Finolex Cables Daily Chart on Price action A daily price action with EMAs, trendlines, and RSI.

1. Price Action & EMAs: The stock is trading at ₹722.25 with a +1.61% gain. The price is below the EMAs (orange 200, green 100, blue 55, red 21), indicating a bearish trend in the short to medium term. The EMAs are sloping downward, suggesting continued weakness.

2. Trendline: A white ascending trendline acts as support near ₹700–₹710. The recent price is testing this line, showing potential for a bounce if it holds.

3. RSI: The RSI (purple line at the bottom) is around 40, indicating neutral to slightly bearish momentum with no extreme oversold or overbought conditions.

The RSI is forming a rising base, hinting at possible positive divergence. . This is a Bullish Divergence when the price makes a lower low, but the RSI forms a higher low. It suggests weakening downside momentum and a possible upcoming upward reversal.

4. The View: The stock shows signs of consolidation near the support trendline. A break above the nearest EMA (red line, ~₹740) could signal short-term bullishness, while a fall below the trendline may trigger further downside.

Divergence alone isn’t a trade signal; it warns of momentum shifts.

Combine with price action (breakouts, support/resistance) for confirmation.

RSI levels (40/70 or 60/80) can add context to divergence strength.

Over-reliance without confirming price action may lead to premature trades.

Possible Price Action:

Buy if Price crosses above the nearest EMA (red/short‑term EMA ≈ ₹740) with the EMA turning flat or upward.

Volume confirmation: The crossover occurs on above‑average volume (at least 1.5× the 20‑day average volume), showing strong buying interest.

Target: Close above ₹740–₹745, indicating a shift from bearish to bullish EMA alignment.

Exit (Sell) Conditions:

Profit target: Sell when the price reaches the next EMA resistance or target zone ₹780–₹800, accompanied by decreasing volume or profit‑taking signals.

Stop loss: Place a stop‑loss at ₹695–₹700 (below the trendline support and recent low) to protect against EMA breakdown. Trigger on high volume if the price breaches this level, confirming a reversal.

X-indicator

VTL 1 Day View 📍 Latest Price Context (Daily Close)

Approx. share price: ~₹432 – ₹433 on NSE (close of last session).

Today’s range (recent session): High ~₹468, Low ~₹407.45.

52-week range: Low ~₹361.10, High ~₹539.90.

📊 Key Daily Levels (1-Day Time Frame)

🔑 Pivot & Intraday Levels

(Based on pivot point calculations for the daily session)

Central Pivot (Daily): ~₹412.33 – baseline pivot for directional bias.

📈 Resistance Levels

R1 ~₹418 – ₹423 – first near-term resistance zone.

R2 ~₹423 – ₹429 – next resistance above pivot.

R3 ~₹429 – ₹446 (or higher intraday) – notable upper resistance zone if price strengthens.

👉 Bullish scenario: Daily close above ~₹429-₹435 could trigger further upside momentum toward higher resistance zones (based on recent highs).

📉 Support Levels

S1 ~₹407 – ₹410 – short-term support near today’s low zone.

S2 ~₹401 – ₹405 – secondary support if price declines below S1.

S3 ~₹396 – ₹399 – deeper support on a pullback.

👉 Bearish scenario: A daily close below ~₹401-₹396 may open further decline toward lower support clusters.

📌 Simple Interpretation (Daily TF)

📍 Above Pivot (~₹412): Slightly bullish / range control.

📍 Holding Support (~₹407 – ₹401): Helps limit downside.

📍 Break above ~₹429: Potential for continuation to next resistance area.

📍 Break below ~₹396: Bearish momentum intensifies.

⚠️ Notes

Levels are based on standard pivot and support/resistance derivations — actual intraday price action may vary with market volatility.

For live charts and real-time plotting, it’s best to check TradingView, your broker’s charting tool, or other live market platforms.

AUROPHARMA 1 Month View📌 Current Price Context

Last traded / current price: ~₹1,207–₹1,208 on NSE.

📊 Key Technical Levels (1-Month View)

🔹 Pivot Point

Pivot (daily): ~₹1,200 – centre of recent price action.

📈 Resistance Levels

R1: ~₹1,226–₹1,228 — first meaningful resistance above current price.

R2: ~₹1,245–₹1,247 — higher resistance zone from classic pivot analysis.

R3: ~₹1,271–₹1,275+ — extended resistance from upper pivot range.

These resistances correspond to areas where price has previously found sellers or consolidation over the last few weeks.

📉 Support Levels

S1: ~₹1,181–₹1,182 — first support just below pivot region.

S2: ~₹1,155–₹1,156 — secondary support from recent swing lows.

S3: ~₹1,136–₹1,138 — deeper support area if market weakens further.

These support zones align with recent range lows and moving average clusters over a monthly period.

📊 Moving Averages & Trend

20-day / 50-day / 100-day EMAs and SMAs are currently around ₹1,164–₹1,192 range — near price but showing neutral-to-slightly bullish bias on daily charts.

Price trading above most short and mid-term moving averages suggests short-term strength if levels hold.

📈 Oscillators / Momentum (Short-term indication)

RSI near mid-to-bullish levels (~58–68) indicating no extreme overbought condition yet.

Momentum suggests neutral-to-slightly uptrend in the recent 1-month timeframe.

📍 Summary (1-Month Technical View)

Bullish breakout zone:

• Above ~₹1,226 → may accelerate toward ₹1,245 / ₹1,270+

Key neutral range:

• ₹1,181–₹1,226 — consolidation band to watch intra-month

Bearish trigger (pullback):

• Below ~₹1,155 → risk of deeper test of ₹1,136+ support

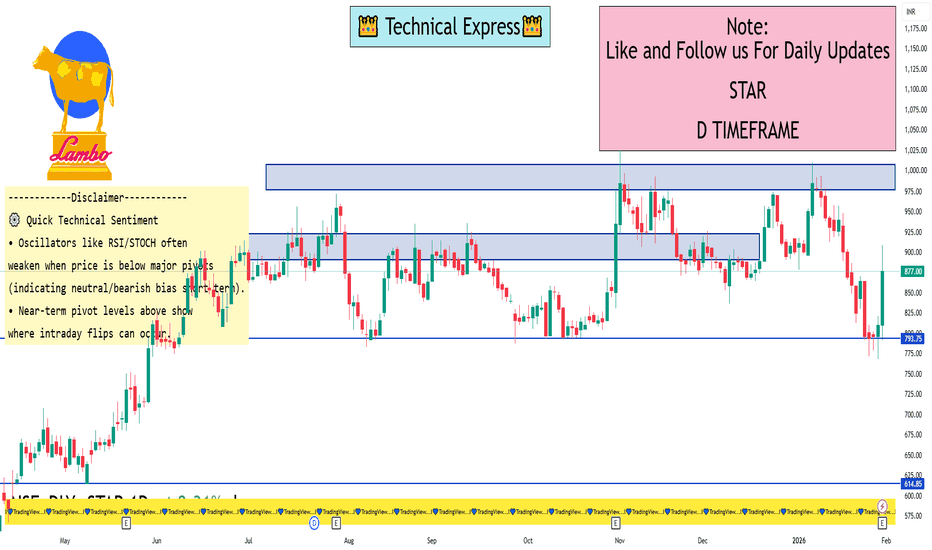

STAR 1 Day View 📌 Live Price Snapshot

• Current price: ~₹877.00 on NSE (Last traded)

• Today’s range: ₹791 – ₹908.40

• 52-Week range: ₹513.05 – ₹1,025.00

📊 Daily Pivot & Key Levels (1-Day Timeframe)

These are approximate pivot, support and resistance levels based on the most recent pivot analysis published today:

📍 Pivot Point

Central Pivot: ~ ₹850.8

🛑 Resistance Levels

R1: ~ ₹868.1

R2: ~ ₹891.0

R3: ~ ₹908.3

(These are short-term upside barriers where price may slow/reverse)

🟩 Support Levels

S1: ~ ₹827.9

S2: ~ ₹810.6

S3: ~ ₹787.7

(These are immediate downside zones where price could find buying interest)

📌 How to Use These Levels Today

✔ Bullish view:

• Above Pivot ₹850.8 → watch for closing above R1 (~₹868) to strengthen upside bias.

• Breaking and holding above R2 (~₹891) could extend toward R3 (~₹908).

✔ Bearish/Range view:

• Failure below Pivot ₹850.8 or S1 (~₹827.9) increases odds of deeper correction toward S2/S3.

• Intraday rejections at R1/R2 can signal short-term sellers.

ACC 1 Month View 📈 1-Month Key Price Range

🔹 1-Month High: ~₹1,779 (late Jan 2026)

🔹 1-Month Low: ~₹1,626 (recent session low)

➡️ So the current 1-month trading range is roughly:

👉 ₹1,626 – ₹1,779

🔥 Short-Term Support & Resistance Levels

Support (Downside)

• S1: ~₹1,626 — recent intra-day low and current 52-week low area.

• S2: ~₹1,600 — psychological/support near multi-session lows (below recent range).

• S3: ~₹1,570 … deeper support if the range breaks down.

Resistance (Upside)

• R1: ~₹1,670–₹1,680 — immediate resistance around recent price reaction zone.

• R2: ~₹1,720 — short-term resistance near 20–30 day moving averages.

• R3: ~₹1,760–₹1,780 — recent 1-month highs.

📊 1-Month Technical Context

📉 Over the past 30 days, ACC has been in a modest downtrend/weak range, with 1-month returns in negative territory and prices sliding from the upper ₹1,700s toward mid-₹1,600s.

Technical indicators also point toward bearish/neutral momentum in the short term (e.g., RSI weak, MACD bearish) — aligning with the recent price pressures.

XAUUSD – Historic Volatility Doji at 1.618 | Exhaustion SignalXAUUSD – HTF Exhaustion at 1.618 | Major Volatility Signal Formed

GOLD HAS PRINTED ITS BIGGEST DOJI IN ENTIRE HISTORY OF DAY CANDLE NEARLY 490$ FROM LOW TO HIGH AND ENDED WITH INDECISION. LETS SEE WHAT HAPPENS NEXT . WAIT FOR LOW AND HIGH OF DOJI.......?

Gold has reacted precisely from the 1.618 Fibonacci extension zone (~5600), where price printed a high at 5597.04 and faced strong rejection.

The current Daily candle is forming an exceptionally large indecision candle (Doji-like structure) after a strong impulsive move.

With an intraday range of nearly 490$, this candle highlights clear exhaustion and aggressive profit-taking at premium prices.

Technical Perspective

Clear rejection from the 1.618 extension resistance

Strong volatility spike following a vertical price expansion

Daily candle structure suggests weakening bullish momentum

Key HTF Levels to Watch

Resistance / Supply: 5580 – 5615

Immediate Reaction Zone: 5350 – 5400

Major Support / Rebalancing Area: 5000 – 4900

HTF Value Area Low: Below 4900 (only if bearish momentum accelerates)

Expectation (Next Sessions / 1–2 Weeks)

As long as price remains below the 1.618 rejection zone, probability favors:

Consolidation or corrective price action

Gradual rotation toward 5000–4900 HTF demand

No immediate V-shaped recovery unless strong acceptance above 5600 is seen

GILD breaks out after months of compression 1 Price has been holding above the old high zone near 120 for months, that looks like controlled building, not panic

2 The breakout was fast, so the reaction around 140 to 141 is the key area now

3 Shapes like a triangle or channel are only visual context here, Silent Flow does not need them

4 Silent Flow is active, it confirms the breakout, but it does not promise a smooth ride

5 Scenario A is holding above the old high zone, then price can cool down and keep working higher

6 Scenario B is slipping back into the prior range, then it starts to look like a failed push

7 Near term, the earnings update on Feb 10 can add volatility even if the chart stays constructive

XAUUSD Gold Next Move In Upcoming 2 Weeks ExpectedGold is Now Moving to 5600 to 5615 Which is Retracement level of 1.618 For Golds Previous Swing Extension levels and can expect a retracement of till 5000 to 5100 Levels In Upcoming Weeks Lets See WhatS Going to Happen..........# XAUUSD .. Check My 4hr chart Frame

Silver Futures: Parabolic Breakdown & Bearish LiquidationSilver Futures: Parabolic Breakdown & Bearish Liquidation (Analysis)

Part 1: Historical Context (The "Why") To understand this violent -17% move, we must look at Silver's distinct "personality" compared to Gold.

1. The "Beta" Factor (Silver vs. Gold) Silver is often called "Gold on steroids." While Gold is a monetary metal held by Central Banks for stability, Silver is 50% industrial and 50% speculative. It has a much smaller market cap, meaning it takes less liquidity to push the price up or down violently.

Historical Rule of Thumb: When Gold drops 5%, Silver often drops 10-15%. This chart confirms a classic high-beta liquidation event.

2. Historical Comparisons

The 2011 Crash: In April 2011, Silver went parabolic to nearly $50/oz before crashing ~17.7% in a single day (the "Sunday Night Massacre"). This was caused by exchange margin hikes, forcing leveraged longs to liquidate.

The 2020 Covid Crash: In March 2020, Silver fell ~30% in weeks due to a liquidity crisis where traders sold precious metals to cover equity losses.

Part 2: Visual & Technical Analysis

A. Daily Timeframe (The "Map")

Step 1: The Parabolic Arc Break: The rally followed a steep, unsustainable curve (Blue Arc on chart). When price cuts vertically through such an arc—as the recent Red Candle has done—the bullish momentum is technically broken.

Step 2: The "Supply Zone" Rejection: The long wick at the top (near 422,000) represents a "concrete ceiling." Buyers were exhausted, and trapped longs at this level will likely sell into any recovery to break even.

Step 3: Bearish Engulfing Candle: The massive red candle has "engulfed" (wiped out) the gains of the previous 7-10 trading sessions. This shifts market psychology from "Buy the Dip" to "Sell the Rally."

Step 4: Momentum Warning (RSI Divergence): Before this drop, while price was making Higher Highs, the RSI likely failed to confirm with a Higher High (Bearish Divergence). This signaled buyer exhaustion before the crash occurred.

B. Intraday / Short-Term Strategy (The "Path") Since the daily trend is broken, the strategy shifts to defensive management.

1. The "Dead Cat Bounce" Scenario: After a vertical drop, the RSI is oversold. A bounce is expected, but it is often a trap. We use Fibonacci Retracement levels from the Swing High to Low to identify resistance:

0.382 Level: The first zone where aggressive bears often reload shorts.

0.5 - 0.618 (Golden Pocket): Historically the highest probability area for a "Lower High" to form.

2. The "Bear Flag" Pattern: In strong liquidations, price rarely recovers in a V-shape. Watch for a "Flag" pattern (slow drift upward on low volume). A break below the flag's support triggers the next leg down.

Part 3: Trading Strategy Summary & Risk Management

Volume Confirmation: Check the volume on the breakdown candle. If it is the highest of the year, it indicates "Capitulation" (potential temporary bottom). If volume is average, the "real" panic selling may still be ahead.

Invalidation Level (When is this view wrong?): This bearish outlook is negated ONLY if we get a Daily Candle close back above the 400,000 supply zone. Until then, the market structure remains corrective.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading futures involves significant risk.

Bank Nifty spot 59610.45 by Daily Chart view - Weekly UpdateBank Nifty spot 59610.45 by Daily Chart view - Weekly Update

- Support Zone 58850 to 59350 for Bank Nifty

- Resistance Zone 59900 to ATH 60437.35 for Bank Nifty

- Bank Nifty seems more matured then Nifty to contain the unwarranted Geo-Political scenario and trending up for New ATH

XAUUSD – INTRADAY🔴 Market Structure

Overall trend: Bearish

Price making lower highs

Current bounce = pullback into resistance

✅ ENTRY (BEST AREA)

Sell between: 5085 – 5100

Or sell on rejection below 5105

🎯 TARGETS

Target 1: 🎯 5045

Target 2: 🎯 5000

Target 3 (extension): 🎯 4945

🛑 STOP LOSS (STRICT)

SL: ❌ 5140

Nifty spot 25320.65 by Daily Chart view - Weekly UpdateNifty spot 25320.65 by Daily Chart view - Weekly Update

- Support Zone 24775 to 25075 for Nifty Index

- Resistance Zone 25325 to 25625 for Nifty Index

- Nothing major Domestically except for the unwarranted Geo-Political scenario affecting our Stock Markets

Canara Bank daily chartThe chart pattern Upward Parallel channel is seen .

Price is hovering around 20 and 50 EMA. Near term (next few days): Expect consolidation around 150–156.

A breakout above 156.80 could target 160–162, while a drop below 150 might lead to testing 148.

Key levels:

Support: 150 / 148.

Resistance: 156.80 / 160.

The View: If Price keeps hovering around moving avgs. consolidation is expected .More than average buying must be seen for price to move above in parallel channel.

Bharat Electronics Limited Weekly Chart

4 EMA Analysis: The stock is trading above the 21, 55, 100, and 200 EMAs(Red, Blue, Green & Orange respectively) indicating a bullish trend. The EMAs are also in a positive alignment, suggesting a strong uptrend.

Volume Analysis: The breakout was supported by healthy volume expansion, validating the move. There's no major selling pressure visible near the breakout zone.

RSI Indicators: The RSI has crossed 60, reflecting healthy strength without signs of exhaustion.

Based on these indicators, the technical analysis suggests:

The trend is bullish, with buyers maintaining control above key demand zones.

The stock is likely to continue its uptrend, with potential targets at ₹460-₹480 (positional).

Support levels to watch: ₹428 - ₹420.

Further prediction:

A daily close above ₹422 could trigger stronger moves, opening room for fresh highs.

If the resistance holds, there could be a retest towards ₹340-₹360, followed by an uptrend.

Keep an eye on the volume and RSI for any signs of exhaustion or reversal. Majorly trend looks positive .

Colgate Palmolive Analysis* The primary trend of the stock is bullish, although prices witnessed a bearish retracement for over a year (Sep 2024 - Oct 2025)

* Since strong Q3 earnings (Oct 2025), a bullish pull-back could be seen, and prices rose more than 16.5% in over +3 months

* Recently prices tested fib level 0.618 (86.67) and started consolidating between fib level 0.618 & 0.50.

* Today's strong earnings results of the company for Q4 might drive the stock prices higher.

* The stock is expected to open with a gap-up near the Entry zone, and rise higher towards the Target area

Technical Indicators

- The prices are existing at the support of the 21 EMA

- A hidden bullish divergence is also visible, driving prices higher

Q4 & Annual Earnings

- Colgate-Palmolive beat estimated earnings by 4.0%, reporting an EPS of $0.95 versus an estimate of $0.91.

- Revenue was up $286.00 million from the same period last year.

- EPS, although beat estimates, but fell 106% from the previous quarter, and turned negative for the quarter

- EPS for the financial year also fell 25% to $2.63 from $3.51

XAUUSD (Gold) – 4H Chart Analysis (Short & Clear)XAUUSD (Gold) – 4H Chart Analysis (Short & Clear)

Market Structure

Overall strong uptrend intact (higher high–higher low).

Recent move shows sharp rally → profit booking / pullback.

Current price ~5127, bounced from below 5000 area.

Key Levels

Resistance:

5250–5280 (minor)

5450–5600 (major supply zone / previous top)

Support:

5050–5000 (important demand zone)

4850–4800 (strong swing support)

Price Action Insight

Big red candles after top = healthy correction, not trend reversal yet.

Last candle shows rejection from lows → buyers still active.

As long as 5000 holds, bias remains bullish.

Buy-side View

Buy on dip near 5050–5000 with confirmation.

Safer buy if market reclaims & holds above 5200.

Targets (short-term): 5250 → 5400

Targets (swing): 5500–5600

Bearish Scenario (Only if)

Clean 4H close below 4950 → deeper correction possible

Downside then: 4850 → 4700

Conclusion

📈 Trend = Bullish

🔁 Phase = Pullback / consolidation

🧠 Best strategy = Buy dips, avoid panic selling

Part 2 Intraday Institutional TradingBest Practices for Retail Traders

1. Start with Buying Options

Risk is limited.

2. Prefer ATM or Slight ITM

Better stability, realistic probability.

3. Avoid Holding Overnight

Unless you understand IV, theta, and event risk.

4. Track Implied Volatility

Buy when IV is low, sell when IV is high.

5. Use a Trading Plan

Entry levels

Stop loss

Target

Position size

6. Don’t Chase Cheap OTM Options

They expire worthless most of the time.

Advance Trade Setup - KSCLKaveri Seed Company Ltd

BSE : 532899

NSE : KSCL

💡 Liked the idea?

Then don’t forget to Boost 🚀 it!

Comments are Most Welcome

Techincal Setup Details

LTP 818.00

VRVP

RSI

LinReg

VRVP :

The Visible Range Volume Profile (VRVP) indicator, often referred to as VPVR, displays trading volume by price rather than time, specifically for the visible chart area. The Value Area High (VAH) is the upper boundary of the price range where a significant percentage (default 70%) of volume occurs, acting as a crucial resistance or support level.

Significance of VAH:

Resistance : When prices are below or approaching the VAH, it often acts as resistance, signaling a potential pullback.

Support : In an upward trend, a breakthrough above the VAH can signal a continuation, turning the former VAH into support.

Trading VAH with VRVP:

Range Trading : If the price is within the VAH (Value area High) & VAL (Value area Low), it suggests a range-bound market. Sellers often enter near the VAH.

Trend Identification : A price moving well above the VAH indicates strong bullish sentiment, while price staying below the VAH suggests bearish sentiment.

RSI :

The Relative Strength Index (RSI) is a momentum oscillator ranging from 0 to 100 that measures the speed and change of price movements to identify overbought (>70) or oversold (<30) conditions. It helps traders detect potential trend reversals or corrections.

Linear Regression Channel :

The Linear Regression Indicator (LRI) is a technical analysis tool that fits a straight line, known as the "least squares regression," to a specific number of price bars (e.g., closing prices) to identify the current trend. It plots the final, predicted value of this regression line, acting as a responsive, noise-filtering alternative to moving averages that indicates where price "should" be

Purpose: Identifies trend direction, potential reversals, and acts as dynamic support/resistance

I've extended the Indicator/Lines on the Right so that when the actual reversal happens, it easy to go with the flow, will be a Helping hand.

In the Current Scenario # KSCL

VAH is @ 740

Price has Broken LinReg Lower Deviation # Channel Broken, which means we can expect further weakness

RSI is @ 30 odd with Bearish signal still ON

Why this idea is Titled as ADVANCE TRADE SETUP, because we must understand that further weakness is expected & we also need to know well in advance whats the BEST possible price to enter for a Decent RR Ratio

LTP stands @ 818

once its below 760 mark, start adding in tranches till 690 Levels

There is one important point that needs to be highlighted.

KSCL operates in the seed business, which is largely driven by the monsoon cycle.

If you look at its balance sheet, you’ll notice a clear revenue swing around June, and historically, the stock price also reacts during the March–June quarter.

As of now, we are nearing the end of January.

Till mid-March, we may get opportunities to accumulate the stock near the above-mentioned best buy zone.

Once the position is in place, the idea is to hold for an upswing, which could range between 40% to 80%, and possibly more.

Stop-loss (closing basis):

• ₹620 / ₹590

Important Note:

This idea is being shared well in advance.

All price levels mentioned are assumptions and expectations, meant only for guidance.

Actual prices may vary by ±10% to 15%.

Members are advised to act based on real-time market behavior and their own judgment.

Plan patiently. Execute with discipline.

For more insights & trade ideas,

📲 Visit my profile and hit Follow

Warm regards,

Naresh G

SEBI Registered Research Analyst

💬 Comment below if you want me to analyse any stock for you 🔍

Part 4 Institutional VS. Technical1. Delta

Measures how much the premium changes with a ₹1 move in the underlying.

Call delta: +0.0 to +1.0

Put delta: –0.0 to –1.0

High delta = faster premium movement.

2. Gamma

Measures how fast delta changes. Used to evaluate momentum and risk.

3. Theta

Measures time decay—how much premium decreases as expiration approaches.

Sellers benefit from theta.

Buyers lose value daily.

4. Vega

Measures sensitivity to implied volatility (IV).

Higher IV → higher premium.

5. Rho

Impact of interest rates (less important for short-term traders).