PRINCEPIPE LONGThe Elliott Wave Theory's description of the structure and pattern of price movements in financial markets is known as the Elliott Wave Structure.

The Elliott Wave analysis indicates that the stock has completed waves (i) and (ii), which are shown as blue numbers on the daily chart. Journey of Wave (iii) is started.

It is anticipated that wave (iii) will have about five subdivisions shown in red color.

wave i (in red color) of wave (iii) will unfold in five sub waves shown in black circle.

Wave levels of wave i in red color is shown on chart.

I am not a registered Sebi analyst. My research is being done only for academic interests.

Please speak with your financial advisor before trading or making any investments. I take no responsibility whatsoever for your gains or losses.

Regards

Dr Vineet

PRINCEPIPE trade ideas

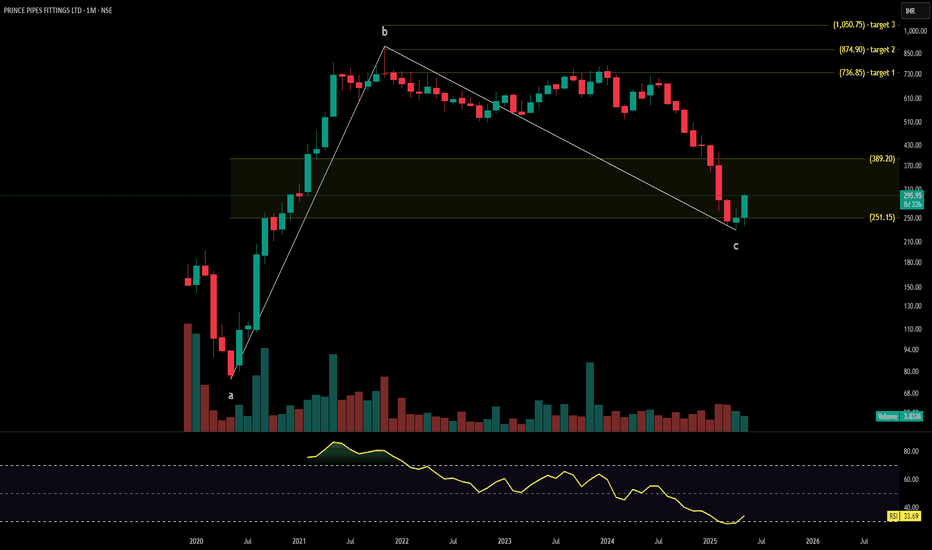

PRINCE PIPES technical analysisPrince Pipes & Fittings Ltd. (NSE: PRINCEPIPE) is currently trading at INR 295.95, reflecting a 17.81% increase. The company is a leading manufacturer of polymer piping solutions, supplying products for plumbing, irrigation, and infrastructure needs across India.

Key Levels

Support Level: INR 251

Swing Level: INR 380 - 484

Possible Upside Levels: INR 736.85, INR 874.90, INR 1,050.75

Technical Indicators

RSI: The Relative Strength Index (RSI) is at 33.69, indicating that the stock is in a low momentum phase, approaching oversold levels, which could suggest potential for recovery.

Volume: Trading volume has seen a surge, confirming heightened investor interest, especially around key price zones. Strong volume during price increases could validate bullish sentiment.

Sector and Market Context

Prince Pipes & Fittings Ltd. operates in the industrial and construction materials sector, which has seen steady demand growth due to infrastructure expansion, real estate development, and government-backed housing initiatives. The sector benefits from cost-efficient polymer solutions replacing traditional materials, contributing to market resilience. However, fluctuations in raw material prices (PVC resin), regulatory policies, and consumer demand cycles could impact performance. The broader market context shows recovery signs, with investors actively looking at fundamental stocks offering long-term stability.

Latest News and Developments

Quarterly Results: The company reported revenue growth driven by higher sales volumes, though margins remained under pressure due to rising input costs.

Analyst Ratings: Some analysts have maintained a neutral-to-positive stance, citing strong market presence but cautious outlook on pricing pressures.

Industry Trends: Increased demand for sustainable and high-performance polymer piping solutions supports long-term prospects.

Dividend Update: No recent dividend declarations, indicating a strategy focused on reinvestment for expansion.

Analysis Summary

Prince Pipes & Fittings Ltd. is currently in a consolidation phase, with RSI suggesting potential for recovery. The stock benefits from sector tailwinds, supported by infrastructure growth and evolving consumer preferences. Investors should watch price action near key levels, volume trends, and sector developments before making informed decisions. A balanced approach is recommended, considering both the opportunities and risks inherent in the market.

Prince Pipes Bearish View Till Target Price Which Is 200 Prince Pipes and Fittings Limited (PPFL) is one of India's largest integrated piping solutions and multi-polymer manufacturers. Established in 1987, the company has evolved over its 35-year journey into the nation's third-largest PVC pipe manufacturer and one of the fastest-growing entities in the industry. citeturn0search3

PPFL offers a diverse range of products, including plumbing systems, borewell systems, agriculture pipes, water storage tanks, industrial piping, electrical conduit pipes, sewage products, and underground drainage solutions. Their operations span seven state-of-the-art manufacturing units located in Haridwar (Uttarakhand), Athal and Dadra (Dadra and Nagar Haveli), Kolhapur (Maharashtra), Chennai (Tamil Nadu), Jobner (Rajasthan), and Sangareddy (Telangana). citeturn0search0

In December 2021, Prince Pipes was listed among the Fortune India 500 companies. Additionally, their Jaipur manufacturing facility received a GOLD medal in the 8th edition of the National Awards for Manufacturing Competitiveness (NAMC) 2021, organized by the International Research Institute for Manufacturing in strategic association with Moneycontrol. citeturn0search0

As of April 1, 2025, the company's share price is ₹263. citeturn0search4

Prince Pipes Bullish View From Here 2020 Ka level hPrince Pipes and Fittings Limited (PPFL), established in 1987, is one of India's largest manufacturers of polymer piping solutions. The company specializes in producing a wide range of products, including CPVC, UPVC, HDPE, and PPR pipes and fittings, catering to sectors such as plumbing, irrigation, sewerage, and industrial applications. citeturn0search0

Over its 35-year journey, Prince Pipes has evolved into India's third-largest PVC pipes manufacturer and one of the fastest-growing companies in the industry. In December 2021, the company was inducted into the Fortune India 500 rankings. citeturn0search5

The company operates seven state-of-the-art manufacturing units located in Haridwar (Uttarakhand), Athal (Dadra and Nagar Haveli), Dadra (Dadra and Nagar Haveli), Kolhapur (Maharashtra), Chennai (Tamil Nadu), Jobner (Rajasthan), and Sangareddy (Telangana). citeturn0search0

Prince Pipes has a strong presence across India, with branch offices in major cities, including New Delhi. The New Delhi branch is located at 911, Kirti Shikhar Tower, District Center, Janakpuri, New Delhi – 110058. citeturn0search2

The company's commitment to quality and innovation has been recognized with accolades such as the Brand of the Year – Pipes Award at the INEX Realty+ Awards 2021. citeturn0search0

Deep Discounted Stock: Prince PipesPrince Pipes has been in strong correction mode for the past 4 months.

Prince Pipes is trading near the 3.6-year support zone of 410.

The stock has corrected ~50 percent from all-time highs of 897 levels.

The stock price is trading above the important support zone of 410 levels.

Pros

Spending by the government on housing and infrastructure may enhance volumes.

Greater probability of imposition of anti-dumping tariff on PVC resin imports.

The capital expenditure projection for FY25 is set at Rs 330-350 crores.

Can consider to short-term to long-term.

Resistance levels: 521, 578, 680, 755

Support levels: 410, 379

STOCK NEAR SUPPORT ZONE: PRINCE PIPES AND FITTINGSPrince Pipes & Fittings has been in a downtrend for a long time.

The stock is trading around the key support level of 559 levels.

Support levels: 544, 521

20 EMA (Black line) is below 50 EMA (Orange trend), indicating that the bearish trend may continue.

Once the price reaches the support levels, we expect some consolidation.

If a breakout with good volume is confirmed, you can enter for long-term targets.

Resistance levels: 584, 617, 642, 680

Scanner scans - Rpower, PrincepipeRpower showed up on the scanner and gave handsome 12% returns in few days.

Now Princepipe and VIPind has come up.

Lets see how this goes.

SPARC which did show up on the scanner is just passing time and not doing anything, hasn't hit the SL or TGT but I got out of it with minor gains and then employed the amount in Rpower.

Prince Pipe Stock Price AnalysisWe are observing a potential buying opportunity around the price of 545. The stock has shown support within this range, making it a Buy Zone for traders. Key levels to watch are:

T1 Target: 709

T2 Target: 775

These are the potential price points where the stock could move towards after a reversal.

SL: 517

NOTE: It's not a recommendation, it is for educational purposes only.

Only for risk takers - Gambling?Prince Pipes

Price is falling but RSI stabilized from some sessions.

It might become a falling knife too.

Other pipe companies like Astral, Finolex Industries Ltd are not looking weak.

May be we will see a news that some large player completely exited and selling is happening all this while.

I am not trading in this, do not have enough capital to bet. Just sharing so you share your thoughts on this.

I call this one gambling or betting. Keep a strict SL that you are okay to take. 545, 530 are support levels. or better off avoiding.

Prince Pipes & Fittings LtdIts near its 52 Week low.

Promoter Holding is good & No promoter Pledged.

Below 200 EMA on weekly chart (White Line).

Demand Zones are marked as Green shaded horizontal areas.

Resistances are marked as red horizontal lines.

Stoploss is marked as orange horizontal line.

Reduction in debt & debt is less than reserves.

Levels:-

Buy 510 - 400

Stoploss 360

tgt 735 - 855 - 1000

This idea is for Educational purpose and paper trading only. Please consult your financial advisor before investing or making any position. Facts or Data given above may be slightly incorrect. We are not SEBI registered.

PRINCEPIPE | Swing Trade📊 DETAILS

Sector: Plastics - Tubes/Pipes/Hoses & Fittings

Mkt Cap: 8,121 cr

Prince Pipes and Fittings Limited is an integrated piping solution & multi polymer manufacturer. It was established in 1987 and initially manufactured PVC products. It is currently engaged in the manufacturing of polymer piping solutions in four types of polymers CPVC, UPVC, HDPE, PPR.

TTM PE : 36.95 (Average PE)

Sector PE : 76.67

Beta : 0.78

📚 INSIGHTS

Strong Performer

Stock with consistent financial performance, quality management, and strong technical momentum indicating good investor enthusiasm. Currently valued at Good to expensive valuation

4.60% away from 52 week high

Underperformer - Prince Pipes & Fittings up by 7.26% v/s NIFTY 50 up by 7.76% in last 1 month

📈 FINANCIALS

Piotroski Score of 7/9 indicates Strong Financials

Disclaimer: This analysis is for educational purposes only, and I'm not a SEBI registered analyst.

If you found this analysis helpful, I encourage you to like and share it. Your observations and comments are also welcomed below. Your support, likes, follows, and comments motivate me to consistently share valuable insights with you.

🔍 More Analysis & Trade Setups 🔍

For more technical analysis and trade setups, make sure to follow me on TradingView: www.tradingview.com

Prince Pipes - Long exact level 723.65, previous swing high

Levels have been marked on 1H Chart with white and red horizontal lines respectively. Please adhere to them.

Disclaimer: I am not a SEBI Registered Analyst and this is only for educational purposes. I will not be responsible for any of your profits or losses. Please consult your financial advisor before making any decision.