Option Selling Strategies – Complete Guide1. Introduction to Option Selling

Option selling, also known as option writing, is a strategy where a trader sells (writes) options to earn premium income. Unlike option buyers, who need a strong price move to profit, option sellers benefit when the market moves sideways, slowly trends, or even slightly moves against them.

In option selling, time decay (Theta) works in your favor. Every passing day reduces the option’s value, allowing sellers to profit even if price does nothing.

However, option selling involves high risk if not managed properly, which is why it is considered a professional strategy, best used with strict risk management.

2. Why Traders Prefer Option Selling

Most professional traders prefer option selling because:

• Higher probability of profit (60–80%)

• Income generation through time decay

• Works best in range-bound markets

• Consistent returns if risk is controlled

Statistically, options expire worthless most of the time, which benefits sellers.

But remember:

Option selling gives small, consistent profits but can lead to large losses if risk is ignored.

3. Key Concepts Every Option Seller Must Know

Before strategies, you must understand:

a) Time Decay (Theta)

Time decay accelerates in the last 2–3 weeks before expiry. Sellers earn as option value melts daily.

b) Implied Volatility (IV)

• Sell options when IV is high

• Avoid selling when IV is extremely low

High IV means higher premium.

c) Margin Requirement

Option selling requires large margin, especially naked selling.

d) Risk Management

Never sell options without a hedge unless you’re highly experienced.

4. Popular Option Selling Strategies

4.1 Short Call (Naked Call Selling)

Market View: Bearish or sideways

Instrument: Sell Call option

How it Works:

You sell a call option expecting the price to stay below the strike price.

Example:

NIFTY at 22,000

Sell 22,200 CE

If NIFTY stays below 22,200 → profit = premium received.

Pros:

• High probability

• Fast premium decay

Cons:

• Unlimited loss if market rallies

• Requires high margin

👉 Best for experienced traders only.

4.2 Short Put (Naked Put Selling)

Market View: Bullish or sideways

Instrument: Sell Put option

How it Works:

You sell a put option expecting the price to stay above the strike price.

Example:

NIFTY at 22,000

Sell 21,800 PE

If NIFTY stays above 21,800 → profit = premium.

Pros:

• Works well in rising markets

• Time decay advantage

Cons:

• Large downside risk

• High margin requirement

4.3 Covered Call Strategy

Market View: Mildly bullish or sideways

Risk Level: Low

How it Works:

You hold shares and sell a call option against them.

Example:

You own 100 shares of RELIANCE

Sell OTM call option

You earn:

• Option premium

• Dividends (if any)

Pros:

• Limited risk

• Extra income on holdings

Cons:

• Upside capped

👉 Very popular among long-term investors.

4.4 Cash Secured Put

Market View: Bullish

Risk Level: Medium

How it Works:

You sell a put while keeping enough cash to buy shares if assigned.

Example:

Sell TCS 3,600 PE

Keep funds ready to buy TCS if assigned.

Pros:

• Safe way to enter stocks

• Premium reduces buying cost

Cons:

• Capital intensive

4.5 Bear Call Spread (Call Credit Spread)

Market View: Bearish or sideways

Risk Level: Limited

How it Works:

• Sell lower strike call

• Buy higher strike call

Example:

Sell 22,200 CE

Buy 22,400 CE

Pros:

• Limited loss

• Lower margin

• Ideal for beginners

Cons:

• Limited profit

4.6 Bull Put Spread (Put Credit Spread)

Market View: Bullish or sideways

Risk Level: Limited

How it Works:

• Sell higher strike put

• Buy lower strike put

Example:

Sell 21,800 PE

Buy 21,600 PE

Pros:

• Defined risk

• Works well in trending markets

4.7 Iron Condor

Market View: Range-bound

Risk Level: Limited

Structure:

• Sell OTM Call

• Buy further OTM Call

• Sell OTM Put

• Buy further OTM Put

Profit Zone:

Price must stay within a defined range.

Pros:

• High probability

• Risk limited

• Stable income strategy

Cons:

• Small profit

• Needs adjustment if breakout occurs

4.8 Iron Butterfly

Market View: Very low volatility

Profit: Maximum at ATM

This is an advanced strategy where both call and put are sold at ATM.

5. Best Time to Use Option Selling

✔ When market is range-bound

✔ When IV is high

✔ During weekly expiry

✔ After major news events

Avoid selling before:

❌ Budget

❌ RBI policy

❌ Global events

6. Risk Management Rules for Option Sellers

This is the most important section.

Golden Rules:

Always define max loss

Use stop-loss

Prefer hedged strategies

Avoid over-trading

Risk only 1–2% capital per trade

Exit early if target achieved

Never sell options emotionally

7. Psychology of Option Selling

Option selling tests patience and discipline.

• Small daily profits feel easy

• One bad trade can wipe weeks of gains

• Overconfidence is dangerous

Successful option sellers:

✔ Follow system

✔ Accept small losses

✔ Think in probabilities

8. Conclusion

Option selling is one of the most powerful ways to generate consistent income in the stock market when done correctly. It suits traders who understand probability, volatility, and risk management.

For beginners, start with:

• Credit spreads

• Covered calls

• Iron Condors

Avoid naked selling until you gain experience.

Remember:

Option selling is not about predicting the market, but managing risk while letting time work for you.

Crypto market

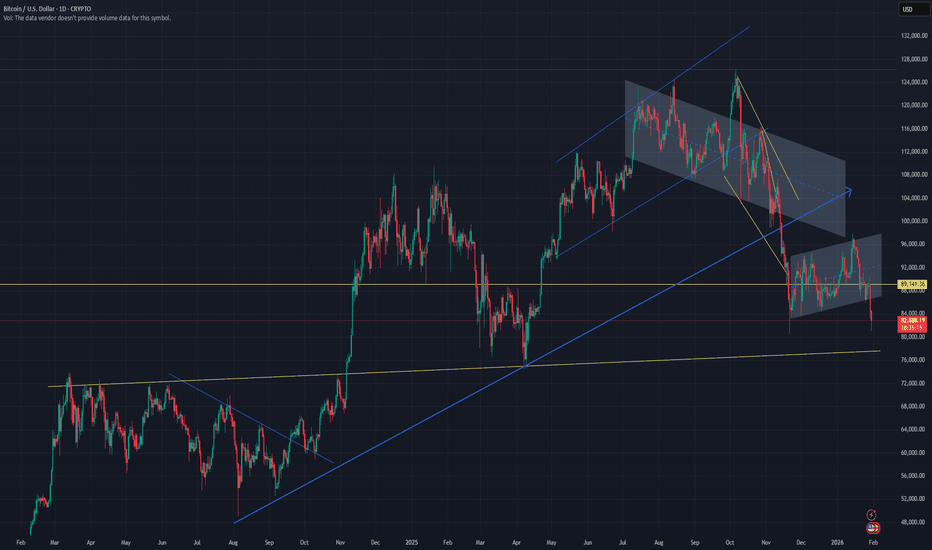

Bitcoin Long-Term Monthly Chart: Parabolic Advance Meets DistribMacro Trend

Bitcoin is still in a long-term bullish structure. Each cycle shows higher highs and higher lows since inception.

The move from ~20k to ~90k happened in very few monthly candles, which signals a parabolic phase rather than healthy trend growth.

2. Current Candle Structure

The most recent candles show:

Large bullish impulse followed by

Strong rejection wicks and consecutive red monthly candles

This usually indicates profit-taking and distribution, not immediate trend continuation.

3. Volatility & Momentum

The current red candle (~-10%) after a blow-off green candle suggests:

Momentum is cooling

Buyers are no longer in full control

Historically, after similar structures (2013, 2017, 2021), BTC entered extended consolidation or deep pullbacks.

4. Volume Insight

Volume peaked during the explosive green candles and is now declining, which often means:

Smart money already positioned

Late buyers are absorbing supply

5. Key Levels to Watch

78k–80k: Current support (short-term)

60k–65k: Strong macro support (prior cycle top zone)

45k–50k: Extreme but historically reasonable retracement in bull cycles

6. Probable Scenarios

Base Case (Most Likely):

Sideways to downward consolidation over several months (range expansion).

Bull Continuation:

Needs a strong monthly close above prior highs with increasing volume.

Bearish Extension:

Loss of 60k opens the door for a deeper macro correction.

$BTC UPDATE: 22% DOWN FROM MY SHORT ZONECRYPTOCAP:BTC UPDATE: 22% DOWN FROM MY SHORT ZONE

When Most MoonBoys Were Calling $200K–$500K... I Shared Shorts at $95K-$98K.

Today: Bitcoin Touched $75,500 ✅

Results Without Leverage: +22%

With 5x Leverage: ~100%+ ProfitIf You Followed the Setup and Now Time to Book Profits.

The Trend Was Clear:

→ Bear Flag Breakdown

→ H&S Failure

→ Lower Highs, Lower Lows

This is Why We Trade Structure, Not Hopium.

Risk Management Saved Portfolios.

Stop Losses Kept You in the Game.

Moon Boys Don't Teach You Risk Management.

Charts do.

Always Trade with a Plan. Always manage Risk.

Hope You Saved Capital & Banked Gains.

Not financial Advice. ALWAYS DYOR.

ETHUSD 45-Min Chart — Counter-Trend Long From Demand After Major

Chart Analysis:

Market Structure:

Ethereum broke decisively below the 2,855 resistance zone, confirming a bearish structure shift. The move down was impulsive, followed by weak consolidation — classic distribution → continuation behavior.

Support / Demand Zone:

Price is reacting around 2,485–2,520, a highlighted demand area. This zone aligns with the first strong base formed after the sell-off, making it a high-interest reaction level.

Current Price Action:

ETH is printing long lower wicks into support, suggesting seller exhaustion and early dip-buying. However, structure is still bearish until a reclaim occurs.

Entry Logic:

The marked entry near ~2,490–2,510 assumes:

Support holds

A short-term higher low forms

Momentum flips on lower timeframes

Upside Targets:

TP1: ~2,690 (range equilibrium / liquidity grab)

TP2: ~2,740 (previous consolidation + minor resistance)

Final Target: ~2,855 major resistance (breakdown origin)

Invalidation:

A clean breakdown and close below 2,480 invalidates the long bias and opens continuation toward lower liquidity.

Bias Summary:

Trade Type: Counter-trend bounce

Risk Profile: Higher risk, higher R:R

Trend Context: Bearish until 2,855 is reclaimed

BTC 1D UpdateThe Hook: Blood in the streets? Or the opportunity of 2026? 🩸📉

If you’re feeling the heat today, you’re not alone. Bitcoin just took a massive swing, slicing through supports to hit a local low around $80,553. The "Fear & Greed Index" has officially tanked into Extreme Fear (20/100), and the timeline is full of panic.

What’s driving this? It’s a perfect storm: nearly $1 billion in ETF outflows in a single day, combined with the uncertainty of a partial US government shutdown and the buzz around Kevin Warsh’s nomination for Fed Chair.

My Technical Roadmap:

The "Bounce" Target: We are sitting right on a major wick support at $80,559. For a bullish reversal, we need to reclaim $84,478 quickly. If we flip that, the path toward the $90k gap and eventually $94,271 reopens.

The "Pain" Scenario: If this $80k floor gives way, don't try to catch the knife. The next major technical "reloading zone" isn't until $74,458.

The Outlook: Historically, "Extreme Fear" is where the smart money builds their next cycle of wealth. We are shaking out the "paper hands" before the February trend takes over.

The Play: Patience is your best friend right now. Watch the 4H close—if we hold $80k, the "spring" could be massive.

#Bitcoin #BTC #CryptoTrading #TechnicalAnalysis #TradingView #Web3 #FOMC #BTCDump

BTCUSD 45-Min Chart — Support Reclaim Setup After Sharp Breakdow

Chart Analysis:

Market Structure:

Clear bearish break from the prior range near 87k resistance, followed by a strong impulsive sell-off → confirms a bearish market shift.

Support Zone (Key Area):

Price is reacting around 80,600–81,000, a marked demand/support zone. This is the first meaningful base after the dump.

Current Price Action:

BTC is testing support after a lower high, suggesting sellers are losing momentum. Wicks into support show buying interest, but confirmation is still needed.

Entry Logic:

The marked entry near 80.6k assumes:

Support holds

A bounce + reclaim of minor structure (above ~82k)

Targets:

TP1: ~83.2k (range midpoint / liquidity)

TP2: ~83.7k (previous consolidation)

Final Target: ~87.1k resistance (major supply zone + breakdown origin)

Bias Summary:

Short-term: Tactical long from support

Invalidation: Clean break and close below 80.6k

Overall trend: Still bearish until 87k is reclaimed

Takeaway:

This is a counter-trend long setup — high reward, but only valid if support holds and momentum flips. Conservative traders should wait for a confirmed reclaim above 82–83k before committing.

$BTC is now trading right on top of Bottom-2 support around 81kCRYPTOCAP:BTC is now trading right on top of Bottom-2 support around 81k, and this is one of those levels where the market must show its hand. There’s no middle ground here.

What price is saying right now:

The sell-off has pushed BTC back into a high-risk zone.

Volatility is compressing after the drop — a classic sign that a large move is loading.

Two clear paths from here:

1️⃣ Breakdown scenario (high risk):

If #BTC loses 81k with strong sell volume, this structure fails completely. In that case, downside liquidity opens fast toward 75k first, and if fear accelerates, even 70k becomes possible. This move would likely be sharp, not slow.

2️⃣ Bounce / relief scenario (structure defense):

If buyers defend 81k and volume on sell candles keeps declining, this turns into a liquidity sweep. That sets up a relief bounce toward 86k–88k, where the first serious supply sits. Only acceptance above that zone would revive the larger recovery narrative.

Let volume + candle closes decide the direction.

A big move is inevitable. The next few candles will decide which way.

Astro Timing🧭 TRADER’S ASTRO-COMPASS: Saturday, Jan 31, 2026 Timezone: New York (EST)

📉 MARKET PROBABILITY: The market has a split personality today. The pre-market session offers high probability setups (an echo of yesterday's Jupiter), but the main session turns into a volatility trap. Rule of the day: "Hit and Run." If you catch a move early, lock it in. Staying until the afternoon increases the probability of a total drawdown.

🟢 PROFIT WINDOW: Until 05:50 AM (EST)

Factors: Moon in Cancer (Intuition) Sextile Uranus (Volatility spike) + Trine Saturn (Structure).

The Setup: We are riding the tailwinds of yesterday’s "Royal Conjunction" with Jupiter. Uranus brings unexpected volume spikes.

Strategy: High liquidity for crypto/forex scalping. Saturn acts as your automatic "Take Profit" button here—don't get greedy, lock the gains immediately.

⚪️ DEAD VOLUME (Void): 05:52 AM – 08:09 AM (EST)

Status: Moon Void of Course.

Risk: Zero edge. Orders may hang, liquidity dries up. Do not initiate new positions.

🔴 MARGIN CALL ZONE: After 11:00 AM (EST)

Factor: Moon enters Leo and applies to Opposition with Pluto (Peak impact at 02:21 PM).

Psychology (Leo): Triggers "God Mode" and FOMO. You might feel the urge to go "all in" to impress or recover losses.

Reality (Pluto): Pluto is the planet of force majeure and bankruptcy. In financial astrology, the Moon-Pluto opposition is the classic signature of a "account wipeout" or a sudden market crash against the retail trader.

Strategy: Close the terminal. You are not trading against the trend here; you are trading against a steamroller.

Part 2 Intraday Institutional TradingOption Trading: Terms and Conditions

- Strike Price: Price at which option can be exercised.

- Expiry Date: Last day option can be exercised.

- Premium: Price paid for option.

- Lot Size: Number of shares/contracts per lot.

- Margin: Required for selling options.

- Exercise: Buyer chooses to buy/sell underlying asset.

- Assignment: Seller obligated to buy/sell if option exercised.

Part 1 Intraday Institutional Trading Who Should Trade Options?

People who:

- Understand options and risks.

- Have experience trading stocks/derivatives.

- Want to hedge existing positions.

- Are comfortable with potential losses.

Not suitable for:

- Beginners without knowledge.

- Risk-averse investors.

Indices and ETFsIntroduction

In the world of finance, the concepts of indices and ETFs (Exchange-Traded Funds) are central to understanding market performance and investment strategies. Both have revolutionized how investors approach the stock market, offering simplified, diversified, and cost-effective ways to invest. While indices track the performance of a set of assets, ETFs allow investors to invest in these indices or other asset collections with flexibility and liquidity.

1. What is a Stock Market Index?

A stock market index is essentially a statistical measure of the performance of a selected group of stocks. These stocks are usually chosen to represent a particular market, sector, or type of asset. The index provides investors with a snapshot of market trends and overall economic health.

Key Points:

Representation: Indices represent either the entire market (broad-market index) or a specific sector or theme (sectoral index).

Benchmarking: They act as benchmarks against which investors measure the performance of individual investments or funds.

Price Movement: Investors use indices to gauge market sentiment—whether it is bullish (rising) or bearish (falling).

Popular Indices Worldwide:

S&P 500 (USA): Represents the 500 largest publicly traded companies in the United States.

Dow Jones Industrial Average (USA): Comprises 30 large-cap US companies, reflecting industrial market performance.

NASDAQ Composite (USA): Focuses mainly on technology stocks.

Nifty 50 (India): Tracks the performance of the top 50 companies listed on the National Stock Exchange (NSE).

Sensex (India): Represents 30 major companies on the Bombay Stock Exchange (BSE).

Types of Indices:

Price-Weighted Index: Stocks with higher prices have more influence. Example: Dow Jones Industrial Average.

Market Capitalization-Weighted Index: Stocks are weighted by their market capitalization. Example: S&P 500, Nifty 50.

Equal-Weighted Index: Every stock has equal importance, regardless of price or size.

Uses of Indices:

Measure overall market trends.

Serve as benchmarks for fund performance.

Guide investment decisions and strategies.

Used in financial derivatives like futures and options.

2. What is an Exchange-Traded Fund (ETF)?

An ETF (Exchange-Traded Fund) is a type of investment fund that holds a collection of assets such as stocks, bonds, or commodities. ETFs are traded on stock exchanges, similar to individual stocks, allowing investors to buy and sell shares throughout the trading day.

Key Features of ETFs:

Diversification: One ETF can provide exposure to multiple assets, reducing the risk compared to investing in a single stock.

Liquidity: ETFs can be traded like regular shares at market prices.

Transparency: Most ETFs disclose their holdings daily, offering transparency to investors.

Cost-Effectiveness: ETFs often have lower management fees compared to mutual funds.

How ETFs Work:

Creation: Authorized participants (large institutional investors) create ETF units by delivering a basket of underlying securities to the fund provider.

Trading: Investors buy and sell ETF shares on the exchange just like stocks.

Redemption: Shares can be redeemed by the authorized participants in exchange for the underlying assets.

3. Types of ETFs

Equity ETFs: Track stock indices like the S&P 500, Nifty 50, or sectoral indices (technology, healthcare, finance).

Bond ETFs: Invest in government or corporate bonds, providing fixed income exposure.

Commodity ETFs: Track commodities such as gold, silver, crude oil, or agricultural products.

International ETFs: Give investors access to foreign markets without directly buying foreign stocks.

Thematic ETFs: Focus on specific trends or themes, such as clean energy, artificial intelligence, or ESG (environmental, social, governance) criteria.

4. Relationship Between Indices and ETFs

Most ETFs are designed to track an index, providing investors with a way to mirror the index’s performance. For example:

An S&P 500 ETF holds stocks in the same proportion as the S&P 500, allowing investors to invest in all 500 companies in a single trade.

Similarly, a Nifty 50 ETF reflects the performance of India’s top 50 companies.

This relationship offers several advantages:

Diversification: Reduces risk as the ETF holds multiple stocks instead of relying on a single company.

Market Performance: Investors can match or replicate the performance of a broad market index.

Cost Efficiency: ETFs typically have lower fees than actively managed mutual funds.

5. Advantages of Investing in ETFs

Diversification: Exposure to many stocks or bonds in one investment.

Liquidity and Flexibility: Can be bought and sold anytime during market hours.

Lower Costs: Reduced management fees compared to traditional mutual funds.

Transparency: Daily disclosure of holdings ensures investors know what they own.

Tax Efficiency: ETFs often generate fewer capital gains taxes than mutual funds because of their unique creation/redemption mechanism.

6. Risks Associated with ETFs and Indices

Even though ETFs are generally considered safe, they carry some risks:

Market Risk: ETF value can fall if the underlying index declines.

Tracking Error: Sometimes the ETF may not perfectly replicate the index due to fees, liquidity, or other factors.

Liquidity Risk: Less popular ETFs may have lower trading volume, making them harder to sell at fair prices.

Sector Concentration: Thematic or sector ETFs may be riskier due to concentration in one industry.

Indices, while not directly investable, also carry implicit risks as market benchmarks. They reflect the overall market movement, and any downturns in the economy can affect index performance.

7. Why Indices and ETFs are Important

Benchmarking: Indices are benchmarks for mutual funds, hedge funds, and individual portfolios.

Passive Investing: ETFs enable passive investment strategies, which have gained popularity over active stock picking.

Accessibility: Small investors can gain exposure to diversified portfolios using ETFs.

Portfolio Management: Both tools help investors manage risk, allocation, and exposure to global or local markets.

8. Practical Examples

Investing in Nifty 50 ETF (India): Buying one unit of a Nifty 50 ETF gives exposure to 50 leading Indian companies like Reliance, HDFC Bank, and Infosys.

S&P 500 ETF (USA): An investor in an S&P 500 ETF essentially invests in 500 large-cap US companies like Apple, Microsoft, and Amazon.

Gold ETFs: Allow investors to own gold without physically buying and storing it.

9. Conclusion

In modern investing, indices and ETFs are indispensable tools. Indices serve as barometers for the market and benchmarks for fund performance, while ETFs provide a cost-effective, diversified, and accessible investment vehicle. Together, they empower investors to participate in financial markets with lower risk, higher liquidity, and greater flexibility.

Whether you are a seasoned investor or a beginner, understanding indices and ETFs is crucial for building a well-rounded, efficient, and informed investment strategy. Their combination of simplicity, transparency, and diversification makes them a cornerstone of contemporary financial markets.

Market Fundamentals: A Comprehensive Overview1. Definition and Importance of Market Fundamentals

Market fundamentals can be defined as the underlying forces or conditions that influence the supply and demand of financial instruments, ultimately determining their prices. These fundamentals are rooted in economic indicators, corporate performance, geopolitical developments, and investor sentiment.

The importance of market fundamentals lies in their ability to:

Provide a rational basis for valuing securities.

Help predict long-term trends in asset prices.

Allow investors to identify mispriced assets and investment opportunities.

Assist in understanding macroeconomic conditions and their impact on various sectors.

By studying market fundamentals, investors can make informed decisions rather than relying solely on speculation or short-term price fluctuations.

2. Key Components of Market Fundamentals

Market fundamentals consist of various factors that can be broadly categorized into economic fundamentals, financial fundamentals, and qualitative factors.

a) Economic Fundamentals

Economic fundamentals are indicators that reflect the overall health of an economy and influence market performance. These include:

Gross Domestic Product (GDP): GDP measures the total value of goods and services produced within a country. A growing GDP signals economic expansion, increased corporate earnings, and potentially higher stock prices. Conversely, declining GDP indicates a slowdown or recession, which can negatively affect markets.

Inflation Rates: Inflation measures the general rise in prices over time. Moderate inflation is often a sign of a healthy economy, but high inflation erodes purchasing power and can lead central banks to raise interest rates, impacting asset prices.

Interest Rates: Set by central banks, interest rates influence borrowing costs, corporate profits, and consumer spending. Lower interest rates encourage investment and spending, typically boosting stock markets, whereas higher rates can dampen economic activity.

Employment Data: Employment levels, wages, and unemployment rates reflect economic productivity and consumer purchasing power. Strong employment data usually boosts market confidence, while rising unemployment may lead to reduced spending and market corrections.

Trade Balance and Currency Strength: A country’s imports, exports, and currency value affect corporate earnings, particularly for multinational companies. A strong currency can reduce export competitiveness but lower import costs.

b) Financial Fundamentals

Financial fundamentals focus on the health, performance, and valuation of individual companies or sectors. Key metrics include:

Revenue and Earnings Growth: The primary indicators of corporate performance are revenue (sales) and net income (profit). Consistent growth signals strong management and potential for long-term stock appreciation.

Profit Margins: Profitability ratios, such as gross, operating, and net profit margins, measure efficiency and cost management. High margins often indicate competitive advantage and financial strength.

Return on Equity (ROE) and Return on Assets (ROA): ROE shows how effectively a company uses shareholder capital, while ROA measures how efficiently assets generate profits. Higher returns typically attract investors.

Debt Levels: The debt-to-equity ratio and other leverage indicators reveal financial risk. Excessive debt can lead to solvency issues, especially in economic downturns, while manageable debt supports growth and expansion.

Cash Flow: Cash flow from operations reflects a company’s ability to generate liquidity for reinvestment, debt servicing, and dividends. Strong cash flow indicates financial stability.

Valuation Metrics: Ratios such as Price-to-Earnings (P/E), Price-to-Book (P/B), and Price-to-Sales (P/S) help investors assess whether a stock is overvalued, undervalued, or fairly priced relative to its fundamentals.

c) Qualitative Factors

Not all market fundamentals are quantitative. Qualitative factors also play a crucial role in determining asset value:

Management Quality: The experience, strategy, and integrity of a company’s leadership affect its long-term success. Good management can navigate market challenges effectively.

Industry Position and Competitive Advantage: Companies with strong brand recognition, technological superiority, or unique market niches tend to outperform competitors.

Regulatory Environment: Government policies, taxation, and regulations can impact profitability and market behavior. For instance, subsidies or trade tariffs can boost or hinder specific sectors.

Geopolitical Stability: Political unrest, international conflicts, and diplomatic relations influence investor confidence and capital flows, affecting markets.

3. Market Fundamentals in Different Asset Classes

Market fundamentals apply across various financial markets:

Equities (Stocks): Stock prices are influenced by company earnings, sector performance, and macroeconomic indicators. Strong fundamentals often indicate long-term investment potential.

Bonds: Bond prices are affected by interest rates, inflation, and credit ratings. Investors look for stable returns and low default risk.

Commodities: Commodity prices depend on supply-demand dynamics, production costs, geopolitical events, and weather conditions. For example, oil prices are highly sensitive to OPEC decisions and global demand trends.

Foreign Exchange (Forex): Currency values are influenced by trade balances, interest rates, inflation, and political stability. Strong economies and fiscal policies attract foreign investment, strengthening the currency.

4. Fundamental Analysis vs. Technical Analysis

While market fundamentals focus on intrinsic value, technical analysis examines historical price patterns and trading volumes to predict short-term market movements. Both approaches complement each other:

Fundamental analysis is long-term oriented, aiming to identify undervalued or overvalued assets.

Technical analysis is short-term oriented, useful for timing entries and exits based on market psychology and trends.

Savvy investors often combine both to make well-informed decisions.

5. Challenges and Limitations of Market Fundamentals

Despite their importance, relying solely on fundamentals has challenges:

Market Sentiment: Emotional behavior, speculation, and herd mentality can cause prices to deviate from fundamental values. For example, during a bubble, assets may be overvalued despite weak fundamentals.

Data Accuracy: Economic and corporate data can be revised, delayed, or manipulated, affecting analysis accuracy.

Complex Interdependencies: Globalization means that local economic changes can have far-reaching effects, making prediction more complicated.

Time Lag: Fundamental changes often take time to reflect in market prices, leading to potential short-term volatility.

6. Practical Applications of Market Fundamentals

Investors and traders use fundamentals to:

Identify long-term investment opportunities by spotting undervalued assets.

Develop portfolio strategies that align with economic cycles and sector performance.

Assess risk by evaluating financial stability, debt levels, and external threats.

Make informed decisions during mergers, acquisitions, and capital investments.

For institutions, market fundamentals guide policy-making, monetary decisions, and strategic planning.

7. Conclusion

Market fundamentals form the backbone of informed investment decision-making. By examining economic indicators, corporate financial health, and qualitative factors, investors can assess the intrinsic value of assets and anticipate market trends. While markets can be influenced by sentiment and speculation, a strong grasp of fundamentals provides a reliable framework for long-term financial success.

In an increasingly complex and interconnected world, understanding market fundamentals is not just a tool for investors but a necessity for navigating the dynamic landscape of global finance. By combining analytical rigor with strategic insight, individuals and institutions alike can make smarter, more sustainable decisions, achieving financial growth while mitigating risk.

Speculative Path-1 for Bitcoin for 2026Bitcoin ( BITSTAMP:BTCUSD ) price action has been showing a lot of weakness lately, even though equities and metals are in bullish zones. That's the nature of the cycle of this asset class that we have to deal with.

In Q1, we may see Bitcoin drift to $74,000 levels, where it will make a local bottom. This scenario will be accompanied by a correction in equity and commodity markets due to the looming fear of recession.

With the possible change of helm at the Federal Reserve and the likelihood of interest rate cuts, we may observe a countertrend rally towards $87,000. And that will become an inflection point for two possible scenarios. Today, we are discussing the Part-1 scenarios that has higher possibility.

At $87,000, we may face resistance at the price levels and the 20WSMA/21WEMA, which can trigger a downward slide towards $68,000 in Q2. With a possible formation of a bearish head and shoulders pattern, with $74,000 as the neckline being breached, new short sellers will enter the market. But it's noteworthy to mention that the $65,000-$69,000 levels were the top of the 2021 bull market, which will act as a strong support going forward.

Again, a snappy countertrend rally can take the prices to $80,000 levels in Q3. The final bottom may happen in Q4 at around $65,000-$69,000 levels, where the prices will meet the 200WSMA. This moving average has been the single most important factor when it comes to searching for Bitcoin market bottoms.

Even on the BTC Power Law chart, we will then enter the ultimate bullish zone for buying. At the lowest gray band, between $66,000-$74,000 levels, long-term investors will step in.

With an unconvincing/incomplete bearish H&S pattern and a lot of shorts in the system, that's when the new bull market will start.

I will present the Part-2 scenario in a different post.

$XRP is currently sitting at the lower trendline support CRYPTOCAP:XRP is currently sitting at the lower trendline support of a falling wedge on the daily timeframe. This is a sensitive area where price usually decides between relief bounce or deeper continuation — and right now, pressure is clearly building.

The 1.71 level is the key line in the sand.

Bearish continuation scenario🔽

If 1.71 gets lost with acceptance:

Structure breaks down

High probability move toward 1.58

Further weakness can drag price into 1.40 zone

This would confirm a deep correction, not just a pullback.

Bullish recovery scenario 🔼

For bulls to regain control:

Price must reclaim and hold above 1.80

Acceptance above this region opens room for: 2.00 - 2.20

Until then, any bounce remains corrective, not trend-changing.

This is a wait-for-confirmation zone.

Let the level decide — not hope.

[SeoVereign] BITCOIN BULLISH Outlook – January 31, 2025Bitcoin is currently deciding its next move around the recent daily low of 80,700 USDT.

At this point, there are three main scenarios that could unfold for Bitcoin. First, it does not break below 80,700 USDT and continues to rise. Second, it breaks below 80,700 USDT but forms a whipsaw movement, fully recovers the decline, and reverses upward. Third, it breaks below 80,700 USDT and leads to a major decline.

Since we are traders, we must determine which of these three scenarios will prove to be correct.

It would be ideal if we could clearly choose one of the three options above. However, a market perspective is rarely something that can be decisively concluded in a black-or-white manner.

Therefore, rather than selecting one of the three scenarios, I will describe my subjective view in a narrative form.

First, I believe that in the short term, Bitcoin could rise without breaking below 80,700 USDT. However, if that happens, I do not expect the upward trend to last very long.

The reason is that historically, when Bitcoin transitions from a major downtrend to an uptrend, it has often broken below the previous low through a whipsaw to stop out long positions before reversing.

This may differ in smaller trends, but in larger timeframes, a double bottom without a whipsaw (where the right bottom is higher than the left) has, in my experience and research, rarely resulted in a meaningful major trend reversal.

Therefore, if the price rises immediately from the current level, I plan to take profits relatively quickly, as indicated on the chart.

On the other hand, if Bitcoin breaks below 80,700 USDT, two possibilities emerge. It could form a whipsaw and then transition into a major bull trend, or it could enter what many would call a “season-ending” level of significant decline. Which of these becomes reality can only be determined by observing the chart structure after some time has passed following the actual breakdown below 80,700 USDT.

Predicting the distant future in advance may be possible for some, but I consider it nearly impossible.

That is why, even though I predicted a rise in my previous idea and currently hold a long position, I did not allocate a large size. Compared to my usual trades, the position is very small, because my level of conviction was not high before placing the bet.

Although it is still early 2026, this moment could turn out to be the most difficult trading environment to predict this year. As I always say, everything is hardest at the beginning. Investing is the same. Capturing the initial turning point from decline to rise is extremely difficult and painful. However, once this phase passes and the next trend forms, reading the market becomes much easier.

The reason I maintain a high win rate is that I do not rashly predict the distant future. If you wait, there are often moments when the chart provides clues about the next move. I simply wait until then. The longer you wait, the more evidence accumulates, and predicting the next move becomes significantly easier.

If Bitcoin breaks below 80,700 USDT, I will update my view in this idea or share a new post.

Another point I would like to mention is that significant movements are occurring across the broader market.

If a book is ever written about the history of silver, January 31 may be recorded as one of its historic days. As of now, silver is showing a drop of over 20% in a single day. Alongside the U.S. market, the commodities market is experiencing enormous volatility. While the exact cause requires further research, what is certain is that asset “rebalancing” is taking place.

For some time, crypto has been thoroughly neglected by the market. While other assets continued their rallies, crypto alone remained in decline. The reason is simple. The crypto market lacked attractiveness, and capital did not flow into it. However, crypto is now at relatively low price levels, while other assets are forming price ranges near their highs.

I believe there is a high probability that funds liquidated from assets positioned at high levels will eventually flow into the crypto market. If crypto continues to decline, it may mean that investors are temporarily holding that capital on the sidelines. In other words, commodities are likely to show weakness or move sideways, while crypto is likely to show strength or move sideways.

Even I am currently holding a substantial amount of cash while waiting for opportunities to increase my spot crypto allocation.

As mentioned in this post, crypto’s direction will soon be determined. When that moment comes, I will decide whether to purchase spot or wait a little longer.

In summary, in the short term, I plan to accumulate long exposure based on this idea. The size of the position will be adjusted over time as the market becomes clearer. For now, since information is limited and multiple directions remain open, I am buying only a small amount. Technically, I am basing this on the Shark Pattern, and from a macro perspective, on the market rebalancing discussed above.

Accordingly, I have set a short-term target around 89,308 USDT.

If the movement becomes clearer or the analysis requires updating, I will add to this post or return with a new one.

Thank you for reading.

BTCUSD Demand Zone in Focus After Strong Bearish MoveBTCUSD is currently trading after a strong bearish move, where price broke below the earlier sideways structure with high selling momentum. The market clearly respected a downward trend, forming lower highs and showing consistent selling pressure. The resistance area around 89,800–90,400 worked as a strong selling zone, where price faced rejection and sellers regained control, leading to a sharp fall.

After this decline, price has now reached a major demand zone near 83,500–84,000. This area is supported by earlier buying activity and base formation, making it an important support level. The present reaction from this zone indicates that sellers are slowing down and buyers are trying to hold price. As long as BTCUSD stays above this demand, short-term stability or a corrective move can be seen.

The risk area below demand shows where downside pressure may increase if support breaks. A clear move below this zone would strengthen the bearish trend further. For now, price is consolidating near support, and volatility is expected around these levels. Overall market bias remains cautious, with bearish control still active, but short-term recovery chances remain while demand holds.

Disclaimer: This analysis is for educational purposes only. It is not financial advice. Trading involves risk and uncertainty.

Part 2 Intraday Institutional TradingBest Practices for Retail Traders

1. Start with Buying Options

Risk is limited.

2. Prefer ATM or Slight ITM

Better stability, realistic probability.

3. Avoid Holding Overnight

Unless you understand IV, theta, and event risk.

4. Track Implied Volatility

Buy when IV is low, sell when IV is high.

5. Use a Trading Plan

Entry levels

Stop loss

Target

Position size

6. Don’t Chase Cheap OTM Options

They expire worthless most of the time.

Two Very Different Futures for Bitcoin Two Very Different Futures for Bitcoin 🔥

Don’t skip this one - the monthly chart decides

Bitcoin is approaching a critical decision zone on the monthly timeframe — one that could shape market behaviour well beyond short-term volatility.

From a structural and macro lens, a few developments stand out clearly:

1. Major supply has been swept, suggesting late-stage participation at higher levels

2. The long-term monthly trendline has been decisively broken

3. Price retested the broken trendline and has since started to roll over — a classic structural shift

4. A clearly defined demand zone between 48K–64K now sits below current price

5. This zone aligns with the 50-period EMA, strengthening it as a potential reaction area

Two macro-consistent paths emerge from here:

Scenario 1 (Higher probability):

Bitcoin retraces into the 48K–64K demand zone, finds support near the 50 EMA, and then resumes its broader bullish trajectory — eventually targeting liquidity above prior all-time highs (~125K).

This would represent a structural reset within a larger bullish cycle, consistent with historical behaviour during expansionary phases.

Scenario 2 (Lower probability, higher impact):

Bitcoin tests the same demand zone but fails to hold, leading to continued downside and a deeper move toward the long-term trendline low near ~18K.

This outcome would likely require a material macro trigger — tighter global liquidity, regulatory shocks, or a broader risk-off event. Less probable, but not dismissible.

Sharing this as a macro-structural study, not a directional call.

Analysis only. Not investment advice.

#ETH ON THE EDGE DELTAIN:ETHUSD.P

ETH is on the edge of the cliff. If it breaks below this level, we can see a significant downward move to $2200 easily and worst case of $1500 & $1400.

Long term investors can accumulate on the supports. Follow me for more.

This indicator is provided for educational and informational purposes only.

It does not constitute financial advice, investment recommendations, or trade signals.

The creator and Systematic Traders Club are not responsible for any financial losses resulting from the use of this indicator.

Trading and investing involve risk. Always do your own analysis and use proper risk management.

BTCUSD Consolidates Near Demand as Market Tests Key ResistanceBTCUSD is currently trading after a corrective phase that followed a strong bearish move. The earlier price action clearly respected a downward structure, with lower highs and consistent selling pressure. After reaching the recent lows, price started to stabilise and move sideways, indicating reduced selling momentum. This behaviour suggests the market is shifting into a consolidation phase rather than continuing aggressively lower.

A clear resistance area is visible around 89,800–90,200. This zone previously acted as a strong selling area where price faced rejection and failed to sustain higher levels. It remains an important upside barrier, and price reactions are expected if this area is retested. Acceptance above this resistance would weaken the bearish structure and improve recovery strength.

On the downside, a well-defined demand zone is located around 86,800–87,400. This area shows strong buying interest in the past, supported by sharp bullish reactions and base formation. It acts as a key support and potential buy interest zone as long as price holds above it. Below this, the marked risk area highlights where bearish momentum may increase if support fails.

At present, price is moving between demand and resistance, showing range behaviour. Small higher lows suggest early accumulation, but confirmation is still required. Overall bias remains neutral to cautious, with volatility expected near key zones.

Disclaimer: This analysis is for educational purposes only. It is not financial advice. Trading involves risk and uncertainty.