Trade ideas

USD trending toward 92USD Index trending towards 92 bouncing off Downward Trending Channel Support Line.

Looking at Fundamentals however, the performance of the USD Index is surprising. Global stocks, crude oil and other risky assets are all bullish, and the latest moves on additional stimulus from US Democrats are all factors that should cause a weakening on the US Dollar.

Perhaps, the stellar ISM Manufacturing Index data and weakness in the Euro, Pound and other currencies that are paired with the greenback may have a hand in the bullishness of the DXY

Will Dollar index spoil the BNF Budget Rally ? The BNF on the budget day gave such a massive green candle, now big question is - will there be a follow-up or consolidation or reversal

When BNF is in full swing applying any rational thinking becomes meaningless, the script has texture, nature of its own which is quite dynamic . When it picks momentum it just doesn't listen to itself just keep accelerating :) Good day for all CE buyers.. 300-400-500-900 lol

What caught my attention today is dollar index - it is forming an inverted H&S on a daily time frame. It may or may not break out. but if it breaks out, it does have the capability to pause BNF rally, when I say pause - BNF may consolidate or correct a little.

So keep a watch on dollar index tomorrow and for next few days

Happy Trading

MSK

#DXY:- US Dollar Index Analysis for short to medium term

What is DXY? DXY is the U.S. dollar index (USDX) is a measure of the value of the U.S. dollar relative to the value of a basket of currencies of the majority of the U.S.'s most significant trading partners. This index is similar to other trade-weighted indexes, which also use the exchange rates from the same major currencies.

The US Dollar Index is used to measure the value of the dollar against a basket of six world currencies - Euro, Swiss Franc, Japanese Yen, Canadian dollar, British pound, and Swedish Krona.

The index was established shortly after the Bretton Woods Agreement dissolved in 1973 with a base of 100, and values since then are relative to this base.

The value of the index is a fair indication of the dollar’s value in global markets.

Interpreting and Trading U.S. Dollar Index (USDX)

An index value of 120 suggests that the U.S. dollar has appreciated 20% versus the basket of currencies over the time period in question. Simply put, if the USDX goes up, that means the U.S. dollar is gaining strength or value when compared to the other currencies. Similarly, if the index is currently 80, falling 20 from its initial value, that implies that it has depreciated 20%. The appreciation and depreciation results are a factor of the time period in question.

The U.S. dollar index allows traders to monitor the value of the USD compared to a basket of select currencies in a single transaction. It also allows them to hedge their bets against any risks concerning the dollar. It is possible to incorporate futures or options strategies on the USDX. These financial products currently trade on the New York Board of Trade. Investors can use the index to hedge general currency moves or speculate. The index is also available indirectly as part of exchange-traded funds (ETFs), options, or mutual funds.

Source: - Investopedia .com site

Elliot Wave Analysis of DXY: -

We seem to have completed the 5th Wave of correction around 89, the immediate resistance is around is 91.238, after which we might see a sharp up move, which is a serious threat to the global stock market because it is inversely related to equities.

US Dollar Index Elliott Wave analysisOm Namah Shivay

The US dollar index has been on correction from feb 2021 ( from 308 days).

The current structure is complete as it looks from the counting. There could be further sideways corrections or the downward continuation.

These needs to be validated again the invalidation points.

The future of the Dollar index looks running for upward for weeks or more as option 1.

This is just for educational purpose. No trading suggestions provided.

Om Namah Shivay

The U.S. Dollar Index rise in the short-termThe U.S. Dollar Index ( DXY ) rise in the short-term, but will downtrend in the long term.

Jan.06 2021, U.S.Capitol riots

U.S.Dollar index rebounded, because capitol riots that be global markets money entry U.S.Dollar.

U.S.Dollar index rebounded until Jan.20 presidential inauguration, and U.S.Dollar index will downtrend.

Reliability: 3-10 Markets Days.

DXY: Key to Continuation of the Current Emerging Market RallyOne of the key drivers of the current rally in Emerging Market and commodities has been weakness in DXY. It is soon going to test the all important level of 87.5-88.5 where it may find support in the near term. We will be closely watching the reaction of the DXY to these levels. While we believe that these levels may eventually be broken but a bounce from that level cant be ruled out as DXY is oversold.

DXY WAVE 5 DOWN The dollar index sold off from the 40dema and daily momentum is on the verge of signalling a sell. As it does and confirms wave 5 down, the minimum projection based on 38.2% of waves 1-3 is to 90.15. If prices continue lower into the end of October to the lower end of the channel we end up at 88.7

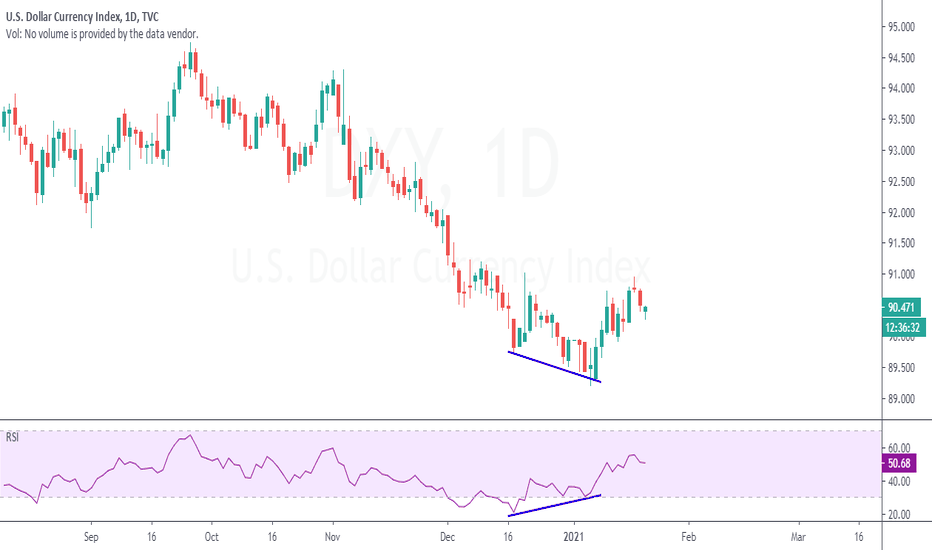

U.S DOLLAR DXY INDEX Good long candidate.U.S DOLLAR DXY INDEX CMP 90

Falling wedge chart pattern formation.

Elliot wave study.

RSI bullish divergence.

Index is on verge to complete impulse phase of elliot wave,, if corrective wave unfolds good rise can be seen.

Support trend line falling wedge pattern around 90 levels ,,with bullish divergence in RSI ,indicate reversal.

U.S DOLLAR DXY INDEX Good long candidate.U.S DOLLAR DXY INDEX CMP 90 LEVELS

Good long candidate at this levels.

Rounding bottom formation on weekly time frame support around 89.8 levels

Rising parallel channel support around 89 levels

View gets negated below 88.7 on closing basis.

Upside can move to levels 94-96-98-100-103.....