OPEN-SOURCE SCRIPT

DCA Strategy with Hedging

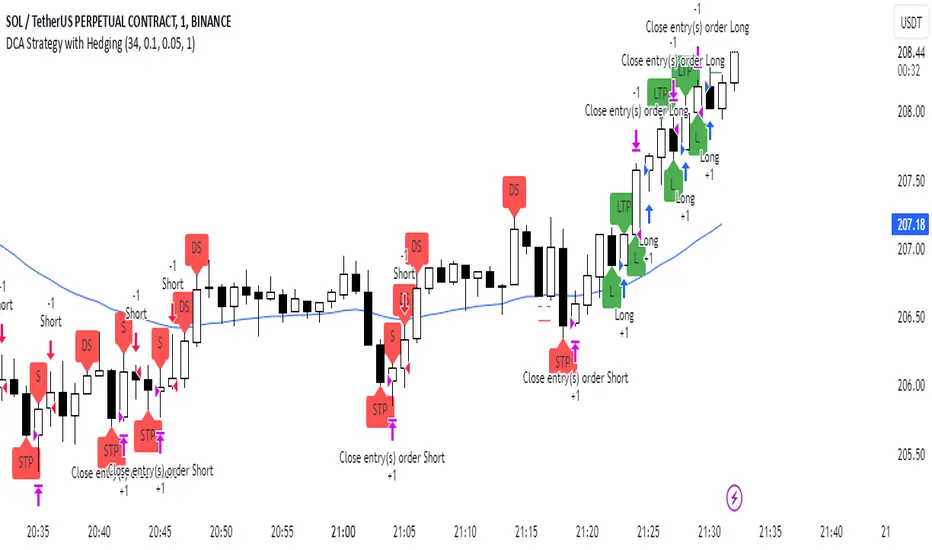

This strategy implements a dynamic hedging system with Dollar-Cost Averaging (DCA) based on the 34 EMA. It can hold simultaneous long and short positions, making it suitable for ranging and trending markets.

Key Features:

How it Works

Long Entries:

Short Entries:

Settings

Indicators

Alerts

Compatible with all standard TradingView alerts:

Position Opens (Long/Short)

DCA Entries

Take Profit Hits

Note: This strategy works best on lower timeframes with high liquidity pairs. Adjust parameters based on asset volatility.

Key Features:

- Uses 34 EMA as baseline indicator

- Implements hedging with simultaneous long/short positions

- Dynamic DCA for position management

- Automatic take-profit adjustments

- Entry confirmation using 3-candle rule

How it Works

Long Entries:

- Opens when price closes above 34 EMA for 3 candles

- Adds positions every 0.1% price drop

- Takes profit at 0.05% above average entry

Short Entries:

- Opens when price closes below 34 EMA for 3 candles

- Adds positions every 0.1% price rise

- Takes profit at 0.05% below average entry

Settings

- EMA Length: Controls the EMA period (default: 34)

- DCA Interval: Price movement needed for additional entries (default: 0.1%)

- Take Profit: Profit target from average entry (default: 0.05%)

- Initial Position: Starting position size (default: 1.0)

Indicators

- L: Long Entry

- DL: Long DCA

- S: Short Entry

- DS: Short DCA

- LTP: Long Take Profit

- STP: Short Take Profit

Alerts

Compatible with all standard TradingView alerts:

Position Opens (Long/Short)

DCA Entries

Take Profit Hits

Note: This strategy works best on lower timeframes with high liquidity pairs. Adjust parameters based on asset volatility.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.