Support Resistance UltimateThe "Support Resistance ULTIMATE" indicator is a comprehensive tool for traders on the TradingView platform, designed to identify key support and resistance levels using two primary techniques: pivot points and volume data. This indicator provides flexibility and customization, allowing traders to adapt it to their specific trading strategies.

KEY FEATURES

Pivot-Based Levels:

This feature calculates support and resistance levels using pivot points, which are derived from the high, low, and close prices of previous trading periods. Pivot points are crucial for forecasting potential market turning points.

Users can customize the pivot calculation by selecting the source type (either 'Close' or 'High/Low') and adjusting the lookback periods for both the left and right sides of the pivot calculation. This flexibility allows traders to adapt the indicator to different market conditions and timeframes.

Volume-Based Levels:

This option focuses on identifying support and resistance levels based on volume data, specifically the Point of Control (POC). The POC represents the price level with the highest traded volume during a specific time period, reflecting a consensus value among market participants.

The indicator includes a rolling POC calculation, allowing traders to dynamically assess areas of significant trading interest that may serve as support or resistance zones.

ADVANTAGES

Customization and Flexibility:

Traders can choose between pivot-based and volume-based levels or use both simultaneously, depending on their analysis needs. This dual approach provides a comprehensive view of market dynamics, accommodating various trading styles.

The indicator offers customizable color settings for support and resistance lines, enhancing chart readability and allowing traders to personalize their visual analysis.

Enhanced Market Insights:

By utilizing pivot points, traders can identify potential reversal or consolidation points, aiding in the prediction of market trends and the establishment of strategic entry and exit points.

Volume-based levels provide insights into market sentiment and participation, highlighting areas of strong support or resistance based on trading volume. This can improve risk management and trade execution by identifying high-probability trading zones.

Importance Scoring:

The indicator calculates the importance of each level based on the number of touches and the duration it holds. This scoring system helps traders assess the strength of support and resistance levels, with thicker lines indicating more significant levels.

This indicator is intended for educational and informational purposes only and should not be considered financial advice. Trading involves significant risk, and you should consult with a financial advisor before making any trading decisions. The performance of this indicator is not guaranteed, and past results do not predict future performance. Use at your own risk.

Rolling

VWAP RollingThis indicator, referred to here as "VWAP Rolling," is a technical tool designed to provide insight into the average price at which an asset has traded over a specified rolling period, along with bands that can indicate potential overbought or oversold conditions based on standard deviations from this rolling VWAP.

Purpose and Utility:

The indicator's primary purpose is to track the volume-weighted average price (VWAP) over a specified period, typically 20 bars in this script. The VWAP Rolling is particularly useful in assessing the average price level at which a security has been traded over the recent history, incorporating both price and volume data. This can help traders understand the prevailing market price in relation to trading volume.

Advantages:

1. Dynamic Average: Unlike fixed VWAP indicators that calculate over a specific session, the rolling VWAP adapts to recent price and volume changes, offering a more responsive and dynamic average.

2. Volume Sensitivity: By weighting prices by volume, the rolling VWAP gives more importance to periods with higher trading activity, providing a clearer picture of where significant trading has occurred.

3. Standard Deviation Bands: The inclusion of standard deviation bands (configurable as 1x and 2x deviations in this script) around the rolling VWAP adds a layer of analytical depth. These bands can serve as potential areas of support and resistance, highlighting deviations from the mean price.

Singularization and Interpretation:

The VWAP Rolling indicator is singularized by its ability to adapt to changing market conditions, offering a dynamic representation of the average price level influenced by volume. To use and interpret this indicator effectively:

• Rolling VWAP Line: The main line represents the rolling VWAP. When this line trends upwards, it suggests that recent trading has been occurring at higher prices weighted by volume, indicating potential bullish sentiment. Conversely, a downtrend in the rolling VWAP may indicate bearish sentiment.

• Standard Deviation Bands: The upper and lower bands (configurable as 1x and 2x standard deviations from the rolling VWAP) are used to identify potential overbought or oversold conditions. A price crossing above the upper band may indicate overbought conditions, signaling a potential reversal or correction downwards. Conversely, a price crossing below the lower band may suggest oversold conditions, potentially signaling a bounce or reversal upwards.

• Band Interaction: Watch for interactions between price and these bands. Repeated touches or breaches of the bands can provide clues about the strength of the prevailing trend or potential reversals.

Interpretative Insights:

• Trend Confirmation: The direction of the rolling VWAP can confirm or contradict the prevailing price trend. If the price is above the rolling VWAP and the VWAP is rising, it suggests a strong bullish sentiment. Conversely, a falling rolling VWAP with prices below might indicate a bearish trend.

• ean Reversion Signals: Extreme moves beyond the standard deviation bands may signal potential mean reversion. Traders can look for price to revert back towards the rolling VWAP after such deviations.

In summary, the VWAP Rolling indicator offers traders a flexible tool to gauge average price levels and potential deviations, incorporating both price and volume dynamics. Its adaptability and standard deviation bands provide valuable insights into market sentiment and potential trading opportunities.

Rolling Candle Closes Summationscript to sum rolling 20 (default) period's prices together

use on volume indicators to get the likes of McClellan Summation

User selection: rolling periods to add

Outlier Detecting Cumulative Moving Average (ODCMA)This is a simple moving average with a rolling length that resets whenever there is an outlier in the data. I have also included volume weighting.

The length represents the lookback period for the outlier detection and the "Outlier Detection" is the deviation level to trigger the detection. You can select from: price detection, volume detection, price or volume detection, price and volume detection.

I hope you can find this script useful. Its like a session weighted moving average but instead it retriggers the cumulative sum whenever there is an outlier.

MTF EMA Ribbon & Bands + BBMulti Timeframe Exponential Moving Average Ribbon & Bands + Boillinger Bands

I used the script "EMA Ribbon - low clutter, configurable " by adam24x, I made some color change and I added a few indicators (Boillinger Bands, EMA on multi timeframe and EMA bands from "34 EMA Bands " by VishvaP).

The script can display various EMA from the chart's timeframe but also EMA from other timeframes.

Bollinger Bands and EMA bands can also be added to the chart.

MTF VWAP & StDev BandsMulti Timeframe Volume Weighted Average Price with Standard Deviation Bands

I used the script "Koalafied VWAP D/W/M/Q/Y" by Koalafied_3 and made some changes, such as adding more standard deviation bands.

The script can display the daily, weekly, monthly, quarterly and yearly VWAP.

Standard deviation bands values can be changed (default values are 0.618, 1, 1.618, 2, 2.618, 3).

Also the previous standard deviation bands can be displayed.

Yearly Percentage ReturnsAn indicator that lets you visualize the historical Yearly Percentage returns of any symbol .

Key Features:

Displays the yearly returns from start to end of each year

Displays a table showing all yearly returns for current symbol

Displays start of each year as a vertical line

Displays up to 5 custom horizontal levels

Table Settings:

Enable table - Show/Hide the table

Size - Sets the size of the table

Position - Sets the position of the table on the screen

Direction - Sets the direction of the table to display the data (Vertically or Horizontally)

Rolling Heikin Ashi Candles█ OVERVIEW

This indicator displays a Rolling Heikin Ashi Candles for a given timeframe Multiplier. Contrary to Heikin Ashi Candles Charts, if the timeframe Multiplier is "5", this indicator plots Heikin Ashi Candles OHLC of the last 5 Candles.

█ WHAT IS THE NEED FOR IT

Let's see if we want to use a Higher timeframe OHLC Data using security function or resolution options. The indicator repaints until the higher timeframe Heikin Ashi Candles closes, leading to a repainting strategy or indicator using higher-timeframe data. So we can use Rolling Heikin Ashi Candles in these cases.

█ USES

To Pull out higher timeframe Heikin Ashi Candles OHLC Data to build a non-repainting strategy or indicator.

█ WHY I AM BUILDING THIS SIMPLE INDICATOR

There is no doubt higher timeframe analysis is a critical study to mastering the markets.

I found a necessity for an indicator that analyses multiple higher timeframes and gives us a cumulative or average trend direction. I already built the indicator; I will release it soon. The Indicator I am building is wholly based on my understanding and perspective of Market Structure. Please use this indicator idea to remove the repainting issue when you make an indicator that utilises higher timeframe data.

I am using this in my upcoming indicators. Felt to share before head.

Stay Tuned...

If you have any recommendations or alternative ideas, then please drop a comment under the script ;)

Rolling OHLC Candles█ OVERVIEW

This indicator displays a Rolling OHLC Bars for a given timeframe Multiplier. Contrary to OHLC Charts, if the timeframe Multiplier is "5", this indicator plot OHLC of the last 5 Candles.

█ WHAT IS THE NEED FOR IT

Let's see if we want to use a Higher timeframe OHLC Data using security function or resolution options. The indicator repaints until the higher timeframe OHLC Candle closes, leading to a repainting strategy or indicator using higher-timeframe data. So we can use Rolling OHLC Candles in these cases.

█ USES

To Pull out higher timeframe OHLC Data to build a non-repainting strategy or indicator.

Prominently, traders use Heikin Ashi Candles to locate trends or trading opportunities easier than traditional candlesticks. But the OHLC in those Heikin Ashi candles doesn't match with conventional candlesticks. We can use these Rolling OHLC Candles as an alternative for Heikin Ashi Candles because Here we can locate trends or trading opportunities easier than traditional candlesticks, and also close of these candles matches the close of the standard candlesticks, which can help us to take trades based on the close of the candles.

█ WHY I AM BUILDING THIS SIMPLE INDICATOR

There is no doubt higher timeframe analysis is a critical study to mastering the markets.

I found a necessity for an indicator that analyses multiple higher timeframes and gives us a cumulative or average trend direction. I already built the indicator; I will release it soon. The Indicator I am building is wholly based on my understanding and perspective of Market Structure. Please use this indicator idea to remove the repainting issue when you make an indicator that utilises higher timeframe data.

I am using this in my upcoming indicators. Felt to share before head.

Stay Tuned...

If you have any recommendations or alternative ideas, then please drop a comment under the script ;)

Rolling CAGRCompound Annual Growth Rate

This indicator is the compound annual growth rate to be used on any ticker.

How to use

Add indicator to your chart

Specify a data source (default is the close for the selected ticker)

Specify how many trading days are in a year (252 for stocks & 365 for crypto)

Restrictions

This is only accurate on the daily timeframe. So to avoid confusion, I disabled the plotting of the CAGR on any timeframe other than daily

Rolling Anchored Vwap ExperimentalCurrently only some timeframes, but I can add more, this was made when requesting additional timeframes from the original creator, this was my quick interpretation of the code.

It works by rolling the vwap, so it never resets but is always X amount of time back as the source for the start of data. Its really useful i use it daily.

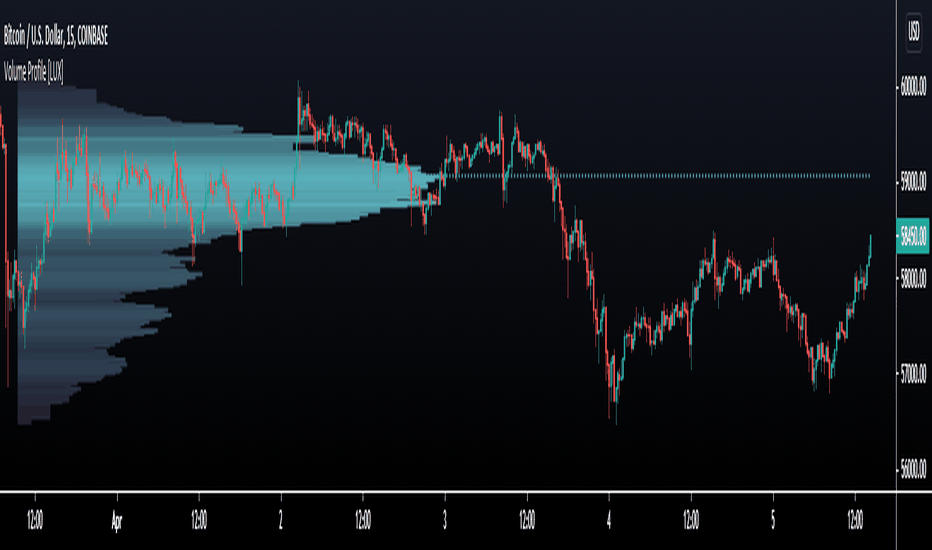

Volume Profile [LuxAlgo]Displays the estimate of a volume profile, with the option to show a rolling POC (point of control). Users can change the lookback, row size, and various visual aspects of the volume profile.

Settings

Basic:

Lookback: Number of most recent bars to use for the calculation of the volume profile

Row Size: Determines the number of rows used for the calculation of the volume profile

Show Rolling POC: Determines whether to display the rolling POC of the volume profile

Style:

Width (% of the box): Determines the length of the bars relative to the Lookback value

Bar Width: Width of each bar

Flip Histogram: Flips the histogram, when enabled, the histogram base will be located at the most recent candle

Gradient: Allows to color the volume profile bars with a gradient, with a color intensity determined by the length of each bar

Rows Solid Color: Color of each bar when 'Gradient' is disabled

POC Solid Color: Color of the POC when 'Gradient' is disabled

Usage

It is very common to display volume over time in order to visualize the trading activity made over a specific candle, however this is not the only way to display volume and it can be interesting to put it in relation with the price, which is what volume profiles do.

Volume profiles are displayed as price relative histograms showing the accumulated volume within certain price areas, the number of areas are determined by the row size of the volume profile. Knowing which price's area accumulated the most volume allow highlighting areas of interest to market participants.

Most accumulated volume will be encountered in zones of equilibrium between buyers and sellers; that is zones of local price stationarity. These zones are highlighted by high volume nodes in the volume profile. Imbalance between buyers and sellers are highlighted by thinner zones of the volume profile.

The price level with the most accumulated volume is highlighted by the "point of control" (POC), displayed by the dotted line in the indicator.

The POC is often considered an important level, commonly used as support/resistance by traders. One can verify the accuracy of this use case by using the rolling POC (assuming one would use the POC over time as SR).

Indicator Limitations

Volume profiles are calculated using tick data, which is not the case of this estimate, as such you won't have an accurate representation of an actual volume profile.

The rolling POC can introduce time outs in the script computation, use lower lookback and row size value to display it.

Futures Annualized Rolling BasisWhat is Annualised Rolling Basis?

Basis

In futures trading, the basis is the relative difference between the price of the future contract and the spot price.

This quantity is usually presented as an absolute price difference, but in its relative form can be annualised by dividing by the time to expiry τ of the contract expressed in years:

Rolling Basis

Let us consider a hypothetical contract starting today with a given tenor of 1 month (1M) or 3 months (3M). Such a contract does not necessarily trade in the market and thus has no observable price to calculate the basis. The rolling basis is the basis between this ’bespoke’ contract and the spot.

This quantity is inferred from existing contracts’ basis and the calculation is accomplished in two steps:

1. Forward yield

First, we select two futures contracts with expiries T1 and T2 surrounding the hypothetical contract’s expiry Ttarget (T1 ≤ Ttarget ≤ T2). The forward yield is calculated as:

Where:

Ti: time to maturity for contract i

BASISi: annualised basis for contract i

2. Weighted Basis Average

The rolling basis is calculated as a weighted average between the first contract’s basis and the forward yield:

The description of the indicator was copied from another source, but fully corresponds to this indicator.

Examples of Rolling Average Using Automated AnchoringIn this study, I present a method to expose NaN values to development environment.

This exposure allows NaN values to be used by methods in scripts.

I also show how to use values, even NaN values, as anchors from which statistics can be computed from.

I demonstrate how to do this with constants and variables in methods for computing the cumulative/rolling average of a series.

I also show how to calculate the cumulative/rolling average from the start of a ticker series using the aforementioned methods.

Each method has a description on how some of their parts work as well as their constraints.

Method #1 - Can only be used for computing the rolling average on the ticker series.

Method #2 - The simple moving average from the Pine Script reference.

- Can be used to calculate the rolling average of the ticker series and number values of a series.

- This method seems to cause an error when there are many bars in the series.

Method #3 - The most versatile method due to the use of computing the rolling average using an array.

- Timeout will occur when computing the rolling average of an entire ticker series which is long.

- Timeout has not occurred when computing a rolling average of a series from NaN or non-NaN anchor points even when the series is long.

This is an attempt to get around the constraints of the built-in sma(source, length) function in which length cannot be dynamically adjusted.

Other Pine Script functions have that constraint which we can get around by defining our own functions.

Rolling summaryStatistical methods based on mean cannot be effective all the time when attributed to financial data since it doesn't usually follow normal distribution, the data can be skewed or/and have extreme values which can be described as outliers.

In order to deal with this problem it is appropriate to use median-based techniques.

The most common one is called five-number summary/box plot, which plots median of the dataset, 25th (Q1) & 75th (Q3) percentiles (the medians of lower & upper parts of the original dataset divided by the original median), and whiskers calculated by taking range between Q1 and Q3, multiplying it by 1.5 and adding it to Q3 and subtracting it from Q1. The values which are outside the whiskers are considered outliers. Default settings of the script correspond to the classic box plot.

Seven-number summary can be also plotted by this script, by turning on 4 additional percentiles/Bowley’s seven-figure summary by turning on first 2 additional percentiles and changing their values to 10 and 90 respectively.

P.S.: Mean can be also turned in just to check the difference.

Rolling Multiday VWAPCouldn't find a VWAP script that worked the way I needed so I created this one. Basically, it provides a multiday rolling VWAP. I made the rolling period configurable, but I primarily use it to add a 2 day VWAP to my chart alongside the standard VWAP indicator. This unique thing that this indicator does is dynamically anchor to the configured period, but starting from today backwards.

Basically, this indicator ensures VWAP never anchors to the current day, but instead always shows a 2 day VWAP on today's charts. The problem I had with other indicators is that every other day my 2 day VWAP indicator would anchor to the current day and essentially become a redundant standard VWAP indicator.

Hope to update in the future to dynamically update based the chart day you have in focus, but will need some time to figure out if that's even possible.

Dukhan: 24 Hours rolling volumeShows rolling volume for 24 hours as exchanges does

default settings is for 1m candles

Inputs:

p = Period : is the number of candle to aggregate to the back, i.e for 1m candle there is 1440 candle in one day

for 5m candles as example: 24h * 60 / 5 = 288

so for 5m you have to change input p to be 288

Plots:

Red line is total volume

white line is per candle volume change from the previous one

True Rolling Pivot Range IndicatorHere is the actual 3 day rolling pivot range indicator as detailed in Mark Fisher's book The Logical Trader.