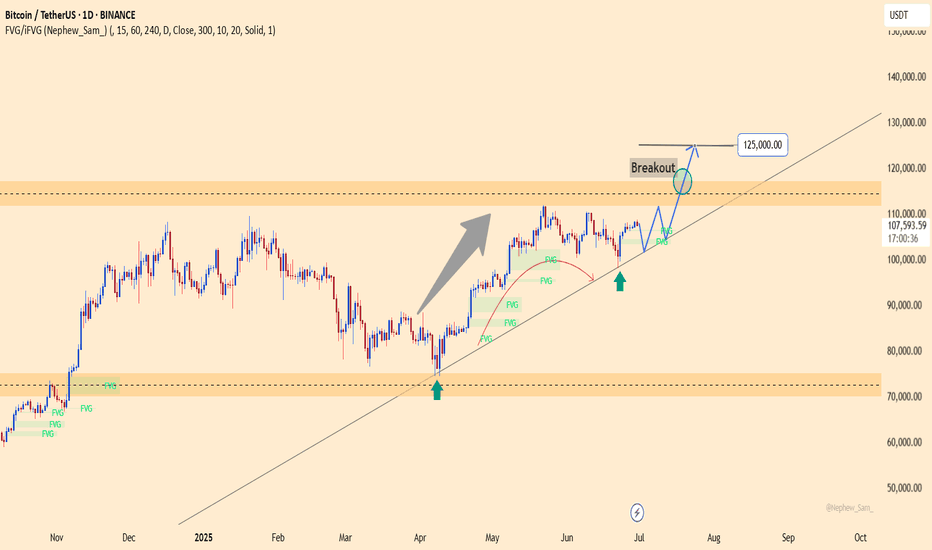

BTCUSDT – Targeting 125,000 if Resistance BreaksBTCUSDT is holding a strong uptrend, with price respecting the ascending trendline and consistently filling fair value gaps. The pair is approaching key resistance around 110,000 and may form a breakout–retest pattern, potentially unlocking a move toward 125,000.

On the news front, institutional inflows are returning, spot ETFs continue to attract capital, and the Fed is keeping rates steady — all supporting bullish momentum. As long as price holds above 101,200, the upside scenario remains in play.

Trade ideas

Bitcoin (BTCUSDT) UpdateBitcoin successfully broke above the resistance level at 108475.34, which served as our early entry trigger. If you entered long positions based on this breakout, you're currently in profit — and this position can still be held while we wait for a cleaner breakout through the main resistance at 110221.73 to open further long opportunities.

🔸 Key Observations:

Price has not yet confirmed a break above 110221.73, our major trigger.

If the price fails to reach this level and instead forms a lower high, it may signal potential downside or a local trend shift.

The market is currently in a wait-and-see phase — patience is key.

🔸 Momentum Indicator Watch:

Price is nearing the SMA 7, and its interaction with current candles could signal whether the bullish move will continue or weaken.

The High Wave Cycle (HWC) pattern will reactivate above 110221.73, strengthening bullish continuation probabilities.

📌 Cycle & Trend Context:

Both the Mid Wave Cycle (MWC) and Low Wave Cycle (LWC) remain bullish.

The Primary Trend is also upward, so long setups still offer more favorable risk-to-reward.

It’s acceptable to engage more aggressively in long positions under this structure, but shorting should be approached cautiously.

📉 Short Scenario Setup:

Only consider short positions if we see a fake breakout above 110221.73, or a new lower high below this key resistance, with proper rejection signals.

In that case, a low-risk short could be considered with tight stops.

⏰ Final Note:

Stick to the dominant trend. Until we see clear invalidation of the bullish structure, favoring long setups — especially after clean triggers — will likely provide more consistent results.

#BTCUSDT #BitcoinUpdate #CryptoAnalysis #TradingView #CryptoOutlook #BitcoinPrice #TechnicalAnalysis #BTCBreakout #SmartTrading

$BTC 30mins Chart Analysis

⚠️ Rising Wedge Formation Detected!

Bitcoin is currently moving within a clearly defined Rising Wedge—typically a bearish reversal pattern indicating possible exhaustion of upward momentum.

🔸 Upper Resistance Zone: ~$108,700 – $109,000

🔸 Lower Support Zone: ~$106,400 – $106,700

🟢 Bullish Scenario:

If price breaks upward decisively (high volume above $109K), it can invalidate the wedge and target $110K+.

🔴 Bearish Scenario (more likely):

If price loses the lower boundary (~$106.4K), expect accelerated selling pressure with potential downside targets near $105K–$104.5K.

Wait for clear breakout/breakdown confirmation before entering trades.

Bitcoin Technical Analysis for the Week of 29, June - 07, July

Here's a Bitcoin price analysis for June 29, 2025, based on available data and technical indicators from recent sources:

#Current Market Overview

Price: Bitcoin is trading around $107,331.08 as of June 28, 2025, with a slight 24-hour decrease of approximately 1.99%.

#Market Sentiment: The market shows a neutral to bullish sentiment. The Fear & Greed Index is at 65 (Greed), indicating optimism but not extreme euphoria. Technical indicators suggest a 67% bullish sentiment, with 25 bullish signals versus 5 bearish signals.

Trading Volume: 24-hour trading volume is around $43.1 billion, slightly below recent averages, suggesting cautious trading amid volatility.

~~ Technical Analysis ~~

Price Trends:

Bitcoin is currently testing support at the 20-day EMA ($106,211), with additional support at the 50-day EMA ($103,110) and 100-day EMA ($98,807). The 200-day EMA ($93,092) serves as a key macro support level.

The 50-day moving average is rising and remains above the 200-day moving average, forming a golden cross, a bullish indicator.

Bitcoin is within a descending triangle pattern, which could resolve by July 1, 2025. A breakout above $110,000 could signal a new bull run, while failure to hold $102,000–$104,000 may lead to a drop toward $95,000–$98,000. even to $90,000.

Key Levels:

Support: $100,000 (recently held), $98,000 (psychological), $95,000 (flag pattern lower border).

Resistance: $108,700 (recent high), $110,000 (key psychological level), $112,000 (all-time high from May 2025)

Trend Bullish - Chart for your reference

-- Disclaimer --

This analysis is based on recent technical data and market sentiment from web sources. It is for informational purposes only and not financial advice. Trading involves high risks, and past performance does not guarantee future results. Always conduct your own research or consult a SEBI-registered advisor before trading.

#Boost and comment will be highly appreciated

Intraday Short Setup | June 28th 2025 | Valid Until Daily ClosePrice has pushed into a potential intraday Pivot supply zone (red box) where sellers may step in. This trade is based on the expectation of a rejection from this area.

Entry: Red box — a short entry zone aligned with overhead supply

Stop Loss: Above the red zone (invalidates the setup)

Target: Green box — area to consider partial/full exit based on momentum

Risk-reward is favorable with a tight invalidation and clean downside target

Price may stall or reverse near the red box, creating short opportunity

Note:

This is an intraday trade idea that expires at 00:00 UTC (Daily Candle Close). Re-evaluate the setup if price remains indecisive near the entry zone close to that time.

BTCUSDT DAILY UPDATEAfter a strong bullish leg from the channel bottom support at 81,039, Bitcoin rallied to 110,221, where it entered a consolidation phase. The price is now ranging between 110,221.73 (resistance) and 101,819.47 (support), forming a sideways structure within a clear ascending channel.

🔍 Technical Overview:

This range has seen multiple touches on both support and resistance levels, which makes it possible to trade both sides (range trading setups). However, since the macro structure on the monthly and weekly charts remains bullish, short positions are not recommended unless very specific conditions are met.

📈 Key Insight:

We recently witnessed a fake breakout below 101,819.47, which was quickly absorbed by buyers, followed by a strong bullish volume spike. This indicates that demand is active, and the range is more likely to resolve to the upside.

✅ Long Setup:

Primary Long Trigger: A confirmed breakout above 110,221.73 is the main trigger for a larger move.

Early Entry (Aggressive): A breakout above 107,513.98 could offer an early entry, especially on lower timeframes like the 4H or 1H, with a tighter stop. This can be used to position early ahead of the 110K breakout, but proper risk management is critical here.

⚠️ Short Setup (Not Recommended but Possible):

If you insist on a short position, you must first see a lower high formation relative to 110,221 and strong rejection signals.

Only consider shorting below 101,819.47, and even then, prefer confirmation through a retest or pullback, as a fake breakdown is still a risk.

📌 Final Thought:

Bitcoin is consolidating within a bullish structure. As long as price stays above 101,819, the bias remains bullish. Prepare for upside continuation — but enter with structure, manage risk, and always align with the broader trend.

#BTC #BitcoinAnalysis #CryptoTrading #BTCUSDT #PriceAction #TradingView #CryptoTechnicalAnalysis #BitcoinPrice

BTCUSDT MONTHLY UPDATE 📈 Bitcoin (BTCUSDT) Monthly Outlook | Bullish Trend within High Wave Cycle Channel

As observed in the chart, Bitcoin is currently moving within a bullish high wave cycle (HWC), forming higher highs and higher lows inside an upward channel. Each touch of the lower channel boundary has resulted in a fresh bullish leg, with consolidation phases lasting around 6–7 candles, indicating a recognizable and repeating market behavior.

🔍 Market Structure & Key Resistance:

At the moment, price is testing both the midline of the channel and a key resistance zone around $107,234.25. A confirmed breakout above this level would act as a technical trigger for long positions, as it would suggest strong bullish continuation and increased momentum.

There are no signs of a bearish reversal at this point. The market structure remains firmly bullish, so there’s no edge in shorting against the trend unless clear reversal signals appear.

📉 Short Setup Scenarios (Only if Market Weakens):

A short position should only be considered under specific reversal conditions:

Price pulls back to $105,940.40, then bounces to form a lower high relative to the $107,270.72 resistance.

Look for a potential failure swing or double top pattern.

A breakdown below $105,940.40 could offer a risky short entry.

For higher confidence: wait for a clean break, followed by a pullback (retest) to confirm bearish momentum before entering a short.

📊 RSI Insight:

The RSI is currently flirting with the 70 level. If a daily candle closes above $107,270.73 and RSI crosses into overbought territory, it could trigger bullish acceleration. This would likely bring strong buying activity and sharp upward moves, potentially forming new monthly highs.

✅ Summary:

Trend: Bullish (High Wave Cycle)

Primary Long Trigger: Breakout above $107,234.25

No clear short signal unless reversal patterns form

Watch RSI and candle close above $107,270.73 for bullish confirmation

A break above this zone could activate a new phase of institutional participation

Stay focused and reactive. Let the market give you confirmation before entering aggressive trades. This breakout zone is key — once breached, expect sharp upside movement.

#BTCUSDT #BitcoinMonthlyAnalysis #CryptoOutlook #BitcoinBreakout #TechnicalAnalysis #BullishBitcoin #PriceAction #RSI #ChartPatterns

📅 June 28, 2025

BTCUSDT creates another head and shoulder pattern BTC is creating inverse head and shoulder pattern in daily time frame as well as in 4H time frame, currently BTC is creating Bullish flag pattern in larger time frame and in that Bullish flag it's likely to create inverse head and shoulder pattern, however in both scenarios it's look Bullish with target of 1,17,000$ for inverse head and shoulder pattern, And 1,45,000$ for Bullish flag pattern, And in daily head and shoulder pattern target is 1,50,000$. It can come to retest 1,03,000$ to 1,04,000$ for LIQUIDITY purposes and to complete Right shoulder.

Intraday Short Setup | June 27th 2025 | Valid Until Daily ClosePrice has pushed into a potential intraday Pivot supply zone (red box) where sellers may step in. This trade is based on the expectation of a rejection from this area.

Entry: Red box — a short entry zone aligned with overhead supply

Stop Loss: Above the red zone (invalidates the setup)

Target: Green box — area to consider partial/full exit based on momentum

Risk-reward is favorable with a tight invalidation and clean downside target

Price may stall or reverse near the red box, creating short opportunity

Note:

This is an intraday trade idea that expires at 00:00 UTC (Daily Candle Close). Re-evaluate the setup if price remains indecisive near the entry zone close to that time.

Bitcoin go to the moon!! BTC/USDT Technical Analysis (4H Timeframe)

1. Overall Trend

The chart shows BTC trading within a wide range between a Supply Zone at the top (~111,500 – 112,500 USDT) and a Demand Zone at the bottom (~100,500 – 102,500 USDT).

The current price is around 107,050 USDT, recently breaking out of a downtrend line and now retesting the upper Demand H4 area.

2. Key Zones

Supply Zone (Sell Area): 111,500 – 112,500 USDT

Strong resistance zone where price was sharply rejected previously.

Resistance H4: ~108,800 – 109,200 USDT

First resistance level if the bullish move continues.

Demand H4 (Short-term Buy Zone): 105,000 – 106,000 USDT

Price is currently retesting this zone after breaking out.

Demand H4 (Stronger Buy Zone): 100,500 – 102,500 USDT

A deeper support zone in case the current demand fails.

3. Trading Scenarios

BUY Scenarios

Buy #1 (Short-Term Entry):

Entry: Around 105,000 – 106,000 USDT

Stop Loss: Below 104,000 USDT

Take Profits:

TP1: Resistance H4 ~109,000 USDT

TP2: Supply Zone ~111,500 – 112,500 USDT

Buy #2 (Safer Entry):

If price breaks below the current Demand H4 and drops to the lower zone (100,500 – 102,500 USDT), consider entering there.

Targeting a bounce back to the resistance or higher zones.

SELL Scenario

Sell Limit Setup:

Entry: At Supply Zone 111,500 – 112,500 USDT

Stop Loss: Above 113,000 USDT

Take Profits:

TP1: ~109,000 USDT

TP2: ~106,000 USDT

TP3 (extended): ~102,000 USDT

4. Conclusion

Since the price is currently testing a breakout + demand confluence area → BUY setups are preferred if bullish confirmation occurs at the 105–106K zone.

If the zone fails, wait for a deeper pullback to the 100.5–102.5K demand zone.

The upper supply zone remains a high-probability SELL area if price rallies that far.

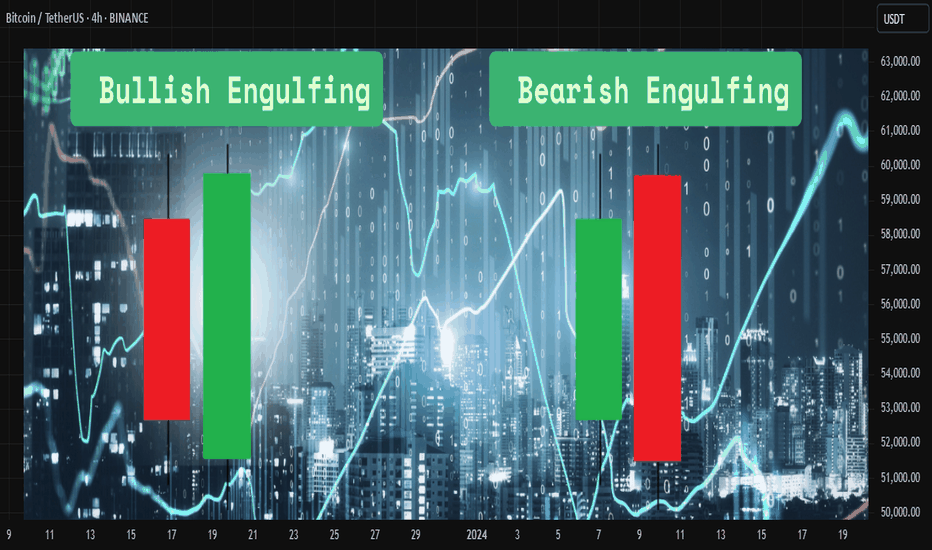

Engulfing Candlestick Pattern Explainedthe engulfing candlestick pattern is a powerful price action signal used by traders to identify potential reversals in the market. it consists of two candles:

🟢 bullish engulfing

* occurs during a downtrend

* the first candle is bearish (red)

* the second candle is bullish (green) and completely engulfs the body of the first candle

* it signals a potential reversal to the upside

🔴 bearish engulfing

* occurs during an uptrend

* the first candle is bullish (green)

* the second candle is bearish (red) and completely engulfs the body of the first candle

* it signals a potential reversal to the downside

📍 key points to remember

* the second candle must fully engulf the body (not just the wicks) of the first candle

* higher volume during the engulfing candle increases its reliability

* it works best when combined with support and resistance levels or trendlines

💡 confirmation

always wait for confirmation before entering a trade. for bullish engulfing, a break above the high of the engulfing candle is ideal. for bearish engulfing, a break below the low adds strength to the signal.

📈 How to use it ?

many traders use this pattern as part of their entry or exit strategy. combining engulfing patterns with indicators like rsi, moving averages, or trend filters can improve accuracy.

⚠️ risk management

like any pattern, engulfing candles are not 100% accurate. always use proper risk management and stop-loss placement to protect your capital.

Disclaimer :

This Video is not financial advice, it's for educational purposes only highlighting the power of coding( pine script) in TradingView, I am not a SEBI-registered advisor. Trading and investing involve risk, and you should consult with a qualified financial advisor before making any trading decisions. I do not guarantee profits or take responsibility for any losses you may incur.

BTCUSDT – Buying Resumes, Bullish Momentum Targets 120,000Bitcoin is flashing strong bullish signals as it continues to hold within a well-defined long-term ascending channel. After a technical bounce from the nearby support zone around 99,614, BTC has regained momentum and is now approaching a key resistance FVG cluster — a potential launchpad for a breakout.

The price structure shows a series of higher lows combined with healthy pullbacks, indicating accumulation and capital rotation back into BTC. A “break–pullback–continuation” pattern is forming, pointing to a likely move toward the psychological resistance level at 120,000 — a target highlighted by many professional traders since the start of the quarter.

Fundamental factors supporting the uptrend:

Large capital inflows are returning to U.S. Bitcoin ETFs, signaling renewed institutional confidence in the bull cycle.

Expectations that the Fed will hold rates steady are weighing on the USD, creating a favorable environment for risk assets like BTC.

Altcoin volatility is fading — often a sign that capital is rotating back into BTC as the market’s leading asset.

BTCUSDT – Is a Breakout Imminent?Bitcoin is once again testing the descending trendline that previously triggered three strong rejections, hovering around the 106,500–106,600 USDT zone. A clear rounded bottom has formed, with strong support holding around 104,200–104,700, fueling the recent rebound.

Price action is now consolidating just below the key resistance, setting the stage for a potential bullish continuation pattern. A clean breakout above this zone could open the door for a rally toward 108,600 and even 110,200 – both previous highs.

However, if the trendline holds again, the highlighted support zone is likely to attract fresh buying interest. The overall market bias leans bullish, but confirmation via breakout is crucial for the next move.

Are you ready to ride the next BTC wave?

Bitcoin is Coiling – Ready to Break Out Toward 112K?On the H8 timeframe, BTCUSDT is forming a clear bullish setup. After a strong rebound from the support zone around 104,489 — which aligns with a previous demand area and Fair Value Gap — price has broken above the descending trendline and is now retesting the resistance near 107,500. This structure is shaping into a broadening triangle pattern, signaling a potential breakout.

If BTC holds the 105,000–106,000 area during the upcoming pullback, there is a high probability of a bullish breakout toward the 112,000 level — a key previous high.

On the news front, market sentiment is improving as U.S.-based Bitcoin ETFs attract fresh inflows, coupled with growing expectations that the Fed will hold interest rates steady amid signs of economic slowdown. These factors are providing strong support for BTC’s medium-term bullish outlook.

Bullish and Bearish harami candlestick patternthe harami pattern is a two-candle reversal formation seen on candlestick charts. it reflects indecision and a possible shift in momentum, making it useful for spotting early signs of a trend change.

🔵 bullish harami

this pattern forms during a downtrend. the first candle is a large bearish one, followed by a smaller bullish candle that fits completely within the body of the first candle. this shows that selling pressure is weakening and a potential upward reversal may occur.

🔴 bearish harami

this pattern appears during an uptrend. the first candle is a strong bullish one, followed by a smaller bearish candle that is completely inside the previous candle’s body. this suggests that buying strength is fading, and a downward move might follow.

📌 key characteristics

* second candle is smaller and opposite in direction

* body of the second candle is fully within the body of the first candle

* confirmation from volume or the next candle increases reliability

✅ usage tips

* combine with support and resistance levels or trendlines

* look for confirmation from indicators like rsi or macd

* avoid using it alone in sideways or noisy markets

Disclaimer :

This post is not financial advice, it's for educational purposes only highlighting the power of coding( pine script) in TradingView, I am not a SEBI-registered advisor. Trading and investing involve risk, and you should consult with a qualified financial advisor before making any trading decisions. I do not guarantee profits or take responsibility for any losses you may incur.

Bitcoin isn’t fully bullish yet — most people are falling for thBitcoin isn’t fully bullish yet — most people are falling for the trap

BTC just bounced beautifully from the $97.8K–$98K demand zone.

It tapped into key confluences:

✅ FVG filled

✅ 0.618-0.786 Fib level

🟪 Bullish Order Block just above 0.786

But let’s be real — we’re not in full bullish mode yet.

This looks more like a short-term pullback, not a trend reversal.

What I'm Watching Closely:

🔹 BTC is forming two HH & HL patterns.

🔹 Super important for us to track both — they’ll guide the next big move.

🟥 LTF last HH = $108,900

🟥 HTF last HH = $110,654

As long as BTC stays below these, the structure is still bearish.

We only flip bullish when candles break and close above them.

If Bullish Breakout happens? We’re eyeing new ATH targets toward $150K 🚀

My Plan Right Now:

🔹 Watching $107K & $109K levels for clean short setups.

Why?

👉 Low-risk entries

👉 Tight SL

👉 Big reward — Targeting around $100K

Stay alert, don’t chase. Let the levels come to us.

Let me know in the comments 👇 Are you flipping bullish, or still cautious?

NFA & DYOR

[SeoVereign] Bitcoin Bearish Outlook – June 22, 2025We are the SeoVereign Trading Team.

With sharp insight and precise analysis, we regularly share trading ideas on Bitcoin and other major assets—always guided by structure, sentiment, and momentum.

🔔 Follow us to never miss a market update.

🚀 Boosts provide strong motivation and drive to the SeoVereign team.

--------------------------------------------------------------------------------------------------------

Currently, Bitcoin appears to have entered a downward phase based on the counting criteria. A movement breaking below the S1 support line has been detected, which I previously mentioned as a signal to consider a mid-to-short term bearish trend.

From a trend perspective, a bullish reversal has not yet occurred. The reason is that on the 20th, when the 105550 level was broken upward, a strong momentum-driven upward move did not follow. If a true trend reversal had occurred at that point, there should have been immediate strong buying pressure without a whipsaw movement after the breakout. However, the market quickly reversed downward, indicating that selling pressure still dominates.

At that point, I was preparing a long idea, but as the bearish trend became clear, I chose not to upload it. At the same time, the 1.414 butterfly pattern I personally developed was confirmed, further supporting the continuation of the downward trend.

As a result, I have continued to hold the Bitcoin short position that began with the idea on the 11th, and I plan to provide further analysis and idea updates as market movements unfold.

I wish you sound judgment in the market and continued good fortune.

BTCUSDT – Long-term uptrend intact, target 111,666 USDTBitcoin is maintaining a strong bullish structure on the daily chart, having successfully retested the long-term ascending trendline. The support zone around 93,932 USDT — which aligns with a Fair Value Gap (FVG) and trendline — continues to act as a key rebound level, as seen in late April.

The current chart suggests a “pullback–breakout–consolidation” pattern, with the potential for a higher low if price revisits the trendline and FVG once more. The base case: price consolidates around the 98k–100k zone before targeting the major resistance at 111,666 USDT.

On the news front, investor sentiment is stabilizing after the Fed signaled rate hold. Additionally, BlackRock’s ETF has seen three consecutive days of net inflows — a strong tailwind for the bulls.