Contract highlights

Related commodities

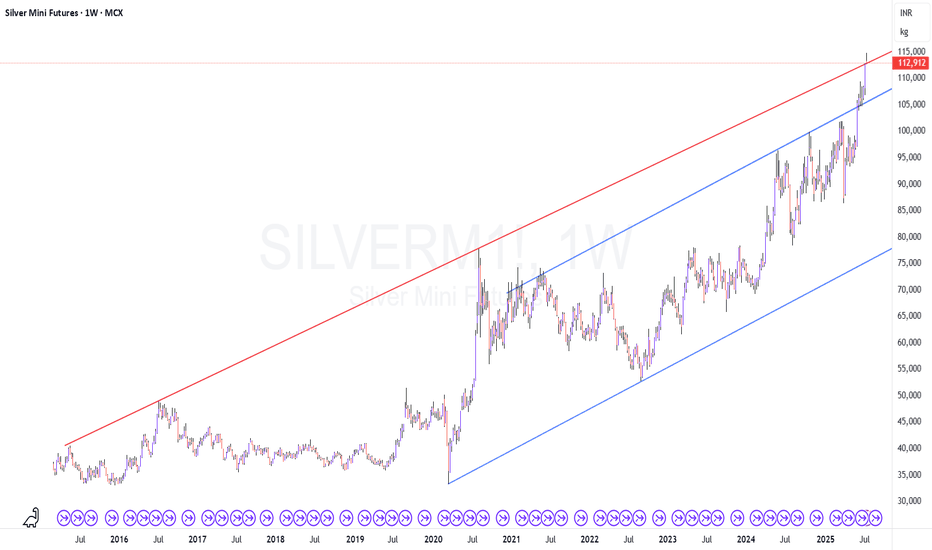

Silver mcx updated levels buy near support 50$ 1st on comex comeSilver mcx updated levels given on chart,silver mcx 10-12 % upside still possible, silver will try to break previous ATH and make fresh ATH

How My Harmonic pattern projection Indicator work is explained below :

Recent High or Low :

D-0% is our recent low or high

Profit booking zone ( Early /

Silver – Riding the WaveMCX:SILVERMIC1! is trending strong, and we are already surfing at 5R.

Our system’s strength lies in catching mean reversals early and riding the momentum that follows.

Disciplined risk, precise trailing, no second-guessing.

This approach has delivered consistent double-digit “R” trades in the pa

Silver Re Entry After booking partial profits at 12R, I am re-entering the MCX:SILVERM1! trade with a fresh position. The setup continues to align with my trend-following and risk parameters, and the market structure supports further upside potential.

Partial exit: 12R booked ✅

New entry: Initiated as per strat

SILVERM1! - At the ResistanceCMP: 112800

TF: Weekly

Price is hitting the resistance on weekly chart, and the breakout from here might be a challenging task for the bulls. Let's see how this week progresses

Disclaimer: I am not a SEBI registered Analyst and this is not a trading advise. Views are personal and for educationa

Silver goes to the moon

Silver is entering a strong upcycle, indicating that the broader script remains firmly in the bullish zone. After consolidating around the $41.20–41.40 support range, the price has not only absorbed selling pressure but also broken above a well-defined descending trendline, which had previously act

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The nearest expiration date for Silver Futures (Sep 2025) is Sep 26, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Silver Futures (Sep 2025) before Sep 26, 2025.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Silver Futures (Sep 2025) this number is 80.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Silver Futures (Sep 2025) shows that traders are closing their positions, which means a weakening trend.