How to Handle Loss in Trading?Handling loss in trading can be a difficult and emotional experience, but it’s an inevitable part of the process. Here are some strategies that you can use to manage losses:

1. Accept that losses are a normal part of trading:

One of the most important things to do is to accept that losses are an

Silver Futures (Mar 2028)

No trades

Contract highlights

Related commodities

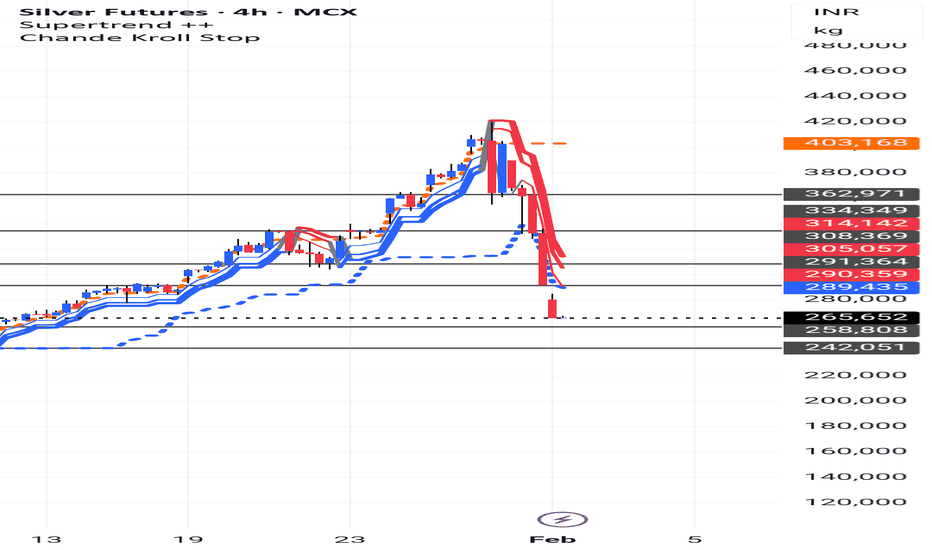

SILVER : Make-or-Break Zone — Double Bottom vs. ABC “C” WaveSilver saw a sharp impulsive sell-off (black leg down), followed by a controlled corrective rebound inside an ascending channel (blue). Price then rejected from the upper channel boundary and broke down, shifting momentum back to the downside.

Now price is approaching a high-importance horizontal s

SILVER1! : Volatility Contraction & Mean Reversion Analysis1. Context & Review (Linking the Past) In our previous analysis Silver Futures: Parabolic Breakdown , we correctly identified the "Bearish Liquidation" event that led to a -17% correction. As predicted, the parabolic arc was violated, and price sought liquidity lower.

2. Current Market Structure:

SILVER CRASH or MEAN REVERSION:What Machine Learning model says?Silver's ~30% down move looks scary because it happened fast, but the structure is straightforward: this is a correction into machine learning levels from my AI algorithm, not a market that has broken down into a crash.

What price has done

Silver has already corrected back to the first major model

SILVER CRASH >>> What next ?Silver

ATH 422K

Sharp Correction/Dip CMP 265k

View

Gap is highlighted via 3 Yellow Circles

CMP 265K is close to Final Gap

Further Dip till 250K or Max 245K is expected

Reversal from 245K cant be ruled out

Max 240K can be considered as SL

For more insights & trade ideas,

📲 Visit my profile

Silver Futures: Parabolic Breakdown & Bearish LiquidationSilver Futures: Parabolic Breakdown & Bearish Liquidation (Analysis)

Part 1: Historical Context (The "Why") To understand this violent -17% move, we must look at Silver's distinct "personality" compared to Gold.

1. The "Beta" Factor (Silver vs. Gold) Silver is often called "Gold on steroids." Whil

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Silver Futures (Mar 2028) is 89.810 USD / APZ — it has fallen −2.55% in the past 24 hours. Watch Silver Futures (Mar 2028) price in more detail on the chart.

Track more important stats on the Silver Futures (Mar 2028) chart.

The nearest expiration date for Silver Futures (Mar 2028) is Mar 29, 2028.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Silver Futures (Mar 2028) before Mar 29, 2028.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Silver Futures (Mar 2028). Today its technical rating is buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Silver Futures (Mar 2028) technicals for a more comprehensive analysis.