Metropolis - Keep On RadarCMP 1817 on 02.05.24

The stock price has tried several times in the last 12 months to cross the resistance levels around 1800. This time consolidating near the zone. If crosses this time, may go to 2250.

One has to choose the position sizing carefully, keeping the risk management or exit in mind.

This is only for learning and sharing purposes, not a trading recommendation in any form.

All the best.

Z-CASH

Adani Ports - Long SetupIt can be clearly seen that the stock price has been moving in a rising parallel channel for the last two months. If the pattern continues, the price may go to 1380/1420/1450.

This setup fails if the price remains below 1300 levels.

The above illustration is only my view. Only for learning and sharing purposes, not a piece of trading advice in any form .

All the best.

Sarla Poly - An OpportunityThe stock has taken a support again on the trendline shown on the charts. and given a reversal. If momentum begins on the upside, this can be a good positional trade with a good risk reward.

All levels are mentioned on the charts.

This illustration is only my view, not a piece of trading advice in any form. This is only for learning and sharing purposes.

All the best.

Infy - Low Risk SetupThe stock is forming a rising wedge pattern on the daily chart. This time at the lowest edge of the wedge. If bounces back from these levels, a bullish run may be seen.

Currently at 1475 around. One should exit if sustains below 1460 ( below the wedge formation).

This illustration is only my point of view, for learning and sharing purposes, not a bit of trading advice in any form.

All the best.

Tata Motors - What happens nextAs you see on the charts, if the stock crosses 550 levels and sustains above, it can be considered as the breakout of the Cup & handle pattern. Also, the rising parallel channel will be giving scope for a further upside move.

If does not cross 550 and not sustaining above, then this setup fails.

This is only one view according to the chart patterns, there may be different views while considering different time frames and setups.

Keep a watch . All the best.

Only for learning and sharing purposes, not a piece of trading advice in any form.

All the best.

Jubilant Ingrevia - Looks BullishIt is clear from the chart that the stock price is traveling in a prominent channel, respecting support and resistance on both sides. If the momentum continues, may go to 500.

Considering risk-reward is the first thing in any setup. one should exit below 440/430 depending on the position size and risk management.

This is only for learning and sharing purposes, not a trading recommendation in any form.

All the best.

Escorts - Positional Long OpportunityFor the last 3 months, the stock has been trading in a range that is forming a downward parallel channel. This moment, just close to the upper side of the formation. If breaks the upper level and sustains, this could be a breakout of a parallel channel.

Targets may be 3245/3440 or even more.

The setup is with a good risk-reward ratio.

The entry point should be chosen patiently ( if the price comes down intraday.)

The setup fails if sustains below 2810 for 2 days, or the exit point should be per one's risk management.

This illustration is only my view. It is not a trading recommendation in any form. It is for learning and sharing purposes only.

All the best.

Bata - Positional SetupThe stock has been going down in recent sessions. Now indicating a possible reversal by forming a double bottom and increased volumes.

The most important factor in this setup is the exit, if does not go in the desired direction. One should strictly follow the predetermined risk.

If goes well, then the risk-reward ratio is quite good according to the projected targets.

Only for learning and sharing purposes, not a piece of trading advice in any form.

All the best.

Sparc - Low Risk SetupThe stock has been traveling in a wedge formation for the last two months. This time it is at the bottom. Can take a chance if bounces from here.

The setup fails if sustains below the lower trendline of the wedge for 2 days.

This is only for learning and sharing purposes. Not a piece of trading advice in any form.

All the best.

Bandhan Bank - Short Term SetupThe stock has formed a good support base at 210 since July 23. In recent sessions, there seems a support of 220.

There is a gap formed at the above side at around 236.

If maintain the support of 220 in the coming sessions, may go to test the gap at 236, and the further target comes around 245.

If sustaining below 220, there should be an exit.

This is my observation shared for learning and sharing purposes, not a bit of trading advice in any form.

All the best.

Aarti Ind - What happens next?It is clear from the chart that the price is near the breakout level of the rectangular channel. My setup is to see it bearish. But have to exit if sustains above 540.

The risk reward is also good in this setup.

Targets are mentioned on the chart. ( If works)

The setup is valid only if it sustains below 540.

It is only for learning and understanding purposes, not a piece of trading advice in any form.

All the best.

Try to maintain patience and calmness while trading, if you consider it to be for the long term.

Jubilant Foods - Time To WatchAs it is clear from the charts, the price is coming to the lower level of the channel. if bounces from these levels, may go bullish, Expected target may be 520 or even 580.

The setup fails if doesn't sustain above 497 on a closing basis.

This is only for learning and sharing purposes, not trading advice in any form.

All the best.

Divis lab - Keep an eyeThe concept of the setup is clearly shown on the charts. The third time, the price is around 3540. If bounces back this time too, may go to 3690, 3800, or even more.

It is a low-risk setup because if the price sustains below 3520 for a couple of days, the setup fails. one should exit below 3520 or according to the one's risk management.

The above illustration and setup are only for learning and sharing purposes. it is not a bit of trading advice in any form.

All the best.

Reliance trade setupIt can be marked that the stock has bounced back from 2290 twice. If crosses 2360 with momentum, can go to 2400 or 2460.

MACD is showing a likely crossover.

Sustaining below 2310 will show the weakness on the charts.

Also, according to the setup (if works), the risk-reward ratio is good.

Exit any trade, if it violates your risk management.

Only for learning and sharing purposes, not a bit of trading advice in any form.

All the best.

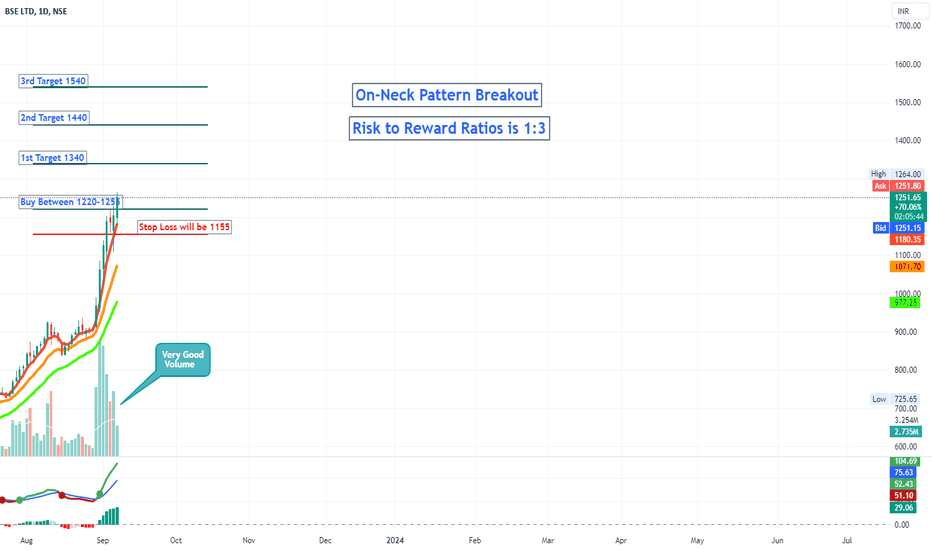

LONG setup in BSE Bullish On-Neck Chart Pattern Breakout happened on the Daily Time frame of NSE:BSE

Price Action is well supported by the volume.

The stock is currently in uptrend making higher highs and higher lows.

One can add this stock into their stocks to buy list.

Initiate the long trade only according to the levels mentioned.

Stop loss will be on Daily closing basis.

Trend Analysis :- UP Trend

Chart Pattern :- Bullish On-Neck

Technical Indicator :- Positive MACD Crossover

Bandhan Bank - Low risk SetupThe chart shows that the stock has bounced back from 210, a support level for the last few months. Also, a retest area for the previous breakout makes it more significant ( if sustains above 210 ).

If sustains above 205-210, may go to 235/252/267 in a short time period. If sustains below 205, will weaken the strength.

Only for learning and sharing purposes, not a bit of trading advice in any form.

Do not gamble in any trade. Try to refine your trading setup in a way so that it should appear like a business.

All the best.

HDFC Life - Keep on RadarThe stock has come down to the support area as shown on the charts. May reverse from here itself or may come down to even 600 levels. Keep tracking for a comfortable entry so that your stop-loss should be humble.

We should learn to hunt like a tiger. Show extreme patience. Take time to identify the trade to make a perfect entry. So that our target may not miss.

Only for learning and sharing purposes, not a piece of trading advice in any form.

All the best for your trading journeys.

SRF - Low Risk SetupThe stock has taken support at the shown trendline third time in the last year. If bounces back again, it can be a good opportunity with a good risk-reward setup.

If goes bullish, humble targets may be 2350/2470. Sustaining below 2130 will weaken the strength.

Only for learning and sharing purposes, not a bit of trading advice in any form.

All the best.

Tata Steel - Low risk setupThe chart shows that the stock is trading in a triangular pattern for the last few days. Also, a rising parallel channel is formed in recent times.

Considering the price of 102-100 as the last support, we can anticipate an upside move up to 135 around.

Only for learning and sharing purposes, not a bit of trading advice in any form.

All the best.

Muthoot Finance - Crossing ResistancesThe chart shows that the stock has crossed the year-long resistances and continuously going forward.

At this level risk-reward ratio is fine for a long entry if thinking of a positional setup.

Buying range is from the current price to as near as 1180.

Sustaining below 1160 will show weakness in the idea.

Targets may be 1390/1510.

Only for learning and sharing purposes, not a bit of trading advice in any form.

All the best.