Gold’s Recent Movement and Market SentimentXAUUSD: Gold Bounces Strongly From the Bottom, Is This the Start of a New Uptrend?

🌍 Macro Overview – Gold’s Recent Movement and Market Sentiment

Gold recently experienced a strong bounce from the 3.282 USD/oz low, reaching up to 3.317 USD/oz. This move has sparked some optimism, but let’s take a look at the key macro factors that might be affecting gold:

📉 US bond yields have dropped, signaling that market risk aversion is starting to return

💵 The USD remains strong, but buying interest for gold in Asia is increasing, as confidence in fiat currencies begins to wane

🇪🇺 The EU is pushing ahead with negotiations with the US on tariffs before the August 1st deadline. If these talks break down, gold could benefit significantly

🏦 The Fed is maintaining interest rates, but the market is betting that cuts could come in September if inflation remains under control

📊 US unemployment data and the Fed’s speech tonight will be key, with the market waiting anxiously for clues on the Fed’s next move

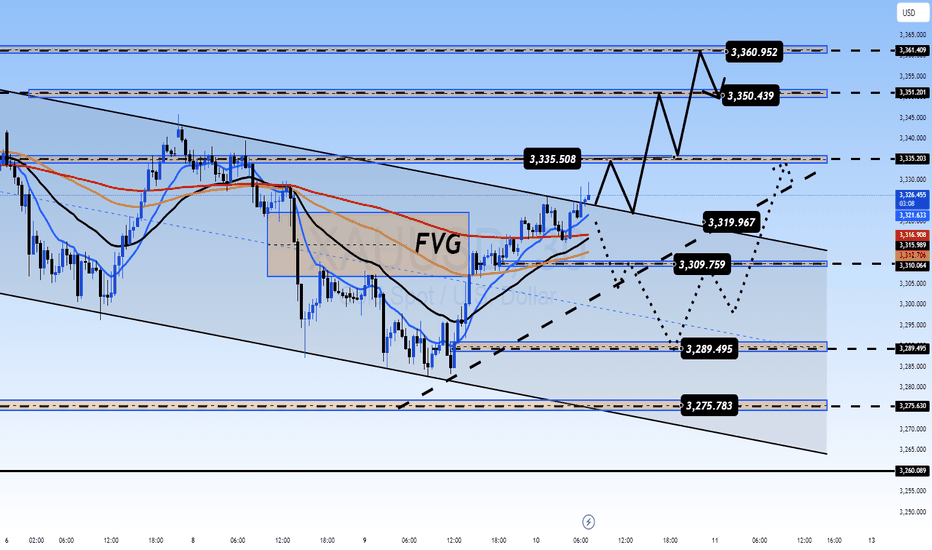

📊 Technical Analysis – Gold Approaching Key Resistance Zones

Gold is trading within a descending channel, but signs of a breakout are emerging after a solid test of the bottom.

Key resistance levels are around 3330 – 3340, and these will be crucial in determining whether gold can continue its upward momentum.

Fair Value Gap (FVG) has appeared between 3310 – 3320, which suggests that if buying pressure remains, a breakout could be on the horizon.

🎯 Trading Strategy for Today – Focused on Clear Entry Points

🟢 BUY SCALP:

Entry: 3310 – 3308

SL: 3304

TP: 3314 → 3318 → 3322 → 3326 → 3330

🔵 BUY ZONE (safer entry points):

Entry: 3290 – 3288

SL: 3284

TP: 3294 → 3298 → 3302 → 3306 → 3310 → 3320 → 3330

🔴 SELL SCALP (if price hits resistance levels):

Entry: 3335 – 3337

SL: 3342

TP: 3330 → 3325 → 3320 → 3315 → 3310 → 3300

⚫ SELL ZONE (strong resistance at 3360-3362):

Entry: 3360 – 3362

SL: 3366

TP: 3356 → 3352 → 3348 → 3344 → 3340 → 3336 → 3330

📌 Note:

Always place SL and TP to protect your account, especially in a market that may experience significant volatility.

Monitor the volume from London and New York sessions for clearer market direction. A strong breakout above resistance could signal the start of a new uptrend.

💬 Gold has bounced strongly, but is this the start of a larger rally, or just a brief pullback? What do you think about today’s potential trend? Share your thoughts in the comments below!

Xauusd(w)

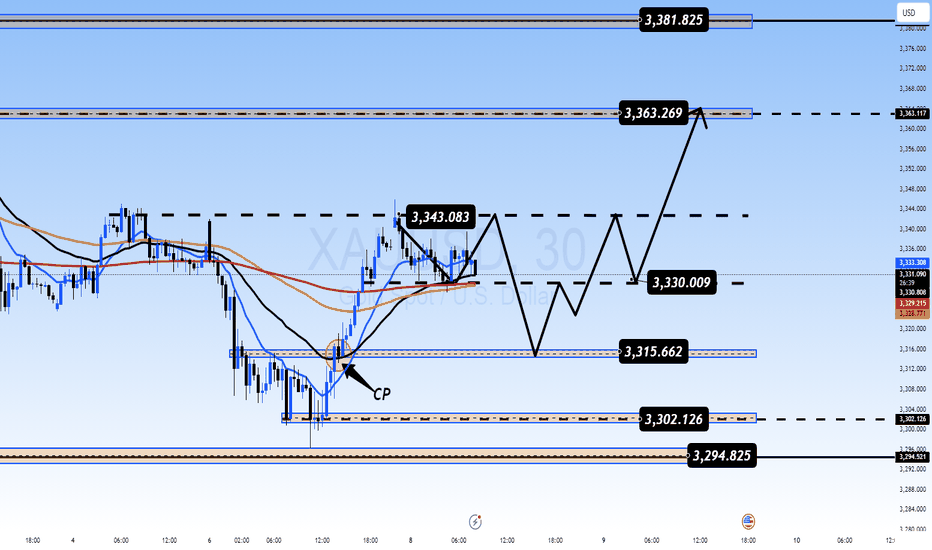

Elliott Wave Analysis – XAUUSD July 10, 2025🌀 Elliott Wave Structure

On the H4 timeframe, price has returned to test the upper boundary of the converging triangle – currently acting as dynamic resistance. Based on the current wave count, wave e (purple) may have completed at the 3279 low, and price is potentially starting a breakout move.

👉 A confirmed breakout above the triangle would validate the end of the abcde correction and mark the beginning of a new upward trend.

🔋 Momentum Analysis

D1 timeframe: As forecasted yesterday, momentum is entering oversold territory and showing early signs of a reversal. This suggests that an upward trend could dominate over the next 5 days.

H4 timeframe: The two momentum lines are sticking together, indicating a weakening upward drive. A minor pullback may be needed before the next leg up. Key nearby resistance levels to watch are 3330 and 3342.

🎯 Key Price Levels & Validation Zones

The following support zones are crucial for identifying potential entries:

Support Zone 1: 3306 – 3308

Support Zone 2: 3294 – 3297

‼️ Important: A break below 3294 would invalidate the current wave structure, and a new count would be required.

📌 Trade Plan

Scenario 1 – Buy at higher support:

Buy Zone: 3308 – 3306

SL: 3303

TP1: 3342

TP2: 3366

TP3: 3390

Scenario 2 – Buy at deeper support (if stronger correction occurs):

Buy Zone: 3297 – 3294

SL: 3287

TP1: 3342

TP2: 3366

TP3: 3390

Scenario 3 – Safer option (breakout confirmation):

Wait for a breakout above the triangle, then enter on the retest (around 3325–3330)

SL: Based on structure formed during the retest

TP range: 3366 – 3390

📌 Preferred strategy: Wait for H4 to reach oversold or wait for a confirmed breakout and retest to enter safely in alignment with the new uptrend.

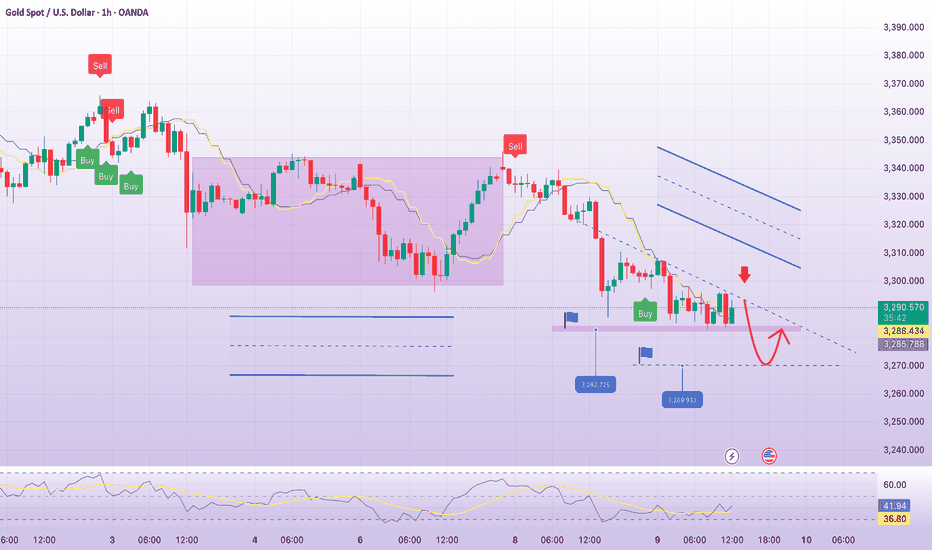

Gold Finds Support as Tariff Tensions RiseHello everyone! What’s your take on XAUUSD today?

OANDA:XAUUSD is showing a mild recovery, currently trading around $3,323, gaining over 100 pips on the day. Despite this bounce, the short-term structure still leans in favour of the bears.

On July 9th, President Biden announced a 50% tariff on copper and a projected 200% tariff on pharmaceuticals, following earlier notices of 25–40% tariffs imposed on 14 countries including Japan, South Korea, Thailand, Laos, and Malaysia.

This escalation has led to a sharp rise in international copper prices and reignited fears of global inflation, supply chain disruptions, and slower economic growth. As consumers cut back and companies face contract renegotiations, financial risk is spreading across global markets.

In this climate, investors are returning to gold as a safe haven, seeking capital protection in anticipation of broader market instability.

📈 Outlook: Gold prices may continue to rally in the short term if the U.S. unveils further tariff measures or reveals new negotiation drafts in the coming days.

Gold Update - July 10th, 2025Yesterday we have seen breakdown below Monday's low , but bulls again stepped in at the lower levels and pushed gold back above 3300 by the daily close. This was actually a really encouraging sign that buyers are still willing to defend this level.Things are looking a bit better now. Gold is trading above the weekly pivot, which is a positive shift from yesterday's weakness.

What's in the way:

The immediate challenge is that dynamic trendline you can see on the chart

Bulls need to break through this first ....

After that, the next big test is around 3340 this is a high volume area where we've seen plenty of action before.

old is basically stuck in a range between 3280-85 on the bottom and 3335-40 on the top. Right now, there's no clear direction.

We need a decisive break from this range. Until then, we're just watching price bounce between these levels without any real commitment from either buyers or sellers.

XAUUSD – Gold Maintains Bullish Momentum Amid Trade TensionsGold continues to respect its long-term ascending trendline that started in September 2024. After a corrective move from the $3,450 resistance zone, price has just retested the trendline near $3,060 and bounced strongly — a clear sign that buyers still control the bullish structure.

Fundamentally, gold is supported by two major factors:

The U.S.–14-nation trade conflict, with a tariff deadline set for August 1st, is fueling risk-off sentiment and driving safe-haven demand — pushing gold above $3,300.

The global de-dollarization trend and over $38 billion flowing into gold ETFs in H1 2025 are strengthening gold’s role as a USD alternative.

Looking ahead: If XAUUSD holds above the $3,060 support zone, it may head toward $3,211 and possibly $3,350. The bullish outlook remains intact as long as the trendline is respected.

Selling pressure, gold downtrendPlan XAU day: 09 July 2025

Related Information:!!!

Gold (XAU/USD) continues to extend its decline on Wednesday for a second consecutive session, as the US Dollar (USD) and US Treasury yields strengthen ahead of the release of the Federal Open Market Committee (FOMC) Meeting Minutes.

The US Dollar Index (DXY) has climbed to a two-week high, exerting downward pressure on XAU/USD, which has fallen below the $3,300 level at the time of writing.

The forthcoming release of the FOMC Minutes from the June meeting is anticipated to provide insight into the Federal Reserve’s internal discussions regarding the future course of monetary policy.

In June, the central bank chose to maintain its benchmark interest rate within the 4.25% to 4.50% range, citing continued labor market resilience and persistent inflationary pressures.

personal opinion:!!!

Gold price is in the accumulation zone below 3300, big selling pressure. Pay attention to selling gold according to the trend line 3294

Important price zone to consider : !!!

support zone point: 3274; 3252 zone

Sustainable trading to beat the market

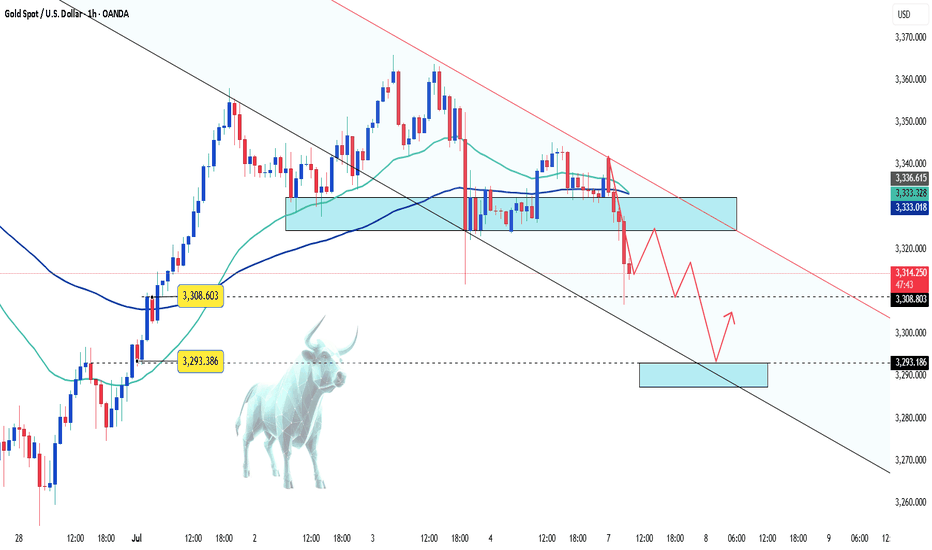

Is a Pullback Coming or Will the Bulls Continue?Gold Faces Resistance at 3300 – Is a Pullback Coming or Will the Bulls Continue?

Market Overview: USD Gains Pressure Gold as Trade Deals Unfold

Gold has been under pressure recently due to the strong recovery of the US dollar. Positive developments in global trade talks and agreements between major nations, including the US, have been a key driver for the USD, which in turn has weighed on gold.

US inflation data continues to show signs of easing, providing the Fed more room to hold off on rate hikes, strengthening the USD.

FOMC meeting minutes due this week will provide further insight into the Fed’s approach to interest rates.

With geopolitical tensions easing and trade deals stabilizing, the demand for safe-haven assets like gold is slightly reduced.

In the short-term, the market is testing crucial levels, and while gold remains bullish in the long run, the current market conditions suggest potential for a pullback before further upside.

Technical Analysis: Gold in a Range-Bound Market

Looking at the H1 timeframe, gold has formed a clear downward channel between 3360 and 3290, which could signal further corrective action if the price remains within this range. If gold fails to break above resistance at 3360, a dip to 3250 might occur, especially if the USD strength continues to put pressure on gold.

However, waiting for confirmation patterns before entering a trade is key. False breakouts can be a risk when price moves quickly through key levels without sustaining momentum.

Buy Bias in Short-Term with Caution on Bearish Moves

Given the current market structure, there is more room for buy opportunities than for selling at the moment. Watch out for a potential bounce back in the 3320-3325 region as gold might test these levels before continuing its rise. The rejection wick on yesterday's D1 candle shows that the sellers are losing control, and buying pressure is starting to build again.

In the M30 chart, there's a continuation pattern forming around the 16-14 zone, which could be an ideal place to enter a buy position if it holds.

Resistance and Support Levels:

Key Resistance Levels: 3302 – 3310 – 3324 – 3335 – 3361

Key Support Levels: 3275 – 3259 – 3248

Trading Strategy – Buy and Sell Zones

BUY ZONE:

3250 – 3248

Stop Loss: 3244

Take Profit: 3254 → 3258 → 3262 → 3266 → 3270 → 3280 → ????

SELL SCALP:

3303 – 3305

Stop Loss: 3310

Take Profit: 3298 → 3294 → 3290 → 3286 → 3280 → 3270 → 3260

SELL ZONE:

3334 – 3336

Stop Loss: 3340

Take Profit: 3330 → 3326 → 3320 → 3315 → 3310 → 3305 → 3300 → ????

Key Updates to Watch: FOMC and Trade Policy News

With FOMC minutes due and trade policy developments on the horizon, it’s crucial to stay alert for any shifts in market sentiment. Ensure you stick to TP/SL levels to protect your account from any unexpected volatility.

Gold at a Crossroads – Rebound or Breakdown?Gold just faced a sharp sell-off as optimism surged around a potential trade truce. After President Trump announced a 25% tariff on Japan and South Korea, the deadline was surprisingly pushed to August 1st, giving countries room to negotiate. That pause eased market fears and triggered a short-term risk-on sentiment.

But the real pressure came from a stronger US Dollar and 10-year Treasury yields hitting a two-week high – a deadly combo for gold, which offers no yield. The shift in capital flow toward safer, interest-bearing assets pushed gold further into the red.

Now, all eyes are on the upcoming Fed minutes and speeches from key officials this week. If the tone is hawkish, gold could lose further ground. But a dovish hint might spark a bounce from the $3,290 support zone.

Elliott Wave Analysis – XAUUSD July 9, 2025

🔻 Momentum Analysis

D1 timeframe: Momentum is approaching the oversold zone and may reverse upwards today or tomorrow.

H4 timeframe: Momentum is already in the oversold zone. The two momentum lines are converging, signaling weakening downward pressure and a potential reversal.

🌀 Elliott Wave Structure

The price level around 3318 (previous buy zone) failed to hold, despite a ~100-pip bounce before continuing to decline.

Currently, price is nearing the lower boundary of a contracting triangle – a typical abcde corrective pattern.

Based on the current wave structure:

Wave d (purple) appears to be complete.

Price is now likely forming wave e, expected to end near 3279, which coincides with the triangle’s bottom support.

If the pattern holds, a strong breakout above the upper triangle boundary is expected once wave e completes.

However, note: the formation of a triangle during a corrective wave often signals that the uptrend is nearing its end in the longer term.

📌 Trading Plan

Given the complex 3-wave structure typical of triangles, risk is elevated, so:

Trade with reduced position size, or

Preferably wait for a confirmed breakout above the triangle before entering.

Suggested Trade Setup:

✅ Buy Zone: 3280 – 3277

❌ Stop Loss: 3270

🎯 Take Profits:

TP1: 3309

TP2: 3342

TP3: 3390

Gold Price Action Update - July 9th, 2025We have seen that gold retested crucial 3300 support level once again yesterday and managed to bounce back, closing above it by day's end. This suggesting that the bulls were still in control.

but again in eary asian session today Gold broke below 3300 and is now trading under Monday's low(3295-96).This is definitely a shift in momentum that we need to watch carefully.

If we stay below Monday's low (3295-96) and can't reclaim the weekly pivot, more downside pressure possible,

The next logical target /support would be the weekly S1 at 3268.

For any bullish recovery, we NEED to reclaim that weekly pivot at 3316,and 3345 our next major hurdle to overcome,while today's action looks bearish on the shorter timeframes, the daily close is still favoring the bulls for now. This creates an interesting dynamic where we're seeing some short-term weakness within what's still technically a bullish structure.

XAUUSD Short Setup – Bearish Structure Break & RetestI’m watching a clean bearish structure on Gold (XAUUSD) as follows:

✅ Trendline Rejections:

Price has respected a descending trendline with three confirmed lower highs, showing clear bearish pressure.

✅ Key Support Broken:

The 3,325–3,330 zone previously acted as strong support. Price has broken below this area with momentum.

✅ Potential Retest:

I expect a pullback retest of the broken support (now resistance) zone. If we see rejection in this area, I plan to enter short.

✅ Target Area:

The final target for this move is set near the 3,262–3,265 zone, which aligns with previous demand and potential liquidity levels.

🎯 Trade Idea Summary:

Bias: Bearish

Entry Zone: 3,325–3,330 (on retest confirmation)

Stop Loss: Above the descending trendline (~3,340+)

Target: 3,262

Risk-Reward: Approx. 1:2 or higher depending on entry execution

⚠️ Note:

Always confirm entries with price action (e.g., bearish engulfing candles or rejections) before entering. Manage risk properly as Gold can be volatile.

💬 What do you think? Share your thoughts and charts below!

#XAUUSD #Gold #TradingView #ShortSetup

Buy Opportunity or A Sign of a Bigger Downtrend?Gold Reverses Below 3300 – Buy Opportunity or A Sign of a Bigger Downtrend?

🧭 Market Update: Is the Sell-Off Really That Dangerous?

Gold had a surprising reversal at the end of the US session yesterday, after a sudden sharp drop targeting the 329x liquidity zone, followed by strong buying momentum pushing the price back above this level.

When gold tested the liquidity zone below 3300, large buying volumes appeared and pushed prices above this region. Overall, the market has not yet made a clear decision for either the bulls or the bears. We are still in an accumulation phase, with liquidity sweeps happening around both highs and lows, so it's crucial for traders to stay cautious and focus on finding appropriate scalping points to enter and exit.

Short-Term Outlook: Buy Bias Takes Over Today

For today, the buy bias appears to be stronger than yesterday. Focus on buying early at continuation patterns to catch the market trend. The D1 candle from yesterday formed a wick rejection, showing that the selling pressure was absorbed and the buying momentum has returned in the short term. So, it’s important to be proactive and look for early buy opportunities.

In the M30 timeframe, a solid continuation pattern is forming in the 16-14 zone, which could be an ideal entry point for today. If the price drops further, we’ll watch for a test of the old bottom at 03-00, and we’ll wait for any strong downward momentum to confirm if the bearish trend continues. On the other hand, for those considering sell positions, caution is advised. As mentioned earlier, with yesterday’s D1 wick rejection, the SELL pressure has likely been absorbed, and BUY momentum may overpower in the next few days. Avoid rushing into sell trades prematurely.

Key Support & Resistance Levels:

Important Resistance: 3342 – 3353 – 3362 – 3381

Important Support: 3330 – 3314 – 3303 – 3295

Scalping Opportunities and Buy Zones:

BUY SCALP:

3316 – 3314

Stop Loss: 3310

Take Profit: 3320 → 3325 → 3330 → 3335 → 3340 → 3350

BUY ZONE:

3303 – 3301

Stop Loss: 3297

Take Profit: 3306 → 3310 → 3315 → 3320 → 3330 → 3340 → ????

Sell Opportunities and Caution on Bears:

SELL SCALP:

3362 – 3364

Stop Loss: 3368

Take Profit: 3358 → 3354 → 3350 → 3345 → 3340 → 3330

SELL ZONE:

3380 – 3382

Stop Loss: 3386

Take Profit: 3376 → 3372 → 3368 → 3364 → 3360 → 3350

Key Takeaway:

We are at a crucial juncture where both bulls and bears are battling for control. Will gold bounce from the support and continue its bullish momentum, or will the sellers take charge and drag prices lower? Be patient and wait for clear price action signals before entering trades.

The market is currently in an accumulation phase, so don't rush into trades. Focus on buying when clear confirmations appear at support zones and be aware of sell rejections at key resistance levels.

💬 What’s Your View on Gold Today?

Do you think gold is ready to break 3390 and continue its bullish trend? Or are we looking at a deeper correction to 3270 in the coming days?

👇 Share your analysis and thoughts in the comments below! I’d love to hear your take on where gold is heading next! Let’s discuss and refine our strategies together!

XAUUSD Long Idea – Inverse Head & Shoulders ReversalTechnical Overview:

I’m observing a clean Inverse Head & Shoulders pattern forming on the 4-hour chart:

✅ Left Shoulder: Formed around 3,270

✅ Head: Rejection and reversal near 3,190

✅ Right Shoulder: Higher low around 3,300

✅ Neckline: Approx. 3,350 zone

Price has broken above the neckline area and is currently retesting it as support, which strengthens the bullish case.

Trade Plan:

🔹 Entry: Current zone near 3,340–3,350 retest

🔹 Targets:

🎯 TP1: ~3,400 (recent structural high)

🎯 TP2: ~3,450–3,460 (major resistance block)

🔹 Stop Loss:

Below the right shoulder area at ~3,290 for risk containment

Rationale:

1. Inverse Head & Shoulders is a classic bullish reversal pattern

2. Break and retest of neckline suggests buyers stepping in

3. Momentum shift confirmed by higher low structure

Potential Path:

I expect price to bounce from the neckline retest and push towards the 3,400 psychological level. If momentum persists, continuation to the 3,450 resistance block is likely.

📊 Risk to Reward Estimate:

Approx. 1:2 to 1:3 depending on target selection

📝 Note:

This analysis is for educational purposes—always manage your risk and validate entries with your own confirmations.

Gold Rebounds Sharply Amid Fed Bets and Risk-Off ShiftsYesterday, the precious metal faced selling pressure as investor risk appetite improved following record highs in major U.S. stock indices.

However, that bearish trend is quickly reversing due to renewed dip-buying activity. Early this morning, gold is trading around $3,335, marking a sharp rebound of over $40 from the previous session.

Expectations of Fed rate cuts and concerns over U.S. fiscal health continue to weigh on the USD, while geopolitical risks may further support the safe-haven appeal of gold.

📊 Key Economic Events to Watch This Week

Tuesday: Reserve Bank of Australia’s monetary policy meeting

Wednesday: FOMC minutes from June’s Fed meeting

Thursday: U.S. weekly jobless claims data

Stay alert – volatility may rise as these events unfold.

Elliott Wave Analysis – XAUUSD – July 8, 2025

🔎 Momentum Analysis

On the daily (D1) timeframe, momentum is currently declining. At the same time, the 4H momentum is showing signs of reversing downward. This suggests a likely short-term corrective decline, which provides a basis for projecting potential Elliott Wave patterns.

🌀 Elliott Wave Structure

On the 4H chart, I currently see two main possible scenarios:

Scenario 1: Contracting Triangle Correction (abcde – purple)

This scenario assumes a contracting triangle correction labeled abcde in purple.

The market appears to be in wave d (purple), which is unfolding as a wxy corrective structure. Currently, it is likely in wave y.

The projected target for the end of wave y is between 3393 – 3402.

However, due to the declining momentum, I expect a short-term pullback to the 3318 – 3321 region before price resumes upward to complete wave d.

Scenario 2: Larger WXY Correction

In this case:

Wave W has completed as a standard 3-wave abc.

Wave X has also completed as a double zigzag.

Wave Y appears to be forming a small contracting triangle abcde in red.

Currently, the price is being compressed between the upper and lower boundaries of the red triangle, suggesting that it is in the final wave e.

In this scenario, the projected retracement also aligns with the 3318 – 3321 zone. After completing wave e, price is expected to break out strongly above the upper boundary of the red triangle.

✅ Strategic Conclusion

Both scenarios point to a confluence zone at 3318 – 3321, making this a key potential buying area. Two trading approaches can be considered:

Aggressive Entry: Buy within the 3318 – 3321 range.

Conservative Entry: Wait for a confirmed breakout above the red triangle before entering a long position.

📈 Suggested Trade Plan

Buy Zone: 3318 – 3321

Stop Loss: 3308

Take Profit 1: 3342

Take Profit 2: 3362

Take Profit 3: 3393

Gold Bounces Back: Quick Recovery from 3300 SupportGold is now trading above this week's pivot at 3316, which is a positive development. This suggests the bulls are regaining control after yesterday's decline, Rather than breaking down after the failed attempt at 3360, gold is showing it can hold key support and bounce back quickly. This resilience is encouraging for the medium-term outlook.

Key Levels Moving Forward:

Support: 3300 (now proven)

Pivot: 3316 (currently holding above)

Resistance: 3360 (still the key level to break)

XAUUSD – Downtrend broken, bullish momentum returnsXAUUSD has broken above the descending trendline and is currently retesting the breakout zone around $3,330. If this area holds, price may continue to rise toward $3,352 and potentially $3,380.

Current price action suggests a bullish continuation pattern is forming. The bullish outlook would be invalidated if price drops below $3,255.

From a fundamental perspective, gold is supported by HSBC’s upward revision of its 2025 forecast, strong central bank demand, and rising geopolitical tensions – all reinforcing a medium-term bullish outlook.

Elliott Wave Analysis – XAUUSD – June 8, 2025🌀 Elliott Wave Structure Timeframe: H4

Currently, price action is overlapping with multiple abc correction patterns. To reduce noise and gain a clearer perspective, I’ve shifted the analysis to the H4 timeframe.

From the 3500 level down to now, the entire corrective move has been composed of overlapping abc patterns rather than sharp, impulsive rallies. This suggests we are likely forming a contracting triangle correction in the form of abcde (green) as shown on the chart.

At the moment, price appears to be in wave d (green), which is unfolding as a wxy structure (red).

Trading during triangle corrections is particularly challenging due to the complex interweaving of corrective waves. Additionally, price is consolidating within the Volume Profile’s high-liquidity zone, as shown on the chart. Therefore, it is best to remain patient and wait for the triangle pattern to complete.

📉 Momentum

Daily (D1) momentum: Currently showing signs of a bearish reversal → suggesting that price may move sideways or lower this week. (Toward the end of a triangle, price tends to compress and lose clear directional bias.)

H4 momentum: Also shows reversal signals, and a strong bearish candle has recently formed. Thus, a short-term bearish bias is preferred until H4 momentum reaches the oversold region.

🎯 Price Targets

Since the market is currently forming overlapping abc structures, setting precise wave targets is difficult. Therefore, I rely on Volume Profile zones to define key levels:

3342 Resistance Zone: Marks the boundary between high and low liquidity areas → This is a Sell Zone, supported by confluence with D1 and H4 momentum signals.

3294 Support Zone: Represents the lower boundary of high liquidity → This is the projected end of wave X (red) and serves as our Buy Zone.

🧭 Trade Plan

🔻 Sell Zone:

Entry: 3340 – 3342

SL: 3350

TP1: 3320

TP2: 3300

🔺 Buy Zone:

Entry: 3295 – 3293

SL: 3285

TP1: 3312

TP2: 3342

TP3: 3390

📌 Personal Note:

At this stage, I prefer to wait for the abcde triangle to complete or for more structural confirmation. If you decide to trade, focus on short-term setups with reduced position size to manage risk during this complex correction phase.

Gold Breaks Below 3300 – Smart Buy Opportunity ... Gold Breaks Below 3300 – Smart Buy Opportunity or Warning of a Larger Downtrend?

🧭 Weekly Kickoff: Is the Sell-off Really That Dangerous?

Gold opened this week with a sharp drop, falling to 3306 USD and even breaching the psychological 3300 level to dip into the 329x region. While this could be alarming at first glance, it's more likely a liquidity sweep than the beginning of a sustained downtrend.

The market seems to be preparing for accumulation before the next big move.

🌐 Macro Highlights Impacting Gold

US inflation continues to cool → creates room for the Fed to ease policy if needed

FOMC minutes due this week → traders eye clues for timing of potential rate cuts

Middle East tension eases → safe-haven demand slightly reduced

Trump’s new tax legislation approved → may increase US debt pressure

US–China trade war sees temporary pause → easing short-term geopolitical risk

Overall, this phase resembles a classic consolidation, where breakout potential is growing rapidly.

📉 Technical Outlook – CP Pattern in Focus

A Continuation Pattern (CP) is forming – typically a sign of trend continuation after correction. This suggests current downside movement could be a technical pullback rather than a true reversal.

Price rejected resistance at 3336, broke below 3323 support, and quickly tested the 3303 region – a highly sensitive short-term support.

If the 3293 level is breached, the next liquidity pool lies around 3278 USD, which could trigger aggressive buy interest.

📌 Key Trading Plan – 04 July

🔵 BUY ZONE

3294 – 3292

Stop Loss: 3288

Take Profit Targets: 3298 → 3302 → 3306 → 3310 → 3315 → 3320 → 3330

🔴 SELL SCALP

3324 – 3326

Stop Loss: 3330

Take Profit: 3320 → 3316 → 3312 → 3308 → 3304 → 3300

🔴 SELL ZONE

3350 – 3352

Stop Loss: 3356

Take Profit: 3346 → 3340 → 3335 → 3330 → 3320

💡 Market Insight Today

This is a crucial “decision zone” for gold – the tug-of-war between bulls and bears is heating up. Will gold bounce off the 3290s and resume its upward journey, or are we heading for a deeper correction?

🧠 Keep an eye on the CP formation and price behaviour near key levels.

⚠️ Breakout traders should be patient – the real move may just be loading.

Gold Slips Sharply to Start the Week – What’s Next?Hello everyone! What are your thoughts on gold today?

As the new trading week kicks off, gold has taken a sharp dive, shedding over 200 pips and currently hovering around $3,316 at the time of writing.

The short-term bearish momentum remains intact, especially after breaking below the key $3,325 support level. The confluence of the EMA 34, EMA 89, and the former support-now-resistance zone forms a critical ceiling. Unless the bulls manage to reclaim this area, the downward trend is likely to persist, keeping sellers in control.

So, what’s your outlook for gold? Is this just a dip—or the start of a deeper correction?

Gold Weekly Analysis : Monday 07/07/2025Gold made a solid attempt to break higher last week, but that 3360 resistance level (previous week's R1) proved to be a tough line to break. The bulls pushed hard but couldn't secure a clean breakout, and now we're seeing some of that momentum fade.

Price opened with a decline today, showing some weakness after last week's failed breakout attempt. This is typical behavior after hitting resistance, some profit-taking and repositioning is expected.

This week's pivot is at 3316, which is actually ascending from last week's 3308 pivot. This is still a positive sign and suggests the underlying structure remains constructive despite the recent pullback.

In the bigger timeframe, gold is still consolidating within a range. We're not seeing a complete breakdown of the bullish structure yet, but rather a pause after the rejection at key resistance.

Critical Levels to Watch:

Upside Breakout Level: Last week's high around 3360 remains the key level bulls need to reclaim for any meaningful continuation higher.

Defense Zone: The 3300-3308 area is crucial support. This zone encompasses both the psychological 3300 level and the previous week's pivot. Bulls need to defend this area to maintain their recent gains.

If price slides below 3300, we could see a decline back toward that recent swing low area. This would signal that the bulls have lost control of the near-term momentum.

Gold Holds the Line and Rallies – A Strong Weekly Close in SightAfter holding firm at the support level around $3,250 per ounce, gold is on track to end this shortened trading week with a notable gain. This is an encouraging sign for investors, highlighting that gold’s appeal remains strong despite recent volatility.

The recent sell-off was not entirely unexpected, as the market recalibrates its interest rate expectations. However, the long-term bullish trend for gold remains intact, even as the price consolidates within a narrow range.