PROTECTED SOURCE SCRIPT

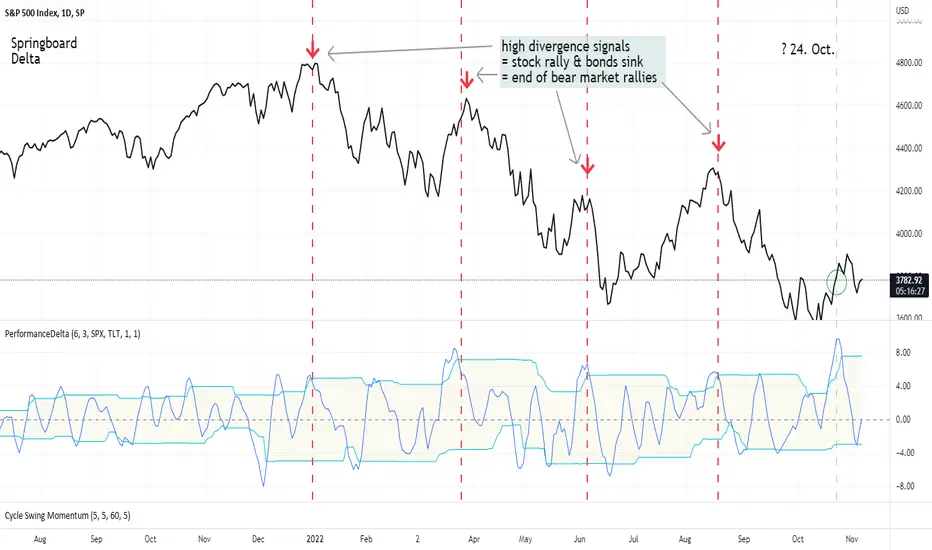

SpringBoard Delta (Bonds vs. Stocks Performance Oscillator)

Bonds and stocks move "in tandem" over the current market context. Higher yields cause bonds and stocks to decline. What's interesting is the timing of when the equity markets try to decouple from the bond market. That is, stocks begin to rise, but bonds do not.

Let's apply the above observation to a cyclical oscillator. We calculate the difference between the change in the price of stocks and the change in the price of bonds. If stocks and bonds move "in sync", that difference will be zero. If stocks move up and bonds move down, we' ll see high values of this indicator.

I like to call the cyclical difference indicator between stock and bond changes "The Springboard." The following chart tells why.

Let's apply the above observation to a cyclical oscillator. We calculate the difference between the change in the price of stocks and the change in the price of bonds. If stocks and bonds move "in sync", that difference will be zero. If stocks move up and bonds move down, we' ll see high values of this indicator.

I like to call the cyclical difference indicator between stock and bond changes "The Springboard." The following chart tells why.

Protected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Lars von Thienen

Join my blog and never miss an update:

stockmarketcycles.substack.com/subscribe

Join my blog and never miss an update:

stockmarketcycles.substack.com/subscribe

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Protected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Lars von Thienen

Join my blog and never miss an update:

stockmarketcycles.substack.com/subscribe

Join my blog and never miss an update:

stockmarketcycles.substack.com/subscribe

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.