AUDNZD trade ideas

AUDNZD - Flag Pattern in daily time frame - Target 1.08466A Flag pattern has been formed in a daily time frame chart of AUDNZD pair and an entry point for a long position is sensible at this point with 1.06916 as a stop loss. The first target for this trade is 1.08017, and 1.08466 is a second target.

A second Chance to Buy in AUDNZDMidterm forecast:

There is no trend in the market and the price is in a range bound, but we forecast an uptrend wave above 1.0630 would begin in Midterm.

We will close our open trades, if the Midterm level 1.0630 is broken.

Technical analysis:

While the RSI support #1 at 53 is not broken, the probability of price decrease would be too low.

A peak is formed in daily chart at 1.0825 on 09/16/2019, so more losses to support(s) 1.0730, 1.0660 and minimum to Major Support (1.0630) is expected.

Price is above WEMA21, if price drops more, this line can act as dynamic support against more losses.

Relative strength index (RSI) is 57.

New trading suggestion:

*There is still a possibility of temporary retracement to suggested support line (1.0630). if so, traders can set orders based on Price Action and expect to reach short-term targets.

* If you missed our first HUNT , you have a second chance to buy above the suggested support line (1.0630).

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words, NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone. To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons :

Trade Setup:

We opened 10 BUY trade(s) @ 1.0354 based on 'Hammer' entry method at 2019.08.06.

Total Profit: 4224 pip

Closed trade(s): 1920 pip Profit

Open trade(s): 2304 pip Profit

Closed Profit:

TP1 @ 1.0430 touched at 2019.08.07 with 76 pip Profit.

TP2 @ 1.0490 touched at 2019.08.07 with 136 pip Profit.

TP3 @ 1.0585 touched at 2019.08.21 with 231 pip Profit.

TP4 @ 1.0660 touched at 2019.08.29 with 306 pip Profit.

TP5 @ 1.0760 touched at 2019.09.13 with 406 pip Profit.

76 + 136 + 231 + 306 + 406 = 1155 pip

Open Profit:

Profit for one trade is 1.0738 (current price) - 1.0354 (open price) = 384 pip

5 trade(s) still open, therefore total profit for open trade(s) is 384 x 5 = 1920 pip

All SLs moved to Break-even point.

Take Profits:

TP6= @ 1.0850

TP7= @ 1.0990

TP8= @ 1.1140

TP9= @ 1.1335

TP10= Free

A second Chance to Buy in AUDNZDMidterm forecast:

While the price is above the support 1.0530, resumption of uptrend is expected.

We make sure when the resistance at 1.0730 breaks.

If the support at 1.0530 is broken, the short-term forecast -resumption of uptrend- will be invalid.

We will close our open trades, if the Midterm level 1.0530 is broken.

Technical analysis:

The ascending flag taking shape suggests we will soon see another leg higher.

While the RSI support #1 at 53 is not broken, the probability of price decrease would be too low.

A peak is formed in daily chart at 1.0705 on 09/03/2019, so more losses to support(s) 1.0630, 1.0585, 1.0545 and minimum to Major Support (1.0530) is expected.

Price is above WEMA21, if price drops more, this line can act as dynamic support against more losses.

Relative strength index (RSI) is 63.

New trading suggestion:

*There is still a possibility of temporary retracement to suggested support line (1.0530). if so, traders can set orders based on Price Action and expect to reach short-term targets.

* If you missed our first HUNT , you have a second chance to buy above the suggested support line (1.0530).

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words, NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone. To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons :

Trade Setup:

We opened 10 BUY trade(s) @ 1.0354 based on 'Hammer' entry method at 2019.08.06.

Total Profit: 2525 pip

Closed trade(s): 617 pip Profit

Open trade(s): 1908 pip Profit

Closed Profit:

TP1 @ 1.0430 touched at 2019.08.07 with 76 pip Profit.

TP2 @ 1.0490 touched at 2019.08.07 with 136 pip Profit.

TP3 @ 1.0585 touched at 2019.08.21 with 231 pip Profit.

TP4 @ 1.0660 touched at 2019.08.29 with 306 pip Profit.

76 + 136 + 231 + 306 = 617 pip

Open Profit:

Profit for one trade is 1.0672 (current price) - 1.0354 (open price) = 318 pip

6 trade(s) still open, therefore total profit for open trade(s) is 318 x 6 = 1908 pip

All SLs moved to Break-even point.

Take Profits:

TP5= @ 1.0760

TP6= @ 1.0850

TP7= @ 1.0990

TP8= @ 1.1140

TP9= @ 1.1335

TP10= Free

Don't miss the great buy opportunity in AUDNZDTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (1.04517). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. AUDNZD is in a range bound and the beginning of uptrend is expected.

. The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 62.

Take Profits:

TP1= @ 1.0545

TP2= @ 1.0630

TP3= @ 1.0720

SL= Break below S2

There is a trading opportunity to buy in AUDNZDMidterm forecast:

While the price is above the support 1.0275, resumption of uptrend is expected.

We make sure when the resistance at 1.0630 breaks.

If the support at 1.0275 is broken, the short-term forecast -resumption of uptrend- will be invalid.

Technical analysis:

While the RSI downtrend #1 is not broken, bearish wave in price would continue.

Price is below WEMA21, if price rises more, this line can act as dynamic resistance against more gains.

Relative strength index (RSI) is 41.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (1.0360 to 1.0275). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (1.0360)

Ending of entry zone (1.0275)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words, NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone. To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons :

Take Profits:

TP1= @ 1.0430

TP2= @ 1.0490

TP3= @ 1.0585

TP4= @ 1.0660

TP5= @ 1.0760

TP6= @ 1.0850

TP7= @ 1.0990

TP8= @ 1.1140

TP9= @ 1.1335

TP10= Free

Don't miss the great buy opportunity in AUDNZDTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (1.0419). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. AUDNZD is in a range bound and the beginning of uptrend is expected.

. The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 48.

Take Profits:

TP1= @ 1.0488

TP2= @ 1.0545

TP3= @ 1.0720

SL= @ 1.0375

Grab the sell and buy opportunity in AUDNZDThe pair has been trading in a falling channel pattern. Traders are suggested to go short at current prices with the target of 1.0475. After a success in this, the traders can grab the buy opportunity with same pattern as most likely the pair will rebound from lower trend line and move towards upper trend line of the channel.

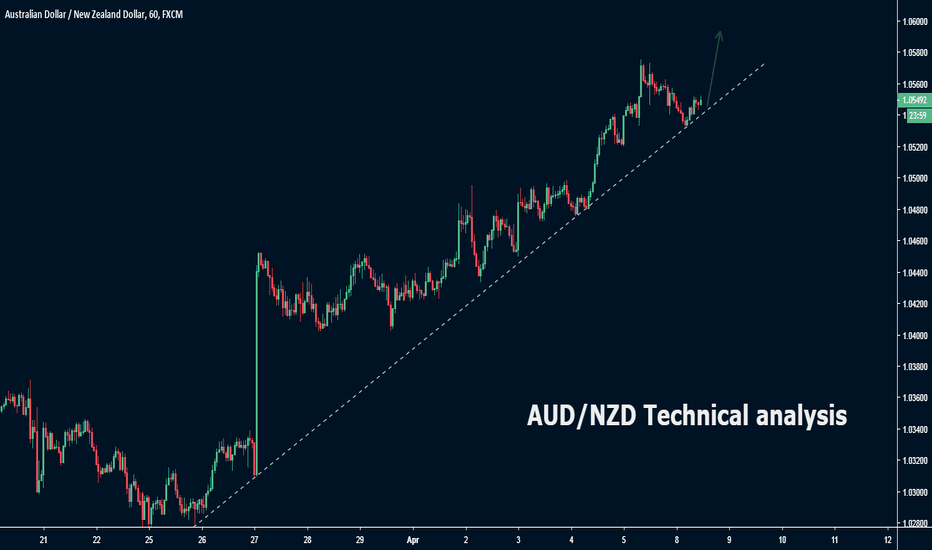

AUD/NZD Technical analysisThe steep rally in AUD/NZD is losing its steam.

It is marked by the formation of rising wedge pattern in the hourly chart.

As expected, it vented a bearish breakout.

Also, the MACD indicators has turned bearish and posits a incrementing bearish momentum.

Hence, we have a bearish view of the counter for the short-term.