CHFEUR trade ideas

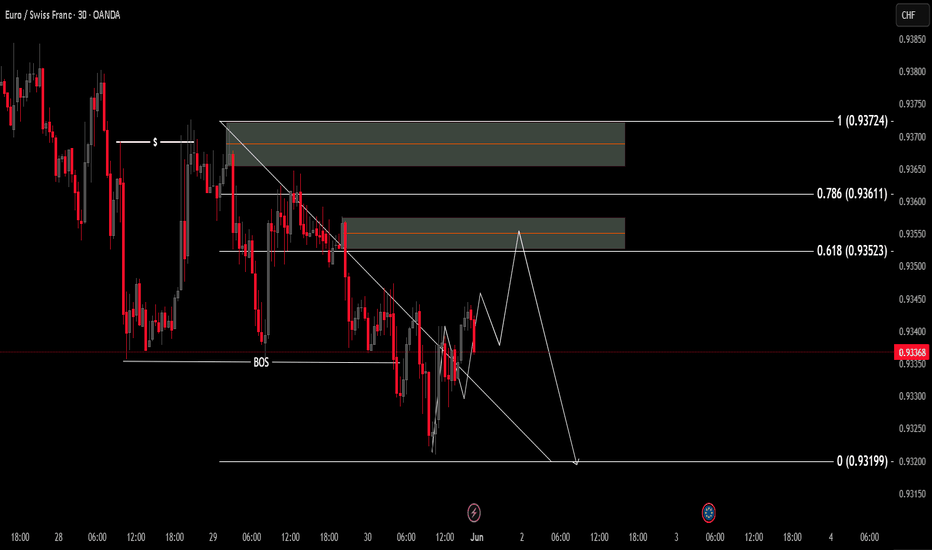

EURCHFNEXT WEEK READY FOR SHORT AFTER CONFRMATION Borrow the asset (usually from a broker).

Sell it immediately at the current market price.

Wait for the price to drop.

Buy it back at the lower price.

Return the borrowed asset and keep the difference as profit.

Example:

You short a stock at $100.

The price drops to $80.

You buy it back and return it.

You make a $20 profit per share.

Risks:

Unlimited losses if the price rises instead of falls.

Requires margin and may incur fees.

Let me know if you want a version tailored for beginners, crypto, or professional use.

EUR/CHF Technical Outlook – Potential Bullish Reversal Setup📈 Pair: EUR/CHF

📆 Date: May 27, 2025

📊 Timeframe: Daily (D1)

📌 Technical Highlights:

🔹 Current Price: 0.93456

🔹 Key Indicators:

50 EMA (Red): 0.93824

200 EMA (Blue): 0.94342

🧠 Chart Analysis:

🔻 Downtrend Resistance Line: A clear descending trendline is pressing price lower, reinforcing a bearish structure since March.

🟣 Reversal Zone (Support Area):

Price is currently hovering just above the marked Reversal Point, a demand zone between 0.93000–0.93400. Historically, this zone has acted as a launch pad for upward momentum.

🟪 Resistance Level:

Located around 0.94300–0.94600, this zone is reinforced by the 200 EMA, making it a critical breakout area. A strong bullish close above this region could invalidate the downtrend.

🔄 Two Scenarios to Watch:

✅ Bullish Breakout Scenario:

Price may bounce from the reversal zone.

A break and retest above the resistance level could lead to bullish continuation toward 0.9500–0.9550.

Confirmation above the 200 EMA will add confidence to the breakout.

📈 Potential Buy Entry: On breakout and retest of 0.9450

🎯 Target: 0.9550

🛡️ Stop Loss: Below 0.9320

❌ Bearish Continuation Scenario:

If price fails to hold above the reversal point, sellers may regain control.

A breakdown below 0.9300 could trigger further downside toward 0.9200 or lower.

📉 Sell Setup Invalid Until: Price closes below 0.9300 on strong volume.

🧭 Conclusion:

This chart suggests a critical decision point for EUR/CHF. A bounce from the reversal zone followed by a confirmed break above resistance could signal the start of a medium-term uptrend. Traders should monitor price action closely for confirmation signals near the trendline and EMA zones.

🚦 Bias: Neutral to Bullish, awaiting confirmation

🧠 Tip: Watch for candlestick patterns (like bullish engulfing or pin bars) near the support zone for early entries.

EURCHF LONGHey everyone

Im looking for a Buy after we break the Daily/4H resistance and retest from it but also we have mulitple confirmation:

1) Daily bullish, 4h bullish

2) after we break above our daily support we went down to retest our 61.80% Fib level

3) break our counter trend line and retest it

4) we need to break above our Daily/4H resistance level and wait for an engulfing bullish 1h/30 and then will get in

Good luck!!

EUR/CHF Bullish Reversal Setup – Support Zone Entry with 1:4 RisThe EMA 200 (blue) and EMA 30 (red) are displayed.

Price is below both EMAs, indicating a bearish trend overall.

However, there's a potential reversal or retracement trade being considered.

2. Trade Setup (Long Position):

Entry Point: 0.92750

Stop Loss: 0.92526 (about 22.4 pips below entry)

Target (Take Profit): 0.93643 (about 89.3 pips above entry)

Risk-Reward Ratio (RRR): Approx. 1:4, which is favorable

3. Support & Resistance:

The entry zone is based on a demand/support area where price previously bounced.

The target

EURCHF - BEARS ARE READY TO PUSH PRICE LOWERSymbol - EURCHF

CMP - 0.9397

EURCHF has breached its trend support, disrupting its overall bullish structure. The strengthening of the US dollar is exerting downward pressure on the forex markets.

The fundamental outlook for the Eurozone remains highly negative, primarily due to the policies of the Trump administration and broader US economic conditions, particularly with regard to the ongoing tariff dispute. The strengthening dollar generally creates a challenging environment for the markets.

From a technical perspective, following the breakdown of the uptrend's support, bearish sentiment is solidifying as prices remain within the selling zone, confirming the dominance of the bears.

Key resistance levels: 0.9380, 0.9417

Key support levels: 0.9329, 0.9294

While a retest of the reversal zone at 0.9400 is possible, attention should currently be directed to the 0.9380 level. A sustained consolidation below this level could trigger further downward movement.

EURCHF is turning bullish EURCHF has broken its structure at the level of 0.93930 and has change its character at the level of 0.94200 once it will close above 0.94464 it will show good move toward upside , i have entered long position at the level of 0.93930 with a small stop loss of 0.93648 and i'm targetting the levels of 0.94796, 0.95182, 0.95817 .

EURCHF M15 EURCHF we can buy after IDM taken out and also if price tap on POI zone.

If price broke red zone then we can see more bullish movement.

Wait for price to come to taken out IDM and plan for BUY with LTF confirmation.

Note : - BUY only after IDM taken out

- BUY with LTF confirmation

- ALWAYS TAKE 1% risk per trade.

- Use Risk management and trade accordingly

Strategic Sell Trade Opportunity for EUR/CHF in Forex Market

**Description:**

Dive into the strategic fundamentals behind a buy trade in the EUR/CHF currency pair. This trade idea leverages the economic strengths and monetary policies of the Eurozone and Switzerland, providing insights into the potential bullish momentum for EUR/CHF.

**Fundamental Analysis:**

The Eurozone's economic outlook has been showing signs of resilience, with improving GDP growth rates, lower unemployment, and steady consumer confidence. The European Central Bank (ECB) has maintained accommodative monetary policies, which support economic growth and inflation targets.

In contrast, Switzerland, known for its strong currency and safe-haven status, has faced challenges with low inflation and slower economic growth. The Swiss National Bank (SNB) continues to implement negative interest rates and intervene in the forex market to curb excessive appreciation of the Swiss Franc, which can hamper export competitiveness.

These diverging economic conditions and monetary policies between the Eurozone and Switzerland create a fundamental case for a potential bullish move in EUR/CHF. Investors may find the Euro more attractive relative to the Swiss Franc, driving the pair higher.

**Disclaimer:**

Trading forex, including the EUR/CHF pair, involves significant risk and may not be suitable for all investors. The high leverage associated with forex trading can result in substantial losses, and past performance is not indicative of future results. It is crucial to conduct your own research, consider your risk tolerance, and seek advice from independent financial advisors before making trading decisions.

EURCHF - Short Trade IdeaSymbol - EURCHF

EURCHF is currently trading at 0.97300

I'm seeing a trading opportunity on sell side.

Shorting EURCHF pair at CMP 0.97300

I will be adding more if 0.97550 comes & will hold with SL of 0.97800

Targets I'm expecting are 0.96300 - 0.96000

Disclaimer - Do not consider this as a buy/sell recommendation. I'm sharing my analysis & my trading position. You can track it for educational purposes. Thanks!

EURCHFLooking very interesting. How I see is after longer period of price consolidating it has finally dropped and that showed us that sellers are willing to step into the market. The only thing I do not like is a pullback into the sell zone so we have to look at the smaller timeframes for confirming our bias. As you know for me that is 15min. Maybe tomorrow in the London session we can se a real movement as now it is to late to enter the position - spreads can get very high in later ours due to lack of volume present, brokers, etc... But a very valid set up. If you look at the volume you will also see how much of a bearish volume is present. Let's see what will happen. Trade well,

T

EUR/CHF 4H Analysis: Anticipating a CorrectionThis EUR/CHF 4-hour chart analysis outlines significant market structure shifts and volume imbalances. Key observations include:

Break of Structure (BoS-4h) identified, indicating previous high points.

Change of Character (ChoCh-4h, ChoCh-1h) marks key reversal zones.

Notable volume imbalance around 0.96500, suggesting a potential correction before further upward movement.

Demand zone (DE-1d) near 0.94000 indicates a strong support level.

Watch for a pullback to the volume imbalance zone around 0.96500 before a potential continuation of the uptrend. Contact me for more detailed analysis and updates.

EUR/CHF Analysis: Potential Reversal Zones and Future Price MoveThis EUR/CHF 4-hour chart analysis highlights significant Break of Structure (BoS) and Change of Character (ChoCh) points. The analysis suggests potential reversal zones, indicated by the FVG (Fair Value Gap) levels at 0.95542, 0.95391, 0.94912, and 0.94420. The chart proposes two possible scenarios: a bullish reversal from the 0.95391 level or a deeper pullback to the 0.94420 level before a potential upward movement. Traders should watch these key levels for signs of reversal or continuation in the coming days.

EURCHF - SHORT TRADESymbol - EURCHF

EURCHF is currently trading at 0.98895

I'm seeing a trading opportunity on sell side.

Shorting EURCHF pair at CMP 0.98895

I will be adding more if 0.99280 comes & will hold with SL of 0.99800

Targets I'm expecting are 0.97745 - 0.97050

Disclaimer - Do not consider this as a buy/sell recommendation. I'm sharing my analysis & my trading position. You can track it for educational purposes. Thanks!