DAX breaking 7-month consolidationDAX Weekly Outlook – Consolidation Breakdown in Progress

The DAX has been moving in a broad 7-month consolidation range, showing neither a clear uptrend nor a downtrend. Such long consolidations often act as distribution zones, where smart money gradually exits positions before a larger move begins

DAX Breaks H&S Pattern – Eyes 22,300–22,200🔎 Chart Setup

DAX has given a breakdown of the Head & Shoulders pattern on the daily chart. This is a strong bearish reversal pattern, usually signaling further downside.

⚖️ Downside Targets

With the breakdown confirmed, the pattern target lies in the 22,300–22,200 zone.

As long as 24,000 (on a

Head & Shoulders on DAX Daily Chart – Watch for BreakdownThe DAX index is currently forming a Head and Shoulders pattern on the daily chart, a well-known bearish reversal formation. This pattern typically signals a potential shift in trend from bullish to bearish if the breakdown occurs.

Left Shoulder – Formed when prices peaked, followed by a correction

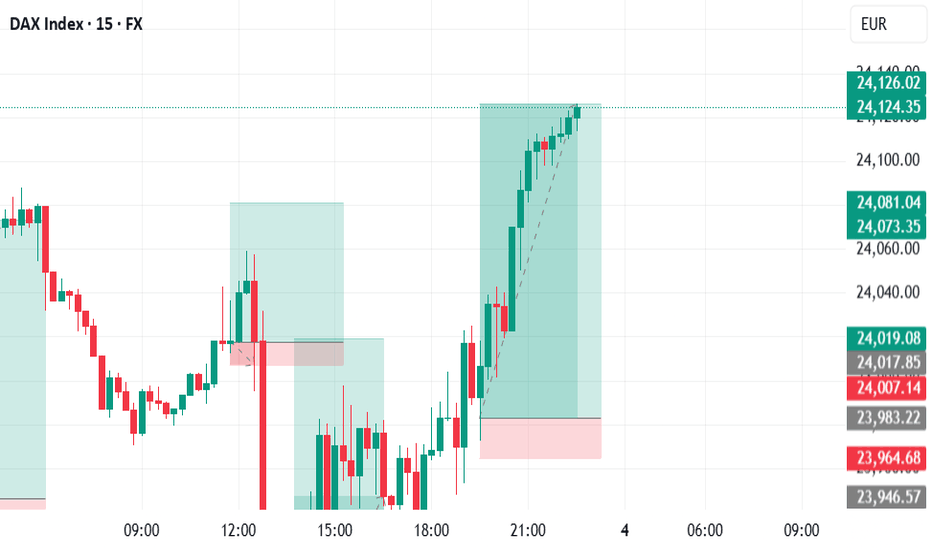

GER40 BUY TODAY RUNNING SMOOTHLYI saw a setup forming on the charts in 5 minutes. Took a Ger40 Buy according to my setup. I just entered another buy which I have shown on the charts. It is currently running around 1;3. my target in the second buy is 1;7 ish. I will hold 1st buy till my TP reaches. Sharing just to show you guys.

DAX40 Recovery Setup-Potential Upside to 24552After a significant intraday selloff, DAX40 shows signs of a potential recovery as price reclaims the earlier support zone with strength.

🔍 Key Observations:

✅ Yellow box marks a cluster of bars after a strong downtrend, hinting at accumulation or exhaustion.

⚠️ Support retest held — recent candl

Global cuesDAX CMP 22272

Candlestick- the Index fell 17% from the highs during the month and then regained most of the fall. The size of the lower wick is a sign of warning. In Japanese candlestick pattern it is a long term reversal candlestick pattern called the Hanging Man . At times after a big fall the

21-08-2024, GERMAN 40 - SHORTS 1. for long term we are seeking premium (LONGS) targeting (18790.01) price level

2. during this perticular day (21-08-2024), we are going short to sweep 4hr Sellside Liq to go up

- looking for shorts in between the dealing range targeting 4hr low (monday low,19-08-2024)

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

Germany 40 (DAX) / Euro reached its highest quote on Oct 9, 2025 — 24,890.1 EUR. See more data on the Germany 40 (DAX) / Euro chart.

The lowest ever quote of Germany 40 (DAX) / Euro is 7,941.8 EUR. It was reached on Mar 19, 2020. See more data on the Germany 40 (DAX) / Euro chart.

Germany 40 (DAX) / Euro is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy Germany 40 (DAX) / Euro futures or funds or invest in its components.