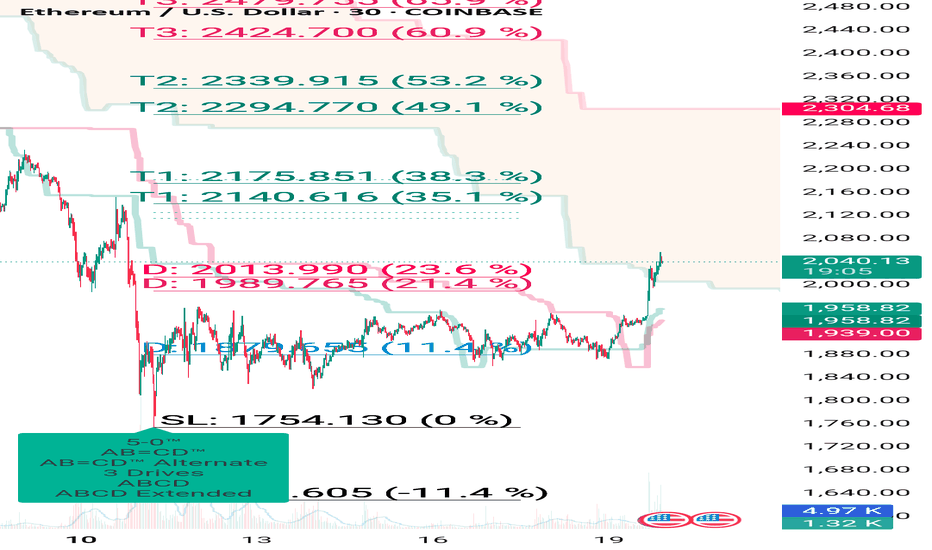

ETHUSD buy given from 1880-90 upside next Target 2140 to 2170How to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 11.4% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 21.4% to 23.6% range then early traders can make fresh reversals trade after breaking 1st D 11.4% safe traders can reversal trade after breaking Point D 21.4% to 23.6% range

Targets :

Target T1 : 35.1% to 38.3%

Target T3 : 49.1% to 53.2%

T3: 60.9% to 64.8% is our 3rd Target since this is reversal zone so must book profit if break then take fresh trade again

Target T4 : 76.4% to 79.7%

Next Targets are 100% , 127.2% ,141.4% and final Target 161.8%.

How to take reversal trade :

If price going upside/ downside then then buy or sell levels appear on Chart ( Automatically show when price reach any reversal zone of harmonic projection pattern based .

After showing reversal levels wait for confirmation until 21.4% or 28.3 % level not break if break then exit from current buy / sell trade and take fresh reverse trade buy/ sell .

Trailing SL:

After reach 1st Target trail SL to just above or below cost ( for example we are holding sell trade from 100 1st Target 110 hit then move trailing sl to 104-105 and move SL as price move upside or Downside)

Re- Entry :

For Re-entry in any pull back Point D ( 11.4% ) is used for re-entry then SL recent high or low Point SL ( 0% ) .

Blue Line is 1st support/ Resistance

Green line is 2nd support/ resistance

Red line is 3rd Support/ resistance

Trade ideas

Ethereum start buy on dip 2450-2500 upside 1st Target How to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 11.4% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 21.4% to 23.6% range then early traders can make fresh reversals trade after breaking 1st D 11.4% safe traders can reversal trade after breaking Point D 21.4% to 23.6% range

Targets :

Target T1 : 35.1% to 38.3%

Target T3 : 49.1% to 53.2%

T3: 60.9% to 64.8% is our 3rd Target since this is reversal zone so must book profit if break then take fresh trade again

Target T4 : 76.4% to 79.7%

Next Targets are 100% , 127.2% ,141.4% and final Target 161.8%.

How to take reversal trade :

If price going upside/ downside then then buy or sell levels appear on Chart ( Automatically show when price reach any reversal zone of harmonic projection pattern based .

After showing reversal levels wait for confirmation until 21.4% or 28.3 % level not break if break then exit from current buy / sell trade and take fresh reverse trade buy/ sell .

Trailing SL:

After reach 1st Target trail SL to just above or below cost ( for example we are holding sell trade from 100 1st Target 110 hit then move trailing sl to 104-105 and move SL as price move upside or Downside)

Re- Entry :

For Re-entry in any pull back Point D ( 11.4% ) is used for re-entry then SL recent high or low Point SL ( 0% ) .

Blue Line is 1st support/ Resistance

Green line is 2nd support/ resistance

Red line is 3rd Support/ resistance

ETH/USD Trading Analysis & Buy RecommendationETH/USD Trading Analysis & Buy Recommendation

⏳ Timeframe: 1H (Short-term) | Exchange: Coinbase

📌 Technical Analysis

Market Structure:

ETH is attempting to recover from a recent downtrend and has found support around $1,858 – $1,866.

The price is currently testing the EMA 33, indicating potential upward momentum.

Key Support & Resistance Levels:

Buy Zone (Entry): $1,870 – $1,875 (Adjusted)

Major Support: $1,858 – $1,866

Immediate Resistance: $1,907 – $1,910

Target Take Profit (TP): $2,025 (Green zone)

EMA 33 Acting as Dynamic Support

EMA 33 High: $1,892 (Currently being tested)

EMA 33 Low: $1,872 (Close to new buy zone)

Trading Volume

Volume is picking up in this consolidation phase, suggesting potential breakout.

🎯 Trade Recommendation

✅ Buy (Long) ETH/USD around $1,870 – $1,875

🎯 Target (TP): $2,025

🛑 Stop Loss (SL): $1,829

📌 Risk-Reward Ratio (R:R): ~3.0 (Potential loss of $45 vs. possible profit of $150)

📌 Note: If ETH breaks below $1,858, consider an early exit to protect capital.

🚀 This setup offers a better risk-reward ratio while still maintaining a strong technical outlook for an upward move.

Ethereum buy near 1890 for long term 2450-2470 1st Target How to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 11.4% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 21.4% to 23.6% range then early traders can make fresh reversals trade after breaking 1st D 11.4% safe traders can reversal trade after breaking Point D 21.4% to 23.6% range

Targets :

Target T1 : 35.1% to 38.3%

Target T3 : 49.1% to 53.2%

T3: 60.9% to 64.8% is our 3rd Target since this is reversal zone so must book profit if break then take fresh trade again

Target T4 : 76.4% to 79.7%

Next Targets are 100% , 127.2% ,141.4% and final Target 161.8%.

How to take reversal trade :

If price going upside/ downside then then buy or sell levels appear on Chart ( Automatically show when price reach any reversal zone of harmonic projection pattern based .

After showing reversal levels wait for confirmation until 21.4% or 28.3 % level not break if break then exit from current buy / sell trade and take fresh reverse trade buy/ sell .

Trailing SL:

After reach 1st Target trail SL to just above or below cost ( for example we are holding sell trade from 100 1st Target 110 hit then move trailing sl to 104-105 and move SL as price move upside or Downside)

Re- Entry :

For Re-entry in any pull back Point D ( 11.4% ) is used for re-entry then SL recent high or low Point SL ( 0% ) .

Blue Line is 1st support/ Resistance

Green line is 2nd support/ resistance

Red line is 3rd Support/ resistance

Will Ethereum Fall below $1500 or Ready to $8000 ?#Ethereum Fresh Weekly Analysis

🔹 Current Trend: CRYPTOCAP:ETH has dropped -51% in the last 3 months, signaling a major retracement.

🔹 Key Support Zone: Trading above $2000-$1900, a crucial accumulation zone for this bull market.

🔹 Upside Targets: If #ETH holds this support, we could see $6000 / $8000 / $10,000 in the coming months.

🔹 Risk Factor: If ETH fails to hold $2000, expect a potential dip towards $1500—a key level for long-term accumulation.

Smart Strategy:

✅ Accumulate ETH on dips instead of chasing tops.

✅ Wealth is built by buying in bear markets and selling in bull cycles.

✅ Long-term holders should focus on accumulation, not panic selling.

IMO ETH/USDT has strong potential in this bull cycle—buy smart, hold strong!

Note: Not Financial Advice so DYOR

Ethereum holding buy trade at 2150 , 2440-2485 Target How to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 11.4% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 21.4% to 23.6% range then early traders can make fresh reversals trade after breaking 1st D 11.4% safe traders can reversal trade after breaking Point D 21.4% to 23.6% range

Targets :

Target T1 : 35.1% to 38.3%

Target T3 : 49.1% to 53.2%

T3: 60.9% to 64.8% is our 3rd Target since this is reversal zone so must book profit if break then take fresh trade again

Target T4 : 76.4% to 79.7%

Next Targets are 100% , 127.2% ,141.4% and final Target 161.8%.

How to take reversal trade :

If price going upside/ downside then then buy or sell levels appear on Chart ( Automatically show when price reach any reversal zone of harmonic projection pattern based .

After showing reversal levels wait for confirmation until 21.4% or 28.3 % level not break if break then exit from current buy / sell trade and take fresh reverse trade buy/ sell .

Trailing SL:

After reach 1st Target trail SL to just above or below cost ( for example we are holding sell trade from 100 1st Target 110 hit then move trailing sl to 104-105 and move SL as price move upside or Downside)

Re- Entry :

For Re-entry in any pull back Point D ( 11.4% ) is used for re-entry then SL recent high or low Point SL ( 0% ) .

Blue Line is 1st support/ Resistance

Green line is 2nd support/ resistance

Red line is 3rd Support/ resistance

Ethereum bought at 2150 Booked at 2520 again holding buy 2280How to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 11.4% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 21.4% to 23.6% range then early traders can make fresh reversals trade after breaking 1st D 11.4% safe traders can reversal trade after breaking Point D 21.4% to 23.6% range

Targets :

Target T1 : 35.1% to 38.3%

Target T3 : 49.1% to 53.2%

T3: 60.9% to 64.8% is our 3rd Target since this is reversal zone so must book profit if break then take fresh trade again

Target T4 : 76.4% to 79.7%

Next Targets are 100% , 127.2% ,141.4% and final Target 161.8%.

How to take reversal trade :

If price going upside/ downside then then buy or sell levels appear on Chart ( Automatically show when price reach any reversal zone of harmonic projection pattern based .

After showing reversal levels wait for confirmation until 21.4% or 28.3 % level not break if break then exit from current buy / sell trade and take fresh reverse trade buy/ sell .

Trailing SL:

After reach 1st Target trail SL to just above or below cost ( for example we are holding sell trade from 100 1st Target 110 hit then move trailing sl to 104-105 and move SL as price move upside or Downside)

Re- Entry :

For Re-entry in any pull back Point D ( 11.4% ) is used for re-entry then SL recent high or low Point SL ( 0% ) .

Blue Line is 1st support/ Resistance

Green line is 2nd support/ resistance

Red line is 3rd Support/ resistance

Ethereum buy given at 2150 enjoy huge profit hold buy trade How to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 11.4% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 21.4% then early traders can make fresh reversals trade after breaking 1st D 11.4% safe traders can reversal trade after breaking 2nd D 21.4%

Targets :

Target T1 : 28.3% ( early trade if entry at 11.4% )

Target T1 : 35.1% to 38.2%

Target T3 : 49.1% to 53.2%

T3: 61.8% to 65.1% is our 3rd Target since this is reversal zone so must book profit if break then take fresh trade again

Target T4 : 76.4% to 79.7%

Next Targets are 100% , 127.2% ,141.4% and final Target 161.8%.

How to take reversal trade :

If price going upside/ downside then then buy or sell levels appear on Chart ( Automatically show when price reach any reversal zone of harmonic projection pattern based .

After showing reversal levels wait for confirmation until 21.4% or 28.3 % level not break if break then exit from current buy / sell trade and take fresh reverse trade buy/ sell .

Trailing SL:

After reach 1st Target trail SL to just above or below cost ( for example we are holding sell trade from 100 1st Target 110 hit then move trailing sl to 104-105 and move SL as price move upside or Downside)

Re- Entry :

For Re-entry in any pull back Point D ( 11.4% ) is used for re-entry then SL recent high or low Point D ( 0% ) .

Target is same as early 21.4% , 28.3 , 35.1 and so on

Blue Line is 1st support/ Resistance

Green line is 2nd support/ resistance

Red line is 3rd Support/ resistance

Ethereum Technical Analysis - Weakly 🇺🇸 CRYPTOCAP:ETH Weekly Technical Analysis: #Ethereum broke previous support at $2250 on the 4-hour timeframe. We are in a bearish trend, 💔raising concerns. As the weekly closing is pending, I will update if there are changes after the weekly and monthly closings.

📈📉Chart for reference. posted on trading view as well link below

ETHUSD Short Strategy:

ETHUSD Short Strategy:

Entry: 2,679 - 2,692

Stop Loss: 2,760

Target 1: 2,600

Target 2: 2,463 - 2,460

Expected timeframe: Target before early next week

Additional strategy: If the price retraces to 2,720 - 2,740, consider adding to the short position.

📌 Follow me for more market insights and real-time trade updates! 🚀

ETHEREUM - $5000 loading! - Super Bullish? Price Overview:

ETH showing signs of a major bull rally! Here’s what’s happening:

1️⃣ Trendline Breakout: ETH has successfully broken out of a major trendline, signaling bullish momentum.

2️⃣ Next Stop: ATH! The next resistance level aligns with its all-time high, making this a crucial milestone.

3️⃣ Altcoin Rally Dependency: For the broader altcoin market to rally, Ethereum must break its ATH first.

✨ The Bitcoin Connection:

Bitcoin dominance plays a pivotal role in the altcoin market? When Bitcoin dominance weakens, it creates room for altcoins—to shine. If ETH breaks its ATH, it could kickstart an exciting altcoin season.

💡My Expectations:

ETH looks poised to reclaim its ATH soon. A breakout here could be the trigger for the next big rally.🚀

Stay tuned for further insights, updates, and trade safely!

If you enjoyed this analysis, leave a comment and help boost the post. Let’s grow together!

⚠️ Disclaimer: This is NOT a buy/sell recommendation. All views are personal and shared for educational purposes only. Do your research before investing.

Thanks & Regards,

Anubrata Ray ⚡

Ethereum - Technical - Weekly❣️#Ethereum has been experiencing a downward trend with lower highs and lower lows, suggesting a bearish outlook in the short term. However, there are signs of a potential sideways movement in the very short term.

sharing a 📉chart for your reference so any body can learn and make decision.💟

Ethereum at a Critical Turning Point: Head & Shoulder PatternEthereum Technical Chart Study

Ethereum is showing some interesting price action. It recently took resistance from its resistance zone and is now forming a classic Head & Shoulder pattern—a structure often signaling potential reversals.

Currently, the price is sitting right at the neckline of the Head & Shoulder pattern. If this neckline breaks, it could lead to further downside movement.

Looking below, there’s some key support to watch:

1. The 2800 resistance zone, which Ethereum broke out of earlier, hasn’t been tested yet. This zone might now act as a strong support if the price moves downward.

2. There’s also a trendline support in play, adding another layer of potential price stability.

So, what’s next?

If Ethereum breaks the neckline, we could see the price fall towards the 2800 zone or possibly to the trendline support. These are the levels to keep an eye on for the next big move.

Ethereum TechnicalEthereum has been pivotal in the blockchain space, not just for its cryptocurrency but for its platform capabilities. Its evolution continues to be watched closely by both enthusiasts and skeptics, given its impact on blockchain technology and decentralized systems. I

chart for your reference