Trade ideas

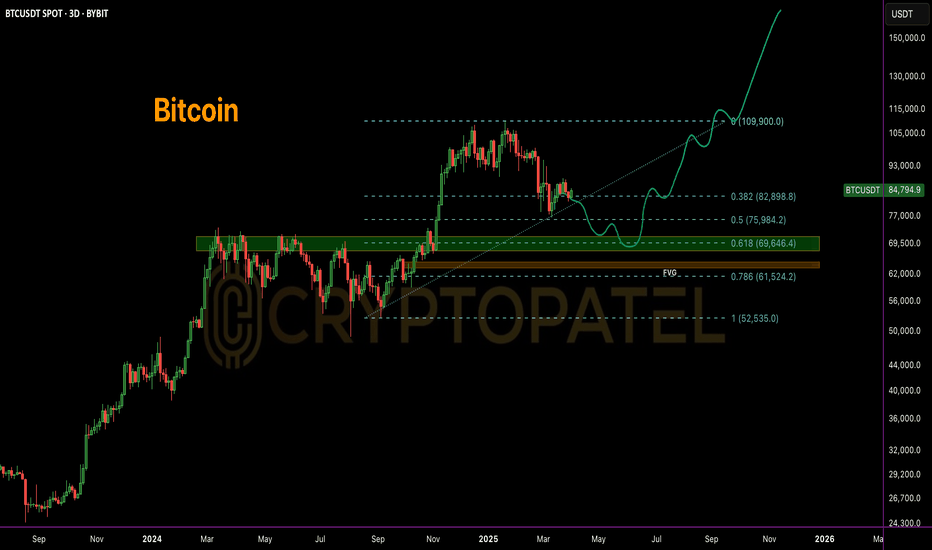

Bitcoin Next move?#Bitcoin reclaimed $85,000, but structurally a deeper retrace remains possible.

Classic TA suggests sustainable rallies often revisit key Fib levels:

1⃣ 0.618 Fib: $69,646

▪️ FVG: $75,582 – $69,916

2⃣ 0.786 Fib: $61,524

▪️ FVG: $64,789 – $63,435

A sweep of these zones could fuel the next leg toward $150K–$180K.

#BTC CRYPTOCAP:BTC

BTC for long on 4 hour - if condition metHere's the analysis of chart:

Bitcoin (BTC/USDT) 4-Hour Chart Analysis

1. Price Action & Trend

o The price is currently at $82,823.27, showing a minor decline of -0.35%.

2. Liquidity Zone & Key Support Levels

o A liquidity zone has been identified, as mentioned in the chart text.

Buying Condition - If a 4-hour candle closes below this level and the next candle forms a strong bullish reversal, it may signal a buying opportunity.

o The near support $81,000 is a significant support area, aligning with the major trendline support.

3. Volume & Market Strength

o Volume is relatively low, which suggests that current price movements might lack strong momentum.

o A volume increase near support or resistance levels could indicate a decisive move.

Trading Outlook

• Bullish Scenario: If BTC holds above the liquidity zone and prints a strong green candle, it could move higher towards $84,000 - $86,000 - $90,000

• Bearish Scenario: A breakdown below liquidity support could lead BTC to test the $78,000 region before finding strong demand.

Follow me for more such ideas.

This analysis is for educational purposes only and should not be considered financial advice. Trading involves significant risk, and past performance does not guarantee future results.

Disclaimer - Before entering any trade, ensure that all criteria and conditions outlined in the analysis are met. Always use a stop-loss to protect your capital and apply proper risk management strategies. Trade responsibly and at your own discretion.

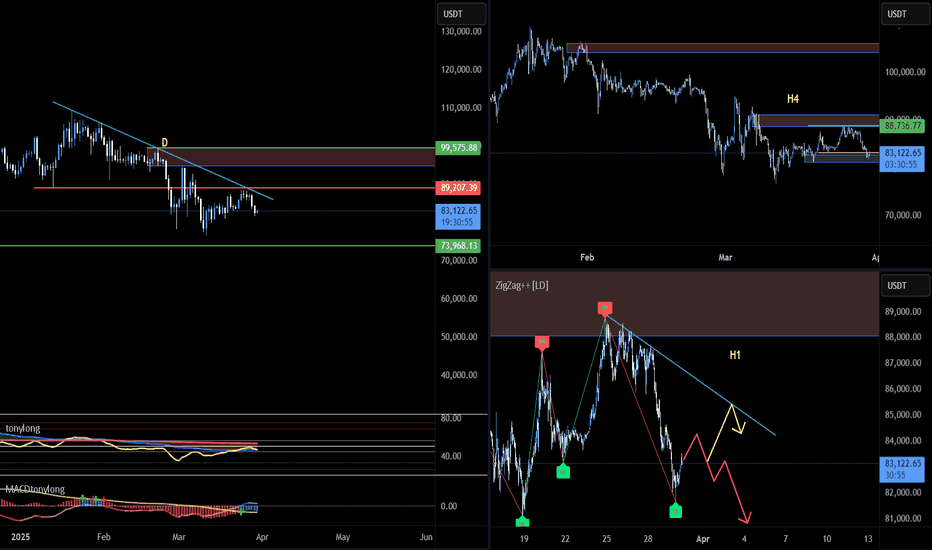

BTC23: BTC falls again. Testing support or finding a new bottom?📊 BINANCE:BTCUSD continued to decrease again in the past 2 days. Let's evaluate and look for opportunities through the multi-timeframe perspective below BINANCE:BTCUSDT :

🔹 **D Frame**: Before the price decrease in the past 2 days, we can see that although BTC had a recovery phase before, the fake decrease structure has not been broken yet.

🔹 **H4 Frame**: The keylever zone has been broken as marked on the chart, however, this is the first decrease after the increase wave in the past days, so it will need clearer confirmation.

🔹 **H1 Frame**: Currently, the price is reacting to the support zone of 81~83k. However, the price is still in a downward wave if looking at the price structure.

🚀 **Trading plan:*

📌 At the present time, we can look for a SELL position in line with the main trend in diagonal resistance areas to look for a trading position in line with the main trend. The current price is at an important support area, so it is no longer suitable to SELL at this time. BUYing in this area is not recommended when the downtrend has not shown any signs of ending. We will have to wait for a clearer signal from the price structure to properly assess the effect of the current support area.

💪 **Wishing you success in making a profit!**

Bitcoin - Buy for Target 90 KBitcoin is showing bullish pattern and right now taking support at key technical level from where its expected to move up for next target of 90K. view are shared well in advance or in quick mode before waiting for confirmation which will delay the chart and good move will be missed. Price should hold this current support area of 83600 to 83700 area and failing which this view will be cancelled. use this view for educational purpose or to take your own decision and this is not a financial advice. Market is big and like many i am also trying my best to predict the next price move and to share my view with others. Likes, comments are welcome. Thanks

BTC to touch 70K if it breaksdown from this zoneTechnical analysis on the 4-hour chart suggests forming a bearish flag pattern—a continuation pattern that typically indicates a pause before the prevailing downtrend resumes.

If the current bearish flag pattern breaks down, Bitcoin's price could potentially decline to around $70,000. Such projections are based on technical analyses that consider factors like weak support levels and historical price movements.

btc is breaking out On the 1-hour timeframe (1H TF):

Resistance at 85.5K: This level is acting as a short-term hurdle where price is facing selling pressure. If the price struggles to break above this zone, it could indicate a potential pullback or consolidation.

Major Resistance at 86K: A key psychological and technical level. If price breaches this level with strong volume, it could signal bullish continuation. However, repeated rejections here may indicate distribution.

Next Resistance at 87K: This serves as the next upside target. If price clears 86K, momentum could drive it toward 87K, where sellers may step in again.

A break and close above 87K on strong volume could confirm a bullish trend, while rejections at these levels might lead to pullbacks or consolidation before another breakout attempt.

Bitcoin - BUY for Targets - 90, 92 & 95KIn chart, price has given breakout of immediate resistance line and retested and price moving up. price move clearly indicating bullish and up move. Fib Levels and resistance lines indicating first target at 90K and on breakout possibility of 92 and 95 K as per fib levels. But first move towards 90K is visible in chart. Other Cryptos - ETH and SOL super bullish after good accumulation clearly indicating up move. Hope and wish this move is quicker !!!!

Elliott Wave Analysis: Short Position

Based on the Elliott Wave theory, the chart indicates a potential short position. The entry point is set at. The target price is projected at 81,400, suggesting a minimum downside potential. This setup aligns with the wave patterns, indicating a bullish trend continuation.

BTCUSDT EA MAN UPDATE > READ THE CHAOTAIN **BTCUSDT EA MAN Update – Analysis in English**

---

### **BTC/USDT Analysis (15 min) – Bullish Trend in Sight**

#### **Key Observations:**

- **FVG Support Zone (Fair Value Gap):** The price has reacted positively to this zone and is showing signs of a bullish recovery.

- **EMA Confluence:** The price is currently below the 30 EMA (red), but a breakout above could confirm stronger bullish momentum.

- **Target Point:** The analysis anticipates a move towards **85,104 USDT**, possibly after a slight pullback to test the support zone.

If the price sustains above the 30 EMA and breaks through the minor resistance, the bullish target seems achievable.

(BTC/USDT) Analysis: Supply Zone Rejection & Potential Drop Key Technical Levels:

Supply Zone (~85,296 - 84,835):

The price has reached a supply zone, which is acting as resistance. A rejection from this area could push BTC down.

Support Zone (~82,260 - 81,977):

This is a demand area where buyers might step in if the price declines.

Indicators:

EMA 30 (Red Line - 83,553.82): Short-term trend indicator.

EMA 200 (Blue Line - 83,743.52): Long-term trend indicator, currently above the price, indicating potential resistance.

Price Action & Prediction:

The price has touched the supply zone and is showing signs of rejection.

The blue projected path suggests a potential pullback followed by a drop toward the support zone (~82,260).

If price breaks below the support zone, further downside could be expected.

Potential Trade Idea:

Short Setup: If rejection at the supply zone continues, a short position could target the 82,260 support zone.

Long Setup: If price reaches the support zone and shows bullish reactions, a long position could aim for a rebound toward resistance.

BitCoin: A new Move about to start.BitCoin has been consolidated for the last 6-8 months in a channel shown in the graph.

As per prediction it is about to break that range and will move towards new and higher highs.

As per the chart and pattern structure in this current move it can go up to 100K easily and more above levels will be unlocked after that

SL must be 56k.

Targets 100k - 120k

Time range 8-10 months

it does not constitute and cannot replace investment advice. We therefore recommend that you contact your personal financial advisor before carrying out specific transactions and investments.

BTC - Triangle or Wedge - Bullish?2 views are there. Ascending Triangle - Bullish and Rising Wedge - Bearish. Price is making HL and never closed even once below previous HL indicating price is in Bullish trend. Weekend price bounced with huge volume and 85 to be watched today. if its taken with strong green bars then price will fly upside. view changes if previous HL is broken un till then buy the dips is the safe trade. But in 2025 and later its going to see new ATH as we have new buyer US Govt forming strategic reserve and not to sell from govt side. Investors are having Golden opportunity to invest and hold for few weeks to months to see higher levels for Bitcoin

Bitcoin (BTC/USDT) Short Trade Setup | 30-Min Chart AnalysisThis chart is a Bitcoin (BTC/USDT) 30-minute timeframe trading setup from Binance on TradingView, showing a short (sell) trade setup with a stop loss, entry, and multiple take profit (TP) levels.

Key Observations:

Indicators Used:

200 EMA (blue line at 83,177.82 USDT) – Long-term trend indicator.

30 EMA (red line at 84,064.45 USDT) – Short-term trend indicator.

Trade Setup:

Entry: 84,423.01 USDT

Stop Loss: 85,315.76 - 85,330.89 USDT (Above the recent high)

Take Profit Levels:

TP1: 84,064.45 USDT

TP2: 83,953.94 USDT

TP3: 83,439.48 USDT

Final Target: 81,850.69 USDT

Market Context:

Price recently tested the 30 EMA and is potentially rejecting it.

Bearish outlook: If price fails to break higher, it may drop to TP levels.

Risk-to-Reward Ratio (RRR): Favorable

Bitcoin (BTC/USDT) 1-Hour Chart Analysis

Bitcoin is currently in a pullback phase after reaching a local high, showing signs of short-term weakness. The price action reflects a clear upward trend supported by higher lows and strong buyer interest, but recent rejection at a resistance zone indicates profit-taking and potential short-term selling pressure.

A key support zone lies below the current price level, marked by increasing volume and a station level where buyers are likely to step in. If the price holds this support, a continuation of the bullish trend could follow, targeting the previous resistance zone. However, if the support fails, a deeper correction toward lower demand levels is possible.

Market sentiment is mixed — short-term signals show bullish strength, while higher timeframes remain cautious. The next key move depends on whether buyers defend the support zone and push through the overhead resistance. A confirmed breakout above resistance could drive the next upward leg, while a breakdown below support could shift momentum back to the bears.

Bitcoin - At Neckline 15th MarchPrice is testing neckline of head and shoulder. Market is divided and not one sided as fear of 77K is still in market. But price at neckline few taking bullish view. Buy only if price move above neckline zone and in my view right now price could be trapping the late bulls. Sell once break out fails as price move drift down from neckline zone. US policy on Stablecoin making all crypto bearish and Bitcoin on top of strategic reserve news price could test lower level again as no one know how much is being bought on daily basis right now by US Govt.

Bitcoin (BTC/USDT) 2-Hour Chart Analysis

Bitcoin is showing signs of recovery on the 2-hour chart after forming a local bottom at a key support zone. The price has bounced from a strong demand area, supported by increased buyer activity, and is currently attempting to push higher within a rising channel. The formation of higher lows (HL) and higher highs (HH) suggests that bullish momentum is building in the short term.

Despite this upward movement, the overall trend remains bearish, indicated by the dominance of red moving averages and the presence of strong resistance overhead. A major resistance zone sits above the current price level, marked by significant volume and selling pressure. The sentiment remains bearish, as confirmed by the red signal on the sentiment panel, although JASMINN AI and regression tools are showing early signs of potential upward strength.

If the price manages to break above the resistance zone and hold, the next upside target lies near the destination levels identified on the chart. However, failure to maintain upward momentum could result in a pullback toward the previous support zone, where buyers are likely to step in again. The key to further upside will be a decisive break and close above the resistance, supported by rising volume and bullish momentum. The overall market outlook remains cautiously bullish in the short term but within a larger bearish trend.

Bitcoin (BTC/USDT) 1-Hour Chart Analysis

Bitcoin is showing signs of bearish pressure on the 1-hour chart after a recent rejection from a key resistance zone. The market structure reflects a mixed trend, with signs of higher and lower lows indicating ongoing volatility. A recent break of structure and expansion suggest that the market is at a turning point.

There’s a clear resistance zone where sellers have stepped in, creating strong selling pressure. On the other hand, a support zone below shows signs of buyer interest, which could act as a floor if the price continues to decline. The equilibrium point near the middle of this range represents a potential decision area for future price movement.

Market sentiment remains bearish across multiple timeframes, reinforcing the downside bias. If the price continues to reject resistance, it could drop toward the support zone, with further downside possible if buyers fail to hold the level. Conversely, a breakout above resistance could signal renewed bullish momentum and lead to higher levels. The current outlook remains bearish, with selling pressure dominating near resistance and moderate buyer interest at support.

Will BTC retest the 85k breakout and continue to fall ? BTC seems to retest the breakout zone of triangle pattern, for me this looks a high probability setup. Good risk to reward ratio potential in this trade.

I will enter this trade only if I see a good bearish engulfing pattern indicating reversal from the breakout area of 85k. ( on 1HR TF )

This will signal a successful retest and continuation towards 75k as my target.

This is my idea according to my analysis and not a trading advice, Please DYOR before taking any trade.

BITCOIN - THE FALL CONTINUESSymbol - BTCUSDT

CMP - 86200

Bitcoin is currently in a sell zone. Despite Trump's comments on the Federal Reserve and the recent Crypto Summit, these events have not had a substantial impact on the cryptocurrency market, aside from triggering a global disruption and liquidation.

So far, the market has failed to exhibit a clear bullish catalyst. Trump's statements regarding the policies related to tariffs led to a global shakeup, resulting in market liquidation. Additionally, the Crypto Summit held yesterday was unable to reverse the negative momentum, preventing the market from entering a positive phase.

From a technical perspective, global growth has temporarily stalled, and Bitcoin is now entering a significant correction phase, with 73K remaining the primary target. The market is in dire need of liquidity, as sustainable growth cannot be achieved at the expense of buyers or solely through perpetual bullish leverage.

Currently, the price is moving within a range of 90K to 82K after exiting the global consolidation phase. A false break above the 91K resistance, which had served as support during the consolidation, has resulted in a decline, potentially continuing to the 82K and 73K levels.

Resistance Levels: 89400, 91000, 93000

Support Levels: 82000, 78000, 73000

The critical liquidity zone lies between 73K and 66K. The price action suggests a false break of resistance, with an imbalance of forces favoring the bears. As such, the first potential stop is likely to be around the 82K range, marking the lower boundary of the current range. Moving forward, it is essential to observe the market's reaction to this support level. Should the market consolidate, break down, and then consolidate further below 82K, this could signal a deeper decline toward lower targets.

Despite the favorable fundamental backdrop created by US politicians, who hold considerable influence over the cryptocurrency market, the price continues to fall.

Eliot wave count indicating long Elliott Wave Analysis: Long Position

Entry Point: 84,400

Stop Loss: 81,950

Target Price: 90,000

Based on the Elliott Wave theory, the chart indicates a potential long position. The entry point is set at 84,400, with a stop loss at 81,950 to manage risk. The target price is projected at 90,000, suggesting a significant upside potential. This setup aligns with the wave patterns, indicating a bullish trend continuation.

If this analysis proves accurate and you find it helpful, you can support my work with a donation via UPI - dineshhoney001@okicici