OPEN-SOURCE SCRIPT

Updated Volume Zone Oscillator by [VanHelsig]

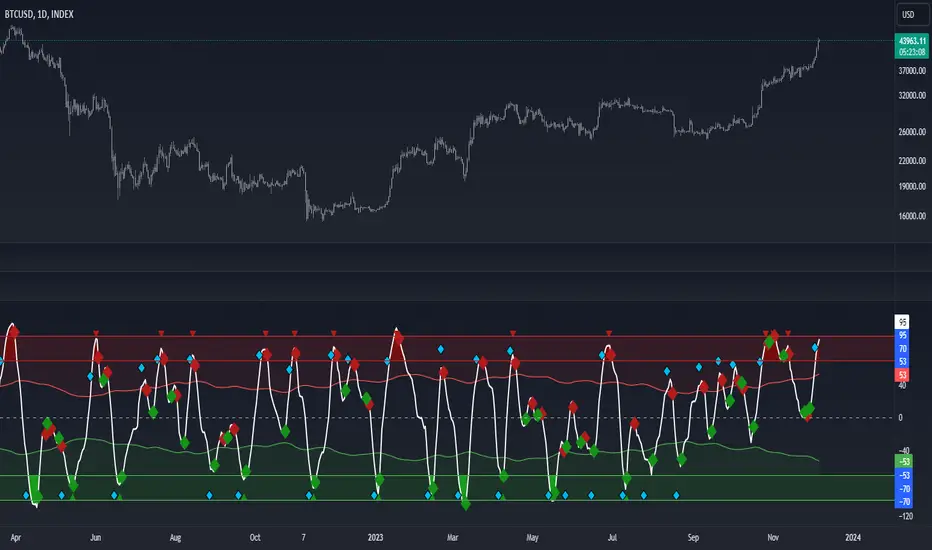

Volume Zone Oscillator

How volume zone oscillator work:

Like other VZO it uses the same principle of calculation Volume direction divided on total volume and then scaled to 100 and -100.

When we have positive momentum close > close[loockback] we have value of positive Volume, other way we have -volume negative one. <- this called a volume direction

Total volume is simply moving average with source of volume

And then MA with source of volume direction divided on MA of total colume and scaled it from 100 to -100

Basically we have few signals what VZO can show:

-Strong buy in oversold zone and strong sell in overbought zone. (Triangles at the top red and at the bottom green)

-Local Buy and Sell (Green and red Robustnesses)

-Posibility of trend change (Blue robustness)

Also you can webhook alerts to your spread sheet that sends values 1 for buys signals and -1 for sell signals in a range of 1 to 10 days

Here you can see marked signals on the chart

How volume zone oscillator work:

Like other VZO it uses the same principle of calculation Volume direction divided on total volume and then scaled to 100 and -100.

When we have positive momentum close > close[loockback] we have value of positive Volume, other way we have -volume negative one. <- this called a volume direction

Total volume is simply moving average with source of volume

And then MA with source of volume direction divided on MA of total colume and scaled it from 100 to -100

Basically we have few signals what VZO can show:

-Strong buy in oversold zone and strong sell in overbought zone. (Triangles at the top red and at the bottom green)

-Local Buy and Sell (Green and red Robustnesses)

-Posibility of trend change (Blue robustness)

Also you can webhook alerts to your spread sheet that sends values 1 for buys signals and -1 for sell signals in a range of 1 to 10 days

Here you can see marked signals on the chart

Release Notes

Updated calculations and backtested. Release Notes

-Release Notes

BackTest BTC Index (BackTest of local buys and local sells) BackTest ETH Index

https://www.tradingview.com/x/Dxb8cWuv/

Release Notes

Organazide code, changed default inputsOpen-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.