Learn Advanced Institutional Trading🎓 Learn Advanced Institutional Trading

Advanced Institutional Trading is the high-level skill of trading financial markets the way professional institutions do — using big data, smart tools, and strategic decision-making to consistently win in the market. 💼📊

Learning this means going beyond basic charts or trendlines. It’s about understanding how big money moves, and how to:

🧠 Read institutional order flow

📉 Trade with algorithms and dark pools

📈 Use volume, liquidity zones & smart money indicators

🛡️ Apply institutional-level risk management

⚙️ Trade options, futures, and other derivatives at scale

💬 Interpret economic data like banks and funds do

You’ll learn to:

Identify entry and exit points based on institutional footprints

Use macro and micro market analysis

Build a trading system with logic and consistency

React to live news, earnings, and global events the way hedge funds do

📌 In simple words:

Learning Advanced Institutional Trading gives you the mindset, tools, and strategies used by the top 1% of traders — so you can trade smart, calculated, and professional just like the big players.

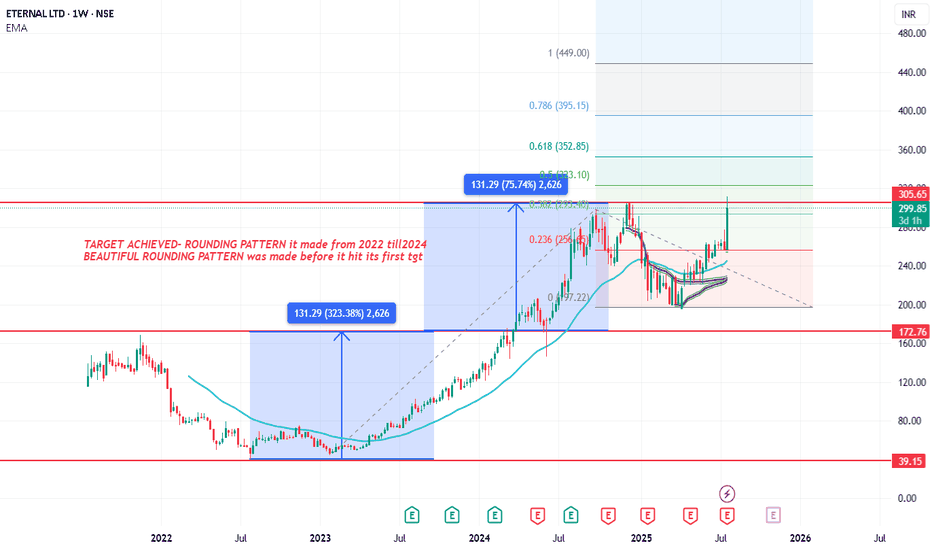

Zomato

Master Institutional Trading🎯 Master Institutional Trading

Master Institutional Trading means learning to trade like the top financial institutions – with precision, strategy, and data-driven decisions. It’s the highest level of trading where you think and act like banks 🏦, hedge funds 📊, and investment firms 💼.

This mastery involves:

🔍 Understanding how smart money moves

📈 Analyzing volume, liquidity zones, and order flow

💹 Executing large trades without impacting the market

🛡️ Applying risk-controlled option & futures strategies

🧠 Using advanced tools, indicators, and market depth

🔄 Adapting to news, events, and institutional triggers

To master this skill, traders must develop:

📊 Strong technical + fundamental analysis

🧘 Discipline and emotion control

🧾 A solid, backtested trading system

💬 Knowledge of macroeconomic impacts

🧮 Command over greeks, derivatives, and hedging

📌 In simple words:

Mastering Institutional Trading means stepping into the shoes of the pros – learning how the big money operates, and trading with structure, edge, and confidence.

Trading Master Class With Experts🎓 Trading Master Class With Experts

The Trading Master Class With Experts is a premium learning experience designed to take your trading skills to the next level by learning directly from market professionals – traders who’ve been in the game, seen the cycles, and built real strategies that work. 💼📈

In this expert-led masterclass, you will:

📊 Learn From Real Market Experts

🧠 Gain insights from institutional traders, analysts, and full-time professionals

🔍 Watch live trading sessions, analysis, and decision-making

🎯 Understand the logic behind high-probability trades

🔄 See how pros adapt to changing markets in real time

🔧 Master Advanced Trading Skills

📉 Deep dive into technical and fundamental analysis

💹 Learn options, futures, and multi-asset strategies

📍 Build a risk-managed trading system from scratch

⚙️ Use institutional tools: order flow, volume profiles, and price action

🛡️ Get Mentorship & Community

👥 Join a private trading community

💬 Get answers in live Q&A sessions

📈 Share progress, refine skills, and grow with a pro network

📌 In simple words:

The Trading Master Class With Experts is where serious traders learn the real rules of the game — directly from those who play it at the highest level.

Meme Stocks & Retail MomentumIn the last few years, the world of stock markets has witnessed something unusual. Stocks of struggling companies suddenly skyrocketed, not because of strong fundamentals or big institutional investments, but because of... memes, social media posts, and retail trader hype.

Welcome to the world of Meme Stocks and Retail Momentum.

This isn’t traditional investing. It’s the new-age, internet-powered way of moving markets — often driven more by emotion and community than by earnings reports or financial analysis.

They are not driven by traditional factors like strong balance sheets, industry leadership, or earnings growth. Instead, they’re driven by community hype and retail investor activity.

Key Features of Meme Stocks:

Sudden, dramatic price surges 🚀

Lots of trading activity by small/retail investors

Heavy buzz on social media & forums

High volatility (prices can jump or crash in hours)

Often targeted by short-sellers

🎯 Real-Life Examples of Meme Stocks

1. GameStop (GME) – USA

In early 2021, GME went from $17 to nearly $483 in weeks. Why?

It was heavily shorted by hedge funds.

Reddit users decided to push back and caused a short squeeze.

Retail investors coordinated buying, sending the price to the moon.

This was a social movement, not just a trade. It became a battle between “small traders” and “Wall Street giants.”

2. AMC Entertainment (AMC)

A struggling cinema chain during COVID saw its stock go up over 1000% in months.

Why?

Meme hype

Reddit army

FOMO (Fear of Missing Out)

3. Bed Bath & Beyond, Blackberry, Nokia

All had their moment as meme stocks even if their business fundamentals were weak.

4. Indian Examples

While India hasn’t seen the exact same meme stock culture, we’ve seen similar retail momentum in:

Zee Entertainment (after merger news & social buzz)

Vodafone Idea (VI) – due to social campaigns and hopes

IRCTC – when people piled in during rapid rallies

👥 What is Retail Momentum?

Now let’s talk about retail momentum — the force behind meme stocks.

Retail Momentum means:

A sudden inflow of buying (or selling) from small, individual investors, usually following trends or hype.

This momentum is usually:

Fast-moving

Emotional

Trend-following

Influenced by influencers, YouTubers, or social forums

Retail traders often follow:

WhatsApp groups

YouTube tips

Trending stocks on Twitter

Telegram pump groups

When thousands (or lakhs) of people chase the same stock, price moves dramatically — even if there's no news or earnings change.

🤖 How Social Media Creates Market Movement

Social media has turned into a financial battleground.

Here’s how a meme stock or retail wave starts:

One user posts a chart, theory, or meme on Reddit, X, or Telegram.

It goes viral. Thousands like or comment.

YouTubers make videos explaining how it can go “5x”.

Traders start piling in.

Price moves rapidly.

News channels pick it up.

Even more retail investors join.

The price spikes even further.

At this point, the stock is not rising on logic. It's rising on human emotion and network effect.

📈 Why Do Meme Stocks Go Up So Fast?

Short Squeezes

Hedge funds or big players short the stock.

Retail investors aggressively buy.

Short sellers are forced to cover — which pushes the price up further.

FOMO (Fear of Missing Out)

When people see others making 100%, 200% in days, they panic and enter at any price.

Retail Buying Power

Today, thanks to apps like Zerodha, Robinhood, Upstox, Groww — it’s easy to buy a stock.

Even a small investor can join in with ₹500.

Community Psychology

People feel like part of a movement.

They hold, buy, and even defend the stock online — often calling it “diamond hands.”

💣 Why Do Meme Stocks Crash?

No Fundamental Support

Eventually, reality hits. The stock isn’t worth the inflated price.

Profit Booking

Early traders book profits → price falls → panic spreads → others sell.

Regulatory Actions

Exchanges might restrict buying (like Robinhood did in GME).

Dilution

Companies issue new shares to cash in on hype → lowers value per share.

🧠 Psychology Behind Meme Stocks

Meme stocks are a human behavior experiment in real-time.

They show:

The power of belief

Herd mentality

Rebellion against institutions

Internet unity

Addiction to risk and gambling thrill

It’s part social movement, part financial play, and part crowd psychology.

🧰 Tips for Trading Retail Momentum Stocks

Enter early or don’t enter at all

Don’t jump in when it's already trending on YouTube.

Use trailing stop-loss

Lock your profits as the stock climbs.

Book profits partially

Don’t wait for the “moon.” Sell in phases.

Avoid margin/leverage

You can be wiped out in one bad move.

Track social buzz

Use tools like Google Trends, Twitter hashtags, Reddit mentions.

Never invest your main capital

Treat it as a speculative side bet, not a long-term investment.

🏁 Final Thoughts: Meme Stocks Are a Mirror of Modern Markets

Meme stocks and retail momentum are not going away. They are part of the new-age investor culture:

Fast-paced

Emotionally charged

Social media influenced

Sometimes logical, often not

They’ve changed how people see the markets. Retail investors now know they can move prices. But with that power comes great risk.

If you want to explore meme stocks, do it with eyes wide open, a small budget, and full acceptance of the risk.

Macro-Driven Risk Planning🔍 What is Macro-Driven Risk Planning?

At its core:

Macro-driven risk planning means managing your investment or trading risks by keeping the larger economic environment in mind.

You don’t just look at a stock or a chart — you ask:

What's happening with interest rates?

Is inflation rising or falling?

What’s the government doing with taxes or spending?

Is the US dollar strong or weak?

What are central banks like the RBI or the Federal Reserve up to?

These macroeconomic factors can make or break entire trades, portfolios, and even industries. So macro-driven risk planning is about aligning your strategies with the economic environment.

🧠 Why Is This Important?

Let’s say you’re trading in India.

If the US increases its interest rates sharply:

Foreign investors might pull money out of Indian markets.

INR might weaken.

Stock market might fall due to FII outflows.

If you're not paying attention to this macro signal, you might be trading blindly — even if your technicals are perfect.

🏦 Key Macro Factors That Drive Risk

Here’s a list of major macroeconomic indicators that smart investors and institutions track:

1. Interest Rates

Central banks (like the RBI or US Fed) control this.

📈 Rising Rates: Borrowing becomes expensive → Business slows → Markets may fall.

📉 Falling Rates: Loans become cheaper → Business expands → Markets may rise.

How to plan risk:

If rates are going up, shift from high-growth, high-debt companies to safer sectors like FMCG, pharma, utilities.

2. Inflation

This measures how fast prices are rising.

Moderate inflation = Normal

High inflation = Dangerous for consumers

Deflation = Danger of recession

Indicators: CPI (Consumer Price Index), WPI (Wholesale Price Index)

Risk Planning Tip:

In high inflation, avoid sectors that depend on raw material prices (like auto, FMCG) and look at commodities or inflation-protected assets (like gold, real estate).

3. GDP Growth (Economic Output)

Gross Domestic Product shows if the economy is expanding or shrinking.

📈 Strong GDP = Business confidence = Higher earnings

📉 Weak GDP = Caution = Lower valuations

Risk Strategy:

During GDP growth, take on slightly higher risk with cyclical stocks (like infra, banks). During slowdown, shift to defensive sectors (like pharma, IT).

4. Currency Movements (INR/USD, etc.)

Currency strength/weakness affects:

Imports/Exports

FII flows

Commodity prices (like oil)

Example: If INR weakens, oil imports become costly → Impacts inflation → May lead to rate hikes.

Plan risk: Export-based sectors (IT, pharma) benefit from weak rupee. Importers (oil, aviation) suffer.

5. Fiscal and Monetary Policies

This includes:

Government budgets (fiscal policy) – Taxes, subsidies, spending

Central bank actions (monetary policy) – Rate changes, money supply

Risk View:

A budget with heavy borrowing = inflation pressure

A tight monetary policy = reduced liquidity in markets

Keep eyes on RBI speeches, Fed meetings, union budgets.

6. Global Events

Even if you only trade in India, global news affects you:

US elections

Crude oil prices

Geopolitical tensions (e.g. China-Taiwan, Russia-Ukraine)

Supply chain issues

US Non-Farm Payroll (NFP) data

Macro-risk planning = Staying alert to these changes.

7. Bond Yields

Especially US 10-year bond yield.

Rising yield = Risk-off = Equities may fall

Falling yield = Risk-on = Equities may rise

Foreign investors use this as a guide. It directly affects FII flows.

📘 Real-Life Example: Macro Risk in Action

Case: COVID-19 Pandemic (2020)

Global economy shut down

Interest rates slashed to zero

Stimulus packages announced

Investors moved money into gold, tech stocks, pharma

Smart traders did this:

Moved into digital, pharma, and FMCG stocks

Stayed away from travel, aviation, real estate

Watched central bank actions daily

Used hedges (like buying puts or moving to cash)

This is macro-driven risk planning in real-time.

⚖️ How to Build a Macro Risk Management Plan

Here’s a step-by-step structure anyone can follow:

Step 1: Define Your Risk Tolerance

Are you a short-term trader or long-term investor?

Can you handle volatility?

Do you rely on leverage or trade with cash?

This tells you how much room you have to play with.

Step 2: Track Macro Indicators Weekly

Use sites like:

RBI website for policy updates

Trading Economics for inflation, GDP, interest rates

Bloomberg, CNBC, or Twitter for global headlines

Set alerts for:

Fed meeting dates

India CPI, GDP, IIP

Crude oil updates

Step 3: Use Hedging Tools

Advanced traders use:

Options (buying protective Puts)

Inverse ETFs (for global markets)

Gold or commodities

Diversification (across sectors, geographies)

Step 4: Stay Flexible

Macro conditions change fast. Stay open to:

Rotating your portfolio

Sitting on cash during uncertain times

Changing strategies with data, not emotions

🧭 Conclusion: Think Bigger, Trade Smarter

Macro-Driven Risk Planning is about being proactive, not reactive.

Markets aren’t moved by charts alone. They’re driven by:

Central banks

Government decisions

Global events

Economic data

So when you plan your next trade or invest in a stock, ask yourself:

“Am I moving with the economic current — or fighting against it?”

The more you understand macro trends, the better you’ll manage your risks and grow consistently.

BANKNIFTY 1D Timeframe📉 Bank Nifty – Daily Overview (as of July 25, 2025)

Opening Price: Around 57,170

Day’s High: Around 57,170

Day’s Low: Around 56,439

Closing Price: Approximately 56,520

Net Change: Down by around 545 points (–0.95%)

🕯️ Candlestick Pattern (1D Chart)

The daily candle is bearish with a long upper wick and small lower wick.

This indicates strong selling pressure from the opening level.

The index failed to hold the highs and reversed sharply during the session.

🔍 Key Technical Zones

Level Price Range

Support 56,500 – 56,400

Next Support 56,150 – 56,000

Resistance 57,200 – 57,300

Major Resistance 57,500 – 57,650

If Bank Nifty breaks below 56,400, it may slide further toward 56,000 or even 55,800.

A move above 57,300 may invite bullish momentum.

📊 Trend & Technical Outlook

Short-Term Trend: Bearish

Medium-Term Trend: Neutral to mildly positive (if above 56,000)

Price Structure: Lower highs are forming; a descending pattern is developing.

Volume Analysis: Increasing volume on red candles suggests sellers are active.

Indicators (general behavior):

RSI may be near 50–55 range — neutral zone.

MACD likely showing bearish crossover.

Moving averages are flat to slightly negative.

✅ Strategy Suggestions

For Swing Traders:

Look for a bullish reversal pattern near 56,400–56,150 zone for possible long entries. Avoid long positions until price shows strength above 57,200.

For Breakdown Traders:

Wait for a solid close below 56,400 with high volume. Target levels can be 56,150 and 55,800.

For Intraday Traders:

Expect a volatile range between 56,400 and 57,200. Trade breakouts or reversals near these levels with confirmation.

📌 Summary

Bank Nifty is currently weak, with clear selling from resistance levels.

It is trading near key support (56,500–56,400). If this zone breaks, expect further downside.

Bulls need to reclaim 57,200+ for any reversal signals.

Trend remains bearish in short term, neutral in medium term.

NIFTY 1D Timeframe📉 Nifty 1D Snapshot (as of July 25, 2025)

Previous Close: 25,062

Opening Price: 25,010

Intraday High: 25,010

Intraday Low: 24,806

Closing Price: 24,833

Change: Down by approximately 230 points (–0.9%)

🕯️ Candlestick Pattern (Daily Chart)

A clear bearish candle was formed today.

The index opened flat, tested the previous day’s low, and faced selling pressure all day.

Closing is near the day’s low, which shows weakness and no buying support at lower levels.

🔍 Support & Resistance Levels

Level Type Price Range

Immediate Resistance 25,000 – 25,050

Immediate Support 24,800 – 24,750

Next Support Zone 24,650 – 24,600

If Nifty breaks below 24,800, expect a move toward 24,650.

If it reclaims 25,000, a minor pullback or bounce could occur.

📊 Technical Overview

Short-Term Trend: Bearish

Medium-Term Trend: Neutral

Structure: Lower highs forming; prices struggling to hold key supports

Indicators (Typical Behavior):

RSI likely near 50 – neutral but leaning bearish

MACD may have crossed downward

Moving averages (like 5 & 20-day) likely showing bearish crossover

🧠 Market Sentiment Factors

Broad-based sectoral weakness led the fall – especially financials, IT, auto, and energy.

Major stocks like Reliance, HDFC Bank, Infosys, and Bajaj twins contributed heavily to the decline.

Investor mood remains cautious due to:

Weak earnings from select companies

Foreign investor outflows

Global uncertainty (interest rates, trade deals, etc.)

✅ Trading Strategy Insights

For Swing Traders:

Avoid long trades unless there’s a strong reversal candle from 24,750–24,800 zone.

Shorting near 25,000 resistance could offer low-risk entries.

For Intraday Traders:

Watch for consolidation between 24,800–25,000.

Play range until a breakout or breakdown occurs.

For Breakdown Traders:

A confirmed break below 24,750 can lead to quick dips toward 24,600 or lower.

📌 Summary

Nifty dropped 230 points, forming a strong bearish candle.

Bears are in control unless bulls reclaim 25,000+.

Support sits at 24,800, with downside potential toward 24,650–24,600 if broken.

Sentiment remains cautious; short-term trend is bearish.

Trading Master Class With Experts.

🔶 Who Are These "Experts"?

The “experts” in a trading master class are usually:

✅ Professional traders working with institutions, hedge funds, or prop firms

✅ Full-time independent traders with consistent profit history

✅ Option Greeks and derivatives specialists

✅ Technical and price action experts

✅ Economists and market analysts

They are people who have traded for years, been through different market cycles, and know what works and what fails in the real market.

🔷 What You Will Learn in a Trading Master Class With Experts?

Here is a detailed breakdown of what such a master class includes:

🧠 1. Trading Mindset & Psychology Mastery

“90% of trading is mindset, not charts.”

Experts teach you:

How to control emotions like fear, greed, FOMO

How to build discipline, patience, and consistency

How to handle losses without revenge trading

How to develop a winning mindset like a hedge fund trader

📊 2. Advanced Technical Analysis (Beyond Indicators)

Forget about just MACD, RSI, Bollinger Bands.

Experts teach:

Price Action Secrets

Multi-timeframe analysis

Structure-based trading (HH, HL, LL, LH)

Breakout vs Fakeout patterns

Volume analysis and hidden traps

🎯 You’ll learn to predict moves with logic, not luck.

📈 3. Institutional Concepts (Smart Money Approach)

This is a core part of the class. You will learn how institutions trade, including:

Liquidity Zones & Order Blocks

Stop Loss Hunting Techniques

Fair Value Gaps (FVG)

Break of Structure (BOS)

Mitigation Blocks

Imbalance trading

You’ll finally understand:

"Why price reverses after breakout?”

"Why your stop loss gets hit and then the market moves in your direction?”

Experts teach you how to track institutional footprints and follow their logic.

📉 4. Derivatives & Options Trading Mastery

For advanced traders, especially in India (Nifty/Bank Nifty), the class covers:

✅ Options Chain Interpretation

✅ Open Interest (OI) Strategy

✅ Option Greeks (Delta, Gamma, Theta, Vega)

✅ Directional & Non-Directional Trading

✅ Intraday Option Scalping Techniques

✅ Straddles, Strangles, Spreads, Iron Condors

✅ Event-based strategies (Budget day, RBI day, earnings)

Live examples are shown using tools like Sensibull, QuantsApp, TradingView.

🔐 5. Risk Management Like Professionals

Trading without risk control is gambling.

In the master class, you’ll learn:

Position Sizing Models

Risk-to-Reward (RRR) Strategies

How to protect capital in volatile markets

Importance of trade journaling

When not to trade (which is as important as trading)

🎯 You’ll be taught how to think like a fund manager, not a gambler.

🧾 6. Trading Plan and Strategy Building

By the end of the class, you will have your own trading system, built with guidance from the experts.

Includes:

Entry and exit rules

Setup confirmation techniques

Trade management

Backtesting

Live trading practice

🎯 You’ll no longer depend on Telegram groups or paid signals. You will have your own tested edge.

💡 7. Live Market Sessions and Analysis

One of the most powerful parts of a master class is live sessions with experts, where you:

✅ Watch experts analyze the market in real-time

✅ Learn how they decide trades

✅ Ask questions on-the-spot

✅ See how they manage losses and winners

✅ Get live updates on index, stocks, options strategies

This removes confusion like:

“Should I buy or sell now?”

“Is this a trap or breakout?”

🔧 8. Tools, Platforms & Market Scanners Training

Learn to use:

TradingView Pro with institutional indicators

Option Analytics Tools (Sensibull, Opstra, Quantsapp)

Volume & Order Flow Tools

How to read market depth (Level 2 data)

How to use backtesting software for strategy building

🎯 The goal is to make you fully independent and tool-savvy.

📁 What’s Included in a Master Class Package?

A typical premium expert trading master class includes:

📌 20-30 hours of recorded sessions

📌 Weekly live sessions (Q&A, market review)

📌 Real trade examples (screenshots or live trades)

📌 Market homework and trade journaling

📌 Access to private trading communities

📌 Lifetime access + updates

📌 Strategy PDFs, cheat sheets

📌 Certificate of Completion (optional)

🔑 Benefits of Taking This Master Class

✅ Get direct mentorship from people who actually trade

✅ Save years of trial & error

✅ Learn real strategies, not just theory

✅ Increase accuracy and reduce losses

✅ Learn why you lose money and how to fix it

✅ Build discipline, process, and patience

✅ Join a community of focused traders

👨🏫 Who Should Join?

This class is perfect for:

Traders who lose consistently and don’t know why

Those who want to learn institutional-style trading

Option traders who want to become premium sellers / scalpers

People ready to invest time and discipline—not chasing “quick money”

Anyone who wants to turn part-time trading into serious skill

🔁 Real Case Example:

Imagine a Bank Nifty trader who always loses during breakouts. He joins the master class.

He learns:

How institutions create false breakouts

How to identify order blocks & liquidity grabs

How to position sell options around key zones

How to protect his capital with hedging and RRR control

Now, instead of gambling, he trades with confidence and understands what’s happening behind the candles.

🎓 Final Words

A Trading Master Class With Experts is like getting a direct map to reach consistent profitability in the market.

It is not a magic formula, but it trains your brain to think like a professional, trade like an institution, and manage risk like a fund.

It teaches you to focus not on tips, indicators, or chasing, but on:

Process

Discipline

Data

Edge

Execution.

Advance Option Trading🔶 What Is Advanced Options Trading?

Advanced Options Trading goes beyond buying and selling simple Calls and Puts. It’s about using multi-leg strategies, managing risk with precision, applying greeks and volatility, and aligning your trades with market conditions.

Advanced traders treat options like a math-based chess game. They don’t gamble—they strategize, hedge, spread, and use data-driven decisions to extract profits in all kinds of markets (bullish, bearish, sideways, volatile, calm).

🔍 Why Learn Advanced Options Trading?

While beginners just "buy options" hoping for a quick profit, advanced traders use options to:

Control risk

Earn consistent income

Capitalize on volatility

Trade sideways or range-bound markets

Create hedges for portfolios

Use smart capital deployment with defined risk

2️⃣ Implied Volatility (IV)

IV tells you how expensive or cheap options are.

📈 High IV = Options are expensive → Ideal for selling

📉 Low IV = Options are cheap → Ideal for buying

Advanced traders use:

IV Rank / IV Percentile

Volatility skew analysis

Volatility crush trades around earnings or events

3️⃣ Option Strategies

Here’s where real skills come in. Advanced trading uses multi-leg strategies to limit loss, increase odds, or make money in non-directional moves.

🔍 Strategy Example: Iron Condor

Sell 22000 CE

Sell 21800 PE

Buy 22100 CE (hedge)

Buy 21700 PE (hedge)

You’ll profit if the index stays between 21800 and 22000, and time decay works in your favor.

✅ Defined risk

✅ Limited profit

✅ Great for expiry week if market is range-bound

💹 Advanced Techniques for Smart Trading

Let’s now explore how pros operate:

🔸 A. Delta-Neutral Trading

Institutional or advanced traders often create delta-neutral positions—no directional bias.

Example:

Buy Call option (Delta +50)

Sell Put option (Delta -50)

Net Delta = 0 → Neutral. The position doesn’t care which way market moves—only volatility or time decay matters.

🔸 B. Hedging with Options

Advanced traders hedge their stock or futures positions using options.

Example:

You hold ₹5 lakh worth of Reliance shares

You buy Reliance PUT options to protect downside risk

Result? You keep profits if stock goes up and protect capital if it drops. It's like insurance.

🔸 C. Trading Earnings or Events

Options let you trade volatility, not just direction. Ahead of events like:

Earnings reports

RBI or Fed meetings

Budget announcements

You can use:

Straddles / Strangles (if expecting big move)

Iron Condors (if expecting no major move)

Calendar spreads (to exploit IV difference)

🔸 D. IV Crush Strategy

Before major events, IV rises. After the event, IV drops (called IV crush).

Advanced traders:

Sell options before events (high premium)

Buy options after IV crash (cheap premium)

They know when NOT to buy options just before news—because premium is inflated!

🔸 E. Adjusting Trades

Advanced traders don’t just “hope” for success. If a trade goes wrong, they adjust it:

Roll to a new strike

Convert from debit to credit spreads

Hedge with opposite positions

Manage Delta/Theta/Vega exposure

This proactive style protects capital and increases recovery chances.

🛠️ Tools Used by Advanced Option Traders

Opstra / Sensibull – Strategy builder, Greek analyzer

TradingView – Charting & technical levels

OI Analysis Platforms – For understanding institutional footprints

Python / Excel – Custom backtesting tools

Algo Platforms – For speed and logic-based execution

📌 Important Rules for Advanced Option Traders

Don't chase trades. Let trades come to you.

Always define risk before entering.

Use multi-leg setups, not naked options unless there's an edge.

Stay Theta positive in low volatility markets.

Only buy options when IV is low and breakout is expected.

✅ Final Thoughts

Advanced options trading is a skillset—not a shortcut.

If you:

Want consistent profits

Wish to trade like institutions

Hate gambling and want a plan

Love logic, numbers, and control

…then advanced option trading is your next big step.

It gives you the tools to win in all market types, not just trending ones.

Option Chain Analysis + Open Interest (OI)🧠 Let’s First Understand: What is Option Chain?

An Option Chain is a table that shows available strike prices for a particular stock/index along with their Call and Put option data—like premium, volume, open interest, change in OI, etc.

✅ Where can you find it?

NSE Website (most reliable)

Trading Platforms like Zerodha, AngelOne, etc.

Apps like Sensibull, Opstra, etc.

The option chain is divided into two parts:

Left side – Call Options (CE)

Right side – Put Options (PE)

Each row shows the strike price and various data like:

LTP (Last Traded Price) – the premium.

Open Interest (OI) – total contracts outstanding.

Change in OI – new positions added or removed.

Volume – how many contracts traded today.

🔍 What is Open Interest (OI)?

OI = Open Interest = Open positions in the market.

It shows how many contracts are live at a particular strike. It’s like a pulse of the market—it tells us where the action is happening.

If OI is going up → Traders are adding positions

If OI is going down → Traders are closing positions

🔑 Why Is OI Important?

Because institutions and smart money create large positions—and OI helps us identify where they’re betting.

OI gives an idea of:

Support and Resistance zones

Strength of a trend

Where market might reverse

Where volatility might increase

📘 Understanding Support & Resistance Using Option Chain

Support and resistance levels can be seen through the OI data in the option chain.

✅ How to Identify Support?

Look at Put OI:

The strike price with highest Put OI is considered strong support.

Why? Because put writers (who are mostly smart money) don’t expect the price to fall below this level.

Example:

If 22,500 PE has the highest OI, it acts as a support level.

✅ How to Identify Resistance?

Look at Call OI:

The strike price with highest Call OI is considered strong resistance.

Why? Because call writers are betting price won’t go above this level.

Example:

If 23,200 CE has the highest OI, it acts as a resistance level.

🔁 Change in OI – Fresh Positions vs Exits

Don't just look at total OI—look at the change in OI today.

Increase in OI = Fresh positions are being added

Decrease in OI = Traders are squaring off positions

It helps confirm if the current market move is genuine or fake.

Example:

If Nifty is going up and Call OI at 23,000 is increasing, it means fresh selling → possible resistance.

But if Call OI is decreasing, it means sellers are exiting → breakout possible.

🧩 How Option Chain + OI Help in Intraday Trading

Find Support & Resistance Zones

Use highest OI levels to set your boundaries.

Avoid buying near strong resistance; avoid selling near strong support.

Use OI to Validate Breakouts

Watch how OI changes near key strike prices.

If resistance strike sees short covering (OI falling), breakout is real.

Trend Confirmation

Long buildup (Price ↑, OI ↑) = Uptrend

Short buildup (Price ↓, OI ↑) = Downtrend

Expiry Day Strategy

Focus on where OI is building rapidly.

Use max pain and max OI to sell straddles/strangles safely.

🧠 Advanced Concepts

🔸 Max Pain Theory

Max Pain is the strike price where the most option buyers lose money on expiry. It is the level where option sellers are most profitable. It usually acts like a magnet near expiry.

Example:

If Max Pain for Nifty is 23,000, market may stay near this level on expiry day.

🔸 PCR (Put Call Ratio)

PCR = Total Put OI / Total Call OI

PCR > 1: More Puts than Calls → Bullish sentiment

PCR < 1: More Calls than Puts → Bearish sentiment

PCR near 1 = Neutral/Rangebound market

Use it with caution—extremely high or low PCR may signal reversal zones.

🛠️ Tools to Use (Free)

NSE India Website – Best for raw data

Sensibull, Opstra, Quantsapp – Visual OI charts

TradingView – Combine charts + option levels

Telegram OI Bots – For quick OI updates

📌 Do's & Don'ts in Option Chain + OI Analysis

✅ Do:

Use OI + Price + Volume together

Watch OI shifts during the day (especially 9:30–10:30 AM and 2–3 PM)

Combine with support/resistance zones from charts

❌ Don’t:

Trade blindly based only on highest OI

Ignore rapid changes in OI—it could signal smart money exit

Confuse high OI with direction—it just means “interest,” not bias

🎯 Final Words

Option Chain + OI analysis isn’t just a tool—it’s your insight into the mind of the market. It tells you what others are doing, especially the big players who move the markets.

To master it, keep practicing:

Observe how OI builds around events (like RBI policy, earnings)

Watch price + OI behavior on breakout and breakdown days

Pair OI with basic technical analysis for solid confidence

Price Action Trading What is Price Action Trading?

Price Action Trading means making trading decisions based on the actual price movement on the chart—nothing else. No RSI, no MACD, no fancy indicators. Just candlesticks, structure, support/resistance, and patterns.

Think of it like this: If the market is a language, price action is learning to read, write, and speak it fluently.

🤔 Why Use Price Action?

Because indicators are lagging. They react after the move has happened. Price action is real-time, showing what’s happening right now.

Benefits:

Helps identify real support/resistance zones

Tells you the story of buyers vs sellers

Works on any time frame (1-min, 5-min, daily, etc.)

No dependency on tools—just your eyes and chart reading skills

🔍 Key Elements of Price Action

1. Market Structure

This is the foundation of price action. Market moves in three ways:

Uptrend (Higher Highs, Higher Lows)

Downtrend (Lower Highs, Lower Lows)

Range (Sideways, Consolidation)

If you understand structure, you already know:

Where the trend is

When it's changing

Where you can enter/exit

2. Support and Resistance

These are areas where price reacts repeatedly. In price action, these are called zones, not exact lines.

How to Identify?

Look for areas where price bounced or reversed multiple times.

These become decision zones for future trades.

Support = Price zone where buyers come in

Resistance = Price zone where sellers push price down

3. Trendlines & Channels

Drawing trendlines connecting swing highs/lows gives you:

A guide to trend strength

Breakout/breakdown points

Dynamic support/resistance

Channels help identify range-bound moves and reversal points at the edges.

4. Breakouts & Fakeouts

Price often breaks out from:

Ranges

Trendlines

Chart patterns

But not all breakouts are real. Some are fakeouts to trap retail traders.

A good price action trader waits for confirmation (like a strong candle close) before reacting.

📘 How to Trade Using Price Action – Step-by-Step

Let’s now apply this knowledge in a live trading-style thinking process.

✅ Step 1: Understand the Trend (Structure)

On a clean chart (no indicators), mark recent swing highs/lows

Ask: Is the market making Higher Highs and Higher Lows (uptrend)?

If yes → look only for buy opportunities

✅ Step 2: Identify Key Zones

Mark:

Major support and resistance

Previous day’s high/low

Intraday breakout zones

These are your action points.

✅ Step 3: Wait for Price Reaction

At those zones, wait for:

Reversal patterns like pin bar, engulfing

Breakout candles with strong body (not doji)

Volume spike (optional)

✅ Step 4: Entry and Stop-Loss

Entry: After confirmation candle closes (not before)

Stop-loss: Just below/above the zone or candle wick

Target: Use recent structure zones or risk-reward ratio (e.g., 1:2)

✅ Step 5: Trade Management

If price moves in your favor, trail SL (e.g., to break even)

Watch for reversal signs to exit manually if needed

Never hold hoping for miracle recovery

🎯 Price Action Trading in Intraday (Example with Bank Nifty)

Check 5-min and 15-min chart.

Mark:

Opening range high/low

Pre-market support/resistance

Day’s high/low from yesterday

Wait for price to reach these zones.

Watch for:

Rejection candles (pin bar, inside bar)

Breakout retests

Place trade with small SL and clear RR.

Example Scenario:

Bank Nifty opens near yesterday’s high

You see a bearish pin bar on 5-min rejecting resistance

You short with SL above the high, target recent swing low

Risk = 30 pts, Reward = 70 pts → good setup

🧠 Psychological Side of Price Action

Trading price action requires:

Patience (waiting for setups)

Discipline (following rules, not emotions)

Chart reading skill (comes with time and practice)

Don’t try to force trades. If price doesn’t reach your zone or give confirmation — stay out.

No trade is better than a bad trade.

🧪 Tools That Help (Optional)

Although price action is tool-free, these tools can support your analysis:

TradingView – for clean charts

Volume – to confirm strength of moves

Sessions Indicator – mark Asia/Europe/US zones

❗ Mistakes to Avoid

Trading every candle — wait for context + confirmation

Ignoring market structure — never go against strong trend

Jumping in during volatile news — sit out

Not marking clean zones — messy chart = messy trades

No stop-loss — one big loss can kill weeks of gains

✨ Summary – Price Action Trading Blueprint

Component Role in Trading

Market Structure Understand the trend

Support/Resistance Identify key decision zones

Candles Watch for rejection/confirmation

Entry Rules Confirm with candle close

SL & RR Define before entry

Patience Only trade A+ setups

💬 Final Thoughts

Price action trading is a skill, not a hack.

It takes practice, patience, and screen time. But once you understand it deeply, you don’t need indicators or news. The chart will tell you everything.

You’ll start seeing things others can’t:

Why that candle reversed exactly there

Why the market faked out and then reversed

Where buyers/sellers are hiding

And most importantly—you’ll gain confidence in your own decisions.

Advance Option Trading vs. Master Institutional Trading🎯 What is Advance Option Trading?

Advance Option Trading means using complex option strategies to manage risk, take advantage of volatility, or make consistent income from the market.

You’re not just buying a Call or a Put here. You’re using combinations of options like:

Spreads (Bull Spread, Bear Spread)

Iron Condors

Butterflies

Ratio Spreads

Calendar Spreads

You're also learning to understand and control variables like:

Delta (directional movement)

Theta (time decay)

Vega (impact of volatility)

Gamma (rate of Delta change)

In short, it’s like playing chess with the market using tools that have defined risk and reward. You can win even if the market moves sideways or only slightly moves in your direction.

🧠 What is Master Institutional Trading?

Master Institutional Trading is about thinking and trading like big institutions – the banks, hedge funds, and FIIs (Foreign Institutional Investors). These players don’t trade like retail traders.

They control large volumes, manage millions or billions in capital, and have the ability to move markets. But here's the secret: they don’t chase price… they create price movement.

In this trading style, your focus is on:

Volume Profile

Order Blocks

Liquidity Zones

Market Structure

Smart Money Concepts (SMC)

Wyckoff Theory

You're not predicting price – you're following the footprints of big money. You’re trying to enter when institutions are entering, and avoid traps they set for retail traders.

🔄 Core Difference at a Glance

Feature Advance Option Trading Master Institutional Trading

Asset Used Options (CE/PE) Stocks, Futures, Options

Main Tool Option Greeks, Option Chain Volume Profile, Order Flow

Style Strategy-based Flow-based

Mindset Structured, mathematical Contextual, dynamic

Learning Curve High (requires math + logic) High (requires market psychology + vol read)

🧰 Tools Used

Tool Option Trading Institutional Trading

Option Chain ✅ ❌

Greeks (Delta, Theta, Vega) ✅ ❌

Volume Profile ❌ ✅

Market Structure (HH/LL) ❌ ✅

Implied Volatility (IV) ✅ ❌

Order Flow/Tape ❌ ✅

Liquidity Zones ❌ ✅

Expiry Analysis ✅ Sometimes

VWAP & POC Optional Core tool

🎯 Goals of Each Trader

🧪 Advance Option Trader:

Earn from time decay (Theta)

Use spreads to protect capital

Trade with defined risk

Take advantage of volatility crush

Scalp on expiry days using option premiums

🎯 Institutional Trader:

Trade in alignment with Smart Money

Ride major directional moves

Avoid retail traps

Use volume as a leading indicator

Trade price action with deeper logic

💥 Example in NIFTY

Let’s say NIFTY is at 22000.

✅ Option Trader's View:

Market is range-bound

Build an Iron Condor:

Sell 21800 PE, Buy 21700 PE

Sell 22200 CE, Buy 22300 CE

Max profit if NIFTY stays in range for next 3 days

✅ Institutional Trader's View:

Market faked a breakout above 22100

Big volume appeared at top, then reversed

Enters short after liquidity sweep

Targets zone near 21850, which is a demand block

🤔 Which One Should You Learn?

Your Profile Go for Option Trading Go for Institutional Trading

You like rules, logic, math ✅ ❌

You enjoy price-action & market behavior ❌ ✅

Want passive income from theta decay ✅ ❌

Want to scalp or swing big moves ❌ ✅

Prefer fixed risk/reward trades ✅ ❌

Want to track where big money trades ❌ ✅

You hate fake breakouts ❌ ✅

🧩 Can You Combine Both?

Absolutely!

In fact, many successful traders today use Institutional Trading concepts (like SMC or Volume Profile) to identify zones and then execute trades using option strategies.

Example:

Use institutional zone to identify support/resistance

Then sell options near those zones

Or place a directional option spread trade

This is called "confluence trading" – where different systems come together to build a stronger edge.

⚠️ Common Mistakes

🚫 In Option Trading:

Ignoring Greeks

Blindly buying options without IV analysis

Trading low volume strikes

Not adjusting positions

🚫 In Institutional Trading:

Overusing Smart Money concepts without confirmation

Misreading fakeouts as real breakouts

Trading against volume

Being impatient and entering early

✅ Final Summary

🔹 Advance Option Trading

You’re a strategy player

Mastering time decay, volatility, and spreads

Goal: Defined profit, controlled loss, consistent income

🔹 Master Institutional Trading

You’re a market observer

Mastering order flow, liquidity, and manipulation

Goal: Ride big moves, avoid traps, think like smart money

Cryptocurrency Day Trading🧠 What is Cryptocurrency Day Trading?

Day trading means buying and selling crypto coins within the same day — sometimes within minutes or hours — to profit from small price movements.

You don’t hold positions overnight. The goal is to enter and exit quickly, catch a few percent in price movement, and repeat.

Examples of popular cryptos for day trading:

Bitcoin (BTC)

Ethereum (ETH)

Solana (SOL)

Ripple (XRP)

Pepe, Shiba Inu (Meme Coins)

New trending tokens (like AI or gaming-based tokens)

These coins can move 5% to 50% or more in a single day — that’s what makes day trading so attractive!

📊 Why People Love Crypto Day Trading

24/7 Market Access

Unlike stock markets, crypto never sleeps.

You can trade anytime, even late at night.

Volatility = Profit Potential

Crypto prices move wildly.

More movement = more chances to make money.

Low Barrier to Entry

You can start with $10 or $100.

No big capital or licenses required.

Leverage Options

Platforms like Binance, Bybit, and KuCoin offer leverage (e.g., 5x, 10x, 50x).

This can amplify profits (but also increase risk!).

Fast Results

Unlike long-term investing, day trading gives instant feedback.

You know within hours if you’re winning or losing.

⚙️ How Crypto Day Trading Works (Simple Explanation)

Let’s say you’re watching SOLANA (SOL) today.

Price is moving between $75 and $80.

You notice a pattern: Every time it touches $75, it bounces back up.

So you buy at $75, wait for a small move to $77, and sell.

You just made a 2.6% gain.

Now imagine doing that multiple times in a day, or with larger capital. That’s the basic idea.

🎯 Key Strategies Used in Day Trading

Let’s explore the most common (and effective) strategies in simple language:

1. Scalping

Fastest form of trading.

Holding a coin for seconds to a few minutes.

Goal: Catch tiny moves — 0.5% to 1% — many times a day.

🛠️ Tools: 1-minute or 5-minute chart, high volume coins, tight spreads.

2. Breakout Trading

Price builds up like pressure, then breaks out of a level.

Traders watch for resistance breakout or support breakdown.

After breakout, price usually moves quickly — giving fast trades.

🧠 Tip: Watch key levels and volume spike during breakout.

3. Range Trading (Buy Low, Sell High)

When price stays inside a box or zone.

Traders buy at the bottom of the range and sell at the top.

Simple but powerful when done right.

📌 Use on sideways markets. Works great with RSI (Relative Strength Index).

4. News-Based Trading

Crypto reacts quickly to news (good or bad).

For example: If Bitcoin ETF gets approved → Price jumps.

Traders jump in right after big news and ride the wave.

⚠️ Be careful — fake news can also move markets quickly.

🛠️ Must-Have Tools for Day Trading Crypto

TradingView – Best for charts and indicators.

Binance / Bybit / KuCoin – Major exchanges with good liquidity.

CoinMarketCap / CoinGecko – Track coins, market caps, news.

Twitter / Telegram / Discord – Stay updated on trending tokens.

Stop Loss & Take Profit Tools – Crucial for risk control.

📉 Risk Management – The Life Jacket of a Day Trader

Here’s the truth: Without good risk management, you will lose money — even if your strategy is good.

Here are golden rules:

✅ Never risk more than 1-2% per trade

✅ Always use a stop loss

✅ Don’t chase the market

✅ Don’t trade with emotions

✅ Keep a trading journal

Example: If you have $1000, don’t risk more than $20 on one trade.

😰 Common Mistakes (And How to Avoid Them)

❌ Overtrading

Trying to take too many trades in one day. Your brain burns out.

👉 Take only high-quality setups. Less is more.

❌ No Plan

Trading based on “gut feeling” is gambling.

👉 Always have an entry, stop loss, and target.

❌ Revenge Trading

You lost money — now you're trying to “win it back” emotionally.

👉 Take a break. Come back with a clear head.

❌ Ignoring Risk

Using 20x leverage on meme coins without a stop loss is financial suicide.

👉 Respect the risk or the market will humble you.

🤖 Can You Use Bots or AI?

Yes, many day traders use trading bots or AI assistants to:

Scan for signals

Enter/exit trades automatically

Apply indicators faster

But remember: Bots don’t guarantee profit. You still need logic and supervision.

🧘♂️ Mindset of a Successful Day Trader

The best traders treat trading like a business, not a game.

They are:

Disciplined

Patient

Data-driven

Emotionally stable

Focused on long-term performance, not just daily wins

They don’t chase hype — they follow the process.

💼 Can You Make a Living from Crypto Day Trading?

Yes, but not easily. It takes:

Skill

Discipline

Capital

Experience

Most beginners lose money in the first 3–6 months. That’s normal. But with proper learning, journaling, and strategy, it is possible to be consistently profitable.

📌 Final Thoughts: Is It for You?

Crypto day trading is exciting, fast-paced, and potentially very profitable — but also risky and demanding.

Pros:

High income potential

No 9–5 job

Remote, flexible lifestyle

Cons:

High risk

Mentally exhausting

Emotionally draining

Steep learning curve

If you love analyzing charts, making quick decisions, and have emotional control — this might be for you.

But if you’re not ready for the pressure, consider swing trading or investing instead.

✅ Bonus Tip:

Start with paper trading (demo mode) or trade small amounts before risking big money. Focus on mastering one strategy first before learning ten things at once.

RELIANCE 1D TIMEFRAME🧾 Basic Market Overview

Open: ₹2,990

High: ₹3,012

Low: ₹2,943

Close: ₹2,956

Change: Down by ~₹34 (approx. -1.13%)

Today, Reliance started strong but faced immediate selling near the ₹3,000 mark, resulting in a negative close. The price remained weak for most of the session, and closed near the day’s low, which is a bearish sign.

🕯️ Candlestick Formation

The candle formed on the daily chart resembles a strong bearish candle — possibly a long red candle or bearish engulfing if it closes below the previous day’s close. This shows:

📈 Trend Overview

Short-Term Trend: Weak — downward momentum building

Medium-Term Trend: Sideways to slightly bullish

Long-Term Trend: Bullish — still intact unless price breaks ₹2,850

Today’s weakness has not yet broken long-term structure, but short-term traders should be cautious.

🔮 What Could Happen Next?

✅ Bullish Recovery:

If Reliance moves back above ₹3,000 and sustains with volume, it can retest ₹3,050–₹3,080

A bullish engulfing or reversal pattern needed for upside confirmation

⚠️ Bearish Continuation:

If it breaks below ₹2,940, more downside is possible toward ₹2,915–₹2,875

Traders may take short positions below this level with tight stop-loss

🔄 Consolidation:

If the price holds between ₹2,940 and ₹3,000, expect sideways movement or base building before a big move

🎯 Strategy Suggestions

For Intraday Traders:

Watch ₹2,940 – ₹3,000 levels closely

Short below ₹2,940 with a target of ₹2,915

Long above ₹3,000 only if backed by strong buying

For Swing Traders:

Avoid new longs until daily candle shows strength

Consider fresh buys near ₹2,900–₹2,915 with SL below ₹2,875

Wait for a breakout above ₹3,050 to confirm bullish reversal

For Investors:

No need to panic; long-term uptrend still valid

Add in dips if it reaches ₹2,875–₹2,850 with confirmation

Fundamental strength supports medium-to-long-term outlook

📌 Summary

Reliance showed bearish sentiment today, breaking below the short-term support of ₹2,975 and closing weak at ₹2,956. It’s trading between a critical support zone of ₹2,940–₹2,915 and facing resistance around ₹3,000–₹3,020.

Short-term: Bearish bias

Medium-term: Neutral to weak bullish

Long-term: Still bullish unless ₹2,850 breaks decisively

Traders should be cautious and wait for confirmation before taking aggressive positions.

Buyers attempted a push above ₹3,000 but failed.

Bears took over the session.

Closing near the day’s low suggests strong downside momentum.

BANKNIFTY 1D TIMEFRAME📉 Market Overview

On the daily chart (1D timeframe), Bank Nifty showed signs of weakness today. It opened strong in the morning, moved higher during the first half, but faced selling pressure at higher levels and eventually closed near the day’s low.

This kind of price movement typically indicates short-term bearish sentiment and hesitation among buyers at higher levels.

📌 Key Market Data

Open: Around 57,200

High: Near 57,286

Low: Around 56,692

Close: Approximately 56,756

Net Change: Down by around 0.35% for the day

🔍 Candlestick Pattern

The candle formed today is bearish in nature. It could resemble something like a dark cloud cover or inverted hammer depending on the exact structure. This shows that bulls tried to push prices higher, but bears took over by the end of the session.

This candle near a resistance level usually suggests a reversal or at least a pause in upward momentum.

🔧 Technical Indicators (Daily Chart)

RSI (Relative Strength Index): Around 50–52

This shows a neutral zone — neither overbought nor oversold. It means the index has room to go either way depending on market sentiment.

MACD (Moving Average Convergence Divergence): Slightly positive

The MACD line is still above the signal line, showing some bullish momentum is intact — but it's fading.

Moving Averages:

20-day EMA: Bank Nifty closed below this line, showing short-term weakness.

50-day SMA: Still holding above this line, so the broader trend remains mildly bullish.

📊 Price Action Summary

Bank Nifty failed to break above the 57,300 zone.

Sellers became active at higher levels, pushing the index down.

Closing near the day's low shows bearish pressure is currently dominant.

The index is moving in a range, with no clear trend yet.

📈 What to Watch for Tomorrow

✅ Bullish Scenario:

If Bank Nifty moves above 57,300 with volume, we may see it head toward 57,500–57,800 in the next few days. This would indicate bulls are regaining control.

⚠️ Bearish Scenario:

If it breaks below 56,600, a further drop toward 56,000 is likely. This would be a signal that short-term correction is underway.

🔄 Sideways:

If the price stays between 56,600 and 57,300, the market is consolidating and waiting for a trigger (earnings, global news, RBI policy, etc.)

🎯 Strategy Outlook

Intraday traders: Be cautious near resistance (57,300) and support (56,600). These are zones where reversals happen.

Swing traders: Watch for a clear breakout or breakdown before taking big positions.

Options traders: Expect volatility to rise if it breaks out of the current range.

📌 Conclusion

Bank Nifty on the daily chart is showing signs of indecision and minor weakness. The index is stuck in a tight range, and traders are waiting for a clear breakout above resistance or breakdown below support. Until then, range-bound trading with proper stop-loss is advised.

If you’d like the same type of analysis for Nifty 50, Sensex, or specific stocks like Reliance or HDFC Bank, just ask — I’ll deliver them without links and in the same easy language.

Master Institutional Trading✅ Introduction: What Is Institutional Trading?

Institutional trading refers to the strategies and market activities carried out by big players—like hedge funds, mutual funds, insurance companies, foreign institutional investors (FIIs), banks, and proprietary trading firms.

Unlike retail traders (individuals), institutions manage large capital, influence markets, and use advanced data-driven strategies to enter and exit positions silently and smartly.

"Master Institutional Trading" is all about learning how these big players operate, how they make decisions, and how you—an individual trader—can read their moves and trade alongside the smart money instead of against it.

🧠 Why Learn Institutional Trading?

Most retail traders lose money because they trade emotionally or follow the crowd. Institutional traders, on the other hand:

Follow data, not emotions

Trade with discipline and risk management

Use volume, price action, and order flow

Focus on capital protection as much as profits

Mastering Institutional Trading helps you:

Understand how smart money moves

Identify hidden demand and supply zones

Trade with precision using volume and price action

Avoid retail traps and manipulation zones

Develop a rule-based, professional approach

📘 What You Learn in Master Institutional Trading

Here’s what a full-fledged Master Institutional Trading program or strategy guide includes:

1️⃣ Market Structure: Understanding the Battlefield

Difference between retail and institutional behavior

Market cycles: Accumulation → Manipulation → Distribution

Price action and how institutions create fake breakouts

Liquidity hunting: How institutions trap retail traders

2️⃣ Smart Money Concepts

Smart money refers to capital controlled by professional institutions. You’ll learn:

How to track smart money footprints

Concepts like Order Blocks, Liquidity Zones, Fair Value Gaps (FVG)

Role of volume spikes and open interest in showing big trades

How smart money builds positions slowly to avoid moving the market

3️⃣ Volume Profile and Order Flow

Institutional traders focus on volume and flow, not indicators.

How to use Volume Profile (POC, Value Area High/Low)

Footprint charts and Delta analysis

How to read Buy vs Sell pressure

Spotting imbalances where smart money takes control

4️⃣ Institutional Candlestick Behavior

Candles tell a story—especially when institutional players are involved.

You’ll learn:

Master Candle setups

Break of Structure (BOS) and Change of Character (CHOCH)

Identifying manipulation wicks and liquidity grabs

Candlestick rejections at key institutional levels

5️⃣ Option Chain Analysis (Institutional Option Trading)

Institutions use options to hedge and speculate quietly.

Interpreting Open Interest (OI) data

Spotting institutional positions at strikes

Using PCR (Put Call Ratio) and Max Pain

Advanced option strategies like short straddles/strangles, iron condors

6️⃣ Institutional Risk Management

Institutions are masters of risk.

You will learn:

Capital allocation strategy

Stop-loss planning based on liquidity zones, not random points

Scaling into trades, position sizing

Trade management and profit-booking plans

7️⃣ Market Psychology & Trap Detection

Institutional traders create fake moves to trap retail traders.

How to avoid bull traps and bear traps

Understand news-based manipulation

The concept of dumb money vs smart money

Mindset training for following your edge

8️⃣ Building Your Institutional Strategy

The final goal is to trade like an institution, even with a small account.

You will build:

A structured plan based on smart money concepts

Entry/Exit criteria using price action + volume

Trade journaling system

Performance review framework

💼 Who Is This For?

"Master Institutional Trading" is ideal for:

Intermediate and advanced traders

Option traders looking to time entries better

Intraday, swing, and positional traders

Traders tired of using random indicators

Anyone serious about building a long-term profitable system

🧭 Real-World Application Examples

Bank Nifty Levels: Institutions often build positions using weekly options and defend key OI levels.

Nifty50 Zones: Watch for institutional buying during heavy dips or selling into rallies.

Futures Volume: A sudden spike in Bank Nifty Futures + Open Interest jump = Institutional entry.

Option Writers: At resistance zones, call writing increases sharply = probable reversal zone.

🎓 Conclusion

Mastering Institutional Trading is not about getting secret indicators or magic tips. It’s about understanding the market at its core—through price, volume, structure, and behavior of smart money.

Once you learn this, you stop following the herd. You become a confident, calm, data-driven trader who knows how to read the market like a pro.

🔹 Whether you're trading Nifty, Bank Nifty, stocks, or forex – the principles of institutional trading remain the same

Sensex 1D Timeframe

📈 Sensex (BSE 30) Today’s Overview (1D Time Frame)

Opening Level: Sensex opened higher around 82,350 to 82,500 points, continuing the positive momentum from previous sessions.

Intraday High: Reached around 82,530 in the first half of the session.

Intraday Low: Dropped to approximately 82,170–82,200 in the afternoon session.

Current Trading Range: Mostly trading between 82,200 and 82,500 levels, with a slight upward bias.

Previous Close: Around 82,180–82,200.

Net Change: Trading +0.2% to +0.3% higher, showing slight gains.

🔍 Key Market Drivers Today

Positive Impact:

Strong earnings from banking stocks, especially HDFC Bank and ICICI Bank, are boosting index strength.

Eternal Group (parent of Zomato) surged significantly, adding positivity to market sentiment.

Low volatility today, with India VIX falling, indicating reduced fear in the market.

Negative Impact:

Realty, PSU Banks, and Media sectors underperformed, capping higher gains.

Profit booking seen in auto and pharma stocks, causing minor mid-session dips.

📝 Technical Summary

Trend: Overall uptrend remains intact, with minor intraday corrections.

Support Levels: Immediate support around 82,170–82,200 zone.

Resistance Levels: Strong resistance around 82,500–82,550, breakout beyond which could take Sensex toward 83,000.

Volatility: Low volatility suggests possible slow and steady upward movement

✅ Summary Conclusion

Today, Sensex is mildly positive, driven by financial sector strength and earnings momentum. Some sector rotation is visible with pockets of weakness in PSU and Realty stocks. Volatility remains low, supporting a controlled trading session with limited intraday swings.

Nifty 1D Timeframe📈 Nifty 50 – Market Overview

Opening Level: Nifty 50 opened positive above 25,100, continuing momentum from the previous session.

Intraday High: Touched around 25,166 during the early session.

Intraday Low: Hovered around 25,111 in the later session.

Current Range: Mostly trading between 25,110 to 25,160, with a slight upward bias.

Previous Close: Around 25,090.

Current Gains: Around +0.1% to +0.3% for the day.

🔍 What’s Driving Nifty Today

Banking Sector Strength: Strong performance from HDFC Bank, ICICI Bank, and other financial stocks lifted the index.

Quick Commerce Rally: Companies like Eternal (Zomato parent) showed double-digit gains, adding upward pressure.

Volatility Decline: The India VIX dropped nearly 3%, suggesting reduced market fear and more stable price action.

Mid-Session Profit Booking: Sectors like Realty, Pharma, and Media witnessed some selling, causing small dips during the day.

📊 Technical Snapshot

Support Level: Immediate support seen around 25,100, below which the next strong zone is around 24,950.

Resistance Level: Strong resistance around 25,160–25,200, with breakout potential toward 25,300–25,400 if breached.

Trend Outlook: The market is holding a bullish tone, with minor intraday corrections typical in a trending market.

💡 Traders’ Perspective

Direction Trigger Level Expected Move

Bullish Scenario Above 25,166–25,200 Target next zone between 25,300–25,400

Neutral/Range-bound Between 25,100–25,160 Choppy movement, watch sector rotation

Bearish Scenario Below 25,100 Possible quick slide toward 24,950–25,000

✅ Summary

Today’s session on Nifty 50 shows mild positivity driven by financial stocks and quick-commerce momentum. The market remains range-bound near recent highs, with sectors like realty and pharma underperforming. The index is showing strength above 25,100, and a breakout above 25,200 could lead to further upside in the coming days

Advance Option Trading📊 Advance Option Trading – Complete Professional Guide

Advance Option Trading focuses on mastering professional-grade strategies that go beyond simply buying Call and Put options. This approach uses multi-leg strategies, Option Greeks, and volatility analysis to help traders profit in bullish, bearish, sideways, or even volatile and low-volatility markets with better control over risk and reward.

This is how professional traders and institutions trade options — systematically, with probability, and smart risk management.

💡 What is Advanced Options Trading?

In Advanced Options Trading, you learn:

✅ Complex Strategies like Spreads, Straddles, Strangles, Iron Condor

✅ How to combine multiple options in one trade

✅ Reading and using Option Greeks to manage your trades

✅ Analyzing Implied Volatility (IV) to predict market reactions

✅ Managing risk and reward scientifically

🎁 What You Master in Advanced Option Trading

1. Option Greeks

Delta — How much option price moves with the underlying.

Theta — Time decay; how much premium you lose every day.

Gamma — Rate of change of Delta; helps in intraday adjustments.

Vega — Sensitivity to volatility changes.

Rho — Impact of interest rates (minor but useful).

➡️ Professionals use Greeks to adjust their positions and decide when to enter, exit, or hedge trades.

2. Volatility Trading

High IV Strategies → Sell Options (Iron Condor, Credit Spread).

Low IV Strategies → Buy Options (Straddle, Strangle).

IV Crush → Profit from fast drop in implied volatility after events (like earnings/news).

3. Advance Risk Management Techniques

Adjusting trades dynamically as price moves.

Hedging positions when necessary.

Avoiding big losses using proper position sizing.

Managing trades based on Greeks exposure

✅ Benefits of Advanced Options Trading

✅ Predictable Profitability — higher consistency

✅ Works in all market conditions

✅ Controlled Risk, Limited Loss

✅ Higher Win Rate Strategies

✅ Option Greeks help you stay professional

✅ Volatility analysis increases trade accuracy

📝 Who Should Learn Advanced Options Trading?

✅ Traders who know basics and want more control

✅ Those interested in hedging and capital protection

✅ Swing or positional traders wanting steady income

✅ Intraday traders aiming for high probability setups

Institution Option Trading📈 Institutional Option Trading – Complete Detailed Guide

Institutional Option Trading refers to how big financial institutions, such as banks, hedge funds, and proprietary trading firms, use options strategically in the market to manage risk, maximize profits, and control large positions with precision. This approach is highly systematic, data-driven, and based on volume, volatility, and liquidity analysis — very different from how retail traders trade options.

💡 What is Institutional Option Trading?

Institutions don’t gamble with options — they use options for:

✅ Hedging — Protecting big portfolios from market drops.

✅ Income Generation — Earning regular profits through premium selling.

✅ Directional Bets — Placing large directional trades with minimal risk.

✅ Volatility Trading — Making profits from changes in volatility without caring about market direction.

📚 Key Features of Institutional Option Trading

1. Focus on Liquidity

Institutions trade highly liquid options, usually:

Index Options (NIFTY, BANKNIFTY, SPX)

Blue-Chip Stocks (Apple, Reliance, TCS, Infosys)

Commodity Options (Gold, Crude Oil)

They avoid low-volume contracts and always trade in markets where they can enter and exit positions without slippage.

2. Use of Option Greeks

Institutions are masters of Option Greeks:

Delta for direction,

Theta for time decay profits,

Vega for volatility play,

Gamma for adjusting positions dynamically.

They don’t trade blindly but monitor how their positions react to price, time, and volatility changes.

3. Premium Selling Bias

Most institutional setups involve selling options (not just buying).

✅ Credit Spreads, Iron Condors, and Covered Calls are preferred.

Why? Because time decay works in their favor, giving consistent income.

4. Hedging Big Positions

Institutions always hedge their trades.

✅ Example: They may hold large stock positions and sell Covered Calls or buy Protective Puts to reduce risk.

✅ This creates balanced portfolios, minimizing market shocks.

✅ Institutional Trading Tools

Open Interest Analysis

Option Chain Data

IV (Implied Volatility) charts

Volume Profile & Market Profile

Real-time Greeks exposure tools

Delta-neutral hedging platforms

📝 Example of Institutional Option Trade

Scenario: NIFTY at 22,000, sideways expectation for next week.

✅ Strategy: Sell 22,500 Call, Sell 21,500 Put (Iron Condor).

✅ Buy hedges: 23,000 Call, 21,000 Put.

✅ Profit Range: If NIFTY stays between 21,500-22,500 → Max Profit.

✅ Risk Managed: Losses capped, steady time decay profit.

🚀 Benefits of Learning Institutional Option Trading

✅ Consistent income instead of gambling

✅ Risk protection using proper hedging

✅ Trade size management for scalability

✅ Ability to handle big accounts with steady growth

✅ Professional market understanding

Option Trading📈 Option Trading – Complete Beginner to Advanced Guide

Option Trading is a powerful method used in stock, forex, commodity, and index markets where you trade contracts (options) instead of buying the actual stock or asset. With options, you get the right, but not the obligation, to buy or sell an asset at a specific price within a specific time. This allows traders to profit in bullish, bearish, and sideways markets — with controlled risk and higher flexibility.

💡 What is Option Trading?

In simple words:

You buy or sell a contract, not the stock itself.

You can control big positions with less money (leverage).

You can make money even if the market goes up, down, or stays sideways.

🎁 Advantages of Option Trading

✅ Small capital, high profits with leverage

✅ Limited risk, especially in buying options

✅ Opportunity to earn in any market direction

✅ Flexible strategies for income, hedging, or speculation

✅ Ideal for short-term trades (1 day to a few weeks)

Simple Example:

You think NIFTY will rise from 20,000 to 20,500 in a week.

You buy a NIFTY Call Option (Strike Price: 20,000).

Pay premium ₹50.

If NIFTY moves to 20,500, your option value increases (maybe ₹200).

Profit = ₹150 per unit (₹200 - ₹50).

With small investment, you earn bigger returns.

✅ Basic Rules for Successful Option Trading

Trade with trend direction (use technical analysis).

Always check Open Interest & Volume.

Avoid holding close to expiry to avoid time decay (theta loss).

Start with single-leg options, move to spreads later.

Risk only 1-2% of your capital per trade.

🎯 Benefits of Mastering Option Trading

✅ Higher returns with lower capital

✅ Master multiple market conditions

✅ Ideal for intraday, swing, and positional trades

✅ Opportunity to hedge existing investments

✅ Fast skill growth in financial markets

New Hedging Opportunity: Gold Futures at IIBX1. What Is IIBX—and Why Are Gold Futures a Game Changer?

India International Bullion Exchange (IIBX), based in GIFT City, Gujarat, launched gold futures trading in July 2025.

This marks the first-ever opportunity for Indian entities to hedge gold price risk onshore but in US dollars with global pricing—bridging domestic participants and international benchmarks.

Unlike traditional futures on MCX, which are rupee-denominated and influenced heavily by Indian domestic factors, IIBX futures track international market dynamics, aligning with real-time global valuations.

Why is this significant?

India is the world’s second-largest consumer of gold—by introducing a dollar-denominated, globally priced futures contract, IIBX allows traders and jewellers to hedge currency and commodity risk simultaneously.

This initiative reduces dependence on foreign exchanges like COMEX or Singapore and supports RBI/IFSCA's goal to develop a robust, transparent bullion trading ecosystem domestically.

2. Who Can Use These Futures—and How Do They Hedge?

Eligible Participants:

Qualified jewellers

Bullion dealers

Refineries

TRQ (Tariff Rate Quota) holders (currently 441+, with more in the pipeline)

Any business entity with gold-related risk exposure

Hedging Scenarios:

Jewellers: Protect import cost from rising gold prices. If they expect gold to cost $2,000/oz in three months, they can lock in prices via futures.

Refiners and Dealers: Manage margin volatility and ensure stable profit spreads regardless of gold price shifts.

TRQ operators: Offset exposure to tariff-based import risks.

Hedging Mechanics:

Buy futures if expecting price increases, offsetting rising import cost.

Sell futures (short positions) to hedge inventory or production, locking in current prices.

Since trades occur in US dollars and settle physically or in cash, participants hedge both commodity and currency risk.

3. Contract Features: What IIBX Has Built-In

📃 Specifications:

Contract unit: 1 kg gold (approx 32.15 oz)

Denomination: U.S. dollars per Troy ounce

Tick size: $0.01 per oz

Minimum trading size: 1 kg; maximum 10 kg per order

Contracts listed: Three consecutive months plus all even-months in a 13-month window (total 8 concurrent maturities)

Trading hours: 09:00–23:30 IST—keeping sync with global gold trading sessions

Risk & Margin Management:

Initial margin: At least 6% of contract value or calculated via Value‑at‑Risk (VaR)

Extreme Loss Margin (ELM): 1% buffer

Daily Mark-to-Market (MTM) settlement

Collateral controls: Members cannot fully exhaust collateral—risk-reduction thresholds are triggered at 85–90%

Concentration & spread margins: Encourage diversification by offering margin benefits for calendar spreads

Settlement:

Daily MTM in USD

Final settlement: Cash or physical delivery, based on pre-declared intent

These features ensure transparency, member protection, and global alignment—while maintaining strong oversight by IIBX and IFSCA.

4. What Makes This Hedging Opportunity Unique Now

💱 Hedge Gold and Currency Simultaneously

Standard MCX contracts hedge gold price risk but not USD/INR fluctuations.