates, the current IPO wave reflects diversity. New-age technology firms, export-oriented manufacturers, and niche service providers are all entering the market. This diversification has expanded investment opportunities and reduced concentration risk for investors.

SME IPOs: The Silent Powerhouse

While mainboard IPOs attract headlines, the real structural change is happening in the SME segment. SME platforms on Indian stock exchanges have become a powerful fundraising avenue for small and mid-sized businesses that were earlier dependent on bank loans or private funding.

SME IPOs allow growing companies to raise capital at an early stage, strengthen their balance sheets, and gain credibility through public listing. For investors, SME listings offer exposure to high-growth, under-researched companies at relatively early stages of their business lifecycle.

The boom in SME listings reflects India’s entrepreneurial depth. Many of these companies operate in specialized niches—engineering components, chemicals, logistics, packaging, IT services, and agro-processing—areas closely linked to domestic manufacturing and export growth. As India pushes initiatives like “Make in India,” “Atmanirbhar Bharat,” and global supply chain diversification, SMEs stand to benefit disproportionately.

Why IPO and SME Boom Matters for the Economy

The IPO and SME boom has broader economic implications beyond capital markets. Public listings improve corporate governance, enhance transparency, and encourage professional management. This strengthens the overall business ecosystem.

Capital raised through IPOs is often used for capacity expansion, technology upgrades, research and development, and market expansion. These investments create jobs, boost productivity, and support long-term economic growth. For SMEs, access to equity capital reduces over-reliance on debt, making businesses more resilient during economic cycles.

From a policy perspective, a vibrant IPO market reflects confidence in the economy. It also helps channel household savings into productive assets, reducing dependence on speculative or unproductive investments.

Investor Participation and Behavioral Shift

One of the most striking features of the current boom is the surge in retail participation. Millions of new demat accounts have been opened, and retail investors are actively applying for IPOs and SME issues. This reflects a shift in mindset—from traditional savings instruments to equity ownership.

Technology has played a key role in this transition. Easy access to online trading platforms, simplified IPO application processes, and increased availability of information have democratized market participation. Social media, financial influencers, and digital education platforms have further increased awareness, though they also highlight the need for investor caution and due diligence.

Institutional investors, both domestic and foreign, continue to play a crucial role by providing stability and price discovery. Their participation validates business models and sets valuation benchmarks, especially for large IPOs.

Opportunities in the IPO and SME Boom Play

For investors, the IPO and SME boom presents multiple opportunities. Early-stage participation in high-quality businesses can generate significant long-term wealth if the company executes well. SME stocks, in particular, can deliver outsized returns due to their smaller base and faster growth potential.

Sectoral trends such as renewable energy, defense manufacturing, specialty chemicals, infrastructure, logistics, digital services, and healthcare are creating fertile ground for new listings. Investors who understand these themes and align them with strong company fundamentals can benefit from structural growth.

From a trading perspective, IPO listings often generate short-term momentum, offering opportunities for listing gains. However, long-term investors focus on business quality, scalability, management credibility, and industry tailwinds rather than short-term price action.

Risks and Challenges to Consider

Despite the optimism, the IPO and SME boom is not without risks. Overvaluation is a key concern, especially during periods of excessive enthusiasm. Not all listed companies will succeed, and some may struggle to meet growth expectations post-listing.

SME stocks, while attractive, come with higher volatility, lower liquidity, and greater information asymmetry. Corporate governance risks, execution challenges, and dependence on a limited client base are common issues in smaller companies.

Market cycles also play a role. IPO activity tends to slow during periods of global uncertainty, rising interest rates, or sharp market corrections. Investors must be prepared for volatility and avoid herd behavior.

Strategic Approach to the IPO and SME Boom

A disciplined approach is essential to navigate this space effectively. Investors should focus on business fundamentals, financial health, promoter track record, and industry prospects. Diversification across sectors and market segments helps manage risk.

Long-term investors may consider holding quality IPOs through market cycles, allowing compounding to work over time. For SME investments, a portfolio approach—investing smaller amounts across multiple companies—can help balance risk and reward.

Continuous monitoring is crucial. Public listing is just the beginning of a company’s journey, not the end. Post-listing performance, earnings growth, capital allocation decisions, and governance practices determine long-term success.

Conclusion: A Structural Growth Story

The Indian IPO and SME boom is more than a market trend—it is a reflection of India’s evolving economic and entrepreneurial landscape. As businesses increasingly turn to capital markets for growth and investors embrace equity participation, this ecosystem will continue to mature.

For investors, the IPO and SME boom play offers a unique opportunity to participate in India’s growth story from the ground up. While risks exist, informed decision-making, patience, and discipline can help transform this wave of listings into a powerful long-term wealth creation journey.

BHEL – Approaching a Key Reversal Zone on the Weekly ChartBHEL has been in a broader W–X–Y corrective structure since topping out near ₹335 on the weekly timeframe. The first leg down (Wave W) completed around ₹176, followed by a steady recovery that is now pushing into a major resistance zone.

The current bounce looks like the tail end of Wave X , with price entering the 100% extension area of (a) near ₹301. This is a natural place where counter-trend rallies often slow down or fully exhaust.

Momentum remains strong — weekly RSI is pushing into the overbought zone — but there is still no confirmed bearish divergence. In simple terms:

strength is there, but it’s reaching the “watch carefully” zone.

If a bearish candlestick forms inside this highlighted region (shooting star, rejection wick, bearish engulfing, anything with real intent), it could mark the start of Wave Y , potentially dragging the stock much lower over the coming months.

Volume is supportive on the way up, but still not showing the kind of impulsive conviction that usually accompanies a fresh bullish trend.

For now, the plan is straightforward:

Let the weekly candle speak. If sellers step in here, Wave Y may begin. If price breaks above the zone decisively, this count gets challenged.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) before making any trading decisions.

Elliott Wave Analysis XAUUSD Week 2 – January 2026

1. Momentum

Weekly (W1)

– Weekly momentum is currently declining

– This suggests the broader bearish trend remains intact

– Price is likely to continue correcting until weekly momentum reaches the oversold zone

Daily (D1)

– Daily momentum has turned bearish

– Therefore, the dominant bias for this week is expected to be to the downside

H4

– H4 momentum is currently in the overbought zone

– A short-term pullback is likely to occur as early as Monday

2. Elliott Wave Structure

Weekly Structure (W1)

– Last week closed as a bullish candle

– However, weekly momentum is still declining and has not confirmed a bullish reversal

– As a result, we continue to follow the main scenario:

→ Wave X has already completed

→ Price is now continuing to develop wave Y

– The two main downside targets for wave Y are:

– 4072

– 3761

Daily Structure (D1)

– Daily momentum has turned bearish, supporting the view that price may continue lower as part of wave Y this week

– However, there is an important risk factor to note:

– Price rallied strongly last week

– It is now trading very close to the previous wave C high

– This increases the risk of a breakout above the prior high, which would require a reassessment of the current wave count

– Plan going forward:

– Wait for Monday’s session

– A bearish daily close would further confirm the continuation of wave Y

H4 Structure

– H4 momentum is in the overbought zone and showing signs of a potential reversal

– The break above 4500 invalidates the previous wave 1–2 scenario

– This suggests that red wave C is still in progress

– The next target for red wave C is the 4521 area

This zone is also selected as the primary trading objective for Monday.

3. Trading Plan

– Sell Zone: 4520 – 4522

– Stop Loss: 4540

– Take Profit 1: 4423

– Take Profit 2: 4331

– Take Profit 3: 4220

SPY - Hope it tops this time :)US markets have been super resilient, sucking capital from across the world.

We have a good pattern in place, as the triggers for pushing the market up have been reducing with time, with everything running quite thin.

The rally has been quite low on breadth and is supported on weak pillars - but still has been resilient and all selling have been bought into.

Let's see if it breaks and sustains this time.

We need a 10-15% (ideally + 20%) fall in US for money to flow into emerging markets :)

It is a good time to try some positional shorts with SL as 7k.

View void if we sustain above 7k.

#Nifty Directions and Levels for Jan 12thGood morning, friends! 🌞

Market Directions and Levels for Jan 12th

Global remains positive, though Indian markets show a bearish bias. Today, the market may open neutral to slightly gap down, as GIFT Nifty trades about 20 points lower.

Current View

> If the market declines initially, the immediate support zone is expected to act as a strong support.

> If price gets rejected from this zone, structurally this could be a 5th sub-wave. In that case, the 5th sub-wave correction may complete here, followed by a bounce of around 38%–61% of the minor swing.

> This is the base structure. However, if price does not reject around the pullback zone, the 5th sub-wave could extend toward 25,550–25,580 for Nifty.

Alternate View

> The alternate scenario suggests a range-bound market with a bearish bias.

> If the market opens positive, we can expect a bounce of around 23%–38%. However, even if a bounce occurs, the broader outlook remains bearish, and the market may return to its opening level by the end of the day.

NIFTY Forms Ending Diagonal (EDT): 25,133–25,000 final Target.✅ STRUCTURE CONFIRMATION

1️⃣ Impulse completed

✔ NIFTY has completed a 5-wave impulse as per the chart

✔ Wave (v) showed:

Overlap

Momentum divergence

Channel resistance

➡️ This strongly suggests an Ending Diagonal–type Wave (v), which often leads to sharp ABC corrections

2️⃣ Current phase: ABC correction in progress

Your ABC expectation is correct.

🔹 Wave A

Sharp decline from the top

Impulsive nature ✔

🔹 Wave B (ongoing / upcoming)

Counter-trend bounce

Overlapping, corrective

Lower volume

📌 Important:

👉 Any Wave-B bounce is a shorting opportunity, not a trend resumption

Ideal Wave-B retracement zone:

25,800 – 26,000

Near broken channel / prior resistance

3️⃣ Wave C termination zone (KEY POINT)

Your final buy zone is well identified.

🎯 High-probability Wave-C completion:

25,133 – 25,000

Why this zone matters:

✔ 200-EMA (~25,133)

✔ Ending Diagonal trendline (EDT) support

✔ 50–61.8% Fibonacci retracement

✔ Prior demand + institutional reference level

📌 This is a confluence zone, which is exactly where Elliott Wave corrections typically end.

4️⃣ Trading logic (very clear)

❌ Do NOT buy during Wave B

✅ Use Wave-B rallies to sell / hedge

✅ Final buy should be planned near 25,133 ± 150 pts

Expect volatility and false breakdowns near the bottom

5️⃣ Invalidation (must know)

❌ Weekly close below 24,600

Would imply a deeper, higher-degree correction

Until then → bullish structure intact

#Banknifty Directions and Levels for Jan 12thCurrent View

> If the market declines initially, the immediate support zone is expected to act as a strong support.

> If price gets rejected from this zone, structurally this could be a 5th sub-wave. In that case, the 5th sub-wave correction may complete here, followed by a bounce of around 38%–61% of the minor swing.

> This is the base structure. However, if price does not reject around the pullback zone, the 5th sub-wave could extend toward 58,737.

Alternate View

> The alternate scenario suggests a range-bound market with a bearish bias.

> If the market opens positive, we can expect a bounce of around 23%–38%. However, even if a bounce occurs, the broader outlook remains bearish, and the market may return to its opening level by the end of the day.

[INTRADAY] #BANKNIFTY PE & CE Levels(12/01/2026)A flat opening is expected in Bank Nifty, with the index continuing to trade within the same downward structure seen over the last few sessions. Price is currently hovering around the 59,250–59,300 zone, which is acting as an intraday equilibrium area where minor pullbacks and short-covering are visible, but no strong buying conviction has emerged yet. Overall sentiment remains cautious unless a clear breakout occurs.

On the upside, a sustained move above 59,550 will be the key trigger for bullish momentum. If Bank Nifty manages to hold above this level, long trades / CE positions can be considered with upside targets at 59,750, 59,850, and 59,950+. A clean breakout above 59,950 may further open the gates toward higher resistance zones.

On the downside, if the index fails to hold 59,250–59,200, selling pressure may intensify. In such a scenario, PE positions can be considered with downside targets at 59,050, 58,950, and 58,750. A decisive breakdown below 58,950 could extend the move toward 58,650 and 58,550-. Until a clear directional move is confirmed, traders are advised to stick to level-based trades with strict risk management and avoid aggressive positions.

NIFTY : Trading levels and Plan for 12-Jan-2026(Timeframe: 15-min | Gap criteria considered: 100+ points)

🔑 Key Levels (from chart)

Last Intraday Resistance: 25,998

Opening Resistance Zone: 25,742 – 25,816

Spot / Pivot Area: 25,700

Opening Support Zone: 25,592 – 25,647

Last Intraday Support: 25,353

🧠 Market structure note: NIFTY is in a short-term downtrend, but currently showing a relief bounce from demand. Price is approaching an important supply zone, where rejection risk remains high unless acceptance improves.

🟢 1. GAP-UP OPENING (100+ Points)

If NIFTY opens above 25,742, it will be a pullback rally into resistance.

🎓 Educational Insight

Gap-ups in a corrective downtrend often face selling near supply zones. Strength is confirmed only when price holds above resistance, not just spikes.

Plan of Action

Avoid aggressive longs in the first 15 minutes ⏳

Sustain above 25,816 → move toward 25,998

Rejection from 25,742 – 25,816 → pullback toward 25,700

Fresh longs only after retest + higher low

Options idea: Bull Call Spread (ATM buy + OTM sell)

🟡 2. FLAT OPENING

If NIFTY opens near 25,680 – 25,720, expect range-bound and volatile price action.

🎓 Educational Insight

Flat opens near VWAP / pivot after a sell-off usually result in false breakouts. Direction emerges only after range expansion with volume.

Plan of Action

Above 25,742 → upside toward 25,816

Failure above 25,742 → sideways to weak bias

Break below 25,592 → selling toward 25,353

Avoid trades inside the middle range 🚫

Options idea: Iron Fly / Short Strangle with hedge

🔴 3. GAP-DOWN OPENING (100+ Points)

If NIFTY opens below 25,592, bears remain firmly in control.

🎓 Educational Insight

Gap-downs into demand can cause short covering bounces, but continuation happens if price fails to reclaim the opening range.

Plan of Action

First support to watch: 25,592 – 25,647

Weak bounce + rejection → downside toward 25,353

Sustain below 25,353 → further trend continuation

Avoid fresh shorts exactly at support

Options idea: Bear Put Spread / Put Debit Spread

🛡️ Risk Management Tips (Options Trading)

Risk only 1–2% capital per trade 💰

Prefer spreads over naked buying in volatile zones

Book partial profits at resistance/support levels

No averaging against the trend 🚫

Stop trading after 2 consecutive losses 🧠

🧾 Summary & Conclusion

Above 25,816: Relief rally toward 25,998

25,742 – 25,816: Selling / supply zone

Below 25,592: Weakness toward 25,353

Focus on price acceptance, not prediction 🎯

⚠️ Disclaimer

I am not a SEBI-registered analyst. This trading plan is for educational purposes only. Markets are risky, and I may be wrong. Please consult a qualified financial advisor before taking trades.

Weekly Timeframe Price Action MasteryObserve the red supply zone where price consistently faces resistance, halting upward moves with precision. The green demand zone, formed after a decisive breakout from prior resistance, now acts as robust support for subsequent bounces. The white counter trend line serves as the pattern's key action line, guiding price movements with remarkable adherence across multiple tests.

Zone Dynamics

Supply zones in red mark areas of overhead selling pressure on weekly charts, often leading to rejections. Demand zones in green emerge post-breakout when former resistance flips, attracting buyers on retracements. These zones filter noise effectively in trending markets.

Counter Trend Line Role

This white line defines the counter-trend structure, respected through pullbacks and rallies. Price follows it as a dynamic guide, confirming pattern integrity without implying direction. Such lines enhance zone analysis by highlighting momentum shifts.

Disclaimer

This post showcases historical price action only and constitutes neither financial advice nor trading signals. Trading involves substantial risk of loss; conduct your own analysis and consult professionals.

Part 4 Learn Institutional Trading What Are Options?

At its core, an option is a financial derivative contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (known as the strike price) on or before a specific date (the expiration date). Unlike buying the asset outright, purchasing an option requires paying a premium, which is the cost of acquiring the right conveyed by the option.

Options are broadly classified into two types:

Call Option: Gives the holder the right to buy the underlying asset at the strike price.

Put Option: Gives the holder the right to sell the underlying asset at the strike price.

Unlock Market Rotation: Turn Shifting Trends into Powerful ProfiStay Ahead of Capital Flow & Capture the Next Big Opportunity

What Is Market Rotation?

Market rotation refers to the movement of capital from one sector, asset class, or investment theme to another as economic conditions, interest rates, inflation, and growth expectations change. Understanding this shift allows investors to align portfolios with where money is flowing next, not where it has already been.

Why Market Rotation Matters More Than Ever

In today’s fast-moving global markets, leadership changes quickly. Sectors that outperform in one phase of the cycle can underperform in the next. Investors who unlock market rotation gain a powerful edge by identifying early signals and positioning before the crowd reacts.

Economic Cycles Drive Rotation

Different sectors perform best at different stages of the economic cycle. Early recovery favors cyclicals, mid-cycle supports growth sectors, late-cycle shifts toward defensives, and slowdown phases reward capital preservation strategies. Market rotation is the bridge between macro trends and smart allocation.

Interest Rates as a Key Trigger

Rising interest rates often rotate money away from high-growth, high-valuation stocks toward value, financials, and commodities. Falling rates usually support technology, consumption, and growth-oriented sectors. Tracking rate expectations is critical to anticipating rotation.

Inflation and Sector Leadership

Inflation reshapes winners and losers. High inflation typically benefits energy, metals, and real assets, while compressing margins in rate-sensitive sectors. Unlocking rotation means understanding how inflation impacts pricing power across industries.

Institutional Money Leaves Clues

FIIs, DIIs, and large institutional players move capital systematically. Volume expansion, relative strength, and sectoral index breakouts often signal early institutional rotation. Smart investors learn to read these footprints rather than react to headlines.

Relative Strength Is the Core Tool

Market rotation is best identified through relative performance. Comparing sectors against benchmark indices reveals which areas are gaining strength and which are losing momentum. Sustained outperformance is a strong sign of rotation in progress.

From Sector to Stock-Level Rotation

Rotation doesn’t stop at sectors—it flows into sub-sectors and then into specific stocks. Leaders within a strong sector usually outperform peers. Unlocking market rotation means narrowing focus from macro to micro with precision.

Risk Management Through Rotation

Instead of exiting markets entirely, rotation allows investors to shift risk, not abandon opportunity. When one theme weakens, another strengthens. This approach smooths volatility and improves long-term consistency.

Psychology of Market Rotation

Most investors chase past performance. Market rotation rewards those who act before trends become obvious. Discipline, data-driven decisions, and patience are essential to avoid emotional investing.

Technical Indicators That Signal Rotation

Moving averages, sectoral relative strength lines, momentum oscillators, and trend confirmation tools help validate rotation. Technical confirmation ensures that allocation decisions are backed by price action, not assumptions.

Macro Events Accelerate Rotation

Central bank decisions, geopolitical shifts, policy reforms, and global growth changes can rapidly accelerate capital movement. Prepared investors use these events as catalysts rather than shocks.

Short-Term vs Long-Term Rotation

Rotation can be tactical (weeks to months) or strategic (quarters to years). Traders benefit from short-term sector momentum, while investors focus on structural shifts like digitization, energy transition, or infrastructure growth.

Equity, Debt, and Alternative Rotation

Rotation is not limited to equities. Capital also moves between stocks, bonds, commodities, and alternative assets. A holistic approach captures opportunities across asset classes.

Market Rotation in Indian Markets

In India, rotation often reflects domestic growth cycles, government policies, earnings visibility, and global capital flows. Understanding local drivers adds a significant advantage to portfolio positioning.

Avoiding Overcrowded Trades

When a sector becomes over-owned, upside potential reduces. Unlocking market rotation helps investors exit crowded themes early and enter emerging ones before valuations expand.

Consistency Beats Prediction

Market rotation is not about predicting tops or bottoms. It is about consistently reallocating capital toward strength and away from weakness based on objective signals.

Portfolio Rebalancing with Purpose

Regular rebalancing aligned with rotation trends keeps portfolios dynamic. This reduces drawdowns and improves risk-adjusted returns over time.

Long-Term Wealth Creation Advantage

Investors who master market rotation compound gains by riding multiple leadership cycles instead of staying stuck in one theme. This adaptability is key to sustainable wealth creation.

Unlock the Edge

Market rotation is the silent force behind every major rally and correction. Those who understand it move ahead of trends, protect capital during uncertainty, and capture opportunity when it matters most.

Unlock Market Rotation is not just a strategy—it’s a mindset. By tracking capital flow, aligning with economic cycles, and acting decisively, investors can transform uncertainty into opportunity and stay one step ahead of the market.

Understanding Rapid Price Movements Through Technical AnalysisTechnical Market Explosion:

A technical market explosion refers to a sudden, powerful, and often unexpected surge in price movement—either upward or downward—driven primarily by technical factors rather than immediate fundamental news. These explosive moves are commonly observed across equities, commodities, forex, and cryptocurrencies and are closely followed by traders because they often create high-profit opportunities within short time frames. Understanding why and how these explosions occur is essential for traders and investors who rely on technical analysis to navigate volatile markets.

1. Meaning of a Technical Market Explosion

A technical market explosion occurs when price action breaks out decisively from a consolidation zone, key resistance, or support level with strong momentum and volume. This move is usually rapid and sharp, leaving little time for indecision. Such explosions reflect a sudden shift in market psychology where buyers or sellers overwhelm the opposing side.

These movements are not random; they are often the result of prolonged price compression, accumulation, or distribution phases that eventually release stored market energy.

2. Role of Support and Resistance Breakouts

Support and resistance levels are the backbone of technical analysis. A technical explosion typically begins when price decisively breaks above resistance or below support. Traders place buy stops above resistance and sell stops below support, and when these levels are breached, a cascade of orders is triggered.

This chain reaction increases liquidity and momentum, accelerating price movement. The stronger and more tested the level, the more explosive the breakout tends to be when it finally occurs.

3. Volume as the Fuel of Explosion

Volume plays a crucial role in validating a technical market explosion. A genuine breakout is almost always accompanied by a sharp rise in volume, signaling strong participation by institutional and retail traders.

Low-volume breakouts often fail, while high-volume explosions suggest conviction and sustainability. Volume confirms that the move is supported by real money, not just speculative noise.

4. Volatility Compression and Expansion

Before a market explodes, volatility usually contracts. This phase is marked by narrow price ranges, tight Bollinger Bands, or triangle and wedge formations. Such patterns indicate indecision and balance between buyers and sellers.

When volatility expands suddenly, it signals the start of a technical explosion. Traders who recognize volatility compression early can position themselves ahead of the breakout.

5. Indicator Alignment and Momentum

Technical indicators often align before a market explosion. Momentum indicators like RSI, MACD, and Stochastic Oscillators show strength or divergence prior to the move. For example:

RSI holding above 50 indicates bullish strength

MACD bullish crossover near zero line signals momentum buildup

Moving averages start flattening or converging before expansion

When these indicators turn simultaneously, the probability of an explosive move increases.

6. Chart Patterns Triggering Explosions

Certain chart patterns are well known for leading to technical market explosions, including:

Ascending and descending triangles

Cup and handle patterns

Flags and pennants

Head and shoulders (especially breakdowns)

These patterns represent structured market behavior, and once their boundaries are violated, price often moves swiftly toward projected targets.

7. Institutional Activity and Smart Money

Institutional players often accumulate positions quietly during consolidation phases. This accumulation is not obvious to most traders but can be detected through price structure and volume behavior.

Once institutions complete accumulation or distribution, they allow price to move aggressively. This is when retail traders observe a technical market explosion, often entering late but still benefiting from momentum.

8. Role of Algorithmic and High-Frequency Trading

In modern markets, algorithmic trading plays a major role in accelerating technical explosions. Algorithms are programmed to react instantly to technical signals such as breakouts, moving average crossovers, and volatility spikes.

When a key level breaks, thousands of automated orders execute simultaneously, intensifying the speed and magnitude of the move.

9. False Breakouts vs True Explosions

Not every breakout leads to a true explosion. False breakouts occur when price briefly moves beyond a key level but lacks volume or follow-through. Recognizing the difference is critical.

True technical explosions show:

Strong closing prices beyond the breakout level

Increasing volume

Momentum continuation across multiple candles

False moves often retrace quickly and trap impatient traders.

10. Risk Management During Explosive Moves

While technical market explosions offer high reward, they also carry high risk. Rapid price movement can lead to slippage and emotional decision-making.

Effective risk management includes:

Predefined stop-loss levels

Position sizing based on volatility

Avoiding over-leverage

Waiting for candle confirmation instead of chasing price

Discipline is essential to survive and profit consistently from explosive markets.

11. Psychological Impact on Traders

Explosive moves create fear and greed simultaneously. Traders who miss the initial move feel fear of missing out (FOMO), while those in profit may panic and exit early.

Professional traders remain calm, follow their strategy, and understand that technical explosions are part of a broader market cycle, not isolated events.

12. Timeframe Perspective

Technical market explosions occur across all timeframes. On lower timeframes, they may last minutes or hours, while on higher timeframes, they can develop into long-term trends lasting months or years.

Swing traders, day traders, and investors interpret explosions differently, but the underlying technical principles remain the same.

13. Post-Explosion Behavior

After an explosive move, markets often pause, consolidate, or retrace partially. This phase is healthy and allows new participants to enter.

Strong markets use post-explosion consolidation as a base for the next leg, while weak markets fail to hold gains and reverse.

Conclusion

A technical market explosion is the result of accumulated market energy released through key technical triggers such as breakouts, volume surges, indicator alignment, and volatility expansion. These moves reflect shifts in market psychology and institutional participation rather than pure randomness.

For traders who master technical analysis, recognizing early signs of an impending explosion can provide significant opportunities. However, success depends not only on identifying the move but also on managing risk, controlling emotions, and respecting market structure. In fast-moving markets, preparation—not prediction—is the true edge.

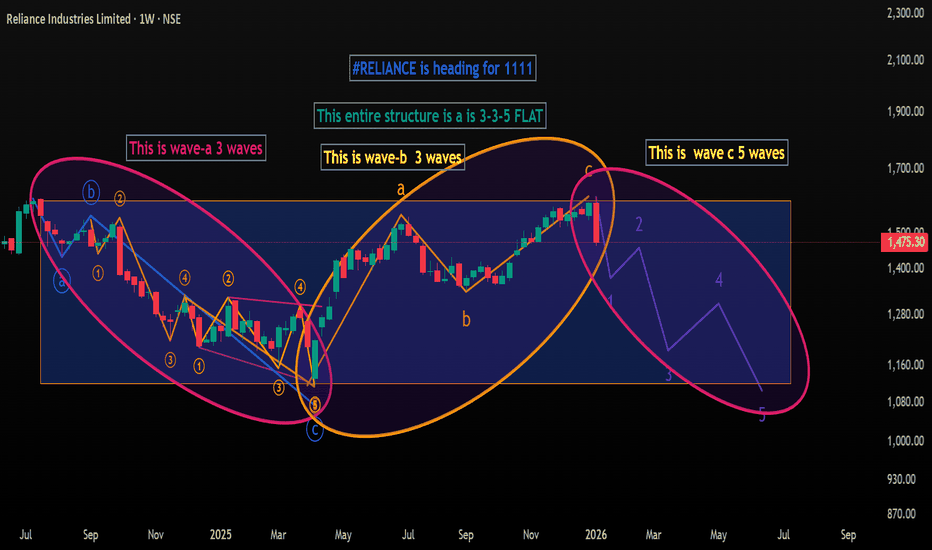

RELIANCE may head for 1111 #RELIANCE is forming a NEAT 3-3-5 FLAT and should head for 1111. Anybody in EW kindly study and share views. In simple terms if you see the two DTF and WTF charts , the stock is forming a 3-3-5 FLAT correction STARTING 12 July 2024 where sub wave -a has three sub waves culminating at 1114 on 07 Apr 2025 and sub sub -c of this wave is ending as a 5 wave Ending Diagonal. Then we have sub wave-b going up in three sub waves again culminating at 1611 high on 03 Jan 2026. Now I am looking for sub wave -c going deep down to 1111 in five sub waves 1-2-3-4-5 as I have shown in the DTF Chart. ANALYSIS INVALIDATION 1611 ( or even 1575 may be good enough for invalidation). THIS DTF CHART ( Daily Time Frame).Lets C

#RELIANCE at 1475 heading for 1111 in 3-3-5 Elliott Wave FLAT #RELIANCE at 1475 is forming a NEAT 3-3-5 FLAT and should head for 1111. Anybody in EW kindly study and share views. In simple terms if you see the two DTF and WTF charts , the stock is forming a 3-3-5 FLAT correction STARTING 12 July 2024 where sub wave -a has three sub waves culminating at 1114 on 07 Apr 2025 and sub sub -c of this wave is ending as a 5 wave Ending Diagonal. Then we have sub wave-b going up in three sub waves again culminating at 1611 high on 03 Jan 2026. Now I am looking for sub wave -c going deep down to 1111 in five sub waves 1-2-3-4-5 as I have shown in the DTF Chart. ANALYSIS INVALIDATION 1611 ( or even 1575 may be good enough for invalidation). Lets C