XAUUSD - Brian | H1 AnalysisXAUUSD – Brian | H1 Technical Outlook – SELL Bias Aligned With the Main Trend

Gold is entering a strong corrective phase after forming a short-term top, with the H1 structure clearly shifting to the downside. The latest bearish leg is impulsive in nature, reflecting active position unwinding and short-term distribution following the prior extended rally.

In this environment, the preferred approach is to prioritize sell setups in line with the dominant intraday trend, focusing on reactions around key psychological and value-based levels.

Market Structure & Price Behaviour

The previous bullish structure has been invalidated by a sharp downside break, confirming a structure shift on H1.

Price is now trading below prior value areas, suggesting a transition from expansion into pullback and continuation to the downside.

Upward moves at this stage are likely to be corrective rallies rather than trend reversals, offering potential sell opportunities.

Key Psychological & Technical Zones

1) Trend-Following SELL Zone

Sell VAL: 5,048 – 5,051

This zone represents the lower value area of the most recent distribution range and is acting as a psychological resistance within the current bearish context. Reactions here are critical for assessing sell-side continuation.

2) Near-Term Balance Level

The 5,000 psychological level remains a focal point for intraday volatility. How price behaves around this round number will help determine momentum continuation.

3) Deeper BUY Zone (Not a Day-Trade Focus)

Buy Zone VAL: 4,450 – 4,455

This is a broader structural support area and should be treated as an observation zone rather than an active buying entry during the current session.

Intraday Trading Bias

Primary bias: SELL, aligned with the current H1 trend

Strategy: Look to sell corrective pullbacks into key psychological and value zones

Risk note: Avoid counter-trend buying positions while the bearish structure remains intact

In volatile conditions, following the dominant structure and waiting for price reactions at key levels is more effective than attempting to pick bottoms.

Refer to the chart for a detailed view of structure and highlighted zones.

Follow the TradingView channel for early market structure updates and ongoing analysis.

If you want:

a shorter intraday note,

a more neutral tone, or

an alternative version in UK / Indian English,

just say the word and I’ll adjust it for you 👌

Xauusdanalysis

XAUUSD (H1) – Below $5,000: Correction or Quick Recovery?Market Context – Gold Enters a Critical Repricing Zone

Gold has officially slipped below the psychological $5,000 level, triggering renewed debate: Is this the start of a deeper corrective phase, or simply a liquidity reset before a sharp rebound?

The timing is crucial.

With speculation around changes in Fed leadership and future monetary policy direction, the market is repricing risk aggressively. This has injected exceptional volatility into Gold, where liquidity is being rapidly redistributed rather than trending cleanly.

➡️ This is no longer a low-volatility trend market — it’s a decision zone.

Structure & Price Action (H1)

The previous bullish H1 structure has failed, confirming a short-term corrective phase.

Price is trading below former demand, now acting as supply.

Current rebounds are technical pullbacks, not confirmed reversals.

Downside momentum remains active until price reclaims key structure levels.

Key insight: 👉 Below $5,000, Gold is trading in rebalancing mode, not trend continuation.

Key Technical Zones (H1)

Major Supply / Rejection Zone:

• $5,030 – $5,060

→ Former structure + Fibonacci confluence

→ Likely area for sellers to defend

Mid-Range Reaction Zone:

• $4,650 – $4,700

→ Short-term demand / potential bounce zone

Deep Liquidity Demand:

• $4,220 – $4,250

→ Major liquidity absorption zone

→ High probability area for a technical or structural rebound

Trading Plan – MMF Style

Scenario 1 – Sell the Pullback (Primary While Below $5,030)

Favor SELL setups on rallies into supply.

Wait for rejection / failure patterns.

Do not chase price lower.

➡️ Bias remains bearish-corrective while below $5,030.

Scenario 2 – Buy Only at Deep Liquidity

BUYs are considered only at major demand with confirmation:

• $4,650 – $4,700 (scalp / reaction only)

• $4,220 – $4,250 (higher-probability swing zone)

➡️ No blind bottom picking

➡️ Confirmation > prediction

Macro Risk Outlook

Fed leadership uncertainty = policy expectation volatility.

Any shift toward dovish credibility could trigger a violent short-covering rally.

Conversely, prolonged uncertainty keeps Gold under pressure short-term.

➡️ Expect fast moves, fake breaks, and wide ranges.

Invalidation & Confirmation

Bearish bias weakens if H1 reclaims and holds above $5,060.

Deeper correction opens if $4,220 fails decisively.

Summary

Gold below $5,000 is not weakness — it’s repricing. This is a market where liquidity hunts traders, not the other way around.

The edge right now is patience and precision:

Sell rallies into supply.

Buy only where liquidity is proven.

Let structure confirm before committing risk.

➡️ In high volatility, survival beats prediction.

XAUUSD "BULLISH" BIAS IDEA.Symbol + Timeframes: XAUUSD — HTF (Daily) & ITF (H4)**

Bias: Bullish (as long as price holds above key support zone)

Structure: – Higher lows intact on HTF

– Intermediate pullbacks LIQUIDATING "fomoing" retailers.

Key Levels: – Support: – 4629.989

And if it breaks , the confluential block at - 4633.96 and marked important swing low at - 4267.383.

– Invalidation: daily candle close below 4267.383

Context: – Price reacting to confluence (fair value gap + structural support + confluential block)

– Dollar bearish pullback adds supporting context

Plan: – Look for corrective pullback to support for continuation setups at smaller timeframe to frame trades, I've marked the path

– Targets based on structural levels

This is analysis, not trade advice.

XAUUSD – D1 Mid-Term AnalysisXAUUSD – D1 Mid-Term Outlook: Volatility Reset Before the Next Structural Move | Lana ✨

Gold has just experienced a sharp and aggressive sell-off from the highs, marking a clear shift from expansion into a volatility reset phase. While the broader bullish trend has not been fully invalidated, price action now suggests the market is entering a medium-term rebalancing process, where liquidity and structure will play a decisive role.

At this stage, the focus moves away from short-term noise and toward key daily levels that will define the next swing direction.

📈 Higher-Timeframe Structure (D1)

The strong vertical rally has been followed by a deep corrective candle, indicating distribution and profit-taking at premium levels.

Price has broken below short-term momentum support but is still trading above major higher-timeframe trend structure.

This behavior is typical after an extended rally, where the market needs time to absorb supply and reset positioning before choosing the next medium-term direction.

The current structure favors range development or a corrective swing, rather than immediate continuation to new highs.

🔍 Key Daily Zones to Watch

Major Resistance Zone: ~5400 – 5450

This area represents strong overhead supply. Any recovery into this zone is likely to face selling pressure and should be treated as a reaction zone, not a breakout zone.

Strong Liquidity Level: ~5100

A key magnet for price. Acceptance above or rejection below this level will heavily influence medium-term bias.

Sell-Side Liquidity Zone: ~4680 – 4700

This is a critical downside target where stops and unfilled liquidity are resting.

High-Liquidity Buy Zone: ~4290

A major higher-timeframe demand area. If price reaches this zone, it would complete a deep correction within the broader bullish cycle and open the door for medium-term accumulation.

🎯 Medium-Term Trading Scenarios

Scenario 1 – Corrective Recovery, Then Sell Pressure (Primary):

Price may attempt a rebound toward 5100 or even the 5400–5450 resistance zone. As long as price remains below this resistance, rallies are more likely to be corrective, offering opportunities to reassess shorts or reduce long exposure.

Scenario 2 – Continuation of the Correction:

Failure to reclaim 5100 increases the probability of a continued move lower toward 4680–4700, where sell-side liquidity is resting.

Scenario 3 – Deep Reset and Structural Buy:

If downside momentum accelerates, a move toward the 4290 high-liquidity zone would represent a full medium-term reset. This area is where stronger buyers may re-enter and where the next swing-long narrative could begin to form.

🌍 Market Context (Medium-Term View)

Such sharp daily moves often occur during periods of macro repricing and sentiment shifts, forcing the market to rebalance expectations. In these environments, gold tends to oscillate between liquidity zones, rather than trend cleanly in one direction.

This makes patience and level-based execution more important than prediction.

🧠 Lana’s Perspective

The market is no longer in a “buy-every-dip” phase.

This is a transition environment, where gold needs to finish its liquidity work before the next sustained move develops.

Lana stays neutral-to-cautious in the medium term, focusing on reactions at daily liquidity zones, not emotional bias.

✨ Let the structure reset, let liquidity clear, and wait for the market to show its hand.

XAUUSD (H4) – Liam Weekly ForecastXAUUSD (H4) – Liam Weekly Outlook

Uptrend under pressure, but not broken | Focus on retests and reactions

Quick summary

Gold has experienced a sharp corrective move after an extended bullish run. The recent sell-off has broken the steep short-term uptrend, but price has not confirmed a full trend reversal on H4.

At this stage, the market is transitioning into a rebalancing phase. For the coming week, the edge is not in predicting direction, but in trading reactions at key structure, Fibonacci, and FVG levels.

Market structure overview

The prior bullish trend has lost momentum after a vertical expansion.

Price has broken below the aggressive trendline, signaling trend exhaustion, not automatic reversal.

Current price action suggests a corrective structure with potential for range development or trend resumption after liquidity is rebalanced.

➡️ Bias remains neutral-to-bullish, conditional on how price reacts at key levels.

Key technical zones for the week

Primary buy-on-retest zone: trendline retest area around 4850 – 4900

This area has already shown reaction and acts as the first decision point for buyers.

Fibonacci 0.618 / key reaction zone: 5030 – 5050

A pivotal mid-range level. Acceptance above favors continuation; rejection keeps price corrective.

FVG + Fibonacci confluence: 5235 – 5260

This is a major imbalance zone. If price rallies into this area, expect strong reaction and two-sided trade.

Lower liquidity / value zone: 4540 area

This remains the deeper downside objective if higher levels fail to hold and the correction expands.

Weekly scenarios (Liam style: trade the level)

Scenario A – Trendline retest holds (bullish continuation)

If price continues to hold above the trendline retest zone and builds higher lows:

Look for bullish continuation toward 5030 → 5235

Break and acceptance above the FVG zone would reopen upside continuation potential.

Logic: This confirms the move as a healthy correction within a broader bullish structure.

Scenario B – Rejection from mid-range (extended correction)

If price fails to reclaim and hold above 5030 – 5050:

Expect choppy, corrective price action

Risk shifts toward a deeper pullback into 4540

Logic: Failure to hold the 0.618 zone keeps the market in rebalancing mode.

Scenario C – FVG test and rejection

If price rallies aggressively into 5235 – 5260:

This zone favors reaction and profit-taking

Acceptance above is required for any sustained bullish continuation.

Logic: FVG zones after strong sell-offs often act as distribution or reaction points before direction is decided.

Key notes for the week

Volatility remains elevated after the sell-off — expect false breaks.

Avoid mid-range trades without confirmation.

Let price prove acceptance or rejection at levels before committing.

This is a week for patience and execution, not conviction.

Weekly focus:

Will gold hold the trendline retest and rebuild higher, or fail at the 5030–5050 zone and rotate deeper into value?

— Liam

High volatility post sell-off, market rebalancing.Market Context

Gold has just experienced a sharp and aggressive sell-off on H1, breaking the short-term bullish structure after an extended impulsive rally. This type of move typically reflects liquidity distribution and capital rebalancing, common during periods of heightened macro-driven volatility.

From a macro perspective:

USD volatility remains elevated due to rate expectations and upcoming data

Risk sentiment is unstable, with fast capital rotation

Gold remains a safe-haven asset, but no longer trades in a one-directional flow

➡️ Current phase: high risk – avoid FOMO – trade only at key levels

Structure & Price Action (H1)

Previous bullish H1 structure has been invalidated

Price is trading below the rising trendline → short-term trend weakness

Current rebounds are technical pullbacks, not confirmed reversals

Wide intraday range increases the probability of liquidity sweeps on both sides

Key insight:

👉 This is a transition phase. The market needs time to rebuild structure before committing to a directional move.

Trading Plan – MMF Style

Scenario 1 – Sell the Pullback (Primary Bias)

Look for SELL opportunities on corrective rallies into supply zones.

SELL Zone 1: 5,020 – 5,060

(short-term supply + technical pullback)

SELL Zone 2: 5,180 – 5,240

(major supply + confluence with broken trendline)

➡️ Execute SELLs only after clear rejection or failure to hold structure.

Scenario 2 – Buy at Deep Liquidity Zones

BUY setups are considered only at major demand areas with strong reaction.

BUY Zone 1: 4,670 – 4,650

(H1 demand + prior reaction low)

BUY Zone 2: 4,500 – 4,490

(deep liquidity absorption zone)

➡️ No blind bottom picking

➡️ Wait for clear reversal confirmation before entry

Expectations & Targets

Short term: choppy price action and high volatility

Directional clarity comes only after consolidation

Holding above 5,240 opens room for deeper recovery

Losing 4,500 expands the corrective leg

Invalidation

SELL bias invalidated if price holds firmly above 5,240

BUY bias invalidated if H1 closes decisively below 4,490

Summary

Gold is currently in a high-volatility transition phase, where patience and discipline matter more than frequency. The edge is not trading more, but waiting for price to reach key liquidity zones and react with clarity.

➡️ Trade less, trade smarter

➡️ Structure first, entries second

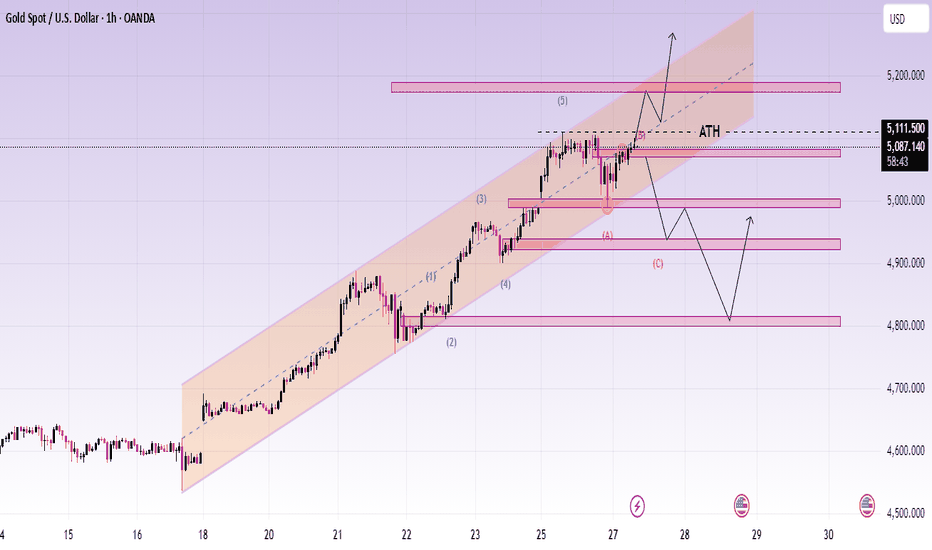

Elliott Wave Analysis XAUUSD – January 30, 2025

1. Momentum

Weekly timeframe (W1)

Weekly momentum is currently rising. With this condition, the market is likely to continue moving higher or remain sideways for at least the next 1–2 weeks.

Daily timeframe (D1)

Daily momentum is currently declining. This suggests that over the next 1–2 days, price may continue to fall or move sideways until D1 momentum reaches the oversold zone.

H4 timeframe

H4 momentum is compressed and overlapping in the oversold area. This indicates that the current bearish or sideways phase may continue, however, the probability of a bullish reversal on H4 is relatively high.

2. Wave Structure

Weekly Wave Structure (W1)

On the weekly chart, the five-wave structure (1–2–3–4–5) in blue is still forming.

Yesterday, price experienced a strong decline. However, to confirm that blue wave 5 has completed, price needs to produce a bearish close below the 4282 level.

At the moment, since W1 momentum remains bullish, this decline is more likely a corrective move within blue wave 5, rather than a completed top.

Daily Wave Structure (D1)

Daily momentum is declining, therefore price may continue to move lower or sideways for another 1–2 days until D1 momentum reaches oversold conditions.

Within the context of blue wave 5, price is likely forming yellow wave 4, which belongs to the internal 1–2–3–4–5 yellow structure of blue wave 5.

Once yellow wave 4 is completed, price is expected to resume its advance to form yellow wave 5, thereby completing blue wave 5.

From the RSI perspective, the previous rally reached extremely overbought conditions. This suggests that buying pressure remains strong enough to support at least one more push to a new high, potentially accompanied by bearish divergence at the top. This further supports the scenario that yellow wave 5 will form, and that the market is currently in yellow wave 4.

H4 Wave Structure

The current decline has already reached the 0.382 Fibonacci retracement of yellow wave 3.

From a momentum standpoint, D1 momentum is still declining, so in the near term, another 1–2 days of decline or sideways movement remain possible. Meanwhile, H4 momentum is compressed in the oversold zone, indicating a high probability of a bullish reversal on H4.

Therefore, the most likely scenario is continued sideways movement on H4, or a minor continuation lower before a bullish reaction develops.

RSI from the prior bullish leg remains in a strongly overbought condition, reinforcing the idea that the current decline is corrective in nature, and that the market may still form a new high afterward.

3. Trading Plan

Swing setups:

At this stage, there are no attractive swing positions, as the market is currently in the late phase of an extended wave, where price behavior becomes difficult to predict.

Additionally, today is Friday and also the monthly candle close, which significantly increases volatility risk. The appropriate approach is to remain patient and observe, waiting for D1 momentum to reach the oversold zone, at which point higher-probability swing setups can be considered.

XAUUSD – Brian | 30M – Value Shift AfterXAUUSD – Brian | 30M – Value Shift After a Sharp Volatility Move

Gold has just experienced a significant volatility event, with price selling off aggressively from the highs before rebounding sharply. The market is now trading around a newly formed value area, a typical behavior when price transitions from expansion into a rebalancing phase. In this environment, value and POC levels tend to guide price more effectively than individual candles.

Macro Context (Brief)

Market sentiment remains sensitive to macro risks, including commodity volatility, geopolitical tensions, and monetary policy expectations. Gold ETF holdings have shown no meaningful change recently, suggesting no clear signs of institutional liquidation. The current volatility therefore appears more consistent with a positioning adjustment rather than a broader trend reversal.

Technical Analysis from the Chart (30M)

Following the sharp sell-off, price is now forming a well-defined trading range, with value areas acting as key reference points:

1) Upper Supply / Reaction Zones

POC – SELL: 5,531–5,526

The previous high-value zone, where selling pressure may re-emerge if price retraces higher.

Sell VAH: 5,365–5,369

The value area high, typically a reaction zone if distribution pressure remains present.

2) Current Balance Area

The 5,180–5,200 region is currently acting as a balancing zone after the volatility. Acceptance and consolidation above this area would increase the probability of a move back towards the VAH.

3) Lower Demand / Support Zones

POC Buy (scalping): 5,187

A short-term support area for technical reactions.

Buy VAL – Support: 5,058–5,064

The most important lower support zone. If a deeper liquidity sweep occurs, this area is likely to attract attention for potential absorption and short-term reversal.

Price Scenarios (Structure-Based)

Scenario A (Preferred if value holds):

Price holds above 5,180–5,200 → recovery towards 5,365–5,369 (VAH).

Scenario B (Rejection from above):

Price retraces into the VAH zone but faces clear rejection → rotation back towards the 5,187 / 5,180 area.

Scenario C (Deeper liquidation):

Loss of 5,180 → liquidity sweep into 5,058–5,064 (VAL) before attempting to rebuild.

Key Takeaway

In a rebalancing phase, value acceptance matters more than directional prediction. Focus on how price behaves around 5,180–5,200, the reaction at 5,365–5,369, and whether deeper support at 5,058–5,064 attracts meaningful buying interest.

Refer to the chart for detailed POC, VAH and VAL levels.

Follow the TradingView channel to receive early structure insights and join the discussion.

XAUUSD – H1 volatility surge | liquidity reset ongoingMarket Context

Gold is entering a high-volatility phase after an extended bullish run. The recent sharp impulse down from the upper zone is not random — it reflects liquidity distribution and aggressive profit-taking near highs, amplified by fast USD flows and event-driven positioning.

In this environment, Gold is no longer trending smoothly. Instead, it is rotating between liquidity zones, creating two-way risk intraday.

➡️ Key mindset: trade reactions at levels, not direction.

Structure & Price Action (H1)

The prior bullish structure has been temporarily broken by a strong bearish impulse.

Price failed to hold above 5,427 – 5,532, confirming this area as active supply / distribution.

The move down shows range expansion, typical after ATH phases.

Current price action suggests rebalancing and liquidity search, not a confirmed macro reversal yet.

Key read:

👉 Above supply = rejection

👉 Below supply = corrective / bearish bias until proven otherwise

Trading Plan – MMF Style

🔴 Primary Scenario – SELL on Pullback (Volatility Play)

While price remains below key supply, selling reactions is favored.

SELL Zone 1: 5,427 – 5,432

(Former demand → supply flip + trendline rejection)

SELL Zone 2: 5,301 – 5,315

(Mid-range supply / corrective retest)

Targets:

TP1: 5,215

TP2: 5,111

TP3: 5,060

Extension: 4,919 (major liquidity pool)

➡️ Only SELL after clear rejection / bearish confirmation.

➡️ No chasing breakdowns.

🟢 Alternative Scenario – BUY at Deep Liquidity

If price sweeps lower liquidity and shows absorption:

BUY Zone: 4,920 – 4,900

(Major demand + liquidity sweep zone)

Reaction targets:

5,060 → 5,215 → 5,300+

➡️ BUY only if structure stabilizes and bullish reaction appears.

Invalidation

A clean H1 close back above 5,432 invalidates the short-term bearish bias and shifts focus back to bullish continuation.

Summary

Gold is transitioning from trend extension to volatility expansion.

This is a market for discipline and level-based execution, not prediction.

MMF principle:

Volatility = opportunity, but only for those who wait for reaction.

Trade the levels. Control risk. Let price confirm.

Gold ATH after FOMC: Reaction or New Wave?Before the FOMC meeting, the market shared the same question:

would gold rally ahead of the meeting and then face a sharp sell-off afterward, or continue breaking higher and extend the trend?

After the FOMC, the Fed kept interest rates unchanged — which was not a surprise.

What really mattered was the Fed’s tone, and Powell clearly chose a balanced stance:

neither too dovish nor too hawkish.

More importantly, the Fed has effectively ruled out further rate hikes, while still maintaining a high interest-rate environment.

As a result, gold did not experience a heavy sell-off after the FOMC, and continues to hold its structure near the highs.

At this stage, market focus is shifting toward external risk factors:

The risk of a U.S. government shutdown

U.S.–Iran tensions

Ongoing trade war risks with major partners

Questions surrounding the independence of the Fed

👉 The current macro backdrop is not bearish for gold.

👉 SELL setups are reactionary, not the core narrative of the trend.

⏱️ H1 Observation Range

Lower bound: 5,415

Upper bound: 5,600

Price is consolidating near the highs with a wide range and may gradually push toward higher round-number levels.

🟢 Support / BUY zones

5,505 – 5,410 – 5,310 – 5,250 – 5,100

🔴 Resistance / Key observation zones

5,660–5,665 – 5,700 – 5,800 – 6,000

🧠 Primary scenario

Wide volatility → risk management is key.

SELLs are only short-term reactions at resistance.

BUY pullbacks to support to ride the broader move, not to pick the top.

⚠️ Key notes for the current phase

Reading the chart is a skill.

Reading the Fed is a strategy.

Reading Trump’s statements is survival.

Markets don’t reward being right —

they reward discipline and alignment with the trend.

👉 SELL to react — BUY to stay in the game.

📌 Follow me to track macro scenarios, key price levels, and the ongoing journey of finding opportunities in the market.

Elliott Wave Analysis XAUUSD – January 29, 2026

1. Momentum

Weekly timeframe (W1)

– Weekly momentum is currently increasing.

– With the present strength on the weekly chart, there is a high probability that the uptrend will continue into next week.

→ Medium- to long-term bias remains bullish.

Daily timeframe (D1)

– Daily momentum is still “compressed” and overlapping.

– This condition shows that bullish pressure is still present and the uptrend remains intact.

H4 timeframe

– H4 momentum is rising but has already entered the overbought zone.

– This signals a high probability that we will soon see a corrective pullback or reversal on H4.

2. Wave Structure

Weekly Wave Structure (W1)

– On the weekly chart, we can clearly see the extension of wave 5.

– This phase represents a transition period driven by crowd psychology.

– Although the long-term trend remains bullish, the main issue at this stage is extreme volatility:

– A single H4 candle can fluctuate 400–500 pips,

– Making real trading execution significantly more difficult.

→ During this phase, observation should be the priority.

– The next major risk comes from the fact that crowd sentiment is becoming extreme.

– When the crowd returns to equilibrium, counter-trend moves tend to be sudden and very aggressive.

– On the other hand, weekly momentum still needs at least another week to reach extreme overbought conditions and potentially reverse.

→ Therefore, the overall bullish trend is still expected to continue.

Daily Wave Structure (D1)

– On the daily chart, the blue 5-wave structure remains valid and continues to unfold.

– The current blue wave 5 is expanding strongly.

– With D1 momentum still compressed, the bullish move may continue,

but at the same time, the risk of a daily momentum reversal is increasing.

H4 Wave Structure

– When price is in an extended wave, one of the main weaknesses of Elliott Wave theory becomes clear:

– Accurate wave labeling is extremely difficult during strong extensions.

→ Therefore, at this stage, H4 wave labeling should be treated as relative and for observation only.

– To refine our bias, we must rely on:

– The depth of price corrections,

– The time spent correcting,

– And the behavior of momentum.

– Observing H4 momentum, the bullish momentum rollover in the overbought zone suggests that the upward move is losing strength.

→ This increases the probability of sideways movement or a corrective decline on H4.

– However, when we look at RSI:

– The current overbought zone is stronger than previous ones,

– This indicates that the bullish force required to form new highs is still present,

– At least until a new high is formed with bearish divergence.

3. Trading Strategy

– Under current conditions, the most appropriate strategy remains:

👉 Wait for momentum reversals on H1 and H4 to BUY in line with the dominant uptrend.

– For now, patience is required while waiting for H4 momentum to return to the oversold zone.

– Once that occurs, we will shift focus to H1 to:

– Identify wave structures,

– Confirm momentum behavior,

– And define suitable price targets for BUY entries.

Why wait for H4 oversold conditions to BUY instead of SELL?

– Because the current uptrend is still very strong.

– Corrective moves at this stage may:

– Move sideways, or

– Decline unpredictably, making downside targets unclear.

→ Selling in this environment carries high uncertainty and elevated risk.

👉 Waiting for H4 to reach oversold conditions allows:

– A clearer trend structure to form on H1,

– And provides opportunities to enter BUY positions aligned with the higher-timeframe trend, with better risk control.

XAUUSD – Bullish trend, focus on Buy pullbacks to 5,700Market Context (M30)

Gold continues to trade in a strong bullish continuation after a clean impulsive leg higher. The recent consolidation above former resistance shows acceptance at higher prices, not exhaustion. This behavior suggests the market is rebalancing liquidity before the next expansion leg.

On the macro side, USD remains under pressure, while safe-haven demand stays firm. Even though bond yields are relatively stable, capital flows continue to favor gold, keeping the upside bias intact.

➡️ Intraday bias: Bullish – trade with the trend, not against it.

Structure & Price Action

• Market structure remains bullish with Higher Highs – Higher Lows

• Previous resistance has flipped into demand and is being respected

• No bearish CHoCH or structural breakdown confirmed

• Current pullbacks are corrective moves within an active uptrend

Key takeaway:

👉 As long as price holds above key demand, pullbacks are opportunities for continuation.

Trading Plan – MMF Style

Primary Scenario – Buy the Pullback

Patience is key. Avoid chasing price into extensions.

• BUY Zone 1: 5,502 – 5,480

(Minor demand + short-term rebalancing zone)

• BUY Zone 2: 5,425 – 5,400

(Trendline support + deeper liquidity zone)

➡️ Only execute BUYs after clear bullish reaction and structure confirmation.

➡️ No FOMO at highs.

Upside Targets

• TP1: 5,601

• TP2: 5,705 (upper Fibonacci extension / expansion target)

Alternative Scenario

If price holds above 5,601 without a meaningful pullback, wait for a break & retest to join the next continuation leg.

Invalidation

A confirmed M30 close below 5,400 would weaken the bullish structure and require reassessment.

Summary

Gold remains in a controlled bullish expansion supported by both structure and macro flow. The edge lies in discipline — buying pullbacks into demand while the trend stays intact, not predicting tops.

➡️ As long as structure holds, higher prices remain the path of least resistance.

gold is going to mars chech this chart and my next tp is 5441/63gold is going to mars chech this chart and my next tp is 5441/6325 gold is going to mars chech this chart and my next tp is 5441/6325 gold is going to mars chech this chart and my next tp is 5441/6300 gold is going to mars chech this chart and my next tp is 5441/6300

XAUUSD (H2) - Liam Plan (Jan 28)XAUUSD (H2) – Liam Plan (Jan 28)

New ATH, strong safe-haven flow | Follow trend, buy FVG pullbacks only

Quick summary

Gold continues to print new all-time highs as global capital rotates into safe-haven assets amid persistent economic and geopolitical uncertainty tied to recent US policy decisions. Additional support comes from concerns around Fed independence and expectations of lower US rates, keeping real yields capped.

Despite the bullish backdrop, price is now extended above equilibrium. The edge is not in chasing strength, but in waiting for pullbacks into imbalance and liquidity zones.

➡️ Bias stays bullish, execution stays patient.

Macro context (why gold stays bid, but volatile)

Ongoing geopolitical uncertainty keeps structural demand for gold intact.

Rate-cut expectations and doubts around Fed autonomy weaken the USD’s long-term appeal.

USD is attempting a technical bounce, but this has not shifted gold’s underlying bid.

➡️ Conclusion: macro supports higher prices, but short-term moves will likely rotate to rebalance inefficiencies.

Technical view (H2 – based on the chart)

Price is trending cleanly higher after multiple bullish BOS, riding an ascending structure and expanding into premium.

Key levels from the chart:

✅ Major extension / sell-side target: 5280 – 5320 (2.618 fib expansion)

✅ FVG / continuation buy zone: 5155 – 5170

✅ Structure support: 5000 – 5050

✅ Trend invalidation (deeper): below 4950

Current price action suggests a likely path of push → pullback → continuation, rather than straight-line expansion.

Trading scenarios (Liam style: trade the level)

1️⃣ BUY scenarios (priority – trend continuation)

A. BUY the FVG pullback (cleanest setup)

✅ Buy zone: 5155 – 5170

Condition: price taps FVG and shows bullish reaction (reclaim / HL / displacement on M15–H1)

SL (guide): below 5125 or below reaction low

TP1: recent high

TP2: 5280

TP3: 5320+ if momentum expands

Logic: This FVG aligns with prior buy-side liquidity and structure — a high-probability continuation zone.

B. BUY deeper structure support (only if volatility spikes)

✅ Buy zone: 5000 – 5050

Condition: liquidity sweep + strong rejection

TP: 5170 → 5280

Logic: This is value within trend. No interest in longs above premium if this level breaks.

2️⃣ SELL scenarios (secondary – reaction only)

SELL at extension (scalp / tactical only)

✅ Sell zone: 5280 – 5320

Condition: clear rejection / failure to hold highs on lower TF

TP: 5200 → 5170

Logic: Extension zones are for profit-taking and short-term mean rotation, not trend reversal calls.

Key notes

New ATHs invite FOMO — don’t be that liquidity.

Best trades come after pullbacks, not during impulse candles.

Reduce size around Fed headlines.

What’s your plan: buying the 5155–5170 FVG pullback, or waiting for a stretch into 5280–5320 to fade the reaction?

— Liam

XAUUSD – M45 Tech AnalysisXAUUSD – M45 Technical Outlook: Strong Momentum, Now Watch Liquidity Reactions | Lana ✨

Gold has surged above $5,250, extending its buying position with strong momentum. Price action remains constructive, but as the market pushes deeper into premium territory, liquidity reactions become more important than raw momentum.

📈 Market Structure & Price Action

Gold continues to trade inside a well-defined ascending channel, confirming a strong bullish structure.

Multiple BOS (Break of Structure) points on the chart highlight persistent buyer control.

The recent leg higher was aggressive, indicating momentum-driven buying, but also increasing the likelihood of short-term reactions.

At current levels, the market is extended above value, which often precedes either consolidation or a controlled pullback.

🔍 Key Technical Zones on M45

Upper Supply / Reaction Zone: 5280 – 5310

This area represents a premium zone where price may face profit-taking or liquidity sweeps before choosing direction.

Immediate Support (Channel Mid / Retest Zone): 5200 – 5220

A key area where price could pull back and attempt to hold structure.

Strong Sell-Side Liquidity Zone: around 5050

Marked clearly on the chart, this is a deeper level where liquidity is resting and where stronger buyer reactions could emerge if the pullback extends.

As long as price remains inside the channel, the broader bullish bias stays intact.

🎯 Trading Scenarios

Scenario 1 – Extension With Caution:

If price continues higher into the 5280–5310 zone, expect increased volatility and potential short-term rejection. This area is better suited for risk management and observation, not aggressive chasing.

Scenario 2 – Healthy Pullback (Preferred):

A pullback toward 5200–5220 would allow price to rebalance liquidity while maintaining structure. Holding this zone supports continuation within the channel.

Scenario 3 – Deeper Liquidity Sweep:

If volatility expands, a move toward the ~5050 sell-side liquidity zone could occur before a stronger continuation leg develops.

🌍 Market Context (Brief)

Gold’s sharp move above $5,250 reflects ongoing demand for safe-haven assets amid persistent macro and geopolitical uncertainty. Strong daily gains reinforce bullish sentiment, but such vertical moves also tend to attract short-term profit-taking, making structure and liquidity levels critical.

🧠 Lana’s View

The trend is bullish, but not every bullish move is a buy.

At extended levels, Lana focuses on how price reacts at liquidity zones, not on chasing momentum.

✨ Respect the structure, stay patient near extremes, and let the market come to your levels.

Elliott Wave Analysis XAUUSD – 28/01/2026

1. Momentum

Daily (D1)

– D1 momentum is still overlapping, indicating that the broader bullish move may continue.

– The prolonged overbought condition reflects excessive market enthusiasm, which also serves as a warning of increasing risk.

H4

– H4 momentum is approaching the overbought zone.

→ This suggests that a corrective move on H4 is likely to occur within the next few hours.

H1

– H1 momentum is currently overbought.

→ This indicates that short-term bullish momentum is weakening, and a corrective phase on H1 is likely before the trend resumes.

2. Elliott Wave Structure

Daily Wave Structure (D1)

– On the daily timeframe, we continue to see an extension of the blue Wave 5.

– This is understandable given the current global environment, where geopolitical and economic risks remain elevated, pushing capital flows into safe-haven assets such as gold and silver.

– However, this strong shift toward safe assets also highlights growing systemic risks within global economies.

– As mentioned last Sunday, historically, recent FOMC cycles have typically occurred during periods of consolidation or correction, followed by the start of a long-term bullish trend after the announcement.

– The key difference this time is that price has already rallied strongly ahead of FOMC. Therefore, today’s FOMC release may trigger significant volatility.

H4 Wave Structure

– As discussed in yesterday’s plan, the recent corrective move did not differ materially in size, duration, or target compared to previous corrective waves within the yellow Wave 3 structure.

→ This strongly suggests that the pullback was merely a sub-wave within yellow Wave 3, keeping the bullish structure intact.

H1 Wave Structure

– On H1, a black 5-wave structure appears to be forming inside yellow Wave 3.

– As previously stated, during an extended wave, assigning precise labels while price is still unfolding is extremely difficult and often impractical, especially under extreme market sentiment.

– However, one point remains very clear:

Looking back at previous overbought RSI conditions (highlighted on the chart), each corrective phase was followed by a new price high.

– Currently, RSI is once again deeply overbought, leading me to expect another upside push to form a new high after the correction, at least until a clear RSI divergence appears at the top.

3. Key Price Zones

– With H4 and H1 momentum preparing to turn bearish, we focus on lower support zones to look for buy opportunities in line with the dominant trend.

Potential support zones

– 5192

– 5101

Upper resistance

– On the upside, multiple Fibonacci projections from different wave structures converge around 5323.

→ This zone represents a strong resistance area.

4. Trading Plan

Buy setup zone 1

– Entry: 5193 – 5191

– Stop Loss: 5172

– TP1: 5249

– TP2: 5323

Buy setup zone 2

– Entry: 5102 – 5100

– Stop Loss: 4982

– TP1: 5192

– TP2: 5323

XAUUSD (H1) – Liam Plan (Jan 27) Bullish TrendQuick summary

Gold is still trending higher inside a clean rising channel, but price is now approaching a weak high / liquidity pocket where stop-runs are likely.

Macro backdrop adds fuel for volatility: reports suggest the US is pressuring Ukraine toward territorial concessions as part of peace talks — this kind of uncertainty often keeps safe-haven demand supported, but it can also create fast spikes + fake breaks.

➡️ Today’s rule: follow the uptrend, but only buy at liquidity test points. No chasing highs.

1) Macro context (why spikes are likely)

If markets start pricing a forced compromise in the Ukraine conflict:

risk sentiment can swing quickly,

headlines can trigger instant pumps, then sharp retraces.

✅ Safe approach: let price hit your zones first, then trade the reaction — not the headline.

2) Technical view (H1 – based on your chart)

Price is respecting an ascending channel and building liquidity around key levels.

Key levels (from the chart):

✅ Support / buy liquidity zone: 4,995 – 5,000

✅ Flip / reaction zone: 5,047

✅ Upper resistance / supply: 5,142

✅ Weak High / liquidity target: 5,192.6

✅ Extension target (1.618): 5,240.8

Bias stays bullish while inside the channel, but near 5,192–5,240 we should expect liquidity sweep → pullback behavior.

3) Trading scenarios (Liam style: trade the level)

A) BUY scenarios (priority – trend continuation)

A1. BUY the pullback into the flip zone (cleanest R:R)

✅ Buy: 5,045 – 5,050 (around 5,047)

Condition: hold + bullish reaction (HL / rejection / MSS on M15)

SL (guide): below 5,030 (or below the reaction low)

TP1: 5,085 – 5,100

TP2: 5,142

TP3: 5,192.6

Logic: This is the best “trend-following” entry — buy support, sell into liquidity above.

A2. BUY deep liquidity sweep (only if volatility hits)

✅ Buy: 4,995 – 5,000

Condition: sweep + strong reclaim (fast rejection / displacement up)

SL: below 4,980

TP: 5,047 → 5,142

Logic: This is the strongest liquidity test zone on your chart — ideal for a bounce if price flushes.

B) SELL scenarios (secondary – reaction scalps only)

B1. SELL the weak high sweep (tactical scalp)

✅ If price runs 5,192.6 and shows rejection:

Sell: 5,190 – 5,200

SL: above the sweep high

TP: 5,142 → 5,085

Logic: Weak highs often get swept first. Great for quick mean reversion back into the channel.

B2. SELL extension (highest-risk, but best location)

✅ Sell zone: 5,235 – 5,245 (around 5,240.8)

Only with clear weakness on M15–H1

TP: 5,192 → 5,142

Logic: 1.618 extension is a common exhaustion pocket — don’t short early, short the reaction.

4) Key notes

Don’t trade mid-range between 5,085–5,142 unless you’re scalping with tight rules.

Expect false breakouts near 5,192 and 5,240 during headlines.

Best execution today = buy support, take profits into liquidity.

Question:

Are you buying the 5,047 pullback, or waiting for the 5,192 sweep to sell the reaction?

— Liam

XAUUSD (Gold) 45-Minute Chart – Strong Bullish Continuation AbovTrend:

Gold is in a clear bullish trend. Price has made higher highs and higher lows, accelerating strongly on Jan 28 with a breakout and momentum expansion.

Market Structure:

Earlier consolidation zones (value areas) were broken to the upside, followed by acceptance above prior ranges.

The most recent move shows impulsive buying, suggesting institutional participation rather than a weak breakout.

Volume Profile (VCP):

Previous High Volume Nodes (HVN) around 5,080–5,120 acted as resistance, now flipped into support.

Current price is trading above the Point of Control (POC), which confirms bullish control.

Low volume above indicates price discovery, meaning less resistance overhead.

Key Levels:

Resistance: 5,270–5,300 (current highs / psychological zone)

Immediate Support: 5,120–5,100 (previous value area high)

Deeper Support: 5,020–4,980 (range low & demand zone)

Bias:

Bullish while above 5,100

Pullbacks into previous value areas are likely to attract buyers.

Trading Insight:

Best opportunities are buy-the-dip setups rather than chasing highs.

A rejection with high volume below 5,100 would be the first warning sign of a deeper correction.

GOLD Buy Pullbacks in Bullish TrendMarket Context (M30)

Gold continues to trade within a strong bullish continuation phase, holding firmly inside a well-defined ascending channel. Recent pullbacks are technical retracements for liquidity rebalancing, not signs of distribution or trend exhaustion.

On the macro side, persistent USD weakness, sustained safe-haven demand, and only modest Fed easing expectations keep the broader backdrop supportive for gold. This combination allows upside momentum to remain controlled and constructive rather than emotional.

➡️ Overall bias: Bullish – prioritize BUY setups aligned with the main trend.

Structure & Price Action

M30 structure remains intact with clear Higher Highs and Higher Lows.

Price continues to respect previous demand and key levels, confirming active buyer participation.

No bearish CHoCH has been confirmed.

The current leg is expanding toward higher Fibonacci extensions, reinforcing trend continuation.

Key insight:

👉 As long as structure holds, pullbacks represent opportunity — not risk.

Trading Plan – MMF Style

Primary Scenario – Trend-Following BUY

Focus on patience and execution at discounted levels, not chasing price at extensions.

BUY Zone 1: 5,185 – 5,170

(Short-term demand + channel support)

BUY Zone 2: 5,106 – 5,085

(Key level confluence + trendline support)

➡️ Execute BUYs only after clear bullish reaction and structure confirmation.

➡️ Avoid FOMO at extended highs.

Upside Targets:

TP1: 5,250

TP2: 5,309 (Next ATH extension zone)

Alternative Scenario

If price holds firmly above 5,250 without a meaningful pullback, wait for a break & retest before looking for continuation BUYs.

Invalidation

A confirmed M30 close below 5,044 would weaken the current bullish structure and require reassessment.

Summary

Gold remains in a controlled bullish expansion, driven by structure and macro flow. The edge is not calling the top, but buying pullbacks within demand while the trend remains intact. As long as structure holds, higher prices remain the path of least resistance.

XAUUSD - H1 Gold structurally bullishXAUUSD – H1 Gold remains structurally bullish near all-time highs| Lana ✨

Gold is extending its bullish momentum for a second consecutive session and continues to trade near all-time highs. Price action remains constructive, with the market holding above key structure while deciding between continuation or a deeper pullback into value.

📈 Market Structure & Trend Context

The short-term and medium-term structure remains bullish, with price respecting the ascending channel.

The recent push above previous highs confirms strong demand, but current price action also shows signs of consolidation near ATH.

This behavior is typical after an impulsive rally, where the market pauses to build acceptance or rebalance liquidity before the next directional move.

As long as price holds above the rising structure, the bullish thesis remains valid.

🔍 Key Technical Zones to Watch

ATH Reaction Zone: 5080 – 5110

This is a sensitive area where price may consolidate, fake out, or briefly reject before choosing direction.

Primary Pullback / Buy Zone: 5000 – 5020

A key structural level aligned with prior resistance-turned-support and the midline of the bullish channel.

Secondary Support (Deeper Pullback): 4920 – 4950

A stronger value area if volatility increases or liquidity is swept below the channel.

Upside Expansion Zone: 5180 – 5200+

If price accepts above ATH, this becomes the next upside objective within the channel.

🎯 Trading Scenarios (H1 Structure-Based)

Scenario 1 – Continuation Above ATH:

If price consolidates above 5080–5110 and shows acceptance, gold may extend toward 5180–5200. This scenario favors patience and confirmation rather than chasing immediate breakouts.

Scenario 2 – Pullback Into Structure (Preferred):

A pullback toward 5000–5020 would allow the market to rebalance liquidity and offer a higher-quality continuation setup. Holding this zone keeps the bullish structure intact.

Scenario 3 – Deeper Correction:

If price loses the primary support, the 4920–4950 zone becomes the next key area to watch for buyer response and trend defense.

🌍 Macro Context (Brief)

Gold continues to benefit from heightened geopolitical risks and ongoing trade uncertainty, reinforcing its role as a safe-haven asset.

At the same time, market attention is shifting toward the outcome of the two-day FOMC policy meeting on Wednesday, which may introduce volatility and short-term repricing.

This backdrop supports gold structurally, while also increasing the likelihood of sharp intraday swings around key levels.

🧠 Lana’s View

Gold remains bullish, but near ATH levels, discipline matters more than conviction.

Lana prefers buying pullbacks into structure, letting price confirm, and avoiding emotional trades during headline-driven volatility.

✨ Respect the structure, stay patient near the highs, and let the market come to your levels.

XAUUSD – Bullish Continuation, ATH Expansion Still in PlayGold continues to trade within a strong bullish channel, maintaining its ATH expansion structure. The recent pullback is corrective in nature and shows clear signs of liquidity absorption rather than distribution.

On the macro side, sustained USD weakness, safe-haven flows, and a still-cautious Fed outlook keep gold supported at elevated levels.

➡️ This environment favors trend continuation, not top-picking.

Structure & Price Action

H1 structure remains bullish with Higher Highs and Higher Lows intact.

The recent drop has respected key demand zones and the ascending trendline.

No bearish CHoCH confirmed → downside moves remain corrective.

Price is rebalancing after an impulsive leg, preparing for the next expansion.

Key takeaway:

👉 Pullbacks are opportunities to position with the trend, not signs of reversal.

Trading Plan – MMF Style

Primary Scenario – BUY the Pullback

Focus on patience and structure confirmation.

BUY Zone 1: 5,045 – 5,020

(Rebalance area + intraday demand)

BUY Zone 2: 4,985 – 4,960

(Trendline confluence + deeper liquidity)

➡️ Only execute BUYs after bullish reaction (rejection wicks / structure hold).

➡️ Avoid chasing price at highs.

Upside Targets (ATH Extension):

TP1: 5,106

TP2: 5,198 (upper extension zone)

Alternative Scenario

If price holds firmly above 5,106 without a meaningful pullback, wait for a break & retest to join continuation BUYs.

Invalidation

A confirmed H1 close below 4,960 would weaken the bullish structure and require a reassessment.

Summary

Gold remains in a controlled ATH expansion phase. As long as structure and demand zones hold, the path of least resistance stays to the upside.

The MMF approach remains unchanged: buy pullbacks, follow structure, and let the trend do the work.

Entry setup 11Before Trade Entry Follow the Step:-(check list)

Step 1:- Identify the Trend

Step 2:- Bullish Trend Wait for Support Price & Reversal Candlestick(Take Buy)

Step 3:- Bearish Trend Wait for Resistance & Reversal Candlestick(Take Sell)

Step 4:- Fibonacci retracement confirm

Step 5:- Wait for Reversal candlestick

My Trading Role:-

1. Don't Lose capital

2. Trade less Earn More

Focus On:-

1. Quality Trades

2. Risk Management

3. Self - Discipline

RISK WARNING:- All trading involves risk. Only risk capital you're prepared to lose. This chart has not given any investment advice, only for educational purposes