Can You Control Revenge Trading?Understanding, Managing, and Eliminating One of Trading’s Deadliest Habits

1. What Is Revenge Trading?

Revenge trading happens when a trader, after taking a loss (or a series of losses), abandons their plan and starts trading emotionally to “get the money back.” The market begins to feel personal. Every candle looks like an insult. Every loss feels unfair.

Instead of trading setups, the trader trades emotions.

Typical signs of revenge trading:

Increasing position size after a loss

Entering trades without confirmation

Overtrading the same instrument

Ignoring stop-loss rules

Trading immediately after a big loss without reflection

Revenge trading is not about strategy failure — it’s about emotional hijacking.

2. Why Revenge Trading Is So Dangerous

Revenge trading compounds mistakes. One small, manageable loss turns into:

Bigger losses

Loss of discipline

Loss of confidence

Eventually, loss of capital

Markets don’t punish traders — traders punish themselves by staying emotionally engaged when they should step away.

The irony?

Most traders who revenge trade are technically capable. They know support/resistance, indicators, patterns. What breaks them is psychology.

3. The Psychology Behind Revenge Trading

To control revenge trading, you must understand why it happens.

a. Loss Aversion

Humans feel losses 2–2.5 times more intensely than gains. Your brain is wired to “fix” pain immediately.

b. Ego and Identity

Many traders subconsciously link their self-worth to being right. A loss feels like:

“I am wrong” instead of “This trade didn’t work.”

So the ego demands redemption.

c. Fight-or-Flight Response

After a loss, stress hormones (like cortisol and adrenaline) spike. Logical thinking drops. Impulsive behavior rises.

You’re literally biologically less intelligent after a loss.

4. Can Revenge Trading Be Controlled?

Yes — but not by willpower alone.

Revenge trading is controlled through:

Systems

Rules

Environment design

Emotional awareness

Habit restructuring

Trying to “just be disciplined” almost never works.

5. Step-by-Step Ways to Control Revenge Trading

1. Define a Maximum Daily Loss (Hard Stop)

This is non-negotiable.

Example:

If you lose 2% in a day, you stop trading — no exceptions.

Why it works:

It removes decision-making during emotional stress

It protects capital and mindset

It trains respect for risk

Professional traders don’t trade every day. They trade when conditions and mindset align.

2. Mandatory Cooling-Off Period After a Loss

After a loss:

Step away for 10–30 minutes

No charts

No news

No social media

This allows your nervous system to reset.

If you re-enter immediately, chances are you’re trading emotion, not probability.

3. Trade Only Pre-Defined Setups

Write down:

Entry conditions

Stop-loss logic

Target logic

If a trade doesn’t meet all criteria, you are not allowed to take it — especially after a loss.

Revenge trades usually start with:

“This looks good enough.”

“Good enough” is where discipline dies.

4. Reduce Position Size After a Loss

Professional risk managers often reduce size after a losing streak, not increase it.

Why?

Confidence drops after losses

Execution quality declines

Emotional sensitivity increases

Smaller size keeps you engaged without emotional overload.

5. Keep a Trading Journal Focused on Emotions

Don’t just log:

Entry

Exit

P&L

Also log:

Emotional state before the trade

Emotional state after the loss

Whether rules were followed

Patterns will emerge. Most traders are shocked to see how often losses come from rule violations, not bad setups.

Awareness is the first layer of control.

6. Separate “Trading Time” from “Review Time”

Never analyze mistakes during live market hours.

After a loss:

Do not “fix” it immediately

Do not prove anything to the market

Review later when emotions are neutral.

Markets reward patience, not urgency.

7. Accept That Losses Are the Cost of Business

This mindset shift is crucial.

Losses are:

Rent you pay to stay in the market

Data points, not judgments

Inevitable in probabilistic systems

Once you truly accept that losses don’t need to be recovered immediately, revenge trading loses its grip.

6. Long-Term Habits That Eliminate Revenge Trading

a. Process Over Profits

Judge your day by:

Rule-following

Execution quality

Not by money made or lost.

b. Fewer Trades, Better Trades

Overtrading fuels emotional spirals. High-quality traders often take very few trades.

c. Capital Preservation First

Your first job is not to make money — it’s to stay in the game.

7. Final Truth About Revenge Trading

Revenge trading isn’t a character flaw.

It’s a human response to uncertainty, loss, and ego.

You don’t eliminate it by being tougher.

You eliminate it by being structured.

The moment you stop trying to “beat the market” and start trying to execute your edge calmly, revenge trading fades.

Remember:

The market will always be there tomorrow.

Your capital and mindset might not be — if you don’t protect them today.

X-indicator

Eurostoxx remains constructive with bullish consolidation1 Price moved higher first and then shifted into bullish consolidations rather than breaking down

2 Each consolidation formed at a higher level, showing controlled digestion of gains

3 The current phase around 58 to 60 looks calm and orderly, with no visible distribution

4 Silent Flow does not confirm a future breakout here, it confirms that trend risk remains contained

5 The indicator is not about prediction, it is about staying aligned during consolidation

6 Scenario A is continued work within the bullish consolidation until price reveals direction

7 Scenario B is a clean break below this zone, shifting risk and forcing the trend to re prove itself

XAUUSD – High Volatility, Trade Reaction Zones (M30)Gold is currently experiencing strong volatility on the M30 timeframe after a sharp rebound from the recent lows. At this stage, the market is no longer trending smoothly but is shifting into a liquidity-driven, two-way environment, where price reacts aggressively at key Supply & Demand zones.

👉 This is not a FOMO market. Priority should be given to trading by levels and waiting for confirmation.

📌 Market Context

The broader structure is still capped by a descending trendline from above.

The latest bullish leg shows active demand, but no clear trend reversal confirmation yet.

Price is ranging within a wide band, making liquidity sweeps on both sides highly likely.

➡️ Short-term bias: Neutral → trade reactions at key zones.

📊 Structure & Price Action (M30)

Price is consolidating between well-defined demand and supply zones.

Each touch of a zone has produced sharp reactions → ideal for short-term MMFlow-style trades.

No confirmed CHoCH yet to validate a sustained bullish trend.

🎯 Trading Plan – MMFlow Style

🔵 BUY Scenario – Focus on Demand Reactions

Only look for BUY setups after bullish confirmation (bullish candles / Higher Low structure on M30).

BUY Zone 1: 4,819 – 4,800

(Short-term demand, multiple strong reactions)

BUY Zone 2: 4,733 – 4,710

(Major demand zone + liquidity low)

Target Zones (TP):

TP1: 4,900

TP2: 4,955

TP3: 5,018

Extended TP: 5,100 – 5,105 (major supply above)

🔴 SELL Scenario – Supply Reaction Trades

If price rallies into supply and fails to sustain bullish momentum:

SELL Zone 1: 4,955 – 4,965

SELL Zone 2: 5,018 – 5,105

Downside Targets:

TP1: 4,900

TP2: 4,819

TP3: 4,733

❌ Invalidation Conditions

Strong M30 close above 5,105 → bearish structure invalidated, reassess overall bias.

M30 close below 4,710 → risk of deeper downside expansion.

🧠 Summary

Gold is in a high-volatility, structure-building phase. The edge comes from:

Trading precise price zones, not chasing candles

Waiting for clear confirmation

Prioritizing risk management over trade frequency

📌 In volatile markets, discipline always beats prediction.

Nifty50 analysis(7/2/2026)CPR: wide + decending cpr: consolidtion

FII: 1,950.77 bought

DII: 1,265.06 sold

Highest OI:

CALL OI: 25500 and 25600

PUT OI: 25700 to 26000

Resistance: - 26000

Support : - 25500

conclusion:.

My pov:

1.today market consolidate and take support from 25600 or 25500 then bullish trend is possible

2.25500 and 25600 has more support and 25700 to 25900 has most resisting oi so possibly those gap will fade and take support .

3. If today price breaks 25850 then bullishness continues.

What IF:

1.If it breaks 25500 then 25400 great support

2. If it breaks 25900 then all time high is the target. Only if it close in day candle.

Psycology:

Find a good setup, retest same setup again and again all this 20 percent and 80 percent are mindset.

note:

8moving average ling is blue colour.

20moving average line is green colour

50moving average line is red colour.

200moving average line is black colour.

cpr is for trend analysis.

MA line is for support and resistance.

Disclaimer:

Iam not Sebi registered so i started this as a hobby, please do your own analysis, any profit/loss you gained is not my concern. I can be wrong please do not take it seriously thank you.

Gold Continues to Shine in the Eyes of Investors

India’s gold exchange-traded funds (ETFs) saw net inflows of $2.49 billion in January 2026, up 98% from December's $1.25 billion, marking the eighth consecutive month of growth.

In 2025, total inflows reached $4.68 billion, a 262% increase from $1.29 billion in 2024; inflows were $310 million in 2023 and $33 million in 2022.

Globally, gold ETFs attracted $19 billion in January, the highest monthly inflow on record, with assets under management hitting $669 billion, up 20% during the month.

Global gold holdings rose by 120 tonnes to an all-time high of 4,145 tonnes.

Asian gold ETFs reported inflows of $10 billion in January, significantly above their 2025 average, marking the strongest monthly inflow for the region.

North America had its second-highest monthly inflow, while Europe also experienced notable investments amid geopolitical tensions.

Although gold prices dipped late in January after the nomination of Kevin Warsh as Federal Reserve Chair, net inflows persisted as investors sought exposure during the price correction.

Geopolitical tensions and the Federal Reserve's interest rate stance influenced investor behavior, with ongoing uncertainty regarding monetary policy contributing to demand for gold ETFs.

Resistance levels: 131, 143, 153

Support levels: 115, 106

Market Outlook & Trade Setup – Monday, 9th Feb 2026🔹 NIFTY: Gift Nifty (25,921: +223)

* Previous Close: 25,694

* Expected Range: 25,500 - 26,000

🔹 SENSEX

* Previous Close: 83,580

* Expected Range: 83,500 - 84,000

🌍 Global & Market Sentiment

* DJIA: +1200| S&P: +133

💰 Institutional Activity (Cash Market)

* FII: Net Buyers: + ₹ 1951 Cr

* DII: Net Buyers: - ₹ 1265 Cr

🔥 Events this Week:

India - US Crude & CPI data, UK GDP

📌 Sectoral Focus (Positive)

FMCG, Realty, Banks

👉 Commodities in Focus: Copper, Gold, Silver, Crude

✌️Important Quarterly Results: Bata, Bajaj electric, Happiest Mind

📈 Trade smart. Manage risk. Stay disciplined.

EURUSD Technical Overview (1H Timeframe)EURUSD remains positioned within a corrective market structure following a strong bearish displacement from the higher-timeframe supply zone. The sharp rejection from the 1.1830 to 1.1850 region highlights the validity of the identified bearish order block, indicating active institutional supply and reinforcing a short-term downside bias.

Market Structure

The broader structure suggests that the recent decline was impulsive, while the ongoing upside movement appears corrective in nature. Price action has transitioned into a consolidation range, reflecting temporary balance rather than a confirmed reversal. The absence of strong bullish displacement further supports the view that buyers currently lack sufficient momentum to shift order flow.

Smart Money Perspective

From a liquidity standpoint, the current upward movement is likely engineered to target buy-side liquidity resting above recent highs. A controlled push into the premium zone would allow larger participants to optimize short positioning and potentially establish a lower high.

A rejection from the supply area would confirm continued institutional control and strengthen the probability of bearish continuation.

Key Levels to Monitor

Supply / Bearish Order Block: 1.1830 – 1.1850

Immediate Liquidity Target (Upside): Equal highs above the recent range

Downside Objective: 1.1760 discount zone, where sell-side liquidity is expected to rest

Trade Narrative

Primary Scenario:

A liquidity sweep into the order block followed by bearish confirmation could initiate the next leg lower, maintaining alignment with the prevailing order flow.

Invalidation Scenario:

A decisive break and sustained acceptance above the supply zone would weaken the bearish thesis and signal the potential for a deeper retracement, possibly shifting short-term structure toward bullish conditions.

Directional Bias

Short-Term Bias: Bearish while price remains below the order block.

Expectation: Corrective rally into supply followed by continuation to the downside.

BTCUSD (1H) – Range Support Bounce | Bullish Reversal SetupBTCUSD (1H) – Range Support Bounce | Bullish Reversal Setup

Bitcoin is trading on the 1-hour timeframe after completing a corrective decline and forming a clear range structure. Price has recently reacted strongly from the lower demand/support zone, indicating buyer interest at this level.

Technical Breakdown:

Support Zone: Price bounced from a well-defined green demand area, aligning with a cyclical low and previous accumulation.

Structure Shift: After making a higher low, BTC is attempting to reclaim the mid-range, suggesting a short-term bullish reversal.

ALMA Indicator: Price is stabilizing around the ALMA, which often acts as a dynamic trend filter. Holding above it favors upside continuation.

Cycle Projection: The curved projection highlights a potential move toward the upper range resistance, following previous cyclical behavior.

Momentum: The oscillator shows recovery from oversold conditions, supporting the bullish bounce scenario.

Trade Idea:

Entry: Near current levels or on a minor pullback above the support zone

Target: Upper resistance / range high area

Invalidation: A clean break and close below the demand zone would invalidate the bullish setup

Bias:

📈 Bullish toward range high, as long as price holds above support.

⚠️ Always wait for confirmation and manage risk accordingly.

GRMOVERGRMOVER | Technical View

GRMOVER is in a clear uptrend. The stock broke above the earlier resistance near 165 and has been consolidating around this level, which is a constructive sign.

Price is trading above key EMAs, and the overall structure remains bullish. If the stock breaks out and sustains above the consolidation zone, there is a probability of further upside.

Keep it on your watchlist.

✅ If you like my analysis, please follow me here as a token of appreciation :) in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

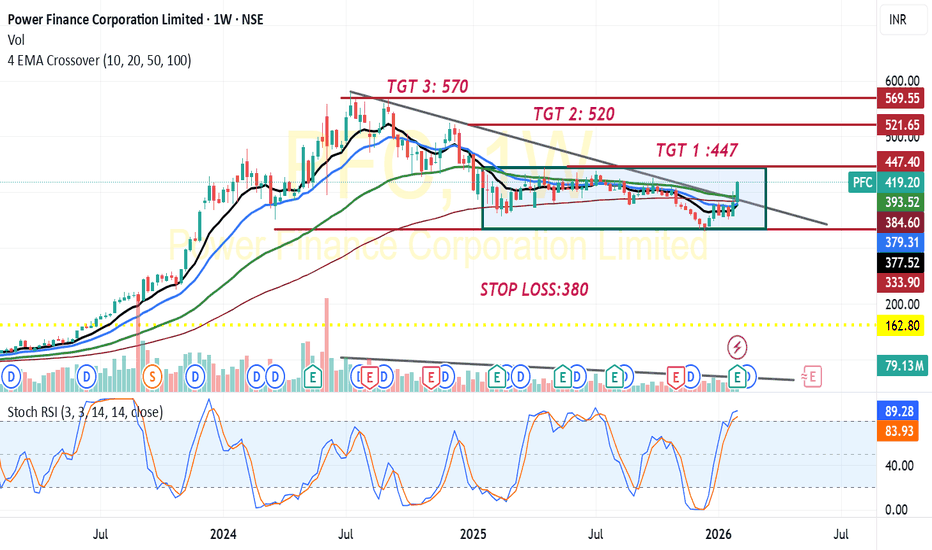

PFC:Likely Huge Trend Line Break OutPFC:

Trading at 419 and above all its Moving averages in daily chart viz 10,20,50,100 DEMA

Has given Golden crossover of 10 DEMA in Daily chart

Sustained increase in volume -latest two weeks noticed

Trading at 419 and above its Trend line resistance

Combination of the above suggests a possible upside ranging from 450-600.

Target 1:450 TGT 2:500 TGT 3:525-550 TGT 4:550-600+

Safer traders might consider going long above 450 on closing basis with a SL of 380 for 550-600 Target(For educational purpose only)

MRPLMRPL is showing a bullish structure. Earlier, the stock broke above the old resistance near 172, then went through a healthy pullback and formed a low around 136, before resuming its upward move.

Notably, price has now again broken the 172 resistance with a strong bullish candle on the weekly timeframe, which signals renewed strength.

The stock is also showing positive performance across multiple timeframes, weekly, monthly, 3month, 6month and yearly, indicating sustained momentum.

Price is currently trading above key EMAs, and if it sustains above the breakout zone, there is a probability of further upside.

Keep it on your watchlist.

✅ If you like my analysis, please follow me here as a token of appreciation :) in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

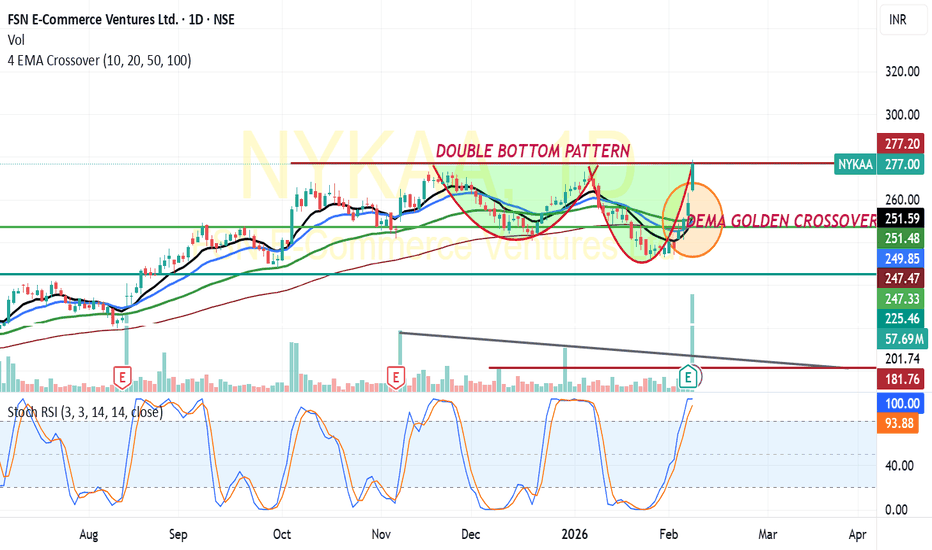

NYKAA :Likely Double Bottom Pattern BreakoutNYKAA

Trading at 277 and in daily chart has given Golden Cross over of DEMA (10DEMA Vs 20/50/100DEMA)

Witnessed Volume break out

Has formed Double bottom pattern -Indicates a possible break out after a period of consolidation.

Holding above its neckline breakout point at 280 on closing basis/sustained level likely to test 300-330+(For educational purpose only)

Is crude headed north?Crude CMP $63.49

Elliott- this entire correction to me is the 2nd wave and now the 3rd wave should commence from here.

Directional signal- the double bottom is a directional signal. It needs to close above 69 on the monthly basis to confirm the same.

Fibonacci- it made a double bottom at the fib confluence at $55.65 and a monthly close above the confluence at 63.85 will make it stronger.

RSI - support above the bull zone is positive.

MA- price is just under all the three MA's is caution. It needs to move above the red MA at 73.50 to go north.

Conclusion - the major reason for a stock mkt collapse has always been exorbitant rise in crude price. In my view it will be no different this time around. That this is the 3rd wave is a very high probability. What this also means crude will make historic levels this time around.

Sharda Cropchem - 65% upside possibility in 12-15 MonthsSharda Cropchem - 65% upside possibility in 12-15 Months.

Fundamentals:

Company has reduced debt.

Company is almost debt free.

Company has been maintaining a healthy dividend payout of 42.5%

Technicals:

Stock has broken out from All time High & now ready to make new highs soon.

LTP - 1192

Targets - 1950+

Timeframe - 12-15 Month.

Happy Investing.

Weekly Analysis with buy/Sell scenarios in Nifty👋👋👋 Friends, What's your view on Nifty???

Nifty was in big pressure during previous weeks because of global events and higher tariffs from US. But last week was good recover week because of big events of IndoEU trade deal and more importantly confirmation on IndoUS FTA. These events pushed positivity in the market and price shown upside move of ~1500 points and finally closed above 25600 (@25693)

On Tuesday Price gaped up ~1200 points and fell sharply losing ~ 600 points from high of the day. Price went on range bound for remaining three days, however price closed in slightly positive mode on Friday.

FIIs/DIIs both were net buyer at the end of week. FIIs - 2,645.53 and DIIs - 2,892.14.

Considering all these factors Nifty should move up side. Our first target level should be 26000 and then all-time high.

Critical points ……………….

1. Price closed positively after sharp fall from the high of Tuesday.

2. Currently price at critical level and most probably it will go upside.

3. Critical Support level is 25500.

4. We should see some really good bullish price formation if price willing to go upside.

5. We should patiently wait for the formation of entry model at least at 1H/15m)

6. If Global sentiments are positive and price gets support from volume at key level, we may see some really good buy scenarios.

Note – if you liked this analysis, please boost the idea so that other can also get benefit of it.

Also follow me for notification for incoming ideas.

Also Feel free to comment if you have any input to share.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) and check with your financial advisor before making any trading decisions.

Gold Consolidates to Form a Base — Bullish Trend Restarting!✅ 4H Trend Analysis

● After rebounding from the 4402 low, the market completed the first phase of recovery and has now entered a stage of gradual consolidation and upward movement.

● The current price has moved back above MA10 and MA20 (around 4900), and the short-term moving averages are beginning to turn upward.

● The Bollinger middle band is rising, and the lower band continues to lift, indicating that the market has shifted from a downtrend into a bullish recovery structure.

● The 4950–5000 zone above is a previous high-volume trading and structural resistance area.

📌 4H Conclusion:

The market has moved away from bearish dominance and entered a bullish recovery phase. As long as the price does not fall back below 4870, the overall bias remains bullish.

✅ 1H Trend Analysis

● On the 1-hour chart, price has formed a continuous rising structure since the 4655 low.

● MA5 / MA10 / MA20 are aligned in a bullish formation, and the Bollinger Bands are opening upward, showing strong short-term momentum.

● The current price is approaching the 4950–4980 resistance zone, where a technical pullback may occur.

● If the pullback holds above 4900, it would be considered a healthy correction.

📌 1H Conclusion:

The short-term bullish rhythm is clear, but as the price is near resistance, chasing the move higher is not advisable.

🔴 Resistance

● 4950–5000 (short-term resistance)

● 5070–5100 (previous 4H structural high)

🟢 Support

● 4900–4870 (key short-term support)

● 4760–4800 (defensive pullback zone)

✅ Trading Strategy Reference

🔰 Long Strategy (buy the pullback)

👉 Entry: 4890–4920, scale in gradually

🎯 Target 1: 4980

🎯 Target 2: 5070

🎯 Extended: 5150

📍 Logic: In a bullish recovery structure, pullbacks to support offer lower-risk entry opportunities.

🔰 Short Strategy (light short at resistance)

👉 Entry1: 4980–5000, light position

👉 Entry2: 5090–5100

🎯 Target: 4920 / 4870

📍 Logic: This is only a technical pullback trade, not suitable for heavy positions.

✅ Risk Control

● If the 4H chart decisively breaks below 4870, the bullish structure becomes invalid

● If the price stabilizes above 5000, the short setup is no longer valid

● At this stage, trading rhythm is more important than direction — avoid chasing highs or selling lows

Weekly Analysis with buy/Sell scenarios in Gold/XAUUSD👋👋👋 Friends, What's your view on Gold ???

Week on Week basis price of Gold shown too much volatility. Price opened ~ $55 gap down and sharply fell and made low of day and week. Next day it showed recover and further three days it was range bound.

Now price is showing change in state of delivery. We may expect slightly slip/consolidation on Monday and later on it may further take the rout of POI/Key Level of 4500. Which is again a very strong round number as well. At this level we may witness reversal pattern/entry model which may further take the price upside to make new highs.

Critical notes.

1. Price may show some consolidation on early sessions or Monday/Tuesday.

2. High probably we will witness KOD and move into lower quadrant of weekly time frame.

3. There should be a proper entry model formation at identified POI/Key level

4. Most probably price will take liquidity of Key Level/FVG/RDRB level and create MSS/CISD/TS/iFVG in LTF.

5. Price should show rejection/reversal in respective LTF (1h/15m) at Key Level/FVG zone.

6. Take the trade only once clear entry model i.e. turtle soup. iFVG break, CDS or MSS happens on LTF

All these combinations are signalling a high probability and high RnR trade scenario.

Note – if you liked this analysis, please boost the idea so that other can also get benefit of it.

Also follow me for notification for incoming ideas.

Also Feel free to comment if you have any input to share.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) and check with your financial advisor before making any trading decisions.