ATUL trade ideas

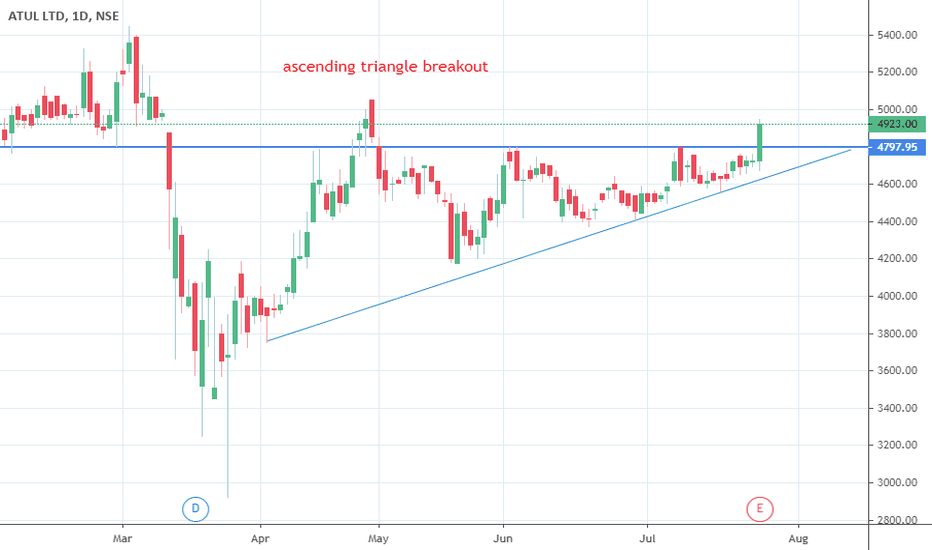

Investment idea in ATUL on NSE (INDIA)This is weekly chart of ATUL on NSE (INDIA) which looks an excellent investment idea based on following observation:

1. It is up trending scrip which is quite obvious by looking at chart. CMP is 3304.65)

2. Two trendlines have been drawn which have been tested many a times exhibiting multiple supports (shown by arrows)

3. Dividend has been paid in July 2018 (Rs 12/-)

4. Resistance at 2560 was decisively broken on 18th Dec 2017 which subsequently acted as support and was tested on correction on 5th Feb 2018. Price then consolidated during 5th Feb 2018 to 20th Aug 2018 and finally given fresh breakout on 27th Aug 2018. Price subsequently tested EMA20 on 1st Oct 2018 which acted as support. It therefore establishes that EMA 20 will act support in near terms on weekly chart on closing basis.

5. Bullish crossover has been witnessed on Stochastic RSI as marked on the chart.

In view of above, it looks an excellent idea to invest in this stock on long term basis keeping initial stop at 2800 and then trailing as price move further towards north. Trailing stop could be weekly closing below weekly EMA20.

Happy investing !!!