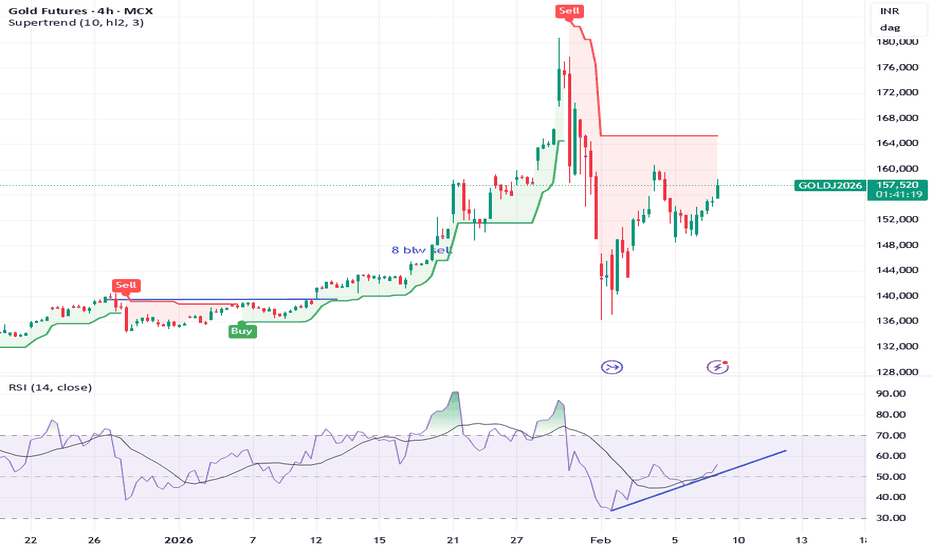

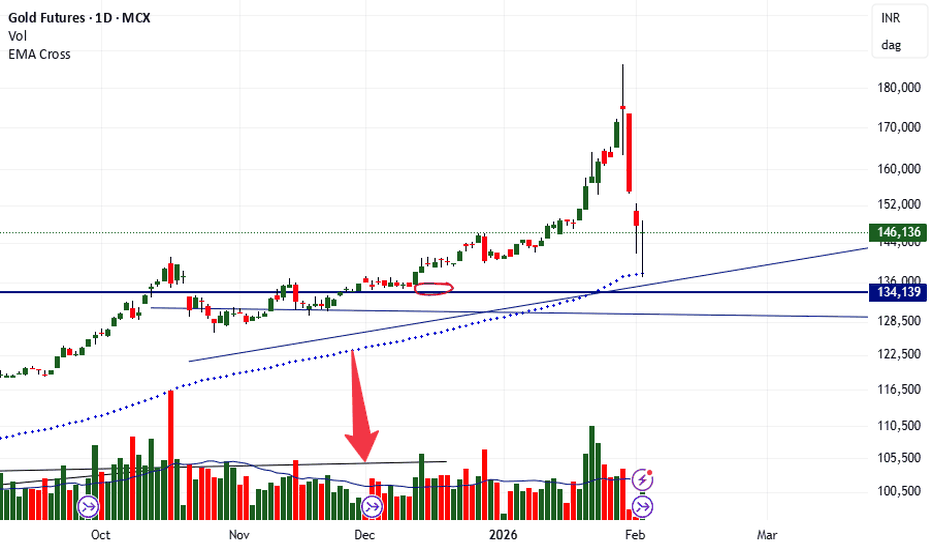

mcx gold update weekly forecastmcx gold eyes on 161000 if market sustain above or close above than will see 167--171000 or above 173000 see 185000++++ soon where support find 154000--154500 if hold below than down side 152--151000 possible rock hard hurdle 147--146000 if close below than down side 141--139--135000++. that's wide

Gold Futures (Oct 2026)

No trades

Contract highlights

Related commodities

MCX Gold — Halt Complete. Expansion LoadingPrice: ~₹1,56,000

Structure: Impulse → Liquidity Flush → Higher Low → Compression

Gold did not reverse.

It reset.

The intraday chart shows a classic stop-hunt below ₹1,52,000 followed by aggressive absorption.

The daily chart confirms the 0.5 retracement at ₹1,48,470 held with precision. That leve

GOLD PRICE$ forecastgold huge discount price central banks still buying gold.dollar index is still weak.japanese yen is more weaker one of the big player of U$ BOND holder incase japan sells U$ bond dollar more bearish. only safe heaven asset in the entire world. the geopolitical tension is more chaos. #epstinfiles

Role of FII and DII in the Indian Stock MarketIntroduction

The Indian stock market is one of the fastest-growing capital markets in the world and attracts investments from both domestic and global participants. Among the most influential players in this ecosystem are Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (

How ₹2 Lakh Can Be Invested in Gold & Silver Using SIP + GTTLet’s take a simple example of an investor who wants to invest ₹2,00,000 in Gold and Silver, but does not want to invest everything at one price.

Instead of predicting the bottom, the investor follows a rule-based SIP + GTT (dip buying) strategy.

📉 Market Context (At the Time of Planning)

Gold h

GOLD FUTURERS :Shooting star Candle shows exhaustion Buy on DipsGOLD Futurers : It has formed a Shooting Star at resistance shows exhaustion at higher levels. Expect a pullback towards 158000-151000.

Trend for Gold MCX remains bullish, but a Shooting Star at resistance signals a short-term pullback

As per Fib retracement and EMA Levels i will be a buyer at the f

Possibility of some cooldown on GOLD for few months.Possibility of some cooldown on GOLD for few months.

Gold after Rally to ATH of 165000+ looks reached on top end of the Channel ... Possibilities are it can consolidate near 170-175K Level for few weeks before providing new direction to the commodity.

LTP - 164K

Range 150K to 175K.

View - Cautio

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Gold Futures (Oct 2026) is 5,102.5 USD / APZ — it has risen 1.91% in the past 24 hours. Watch Gold Futures (Oct 2026) price in more detail on the chart.

The volume of Gold Futures (Oct 2026) is 100.00. Track more important stats on the Gold Futures (Oct 2026) chart.

The nearest expiration date for Gold Futures (Oct 2026) is Oct 28, 2026.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Gold Futures (Oct 2026) before Oct 28, 2026.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Gold Futures (Oct 2026) this number is 5.11 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Gold Futures (Oct 2026) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Gold Futures (Oct 2026). Today its technical rating is buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Gold Futures (Oct 2026) technicals for a more comprehensive analysis.