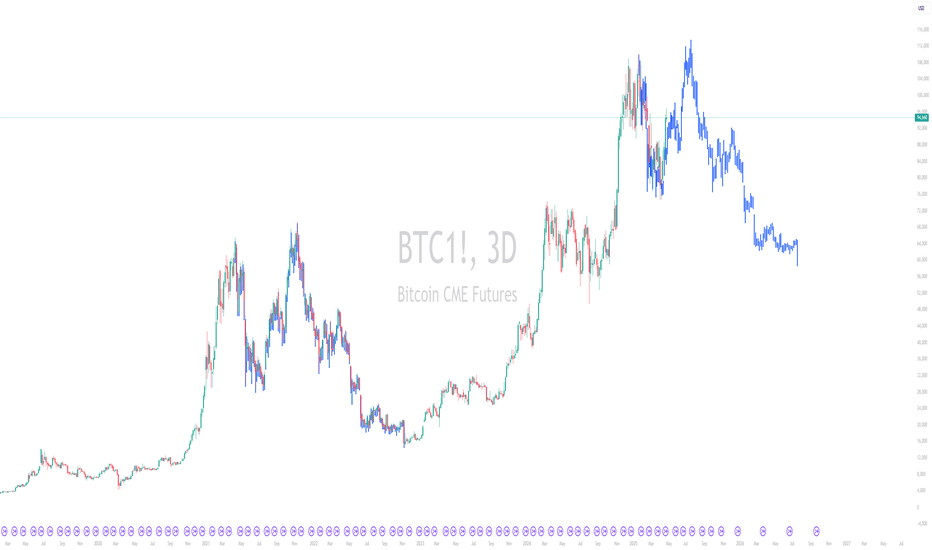

Bitcoin Next move $70k or $120k?CRYPTOCAP:BTC Is About to Bounce From the Level Everyone Is Ignoring

CME Gap 👉 $91,170

FVG below 👉 $89,020

Both zones = liquidity magnets.

No upside CME gaps left… only 1 upside FVG at $120,370

My view:

Fill → Sweep → Strong bounce expected from $89K–$91K range.

Next major draw = $120K FVG.

NF

Related futures

BITCOIN CME Gap Alert: CME GAP around $91000BITCOIN CME Gap Alert:

As per CME chart, Bitcoin still has an unfilled gap between $91,970 – $92,730.

In my opinion, BTC must revisit around $91,970 to fully close this gap.

Price usually returns to CME gaps because they act as liquidity zones and market inefficiencies, the market tends to fill th

Survival First, Success LaterThere was once a stone that lay deep in the heart of a flowing river.

Every day, the water rushed past it, sometimes gently, sometimes with force. The stone wanted to stay strong, unmoved. It believed that by holding its ground, it could outlast the river.

For years, the stone resisted. It didn’t

Short Bitcoin

### 📉 Micro Bitcoin Futures (MBT1!) - 4H Chart Analysis 🕵️♂️

**Current Price:** $83,725

**Chart Type:** 4H (CME Futures)

---

### 🔍 Market Context:

- MBT is currently facing resistance at the **200 EMA** and the marked **supply zone** around **$84,000–$86,300**.

- After failing to break this r

Target for Bear Market FVGs = Fair Value Gaps can hold as Liquidity Zone.

Plus, this market looks exactly like the Dotcom. Any project that includes crypto, blockchain, layer,.... just shoot the sky with billions upon billions of dollars.

With all the hypes, they die out eventually. Pepe: billions of MC, Doge, Shib....

th

Bitcoin Mini Future Bearish Price ActionAfter the accelerated fall post breakdown of horizontal channel, the price dropped to fill the gap and bounced back.

The bounce took price back into the horizontal channel but the price slid out of it.

Then price dropped towards the gap and bouncing just above it.

The price tried to enter the hor

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Bitcoin Futures (Dec 2025) is 87,690 USD — it has fallen −4.84% in the past 24 hours. Watch Bitcoin Futures (Dec 2025) price in more detail on the chart.

The volume of Bitcoin Futures (Dec 2025) is 2.05 K. Track more important stats on the Bitcoin Futures (Dec 2025) chart.

The nearest expiration date for Bitcoin Futures (Dec 2025) is Dec 26, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Bitcoin Futures (Dec 2025) before Dec 26, 2025.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Bitcoin Futures (Dec 2025) this number is 23.18 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Bitcoin Futures (Dec 2025) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Bitcoin Futures (Dec 2025). Today its technical rating is strong sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Bitcoin Futures (Dec 2025) technicals for a more comprehensive analysis.