INREUR trade ideas

Learn with Shreekrishna, Mastering the Art of Patterns I have used Highest Time frame in order to Get the data in orderly manner or You can say an effort to recognize patterns in easiest way

This shows all the basic rules of Elliott wave is met and also Meets the Guidelines

Most often people ignore either rules or Guidelines,

Kindly note this chart is 3 Month time frame so expect the down move of EURINR will likely continue till 66 or near to it

if you are Currency Trader or You are Exporter who hedge the Currency of selection then this Simple Method will help you to understand batter way

Please note when you are trading on daily time frame or Weekly time frame trade with your Own Methods of entry and Trailing the stop

Good luck

Skills of Wave Theory , Upcoming Forecast I have made an efforts in Explaining how to forecast upcoming Patterns which are self repeating in itself

Most dont understand wave theory including self claimed Wave theory experts

Hope you have learnt something today

Trade with your own Method of entry & Exit

Good luck

Running triangle Leading and Ending Diagonals

Comparison between Running triangle-Leading and Ending Diagonals

Chart 1 depicts a theoretical structure of Running triangle and an ending diagonal in a down trend.

As mentioned the comparison is in a downtrend. Accordingly downward move is termed as directional move and move to the upside is termed as non-directional.

A running triangle has non-directional momentum ie faster moves to the upside (wave A, C and E) than the downward moves (Waves B and D). These non-directional moves donot retrace the previous move completely.

On the contrary, Ending diagonal has directional momentum ie faster moves to the downside (waves 1, 3 and 5) in the direction of trend and these downward moves completely retrace the previous non-directional corrective moves (wave 2 and 4).

Chart 2 depicts a theoretical structure of Running triangle and an ending diagonal in an uptrend.

Differences in a running triangle and leading diagonal is opposite to that mentioned for downtrend.

As mentioned the comparison is in an uptrend. Accordingly upward move is termed as directional move and move to the downside is termed as non-directional.

A running triangle has non-directional momentum ie faster moves to the downside (wave A, C and E) than the upward moves (Waves B and D). These non-directional moves donot retrace the previous move completely.

On the contrary, Ending diagonal has directional momentum ie faster moves to the upside (waves 1, 3 and 5) in the direction of trend and these upward moves completely retrace the previous non-directional corrective moves (wave 2 and 4).

Update 16-EUR/INRPrice action takes its own path. My duty is to predict all possible options and spot entry and exits to trade.

What had happened overnight and what to expect further?

Chart 1: Details the the options predicted in Update 15-EUR/INR

Price action in incomplete wave had broke above wave A and had turned down with momentum greater than the incomplete wave. What does that mean? Option-1 and Option-2 are invalidated. So what to expect next?

Chart 2: This chart details the further predictions.

There are three possibilities predicted from the current move.

Option 1- Price might correct the current move and then move downwards.

Option 2- Price might complete wave C at zone 1 and then turn down.

Option 3- Price might complete wave C at zone 2 and then turn down.

Whatever might be the case, a break below 82.0803 validates the downward move then the following targets as mentioned in Update 14-EUR/ INR still holds valid.

Position : Short

Trading timeframe: 1H chart

Entry : 82.0803 (based on validation with break below 82.0803)

Stop loss : Above recent high

Target 1 : 81.4856

Target 2 : 80.3217

To catch the entry earlier, track the wave C for a 5 wave motive move to the upside. Spot wave 5 and enter short upon the price break below wave 4 of wave C.

Keep watching this space for further updates on trading and managing the trade.

To understand the concepts behind my analysis please checkout the linked idea. Happy trading :)

Disclaimer: Validate with your analysis before trading. This post is not a trading advise but a product of personal research and analysis

Update 15-EUR/INRThe pattern expecting in Chart 3 of Update 15-EUR/INR had not happened. Following chart explains it.

Chart 1:

It the pattern is to recognized as triangle then the wave E should have been a corrective to wave D which means that it should take more time to retrace wave D. However, in this case the price action labelled as wave E had retraced the complete wave D within a period faster than wave D. If this is yet to be considered as an exceptional triangle, then it should not break above Wave A. If the price breaks above wave A then the triangle pattern is invalidated.

As this pattern is suspected to be a triangle, a conservative trade pan can be applied with a short entry upon the price action breaking below the wave E with momentum greater than wave E and it marks the end of total correction. However this wave E is not yet over. End of wave E shall be marked either by price breaking below wave E or breaking above wave A (note: break above wave A shall invalidate the triangle pattern and total wave count should be relooked).

Chart 2: Depicting the incomplete wave E and conservative entry line.

Other possibilities are discussed below:

Chart 3: If suppose the incomplete wave breaks above wave A and then turns downs with a momentum slower than this wave then the following wave movements could be a possibility.

Chart 4: if the incomplete wave breaks above wave A and continues up without turning down and if it ends within/after the marked period below the resistance zone then it shall be wave C. Expect bearish signals at resistance zone within the period for the price to turn down.

Other opportunities shall be discussed after 15 April based on price action. Let's wait for the market to resolve itself and to provide signals. I am looking for shorting opportunities because the previous major trend is bearish.

If market resolved as predicted in chart 2 then the following targets as mentioned in Update 14-EUR/INR still holds valid.

Position : Short

Trading timeframe: 1H chart

Entry : 82.3210 (based on validation with a higher bearish momentum than wave E)

Stop loss : Above Wave E

Target 1 : 81.4856

Target 2 : 80.3217 ( if price breaks below 81.1737 with high momentum before 19 April 2022)

Target date : 22 April 2022 +/- 1 day

Keep watching this space for further updates on trading and managing the trade.

To understand the concepts behind my analysis please checkout the linked idea. Happy trading :)

Disclaimer: Validate with your analysis before trading. This post is not a trading advise but a product of personal research and analysis

EURINR Short Trade- AnalysisHello everyone,

Post the FED outcome lot of activity has been going on in the currency markets. Here is a trade idea for one such opportunity.

The fundamental rational:

Powell has been hawkish in his views. Currently market is expecting 4 rate hikes this year along with the thought that inflation in the US market is not temporary as earlier thought.

The impact was such that even a strong GDP number failed to impress the markets (equities).

This has resulted in Dollar strengthening and we observed the following things:

USDINR bounced from a 73.80 region back above 75. Multiple factors: Crude trading above 85, FII outflows in the market has kept a depreciating view for Rupee.

Rupee is weak against the dollar , Euro is weak against the dollar.

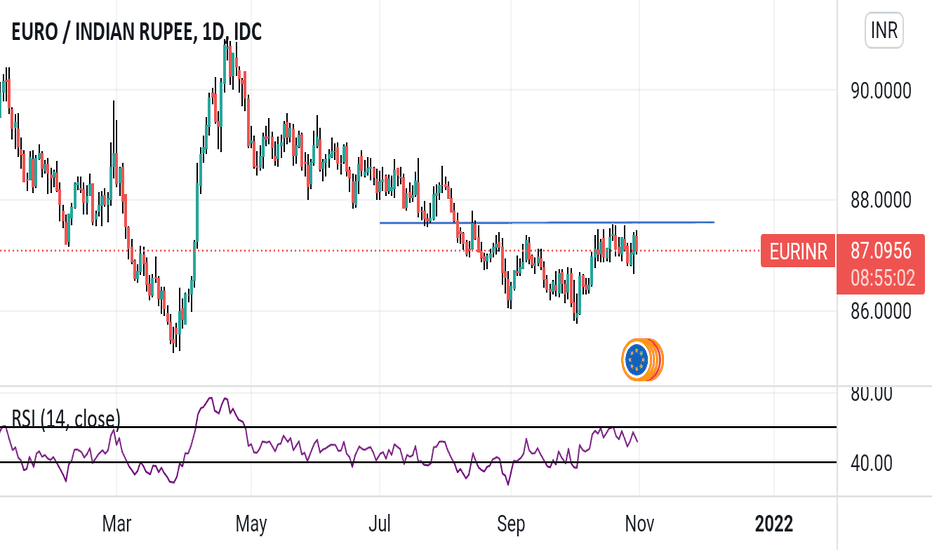

Let us look at EURINR weekly chart. Remember these are NDF market charts, the Indian Spot market is already closed. So if refer something as weekly closing below support, I am assuming in the Indian charts, it has occurred.

Price action:

This chart is the weekly price action for EURINR.

Key Observations:

EURINR has moved in ranges previously. The price action was in a broader range of 86.45 and 83.85 levels.

On a weekly basis, price has closed below the range indicating a new phase for weakness.

Let us look at the daily chart to hunt for potential retracement and stop level:

Retracements are a common occurance post any sort of breakout. Price and market players adjust to the new reality. A move above 84.05 is a potential fair level for retracement and a breach should lead to negating this short view.

That means roughly the stop loss on this trade is 40 paisa.

If we use the Ichimoku Analysis:

Chikou Span is breaking freely from the cloud indicating a trend change on the weekly chart.

Here is a look at the daily chart:

Here we analyse momentum :

Chikou has no scope to get stuck in price (it is free of prices)

Span A, Tenkan and Kijun are downward indicating a bearish momentum along with MACD sell signal.

Now let us analyse position sizing and profit targets:

I have used the fibonacci tool and enabled 1.5 and other such levels for target. If we see, the previous move's 100% retracement level break should act as an indication for adding to the existing short position.

Always follow risk management rules and pyramiding is a great way of doing it. Enter half the quantity at MACD sell signal and another half post actual evidence that move is going our way.

EURUSD has given a range breakout as well. When trading EURINR, two pairs are to be observed:

EURUSD and USDINR as EURINR is derived from that. Currently even with INR depreciating against the Dollar we have seen a weak EURINR, indicating the strength in EURUSD downtrend.

Caution:

I am already in this trade. I am following my risk management parameters and I have no attachment towards my view. If it goes wrong, I exit ass quickly I enter.

The views are personal in nature and do not represent views of my employer. I or my employer cannot be held liable for any trading losses. Kindly follow your rules for risk management.