$ETH has officially lost the 2000–2020 base CRYPTOCAP:ETH has officially lost the 2000–2020 base we highlighted on the 1H chart.

Triple-top rejection (Top 1 → Top 2 → Top 3) played out perfectly — buyers failed at the 2140–2160 supply zone, and breakdown followed.

📍 First reaction target (1980–1950) ✅ Hit

That’s roughly a 2.6–3% move from breakdown level, which is 26–30% profit on 10x leverage 💥

Momentum is clearly tilted downside after repeated rejections.

Next Target zones remain:

➡️ 1900–1850 (previous impulse base)

➡️ 1800–1750 (HTF demand / liquidity)

If you entered on breakdown — shift SL to entry now and protect gains.

Let the rest run risk-free.

Structure delivered. Execution matters.

What traders are saying

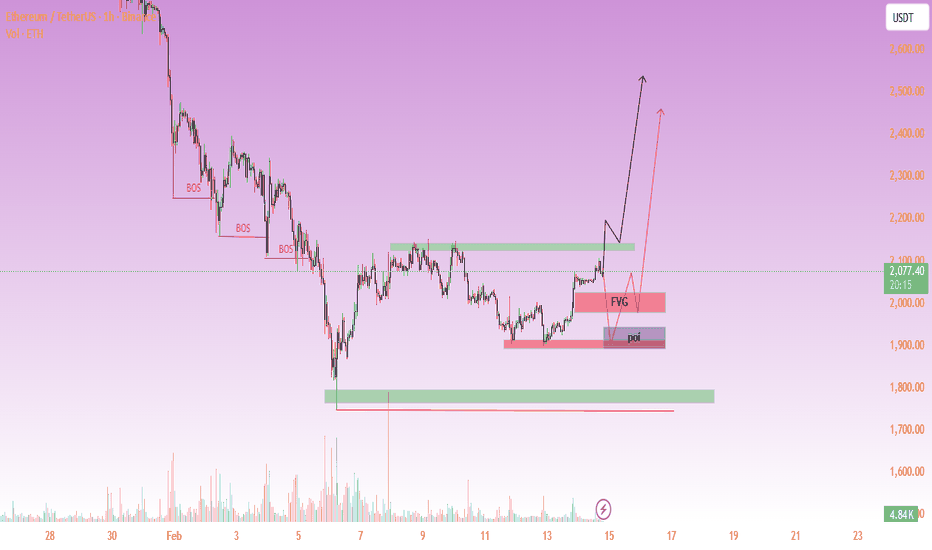

ETHUSDT – Potential Bullish Reversal From Discount Zone🧠 Market Structure

ETH has been trading in a clear bearish market structure, confirmed by multiple Breaks of Structure (BOS) to the downside.

Recently, price printed a short-term higher low, suggesting potential early accumulation and a shift toward internal bullish momentum.

Currently, price is approaching a key premium resistance / supply zone (~2100-2150) which may act as the next decision point.

📍 Key Zones on Chart

🟥 FVG (Fair Value Gap): ~2000-2030

⬛ POI / Demand Zone: ~1920-1970

🟩 Major Support / Demand: ~1780-1820

🟩 Immediate Resistance: ~2120-2150

These zones represent imbalance areas and liquidity pools where reactions are likely.

🔎 Bullish Scenario (Primary Bias)

Price retraces into FVG / POI zone

Liquidity sweep into demand

Strong bullish reaction with internal BOS

Continuation toward:

🎯 2150 (local resistance)

🎯 2350 – 2450 (mid-range supply)

🎯 2550+ (higher timeframe resistance)

This aligns with the red and black projected paths on the chart.

⚠️ Alternative Scenario

If price fails to hold POI:

Sweep toward major demand ~1800

Possible deeper accumulation phase

Bullish continuation delayed

📈 Confirmation Triggers

Bullish engulfing candle inside POI

LTF BOS / CHoCH

Volume expansion from demand

Strong rejection wicks from imbalance

❌ Invalidation

Strong acceptance below 1780

Continued lower highs without reclaiming 2100

Breakdown of current higher-low structure

📝 Summary

Market is transitioning from bearish momentum into a potential reaccumulation phase.

Best strategy is waiting for discount entries inside FVG / POI rather than chasing price into resistance.

⚠️ Disclaimer

This analysis is for educational purposes only and not financial advice. Always manage risk and trade your own plan.

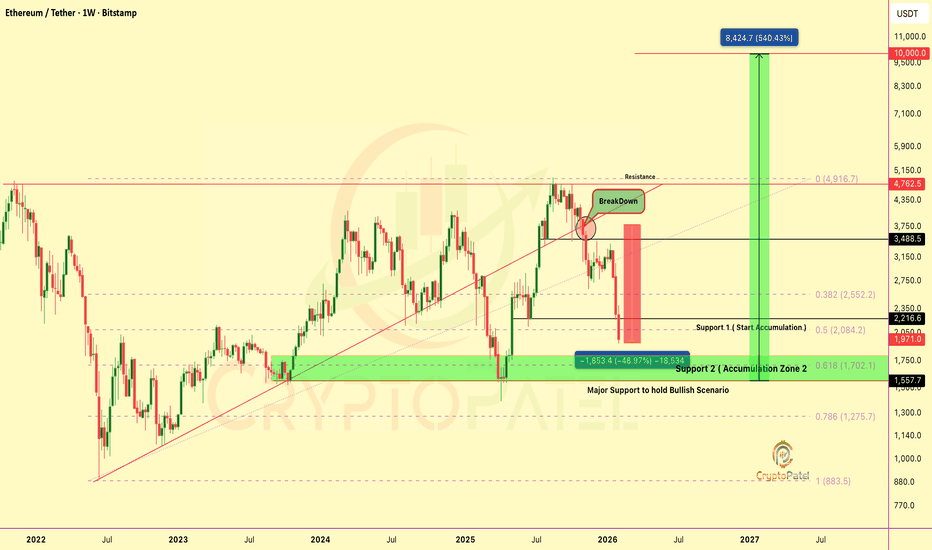

$ETH UPDATE: NOW 48% DOWN FROM MY WARNINGCRYPTOCAP:ETH UPDATE: NOW 48% DOWN FROM MY WARNING

When #ETHEREUM Broke $3,700-$3,600 Support, I warned you about a major breakdown.

✅ From $3,700 → $1,928 (48%) in Just 3 Months

✅ Previous Entry at $2,200-$2000 FILLED

NEW ACCUMULATION ZONE:

🔹 $2,000 - $1,500 (Start Building Positions)

🔹 $1,700 (0.618 Fib - Strong Support, Bid Placed)

🔹 $1,300 (0.786 Fib - Worst Case Scenario Bid)

Why I'm Still Confident:

→ $10K Target (5x from current levels)

→ $15K Target (Extended cycle target)

This is NOT for short-term trades.

This is LONG-TERM spot accumulation.

The best opportunities come when everyone else is fearful.

Fibonacci levels don't lie:

0.618 at $1,700 = Historical bounce zone

0.786 at $1,300 = Maximum pain / Maximum opportunity

My Approach:

Scale in. Don't all-in.

Place bids at key levels.

Let the market come to you.

Remember: In crypto, 500-1000% moves happen every cycle. But only for those who accumulate during fear, not FOMO.

NFA. ALWAYS DYOR.

$ETH is once again testing the 2200–2100 demand zoneCRYPTOCAP:ETH is once again testing the 2200–2100 demand zone, the same area that previously absorbed heavy selling and triggered a strong bounce. This zone has history — every touch here has forced buyers to step in, which is why it matters again now.

The upward arrows on the chart mark earlier reactions from this exact range, confirming it as a high-interest level for both bulls and bears. Price is currently hovering inside this zone, but the decision is still pending — no confirmation yet.

If this zone holds: Expect a relief bounce and short-term stabilization, similar to prior reactions.

If this zone fails: Structure weakens fast, opening the door toward 1800 first, with a deeper extension possible into the 1500 region.

Support zones decide trends, not opinions.

As discussed earlier, $ETH re-tested the 2200–2100 demand zoneAs discussed earlier, CRYPTOCAP:ETH re-tested the 2200–2100 demand zone — a level that has historically absorbed heavy selling pressure. This zone did its job once again.

#ETH bounced from around 2150 and pushed toward 2400, confirming a short-term relief rally. This move was expected, especially after the sharp drop from the 3000 region, which created oversold conditions and forced reactive buying.

Key insight from the charts:

The 2200–2100 zone remains a high-interest demand area (multiple historical reactions).

The current move is a temporary bullish recovery, not a confirmed trend reversal.

Price is still below major resistance levels formed during the breakdown from 3000.

Levels to watch now:

Support: 2200–2100 (must hold to avoid renewed weakness)

Immediate resistance: 2400–2500

Stronger resistance: 2700–2800

Risk zone: A clean loss of 2100 opens the door back toward 1800 → 1500

This bounce is reactionary, driven by demand + oversold pressure.

For a real bullish shift, Ethereum needs acceptance above key resistance, not just a bounce.

Support zones decide moves — patience decides profits.

$ETH is forming a clear triple-top rejection on the 1Hr Chart CRYPTOCAP:ETH is printing a clear triple-top style rejection on the 1H timeframe.

Marked as Top 1 → Top 2 → Top 3, price keeps failing to hold above the same supply zone, which tells us buyers are losing strength on every push.

At the same time, price is holding a horizontal base around ~2000–2020, which is acting as short-term demand. This creates a compression structure — range is tightening, and directional expansion is coming.

If #ETH loses the base (~2000–2020) with a strong close:

Downside targets

1980 – 1950 (first reaction zone)

1900 – 1850 (previous impulse base)

1800 – 1750 (major HTF demand / liquidation zone)

This aligns with past breakdown behavior after multiple top rejections.

🟢 Bullish Scenario (needs confirmation)

Only valid if #ETHEREUM reclaims and holds above 2140–2160 with volume:

Upside targets

2200 – 2250

2320 – 2350 (range high / liquidity sweep)

Without a clean reclaim, upside moves are likely to be sell-the-rip.

$ETH is printing a inverted Head & Shoulders structure on 15minsCRYPTOCAP:ETH is printing a clear inverted Head & Shoulders structure on the 15m chart. The left shoulder and head are already formed, and the right shoulder is developing near the same resistance band, showing sellers are still active on every push higher. This is not panic selling — it’s controlled distribution.

Price is currently hovering around 2080–2090, which is acting as a neckline reaction area. As long as #ETH stays below the dotted resistance path, upside remains capped and moves are likely to stay corrective.

If momentum weakens further and this structure plays out, downside continuation becomes the higher-probability path.

Support: 2070 → 2055

Resistance: 2105 → 2120

CALLED ETH CRASH AT $3,700. NOW 65% DOWN. CALLED ETH CRASH AT $3,700. NOW 65% DOWN. ACCUMULATION ZONE ACTIVATED

REMEMBER MY WARNING?

When ETH Broke $3,700-$3,600 Support, I told you: "Major Breakdown Incoming"

THE RESULT:

✅ Entry Warning: $3,700

✅ Current Price: ~$1,700

✅ Total Drop From Our Entry: -54% (65% from Peak in Last 6 months)

ACCUMULATION ZONES:

✅ Zone 1: $2,000-$1,800 - FILLED (First Bids Triggered)

🎯 Zone 2: $1,400-$1,270 (0.786 Fib) - BIDS PLACED

→ This is maximum Pain Zone

→ Historical Bounce Level

→ Best Long-Term Entry

WHY I’M LONg-TERM BULLISH ON CRYPTOCAP:ETH :

→ U.S. ETH ETFs Have Accumulated 6M ETH ($55B) in ~18 months

→ Bitmine Continues aggressive Accumulation, Now Holding 4.28M ETH (~$13B+)

→ Combined with Other ETH-Strategy Firms, Institutions Now Control ~13M ETH

This Level of Structural, Long-Term Demand is Extremely Bullish for Ethereum’s Next Cycle.

Long-Term Targets: $10,000-$20,000 (5-10x Potential)

MY APPROACH:

1️⃣ Scale in Slowly (Not All-In)

2️⃣ Place Bids at Key Technical Levels

3️⃣ Let Market Come to Me

4️⃣ Think in Years, Not Weeks

THE MINDSET (THE REALITY):

❌ Most Bought at $3,700 (Greed)

✅ I'm Buying at $1,800 (Fear)

This is how generational wealth is built in crypto.

IMPORTANT:

This is NOT Short-term Trading, This is LONG-TERM Accumulation

65-80%% Corrections = Normal in Crypto

Next Bull Run = 500-1000% Moves

THE FIBONACCI PROOF:

0.618 Fib ($1,700) = Current Support Test

0.786 Fib ($1,270) = Maximum Opportunity

More Downside Possible Before Reversal.

But When $10K-$20K Hits, You'll Remember this Post.

NFA. ALWAYS DYOR. Scale in Smart.

$ETH is currently broken down 2,000CRYPTOCAP:ETH is currently trading around 1,987, slowly moving deeper into the yellow macro demand zone.

In 2022–2023, Ethereum spent months consolidating inside this same zone before any meaningful trend emerged

Again in March 2025, price broke below $2,000, entered this region, and consolidated for weeks

That consolidation ended with a strong reclaim on May 5, which ignited the next upside leg to ATH ( $4,956)

Now we’re back at the exact same area:

$2,000 is lost again

Price is accepting below it

Downside opens toward 1,800 → 1,650 → 1,500

🔼 If the zone holds

Sideways accumulation first

A clean reclaim above $2,000 would once again act as the short term bullish trigger

Intraday Long Setup | Jan 16th 2026 | Valid Until Daily ClosePrice might retrace to a strong pivot zone.

Structure remains bullish with potential for continuation after pullback.

Tight risk control.

Watch for price reaction within the red zone. Entry only if confirmation appears

The setup expires at end of the daily candle close.

Weekly Long Setup | Jan 20th 2026 | Valid Until Weekly ClosePrice has retraced to a strong pivot zone (marked by the red box).

Structure remains bearish however, with potential reversal for continuation after pullback.

The green box represents a high-probability long opportunity with tight risk control.

Watch for price reaction within the red zone. Entry only if confirmation (e.g., bullish engulfing, strong wick rejections) appears.

The setup expires at end of the weekly candle close.

Intraday Short Setup | Jan 15th 2026 | Valid Until Daily ClosePrice when pushed into a potential intraday Pivot supply zone (red box) where sellers may step in. This trade is based on the expectation of a rejection from this area.

Entry: Red box - a short entry zone aligned with overhead supply

Stop Loss: Above the red zone (invalidates the setup)

Target: Green box - area to consider partial/full exit based on momentum

Risk-reward is favorable with a tight invalidation and clean downside target

Price may stall or reverse near the red box, creating short opportunity

Note:

This is an intraday trade idea that expires at 00:00 UTC (Daily Candle Close). Re-evaluate the setup if price remains indecisive near the entry zone close to that time.

ETH HTF DIRECTION : BREAKOUT WILL SET THE TREND📌 1. Pattern Overview

ETH is sitting in a decision box the kind that usually leads to a fast expansion in either direction. The next clean break from this range could define the next multi week trend.

We’re seeing a post-selloff consolidation / range after a strong impulsive drop.

In simple terms: sellers already did the heavy lifting, and now price is “balancing” while liquidity builds on both sides. Institutions typically wait for a clean sweep + reclaim (or a break + acceptance) before committing size — because that’s where direction becomes obvious.

📉 2. Key Levels

Support

2,790 — Major base of the current range. If this fails, the market is telling you demand isn’t strong enough to hold the structure.

2,090 — The next “air pocket” level. If we lose 2,790 with acceptance, this is the logical magnet where buyers may step in again.

Resistance

3,450 — First key supply zone. A reclaim and hold above this level usually flips momentum back to the bulls.

3,665 — Range ceiling / decision line. This is where sellers have defended hard — clearing it is what opens the path for a larger trend continuation.

📈 3. Market Outlook

Bias is neutral-to-bullish as long as 2,790 holds, because price is stabilizing after the selloff and building a base.

Momentum shifts bullish on a daily close and hold above 3,450, with real confirmation coming on acceptance above 3,665.

What smart money is likely waiting for: either

a break above 3,665 + retest hold (clean continuation), or

a liquidity dip into support (near 2,790) that gets reclaimed quickly (trap-and-go reversal behavior).

🧭 4. Trade Scenarios

🟢 Bullish Scenario

Entry trigger: Daily close above 3,450 (stronger if it breaks 3,665 and holds on a retest)

First target: 3,665

Second target: 4,200 → 5,000 zone (expansion leg if the range resolves upward)

Why: Breaking resistance tells you buyers are finally absorbing sell pressure — and once a range clears, price often accelerates because shorts cover and sidelined buyers chase confirmation.

🔻 Bearish Scenario

Breakdown trigger: Daily close below 2,790 with follow-through (not just a wick)

Target: 2,090

Why this happens: If 2,790 fails, it signals the base couldn’t hold. That usually pulls price into the next major demand zone where liquidity is resting.

⚠️ 5. Final Note

Don’t chase the first spike wait for a candle close and a retest to avoid getting trapped in a fakeout.

If you want more clean, level based breakdowns like this, follow me for the plans with clear targets.

$ETH Dailly Chart Update

On 6th Jan, we shared a detailed update on #ETH highlighting the daily triangle structure and clearly warned that price was approaching the upper trendline, where rejection was highly possible. The plan was simple and disciplined: don’t chase near resistance, wait for confirmation.

#Ethereum moved into the 3300–3350 zone, tested the upper boundary of the triangle, and faced a clean rejection. There was no daily close above resistance, no acceptance — sellers defended the level exactly as expected.

After the rejection at 3300, price is now moving down to kiss the lower support zones . This is a critical area. We now need to see whether support holds or breaks.

Resistance: 3300–3350 (upper trendline)

Support zone: 3050(horizontal) – 3000 (triangle lower trendline)

Breakdown risk: Below 2900–2850

Upside only if: Daily close & hold above 3300

$ETH on the daily timeframe is trading inside a triangle CRYPTOCAP:ETH on the daily timeframe is trading inside a well-defined triangle, a classic compression structure that usually precedes a strong directional move. After the sharp drop from the highs, price has stopped trending and is now printing lower highs + higher lows, showing balance between buyers and sellers.

Right now, price is sitting near the upper half of the triangle, which slightly tilts the bias toward an upside resolution, but confirmation is everything.

🔍 Breakout scenarios

Bullish breakout: A daily close and hold above 3,300–3,350 can trigger expansion toward 3,600 → 3,900 → 4,200 (range-measured move)

Bearish breakdown: Loss of 2,900–2,850 support opens the door to 2,600 → 2,400 zones

No chasing inside the triangle — let price choose direction, then follow with controlled risk.

$ETH is trading sideways just below $3,000, indicating tension CRYPTOCAP:ETH is trading sideways just below $3,000, indicating tension rather than weakness. The price hovers around $2,950–$2,960, slightly down for the day and week, but maintaining structure amid macro noise and a #Bitcoin-led market

Positioning is mixed. Large players and treasuries are accumulating aggressively, tightening liquid supply, while spot ETFs show intermittent outflows, keeping sentiment cautious. Social mood is slightly below neutral—there's no panic, just patience.

Key levels are crucial:

Support: $2,800–$2,850 is the line bulls must defend. As long as this holds, downside risk remains controlled.

Resistance: $3,100–$3,200 is the key ceiling. A clean hold above this zone could flip momentum and invite rotation back into #Eth

Scenarios (we can expect) :

* If the price holds above support → expect continued chop and slow accumulation.

* If the price reclaims $3,100+ → momentum expansion toward $3,300+ becomes likely.

* If the price loses $2,800 → risk opens toward deeper downside levels.

Until a catalyst emerges, expect range play and patience. #Ethereum moves when conviction returns—not before.

$ETH at a Critical HTF Support Inflection.CRYPTOCAP:ETH at a Critical HTF Support Inflection.

$2,890 is the Structural Demand level.

Acceptance above this level Preserves Bullish Market Structure.

If Support Holds → Upside Continuation Toward $3,650 and $4,250.

Failure to Hold → Bullish Thesis Invalidated.

Binary Zone. Directional Expansion Pending.

NFA & DYOR

Option Trading Showdown: Your Strategy vs. the Market’s RealityWhat Is the Option Trading Showdown?

The Option Trading Showdown represents the real-life challenge every trader faces:

Can your strategy survive market volatility, emotional pressure, and rapid price movement?

Unlike simple buy-and-sell trading, options demand precision. Time decay, implied volatility, Greeks, strike selection, and position sizing all play a role. One wrong move can erase gains, while a well-planned strategy can multiply returns even in sideways or falling markets.

This showdown highlights:

Strategy vs. randomness

Discipline vs. emotion

Probability vs. prediction

Risk management vs. greed

The market does not reward hope. It rewards preparation.

Why Most Traders Lose the Showdown

Many traders enter option trading chasing quick profits. They focus on:

Tips and rumors

Overleveraging positions

Ignoring risk-reward ratios

Trading without a plan

Letting fear and greed control decisions

In the Option Trading Showdown, these weaknesses are exposed instantly. Markets punish emotional trading faster than any other financial instrument. Without structure, even the best analysis fails.

This is why 90% of option traders struggle with consistency—not because options are bad, but because discipline is missing.

Turning the Tables: How to Win the Showdown

Winning the Option Trading Showdown is not about predicting every move. It’s about stacking probabilities in your favor.

Key pillars of success include:

1. Strategy Selection

Choose the right strategy for the right market condition:

Trending markets → Directional option buying

Sideways markets → Option selling strategies

High volatility → Spreads and hedged positions

Every market phase has an ideal weapon. Using the wrong one leads to losses.

2. Risk Management

In this showdown, capital protection is survival.

Pre-defined stop losses

Fixed risk per trade

Position sizing based on volatility

Avoiding revenge trading

Professional traders focus on how much they can lose, not how much they can gain.

3. Understanding Market Psychology

Markets move on perception, not logic alone. News, data, global cues, and institutional positioning influence option premiums. Reading sentiment gives you an edge before the move happens.

4. Discipline Over Emotion

Fear causes early exits. Greed causes overtrading. Discipline keeps you in control. In the Option Trading Showdown, emotional traders are eliminated quickly.

Retail Trader vs. Institutional Power

One of the biggest myths is that retail traders cannot compete with institutions. The truth is:

Retail traders can win—if they trade smart.

Institutions move large volumes, but they also leave footprints:

Open interest buildup

Unusual option activity

Volatility expansion and contraction

Support and resistance through option data

Understanding these signals allows you to align with smart money instead of fighting it.

The showdown is not about fighting institutions—it’s about riding the same wave.

Consistency: The Ultimate Victory

Anyone can win one trade. Very few can win consistently. The Option Trading Showdown focuses on building:

Repeatable setups

Rule-based execution

Performance tracking

Continuous improvement

Consistency transforms trading from gambling into a professional skill.

A trader who controls losses will eventually control profits.

Why This Showdown Matters Now

Today’s markets are faster, more volatile, and more news-driven than ever. Algorithms react in milliseconds. Option premiums change instantly. Traders who rely on outdated methods get left behind.

The Option Trading Showdown prepares you for:

High-volatility sessions

Event-based trading (budgets, results, global cues)

Sudden trend reversals

Capital preservation during drawdowns

In uncertain markets, structured option traders survive and grow.

This Is Not a Get-Rich-Quick Game

Let’s be clear: option trading is powerful—but only when respected. This showdown is about:

Long-term mindset

Skill development

Strategic thinking

Controlled aggression

If you’re looking for shortcuts, the market will teach you expensive lessons. If you’re ready to learn, adapt, and execute with discipline, the rewards are real.

The Final Call: Step Into the Arena

The Option Trading Showdown is not about luck—it’s about preparation meeting opportunity. Every trade you take is a reflection of your mindset, your system, and your discipline.

Ask yourself:

Do I have a clear strategy?

Do I respect risk?

Do I control my emotions?

Do I trade with probability, not hope?

If your answer is yes, you’re already ahead of most participants.

The market will always challenge you. The question is—are you ready for the showdown?

Option Trading Showdown: Where Discipline Wins, Strategy Survives, and Consistency Pays.

Part 11 Trading Master Class Best Practices for Option Traders

To trade options effectively, follow these disciplined rules:

Focus on market structure and volume profile before entering trades.

Avoid buying options during low volatility periods.

Always hedge when selling options.

Trade liquid strikes—prefer ATM or near OTM.

Avoid holding OTM options on expiry day.

Use stop loss and position sizing.

Track Greeks, especially Theta and Delta.

Avoid revenge trades; options can wipe capital fast.

Ethereum is compressing inside a bullish pennant Ethereum is compressing inside a bullish pennant after a strong impulsive move from the lows.

This is classic trend continuation behavior, not distribution.

A decisive close above 3,000–3,020 should trigger momentum expansion toward 3,080 → 3,150+

If price loses 2,920, the pennant fails and we may revisit 2,880–2,850.

CRYPTOCAP:ETH is not weak here — it’s coiling.

Stay patient. Let price confirm.

"ETH/USDT Forecast""ETH/USDT Forecast"

The market shows evidence of strong participation earlier, where price moved with speed and consistency, reflecting clear intent. That phase established direction and control without prolonged hesitation.

As price progressed, momentum began to ease. Movement slowed, reactions became more frequent, and volatility compressed. This change indicates a shift from active pressure to evaluation, where participants reduced aggression and allowed price to stabilize.

The subsequent recovery unfolded in a measured and uneven manner. Advances were short, overlapping, and lacked continuation, suggesting limited commitment behind higher prices. Opposing flow remained active, preventing expansion.

Currently, price behavior is defined by balance and compression. Activity reflects positioning rather than resolution. Until behavior shifts from overlap to decisive movement, the market remains in a waiting state, with continuation favored once imbalance returns.