Copper Futures (Feb 2026)

No trades

Contract highlights

Related commodities

MCX COPPER: RSI Overheated – Prepare for the Final ClimaxTicker: COPPER1! Timeframe: Weekly (1W)

Key Observations

1. Wave Structure

MCX Copper is mirroring the global structure, confined within a perfect rising channel.

The market is in the final stages of Wave 5.

2. The RSI Warning (Crucial)

RSI is at 81.15: This is an extreme "Overbought" reading.

I

copper crucial update in long term copper month chart showing again stair pattern like gold which indicate heavy bull zone possible yes some down correction can be seen due to dxy strength or some profit booking at higher lvl. technical ideas---- copper has strong support 950-40 if mkt comes down due to given reason than should b

Swing Trade Journey – Trade 8: Copper FuturesTrade 8 Log

Long in #CopperFut at ₹972 on 03/10/2025

Gap-up entry executed as per alert.

Reasoning:

Price triggered the alert on a gap-up opening, confirming strength after consolidation. Trend remains intact above short-term averages with momentum favouring continuation. Setup offered a clean entr

Round Bottom and Retest in COPPERA well-defined Round Bottom formation and subsequent retest is observed in Copper Futures (MCX) on the 15-minute chart. After a prolonged downtrend, price has rounded out a base and reclaimed the neckline resistance near ₹884. This breakout was confirmed by a successful retest, with bulls defending

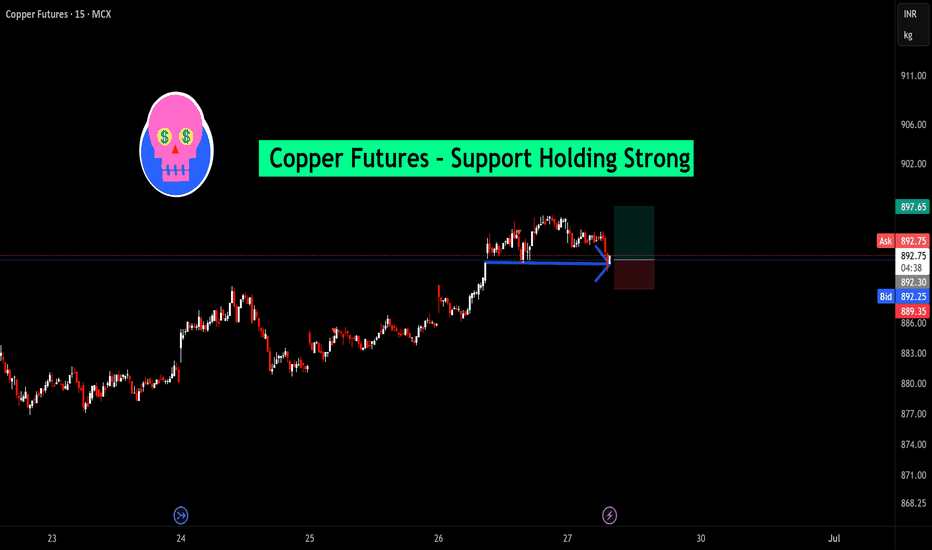

Copper Futures – Support Holding Strong, Bulls May Step In📌 Trade Idea:

Bias: Bullish

Setup: Bounce from Demand Zone

Entry: Around ₹892.00–₹892.35

Stop-Loss: Below ₹889.35

Target: ₹897.65+

A successful defense of this support could pave the way for a quick recovery move toward higher resistance levels. Watch closely for a bullish candle confirmation a

Copper Futures – 15 Min Chart Analysis (MCX)Copper is showing signs of a potential short-term reversal after a strong upward rally. The price action has faced resistance around 895, which is marked with a red candle and a small rejection wick (highlighted with the blue arrow).

This region could act as a supply zone, where sellers are steppin

Copper Weekly PlanAll detail for chat. good entry at mark price only. and must stoploss minimum risk and good profit. risk ratio 1:1 to manage modified SL.

📌 This is not a buy/sell recommendation, just an educational trading idea.

📌 Market conditions can change; always conduct your own research.

📌 Understand risks b

Copper Futures Update – Bullish Setup Alert!A strong trendline support pattern has formed in Copper (MCX), as seen on the 15-minute chart. Price has successfully respected the support zone near ₹876, indicating buyers are stepping in around this level.

With a positive price reaction from support and a favorable risk-to-reward setup, a potent

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Copper Futures (Feb 2026) is 5.7925 USD / LBR — it has risen 0.37% in the past 24 hours. Watch Copper Futures (Feb 2026) price in more detail on the chart.

The volume of Copper Futures (Feb 2026) is 1.34 K. Track more important stats on the Copper Futures (Feb 2026) chart.

The nearest expiration date for Copper Futures (Feb 2026) is Feb 25, 2026.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Copper Futures (Feb 2026) before Feb 25, 2026.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Copper Futures (Feb 2026) this number is 2.54 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Copper Futures (Feb 2026) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Copper Futures (Feb 2026). Today its technical rating is neutral, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Copper Futures (Feb 2026) technicals for a more comprehensive analysis.