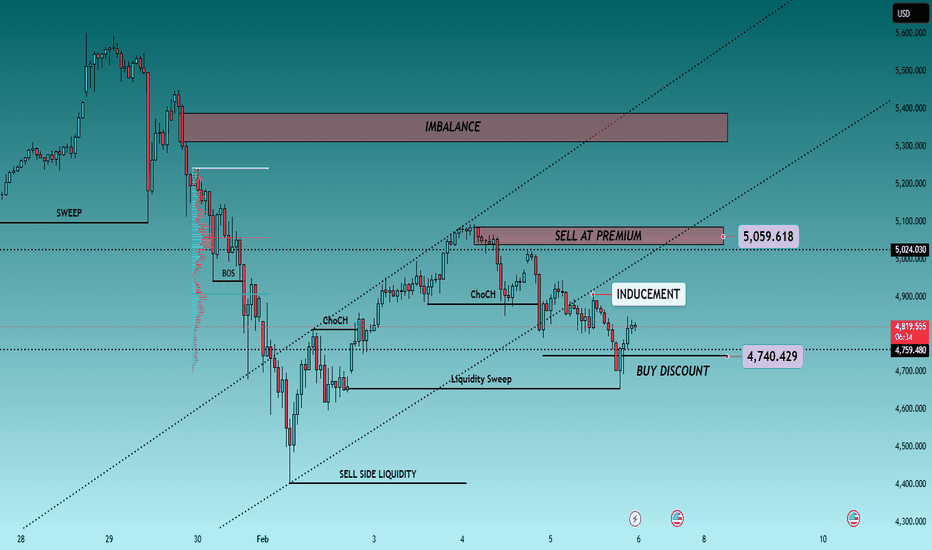

Gold Trades the Extremes as News Fuels Liquidity Games🟡 XAUUSD – Intraday Smart Money Plan (H1)

📈 Market Context

Gold remains highly sensitive today as markets react to President Trump’s announcement, keeping USD flows unstable and risk sentiment mixed. This environment favors liquidity engineering, not trend chasing. Institutions are exploiting news-driven emotions to distribute at premium and accumulate at discount.

With volatility elevated, expect false breaks, inducements, and stop hunts around key levels rather than clean directional moves.

🔎 Smart Money Technical Read

Current State:

Price is trading inside a managed range after a buy-side liquidity grab. Intraday structure shows distribution from premium, while downside moves are corrective rather than impulsive.

Core Idea:

Let price come to Smart Money — sell premium or buy deep discount only after confirmation.

Structure Observations:

• Buy-side liquidity already delivered

• Multiple CHoCH signals confirm corrective flow

• Price respecting descending internal channel

• Discount aligns with prior sell-side liquidity

• Premium capped by institutional supply & imbalance

Liquidity Zones & Key Levels

• 🔴 SELL GOLD: 5,020 – 5,060

• 🟢 BUY GOLD: 4,720 – 4,760

🧠 Institutional Expectation

Inducement → Liquidity sweep → CHoCH / MSS → BOS → displacement → OB / FVG entry → expansion

🔴 SELL Scenario — Premium Distribution

Sell Zone: 5,020 – 5,060

Conditions:

✔ Price taps premium / prior sell-high

✔ News-driven push into resistance

✔ Bearish CHoCH or MSS on M5–M15

✔ Downside BOS confirms intent

✔ Entry via bearish OB or FVG

Targets:

• 4,950 — internal reaction

• 4,820 — range low

• Trail if momentum expands

🟢 BUY Scenario — Discount Accumulation

Buy Zone: 4,720 – 4,760

Conditions:

✔ Sweep below sell-side liquidity

✔ Discount relative to HTF range

✔ Bullish CHoCH / MSS on LTF

✔ Strong displacement confirms buyers

✔ Entry from refined bullish OB

Targets:

• 4,850 — first reaction

• 4,980 — internal liquidity

• 5,050+ — if expansion resumes

⚠️ Risk Notes

• Expect fake breakouts during headlines

• No trade without structure confirmation

• Reduce size near news spikes

• Patience > prediction

📍 Summary

Gold is a Smart Money range play today:

• Sell strength at premium

• Buy weakness only at deep discount

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.

Xauusdanalysis

Bearish Rejection From Supply, Targets Below

Market Structure

Price previously made a blow-off top (sharp impulsive high, marked by the red arrow), followed by a strong bearish reversal, breaking short-term structure.

The subsequent bounce formed a lower high, confirming a bearish market structure shift on the intraday timeframe.

Key Zones

Gray zone (≈ 4,880–4,950): Former demand → now supply / resistance.

Price retested this area and rejected, which is classic bearish continuation behavior.

Blue zone (≈ 4,520–4,600): Major support / demand zone from the prior swing low.

Trade Idea Logic (as drawn)

Entry: Short on rejection from the gray supply zone after weak bullish retracement.

1st Target: Around 4,714 — interim support / liquidity pool.

2nd Target: The blue support zone — completion of the bearish leg and likely reaction area.

Price Action Clues

Retracement into resistance was corrective (overlapping candles), not impulsive → favors sellers.

Failure to reclaim the gray zone = sellers still in control.

Momentum points downward, aligning with the projected path.

Invalidation

A clean 45-min close and hold above the gray supply zone would weaken the bearish bias and suggest deeper consolidation or reversal.

XAUUSD (H2) – Liam ViewXAUUSD (H2) – Liam View

USD strength continues to limit gold | Sell-side structure still active

Quick summary

Gold remains under pressure on the H2 timeframe as a firm US Dollar keeps weighing on precious metals. The recent rebound looks corrective and lacks solid acceptance above supply. With markets positioning ahead of the delayed US Non-Farm Payrolls on Feb 11, volatility may increase, but structure still favours selling rallies.

Macro context

A stronger USD generally acts as resistance for gold and silver.

If the current USD rebound sustains, downside pressure on gold can continue.

Positioning ahead of US labour data increases the risk of liquidity-driven moves.

Technical view (H2)

After a sharp sell-off, price bounced from demand but stalled below previous distribution.

Key zones

Major sell zone: 5115 – 5130, extending toward 5535

Current reaction area: around 5000

Key demand / liquidity base: 4550 – 4580

Lower highs below resistance keep sell-side control intact unless price reclaims 5115 decisively.

Trading scenarios

Primary: Sell rallies into 5000 → 5115, targeting 4550

Continuation: Clean break below 4550 opens further downside

Invalidation: Only strong H2 acceptance above 5115 shifts bias bullish

Execution notes

Expect stop runs near data releases.

Wait for level reaction, not candle chasing.

Bias: sell rallies until structure changes.

— Liam

BTCUSD (1H) – Bearish Continuation | Trendline Breakdown IdeaMarket Structure

Bitcoin remains in a clear descending channel on the 1H timeframe. Price has consistently respected the downward sloping trendline, confirming a strong bearish structure with lower highs and lower lows.

Technical Confluence

Trendline Resistance (Red): Multiple rejections validate seller dominance.

Auto Pitchfork: Price is trading below the median line, indicating continuation toward the lower parallel.

Dynamic Support (Green): The recent breakdown below channel support signals bearish continuation rather than a reversal.

Balance of Power (BoP): Reading around -0.38 reflects sustained selling pressure with no bullish divergence.

Price Action

A brief consolidation failed to hold, followed by a strong bearish impulse that broke key intraday support. The current move suggests momentum-driven continuation, not exhaustion.

Trade Idea

Bias: Bearish

Sell Zone: Pullback toward broken support / descending trendline

Targets:

First target: Previous minor low

Extended target: Lower pitchfork boundary / demand zone

Invalidation: Sustained close above the descending trendline

Conclusion

As long as BTC remains below the descending trendline and pitchfork median, the path of least resistance is downward. Any retracement into resistance is likely to be a selling opportunity unless market structure shifts.

Always manage risk and wait for confirmation.

XAUUSD (H45) – Liam's AnalysisXAUUSD (H45) – Liam View

Geopolitical risk rising | Gold reacting from demand

Gold is stabilizing around the 4745 demand zone, where price is reacting from the rising trendline after a corrective sell-off. The current structure suggests short-term accumulation, with buyers defending value rather than aggressive selling continuation.

From a macro perspective, escalating tensions between the US and Iran—especially risks around the Strait of Hormuz, a key global oil route—are increasing geopolitical uncertainty. Historically, this type of risk environment tends to support safe-haven demand, keeping downside pressure on gold limited while volatility expands.

Technical structure (from the chart)

Key buy zone: 4745 (trendline + demand alignment)

Immediate resistance / liquidity: 5000 – 5100 (buyside liquidity)

Upper imbalance (FVG): 5250 – 5300

Major supply: 5575 (higher-timeframe sell zone)

Price holding above 4745 keeps the bounce scenario active, with potential rotation toward 5000–5100 to rebalance liquidity. Acceptance above this zone would open a path toward the FVG area, where sell-side reactions are expected.

Failure to hold 4745 would invalidate the short-term bullish thesis and reopen downside exploration.

Liam’s takeaway

This is not blind risk-on buying — it’s a measured response to rising geopolitical stress and technical demand.

Trade the zones.

Respect the volatility.

Let price confirm before committing.

— Liam

UPDATE ON "XAUUSD" BULLISH IDEA Symbol + Timeframes: XAUUSD— HTF (Daily) & ITF (H4)**

Bias: Bullish (as long as price holds above key DAILY FAIR VALUE GAP)

Structure: – Higher lows intact on HTF and SHORTS LIQUIDATED

– Intermediate pullbacks respecting demand zones

Key Levels: – Support: 4820.360

Context: – Price reacting to confluence (fair value gap + structural support)

Plan: – Look for corrective pullback to support for continuation setups , current buy setup would be inbetween 4820-4815.

– Targets based on structural levels - (I) 5090.890 (ii) 5567 (iii) 5599

This is analysis, not trade advice.

XAUUSD – H4 Technical and Macro AnalysisXAUUSD – H4 Technical & Macro Outlook: Liquidity Compression Ahead of Fed Expectations | Lana ✨

Gold is currently trading in a tight compression structure, while macro conditions are beginning to tilt in favour of precious metals. Weak US labour data and a growing probability of Fed rate cuts are putting pressure on the US Dollar, creating an important backdrop for the next move in gold.

At the same time, price action on XAUUSD suggests the market is approaching a key liquidity-driven decision point.

📈 Technical Structure & Price Behaviour

After failing to sustain above the upper supply zone near 5,200–5,300, gold entered a corrective decline and is now trading inside a descending wedge, bounded by falling resistance and rising support.

Price is currently holding around 4,800–4,830, a short-term balance area.

Repeated rejections from descending resistance indicate supply remains active.

At the same time, sell-side liquidity is clearly resting below the structure, near 4,570–4,550.

This behaviour suggests the market is not trending yet, but preparing for a liquidity expansion.

🔍 Key Levels to Monitor

Near-Term Resistance: ~5,070 – 5,130

A key reaction zone aligned with Fibonacci retracement and prior structure.

Compression Pivot: ~4,800 – 4,830

Holding above this area keeps price in consolidation mode.

Sell-Side Liquidity: ~4,570 – 4,550

A likely downside target if the structure breaks lower.

Major Supply (Higher TF): ~5,500

Still the upper boundary for any medium-term bullish continuation.

🎯 Likely Scenarios

Scenario 1 – Liquidity Sweep Lower (Base Case):

If price fails to hold the rising support, gold may dip toward 4,570–4,550 to clear sell-side liquidity. Such a move would likely be corrective, not a trend reversal, especially given the macro backdrop.

Scenario 2 – Bullish Break from Compression:

If price accepts above 5,070–5,130, the descending structure would be invalidated, opening the door for a recovery toward higher resistance zones.

🌍 Macro Context: USD Weakness & Fed Expectations

Recent US labour data has reinforced concerns about economic momentum:

JOLTS job openings fell sharply below expectations.

ADP employment growth slowed significantly.

CME FedWatch now shows a rising probability of a March rate cut, up from earlier in the week.

As a result, the US Dollar Index (DXY) has struggled to extend its weekly gains, trading slightly lower while remaining near recent highs. This environment is typically supportive for gold, especially during corrective phases.

Upcoming NFP data will be a key catalyst and may act as the trigger for the next liquidity expansion.

🧠 Lana’s View

Gold is currently in a waiting phase, balancing between technical compression and shifting macro expectations. The focus should remain on how price reacts at the edges of the structure, rather than predicting direction too early.

Patience is essential here. The next move is likely to be fast and liquidity-driven once the market commits.

✨ Respect the structure, follow the levels, and let the market reveal the next expansion.

XAUUSD – Brian | H1 Weekend AnalysisXAUUSD – Brian | H1 Weekend Outlook: Volatility Reset & Range Opportunities

Gold delivered a sharp volatility spike in early Asia on Feb 6, flushing down toward the 4,680 area before quickly reclaiming ground as risk sentiment stabilized and the USD softened. The earlier drop looks driven by position reduction and portfolio rebalancing (traders covering equity losses), rather than a clean trend continuation. The recovery back above 4,830 confirms that buyers are still active when price returns to value.

Market Structure (H1)

On the H1 chart, price has transitioned into a two-way environment:

We’ve moved from an impulsive drop into a descending channel / corrective structure.

The rebound is strong, but still behaves like a corrective bounce inside the larger pullback.

This sets up a high-probability range/rotation into the weekend, where liquidity runs and mean-reversion moves can appear.

Key Zones To Watch

1) Upper Supply / Sell Pressure

5,100 – 5,200 zone (overhead supply)

This is the main area where rallies may face profit-taking and sell pressure. If price tags this zone and stalls, the market may rotate back down.

2) Mid-Range Reaction Area

~4,820 – 4,900 (current balance / pivot area)

This is the “decision zone.” Holding above it supports another push higher; losing it increases the probability of a deeper pullback.

3) Lower Demand / Liquidity Floor

4,650 – 4,700 (demand + volatility base)

The prior flush low area. If the market revisits this zone, watch for absorption and a potential rebound—especially if volatility spikes again.

Weekend Game Plan (Brian Mindset)

Primary expectation: sideways rotation with spikes (weekend-style volatility)

Best approach: trade reactions at the zones, not in the middle of the range

Bias handling:

Above the pivot → favor pullback-buys toward resistance

Into supply → be alert for rejection and rotation sells

Into demand → watch for absorption before considering longs

In a volatility-reset phase, levels and reactions matter more than prediction.

✅ Follow the TradingView channel to catch the next structure update early and exchange ideas with Brian.

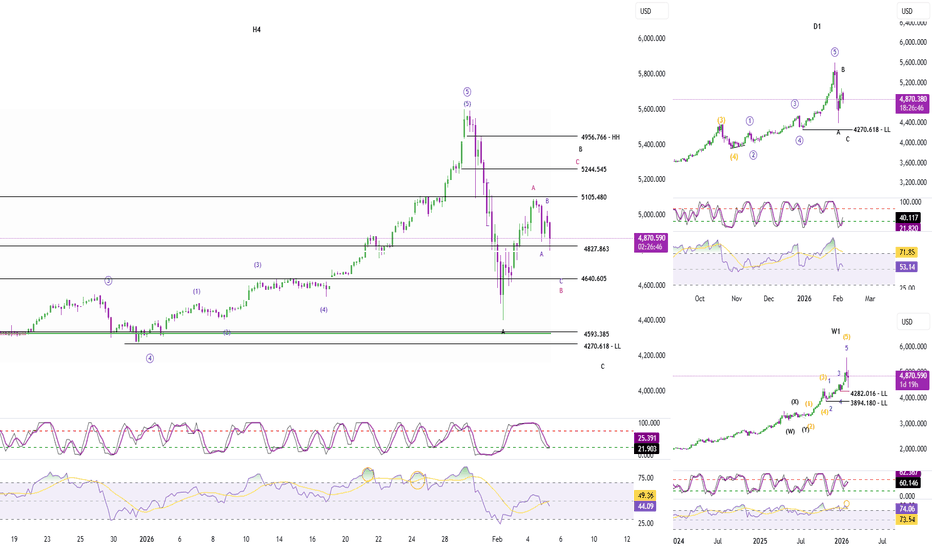

Elliott Wave Analysis XAUUSD – February 6, 2026

Momentum

– Daily (D1) momentum is currently rising, indicating that the upward move may still continue for another 1–2 days, until D1 momentum reaches the overbought zone.

– H4 momentum has started to reverse to the upside, therefore we expect a bullish move over the next few H4 candles.

– H1 momentum is currently in the overbought zone and is showing early signs of a potential reversal. As a result, within the next few hours, a short-term pullback or momentum reversal on H1 is expected.

Wave Structure

Daily (D1) Wave Structure

On the D1 timeframe, momentum continues to rise while price has not yet expanded strongly. This suggests that the corrective rebound of wave B is still in progress.

We expect wave B to complete once D1 momentum reaches the overbought zone, preparing the market for the next phase.

H4 Wave Structure

On the H4 chart, momentum is reversing to the upside, which supports a short-term bullish move of approximately 4–5 H4 candles.

This advance is still considered part of wave B. Once wave B is completed, price is expected to continue into wave C (black) as previously outlined.

H1 Wave Structure

Within black wave B, we are observing a red ABC corrective structure, with price currently trading inside red wave B.

Unfortunately, price did not trigger our intended entry from yesterday’s setup.

For now, we wait for H1 momentum to reverse lower and move into the oversold zone. At that point, if both H4 and H1 momentum align and reverse upward, we will have a strong momentum confluence to consider new entries.

– If price holds above 4658: this will confirm that an H4 bottom has formed at 4658, and price is likely to continue higher in line with H4 momentum.

– If price breaks below 4658: this would indicate that wave B may still be unfolding, and we will then focus on the 4640 – 4597 zone. This area represents high liquidity, combined with the Fibonacci zone identified in yesterday’s analysis, making it a key region to look for buy opportunities.

Risk Management Notes

At this stage, price volatility remains very wide. The potential trading range spans more than 500 pips, which makes placing limit orders extremely difficult.

Therefore, the preferred approach is direct execution, based on:

– Momentum behavior

– Key price target zones

– Clear reversal candlestick patterns

Strict risk management is critical in the current market environment:

– Small accounts: risk no more than 5% per trade

– Large accounts: risk no more than 3% per trade

Proper position sizing at this time is essential to protect trading capital during periods of elevated volatility.

Elliott Wave Analysis XAUUSD – February 5, 2026

1. Momentum

Weekly Momentum (W1)

– Weekly momentum is currently showing signs of a bearish reversal. However, we need to wait for the weekly candle to close in order to confirm this reversal.

– If the reversal is confirmed, the market is likely to enter a declining or sideways phase lasting at least several weeks.

Daily Momentum (D1)

– Daily momentum is currently rising, which suggests that the market may continue to move higher or consolidate sideways over the next few days.

– One important point to watch closely: if D1 momentum moves into the overbought zone without price creating a new high, this would be a strong signal confirming that the long-term bearish trend remains intact.

H4 Momentum

– H4 momentum is currently in the oversold zone and is preparing to reverse.

– This suggests that a bullish reversal on the H4 timeframe is likely to occur today or very soon.

2. Wave Structure

Weekly Wave Structure (W1)

– On the weekly chart, the 5-wave structure (1–2–3–4–5) has already completed, and price is now moving within a corrective phase.

– Combined with the potential bearish reversal in weekly momentum, if confirmed, this corrective move is expected to extend for at least several weeks.

Daily Wave Structure (D1)

– On the daily chart, the sharp and steep decline strongly suggests a 5-wave structure forming wave A.

– The current upward move is therefore considered wave B.

– Wave B structures are often complex, so at this stage we should focus on monitoring D1 and H4 momentum, together with projected price targets, to identify where wave B may complete.

– When price reaches the target zones while both D1 and H4 momentum are in overbought territory and begin to reverse, this will confirm the completion of wave B.

3. H4 Wave Structure

– On the H4 timeframe, black wave A has already formed, and price is currently developing wave B.

– Rising daily momentum indicates that the bullish move may continue for a few more days, while H4 momentum is preparing to turn higher.

– This supports the view that wave B is still in progress.

– Wave B may form at least a three-wave ABC structure (red).

– At the moment, price may be developing red wave B, within which we can observe a smaller three-wave structure forming.

– Price is currently in blue wave C.

Blue wave C has two main projected targets:

– 4827: where wave C equals wave A

– 4640: where wave C equals 1.618 of wave A, aligning with a major liquidity zone

– I expect price to decline into the 4640 area to look for a buying opportunity.

4. Trading Plan

– Current candle ranges remain extremely wide, making stop-loss placement difficult and requiring wider stops to avoid being taken out prematurely.

– Therefore, strict risk management is essential.

– Small accounts: maximum risk 5% per trade

– Large accounts: maximum risk 3% per trade

Trade setup:

– Buy Zone: 4642 – 4640

– Stop Loss: 4600

– TP1: 4827

– TP2: 5105

– TP3: 5244

What’s Next for Gold?Gold’s sharp rebound from the recent lows has reignited calls for an immediate continuation toward new highs. But the structure tells a more nuanced story.

The rally so far looks less like fresh upside momentum and more like a classic relief move after forced liquidation.

The recent selloff flushed leverage aggressively. Stops were triggered, weak hands exited, and positioning reset fast. What followed wasn’t accumulation — it was short-covering and mean reversion.

This matters because markets that truly want to trend higher don’t need to retrace this violently first.

The key zone: supply above, not support below

Gold is now approaching a well-defined supply band, roughly around the 5,250–5,300 region.

This zone is important for three reasons:

It was a prior distribution area before the breakdown

It aligns with VWAP / value rejection from the last impulse down

It represents the level where trapped longs may look to exit breakeven

In other words, this is where selling interest naturally returns, not where new longs should feel comfortable.

If Gold were truly in a strong continuation phase, it would have:

Built a base

Absorbed supply

Then expanded higher

Instead, price is walking straight back into overhead resistance.

Liquidity behavior doesn’t confirm strength

Despite the bounce, liquidity behavior remains defensive.

• Rallies are corrective, not impulsive

• Volume expands on down moves, not up moves

• Buyers are reactive, sellers are proactive

This is typical of a market inside a larger corrective phase, not the start of a fresh leg higher.

Gold often rallies hardest after fear peaks — but it doesn’t trend sustainably until supply is fully absorbed. That process takes time.

Macro tailwinds aren’t immediate triggers

Yes, long-term macro drivers for gold remain intact.

But markets don’t move on narratives alone — they move on timing and positioning.

If global liquidity remains tight or even mildly restrictive, gold doesn’t collapse — but it also doesn’t trend freely. It oscillates, frustrates, and cleans up positioning.

That’s exactly what current structure suggests.

The probable path from here

From a trader’s perspective, the higher-probability sequence is:

• Price tests the 5,250–5,300 supply zone

• Sellers re-engage into strength

• Volatility compresses or rejection appears

• Market either ranges or pulls back before the next real move

A clean break and acceptance above this zone would invalidate the view — but until then, this is resistance, not confirmation.

Bottom line

Gold’s bounce is real — but bounces are not trends.

This move looks like:

A reaction, not initiation

Short-covering, not accumulation

Repair work, not breakout

Strong markets build value below resistance.

Weak or corrective markets rush into it.

Right now, Gold is doing the latter.

Bullish Pullback Into Demand, Targeting Prior Resistance

Chart Analysis

Market structure:

Overall structure shows a downtrend → base → higher low, suggesting a short-term bullish correction rather than a full trend reversal (yet).

Demand / Entry zone (green box ~4,900):

Price previously consolidated here and broke higher, turning this zone into valid demand. The current pullback into this area looks healthy — classic buy-the-dip behavior if it holds.

Price action:

The pullback is controlled (no impulsive bearish candles), which supports the idea of buyers still defending this level.

Resistance / Supply (red box ~5,200):

This zone aligns with prior breakdown structure and strong selling pressure. Logical profit target for longs and likely reaction area.

Projected path (white arrows):

A bounce from demand → minor higher high → continuation into resistance is a textbook liquidity-driven move.

Bias

Short-term bias: Bullish while above demand

Invalidation: Clean breakdown and close below the green zone

Context: Counter-trend long within a larger bearish structure — manage risk tightly

XAUUSD – Brian | H4 Technical AnalysisXAUUSD – Brian | H4 Technical Outlook – Selling Bias After Exhaustion Rally

Gold has completed a strong upside expansion and is now showing clear signs of trend exhaustion on the H4 timeframe. After printing a sharp impulse leg higher, price failed to sustain acceptance above the recent highs and quickly transitioned into a deep corrective move, signalling a shift in short-term market control.

From a structural perspective, the market has moved from impulse → distribution → correction, favouring a selling bias while price remains capped below key resistance.

Market Structure & Fibonacci Context

The recent rally stalled near the upper resistance zone, followed by an aggressive rejection.

Price has retraced deeply into the Fibonacci 0.618–0.75 area, confirming that the move lower is not a minor pullback but a meaningful correction.

Current price action suggests lower highs are forming, keeping selling pressure active on rebounds.

As long as price fails to reclaim and accept above the prior breakdown levels, the bearish structure remains valid.

Key Zones to Watch

Primary SELL Zone

5,716 – 5,866

This is the major supply and sell-liquidity zone on H4. Any corrective rally into this area is likely to attract sellers, especially if price shows hesitation or rejection.

Intermediate Reaction Zone

Around the 0.5–0.618 Fibonacci retracement area, where short-term rebounds may stall before continuation lower.

Downside Targets / Demand

The lower support zone near 4,800–4,850 remains the first key downside area to monitor.

Deeper continuation would expose the 4,600–4,500 region, where broader demand may attempt to absorb selling pressure.

Macro Context (Brief)

Fundamentally, gold is facing headwinds from persistent uncertainty around interest rate expectations. Recent central bank commentary continues to signal caution toward near-term rate cuts, keeping real yields supported and limiting gold’s upside in the short term. This backdrop aligns with the current technical correction and distribution phase.

Trading Outlook

Bias: Selling / sell-on-rallies

Focus: Selling corrective rebounds into resistance zones

Risk note: Avoid chasing price at lows; let structure and levels guide entries

In this phase, patience is key. Selling strength at predefined zones offers higher probability than predicting bottoms.

Refer to the chart for Fibonacci levels, structure shift, and highlighted sell zones.

✅ Follow the TradingView channel to receive early updates on market structure, liquidity shifts, and high-probability zones.

XAUUSD – Bullish Reversal from Demand Zone (H1)Gold (XAUUSD) was previously trading inside a well-defined ascending channel, indicating a strong bullish trend. After reaching the upper boundary, price faced a sharp bearish correction and broke down from the channel.

Following this drop, price found strong support near the 5,000 demand zone, where buyers entered aggressively. From this area, price formed a V-shaped / rounded bottom recovery, signaling a shift in momentum from bearish to bullish.

Currently, price has reclaimed and is holding above the demand zone, showing strong bullish continuation. As long as price remains above this zone, the upside bias remains intact.

Trade Bias: Bullish above the demand zone

Entry Zone: Demand zone retest or bullish continuation

Targets:

Target 1: 5,120

Target 2: 5,198

Invalidation:

A strong break and close below the demand zone would invalidate the bullish setup.

This setup aligns with demand–supply dynamics, trend continuation, and a momentum shift, favoring buyers in the near term.

XAUUSD – Trade key zones with discipline, volatility up.XAUUSD – Volatility Expansion, Trade Key Zones With Discipline (H1)

Market Context

Gold is trading in a high-volatility recovery phase after a sharp sell-off, with price now rotating aggressively between key technical zones. This behavior reflects liquidity rebalancing under macro uncertainty, rather than a clean trend.

Ongoing uncertainty around Fed leadership changes, future monetary policy direction, and headline risk keeps gold highly sensitive to flows. In this environment, reaction at levels matters more than direction.

➡️ Market state: fast moves, deep pullbacks, strong reactions – avoid emotional entries.

Structure & Price Action (H1)

Price is holding inside a rising corrective channel, indicating a recovery structure.

Higher lows are forming, but bullish structure is still conditional, not fully confirmed.

Upper zones show hesitation and rejection, while lower zones attract strong demand.

Expect sharp swings and fake breaks during this phase.

Key insight:

This is a reaction-driven market. Trade the zones, not the noise.

🎯 Trading Plan – MMF Style

🔵 Primary Scenario – Buy the Pullback (Reaction-Based)

BUY Zone 1: 5,008 – 4,990

• Short-term demand

• 0.618 Fib retracement

• Channel support

BUY Zone 2: 4,670 – 4,650

• Major demand

• Prior liquidity sweep area

• Strong structural base

➡️ Only consider BUYs after:

Clear bullish rejection candles

Or a Higher Low confirmed on H1

🔴 Alternative Scenario – Sell at Upper Reaction Zones

SELL Zone 1: 5,250 – 5,275

• Prior resistance

• Mid-channel reaction zone

SELL Zone 2: 5,560 – 5,575

• Major extension / supply zone

• Fibonacci expansion resistance

➡️ Look for:

Rejection wicks

Loss of bullish momentum on H1

🎯 Targets (TP Zones)

Upside Targets (from BUY setups):

TP1: 5,253

TP2: 5,573

Downside Targets (if SELL scenario plays out):

TP1: 5,008

TP2: 4,670

❌ Invalidation

A confirmed H1 close below 4,650 invalidates the recovery structure

Requires a full reassessment of bias

Gold Faces Key Resistance as Pullback Risk BuildsChart Analysis

Gold is in a short-term recovery phase after a clear bearish structure earlier (multiple BOS to the downside). The market has since printed a CHoCH, signaling a potential shift toward bullish momentum, and price is now trading inside a broader discount zone (green box), which supports the recovery narrative.

However, price is currently stalling below a key resistance area around 4995, where multiple technical factors converge:

Prior structure resistance (BOS level)

Fair Value Gap (FVG) mitigation

Local equal highs / liquidity resting above

This makes the current zone a decision area rather than a clean breakout point.

The highlighted POI between ~4840 – 4790 aligns well with:

Demand zone

FVG support

Previous structure support

A pullback into this zone would be technically healthy and could offer a higher-probability continuation setup if bullish reaction and displacement appear.

Bias summary:

Short-term: Cautious bullish, but vulnerable to pullback

Resistance: ~4995

Support / POI: 4840 – 4790

Bullish continuation requires: Strong break and acceptance above resistance

XAUUSD – Brian | H2 Technical AnalysisXAUUSD – Brian | H2 Technical Outlook – Consolidation & Range-Building Phase

After the recent sharp sell-off, gold is now transitioning into a consolidation phase on the H2 timeframe. The strong bearish impulse has slowed, and current price action suggests the market is shifting from directional movement into range-building and accumulation, rather than continuing lower immediately.

This type of behavior is typical after aggressive volatility, as the market reassesses value and balances supply and demand.

Market Structure & Current Behavior

Structurally, price has broken below the prior bullish leg and is now trading within a defined value range:

Selling pressure has eased following the downside expansion.

Price is rotating around the VAL and lower value areas, indicating acceptance rather than rejection.

Momentum is no longer impulsive, pointing to sideways development rather than trend continuation.

As long as price remains inside this value range, range trading conditions dominate.

Key Value & Liquidity Zones Upper Resistance / Supply

Sell Liquidity: 5,330

Sell Zone POC: 5,045

These zones act as overhead supply where upside attempts may be capped during consolidation.

Lower Support / Demand

VAL zone

Buy scalping POC: 4,673

This lower area represents short-term demand, where downside moves are more likely to stall during the accumulation phase.

Intraday Expectation

For today’s session:

Primary expectation: Sideways consolidation within the established range

Price is likely to rotate between value extremes rather than trend strongly

Breakouts require clear acceptance above resistance or below support to shift bias

Until such acceptance occurs, patience and range awareness are more effective than directional conviction.

Key Takeaway

After strong volatility, markets often pause to rebuild structure. For now, gold appears to be absorbing orders and forming balance, making consolidation the higher-probability scenario.

Refer to the chart for highlighted value zones and projected range behavior.

✅ Follow the TradingView channel to receive early market structure updates and intraday outlooks.

XAUUSD – H2 Technical AnalysisXAUUSD – H2 Technical Outlook: Scenario 3 – Corrective Rebound Before the Next Decision | Lana ✨

Gold is showing signs of stabilization after a strong sell-off, and today’s price action may favor Scenario 3: a corrective rebound. This is not a full trend reversal yet, but a likely recovery phase into key imbalance zones, where the market will decide whether to continue lower or rebuild structure for a broader rebound.

📈 Market Structure & Context

The recent move down was impulsive, clearing multiple supports and creating a clear bearish displacement.

Price is now reacting from a lower base, suggesting selling pressure is slowing and a technical retracement can develop.

In this environment, the focus is on how price reacts at FVG/supply zones above, not on chasing moves in the middle of the range.

🔍 Key Zones to Watch Today

Buy Liquidity / Base Support: 4640 – 4645

This is the current stabilization area and the most important zone to defend for any rebound scenario.

FVG Support Zone: 4953 – 4958

First major upside target for a corrective rebound. This zone may act as a magnet for price, but also as a reaction area.

Sell FVG (Upper Supply): ~5250 – 5320

If the rebound extends, this becomes the next resistance zone where selling pressure may return.

Strong Resistance: ~5452

A higher objective only possible if price shows clear acceptance and trend rebuilding above key levels.

Structural Pivot: ~5104

A key mid-level. Acceptance above it would strengthen the rebound thesis.

🎯 Scenario 3 – Corrective Rebound Plan

If price holds above 4640–4645 and continues to build higher lows, the market may attempt a push back into imbalance:

First recovery path: 4640–4645 → 4953–4958

If price accepts above the mid-structure: → 5104

Extension (only with strong acceptance): → 5250–5320

Higher target (less likely today): → 5452

This is a structure-first environment: the rebound is valid as long as price defends the base and prints cleaner bullish follow-through.

🧠 Lana’s View

Today’s setup leans toward a retracement-driven rebound, where price rebalances into key zones after a sharp drop. The best approach is to stay patient, track reactions at 4953–4958 and 5250–5320, and let structure confirm whether this rebound is only corrective or the start of a broader recovery.

✨ Stay calm, respect the zones, and let price confirm the next move.

XAUUSD (H2) – Liam Bearish TrendXAUUSD (H2) – Liam Bearish Outlook

Structure broken | Selling pressure remains dominant

Quick summary

Gold has shifted into a clear bearish phase after failing to hold key support levels. The strong sell-off has broken the prior bullish structure, and recent rebounds show signs of weakness rather than accumulation.

At this stage, the market is no longer in a buying/entry environment. The priority is selling rallies, not catching bottoms.

Market structure

The previous uptrend has been decisively invalidated by a sharp downside impulse.

Price is now trading below former support, which has flipped into resistance.

Recent recovery attempts lack follow-through and are corrective in nature.

This keeps the broader intraday-to-short-term bias bearish.

Key technical zones

Primary sell zone: 5100 – 5110

Former support turned resistance. This area favours sell reactions if price retests.

Secondary sell / liquidity zone: 4860 – 4900

A corrective bounce into this zone is likely to attract sellers again.

Near-term support: 4690 – 4700

A weak support area that may give way if selling pressure resumes.

Deeper downside targets:

4400 – 4450, then 4120 if the bearish momentum expands.

Trading plan (Liam style: sell the structure)

Primary scenario – SELL rallies

As long as price remains below 5100, any rebound should be treated as corrective. Sell reactions are preferred at resistance and liquidity zones, targeting further downside continuation.

Secondary scenario – Breakdown continuation

Failure to hold 4690 – 4700 would confirm continuation lower, opening the path toward deeper value zones.

Invalidation

Only a strong reclaim and acceptance back above 5100 – 5150 would force a reassessment of the bearish bias.

Key notes

Volatility remains elevated after the breakdown.

Avoid premature buying/entry against structure.

Let price come into resistance, then execute.

Trend and structure first, opinions second.

Focus for now:

Selling rallies while structure remains bearish.

No bottom fishing.

— Liam

XAUUSD – High volatility, monitor key reaction zones.📌 Market Context

Gold is currently trading in a high-volatility environment after a sharp drop below the $5,000 level, reflecting aggressive repricing ahead of major macro uncertainty. The market has shifted away from smooth trend behavior into a liquidity-driven, fast-reaction phase, where price moves sharply between key technical zones.

With ongoing changes in Fed leadership and uncertainty around future monetary policy direction, gold remains extremely sensitive to expectations, flows, and headlines.

➡️ Current state: Volatile conditions – wait for confirmation, avoid emotional trades.

📊 Structure & Price Action (M30)

The prior bearish impulse is losing momentum, with short-term higher lows starting to form.

Price is currently in a technical recovery phase, not a confirmed trend reversal yet.

Market continues to respect Demand and Key Levels, producing sharp reactions.

No confirmed bullish CHoCH at this stage — further validation is required.

🔎 Key insight:

Gold is trading inside a decision zone, where each key level can trigger strong directional moves.

🎯 Trading Plan – MMF Style

🔵 Primary Scenario – Buy the Technical Pullback

Focus on reaction-based execution, not anticipation.

BUY Zone 1: 4,667 – 4,650

(Near-term demand + first recovery base)

BUY Zone 2: 4,496 – 4,480

(Deep demand + prior liquidity sweep low)

➡️ Execute BUYs only if:

Clear bullish candle reaction appears

Or a Higher Low structure forms on M30

Upside Targets:

TP1: 4,932

TP2: 5,124 (Major recovery resistance/supply zone)

🔴 Alternative Scenario – Sell at Resistance Reaction

If price retraces into supply and fails to hold bullish momentum:

SELL Zone: 5,120 – 5,140

→ Look for short-term rejection following M30 structure

❌ Invalidation

A confirmed M30 close below 4,480 invalidates the recovery structure and requires a full reassessment.

🧠 Summary

Gold is in a high-volatility, structure-building phase, not an environment for emotional or aggressive positioning. The edge lies in:

Trading key levels, not impulses

Waiting for price confirmation

Prioritizing risk management over prediction

📌 In volatile markets, discipline outperforms frequency.

(XAUUSD) – Bearish Continuation From Major Supply Zone (45m)

Market Structure

Clear trend reversal from the highs → strong impulsive sell-off.

The curved marking shows a distribution/top formation, followed by aggressive downside momentum.

Overall structure is lower highs & lower lows → bears in control.

Key Zones

Resistance / Supply Zone (~4,700–4,750)

Previous support flipped into resistance.

Price has retested this zone multiple times and failed to break above → strong seller presence.

Target / Demand Zone (~4,350)

Prior demand area and liquidity pool.

Logical downside objective if resistance continues to hold.

Entry Logic (as drawn)

Short entry after rejection inside the resistance zone.

Confirmation comes from:

Weak bullish candles

Long upper wicks

Failure to reclaim the zone

Price Action Read

The small bounces are corrective pullbacks, not reversals.

Each push up is being sold → classic bearish continuation / pullback-to-supply setup.

Bias & Expectation

Bias: Bearish

Expectation:

Rejection from resistance → continuation toward 4,350 target

Invalidation if price accepts and closes above the resistance zone

Summary

This chart shows a textbook support-to-resistance flip after a strong sell-off. As long as price remains below the highlighted resistance, the path of least resistance is down, targeting the lower demand zone.

XAUUSD – H4 Outlook: Liquidity ResetFebruary has opened with heightened volatility across global markets, and gold is no exception. After a strong upside run, XAUUSD has experienced a sharp corrective move, driven largely by deleveraging flows rather than a structural trend reversal.

Current price action suggests gold is entering a rebalancing phase, where liquidity is being cleared before the market can attempt a renewed push higher.

📈 Market Structure & Higher-Timeframe Context

Gold previously traded in a strong bullish structure, but the recent sell-off marked a clear market structure shift (MSS) on the H4 timeframe.

The impulsive decline swept sell-side liquidity below prior consolidation zones, a typical behavior after an extended rally.

Despite the speed of the drop, price is now approaching key support and demand areas, where selling pressure may begin to slow.

This type of move often reflects position reduction and risk-off behavior, not the end of the broader bullish narrative.

🔍 Key Zones to Monitor

Primary Support / Buy Zone: ~4,280 – 4,350

This area represents a strong demand zone where price may stabilize and form a base.

Short-Term Reaction Zone: ~4,450 – 4,500

A zone where price could oscillate during consolidation, suitable for short-term reactions rather than trend trades.

Sell-Side Liquidity Cleared:

The recent drop has already taken liquidity below previous lows, reducing immediate downside pressure.

Upside Rebalance Zones (FVG / Supply):

~4,850 – 4,900

~5,200 – 5,350

These areas are likely to act as resistance during any recovery phase.

🎯 Market Scenarios

Scenario 1 – Controlled Correction (Base Case):

Gold may continue to range or dip modestly into the 4,280–4,350 support zone, allowing the market to complete its liquidity reset. Holding this area would keep the broader bullish structure intact.

Scenario 2 – Recovery After Stabilization:

Once selling pressure is absorbed, price may begin a gradual recovery, targeting the 4,850–4,900 zone first. Acceptance above this level would open the door toward higher resistance areas.

Scenario 3 – Deeper Reset (Lower Probability):

A clean break below the main support would suggest a deeper correction, but at this stage, such a move would still be viewed as corrective within a larger cycle, not a full trend reversal.

🌍 Macro Backdrop (Brief)

The sharp sell-off in gold, silver, equities, and crypto reflects a global deleveraging wave, intensified by rising geopolitical risks and shifting risk sentiment. In such environments, gold often experiences short-term drawdowns, even as its longer-term role as a hedge remains intact.

This reinforces the idea that the current move is more about resetting positioning than changing long-term direction.

🧠 Lana’s View

Gold is not in a hurry.

After a powerful run, the market often needs to pause, rebalance, and absorb liquidity before the next meaningful expansion.

Lana remains patient, focusing on how price behaves around key H4 support zones, rather than reacting emotionally to volatility.

✨ Let the correction do its work. Structure will guide the next move.