Trade ideas

#Bitcoin 30 Minutes Chart Scalp profit Update:#Bitcoin 30 Minutes Chart Scalp Profit Update:

That quick scalp move delivered a clean +3.60% — just as planned. Scalp trades are meant for small, fast targets, and this one hit perfectly. ✅

But If Still holding?

🔹 Move SL to Break Even to protect capital

🔹 Structure looks fine for now, but don’t get greedy — manage your risk.

Always trade with a plan.

BTC/USDT 1DAY CHART UPDATE50-day moving average (red line):

This is a short-term trend indicator. It reacts more quickly to price changes and is often used to identify short-term trends.

When the price is above this moving average, it usually indicates bullish momentum; when it is below, it may signal bearish momentum.

200-day moving average (green line):

This is a long-term trend indicator. It provides a smooth moving average that helps identify the overall trend over a long period.

A price above this line indicates a long-term bullish trend, while a price below it indicates a potentially bearish market.

Current Analysis

Price Action: As of the current date, the price is hovering around the 80,000 USDT, just below the 50-day MA, which may indicate a potential resistance area.

Convergence of MAs: The behavior of both the 50-day and 200-day MAs can provide insight:

If the 50-day MA crosses above the 200-day MA (a “golden cross”), this typically indicates a bullish signal.

Conversely, if it crosses below (a “death cross”), this can indicate a bearish sentiment.

Support and Resistance: The chart also shows areas of support (horizontal green lines) around 76,000 to 80,000 USDT. If the price breaks this resistance, it may have room to move towards the next levels indicated.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

BTC/USDT – 30-Min Chart Technical BreakdownBTC/USDT – 30-Min Chart Technical Breakdown

🔺 Pattern Formation:

Price action is currently developing a rising wedge, generally considered a bearish continuation pattern. However, the ongoing Higher High (HH) and Higher Low (HL) structure suggests short-term bullish momentum is still intact.

Key Resistance Levels:

* $84,700 – Major horizontal resistance

* $83,600 – Local supply zone / recent rejection point

Key Support Levels:

* $81,200 – Trendline + structure support (wedge base)

* $78,400 – Secondary structural support

* $74,900 – High-confluence demand zone

Long Setup (High-Risk Trade – Counter to Pattern Bias):

* Entry Zone: $82,500 – $83,000 (wedge support retest zone)

* TP1: $83,900

* TP2: $85,200

* TP3: $87,000 (upper wedge boundary)

* SL: Below $81,100 (wedge break + structural invalidation)

Confirmation Needed:

Watch for bullish engulfing or a strong bounce from the wedge support (red dashed trendline) with solid volume influx.

Risk Note:

Despite current bullish flow, wedge patterns often resolve bearishly. If price breaches below $81,100, invalidate longs and reassess for possible shorting opportunity.

BTC/USDT – Major Breakout Imminent? 🔍 Chart Breakdown:

After weeks of consolidation and lower highs, Bitcoin has finally broken out of a falling wedge – a classic bullish reversal pattern! 🐂 The volume spike confirms the breakout, suggesting strong momentum backing this move.

🔹 Breakout Zone: Around $81,000

🔹 Retest & Bounce: Price respected the previous resistance, now flipped to support.

🔹 Target: 🎯 $108,819

🔹 Stop Loss: 🛑 $78,220

🔹 Risk-to-Reward Ratio: A juicy 4.5R setup!

📈 Technical Confluences:

Falling wedge breakout ✅

Strong horizontal support zone below ✅

High volume breakout ✅

Bullish engulfing candle forming ✅

💬 What’s Your Bias?

Are we seeing the beginning of Bitcoin's next impulsive wave? Or is this just a bull trap? Share your thoughts in the comments! 🧠👇

📢 Smash that Boost button if you caught this breakout early or if you're learning something new! Let’s grow as a trading community 📊❤️

#Bitcoin #BTCUSDT #CryptoTrading #BreakoutStrategy #TechnicalAnalysis #TradingSetup #VolumeConfirmation #CryptoCommunity #PriceAction #FallingWedge

BTCUSDTBitcoin seems poised for a notable shift following the completion of a classic technical setup.

The price has recently pushed above a critical level and appears to be testing this threshold again, a move that often hints at further momentum.

Should this pattern hold, we might see a robust climb toward higher targets, potentially well beyond current levels.

Keep an eye out for signs confirming this direction.

Market Turning Point? Watch 87,533.05 for a Bullish BreakoutThese 3 candle wicks indicate that the bears are no longer in strong control of the market. However, for the market to turn bullish, it is essential to close above the 87,533.05 level on the daily chart. Only after that can the market become bullish in the short term, with potential targets of 96,000 or even 102,682. But sustaining above the 87,533.05 level on a daily basis is crucial.

BITCOIN BULLISH POTENTIALPrice has entered the discount zone near a weak low, signaling a potential reversal as smart money may be accumulating after a liquidity sweep. This area often serves as a launchpad for bullish moves, especially when sell-side liquidity has been taken.

Short-term sentiment is shifting bullish, suggesting momentum could be building for a move upward. With key bearish targets already met, the downward pressure may be fading, setting the stage for a corrective move or full reversal.

If bullish structure forms—such as a break of structure or a bullish order block holding—price could begin climbing toward equilibrium and possibly into premium territory. Look for confirmation through price action and volume shifts.

BITCOIN MAY DROP TO 74K - BEARISH STRUCTURE INTACTSymbol - BTCUSD

CMP - 84600

BTCUSD is undergoing a shift in market structure, transitioning into a bearish phase following the breakdown at 90K. A deeper correction is currently developing, which, in my view, represents a logical and technically sound progression for a healthy market. It is concerning when the market only experiences upward movement driven solely by buying pressure, such as in the case of large-scale injections of funds into high-yield investment programs (HYIPs).

A correction in Bitcoin’s price or even a trend reversal could inject vitality back into the market. From a fundamental perspective, traders have not seen the expected active support for cryptocurrencies from the US, which was previously suggested during Trump's election campaign. Additionally, issues such as crypto exchange hacks, fraudulent coins, and Bitcoin's dominance are exerting negative pressure on altcoins.

Bitcoin’s current downturn, with the possibility of a further drop to the 75K-73K range, could present an opportunity for fundamentally strong altcoins, assuming the declining Bitcoin dominance index also continues to trend downward. The simultaneous reallocation of funds from Bitcoin to altcoins, along with a rebound in Bitcoin from a strong support level, could rejuvenate the prospects for an altcoin season.

Resistance levels: 88150, 90700

Support levels: 75000, 73570, 66830

A modest retracement towards the 88100 to 90700 range is possible before the price begins its descent. While Bitcoin may attempt a deeper pullback, the current market imbalance, coupled with the absence of a clear driving force or supportive factors, suggests that the price may continue to fall in the medium term, potentially reaching the liquidity zone between 75K and 73K

Huge fall in bitcoin, let's play some contra now with small SLHello Traders! In today’s post, we’re looking at Bitcoin (BTC) on the 15-minute chart. The price is currently showing a potential reversal setup, with the market consolidating around 78,000. The recent price action suggests that Bitcoin could either push higher or face further downside depending on how it reacts to this level.

The MACD is showing some Bullish crossver on chart, may be we can see some positive reversal momentum from here, but watch for the price action to confirm whether a reversal is likely. If Bitcoin does not take our stop loss, we could see a move toward 79,892. Stay sharp, and as always, manage your risk effectively!

Disclaimer: This analysis is for educational purposes only. Please consult a financial advisor before making investment decisions.

If you Found this helpful? Don’t forget to like, share, and drop your thoughts in the comments below.

Bitcoin - 140 K in 2025 - 5th wave targetPrice is at technically buying zone - Fib buy zone and also breakout zone and right now double bottom. at any price around this price based on big players buying orders fourth wave will get completed and 5th wave will start. Breakout of resistance red line is confirmation of 5th wave progress. previous resistance areas could give selling pressures due to tax fears and global recession fears. Supporting reasons - Strategic reserve and US Govt is one new player now. what ever buying happening during bear trend will be visible only in data about who is buying like Black Rock, Strategy - Saylor etc. As and when positive mood comes in market BTC will keep bouncing back and price is accumulation area for sure for big players. This is not a time to sell but to accumulate BTC for sure. All tax war will only slowdown the BTC up move but will not fall further much. But still hold long qty with required margins and to be safe keep liquidation levels as 73 at least to be safer to avoid any big liquidation candle in case any exchange liquidate retail people's holdings. US Strategic reserve data is awaited. Every Monday Saylor in his X profile posting his purchases and Black Rock too seen buying BTC last several days or weeks, Price is dropping since loose hands sell in fear. As per data, spot buyers didnt sell at all. Its only traders with 50x or 100x moving the market.

BTCUSDTHello Traders,

Bitcoin’s price action is currently respecting key volume levels, aligning with market auction theory. This concept suggests that price tends to rotate between value area high (VAH) and value area low (VAL), using the point of control (POC) as a midpoint. With price recently rejecting the VAH, the probability of a move lower has increased.

Key Technical Points:

• Market Auction Theory: Price typically rotates between VAH and VAL, with the POC acting as a key pivot.

• Current Price Structure: The VAH at $88,200 has seen rejection, increasing the likelihood of a move toward the POC at $67,200.

• Volume Profile Insight: Declining volume suggests consolidation is nearing its end, with an expected volume spike driving the next major move.

If Bitcoin loses the POC at $67,200, it significantly increases the probability of a full rotation down to the VAL at $49,500, completing the auction cycle. However, a bounce from POC could provide short-term support before the next major move develops.

For now, Bitcoin is consolidating, but the volume profile suggests a breakout is imminent. Traders should monitor key levels closely, as an influx in volume will likely dictate the next major directional move.

Bitcoin Short played out perfectly and Down 7%Bitcoin Short played out perfectly.

Price respected the SMC chart structure — 4H candle failed to close above FVG + -OB zone.

Post Trump Tariff news, market triggered high-leverage stop hunts with a fake pump before a sharp dump.

📉 Entry: $88,440 ✅

📈 Exit: $82,200 ✅

✅ ~7% move captured. Trade closed in profit.

BTC - 3rd April 2025 At Support now - Good to buy long qty nowBTC looks good to buy long qty at previous support zone of 82200 to 81300 zone. In 2 days US Govt going to announce how much crypto they have now and what they did last few days after announcing strategic reserve. At least for again 88 or 89 K levels looks possible from there. By next week or this april month all tax fears will fade. And good change for this weekend NFP and other data could take importance for new trend. Use this view for educational purpose and consult ur advisor or take your own decision for taking trades.

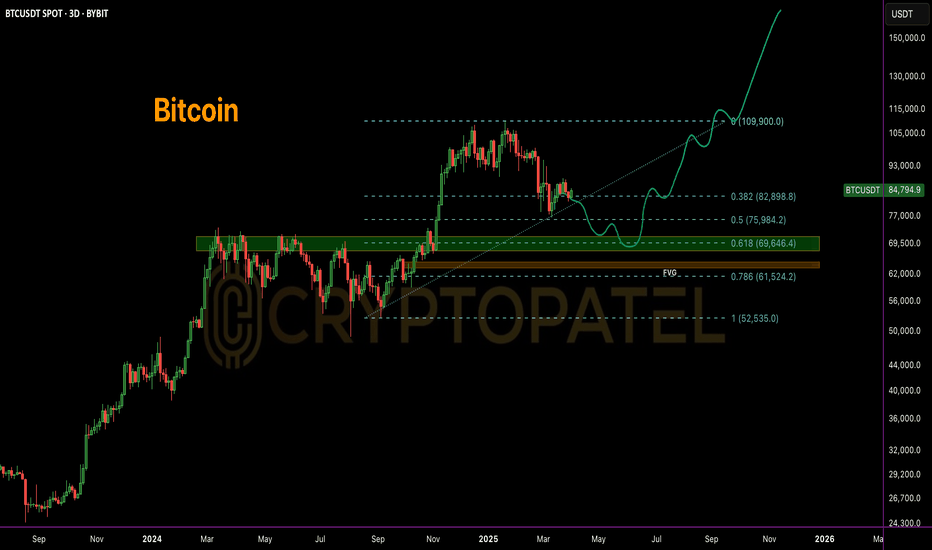

Bitcoin Next move?#Bitcoin reclaimed $85,000, but structurally a deeper retrace remains possible.

Classic TA suggests sustainable rallies often revisit key Fib levels:

1⃣ 0.618 Fib: $69,646

▪️ FVG: $75,582 – $69,916

2⃣ 0.786 Fib: $61,524

▪️ FVG: $64,789 – $63,435

A sweep of these zones could fuel the next leg toward $150K–$180K.

#BTC CRYPTOCAP:BTC

BTC for long on 4 hour - if condition metHere's the analysis of chart:

Bitcoin (BTC/USDT) 4-Hour Chart Analysis

1. Price Action & Trend

o The price is currently at $82,823.27, showing a minor decline of -0.35%.

2. Liquidity Zone & Key Support Levels

o A liquidity zone has been identified, as mentioned in the chart text.

Buying Condition - If a 4-hour candle closes below this level and the next candle forms a strong bullish reversal, it may signal a buying opportunity.

o The near support $81,000 is a significant support area, aligning with the major trendline support.

3. Volume & Market Strength

o Volume is relatively low, which suggests that current price movements might lack strong momentum.

o A volume increase near support or resistance levels could indicate a decisive move.

Trading Outlook

• Bullish Scenario: If BTC holds above the liquidity zone and prints a strong green candle, it could move higher towards $84,000 - $86,000 - $90,000

• Bearish Scenario: A breakdown below liquidity support could lead BTC to test the $78,000 region before finding strong demand.

Follow me for more such ideas.

This analysis is for educational purposes only and should not be considered financial advice. Trading involves significant risk, and past performance does not guarantee future results.

Disclaimer - Before entering any trade, ensure that all criteria and conditions outlined in the analysis are met. Always use a stop-loss to protect your capital and apply proper risk management strategies. Trade responsibly and at your own discretion.

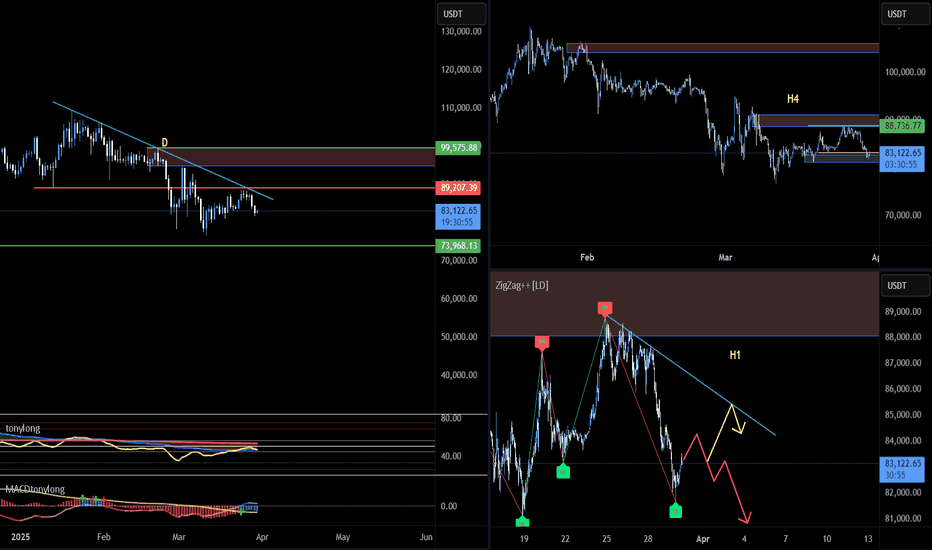

BTC23: BTC falls again. Testing support or finding a new bottom?📊 BINANCE:BTCUSD continued to decrease again in the past 2 days. Let's evaluate and look for opportunities through the multi-timeframe perspective below BINANCE:BTCUSDT :

🔹 **D Frame**: Before the price decrease in the past 2 days, we can see that although BTC had a recovery phase before, the fake decrease structure has not been broken yet.

🔹 **H4 Frame**: The keylever zone has been broken as marked on the chart, however, this is the first decrease after the increase wave in the past days, so it will need clearer confirmation.

🔹 **H1 Frame**: Currently, the price is reacting to the support zone of 81~83k. However, the price is still in a downward wave if looking at the price structure.

🚀 **Trading plan:*

📌 At the present time, we can look for a SELL position in line with the main trend in diagonal resistance areas to look for a trading position in line with the main trend. The current price is at an important support area, so it is no longer suitable to SELL at this time. BUYing in this area is not recommended when the downtrend has not shown any signs of ending. We will have to wait for a clearer signal from the price structure to properly assess the effect of the current support area.

💪 **Wishing you success in making a profit!**

Bitcoin - Buy for Target 90 KBitcoin is showing bullish pattern and right now taking support at key technical level from where its expected to move up for next target of 90K. view are shared well in advance or in quick mode before waiting for confirmation which will delay the chart and good move will be missed. Price should hold this current support area of 83600 to 83700 area and failing which this view will be cancelled. use this view for educational purpose or to take your own decision and this is not a financial advice. Market is big and like many i am also trying my best to predict the next price move and to share my view with others. Likes, comments are welcome. Thanks

BTC to touch 70K if it breaksdown from this zoneTechnical analysis on the 4-hour chart suggests forming a bearish flag pattern—a continuation pattern that typically indicates a pause before the prevailing downtrend resumes.

If the current bearish flag pattern breaks down, Bitcoin's price could potentially decline to around $70,000. Such projections are based on technical analyses that consider factors like weak support levels and historical price movements.