XAUUSD/GOLD PMI NEWS FORECAST 02.02.26XAUUSD / GOLD – ISM Manufacturing PMI Trade Plan

Date: 02-02-2026

Hello traders,

Welcome back to Tamil Trading Education.

Today we are analyzing XAUUSD (Gold) based on the ISM Manufacturing PMI news.

This is a news-based breakout and retest strategy, so please avoid emotional or early entries.

🔑 Key Levels Marked on the Chart

Resistance R2 – Major upside target

Resistance R1 – Breakout decision zone

Support S1 – First downside confirmation

Support S2 – Major bearish target

We will trade only after confirmation.

📈 Scenario 1: ISM PMI is NEGATIVE (Bullish for Gold)

If the ISM Manufacturing PMI comes out negative:

Gold is expected to move upward

Wait for a clear breakout above Resistance R1

After breakout, wait for a proper retest

👉 BUY Entry:

Enter BUY only after breakout and retest confirmation

🎯 Targets:

First target near Resistance R

Xauusdsetup

XAUUSD/GOLD 1H RISING WEDGE SELL PROJECTION 03.02.26XAUUSD / GOLD – 1H Rising Wedge Sell Projection

Date: 03-02-2026

Hello traders,

In this video, I’m going to explain a clear sell setup on XAUUSD (Gold) based on price action and chart patterns.

📉 Market Structure Overview

Gold is currently trading under a 1-hour major downtrend line, which shows the overall bearish market structure.

Price has moved up inside a Rising Wedge pattern, which is a bearish reversal pattern when it forms during a downtrend.

⚠️ Key Technical Observations

At the top of the rising wedge, price is facing a strong resistance zone (R1).

We can clearly see a double top formation expectation, which signals weak buying strength.

This area also aligns with the trendline rejection, increasing the probability of a downside move.

🔴 Sell Trade Plan

Sell Entry: Near the wedge top and resistance zone

Stop Loss: Above the resistance and wedge breakout area

Target Price: Support S1 zone (previous demand area)

This setup offers a good risk-to-reward ratio, with sellers likely to take control after rejection.

XAUUSD/GOLD 1H BUY PROJECTION 03.02.26XAUUSD / GOLD – 1H BUY PROJECTION (03-02-2026)

Hello traders,

Let’s break down today’s XAUUSD 1-hour buy setup step by step.

🔍 Market Structure Analysis

Gold was moving inside a symmetrical triangle pattern, showing strong price compression.

Recently, price has broken above the descending trendline, which signals a potential bullish reversal.

This breakout confirms that buyers are stepping back into the market.

📌 Key Levels

Support Zone: Strong buying area around the previous consolidation

Resistance 1: Near the breakout retest zone

Resistance 2: Upper resistance acting as the next bullish checkpoint

Price is currently holding above support, which increases the probability of continuation to the upside.

🟢 Trade Plan (Buy Setup)

Entry: After confirmation above the breakout zone

Stop Loss: Below the support and triangle base

Target (TP): Previous high / upper resistance zone

Risk is clearly defined, and the risk-to-reward ratio is favorable.

🚀 Projection Logic

If price respects the support and continues higher:

Expect a pullback → continuation move

Momentum can accelerate once Resistance 1 is broken

Final move projected toward the TP zone

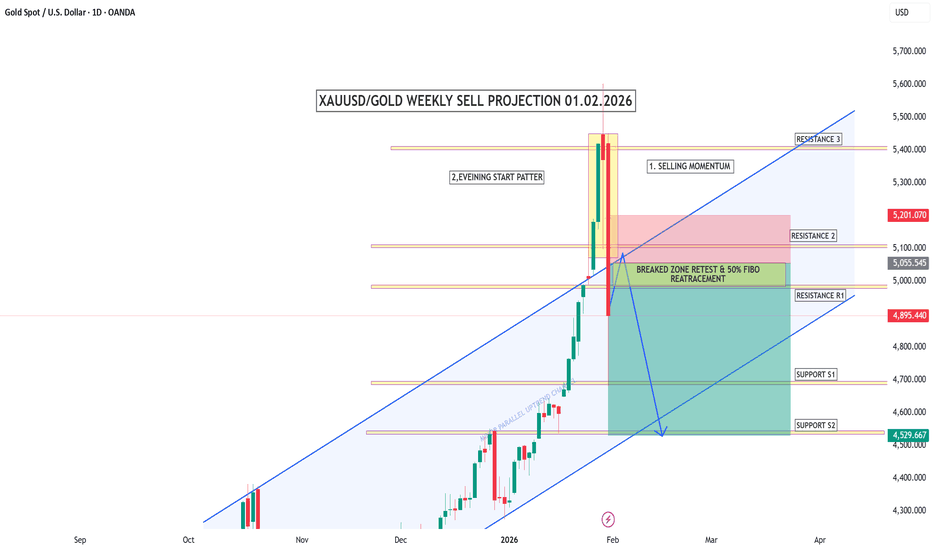

XAUUSD/GOLD WEEKLY SELL PROJECTION 01.02.26“This is the weekly sell projection for Gold, XAUUSD.

Price has reached a major resistance zone and shows clear selling momentum.

An evening star pattern is formed at the top, which indicates a potential trend reversal.

The market has broken the previous support and is now retesting the broken zone.

This area also aligns with the 50% Fibonacci retracement, making it a strong sell zone.

As long as price stays below this resistance, the bearish bias remains valid.

Downside targets are the next support levels, Support S1 and Support S2.

Risk management is very important.

Always use proper stop loss and trade with confirmation.

This is a technical analysis, not financial advice.

Trade smart, stay disciplined, and protect your capital.”

XAUUSD/GOLD 15MIN SELL LIMIT PROJECTION 30.01.26XAUUSD (Gold) – 15 Minute Sell Limit Projection | 30-01-2026

Gold is currently moving in a higher-timeframe uptrend, but in the short term, price is showing signs of a pullback and potential rejection.

The marked sell limit zone is a strong resistance area formed by the 1-hour trendline and the 50% Fibonacci retracement level. This confluence increases the probability of a bearish reaction from this zone.

Trade Idea

Sell Entry: Near the 1H trendline + 50% retracement resistance

Stop Loss: Above the resistance zone (trendline break level)

Target: Previous demand / liquidity area around 5238

Market Expectation

Price may first move upward to test resistance, then reject and continue downward toward the target zone.

This setup is a retracement sell, not a trend reversal.

Risk Note

Always wait for price action confirmation on lower timeframes and manage risk properly, as gold volatility remains high.

XAUUSD/GOLD CORRECTION BUY PROJECTION 29.01.26XAUUSD / Gold – Correction Buy Setup (29-01-2026)

Market View:

Gold is in a strong bullish trend. The current move is a normal correction, not a trend reversal.

Buy Zone:

Support S2 + Fair Value Gap (FVG)

0.618 Fibonacci Golden Ratio

Area around 5396 – 5400

Trade Plan:

Look for buy confirmation in the marked support zone.

Expect price to respect the uptrend line and move higher.

Targets:

First target: Resistance R1

Main target: 5600+

Stop Loss:

Below Support S2 / below recent structure low.

Three White Soldiers Pattern Gold Buy Projection 27.01.26🔍 Technical Breakdown

Market Structure:

Overall structure remains bullish. Price already broke the neckline and a successful retest is completed, confirming continuation bias.

Retracement Zone:

Price has completed a 50% Fibonacci retracement, which is a high-probability buy zone in an uptrend.

Candlestick Confirmation:

Formation of Three White Soldiers indicates strong bullish momentum returning after the pullback.

📍 Key Levels

Entry for Buy:

Near 5065 – 5070 (Support + Retest zone)

Support Levels:

Support: ~5070

Support S1: ~5050

Targets / Resistance:

R1 / Target Zone: 5095 – 5105

Further upside possible if R1 breaks with volume

🎯 Trade Idea (Projection)

Bias: BUY on dips

Logic:

✔ Break & retest confirmed

✔ 50% retracement respected

✔ Bullish candle pattern

✔ Strong rejection from support

⚠️ Risk Note

If price sustains below 5050, bullish projection may fail and consolidation / deeper correction is possible.

XAUUSD – Monday Focus: Buy the Dip Toward 5,020–5,043Market Context

Gold remains firmly supported by a bullish risk environment. The recent impulse leg confirms that buyers are still in control, while pullbacks are being absorbed rather than extended.

This is continuation behavior, not distribution.

The question for Monday is not if Gold is bullish —

but where the dip becomes opportunity.

Technical Structure (H1)

Market has already confirmed bullish BOS

Strong impulsive leg created multiple stacked FVGs below

Current price is consolidating above structure, not breaking it

Pullback is corrective in nature

This is a classic impulse → retracement → continuation setup.

Key Zones to Watch

Immediate resistance / BOS level: 4,969 – 4,970

Intraday BUY zone: 4,933 – 4,940

Upper FVG support: 4,920 – 4,899

Deeper demand (HTF): 4,860 – 4,880

As long as price holds above the upper FVG, bullish bias remains intact.

Scenarios (If – Then)

Scenario 1 – Bullish Continuation (Primary)

If price pulls back into 4,933 – 4,940 and holds

Buyers step in → continuation toward:

5,020

5,043 (1.618 extension)

Scenario 2 – Deeper Pullback (Alternative)

If price loses 4,933

Expect mitigation toward 4,920 – 4,899

Only a sustained H1 close below 4,899 would weaken the bullish structure

Summary

Gold is not overextended — it is rebalancing within a bullish trend.

The structure favors buying pullbacks, not chasing highs.

This is a dip-buying market until structure says otherwise.

XAUUSD – Monday Focus: Buy the Dip Toward 5,020–5,043 Market Context

Gold remains firmly supported by a bullish risk environment. The recent impulse leg confirms that buyers are still in control, while pullbacks are being absorbed rather than extended.

This is continuation behavior, not distribution.

The question for Monday is not if Gold is bullish —

but where the dip becomes opportunity.

Technical Structure (H1)

Market has already confirmed bullish BOS

Strong impulsive leg created multiple stacked FVGs below

Current price is consolidating above structure, not breaking it

Pullback is corrective in nature

This is a classic impulse → retracement → continuation setup.

Key Zones to Watch

Immediate resistance / BOS level: 4,969 – 4,970

Intraday BUY zone: 4,933 – 4,940

Upper FVG support: 4,920 – 4,899

Deeper demand (HTF): 4,860 – 4,880

As long as price holds above the upper FVG, bullish bias remains intact.

Scenarios (If – Then)

Scenario 1 – Bullish Continuation (Primary)

If price pulls back into 4,933 – 4,940 and holds

Buyers step in → continuation toward:

5,020

5,043 (1.618 extension)

Scenario 2 – Deeper Pullback (Alternative)

If price loses 4,933

Expect mitigation toward 4,920 – 4,899

Only a sustained H1 close below 4,899 would weaken the bullish structure

Summary

Gold is not overextended — it is rebalancing within a bullish trend.

The structure favors buying pullbacks, not chasing highs.

This is a dip-buying market until structure says otherwise.

Trump Davos Warning Keeps Gold in Strong Uptrend Market Context (News → Flow)

Comments from Trump at Davos, including renewed threats and pressure around Greenland, have escalated geopolitical uncertainty during the Asian session.

Markets reacted in classic risk-off mode:

USD weakens amid political uncertainty

Equities hesitate, risk appetite fades

Safe-haven flows rotate into Gold, driving momentum higher

Gold is not moving on speculation — it is reacting to capital seeking protection.

Technical Structure (H1 – SMC)

Overall structure remains bullish, confirmed by multiple BOS

Price is trending inside a well-defined ascending channel

Recent pullback respected the bullish FVG, showing strong demand

No bearish acceptance below structure at this stage

➡️ FVG respected → continuation remains in play

Key Decision Zones

Upper FVG: 4,765.425

Mid support: 4,727.188

Current impulse high: 4,883.900

These are reaction zones, not chase levels.

Scenarios (If – Then)

Primary Scenario – Trend Continuation

If price holds above 4,765.425

Bullish structure remains intact

Gold can continue advancing toward higher channel resistance

Alternative Scenario – Technical Pullback

If price loses 4,765.425

A pullback toward 4,727.188 is possible for rebalancing

Only a clear H1 close below 4,727.188 would weaken the bullish bias

Summary

Geopolitical rhetoric is accelerating volatility, but structure still leads the narrative.

Gold is not reacting emotionally —

it is pricing risk.

XAUUSD/GOLD WEEKLY BUY PROJECTION 21.01.26Resistance R1: 4826.190

✅ Target Price 1: Around 4900 zone

✅ Target Price 2: Around 5000 zone

✅ Long-Term Resistance Target: 2.618 Fibonacci = 4996.920

🟩 Best Buy / Entry Zone

📍 Broken trendline + Resistance retest area

If price pulls back into this zone,

fills the Fair Value Gap (FVG),

and gives a strong bullish confirmation candle,

✅ then it becomes a high-probability buy entry.

🟥 Stoploss Area

📍 Stoploss should be placed below the Fair Value Gap / retest zone

Safer stoploss: below the last swing low.

SKY ROCKET XAUUSD/GOLD BUY PROJECTION 21.01.26rend = Strong Bullish

Price uptrend channel la travel pannudhu ✅

Bullish momentum candle confirm pannudhu ✅

Break + retest idea perfect ✅

Fair Value Gap (FVG) zone la re-entry buy chance iruku ✅

📌 Trade Plan (Based on your chart)

🟦 BUY AREA (Entry Zones)

✅ Zone 1 (Best Entry):

📍 FVG + retest area around 4720 – 4680

✅ Zone 2 (Aggressive Entry):

📍 Breakout retest near 4750 – 4720

🛑 STOPLOSS (Chart la marked)

📍 Below structure support / zone

✅ Stoploss: 4660 – 4640

🎯 Targets (As per Projection)

🎯 Target 1: ~4850 (Target Price 1)

🎯 Target 2: ~5000 (Target Price 2 / Major resistance + Fib retracement)

📌 Confirmation Checklist (Signal)

Buy confirm panna:

✅ Retest candle + rejection wick

✅ Bullish close above retest zone

✅ Trendline hold

XAUUSD/GOLD 4H SELL LIMIT PROJECTION 20.01.26Resistance / Sell Zone

4755.588 = RESISTANCE ATH (Main sell area)

✅ Entry Plan

SELL LIMIT around 4750 – 4756

Only take sell if price obeys trendline (rejection / wick / bearish candle)

🟩 Targets (Support Zones)

TP1: ~4700 (Day Low Support S1)

TP2: ~4666.195 (Day Low Support S2)

🛑 Stop Loss

Above ATH zone: ~4779.491

🧠 Trade Logic (Simple)

Price is in an up channel but reached ATH resistance.

So expectation: pullback move down to daily supports.

Risk Ratio: 1:4 (as marked)

XAUUSD/GOLD 15MIN BUY PROJECTION 20.01.26Market Structure

Bullish continuation pattern formed

Clear BOS (Break of Structure) confirming buyers strength

Support Zones

Day Opening acting as Support

Day Low Support (S2) – strong demand base

Resistance

Yesterday High acting as Resistance

Price is trying to break & hold above this level

Entry Plan

✅ Entry only AFTER RETEST

Wait for price to retest the breakout zone

Confirm with bullish candle / rejection wick

Targets

🎯 Target Zone: Top green box area

Expect price to push higher towards target price zone

Stoploss

🛑 Stoploss Zone: Red box

Below retest support area / below structure low

🎙️ NARRATION (For YouTube / Telegram)

“XAUUSD Gold 15-minute chart shows a strong bullish continuation setup.

We got a clear break of structure, confirming buyers are in control.

Day opening is acting as support and day low support zone is holding strongly.

Right now price is approaching yesterday’s high resistance, so the best plan is to take entry only after a clean retest of the breakout zone.

Once the retest confirms with bullish rejection, we can expect price to continue upside towards the target zone.

Stoploss will remain below the retest support to protect the trade.”

If you want, I will also make this into short 15-sec voice style script for YouTube Shorts 🎬

“Liquidity Grab → Pivot Support Holds → Next Bullish Leg Loading🔍 Market Structure & Key Observations

Overall market structure remains bullish with clear higher highs & higher lows ✔️

Price is respecting the upward trendline, confirming ongoing bullish momentum 📈

The recent sharp drop was a liquidity sweep into the Pivot Point / Demand zone, followed by a strong bullish reaction → Smart Money accumulation 💼💰

Multiple POI (Point of Interest) reactions below show buyers are active on dips

Current consolidation above the Pivot Point zone suggests preparation for the next impulsive move up, not distribution

🎯 Suitable Target Zones (High Probability)

🎯 Primary Target (TP1)

➤ 4,615 – 4,625 🎯

Prior resistance / range high

Liquidity resting above recent consolidation highs

Most realistic short-term objective

🚀 Extended Target (TP2)

➤ 4,650 – 4,670 🚀💸

Measured move from the last bullish impulse

Upper expansion of the ascending structure

Valid if bullish momentum accelerates

📌 Optional BUY Trade Idea (Trend-Following)

🟢 Buy Zone (on pullback):

➤ 4,560 – 4,580

(confluence of Pivot Point + trendline support)

❌ Stop-Loss (invalidation):

➤ Below 4,540

🎯 Take Profit:

TP1: 4,620 🎯

TP2: 4,660 🚀

📊 Risk–Reward: approx. 1:2.5 – 1:3+

🧭 Market Outlook Summary

Factor Bias

Trend Bullish 📈

Momentum Buyers in control 💪

Structure Continuation pattern ✅

Liquidity Upside targets active 💧

GOLD SHOWING A GOOD UP MOVE WITH 1:8 RISK REWARD GOLD SHOWING A GOOD UP MOVE WITH 1:8 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for break

C. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follws good risk reward

please dont use more than one percentage of your capitalfollow risk reward and tradeing rules

that will help you to to become a bettertrader

thank you

XAUUSD/GOLD 1H SELL LIMIT PROJECTION 19.01.26✅ XAUUSD / GOLD (1H) – SELL LIMIT PROJECTION (19.01.26)

Gold is currently respecting the 1H downtrend line, and price is moving in a bearish structure. Even though we saw a bullish engulfing reaction from demand, this move is likely a pullback before bearish continuation.

📌 Key Levels

🔴 Supply / Resistance Zone: 4615.608

This level is acting as a premium zone + resistance area.

⚫ Key Mid Support/Resistance: 4585.679

Important reaction level. Price must reclaim & hold above this for further upside push.

🔵 Demand / Support Zone: 4576 – 4578

Strong demand region where buyers previously entered and formed engulfing.

📍 Current Market Price: 4596.320

📉 Trade Idea (Sell Limit Setup)

✅ Sell Limit Entry: 4610 – 4615 (inside supply + trendline confluence)

🛑 Stoploss: 4628 – 4630 (above supply highs)

🎯 Targets:

TP1: 4585.679

TP2: 4576 – 4578 (Demand zone)

📊 Risk-Reward: 1:2

🧠 Setup Logic

✔ 1H trendline still bearish

✔ Entry at premium / supply zone (4615.608)

✔ Target into support/demand zone (4576 – 4578)

✔ High probability continuation after pullback

⚠️ Confirmation: Watch for bearish rejection / wick near 4615 zone

Technical Analysis on goldGold has recently experienced a strong upside move, primarily driven by heightened geopolitical tensions, which fueled safe-haven demand. This aggressive move resulted in a gap-up opening, leaving an unfilled gap around the 4508 level, which remains an important technical magnet.

From a technical perspective, price is currently trading within an ascending structure but is showing signs of compression near the upper boundary, suggesting potential exhaustion. A short-term triangle / consolidation structure is forming, indicating that a decisive move may be imminent.

The key level to watch is 4565.

A sustained break and acceptance below 4565 would confirm a shift in momentum and strengthen the bearish case.

If the rising trendline is broken, it would signal bearish continuation, with increased downside momentum likely to follow. In such a scenario, price could retrace further to fill the unfilled gap near 4508, which aligns with prior demand and liquidity.

From a fundamental standpoint, while gold initially rallied on geopolitical stress, recent developments suggest some easing in risk sentiment. Reduced escalation and a softer geopolitical tone have slightly cooled safe-haven flows, supporting a short-term bearish bias unless new risk catalysts emerge.

That said, the bullish scenario remains valid if geopolitical tensions escalate again. In such a case, renewed safe-haven demand could push gold higher, with a potential breakout above the previous ATH and extension toward the 4670 zone.

Summary

Bullish above trendline & resistance break → potential ATH continuation toward 4670

Bearish below 4565 & trendline break → downside continuation toward 4508 gap fill

Market currently at a decision point, awaiting confirmation

⚠️ As always, wait for confirmation and manage risk accordingly.

GOLD (XAU/USD) – Bullish Continuation After Breakout🔍 Market Structure & Key Observations

Price is respecting a clean upward trendline, confirming a strong bullish structure 📈

Multiple POI (Point of Interest) reactions show consistent buying interest → Smart Money accumulation 💼

Clear Breakouts + BOS (Break of Structure) validate trend continuation ✔️

The former resistance at the High Pivot Point has flipped into strong support 🟢

Current consolidation above support suggests bullish continuation, not distribution

🎯 Suitable Target Zones (High Probability)

🎯 Primary Target (TP1)

➤ 4,640 – 4,655 🎯

Aligns with the upper channel resistance

Matches measured move from the recent impulse

High-probability target while price holds above support

🚀 Extended Target (TP2)

➤ 4,680 – 4,700 🚀💰

Channel expansion target

Liquidity resting above recent highs

Valid if bullish momentum accelerates

📌 Bullish Trade Idea (Optional Setup)

🟢 Buy on Pullback Zone:

➤ 4,590 – 4,605

(confluence of support level + trendline)

❌ Invalidation / Stop-Loss:

➤ Below 4,565

🎯 Take Profit Levels:

TP1: 4,650 🎯

TP2: 4,690 🚀

📊 Risk–Reward Ratio: ~ 1:2.5 to 1:3+

🧭 Overall Market Outlook

Factor Bias

Trend Strong Bullish 📈

Momentum Buyers in control 💪

Structure Higher Highs & Higher Lows ✅

Liquidity Target Above recent highs 💧

XAUUSD (15M) – Liquidity Sweep → Distribution SetupPrice is currently trading inside a clearly defined range.

Previous sell-side liquidity has already been swept from the equal lows, triggering a sharp displacement to the upside. This move looks corrective rather than impulsive.

Key observations:

Upside move is targeting equal highs / range high liquidity.

Area near the range high aligns with premium zone + likely supply.

Expecting buy-side liquidity grab above highs to trap late longs.

Plan & Bias:

Allow price to run the highs and complete the liquidity sweep.

Watch for bearish shift in market structure (MSS) on lower timeframe near the range high.

Look for short entries on retest of supply / FVG after MSS.

Target is a range rotation back to sell-side liquidity near the range lows.

Narrative:

Classic range manipulation. Market clears the downside, entices breakout buyers at the highs, then distributes and reverses. Patience until liquidity is taken, then execution.

📌 Bias remains short after buy-side liquidity is swept.

“Bullish Momentum Accelerates → Trendline Support Holding for ?🟡 GOLD (XAU/USD) – Strong Bullish Continuation After Breakout 🚀📈

🔍 Market Structure & Key Observations

Price is respecting a clean upward trendline, confirming a strong bullish structure 📈

Multiple POI (Point of Interest) reactions show consistent buyer absorption → Smart Money accumulation 💼

A clear Breakout + BOS (Break of Structure) has occurred above the previous range ✔️

Price is now holding above the High Pivot Point, which has flipped into support 🟢

Current consolidation above support signals bullish momentum continuation, not exhaustion

🎯 Suitable Target Zones (High Probability)

🎯 Primary Target (TP1)

➤ 4,620 – 4,635 🎯

Aligned with projected bullish leg

Matches upper continuation structure

High probability if price holds above support

🚀 Extended Target (TP2)

➤ 4,660 – 4,680 🚀💰

Channel expansion target

Liquidity resting above recent highs

Valid if momentum accelerates

📌 Bullish Trade Scenario (Optional Setup)

🟢 Buy on Pullback Zone:

➤ 4,565 – 4,585 (trendline + support confluence)

🎯 Take Profit Levels:

TP1: 4,630 🎯

TP2: 4,675 🚀

📊 Risk–Reward: ~1:2.5 to 1:3+

🧭 Market Outlook

Factor Bias

Trend Strong Bullish 📈

Momentum Buyers in control 💪

Structure Higher highs & higher lows ✅

Liquidity Target Above highs 💧