Trade ideas

#ETH Bullish Idea And Possible MoveAll signs point to Ethereum’s crash risk being behind us for now. Get ready—once the volume picks up, ETH is set to pump hard!

I’m using a unique approach beyond just the usual TA and PA, so don’t overthink it. Just follow the trend and watch those candlesticks light up!

Disclaimer: This isn’t financial advice or a trade call—just sharing my excitement!

ETHEREUM Long Outlook – Grand Supercycle Perspective(2025.05.21)Hello everyone,

This is SeoVereign, operator of the SeoVereign Team.

Today, I would like to share an Ethereum analysis based on the daily (1D) chart for the first time in a while.

Before reading this post, please refer to the idea I uploaded on April 18, 2025, through the link below. It will help you better understand the context:

🔗

(Clicking the image will take you to the corresponding link.)

If you look at the April 18 idea, you’ll see that I presented a bullish outlook based on the Deep Crab pattern.

This analysis is a continuation of that idea.

Through years of research, I’ve observed that when a Deep Crab pattern sees a rebound from the PRZ (Potential Reversal Zone), the trend that begins from that point tends to extend for a long time.

If you look closely at the chart, you’ll also see the 2.24 Fibonacci extension level.

Some people messaged me saying, “Since it went above 1.902 and even exceeded the 2.0 Fibonacci line, isn’t this Deep Crab invalid?”

However, I’ve studied harmonic patterns in depth for a long time and have set my own Fibonacci criteria based on that research.

In this particular Deep Crab case, I define the invalidation level as 2.24.

Therefore, I judged that the pattern is still valid, and this allowed me to forecast a long-term bullish trend.

Back to the main point,

Based on this Deep Crab pattern, I’ve consistently maintained a bullish outlook on the daily chart,

and so far, there have been no clear signals indicating a reversal into a bearish trend.

Thus, I would like to post a continuation of the bullish outlook on the daily chart.

On May 19, 2025, there was a sharp drop around the 2,587 USDT level.

At that time, our team expected the bullish trend that started from around 2,447 USDT to hold its low and continue.

However, the price broke below 2,447 USDT and made a new low.

We then closely monitored Bitcoin’s movement in response.

Typically, strong volatility occurs before a major trend begins.

Bitcoin was also showing significant volatility at the time.

So we concluded: “Let’s maintain a bullish stance, but do not be fully convinced until the previous high of 2,587 USDT is clearly broken upward.”

And by the time this post is published, we’ve confirmed that the price has indeed broken above 2,587 USDT.

Therefore, I have come to the conclusion that the bullish trend is still valid.

Based on this, I present the following three target levels.

🎯 SeoVereign’s Ethereum Bullish Targets

1st Target: 3,000 USDT

2nd Target: 3,400 USDT

3rd Target: 3,700 USDT

The market still shows strong volatility.

I sincerely hope you all trade wisely and calmly, achieving great returns,

and may great fortune be with you both in trading and in life.

I’ll see you again in the next daily analysis.

Thank you.

- SeoVereign

Ethereum Breakout Confirmed – Retest CompletedCRYPTOCAP:ETH has broken out Inverse Head & Shoulders on daily chart.

✅ Neckline breakout above $2,850

✅ Retest successful – strong support confirmed

✅ Targeting full move toward $6,000

Structure is bullish, momentum building. As long as #Ethereum holds above the neckline, continuation is likely.

Note: NFA & DYOR

Everyone’s bullish now… but smart traders are waiting for this EEthereum just tapped a key resistance near $3,672 and is starting to show signs of cooling off.

A healthy retracement could bring ETH back to:

0.382 Fib – $2,970

0.5 Fib – $2,781

0.618 Fib – $2,605 (Strong demand zone)

IMO, we can expect ETH to revisit the $2,700–$3,000 zone before the next leg up.

This area will be the golden re-entry for long-term targets of $6,000–$8,000.

Stop-loss: Recent high and candle close above $3,675

Structure remains bullish:

✅ Previous dips into Fibs triggered strong buybacks

✅ Clean higher highs and higher lows

✅ Demand zone + retracement = opportunity

My View: Let price pull back. Then load up again. Bigger wave incoming.

DYOR | NFA

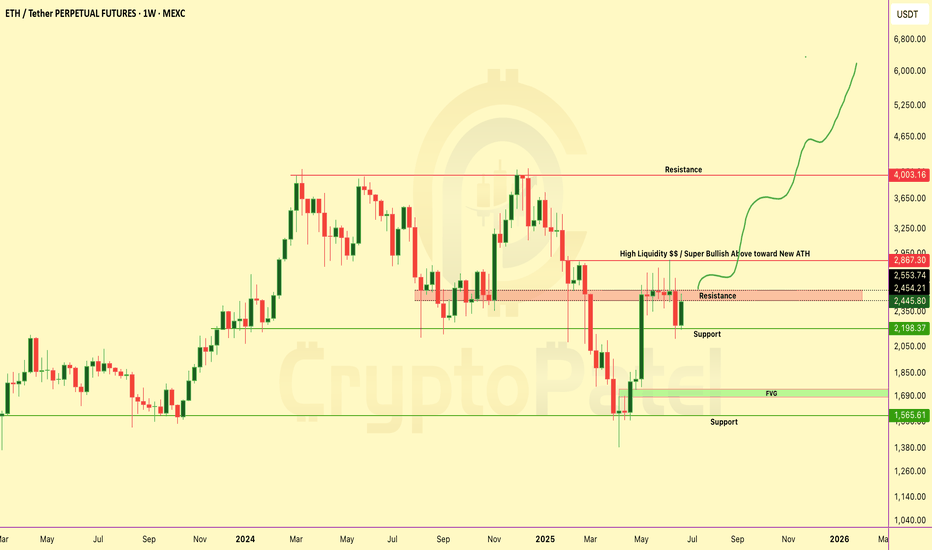

$ETH IS FLIRTING WITH A MASSIVE BREAKOUTCRYPTOCAP:ETH IS FLIRTING WITH A MASSIVE BREAKOUT

Price is hovering just below the HIGH LIQUIDITY ZONE at $2,867 — a major inflection point!

✅ Break above… We could see a parabolic push toward ATHs.

❌ Rejection = A sharp correction might hit hard.

It’s make or break time for Ethereum.

What’s your plan if this breaks?

NFA & DYOR

Weekly Long Setup | Jul 8th 2025 | Valid Until Weekly ClosePrice might retrace to a strong pivot zone (marked by the red box).

Structure remains bullish with potential for continuation after pullback.

The green box represents a high-probability long opportunity with tight risk control.

Watch for price reaction within the red zone. Entry only if confirmation (e.g., bullish engulfing, strong wick rejections) appears.

The setup expires at end of the weekly candle close.

Intraday Long Setup | July 4th 2025 | Valid Until Daily ClosePrice retraced to a strong pivot zone.

Structure remains bullish with potential for continuation after pullback.

Tight risk control.

Watch for price reaction within the red zone. Entry only if confirmation appears

The setup expires at end of the daily candle close.

Intraday Long Setup | July 1st 2025 | Valid Until Daily ClosePrice retraced to a strong pivot zone.

Structure remains bullish with potential for continuation after pullback.

Tight risk control.

Watch for price reaction within the red zone. Entry only if confirmation appears

The setup expires at end of the daily candle close.

Intraday Short Setup | June 29th 2025 | Valid Until Daily ClosePrice has pushed into a potential intraday Pivot supply zone (red box) where sellers may step in. This trade is based on the expectation of a rejection from this area.

Entry: Red box — a short entry zone aligned with overhead supply

Stop Loss: Above the red zone (invalidates the setup)

Target: Green box — area to consider partial/full exit based on momentum

Risk-reward is favorable with a tight invalidation and clean downside target

Price may stall or reverse near the red box, creating short opportunity

Note:

This is an intraday trade idea that expires at 00:00 UTC (Daily Candle Close). Re-evaluate the setup if price remains indecisive near the entry zone close to that time.

ETHEREUM Weekly Chart Breakdown – Massive Move Loading?ETHEREUM Weekly Chart Breakdown – Massive Move Loading?

ETH just pumped +9.9% this week... but it’s what comes next that really matters 👇

Key Resistance Wall → $2,867

🔹 This zone is packed with liquidity traps and past rejections.

🔹 Break this level = Unlocks ATH push toward $4K–$6K-$10k

Why This Chart Matters:

✅ Bullish structure reclaim

✅ Targeting “High Liquidity” zone above

✅ Possible parabolic rally if breakout confirms

Dips = Opportunities

If ETH dips from here... don’t panic.

→ Every dip = fresh accumulation zone

→ Below $2,000 = golden buy zone for long-term bulls

Liquidity Zone Break it = ATH rally incoming

Reject it = Buy the dip and ride the next wave

Comment & tag a friend who needs this alpha!

NFA & Dyor

[SeoVereign] ETHEREUM Bearish Outlook – June 27, 2025We are the SeoVereign Trading Team.

With sharp insight and precise analysis, we regularly share trading ideas on Bitcoin and other major assets—always guided by structure, sentiment, and momentum.

🔔 Follow us to never miss a market update.

🚀 Boosts provide strong motivation and drive to the SeoVereign team.

--------------------------------------------------------------------------------------------------------

Hello,

I would like to present a bearish outlook on Ethereum as of June 27, 2025.

In the most recent Bitcoin idea I shared on the 22nd, I explained the reason for setting the take-profit zone at 98,875 and mentioned the possibility of a short-term rebound. Amidst the ongoing war risks in the Middle East that are shaking the overall crypto market, the market has shown a successful rebound, with Bitcoin at the center of this movement.

However, this upward movement has been limited to Bitcoin alone, while other major altcoins have shown weak and sluggish rebounds. In such a situation, when predicting a future decline and considering short positions, I believe it is strategically more advantageous to target altcoins rather than Bitcoin. The inability to properly rebound suggests a momentum issue, which is likely to lead to relative weakness in the market.

Many investors tend to short Bitcoin simply because it has risen significantly in price, but this is a beginner-level mistake. Taking a short position solely based on a large price increase carries high risk, and it is more rational to base strategies on altcoins that are failing to gain upward momentum.

From this perspective, I was preparing the basis for a short position in this idea, and as a technical confirmation signal has appeared, I now present a short strategy for Ethereum. The first target is set around the 2,357 level.

If the movement unfolds, I will further explain the analytical thinking that made it possible to anticipate this decline, along with additional key points to monitor in the market.

Thank you.

ETH/USDT Bullish Reversal AnalysisETH/USDT Bullish Reversal Analysis 🚀📈

🔍 Chart Overview:

Ethereum (ETH) has shown a strong bullish reversal from the support zone near $2,200, forming a V-shaped recovery pattern. The price is currently trading around $2,450, with upward momentum targeting the next key resistance level.

📌 Key Technical Highlights:

✅ Support Zone:

Clearly respected at $2,200 – $2,300 range

Multiple candle wicks suggest strong buyer interest

✅ Resistance Zone:

Major resistance expected around $2,900

Historical rejection indicates potential selling pressure

✅ Target Level:

Short-term target marked at $2,610 🟣

If momentum sustains, price could push towards this zone before facing resistance

📈 Bullish Momentum:

Strong breakout from downtrend channel

Formation of higher highs and higher lows

Price action respecting upward trend structure

🛠 Pattern Structure:

Reversal pattern after corrective phase

Bullish engulfing candles suggest continuation

📊 Forecast Path:

Two potential scenarios are outlined:

📈 A clean push to the $2,610 target, followed by consolidation

🔄 A short pullback to $2,374 before continuation to the target

⚠️ Conclusion:

ETH/USDT is showing bullish signs with potential to reach $2,610. Watch for consolidation or pullbacks as buying opportunities, but be cautious of heavy resistance above $2,900. Ideal for short- to mid-term bullish setups.

🔔 Recommendation:

Monitor price action around $2,374–$2,450 zone for potential entries with tight risk

If you're shorting Ethereum, watch $2570 closely.If you're shorting Ethereum, watch $2570 closely.

If a candle closes above $2570, that invalidates the short — time to exit.

Why?

Because above this level, the risk/reward flips against you.

Better to wait for a cleaner entry with less risk, more reward.

Target: $2000

Retweet if this helps your trade plan.

NFA & DYOR

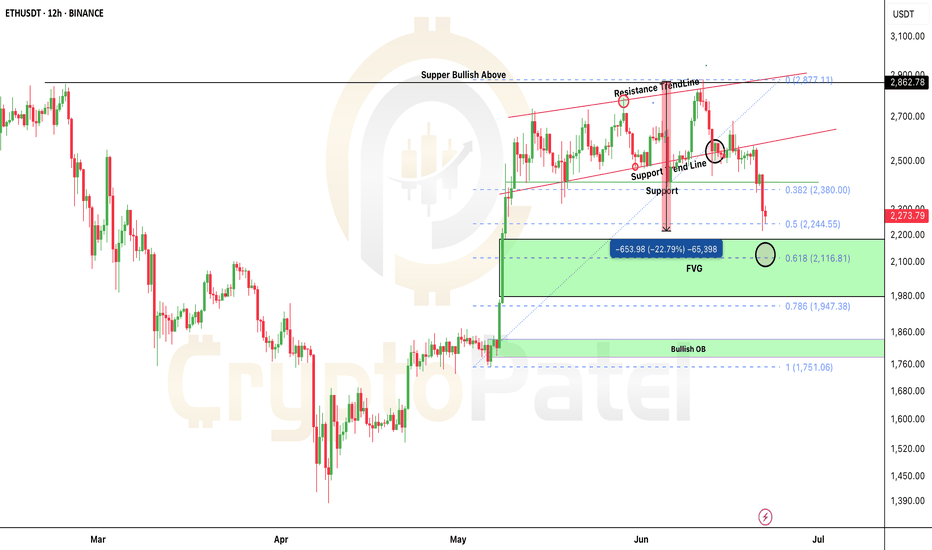

Ethereum Accumulation Zones Huge Dip Incoming- Ethereum is currently trading at 2262, down more than 22%

- Ethereum has two important areas to look at, and some important zones like 2110 & the OTEs 1694-1880$

- From an accumulation perspective, I would like to wait for ETH to purge either below the Inefficient gap or start going sideways at the buying zones

- To confirm this bias, we also need to make sure we consider taking a look at USDT D as well once it tops out, ETHs bottom will be near

- Manage risk properly and try to only trade in Spot

ETH/USDT Dumped hard as I predicted and next Target?ETH SHORT HIT — As Predicted!

Hey fam

Hope you enjoyed the ETH short setup I shared earlier when price was around $2700–$2800

ETH is now down 22% from that level.

Broke support just like we discussed…

And remember I said — if $2500 breaks, we could see $2200.

Well… we’re already there now ✅

What Now?

This is where we start accumulating on spot.

Why?

Because ETH is currently at the 0.5 Fib level — could hold.

If not, we target 0.618 Fib for next entry.

Best Accumulation Zone: $2200–$1800

Strong bullish OB around $1782–$1840

If price drops there, expect a solid bounce!

I’m personally watching this zone for spot entries targeting $8000–$10,000 next run 🚀

Let me know below if you're buying this dip!

And as always… stay tuned for the next sniper setup.

NFA & DYOR