USXUSD trade ideas

DXY - Inverted Head and shoulders reversal An inverted head and shoulders pattern has formed in DXY hourly. Watch for a level above 93.70 for a move to 94.80. This may very well be the reversal on the shorter term chart which would confirm that DXY has bottomed and on a path towards 98 in a few weeks/months time.

if this pattern is confirmed, we can see some corresponding correction in Metals and EM equities.

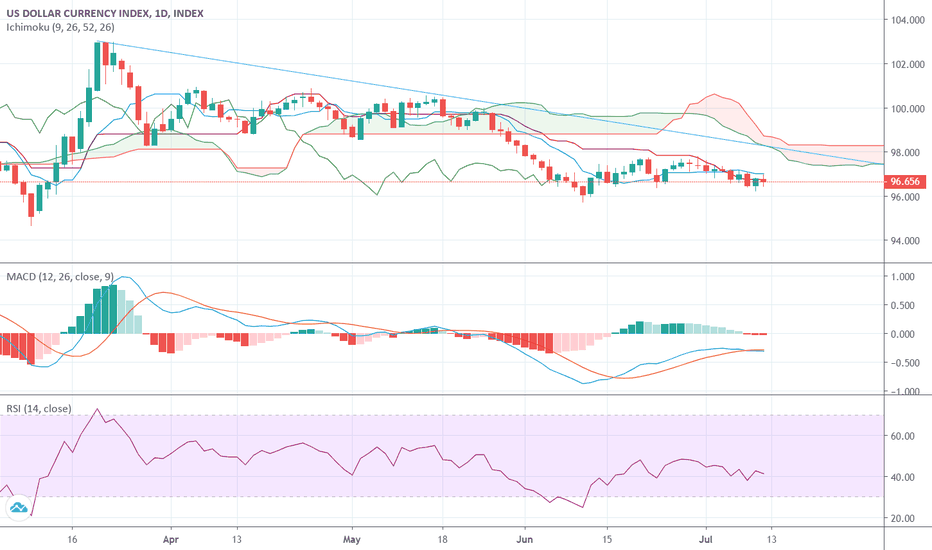

Risk to dollar or the basket currencies ?DXY is on edge of the support at 96. RSI has formed positive divergence but yet not turned up. Circle marks the perfect support which should be touched by 23-26th July, if it has to work. The overall frame of the trend is still pointing 94 but positive divergence can't be ruled out. Better to be on the sideline and see which support is in motion. If it comes to 94 then the overall trend, started at 103, will get complete and we might see a bounce from there towards 96-98 zone.

DXY US dollar index Bearish Flag prepare for Big Crash !!!Disclaimer : This is not financial advice please do your own research before investment.

As you can clearly see right now DXY creating Bear flag if DXY failed to sustain

above and breaks the flag from downside then the next support will be around 95.9

and if the price goes below 95 then the technically support will be around 93.