Investing:Nifty IT is looking good for long term accumulation!If you have been following the tech related news lately, it has been about the new AI "revolutionary" tool named Anthropic.

And the same is visible on charts of Nifty IT.

TCS is available at a price at which it was trading in December 2020.

Infy has just broke a crucial support.

Wipro has always b

ETF market

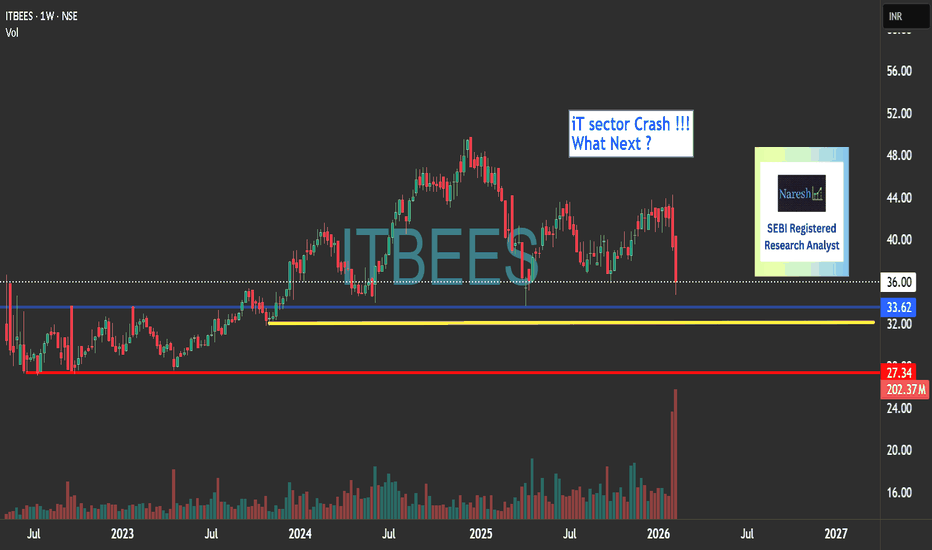

iT Crash !! What Next ??💡 Liked the idea?

Then don’t forget to Boost 🚀 it!

Comments are Most Welcome

iT Bees

CMP 35.90

Add on Dips till 32.00

SL CLB 28

Tgt upto 49

Maintain TSL & Keeping Booking/Churning as per Moves

For more insights & trade ideas,

📲 Visit my profile and hit Follow

Warm regards,

Naresh G

SEBI Re

TATA GOLD Next StepGold and gold-linked ETFs can be sensitive to:

📉 Short-Term Risks

Profit booking after strong rallies (can cause dips).

Global macro data (e.g., US rate news, dollar strength) affecting gold prices.

Market corrections can continue before new trend emerges.

📈 Short-Term Positives

Safe-haven dem

Eurostoxx remains constructive with bullish consolidation1 Price moved higher first and then shifted into bullish consolidations rather than breaking down

2 Each consolidation formed at a higher level, showing controlled digestion of gains

3 The current phase around 58 to 60 looks calm and orderly, with no visible distribution

4 Silent Flow does not confi

Gold Continues to Shine in the Eyes of Investors

India’s gold exchange-traded funds (ETFs) saw net inflows of $2.49 billion in January 2026, up 98% from December's $1.25 billion, marking the eighth consecutive month of growth.

In 2025, total inflows reached $4.68 billion, a 262% increase from $1.29 billion in 2024; inflows were $310 million in

Semiconductor ETF Ending Diagonal Warning !NASDAQ:SMH Daily Chart is showing an Ending Diagona Pattern🐻⚠️

(which can also become a Head and Shoulders Top)

Semiconductor industry is at risk if the AI Bubble bursts as it would lead to Overcapacity

I wonder what happens then...

all Supercycles end like this don't they📉🩸

Invalidation above

SPY Weekly levels ( 2 Feb - 7 Feb 2026)

Here’s weekly levels for SPY —

1) Bull Case — “Acceptance above equilibrium → reclaim upper rail”

Trigger: Hold above 692.18–692.28, then reclaim and accept above 698.48–698.68.

Targets: 704.98

Stretch (only if momentum persists): 711.28

Notes: The 698.5–698.7 zone is the “decision ceiling.” Clea

SPY | Daily: Buying Volume Moderates Near Resistance, Support-1 Description

Price has recently moved into a resistance zone, where buying volume appears to be moderating, indicating a lack of strong upside follow-through.

Price is currently hovering near Support-1, making this a key level to monitor in the near term.

Technical Observations

Buying volume has

See all popular ideas

Community trends

Most active funds

Best performing funds

SymbolPrice & chgNAV total return 1Y

SymbolNAV total return 1Y / Price

SymbolPrice & chgDividend yield FWD

SymbolDividend yield FWD / Price

ETF collections

LargestHighest AUM growthHighest returnsBiggest losersEquityBitcoinEthereumGoldFixed incomeReal estateTotal marketCommoditiesAsset allocationInverseLeveragedMost tradedLargest inflowsLargest outflowsHighest discount to NAVHighest premium to NAVHighest yieldDividendMonthly distributionsHighest diversificationActively managedSectorHighest betaLowest betaNegative betaHighest expense ratioAll-time highAll-time low52-week high52-week lowETFs of the USAETFs of CanadaETFs of the United KingdomETFs of GermanyETFs of JapanETFs of AustraliaSee all

Asset allocation