Trade ideas

[SeoVereign] Bitcoin Bearish Outlook – June 17, 2025We are the SeoVereign Trading Team.

With sharp insight and precise analysis, we regularly share trading ideas on Bitcoin and other major assets—always guided by structure, sentiment, and momentum.

🔔 Follow us to never miss a market update.

🚀 Boosts provide strong motivation and drive to the SeoVereign team.

--------------------------------------------------------------------------------------------------------

Hello,

This is SeoVereign, approaching technical analysis not as a result but as a prediction, with a realistic perspective.

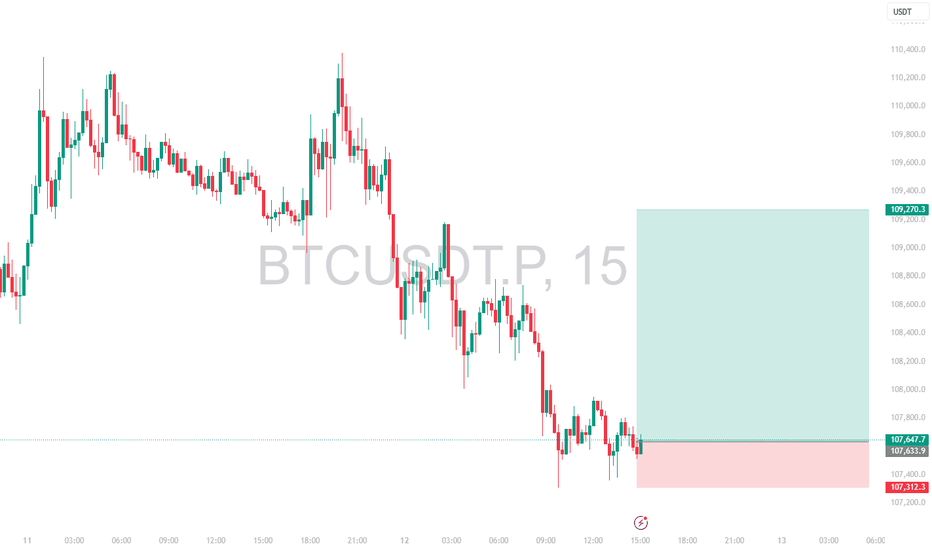

I am presenting a bearish view on Bitcoin as of June 17, 2025.

First, based on the fact that a downtrend appeared near the 0.786 level of the overall Fibonacci retracement, I believe strong downward pressure is forming, and thus I am outlining this bearish perspective.

This 0.786 level corresponds to around the 109,000 price range. On the chart, the 109,000–110,600 range is a very strong supply zone where support and resistance have repeatedly been confirmed.

Next, from a wave counting perspective, the 1.272 trend-based Fibonacci extension lies in a similar area as the 0.786 retracement level, which further reinforces my conviction in this view.

After successfully predicting the downward movement from the 11th, I have been continuously counting the recent upward wave, and the wave structure on the chart appears to align naturally, as I see it.

In addition, from a harmonic perspective, the Alt Bat pattern is functioning effectively, and since the movement has been captured within the pre-set X–1.13 range, the confirmation of this pattern can also be considered successful.

The first target is currently set around the 105,700 level.

I will continue to monitor the market closely, and once this idea progresses to a certain point, I will share more specific evidence and the thought process behind the bearish entry through an additional update.

Thank you.

Bitcoin (BTC) Technical Analysis for the Week of Jue 16 -June 22~~ Technical Analysis ~~

-- Trend:

Short-Term: Bitcoin has broken the floor of a rising trend channel, suggesting a slower rise or potential sideways movement.

Medium/Long-Term: Despite the short-term slowdown, the long-term trend remains bullish, with Bitcoin testing resistance at ~$106,000–$110,000. A breakout above $111,000 could signal strong upward momentum.

Bearish Signals: Negative volume balance (higher volume on down days) and RSI divergence indicate potential for a short-term correction.

Key Levels:

Support: $102,400, $90,000

Resistance: $106,000–$110,000, with a critical zone at $110,000–$111,800. Breaking this could push BTC toward $125,000–$155,000.

-- Disclaimer --

This analysis is based on recent technical data and market sentiment from web sources. It is for informational purposes only and not financial advice. Trading involves high risks, and past performance does not guarantee future results. Always conduct your own research or consult a SEBI-registered advisor before trading.

#Boost and comment will be highly appreciated

BTC/USDT 4H Analysis – Bullish Cup Formation 📈 BTC/USDT 4H Analysis – Bullish Cup Formation ☕🚀

🔍 Chart Overview:

The 4-hour chart of Bitcoin against USDT on Binance displays a clear "Cup" pattern, suggesting a strong bullish continuation setup. The price action reflects a rounded bottom forming after hitting a solid support zone.

🟣 Key Zones:

🔻 Support Zone: ~$101,000–$103,000

Strong buying interest was observed here with a sharp wick rejection, forming the bottom of the cup.

🔺 Resistance Zone: ~$110,000–$112,000

This area has acted as a historical rejection zone and now stands as the next major target for bulls.

📊 Technical Insights:

The price is gradually curving upward, respecting the rounded cup pattern, often a precursor to a breakout.

A clean break above the resistance zone may trigger continuation toward new highs, possibly above $112,000.

The price is currently at ~$107,700 and gaining momentum with higher lows forming consistently.

🎯 Price Projection:

📌 Target: $111,500–$112,000

📉 Invalidation: Break below the $103,000 support

💡 Conclusion:

If the bullish momentum continues and breaks past resistance, we can expect a powerful upside breakout. Traders should watch for volume confirmation near the resistance zone for potential entry or breakout trades.

📍Pattern in Play: Cup Formation

⚠️Watch for pullbacks before breakout attempts.

BTC/USDT Bullish Reversal Zone AnalysisSupport Zone:

The horizontal purple box (~104,000 USDT area) has acted as a strong support/resistance flip zone multiple times.

Falling Wedge Breakout:

The price action broke out of a falling wedge pattern earlier, confirming bullish momentum.

Flag Formation (Current):

A smaller bullish flag/pennant appears to be forming, and a breakout above could trigger a strong upward move.

Projected Move:

The black arrow indicates a potential bounce from this support zone, with the price targeting the 111,000–112,000 USDT zone (highlighted in the top purple box).

Volume Spike:

Notable volume spike near the bottom supports the idea of accumulation and possible reversal.

📈 Conclusion:

If the support zone holds and price breaks above the minor flag, a bullish continuation is likely toward the 111,000–112,000 resistance area. Traders should watch for confirmation of a breakout and volume increase for validation.

BTCUSDT – Rebound from 104,200, recovery opportunity emergingBTCUSDT has bounced back from the 104,200 support zone with a potential double bottom pattern, signaling the return of buying pressure. The price is consolidating around the 106,000–107,000 area. If this zone holds, the probability of retesting the previous high at 110,500 is high.

The EMA34 and EMA89 are narrowing – a sign of weakening selling pressure.

Supporting news:

The Fed kept interest rates unchanged, U.S. CPI slightly declined, and capital inflows from ETFs like BlackRock are returning to the market, creating momentum for recovery.

BITCOIN Short Position Update – June 11, 2025We are the SeoVereign Trading Team.

With sharp insight and precise analysis, we regularly share trading ideas on Bitcoin and other major assets—always guided by structure, sentiment, and momentum.

🔔 Follow us to never miss a market update.

🚀 Boosts provide strong motivation and drive to the SeoVereign team.

--------------------------------------------------------------------------------------------------------

Bitcoin downside perspective shared.

Currently, Bitcoin appears to have entered an overheated zone based on both Elliott Wave Theory and harmonic pattern analysis.

While it has been continuously setting new highs alongside Ethereum, the technical structure suggests the possibility of a short-term pause.

Accordingly, a bearish idea is shared.

The first target is set at 108,600.

More detailed ratio analysis and additional reasoning will be shared through an idea update once the first target is reached.

Flexible response according to market conditions is necessary.

BITCOIN ANALYSIS UPDATE — READ THIS CAREFULLY!🚨 BITCOIN ANALYSIS UPDATE — READ THIS CAREFULLY! 🚨

Hope you followed our last BTC analysis — and DID NOT open any longs at the top.

If you followed: Congrats — you either made big profits on the short, or at least saved your money by not longing.

✅ We clearly warned when BTC was around $110K — more correction was coming.

Result? Bitcoin is now 7% DOWN since that call.

❗ Now the situation is DANGEROUS:

👉 BTC broke my Bullish Order Flow at $105K.

👉 If this $105K support doesn’t hold soon → we may see a deep correction towards $90K.

$105K is the level to watch like a hawk.

👉 Iran-Israel news just accelerated the fall — but we already predicted this move before the news.

🚫 NEVER gamble with your hard-earned money.

✅ Always wait for solid confirmation before entering trades.

👉 Stay smart. Stay safe. Stay patient.

💬 Comment your thoughts below.

🔁 Forward this to your crypto friends — they NEED to see this!

BITCOIN ANALYSIS UPDATE — READ THIS CAREFULLY! BITCOIN ANALYSIS UPDATE — READ THIS CAREFULLY!

Hope you followed our last BTC analysis — and DID NOT open any longs at the top.

If you followed: Congrats — you either made big profits on the short, or at least saved your money by not longing.

We clearly warned when BTC was around $110K — more correction was coming.

Result? Bitcoin is now 7% DOWN since that call.

Now the situation is DANGEROUS:

👉 BTC broke my Bullish Order Flow at $105K.

👉 If this $105K support doesn’t hold soon → we may see a deep correction towards $90K.

$105K is the level to watch like a hawk.

Iran-Israel news just accelerated the fall — but we already predicted this move before the news.

🚫 NEVER gamble with your hard-earned money.

✅ Always wait for solid confirmation before entering trades.

Stay smart. Stay safe. Stay patient.

Comment your thoughts below.

Forward this to your crypto friends — they NEED to see this!

Intraday Long Setup | June 11th 2025 | Valid Until Daily ClosePrice retraced to a strong pivot zone.

Structure remains bullish with potential for continuation after pullback.

Tight risk control.

Watch for price reaction within the red zone. Entry only if confirmation appears

The setup expires at end of the daily candle close.

Weekly Short Setup | Valid Until Weekly ClosePrice has pushed through a potential weekly Pivot supply zone (red box) where sellers may step in. This trade is based on the expectation of a rejection from this area.

Entry: Red box — a short entry zone aligned with overhead supply

Stop Loss: Above the red zone (invalidates the setup)

Target: Green box — area to consider partial/full exit based on momentum

BTCUSDT has shown a strong bounce and has now approached a key pivotal resistance zone

Risk-reward is favorable with a tight invalidation and clean downside target

Price may stall or reverse near the red box, creating short opportunity

Note:

This is an weekly setup and idea that expires at Weekly Candle Close. Re-evaluate the setup if price remains indecisive near the entry zone close to that time.

This BTC Pullback Could Be The Last Dip Before $120K+ — Are You #Bitcoin has just delivered a textbook breakout — but what comes next might surprise you. Let’s break it down: 👇

🔸 Bearish Order Block @ $109K–$110K

Price tapped into this zone and is currently reacting. Expect short-term volatility here.

🔸 FVG (Fair Value Gap) Filled + Tapped

A clean move back up filled the previous FVG — this typically signals strength but also invites sellers at OB zones.

🔸 Key Bullish Order Block @ $106K

If BTC pulls back, this zone will be crucial. A strong defense here could ignite the next leg up.

🔸 Fib Levels Aligned:

0.382 Fib @ ~$104.5K

0.5 Fib @ ~$102.2K

0.618 Fib & Bullish OB cluster @ ~$100K ( Filled )

Possible Play Ahead:

A dip toward $106K–$104K is healthy → watch for buyer reaction.

If CRYPTOCAP:BTC holds the $106K OB and bounces, a move back toward $112K+ ATH retest is very likely.

Big Picture:

The breakout from the descending channel + OB retest gives BTC strong bullish structure — as long as the $106K zone holds.

Are you ready for the next BTC move?

📈 Comment below: BULLISH or BEARISH?

🔄 Retweet to keep others in the loop!

NFA & DYOR

BTCUSDTPrice action trading is a methodology in financial markets where traders make decisions based on the actual price movements of an asset over time, rather than relying heavily on technical indicators or fundamental analysis. It involves observing and interpreting patterns and trends in price charts to predict future price movements.

Danger Ahead? Bearish Signal Spotted on the Daily Timeframe!Price Action Analysis (Daily & Intraday)

A bearish pattern has formed on the Daily Timeframe, and early signs of execution are visible on the 1-hour chart, indicating a potential Double Top formation. If confirmed, the price may drop with an initial target around 100263. Should the bearish momentum continue, the next significant weekly support could be tested near 88372.

Caution:

This setup is considered risky, primarily because the higher timeframe (Monthly) still shows an overall uptrend. However, with a well-defined stop-loss above 16367 and proper risk management, the trade could offer a favorable risk-to-reward ratio.

Disclaimer:

Trading, especially in futures and options, involves a high degree of risk. Losses can exceed capital if not managed properly. This is not financial advice. Please do your own analysis or consult a certified financial advisor before making any investment decisions.

BTCUSDT – Strong rebound, waiting to break previous highsBitcoin is maintaining a fairly positive uptrend after bouncing from the support zone around 105,245 USDT – a confluence area of the EMA89 and previous lows on the 8H chart. Currently, the price has approached the key resistance area between 110,192 and 111,931, which has previously rejected bullish attempts twice.

Price action suggests that BTC may temporarily pull back to gather momentum before continuing to test the green resistance zone around 113,331. A short-term accumulation pattern is forming with a higher-low structure – a good sign for buyers as long as the price holds above the 106,000 area.

On the news front, investor sentiment has improved following weaker U.S. jobs data, reinforcing expectations that the Fed may cut interest rates sooner. This has prompted a return of safe-haven flows to the crypto market, adding fuel to BTC’s upward momentum.

Inverse Head and Shoulders Breakout Signals Bullish The chart under review presents a classic Inverse Head and Shoulders pattern, a reliable and widely recognized bullish reversal formation in technical analysis. This structure typically forms after a downtrend, indicating a potential shift in market sentiment from bearish to bullish.

The pattern is composed of:

Left Shoulder: A modest price decline followed by a temporary upward correction.

Head: A deeper price decline forming the lowest point in the pattern.

Right Shoulder: A higher low that mirrors the left shoulder, followed by another upward movement.

The neckline, which acts as a critical resistance level, is clearly illustrated at approximately 106,840.37 USDT. A confirmed breakout above this neckline suggests the completion of the reversal pattern and validates the potential for a sustained bullish movement.

---

2. Breakout Confirmation

The current price action confirms a successful breakout above the neckline, with the market currently trading around 107,586.58 USDT. This breakout is a key signal for bullish continuation, provided it is supported by increased volume and follow-through price action.

From a technical standpoint, the breakout is reinforced by:

A clean violation of neckline resistance

Price consolidation near breakout zone before a strong upward thrust

Higher lows preceding the breakout, indicative of growing buying pressure

This confluence of technical signals strengthens the case for an upward price trajectory in the near term.

3. Projected Price Targets

Upon confirmation of the Inverse Head and Shoulders breakout, target levels can be derived using the measured move technique. This involves projecting the vertical distance from the head to the neckline upward from the breakout point.

Target 1 (Initial Resistance):

108,878.29 USDT – This level represents a potential short-term resistance where price may consolidate or retrace slightly before continuing.

Target 2 (Measured Move Completion):

110,752.24 USDT – This is the ultimate price target derived from the height of the head-to-neckline structure. Reaching this level would represent the full realization of the reversal patt

4. Key Support and Risk Levels

Risk management is a critical component of any trading strategy. The following support levels should be closely monitored:

106,840.37 USDT (Neckline Support):

Former resistance turned support. Holding above this level post-breakout is essential for sustaining bullish momentum.

105,997.09 USDT:

Acts as a secondary support level and potential stop-loss region for conservative traders.

If price fails to hold above the neckline and falls back below these levels, the breakout could be classified as a false breakout, warranting caution.

5. Strategic Implications for Traders

This setup provides a favorable risk-to-reward ratio for long entries, particularly for traders seeking to capitalize on momentum-based patterns. An optimal trading approach could involve:

Entry: Near the neckline breakout or on a minor retest of 106,840.37 USDT

Stop-Loss: Below 105,997.09 USDT or under the right shoulder to account for volatility

Take-Profit Zones: Partial profits near 108,878.29 USDT, with final target at 110,752.24 USDT

6. Final Remarks

This chart illustrates a textbook example of a bullish reversal pattern in play. While the technical outlook is favorable, traders should remain cautious of potential invalidation scenarios, especially in highly volatile or news-driven markets. Confirmation through volume analysis and supportive macro/fundamental conditions can further enhance confidence in the bullish thesis.

Overall, the current setup indicates a well-structured opportunity for upward price movement, with a clearly defined entry, risk, and reward framework.

Let me know if you'd like this tailored for a trading journal, client report, or automated strategy setup.

BTC Daily Bias – Bullish – 10 June 2025 (PDH + PMH Liquidity)📌 Notes:

This analysis is part of my daily bias posting. Use it as an educational reference only. Always manage risk properly.

🧠 Market Overview:

Today, my bias on Bitcoin (BTC) is bullish, with a focus on liquidity resting above the Previous Day High (PDH) and Previous Month High (PMH). Price is showing signs of strength and may aim to take out these highs before any significant reversal.

🕵️♂️ Intraday Bias:

– Session Focus: London & NY

– Liquidity Targets:

🔹 PDH: 110655.0

🔹 PMH: 120000

🎯 Trade Setup Plan:

– Ideal Entry: On retracement or after liquidity grab below LO

– SL: Below short-term swing low / demand

– TP1: PDH | TP2: PMH | Optional: Trail beyond

📌 Notes:

This is my directional bias based on Smart Money Concepts (SMC) and liquidity framework. Use for educational purposes and always follow your risk management rules.

—

Posted by

🎥 YouTube: Trading Pulse

Intraday Long Setup | June 9th 2025 | Valid Until Daily ClosePrice is retracing to a strong pivot zone (marked by the red box).

Structure remains bullish with potential for continuation after pullback.

The green box represents a high-probability long opportunity with tight risk control.

Watch for price reaction within the red zone. Entry only if confirmation (e.g., bullish engulfing, strong wick rejections) appears.

The setup expires at end of the daily candle close.

Bitcoin (BTC) Technical Analysis for the Week of Jue 10 -June 16~~ Technical Analysis ~~

- Trend: Bitcoin is in a bullish trend on higher time frames (3-day and above), forming higher highs and higher lows. However, short-term signals are mixed, with some indicators suggesting consolidation or a potential pullback.

4-Hour Chart: Bullish, with the 50-day moving average (MA) sloping up, but the 200-day MA is sloping down since December 27, 2024, indicating a weaker short-term trend.

Daily Chart: Bullish, with the 50-day MA rising and below the current price, potentially acting as support. The 200-day MA has been rising since June 5, 2025, signalling a strong long-term trend.

Weekly Chart: Bullish, with the 50-day MA below the price and the 200-day MA sloping up since July 9, 2024.

Monthly Chart : Bullish which has a potential to hit All Time High

# Support, resistance and Targets marked in the chart for your reference

-- Disclaimer --

This analysis is based on recent technical data and market sentiment from web sources. It is for informational purposes only and not financial advice. Trading involves high risks, and past performance does not guarantee future results. Always conduct your own research or consult a SEBI-registered advisor before trading.

#Boost and comment will be highly appreciated