INRUSD trade ideas

USDINR signals Nifty has legsinter-market analysis can be tricky but even as the USDINR hit a new high yesterday, the last two days bounce on hourly charts is a-b-c, what that means is that it is not a new move but the end of something. If USDINR closes down today after that it would add weight to a positive near-term outlook for the Nifty given the historical inverse correlation between Nifty and USDINR.

USDINR multi time frame aligned Elliott wave counts analysisUSDINR possible and aligned Elliott wave structure of multi time frames from monthly to hourly.

Monthly chart

Weekly chart

Daily chart

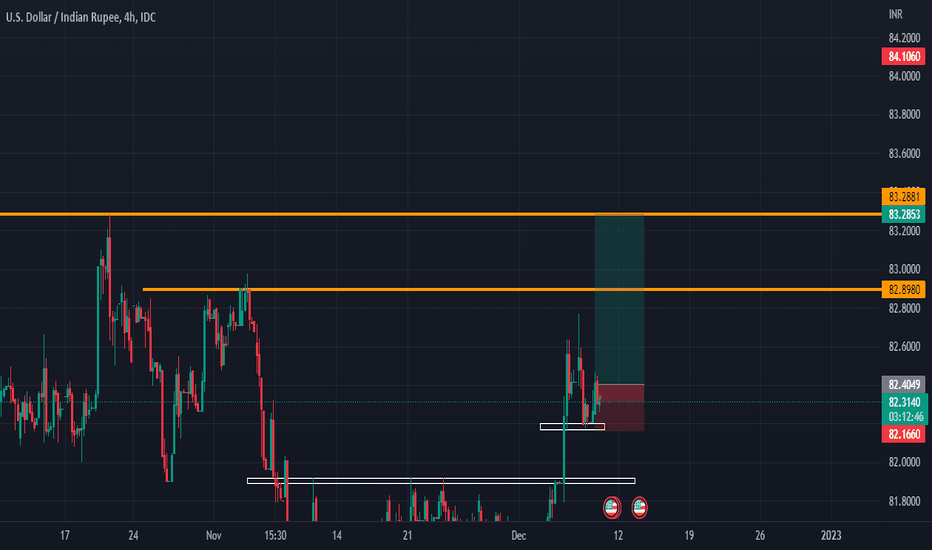

4 Hourly chart

1 Hourly chart

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Disclaimer.

I am not sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

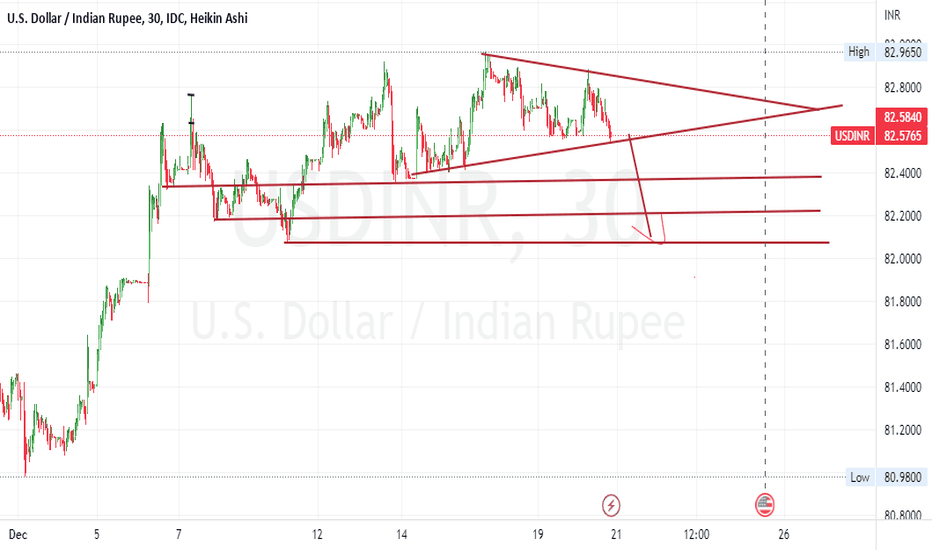

USDINR-Currency ViewThe pair moved in a range of 81.37-82.96 during last week. The pair seem to be in a dilemma and un-willing to breach either side. We may see one more week of narrow range of 83.10-82.40. While the monthly candle is still in progress, it appears that the pair may make one more attempt of the trend line resistance at 83.30. Deeper corrections cannot be expected till we see a close below 81.20. We can expect supply around the closer resistance at 83.10. This seems to be another phase where the demand is led by lower crude and other unhedged imports getting covered. Most likely scenario would be a consolidation between 82.20 and 83.20. A close outside this range requires re-assessment of risk/direction and target.

A few more observations:

The long term trend line till at 83.10-83.30 levels holds for now and we are likely to see a consolidation between 79-82

We may not see a runaway in DXY. We have once seen the support at 105 giving-up. There can be relief rallies.

Full impact of the correction has not yet been seen in USDINR currency pair. Hence, the spikes in DXY need not necessarily impact this pair

The raising upward channel indicate the broader range of 80.10-83.10

The increased volatility and wild swings likely to continue

Disclaimer: The views expressed here are personal and not connected to SYFX Treasury Foundation. The views are for learning and reference purpose only.

USDINR Analysis as per Elliott Wave TheoryUSD-INR after such a steep rise looks like it is in the 5th wave of bigger degree .

Within this bigger 5th wave, which should ideally be the last wave of a Major Rise, normally consists of 5 sub waves in smaller degree .

Now, Market is looking in 3rd wave of sub degree of bigger 5th wave that I was talking about in the previous two lines.

Inter Market Divergence Nifty v/s RupeeThe lead lag between the currency pair and Nifty can give lead indications of a trend change in the offing. A new high in USDINR in Oct not confirmed by a new low in Nifty was a bullish indication, but this week a new high in Nifty not confirmed by a new low in USDINR is a bearish indication.

USDINR: Bearish Divergence in hourly chartIn FX_IDC:USDINR here are the features we can see:

There is a clear bullishness throughout the session. I would say Very Bullish. All candles are hollow and green in hourly charts.

There is a bearish divergence in the #USDINR hour chart. Price highs are not sustained by RSI new highs - shown in the photo

Most likely: the uptrend will pause as there is a momentum missing.

So Dec Future is a short candidate for USDINR.

Find a perfect Trend Line With this check listThere are many traders out there who trade trend lines. Mastering trend lines is not easy as it seems, with experience things changes with your perception about Trend Lines. What I learned from my experience is that it is important to find a trend line, but it is more important to filter it so that, we can trade only the potential opportunities. Here I do not say that those trades which we filter out will not work or we efficiently filter out those less profitable trades, because adding a filter in your system not only filter trades which are unprofitable but also filter out profitable trades.

You have to accept that you are leaving better for best.

So, what are the check points I follow to filter out Trend Lines,

1) Touches, I prefer more than three touches and I strictly follow it. See what happens with two touch the number of trades increases too much; I am not saying trend line with two touches does not work but that trend line cannot be of higher profit potential than 3 or four touches.

2) Distance between touches, it is stated that if touches have equal distance between them the trend line is considered as a good Trend Line, but i do not strictly apply if the touches are places at enough spacing and the distance between then approximately equal that it is a good Trend Line. I do check distances but not strict on it.

3) Apply your own logic, this is a very subjective thing, person to person it will vary. Every trader looks the same setup differently, setups will only work when his psychology matches with those setups otherwise it will not work. Build your own logic.

At last, I want to end this post by a quote I have in my mind.

"True Knowledge cannot be taught, it can only be caught."