ABCAPITAL trade ideas

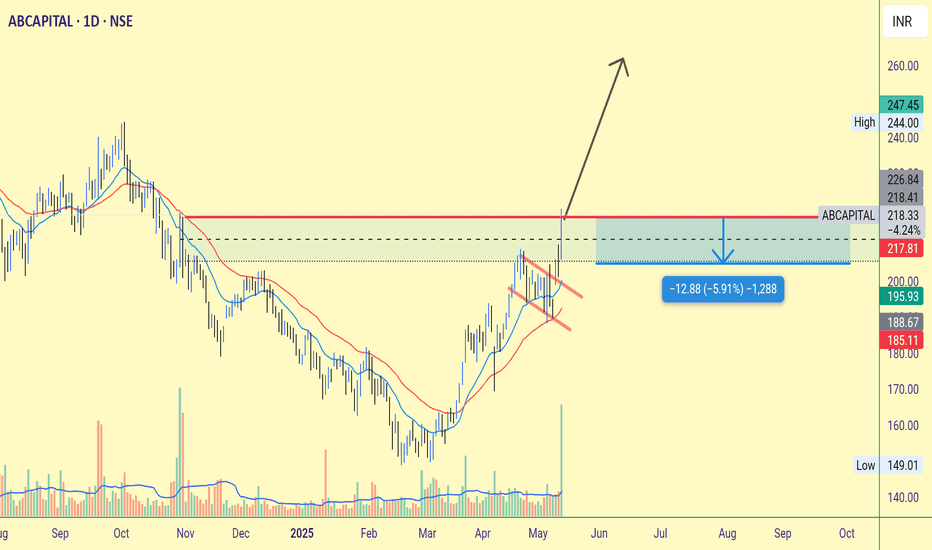

ADITYA BIRLA CAPITAL - Bullish Head & Shoulder Pattern formationAditya Birla Capital ( ABCAPITAL) has formed an Inverse Head & Shoulder Pattern on the Daily charts.

The inverse head and shoulders pattern is a bullish reversal pattern in technical analysis, indicating a potential shift from a downtrend to an uptrend. It's characterized by three consecutive troughs, with the middle trough (the "head") being the lowest, and the other two troughs (the "shoulders") forming higher lows. The neckline is a trendline connecting the highs of the shoulders and the head.

ABCAPITAL broke the neckline of Inverse Head & Shoulder Pattern, after breaking the neckline, bearish divergences were made on MACD AND RSI indicator and the stock fell and took support near the trendline and is probably back on its upward journey.

Divergences - RSI divergence occurs when the price of an asset moves in one direction, while the Relative Strength Index (RSI) moves in the opposite direction, suggesting a potential trend reversal or weakening momentum. Essentially, it's when the price and the RSI are not in sync, hinting at a potential change in the market's direction.

Indicators - On the Daily timeframe,the stock is trading above its 11 day EMA and 22 day EMA,and RSI is at 60 suggesting positive bias.

CMP - Rs. 198.

Target - Rs. 235

SL - Rs. 190

Disclaimer: This is not a Buy/Sell recommendation. For educational purpose only. Kindly consult your financial advisor before entering a trade.

ADITYA BIRLA CAPITAL LTD Company Name: Aditya Birla Capital Ltd (NSE: ABCAPITAL)

Sector: Financial Services

Market Cap: Large Cap | ~₹53,000 Cr

Headquarters: Mumbai, India

Parent Group: Aditya Birla Group

🧾 Business Overview:

Aditya Birla Capital is a diversified financial services player offering a wide range of solutions across:

Lending: Personal, SME, and housing loans through Aditya Birla Finance

Asset Management: One of India's top AMC players via joint venture with Sun Life

Insurance: Life and health insurance products

Wealth & Broking: Wealth management, equity broking, and portfolio management services

💼 Key Strengths:

Strong backing of Aditya Birla Group

Wide distribution network across India

Growing AUM and diversified revenue streams

Focus on digital and retail loan expansion

📊 Stock Insight:

NSE Symbol: ABCAPITAL

52-Week Range: ₹153 – ₹225

Trend: Medium-term bullish with support near ₹209

Support and Resistance Levels (Intraday – 15M):

Immediate Resistance: ₹215.50

(Price tested this level twice, indicating strong short-term selling pressure.)

Next Resistance: ₹218.20

(Gap-fill zone; breakout above this may trigger momentum buying.)

Immediate Support: ₹211.70

(Recent bounce zone and short-term base.)

Strong Support: ₹209.50

(Multiple rejections below this level; buyers likely to defend.)

Trend Insight:

Price is consolidating in a narrow range between ₹211.70 and ₹215.50. A breakout above or below this band may set the next directional move.

Amazing breakout on WEEKLY Timeframe - ABCAPITALCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

A B CAPITAL : Unfolding one more opportunityStock trying hard to consolidate and go up

But as we can see there lies an opportunity on the upside with Drop - Base - Drop range (168 - 172)

If stock reaches and pauses in the above mentioned area, It may be possibly give an sell opportunity in Lower Time Frame

Keep an eye

Sl will be above 175

Targets on the downside can be expected up to 150

Advance alerts and preparation gives sufficient time to prepare entry with peace of mind

Aditya Birla Capital LtdDate 11.03.2025

Aditya Birla Capital

Timeframe : Weekly

Technical Remarks :

1 Currently at ending phase of wave 4

2 If crosses above 61% of internal Wave C & 38% of Wave 4 which is 165, then strong upside

3 Right now at no trading zone, wait for it to cross above mentioned zones at point number 2

4 Once exceeds 165, target would be 200 or 200 + & keep swing low of 150 as initial stoploss & trail stoploss therefore

About Company

1 Company has delivered good profit growth of 32.7% CAGR over last 5 years

2 Trading at 1.4 times of book value which reasonable amid heated valuations across

3 Stock pe ratio at 11.13

Business Segments

1 Life Insurance 44%

2 NBFC 33%

3 Health Insurance 10%

4 Housing Finance 6%

5 Asset Management 4%

6 Other Businesses 3%

Operational Metrics: All Data of 9M FY25

Life Insurance

AUM (Rs. Cr): 97,286

Solvency Ratio: 194%

NBFC

AUM (Rs. Cr): 1,19,437

CRAR: 16.77%

Average Yield: 13.17%

NIM: 6.27%

GNP : 2.27%

AUM Mix:

Business Loans: 55%

Corporate & Mid-Market: 32%

Personal & Consumer Loans: 13%

Health Insurance 10%

Housing Finance

AUM (Rs. Cr): 26,714

Customers: 82,300

GNPA: 1%

PCR: 40.4%

Asset Management

Mutual Fund Closing AUM (Rs. Cr): 3,66,044

Individual MAAUM (Rs. Cr): 1,97,331

Regards,

Ankur

ABCPITAL 1HRINTRADAY TRADE

- EARN WITH ME DAILY 10K-20K –

ABCPITAL Looking good for Downside..

When it break level 168.47 and sustain.. it will go Downside...

SELL @ 168.47

Target

1st 165.62

2nd 163.81

FNO

ABCPITAL JAN FUT – LOT 9 (Qty-24300)

ABCPITAL JAN 1800 PE – LOT 9(Qty-24300)

Enjoy trading traders.. Keep add this STOCK in your watch list..

Big Investor are welcome..

Like this Post??? Hit like button..!!!

Follow me for FREE Educational Post and Alert.

13th jan ab capital for intradayab capital has shown highest prevolume in 7 days in intraday

stock is also moving in downward funnel channel trying to breakout

today index is down but this counter will perform

i am hoping OI data to reduce substantiall for good shortcovering

so buy ab capital in zone 168-172

with stop loss at 163

target will be 177 -180-184 intraday

forget the index focus on data, and data is highly positive here

ABCAPITAL Trading Above Fresh Weekly Demand ZoneABCAPITAL is currently trading at ₹183.01, above its demand zone between ₹178.4 and ₹174.55, established on 5th April 2024. This fresh zone has not been tested yet, indicating potential buying interest if the price pulls back to this range. Investors may monitor for a potential entry opportunity near this support level.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. Please conduct your own research or consult a financial advisor before making any investment or trading decisions.

ABCAPITAL: Potential Short Setup with Key LevelsStock Name: ABCAPITAL

Entry Point: Considering a short position if the price breaks below today's low, supported by strong open interest (OI).

Stop-Loss (SL): Placed above candle high to control risk effectively.

Target: Near the next key support level or adjusted based on real-time price movement.

Disclaimer:

This analysis is shared purely for educational purposes and is not a recommendation to trade. Please perform your own research and consult a financial advisor before making any investment decisions.

Aditya Birla Capital Limited, Strong technical support at ATHAditya Birla Capital Limited, the holding company for the financial services businesses of the Aditya Birla Group, is a universal financial solutions group catering to the diverse financial needs of its customers across their life stages.

ATH Sales and -profit. strong support at ATH level and fundamentally strong company.

Lets have a tea Technical Analysis of Aditya Birla Sun Life AMC Ltd. (ABSLAMC)

Background:

Aditya Birla Sun Life AMC Ltd. is one of India's leading asset management companies, offering a wide range of mutual fund schemes.

Technical Analysis: Rounding Bottom Pattern

The chart indicates a potential Rounding Bottom Pattern formation for ABSLAMC. This is a bullish reversal pattern that suggests a potential uptrend after a period of decline.

Key Characteristics of the Pattern:

* U-Shaped Bottom: The price action forms a U-shaped bottom, indicating a reversal of the downtrend.

* Low Volume During the Bottom: The volume tends to be low during the formation of the bottom, suggesting a period of consolidation.

* Increased Volume on the Breakout: As the price breaks out of the pattern, volume typically increases, signaling a strong buying interest.

Trading Strategy:

Buy Signal:

* A decisive breakout above the neckline resistance level (the horizontal line drawn at the top of the pattern) would confirm the pattern.

* Increased trading volume during the breakout would strengthen the bullish signal.

Stop-Loss:

* Place a stop-loss below the recent swing low or the neckline support level.

Take-Profit:

* Set profit targets based on the height of the pattern. Common targets are 1.5 times, 2 times, and 3 times the height of the pattern.

Important Considerations:

* Confirmation: Wait for a confirmation candle (a candle that closes above the neckline) to enter the trade.

* Risk Management: Always use stop-loss orders to protect your capital.

* Market Sentiment: Consider the overall market sentiment and economic conditions.

* Fundamental Analysis: While technical analysis is useful, it's important to consider the company's fundamentals.

Disclaimer:

This analysis is for informational purposes only and should not be considered financial advice. It is essential to conduct your own research or consult with a financial advisor before making any investment decisions. Past performance is not indicative of future results.

Lets have a tea Technical Analysis of Aditya Birla Sun Life AMC Ltd. (ABSLAMC)

Background:

Aditya Birla Sun Life AMC Ltd. is one of India's leading asset management companies, offering a wide range of mutual fund schemes.

Technical Analysis: Rounding Bottom Pattern

The chart indicates a potential Rounding Bottom Pattern formation for ABSLAMC. This is a bullish reversal pattern that suggests a potential uptrend after a period of decline.

Key Characteristics of the Pattern:

* U-Shaped Bottom: The price action forms a U-shaped bottom, indicating a reversal of the downtrend.

* Low Volume During the Bottom: The volume tends to be low during the formation of the bottom, suggesting a period of consolidation.

* Increased Volume on the Breakout: As the price breaks out of the pattern, volume typically increases, signaling a strong buying interest.

Trading Strategy:

Buy Signal:

* A decisive breakout above the neckline resistance level (the horizontal line drawn at the top of the pattern) would confirm the pattern.

* Increased trading volume during the breakout would strengthen the bullish signal.

Stop-Loss:

* Place a stop-loss below the recent swing low or the neckline support level.

Take-Profit:

* Set profit targets based on the height of the pattern. Common targets are 1.5 times, 2 times, and 3 times the height of the pattern.

Important Considerations:

* Confirmation: Wait for a confirmation candle (a candle that closes above the neckline) to enter the trade.

* Risk Management: Always use stop-loss orders to protect your capital.

* Market Sentiment: Consider the overall market sentiment and economic conditions.

* Fundamental Analysis: While technical analysis is useful, it's important to consider the company's fundamentals.

Disclaimer:

This analysis is for informational purposes only and should not be considered financial advice. It is essential to conduct your own research or consult with a financial advisor before making any investment decisions. Past performance is not indicative of future results.

ABCAPITALABCAPITAL - need to break range move upside

Hello traders,

As always, simple and neat charts so everyone can understand and not make it too complicated.

rest details mentioned in the chart.

will be posting more such ideas like this. Until that, like share and follow :)

check my other ideas to get to know about all the successful trades based on price action.

Thanks,

Ajay.

keep learning and keep earning.

ABCAPITAL levels ABCAPITAL (A shares)

Support Levels:

Psychological Level: 1.50 (a significant round number)

Fibonacci Level: 1.555 (38.2% Fibonacci retracement of the 2022-2023 rally)

Trend Line: 1.530 (the lower end of the ascending trend channel)

Resistance Levels:

Psychological Level: 1.70 (another significant round number)

Fibonacci Level: 1.742 (61.8% Fibonacci retracement of the 2022-2023 rally)

Trend Line: 1.750 (the upper end of the ascending trend channel)

ABCAPITAL - Cup and Handle- Breakout- WklyABCAPITAL - Cup and Handle- Breakout - Wkly

Name - ABCAPITAL

Pattern - Cup and Handle

Timeframe - Wkly

Status - Breakout

Volume - Very Good

Cmp - 226

Target - 354

SL - 196

Pattern: Cup and Handle

The Cup and Handle pattern is a bullish continuation pattern often used in technical analysis.

Fundamental ratios:

Here are some key fundamental ratios and metrics for Aditya Birla Capital Ltd. (ABCAPITAL):

Key Financial Ratios:

Price to Earnings (P/E) Ratio: 16.80

Price to Book (P/B) Ratio: 2.24

Return on Equity (ROE): 13.87%

Debt to Equity Ratio: 8.17

Net Profit Margin: 9.43%

Operating Profit Margin: 28.73%

EBITDA Margin: 29.91%

Financial Highlights:

Market Capitalization: ₹57,539.7 crore

Revenue Growth (YoY): 30.54%

Net Profit: ₹3,424.19 crore

Earnings Per Share (EPS): ₹13.17

These metrics provide a snapshot of Aditya Birla Capital Ltd.'s financial health and performance.