PROTECTED SOURCE SCRIPT

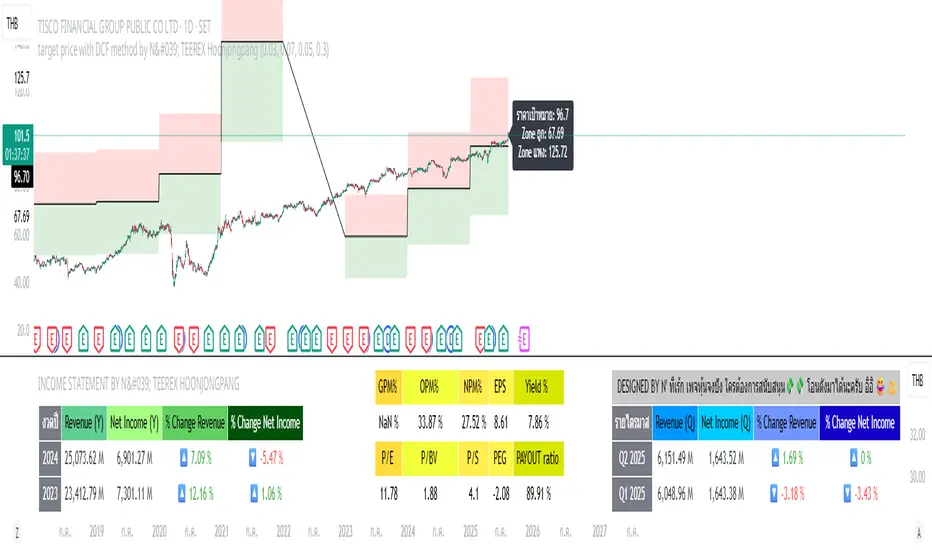

target price with DCF method by N' TEEREX Hoonjongpang

This indicator calculates a stock’s intrinsic value using the latest fiscal year data: free cash flow, debt, equity, shares outstanding, and taxes.

It computes the Weighted Average Cost of Capital (WACC), applies the Gordon Growth formula, and derives a price per share.

A margin of safety is applied to define zones on the chart:

Green Zone: Safe (undervalued)

Red Zone: Not Safe (overvalued)

All key numbers, including WACC, price target, and zones, are displayed as a label.

Result: A visual and numeric guide to the stock’s fair value, helping investors quickly see if the current price is above or below estimated intrinsic value.

It computes the Weighted Average Cost of Capital (WACC), applies the Gordon Growth formula, and derives a price per share.

A margin of safety is applied to define zones on the chart:

Green Zone: Safe (undervalued)

Red Zone: Not Safe (overvalued)

All key numbers, including WACC, price target, and zones, are displayed as a label.

Result: A visual and numeric guide to the stock’s fair value, helping investors quickly see if the current price is above or below estimated intrinsic value.

Protected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Protected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.